Market Overview

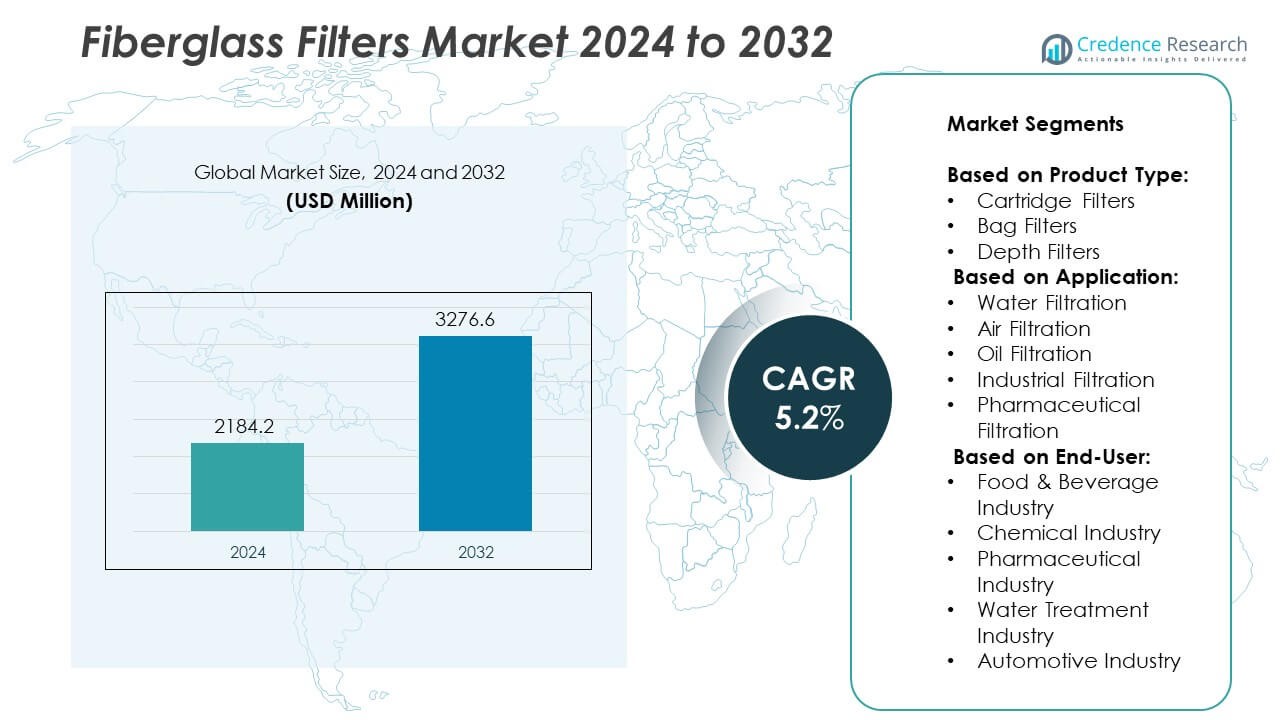

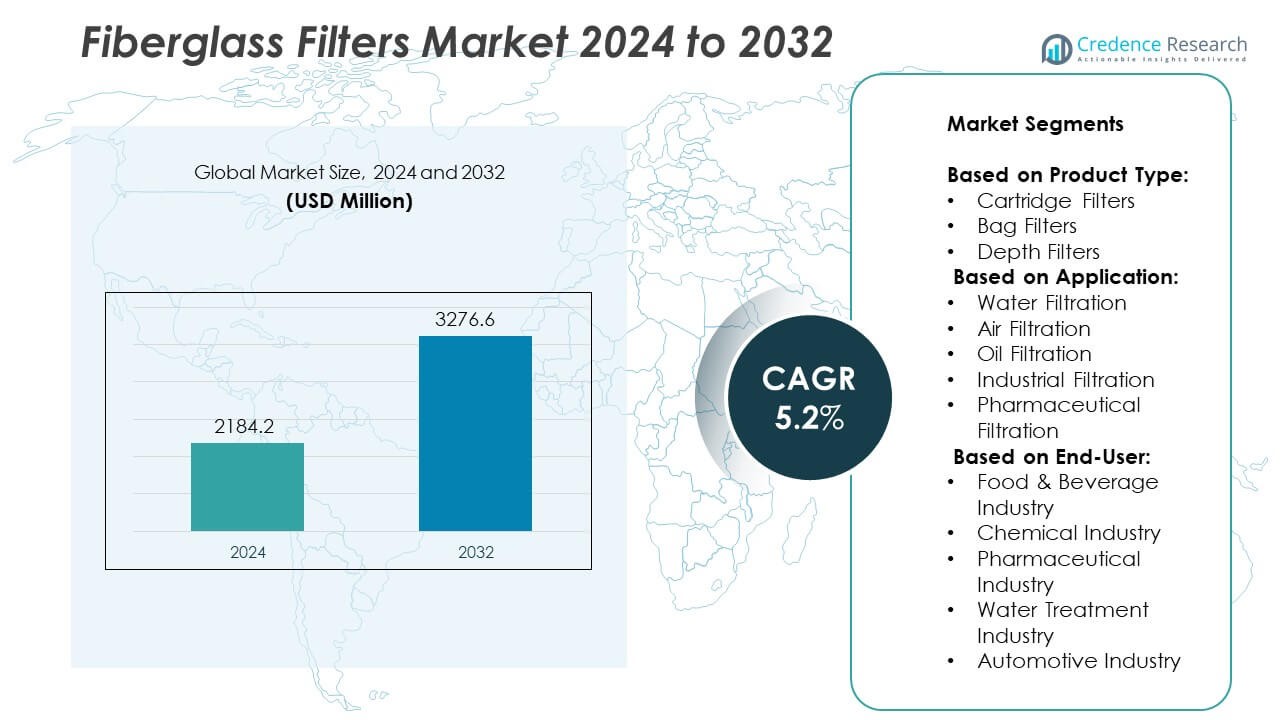

Fiberglass Filters Market size was valued at USD 2184.2 million in 2024 and is anticipated to reach USD 3276.6 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiberglass Filters Market Size 2024 |

USD 2184.2 Million |

| Fiberglass Filters Market, CAGR |

5.2% |

| Fiberglass Filters Market Size 2032 |

USD 3276.6 Million |

The Fiberglass Filters market grows steadily due to rising demand for high-efficiency filtration in HVAC systems, industrial facilities, and cleanroom environments. Regulatory enforcement of air quality standards and emission controls accelerates adoption across sectors including pharmaceuticals, electronics, and food processing. Trends favor integration with smart HVAC systems, lightweight filter designs for transportation, and custom-engineered solutions for industrial use. Manufacturers invest in sustainable production processes and recyclable materials to align with environmental regulations.

The Fiberglass Filters market shows strong geographic presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific leads in growth due to expanding industrialization, urban infrastructure, and increased focus on air and water quality in countries like China and India. North America follows with widespread adoption in HVAC, pharmaceutical, and food processing applications, supported by regulatory standards and advanced filtration infrastructure. Europe emphasizes eco-friendly filter systems and cleanroom applications across healthcare and manufacturing. Key players driving the global fiberglass filters market include Camfil AB.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fiberglass Filters market was valued at USD 2,184.2 million in 2024 and is expected to reach USD 3,276.6 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Growth is driven by rising demand for efficient air and liquid filtration across HVAC systems, cleanrooms, industrial manufacturing, and water treatment applications.

- A key trend is the integration of fiberglass filters into smart HVAC systems and compact filtration units used in transportation and commercial buildings.

- Manufacturers invest in sustainable production practices, recyclable media, and application-specific filter designs to meet evolving regulatory and performance demands.

- Competitive dynamics are shaped by global players such as Camfil AB, Donaldson Company, Inc., MANN+HUMMEL GmbH, and Parker Hannifin Corporation, all focusing on technology advancement and market expansion.

- Restraints include fluctuating raw material prices, media fragility, and rising competition from synthetic and nanofiber alternatives in certain application areas.

- Asia-Pacific dominates in volume due to rapid industrial growth and urbanization, while North America and Europe follow with established infrastructure and regulatory-driven demand.

Market Drivers

Rising Emphasis on Air Quality Standards and Regulatory Compliance Across Industrial Sectors

Stringent air pollution regulations from environmental agencies continue to drive the adoption of high-efficiency filtration solutions. Industries including power generation, chemical processing, and manufacturing must comply with emission limits to operate legally. Fiberglass filters offer excellent dust-holding capacity and low pressure drop, making them ideal for achieving compliance. Governments in North America, Europe, and Asia-Pacific are enforcing clean air initiatives that mandate the use of effective particulate control systems. The Fiberglass Filters market benefits directly from this regulatory focus, particularly in heavy industrial applications. It sees continued growth due to rising environmental accountability and regulatory enforcement.

- For instance, Donaldson Company, Inc. has implemented Ultra-Web® fine fiber technology in over 16,000 industrial air filtration installations globally, which achieves filtration efficiency down to 0.3 microns with over 99.97% particle capture.

Growth in HVAC Infrastructure Modernization and Commercial Building Retrofitting

Modern commercial spaces increasingly rely on high-performance HVAC systems to ensure indoor air quality and energy efficiency. Facility managers replace older filter systems with fiberglass variants due to their long service life and stable filtration efficiency. Demand rises in office complexes, healthcare facilities, and airports where air cleanliness directly impacts occupant health. Governments and private developers invest in upgrading ventilation systems to meet evolving building codes. The Fiberglass Filters market aligns with this transition, particularly in urban and high-density regions. It supports system optimization and cost-effective maintenance in commercial infrastructure.

- For instance, Camfil AB, a company specializing in air filtration, provided over 21,000 fiberglass panel filters for HVAC system upgrades in French healthcare and airport facilities. These filters are designed to improve air quality and energy efficiency in HVAC systems.

Expansion of Pharmaceutical, Food Processing, and Cleanroom Manufacturing Activities

Sectors such as pharmaceuticals, biotechnology, and electronics manufacturing require contamination-free environments to protect product integrity. Fiberglass filters meet strict hygiene and particulate control standards essential in cleanroom operations. In food and beverage processing, they support compliance with health regulations by preventing microbial and particulate contamination. Increased demand for sterile packaging and precision manufacturing strengthens filter consumption. The Fiberglass Filters market gains traction due to its compatibility with controlled environments and critical process zones. It ensures low-fiber shedding and high filtration efficiency under demanding conditions.

Increasing Investments in Energy Sector and Gas Turbine Air Inlet Filtration Systems

Gas turbines and other energy generation assets require clean air intake to maintain operational efficiency and reduce component wear. Fiberglass filters provide consistent performance in harsh environments with high dust loads and temperature variation. Energy producers invest in filtration upgrades to reduce turbine downtime and improve fuel efficiency. Onshore and offshore installations both use fiberglass-based systems for inlet protection. The Fiberglass Filters market benefits from this demand in oil and gas, power plants, and renewable energy infrastructure. It enables reliable operation in mission-critical environments with minimal maintenance.

Market Trends

Integration of Fiberglass Filters into High-Efficiency HVAC and Smart Building Systems

HVAC manufacturers now incorporate fiberglass filters into next-generation systems designed for optimized airflow and energy performance. Smart buildings demand consistent indoor air quality, and fiberglass filters meet these requirements through superior particulate retention. IoT-based monitoring platforms track filter condition, improving maintenance schedules and system longevity. Commercial properties adopt this integrated approach to meet sustainability targets and operational efficiency goals. The Fiberglass Filters market supports this shift by supplying components compatible with modern HVAC architectures. It plays a crucial role in aligning filtration performance with intelligent energy management.

- For instance, Freudenberg Filtration Technologies installed ISO Class 5-compatible fiberglass filters at over 3,500 pharmaceutical cleanroom facilities across Europe.

Preference for Lightweight and Nonwoven Filter Media Across Mobility Applications

Transportation industries, including automotive, aerospace, and rail, adopt fiberglass filters for cabin air and engine intake systems. These filters offer reduced weight, high durability, and resistance to temperature extremes. Fiberglass media ensures cleaner cabin environments while meeting stringent particulate control benchmarks. Manufacturers invest in composite filter designs that combine fiberglass with other advanced polymers. The Fiberglass Filters market expands in mobility sectors by addressing performance demands without compromising structural integrity. It supports clean-air technologies in both electric and internal combustion platforms.

Increased Demand for Custom Engineered Filters in Industrial and Process Applications

End-users in petrochemical, metalworking, and pulp and paper sectors require customized filter solutions tailored to specific operating environments. Fiberglass filters offer flexibility in dimensions, media thickness, and layering options to match industrial flow and pressure requirements. Engineers specify filter elements that maintain particulate control under high humidity, corrosive atmospheres, or extreme temperature conditions. Vendors collaborate directly with OEMs and system designers to develop application-specific products. The Fiberglass Filters market gains from this trend by offering bespoke filtration solutions that enhance productivity. It meets evolving requirements for efficiency, durability, and regulatory compliance.

Shift Toward Sustainable Filter Manufacturing and Low-Emission Operations

Environmental policies encourage filter producers to reduce their carbon footprint across production and disposal processes. Manufacturers explore recyclable fiberglass media and solvent-free resin systems to lower ecological impact. Investments increase in clean manufacturing lines and waste minimization strategies. Customers favor filtration solutions that meet both performance and sustainability criteria. The Fiberglass Filters market reflects this shift with product lines emphasizing lifecycle efficiency and environmental stewardship. It aligns with global sustainability initiatives without compromising air quality performance.

Market Challenges Analysis

Volatile Raw Material Prices and Supply Chain Instability Affecting Production Costs

Fiberglass filters rely on consistent supply of glass fibers, resins, and binders, which remain vulnerable to global raw material price fluctuations. Geopolitical events, energy cost shifts, and transportation bottlenecks create procurement challenges for manufacturers. Price volatility reduces margin predictability and complicates long-term supply agreements. Smaller filter producers face difficulties securing materials at competitive rates, especially during periods of global demand imbalance. The Fiberglass Filters market experiences cost pressures that hinder scalability and delay contract fulfillment in price-sensitive sectors. It must navigate sourcing complexities while maintaining product quality and delivery timelines.

Competition from Alternative Filtration Technologies and Material Substitution Risks

Advanced synthetic filter media, such as melt-blown polypropylene and nanofiber composites, compete with fiberglass in both performance and lifecycle cost. These alternatives offer design flexibility, easier handling, and better recyclability in some use cases. OEMs and system integrators evaluate filter options based on durability, efficiency, and total cost of ownership, not just material type. Market penetration of substitutes is growing in segments where fiberglass performance advantages are marginal. The Fiberglass Filters market faces pressure to differentiate through innovation, value-added features, and certification compliance. It must defend its position by addressing concerns around media fragility, waste disposal, and long-term reliability.

Market Opportunities

Expanding Role of Air Filtration in Healthcare, Pharma, and Biosafety Environments

Healthcare facilities, cleanrooms, and pharmaceutical labs require high-efficiency filtration to maintain sterile conditions and protect sensitive processes. Regulatory authorities mandate stricter air quality standards in these environments, creating demand for reliable and durable filter media. Fiberglass filters offer high thermal resistance, low fiber shedding, and consistent particulate capture across varying flow rates. Hospitals and research labs continue upgrading air handling systems, especially in high-containment and isolation zones. The Fiberglass Filters market finds growth by meeting the specific filtration requirements of these critical sectors. It supports infection control, product safety, and operational continuity in controlled environments.

Rising Infrastructure Investment in Emerging Markets and Industrial Expansion

Emerging economies are investing in industrial parks, smart cities, and energy projects that require scalable air quality solutions. These developments increase the deployment of centralized HVAC systems, dust collection units, and turbine filtration infrastructure. Fiberglass filters meet the technical and operational demands of large-scale installations in manufacturing, utilities, and construction. Government-led clean air initiatives in countries like India, Vietnam, and Brazil support rapid market entry for filtration suppliers. The Fiberglass Filters market benefits from localization efforts and capacity expansion in high-growth regions. It aligns with infrastructure development plans that prioritize environmental performance and energy efficiency.

Market Segmentation Analysis:

By Product Type:

Cartridge filters hold a significant share due to their compact design, ease of replacement, and high filtration precision. Industries use them for fine particulate removal in both air and liquid systems. Bag filters provide larger surface area and high dust-holding capacity, making them suitable for bulk dust collection and industrial HVAC systems. Depth filters gain traction in applications requiring multi-layer particle retention and long service intervals. The Fiberglass Filters market supports all three formats with tailored media specifications and structural durability. It meets varying operational demands across low and high-pressure systems.

- For instance, MANN+HUMMEL GmbH’s WAVE Cartridge Filters used in industrial dust collection systems achieved over 1200 m³/h airflow rate per unit with particle separation efficiency above 99.99%, deployed in more than 2,100 installations globally.

By Application:

Air filtration leads the segment due to increasing indoor air quality standards and the expansion of HVAC systems in commercial and industrial spaces. Water filtration applications follow closely, driven by demand for clean water in municipal and industrial processes. Oil filtration adopts fiberglass filters for their thermal stability and compatibility with aggressive fluids in lubrication and hydraulic systems. Industrial filtration spans cement, power, and metallurgy sectors where particulate control and equipment protection remain critical. Pharmaceutical filtration represents a precision-driven segment where fiberglass filters provide sterile conditions and particle-free processing. The Fiberglass Filters market serves each application with targeted performance features and compliance standards.

- For instance, Ahlstrom supplied fiberglass media to over 4,500 water treatment plants globally , each capable of removing particles as small as 1.2 microns with an operational flow rate exceeding 1,600 liters per hour per unit.

By End-User:

The chemical industry dominates end-user adoption, leveraging fiberglass filters for emissions control, solvent recovery, and air purification under corrosive conditions. The pharmaceutical industry follows with demand for sterile and high-purity filtration across cleanrooms and production areas. The food and beverage industry applies fiberglass filters in process air systems and product safety assurance across bottling, dairy, and packaging lines. Water treatment plants depend on fiberglass media to handle suspended solids and protect downstream membranes. The automotive industry uses fiberglass filters in paint booths, air intake systems, and fluid filtration to maintain component quality. The Fiberglass Filters market offers reliable filtration technologies tailored to each sector’s operational and regulatory demands.

Segments:

Based on Product Type:

- Cartridge Filters

- Bag Filters

- Depth Filters

Based on Application:

- Water Filtration

- Air Filtration

- Oil Filtration

- Industrial Filtration

- Pharmaceutical Filtration

Based on End-User:

- Food & Beverage Industry

- Chemical Industry

- Pharmaceutical Industry

- Water Treatment Industry

- Automotive Industry

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28.7% of the global street sweeper market share, driven by robust municipal infrastructure, stringent cleanliness regulations, and continuous urban maintenance programs. The United States leads regional demand with strong procurement from city councils, state transportation departments, and private contractors. High adoption of mechanical and vacuum sweepers supports road debris removal, particularly in urban zones, highways, and parking facilities. Canada follows with investments in eco-friendly and low-emission sweepers suited for cold-weather operation and debris management during seasonal transitions. Government emphasis on sustainable urban development drives replacement of older diesel-powered models with electric and hybrid variants. The region benefits from the presence of key manufacturers offering advanced automation and telemetry-enabled equipment. It continues to invest in cleaner street environments aligned with smart city objectives and environmental benchmarks.

Europe

Europe captures 25.4% of the street sweeper market share, supported by strict environmental legislation, growing emphasis on emission reduction, and rising investment in smart mobility. Countries including Germany, France, and the United Kingdom deploy compact and low-noise electric sweepers across densely populated urban areas. Municipalities prioritize equipment that meets Euro 6 emission norms and operates efficiently within narrow streets and pedestrian zones. Italy and the Nordic countries also contribute to growth, with increasing adoption of multifunctional road-cleaning equipment suited for both dry and wet sweeping tasks. The European market benefits from early regulatory alignment toward low-emission vehicle deployment and waste collection efficiency. It sees growth in autonomous and GPS-guided sweeping systems integrated into broader smart city platforms.

Asia-Pacific

Asia-Pacific holds the largest share at 32.1%, fueled by expanding urbanization, rising population density, and government-backed investments in public sanitation. China dominates the region with significant municipal purchases aimed at improving air quality and urban hygiene. Tier-1 and Tier-2 cities invest in high-capacity mechanical and regenerative air sweepers to manage growing traffic dust and waste. India accelerates demand through Smart Cities Mission initiatives and greater budget allocations for automated road cleaning. Japan and South Korea adopt compact and electric models for use in narrow streets and environmentally sensitive areas. Local manufacturing, combined with growing infrastructure development, strengthens regional competitiveness. The Fiberglass Filters market also intersects with this trend by supporting air quality control in sweeper filtration systems.

Latin America

Latin America contributes 7.2% to the global market share, driven by gradual infrastructure modernization and increased investment in municipal services. Brazil and Mexico lead regional demand, focusing on equipment that reduces manual cleaning dependency and improves coverage in urban centers. The region still faces budget constraints and procurement inefficiencies, but demand is rising for cost-effective mechanical sweepers. Governments recognize the link between public health and urban cleanliness, encouraging partnerships with private contractors for fleet modernization. Local manufacturers and regional distributors gain traction by offering durable, easy-to-maintain equipment suited for uneven roads and mixed waste conditions.

Middle East & Africa

The Middle East & Africa region holds a 6.6% market share, led by infrastructure development projects in the Gulf countries and urban renewal initiatives in parts of Africa. The UAE, Saudi Arabia, and Qatar prioritize municipal sanitation in preparation for global events and tourism-driven urban development. High temperatures and dust-prone conditions increase the demand for sweepers with enhanced filtration and high suction capacity. Africa shows steady adoption in major cities like Johannesburg, Lagos, and Nairobi where growing urban populations stress traditional waste management systems. Procurement trends favor affordable, fuel-efficient models that require minimal maintenance. The region also explores leasing and public-private operational models to increase sweeper fleet coverage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Filtration Group Corporation

- Tri-Dim Filter Corporation

- Glasfloss Industries

- Smith Filter Corporation

- Donaldson Company, Inc.

- Superior Filtration Europe Ltd.

- Ahlstrom

- Koch Filter Corporation

- MANN+HUMMEL GmbH

- 3M Company

- Lydall, Inc.

- Camfil AB

- Parker Hannifin Corporation

- AAF International

- Freudenberg Filtration Technologies

Competitive Analysis

The leading players in the Fiberglass Filters market include Camfil AB, Donaldson Company, Inc., MANN+HUMMEL GmbH, Parker Hannifin Corporation, AAF International, Filtration Group Corporation, and Freudenberg Filtration Technologies.These companies compete through innovation in filtration media, product customization, and expanded service capabilities. They maintain strong global supply chains and technical support networks to serve industrial, commercial, and cleanroom applications. Product development focuses on high-efficiency particulate retention, thermal stability, and regulatory compliance across HVAC, pharmaceutical, food processing, and automotive sectors. Strategic acquisitions and partnerships allow these players to strengthen their portfolios and extend their geographic reach. Manufacturers continue investing in automation and sustainable production to meet rising environmental standards. Differentiation is built on filter longevity, low pressure drop, and system compatibility. Key players emphasize R&D in areas such as nanofiber integration, recyclable materials, and smart filtration technologies. They serve a diverse customer base by aligning products with operational needs, safety standards, and lifecycle cost-efficiency.

Recent Developments

- In April 2025, 3M launched the Filtrete Refillable Air Filter, a sustainable solution for residential HVAC systems. This product allows homeowners to replace only the filter media, reducing waste and offering a cost-effective alternative to traditional disposable filters. The refillable design aligns with growing environmental concerns and the push for sustainable living.

- In 2024, Parker Hannifin Corporation introduced its ChromGas Hydrogen Fuel (H2F) and Zero Air Gas (ZAG) generators, aimed at boosting performance of gas chromatography instruments in laboratory environments.

- In 2023, Camfil AB focused on enhancing its air filtration solutions for HVAC systems, in response to growing demand for improved indoor air quality.

Market Concentration & Characteristics

The Fiberglass Filters market shows moderate concentration, with a mix of global corporations and regional manufacturers competing across industrial, commercial, and residential applications. Leading players maintain strong distribution networks, advanced R&D capabilities, and diversified product portfolios tailored to HVAC, pharmaceutical, food processing, and automotive sectors. The market features both standardized and custom-engineered filter solutions, allowing suppliers to address specific regulatory and operational requirements. Product differentiation depends on factors such as filter efficiency, media durability, thermal stability, and compliance with safety standards. Companies focus on expanding sustainable production practices and enhancing filter performance through material innovations and system integration. The Fiberglass Filters market operates within a quality-driven environment, where consistent product performance and lifecycle value shape buyer decisions. It evolves in response to tightening environmental standards, increased demand for clean air solutions, and a growing shift toward energy-efficient infrastructure across key global regions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market demand will grow steadily due to stricter global air quality regulations.

- Adoption in HVAC and cleanroom systems will expand across industrial and commercial sectors.

- Integration with smart building technologies will enhance operational control and filter efficiency.

- Asia-Pacific will remain the fastest-growing region driven by urbanization and infrastructure development.

- Manufacturers will prioritize low pressure drop designs to support energy-saving goals.

- Filter replacement rates will rise in residential and commercial applications due to health-focused regulations.

- High-efficiency requirements in pharmaceutical and electronics industries will boost specialized filter demand.

- Companies will increase investment in regional production and distribution to improve market reach.

- Innovation will focus on recyclable materials and sustainable manufacturing processes.

- Market leaders will maintain a competitive edge through product customization and performance optimization.