Market Overview

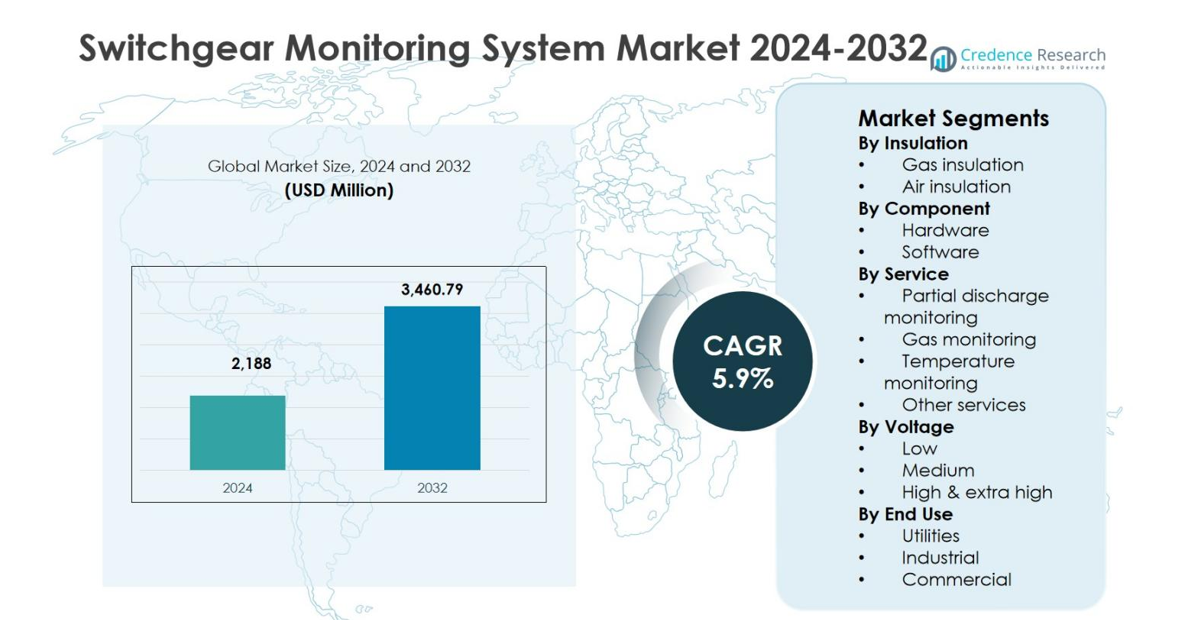

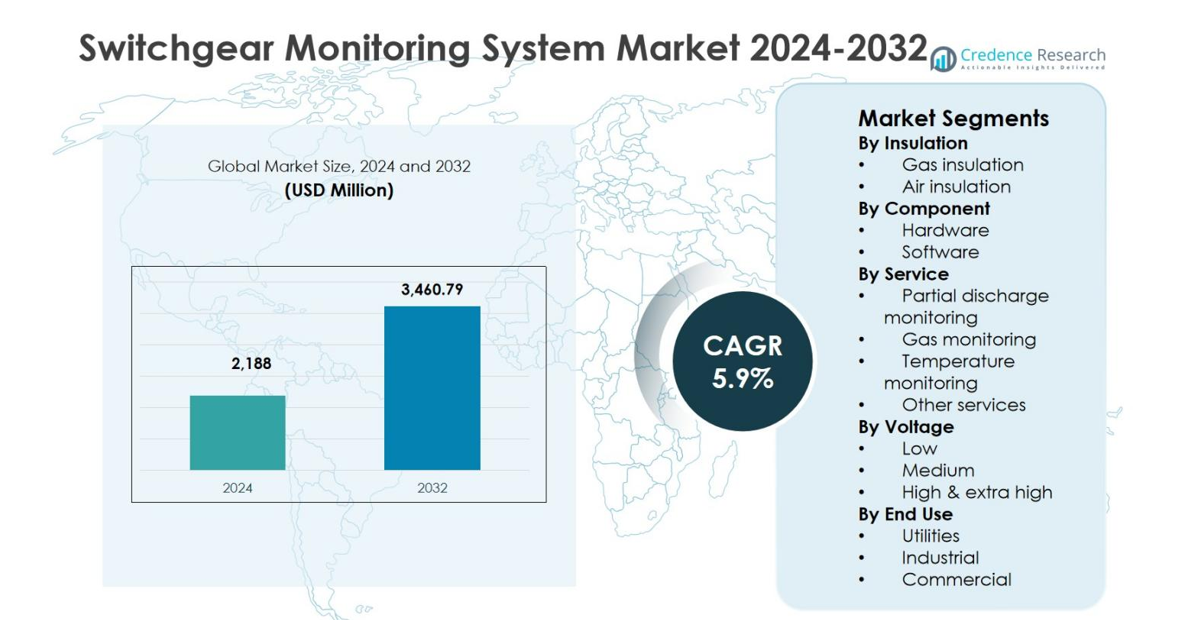

Switchgear Monitoring System Market size was valued at USD 2,188 Million in 2024 and is anticipated to reach USD 3,460.79 Million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Switchgear Monitoring System Market Size 2024 |

USD 2,188 Million |

| Switchgear Monitoring System Market, CAGR |

5.9% |

| Switchgear Monitoring System Market Size 2032 |

USD 3,460.79 Million |

Switchgear Monitoring System Market is dominated by key players such as ABB, Siemens, Eaton, General Electric, Hitachi, Mitsubishi Electric, Emerson Electric, MEGGER, IPEC LTD., and OSENA Innovations, who lead the development and deployment of advanced monitoring solutions. These companies focus on integrating IoT-enabled sensors, predictive maintenance platforms, and analytics dashboards to enhance switchgear reliability and operational efficiency. North America holds the largest regional share at 31.6% in 2024, driven by extensive smart grid adoption and infrastructure modernization. Europe follows with 27.4%, supported by industrial expansion and renewable energy integration. Asia Pacific commands 26.1% share, propelled by rapid urbanization and large-scale substation projects. Latin America, Middle East, and Africa account for 6.8%, 5.2%, and 3.0% respectively, as governments and industries adopt monitoring solutions to improve power distribution reliability and ensure regulatory compliance.

Market Insights

- Switchgear Monitoring System Market size was valued at USD 2,188 Million in 2024 and is expected to reach USD 3,460.79 Million by 2032, growing at a CAGR of 5.9%. Gas insulation leads the market with a 58.2% share in 2024, while hardware dominates the component segment with 62.5% share. Partial discharge monitoring accounts for 47.3% of the service segment.

- Rising adoption of smart grids, increasing industrialization, and regulatory compliance are key drivers boosting demand for real-time monitoring solutions across utilities and industrial sectors.

- Integration of predictive maintenance technologies, AI-enabled analytics, and the expansion of renewable energy projects are notable trends and opportunities shaping market growth.

- Leading companies such as ABB, Siemens, Eaton, General Electric, Hitachi, and Mitsubishi Electric are focusing on technological innovations, partnerships, and regional expansions to strengthen their market presence.

- North America holds 31.6% market share, Europe 27.4%, Asia Pacific 26.1%, Latin America 6.8%, Middle East 5.2%, and Africa 3.0%, reflecting strong regional adoption of monitoring solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Insulation:

The Gas Insulation sub-segment dominates the Switchgear Monitoring System Market with a 58.2% share in 2024, driven by the growing deployment of gas-insulated switchgears in urban substations and industrial facilities due to their compact size, higher reliability, and lower maintenance requirements. Rising adoption of smart grid technologies and stricter regulatory standards for equipment safety further propel demand. Air-insulated switchgears, while cost-effective, hold a smaller market share of 41.8%, primarily due to their space requirements and higher exposure to environmental risks, limiting their growth in densely populated regions.

- For instance, Hitachi Energy will deliver 1100 kV GIS for the expansion of China’s 1000 kV Nanchang UHV substation, supporting stable operations and renewable energy integration in a high-density grid node with compact, high-endurance technology.

By Component:

The Hardware sub-segment leads the Switchgear Monitoring System Market with a 62.5% share in 2024, fueled by the increasing demand for sensors, relays, and communication modules for real-time monitoring of switchgear health and operational efficiency. Hardware adoption is further driven by the integration of IoT-enabled devices and predictive maintenance solutions. The Software sub-segment, holding 37.5% share, benefits from rising adoption of analytics platforms and monitoring dashboards; however, its growth is contingent upon hardware deployment and network integration across substations and industrial environments.

- For instance, Schneider Electric launched its digitally-enabled SureSet medium voltage switchgear in February 2024, which integrates advanced sensors to detect real-time problems, allowing for immediate maintenance and reduced operational interruptions.

By Service:

Partial Discharge Monitoring emerges as the dominant service sub-segment in 2024, capturing a 47.3% market share, supported by the critical need to detect early insulation faults and prevent switchgear failures. Gas monitoring services follow with a 26.1% share, driven by regulatory mandates and environmental compliance for SF6 and other insulating gases. Temperature monitoring holds 18.5%, aiding operational safety and performance optimization. Other services account for 8.1%, encompassing maintenance support and analytics; growth in these services is propelled by the rising trend of predictive maintenance and condition-based monitoring in industrial and utility sectors.

Key Growth Drivers

Rising Adoption of Smart Grids

The increasing deployment of smart grids across developed and developing regions is a major growth driver for the Switchgear Monitoring System Market. Utilities and industrial operators are investing in real-time monitoring solutions to enhance operational efficiency, reduce downtime, and optimize asset management. Integration of IoT-enabled devices and advanced communication protocols facilitates predictive maintenance and early fault detection. This trend is accelerating the replacement of conventional switchgears with monitored systems, driving substantial market expansion globally.

- For instance, ABB’s Ability™ Condition Monitoring for Electrical Systems (CMES) integrates into switchgear like NeoGear and MNS, tracking temperature, current, energy use, and alarms in real time via on-premise Digital Edge devices.

Regulatory Compliance and Safety Standards

Stringent safety and environmental regulations are compelling utilities and industries to adopt advanced switchgear monitoring systems. Compliance with standards related to gas emissions, insulation integrity, and electrical safety necessitates continuous monitoring and fault diagnostics. Switchgear monitoring systems support preventive maintenance and mitigate risks of equipment failure, fire hazards, and operational downtime. Governments and regulatory authorities worldwide are enforcing these standards, which significantly propels the demand for both hardware and software solutions in switchgear monitoring applications.

- For instance, ABB India integrates sensors into switchgear for real-time condition monitoring and arc safety compliance, enabling predictive maintenance and fault diagnosis per industry standards.

Increasing Industrialization and Urbanization

Rapid industrial growth and urban infrastructure development are boosting the need for reliable and efficient power distribution. Industrial facilities, commercial complexes, and smart cities require uninterrupted power supply, which is supported by switchgear monitoring systems. These systems provide real-time condition monitoring, temperature analysis, and partial discharge detection, enhancing reliability and operational efficiency. Expanding power networks, coupled with increasing investments in substations and renewable energy integration, are driving the adoption of advanced switchgear monitoring solutions across multiple sectors globally.

Key Trends & Opportunities

Integration of Predictive Maintenance Technologies

The adoption of predictive maintenance through AI and machine learning is emerging as a key trend in the Switchgear Monitoring System Market. Advanced analytics enable early fault detection, reducing operational costs and equipment downtime. Companies are leveraging cloud-based monitoring platforms and remote diagnostics to optimize asset life cycle management. This presents opportunities for system integrators, hardware manufacturers, and software developers to offer value-added solutions tailored to utilities, industrial plants, and renewable energy projects, thereby increasing market penetration and fostering long-term growth.

- For instance, Schneider Electric’s EcoStruxure Foresight Operation applies machine learning to power systems for predictive analytics on electrical parameters.

Growth in Renewable Energy Deployments

Expanding renewable energy infrastructure, including solar and wind power projects, is creating new opportunities for switchgear monitoring systems. Renewable energy installations demand reliable, automated, and real-time monitoring to manage grid stability and protect high-voltage equipment. Switchgear monitoring solutions offer temperature, partial discharge, and gas monitoring, ensuring safety and efficiency in variable load conditions. Market players can capitalize on this trend by developing specialized systems for renewable energy applications, driving regional expansion and increased adoption across emerging economies.

- For instance, Siemens Energy delivered its 2000th SF6-free 8VM1 Blue GIS unit to the Hornsea 3 offshore wind farm in the North Sea, developed by Siemens Gamesa. The switchgear integrates Sensgear digital technology for enhanced monitoring and transparency in harsh marine environments.

Key Challenges

High Initial Investment Costs

The adoption of switchgear monitoring systems requires significant upfront investment in hardware, software, and installation. Many small and medium-sized enterprises face budgetary constraints, delaying system deployment. Although the solutions offer long-term operational benefits and cost savings, the high capital expenditure can restrict market growth, particularly in price-sensitive regions. Vendors need to focus on cost optimization, scalable solutions, and flexible financing models to overcome this barrier and facilitate wider adoption across industrial and utility sectors.

Integration and Technical Complexity

Integrating switchgear monitoring systems with existing infrastructure can be technically complex due to compatibility issues with legacy equipment. Ensuring seamless data acquisition, communication, and analytics requires skilled personnel and robust system architecture. Additionally, cybersecurity concerns and network reliability challenges may impede system performance. Addressing these technical complexities demands continuous innovation in hardware and software interoperability, comprehensive training programs, and standardized protocols, which remain critical challenges for market players aiming to scale adoption across diverse industrial and utility applications.

Regional Analysis

North America

The North America region holds a significant market share of 31.6% in 2024 in the Switchgear Monitoring System Market, driven by extensive adoption of smart grid technologies and modernization of aging power infrastructure. The United States and Canada are investing heavily in IoT-enabled monitoring solutions for utility and industrial applications. Rising awareness of predictive maintenance, coupled with stringent safety and environmental regulations, is accelerating the deployment of gas and air-insulated switchgear monitoring systems. Strong presence of major technology providers and early adoption of advanced analytics platforms further strengthens North America’s leadership position in the market.

Europe

Europe commands a market share of 27.4% in 2024 in the Switchgear Monitoring System Market, supported by widespread industrialization and renewable energy integration. Germany, France, and the UK are spearheading investments in high-voltage substations equipped with monitoring systems to enhance reliability and minimize operational risks. Regulatory compliance with safety and environmental standards is driving the deployment of partial discharge and gas monitoring solutions. Additionally, Europe’s focus on energy efficiency, grid automation, and digitalization initiatives in power distribution networks is contributing to robust market growth across hardware and software components within the region.

Asia Pacific

Asia Pacific represents a market share of 26.1% in 2024 in the Switchgear Monitoring System Market, fueled by rapid urbanization, industrial expansion, and renewable energy projects in China, India, Japan, and South Korea. Governments are investing in smart grids and substation modernization programs, which increase demand for temperature, gas, and partial discharge monitoring systems. Rising electricity consumption and the need for reliable power supply in industrial and urban infrastructure are major drivers. Adoption of IoT-enabled monitoring solutions and increasing penetration of gas-insulated switchgear systems provide significant opportunities for market players in this fast-growing region.

Latin America

Latin America accounts for a market share of 6.8% in 2024 in the Switchgear Monitoring System Market, primarily driven by urban electrification projects and industrial infrastructure upgrades in Brazil, Mexico, and Argentina. Demand for switchgear monitoring systems is supported by government initiatives to enhance grid reliability and reduce operational losses. Utilities are increasingly investing in gas and air-insulated switchgear with integrated hardware and software solutions. While growth is moderate compared to North America and Europe, the focus on renewable energy integration and predictive maintenance services presents opportunities for market expansion in the region.

Middle East

The Middle East holds a market share of 5.2% in 2024 in the Switchgear Monitoring System Market, driven by large-scale investments in power transmission and distribution infrastructure across the UAE, Saudi Arabia, and Qatar. The region is witnessing increased deployment of gas-insulated switchgear monitoring systems to manage high-voltage networks in extreme climatic conditions. Government-led initiatives to enhance energy efficiency and grid modernization are supporting demand for partial discharge, gas, and temperature monitoring solutions. Growth in renewable energy projects and industrial expansions further contribute to the adoption of advanced switchgear monitoring systems in this region.

Africa

Africa represents a market share of 3.0% in 2024 in the Switchgear Monitoring System Market, driven by efforts to modernize power infrastructure in South Africa, Nigeria, and Egypt. Investments in gas and air-insulated switchgear with monitoring solutions aim to improve reliability and reduce operational downtime in industrial and urban areas. Demand is supported by increasing electrification, renewable energy integration, and regulatory initiatives to enhance safety standards. While the market is still emerging, the growing focus on predictive maintenance, grid stability, and infrastructure development presents potential opportunities for market players to expand their presence across the continent.

Market Segmentations:

By Insulation

- Gas insulation

- Air insulation

By Component

By Service

- Partial discharge monitoring

- Gas monitoring

- Temperature monitoring

- Other services

By Voltage

- Low

- Medium

- High & extra high

By End Use

- Utilities

- Industrial

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the Switchgear Monitoring System Market include ABB, Siemens, Eaton, General Electric, Hitachi, Mitsubishi Electric, Emerson Electric, MEGGER, IPEC LTD., and OSENA Innovations. The market is characterized by the presence of well-established multinational corporations offering integrated hardware and software solutions for switchgear monitoring. Companies focus on technological innovation, including IoT-enabled sensors, predictive maintenance platforms, and advanced analytics dashboards, to differentiate their offerings. Strategic partnerships, mergers, and regional expansions are common to strengthen market reach, particularly in Asia Pacific and North America. Product portfolio diversification, including partial discharge, gas, and temperature monitoring systems, allows key players to address industrial, utility, and renewable energy sectors. Additionally, investments in R&D, customer support services, and digital platforms enhance operational reliability and drive adoption. Market competition is intense, with emphasis on providing cost-efficient, scalable, and compliant monitoring solutions to gain a competitive edge globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi

- ABB

- MEGGER

- Mitsubishi Electric

- Eaton

- OSENA Innovations

- IPEC LTD.

- Emerson Electric

- General Electric

- Dynamic Ratings

Recent Developments

- In June 2025, Eaton and Siemens Energy formed a strategic alliance to accelerate the delivery of power and technology solutions supporting the build‑out of new data center capacity, including integrated power systems and switchgear infrastructure deployments.

- In March 2025, Schneider Electric unveiled the EcoStruxure Service Plan featuring the PowerLogic PD100 sensor for partial discharge monitoring on medium voltage switchgear, enabling 24/7 wireless detection of issues like corona and surface discharges with real-time SMS alerts.

- In October 2025, ABB launched the MNS low-voltage switchgear integrated with the SACE Emax 3 air circuit breaker, providing advanced real-time sensing for load balance, voltage stability, temperature monitoring, and cybersecurity-certified condition monitoring.

Report Coverage

The research report offers an in-depth analysis based on Insulation, Component, Service, Voltage, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of IoT-enabled switchgear monitoring solutions will increase across utilities and industrial sectors.

- Predictive maintenance technologies will drive operational efficiency and reduce equipment downtime.

- Expansion of smart grids and substation modernization programs will create new market opportunities.

- Growth in renewable energy installations will increase demand for advanced monitoring systems.

- Integration of AI and analytics platforms will enhance fault detection and asset management.

- Gas-insulated switchgear monitoring systems will continue to dominate in urban and high-voltage applications.

- Regulatory compliance and safety standards will remain key drivers for market adoption.

- Partnerships and collaborations among key players will strengthen regional market presence.

- Emerging economies will witness gradual adoption due to infrastructure development initiatives.

- Continuous innovation in hardware and software solutions will sustain market competitiveness.