Market Overview

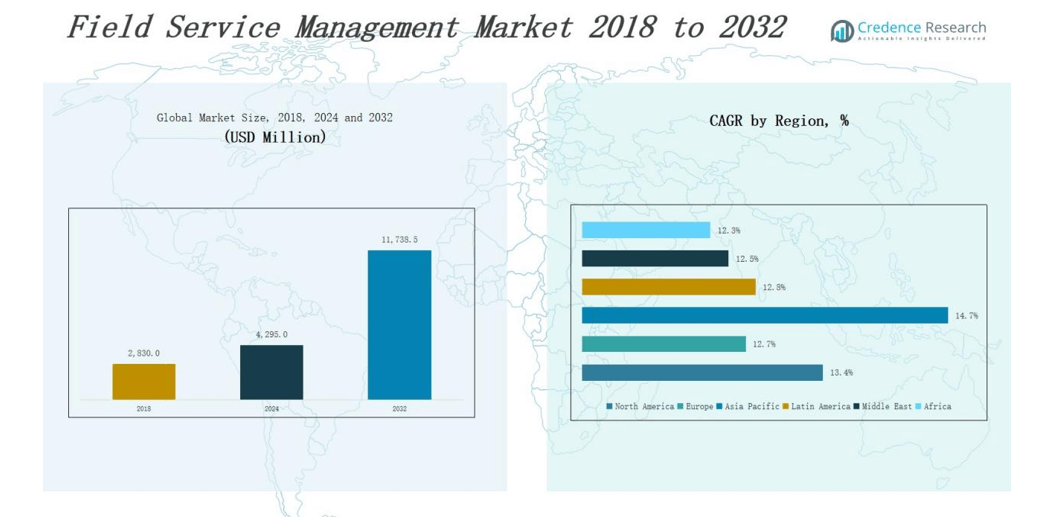

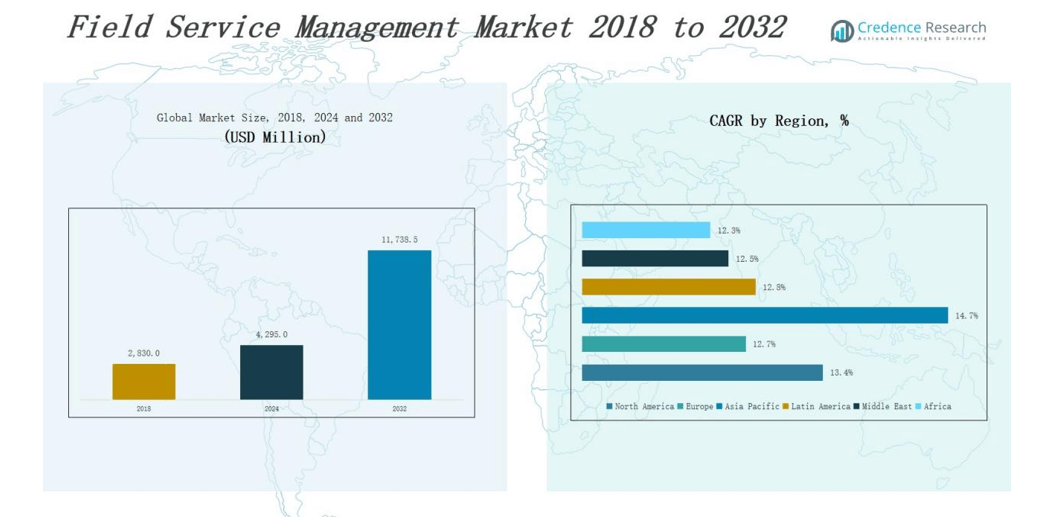

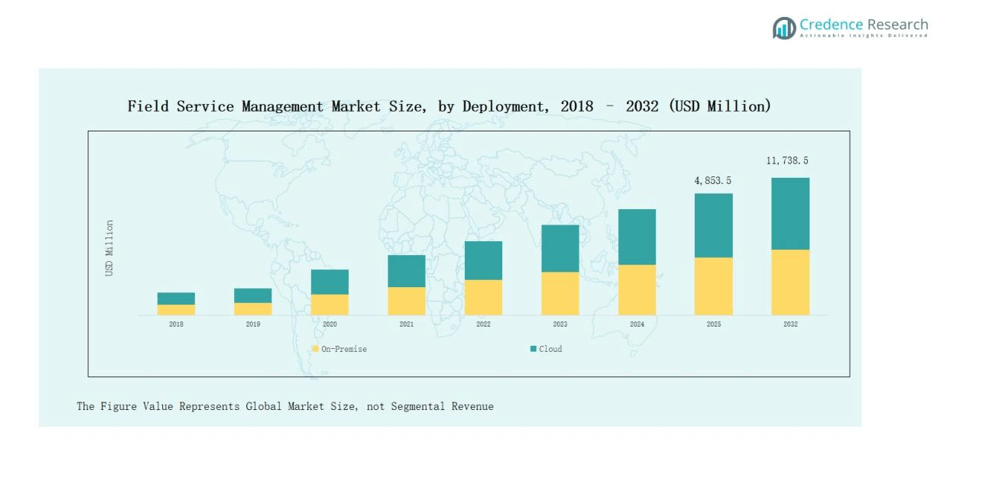

Field Service Management Market size was valued at USD 2,830.0 million in 2018 to USD 4,295.0 million in 2024 and is anticipated to reach USD 11,738.5 million by 2032, at a CAGR of 13.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Field Service Management Market Size 2024 |

USD 4,295.0 million |

| Field Service Management Market, CAGR |

13.4% |

| Field Service Management Market Size 2032 |

USD 11,738.5 million |

The Field Service Management Market is shaped by leading players such as IBM Corporation, Agile 3 Solutions LLC, Accenture, Comarch SA, Salesforce, Inc., Infor, Klugo Group, SAP SE, Astea International, Inc., Trimble Navigation Limited, and Tech Mahindra Limited. These companies strengthen the market through advanced software platforms, mobile field solutions, and integration of AI and cloud technologies to enhance service delivery and workforce productivity. Their strategies focus on innovation, global partnerships, and industry-specific solutions to meet the growing demand across manufacturing, utilities, healthcare, and logistics. Regionally, North America dominates the Field Service Management Market with a 38 percent share, supported by strong digital adoption, presence of global technology providers, and high demand for operational efficiency in large enterprises.

Market Insights

- The Field Service Management Market grew from USD 2,830.0 million in 2018 to USD 4,295.0 million in 2024 and is projected to reach USD 11,738.5 million by 2032 at a CAGR of 13.4%.

- Solutions lead with 62% share, driven by mobile field execution, workforce management, and customer management, while services account for 38%, supported by strong demand for implementation and consulting.

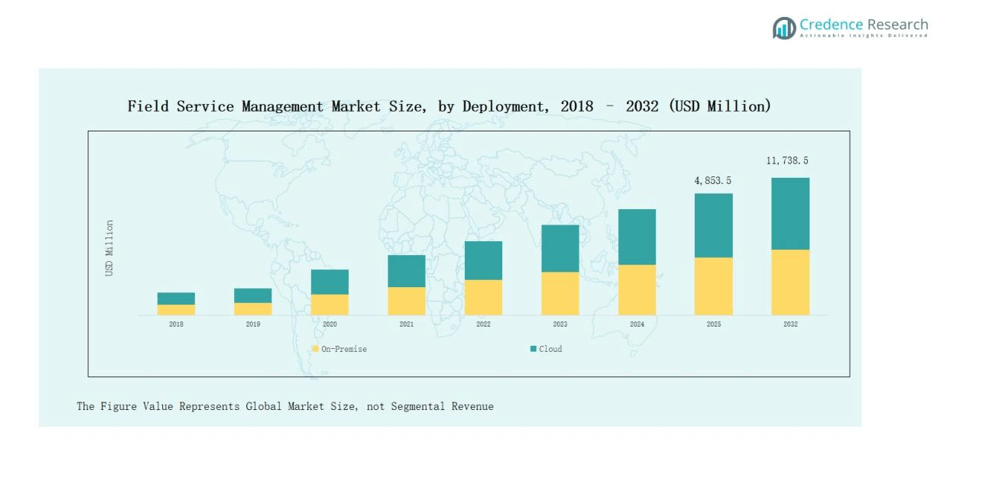

- Cloud deployment dominates with 68% share due to scalability, cost efficiency, and easy integration, while on-premise retains 32% share for regulated industries requiring tighter control and customization.

- Energy and utilities lead end-use with 29% share, followed by manufacturing at 24%, healthcare at 18%, transportation and logistics at 16%, and others at 13%, highlighting sector-specific demands.

- North America leads with 32% share, Europe follows with 29%, Asia Pacific holds 30% and grows fastest, while Latin America, Middle East, and Africa together account for 19%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

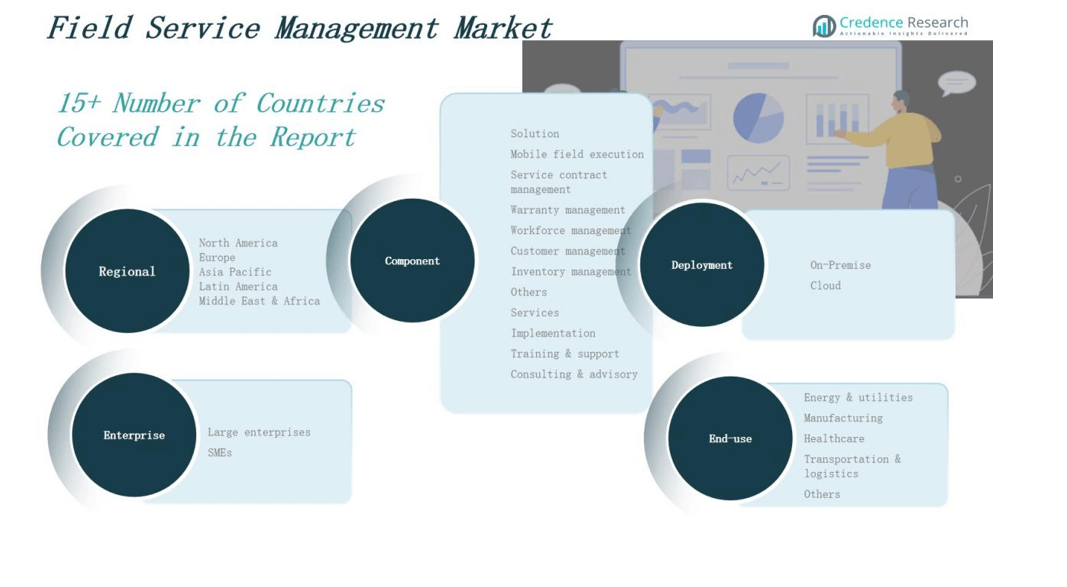

By Component

Solutions lead the Field Service Management market with a 62% share, reflecting uptake of mobile field execution, workforce management, and customer management modules. Enterprises prioritize real-time scheduling, route optimization, and closed-loop feedback to raise first-time-fix rates and SLA adherence. Services hold 38%, anchored by implementation and consulting, as buyers seek integration, data migration, and user training to realize value swiftly.

- For instance, ServiceMax reported that GE Healthcare uses its FSM platform to optimize equipment servicing, improving technician productivity and machine uptime.

By Deployment

Cloud deployment dominates with a 68% share, propelled by lower upfront costs, elastic scaling, and seamless CRM/ERP integrations. Organizations favor anywhere access, automatic updates, and built-in security certifications to accelerate rollouts and standardize processes across regions. On-premise maintains a 32% share, serving regulated environments that mandate local data control, custom workflows, and tight integration with legacy operational technologies and systems.

- For instance, Salesforce delivers three automatic updates annually for its multi-tenant cloud CRM, ensuring customers receive new features without downtime.

By End-Use

Energy and utilities lead end-use with a 29% share, driven by dispersed assets, outage response, and regulatory service-level compliance. Utilities deploy scheduling, inventory, and mobile work order capabilities to reduce truck rolls and improve reliability indices. Manufacturing holds 24%, healthcare 18%, transportation and logistics 16%, and others 13%, reflecting varied needs in equipment uptime, safety, and customer experience and satisfaction.

Market Overview

Rising Demand for Real-Time Workforce Optimization

The need for real-time workforce optimization serves as a key growth driver in the Field Service Management Market. Enterprises increasingly deploy solutions to enhance technician productivity, reduce idle time, and ensure first-time-fix rates. Mobile field execution and AI-powered scheduling enable accurate resource allocation and faster task completion. As industries prioritize efficiency, the ability to deliver seamless, data-driven workforce management strengthens FSM adoption across sectors such as utilities, manufacturing, and healthcare, ensuring operational continuity and enhanced customer satisfaction.

- For instance, Honeywell adopted a virtual reality training platform for its field technicians, achieving a 70% reduction in training costs and a 25% reduction in service time, while enhancing the accuracy and consistency of field service delivery.

Growing Adoption of Cloud-Based Solutions

Cloud deployment fuels rapid expansion in the Field Service Management Market, offering scalability, cost-efficiency, and simplified integration with existing IT ecosystems. Cloud-based platforms support remote access, real-time updates, and mobile-enabled field teams, aligning with enterprise digital transformation agendas. As organizations seek agility, cloud FSM solutions enhance collaboration, reduce infrastructure overheads, and improve overall service visibility. Widespread use of SaaS platforms and subscription-based pricing further accelerates uptake, particularly among SMEs, driving strong market momentum and reinforcing the shift toward digital-first service operations.

- For instance, Microsoft Dynamics 365 Field Service, a cloud-native solution, integrates with Azure IoT Hub to proactively detect and resolve equipment issues, minimizing site visits and improving service efficiency.

Increasing Customer-Centric Service Delivery

The growing emphasis on customer-centric service delivery significantly drives FSM adoption. Businesses deploy advanced solutions for proactive communication, transparent scheduling, and timely service resolution, improving overall customer experiences. Integration of FSM platforms with CRM systems enhances service personalization and builds stronger client relationships. Enterprises across utilities, logistics, and healthcare focus on reducing downtime, ensuring compliance, and delivering consistent service quality. As customer expectations rise, FSM tools help organizations maintain competitiveness by aligning operational efficiency with customer satisfaction, creating sustained demand across global markets.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

Artificial intelligence and predictive analytics represent a major trend shaping the Field Service Management Market. Companies leverage AI-driven forecasting to anticipate equipment failures, optimize technician routing, and reduce operational costs. Predictive tools allow for proactive maintenance strategies, minimizing downtime and improving asset utilization. The integration of machine learning into FSM enhances decision-making and resource allocation, creating opportunities for vendors to deliver more intelligent platforms. As enterprises embrace Industry 4.0, AI-enabled FSM solutions emerge as a critical enabler of smarter service ecosystems.

- For instance, Agentforce integrates real-time data and AI computing to auto-generate work orders, track inventory, and sync logistics, enabling technicians to be fully equipped before arriving at the site, which reduces delays and unnecessary return visits.

Expansion into Emerging Industries and SMEs

The expansion of FSM solutions into emerging industries and SMEs presents a significant growth opportunity. Traditionally adopted by utilities and manufacturing, FSM platforms are now gaining traction in retail, construction, and healthcare due to rising demand for operational efficiency. SMEs, in particular, benefit from cloud-based subscription models that reduce upfront investment and deliver enterprise-grade features. This democratization of FSM adoption broadens the addressable market and creates opportunities for solution providers to tailor cost-effective, scalable offerings aligned with industry-specific needs.

- For instance, Ricoh South Pacific deployed Salesforce Service Cloud and Field Service to replace eight legacy apps, significantly modernizing scheduling and reporting processes and improving overall operational efficiency.

Key Challenges

High Implementation and Integration Costs

High implementation and integration costs pose a challenge for widespread FSM adoption. Enterprises often face expenses related to software customization, system integration with existing IT infrastructure, and user training. These costs can deter smaller businesses with limited budgets from adopting advanced solutions. In addition, hidden expenses such as ongoing maintenance and upgrades create financial pressure. Vendors must address this barrier by offering modular, cost-efficient solutions and transparent pricing models to encourage adoption across small and medium enterprises seeking operational efficiency.

Data Security and Compliance Concerns

Data security remains a significant challenge in the Field Service Management Market, particularly with cloud deployments. FSM platforms handle sensitive customer information, service records, and workforce data, making them potential targets for cyberattacks. Enterprises must comply with data protection regulations across multiple regions, adding complexity to implementation. Breaches or non-compliance risks can erode customer trust and result in financial penalties. Ensuring robust security frameworks, encryption, and compliance readiness is critical for vendors to address enterprise concerns and support secure digital service transformation.

Resistance to Technology Adoption

Resistance to adopting new technologies creates challenges for FSM market growth. Many organizations, particularly in traditional industries such as utilities and logistics, rely on manual processes and legacy systems. Transitioning to digital FSM platforms often requires cultural change, process reengineering, and workforce training, which can encounter resistance from employees and management. Concerns over operational disruption during implementation further slow adoption. Vendors must invest in change management support, intuitive interfaces, and phased deployment strategies to reduce resistance and promote smoother technology adoption.

Regional Analysis

North America

North America dominates the Field Service Management Market with a 32% share in 2024, valued at USD 1,211.6 million and projected to reach USD 3,304.7 million by 2032, expanding at a CAGR of 13.4%. Growth is driven by strong digital adoption, established technology providers, and rising demand for real-time workforce optimization across utilities, manufacturing, and healthcare. The U.S. leads with significant investments in AI-powered FSM platforms and mobile workforce solutions, supported by high cloud penetration. The region’s emphasis on operational efficiency and enhanced customer experience ensures its continued leadership throughout the forecast period.

Europe

Europe holds the second-largest position with a 29% market share in 2024, generating USD 1,097.7 million and expected to reach USD 2,835.5 million by 2032 at a CAGR of 12.7%. The region benefits from strong regulatory frameworks, high enterprise IT spending, and widespread adoption of digital platforms across manufacturing, energy, and logistics sectors. Countries such as Germany, France, and the UK drive market expansion through investments in automation and cloud-based FSM systems. Increasing demand for compliance management, efficient scheduling, and predictive maintenance further enhances solution adoption, solidifying Europe’s role as a key global market contributor.

Asia Pacific

Asia Pacific represents the fastest-growing region with a 30% share in 2024, valued at USD 1,153.8 million and forecast to reach USD 3,453.8 million by 2032 at a CAGR of 14.7%. The region’s rapid digitalization, rising industrialization, and strong investments in smart infrastructure fuel demand for FSM platforms. China, India, and Japan lead adoption, driven by expanding manufacturing bases, utility upgrades, and healthcare modernization. SMEs increasingly embrace cloud-based solutions due to their scalability and cost efficiency. Growing reliance on mobile workforce management and predictive analytics positions Asia Pacific as the most dynamic and competitive FSM market globally.

Latin America

Latin America captures a 10% share in 2024, valued at USD 401.1 million and projected to reach USD 1,043.3 million by 2032, growing at a CAGR of 12.8%. Market growth is fueled by expanding telecom, energy, and logistics industries seeking digital tools for improved service delivery and asset management. Brazil leads regional adoption, supported by government-backed digitization initiatives and enterprise modernization programs. Cloud-based FSM solutions are gaining traction due to affordability and ease of deployment, especially among SMEs. Rising urbanization, coupled with the need for cost efficiency and workforce productivity, strengthens FSM adoption across the region.

Middle East

The Middle East accounts for a 6% market share in 2024, with revenue of USD 225.0 million, projected to reach USD 574.1 million by 2032 at a CAGR of 12.5%. Growth is supported by large-scale infrastructure development, smart city projects, and digitization of utilities and logistics. GCC countries dominate adoption, with strong demand for cloud-based FSM to streamline complex service networks. Sectors such as oil and gas, telecom, and healthcare are key drivers, seeking real-time monitoring and workforce optimization. The region’s focus on modernizing service delivery and improving operational transparency accelerates technology integration and market expansion.

Africa

Africa holds a 5% share in 2024, valued at USD 205.7 million and expected to reach USD 527.1 million by 2032, recording a CAGR of 12.3%. South Africa and Egypt lead adoption, while emerging economies across Sub-Saharan Africa contribute steadily. Growing investments in telecom, energy distribution, and healthcare drive FSM demand, particularly for mobile workforce execution and contract management. Cloud-based platforms are increasingly preferred due to their scalability and affordability, overcoming infrastructure challenges. The region’s gradual shift toward digital service ecosystems positions FSM as a vital tool for improving efficiency, reducing operational costs, and supporting enterprise modernization.

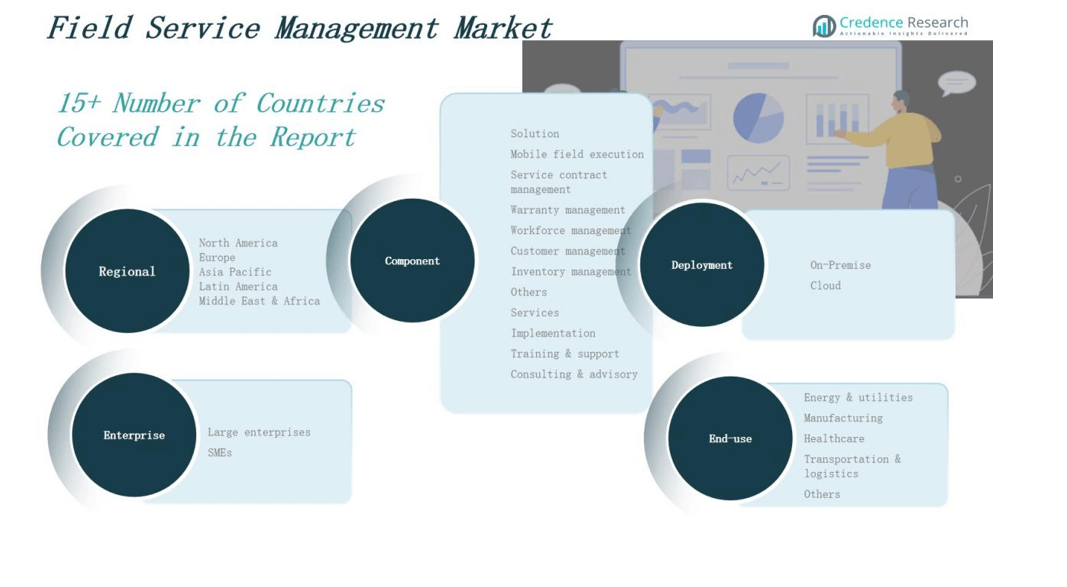

Market Segmentations:

By Component

Solutions

- Mobile field execution

- Service contract management

- Warranty management

- Workforce management

- Customer management

- Inventory management

- Others

Services

- Implementation

- Training & support

- Consulting & advisory

By Deployment

By End-Use

- Energy & utilities

- Manufacturing

- Healthcare

- Transportation & logistics

- Others

By Enterprise

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Field Service Management Market is highly competitive, characterized by the presence of global technology providers and specialized service vendors offering diverse solutions to enhance operational efficiency and customer experience. Key players such as IBM Corporation, Accenture, Salesforce, Comarch SA, Infor, SAP SE, Astea International, Trimble Navigation Limited, Tech Mahindra Limited, and Agile 3 Solutions LLC dominate through strong portfolios of mobile execution, workforce management, and cloud-based platforms. These companies emphasize innovation by integrating AI, predictive analytics, and IoT capabilities into their offerings, enabling predictive maintenance, optimized scheduling, and real-time workforce tracking. Strategic partnerships, acquisitions, and product enhancements are core strategies, as vendors seek to expand geographic presence and cater to industry-specific requirements in utilities, manufacturing, and logistics. While established players leverage scale and brand recognition, regional firms compete by delivering customized, cost-effective solutions to SMEs. The competitive landscape continues to evolve with growing demand for cloud deployments and customer-centric service delivery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- IBM Corporation

- Agile 3 Solutions LLC

- Accenture

- Comarch SA

- Salesforce, Inc.

- Infor

- Klugo Group, SAP SE

- Astea International, Inc.

- Trimble Navigation Limited

- Tech Mahindra Limited

Recent Developments

- l In May 2025, ServicePower acquired Inveniam, integrating AI-powered computer vision into its field service management platform to deliver automated quality assurance and improved operational performance.

- In August 2025, Valsoft Corporation acquired Progression (ProgressionLIVE), a leading Quebec-based FSM software provider, expanding its portfolio of vertical market solutions and strengthening its field service management capabilities.

- In June 2025, IFS AB acquired TheLoops, an industrial AI provider, expanding its AI-driven offerings within its FSM and asset management suite.

In 2025, SAP launched SAP Field Service Management 2411, enhancing its generative AI capabilities with stronger multilingual support and intelligent features to improve efficiency and service delivery

Market Concentration & Characteristics

The Field Service Management Market demonstrates a moderately concentrated structure, with leading global players holding a significant share through comprehensive product portfolios and extensive client bases. It is defined by high competition, rapid technological innovation, and a strong push toward cloud-based platforms that enhance scalability and flexibility. Large enterprises drive adoption by seeking AI-enabled scheduling, predictive maintenance, and real-time workforce optimization, while SMEs increasingly prefer subscription-based solutions that lower costs and simplify integration. Vendors actively pursue partnerships, mergers, and product advancements to expand reach and strengthen capabilities. The market is highly dynamic, shaped by rising customer expectations for transparency, compliance-driven industries, and the growing emphasis on operational efficiency across utilities, manufacturing, logistics, and healthcare. While multinational corporations dominate global revenues, regional and niche providers compete effectively by offering tailored solutions aligned with local regulatory requirements and cost sensitivities, ensuring a balance between scale-driven advantages and localized adaptability.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment , End-Use, Enterprise and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and predictive analytics will drive smarter workforce planning and service delivery.

- Cloud-based platforms will expand further as enterprises prioritize scalability and remote access.

- Mobile-first solutions will become central to technician productivity and real-time customer engagement.

- Integration with IoT devices will enable predictive maintenance and proactive asset management.

- Customer-centric platforms will gain traction as businesses focus on transparency and faster resolution.

- SMEs will increasingly adopt subscription-based solutions due to affordability and ease of use.

- Industry-specific customization will grow, addressing unique needs in utilities, healthcare, and logistics.

- Security and compliance features will strengthen to meet regulatory requirements across global markets.

- Partnerships and acquisitions will accelerate, allowing vendors to expand portfolios and global reach.

- Regional providers will capture share by delivering localized, cost-effective, and industry-aligned solutions.