Market Overview:

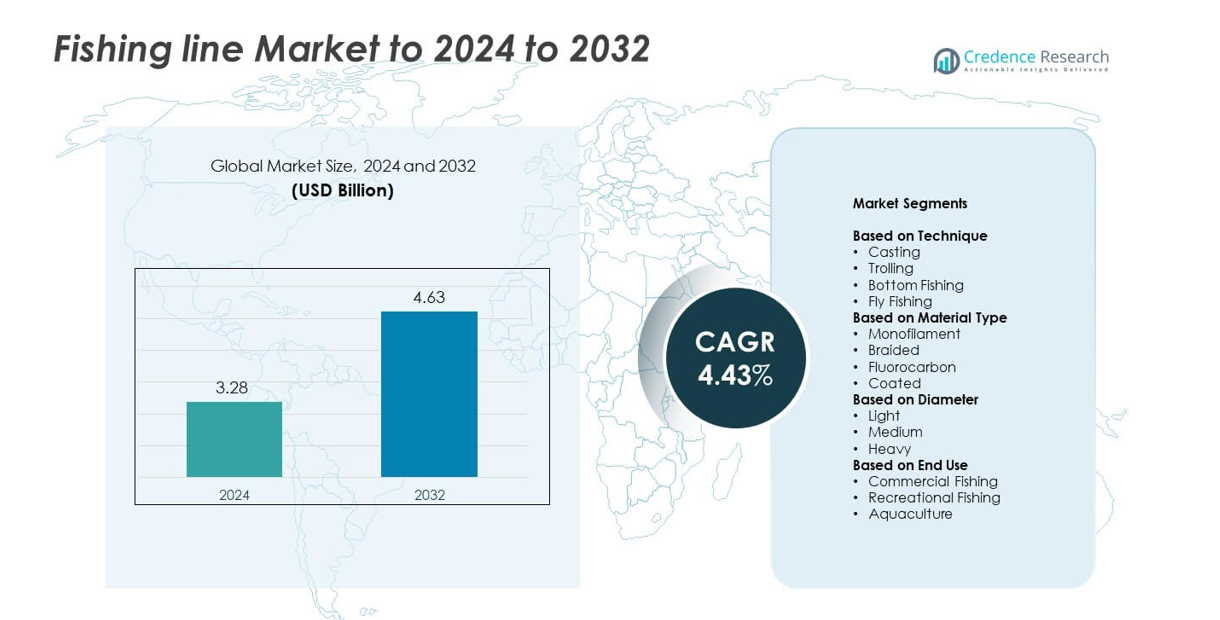

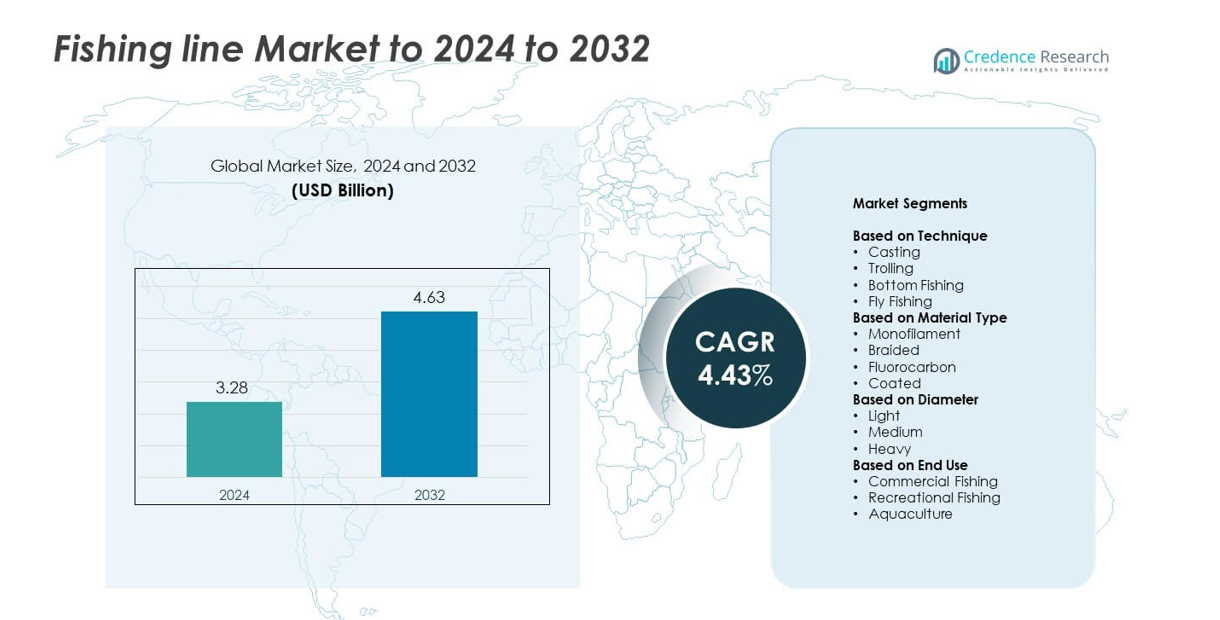

Fishing line Market size was valued USD 3.28 Billion in 2024 and is anticipated to reach USD 4.63 Billion by 2032, at a CAGR of 4.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fishing Line Market Size 2024 |

USD 3.28 Billion |

| Fishing Line Market, CAGR |

4.43% |

| Fishing Line Market Size 2032 |

USD 4.63 Billion |

Shimano, Rapala, Berkley, Daiwa, Okuma, Cabela’s, Seaguar, Sufix, Stren, Fenwick, Pline, TufLine, Zebco, Pure Fishing, and Eagle Claw lead the Fishing Line Market, driving innovation in material strength, durability, and specialized line types. These companies focus on monofilament, braided, and fluorocarbon lines to cater to recreational, commercial, and aquaculture applications. North America dominates with a 28% market share, supported by a strong recreational fishing culture and established commercial operations. Asia Pacific follows with 30% share, driven by expanding aquaculture and rising seafood demand. Europe holds 24% share, fueled by sport angling and sustainability trends. Latin America and the Middle East & Africa account for 10% and 8%, respectively, with growth supported by commercial fishing expansion and recreational adoption. Strong distribution networks and technological advancements reinforce these players’ leadership positions globally.

Market Insights

- The Fishing Line Market was valued at USD 3.28 Billion in 2024 and is projected to reach USD 4.63 Billion by 2032, growing at a CAGR of 4.43% during the forecast period.

- Rising recreational fishing participation and growth in commercial fishing and aquaculture drive market demand, supported by technological advancements in line materials.

- Trends include increasing adoption of eco-friendly biodegradable lines, demand for specialized lines for specific techniques, and expansion of e-commerce channels enhancing global accessibility.

- The market is competitive, led by established companies focusing on high-performance lines, product innovation, and broad distribution networks to maintain brand loyalty and market share.

- North America leads with a 28% share, followed by Asia Pacific at 30%, Europe at 24%, Latin America at 10%, and Middle East & Africa at 8%, with monofilament lines holding the largest segment share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technique

The Casting segment dominates the Fishing Line Market with a 38% share, driven by widespread adoption among recreational and sport anglers. Its ease of use, compatibility with various rod types, and adaptability to different water conditions fuel demand. Growing participation in freshwater and saltwater fishing tournaments further boosts casting line adoption. Manufacturers focus on producing durable, low-stretch lines that improve casting distance and accuracy, enhancing angler performance. Technological improvements, such as abrasion resistance and smooth coatings, reinforce its preference over other techniques, supporting sustained growth across both amateur and professional fishing communities.

- For instance, Shimano reports that its PowerPro Super8Slick V2 braided line in 20 lb test delivers a 0.23 mm diameter rating, enabling longer casting distance in competitive angling.

By Material Type

Monofilament lines hold the largest share at 41% in the Fishing Line Market due to their versatility, affordability, and ease of handling. Anglers favor monofilament for casting, trolling, and bottom fishing applications because of its stretch properties and knot strength. Rising recreational fishing participation and demand for beginner-friendly lines accelerate adoption. Enhanced UV and abrasion-resistant formulations improve line longevity, attracting commercial and hobbyist users. Continuous innovation in lightweight and high-visibility monofilament further strengthens its position as the preferred material type over braided, fluorocarbon, and coated alternatives.

- For instance, Berkley’s product information for the Trilene XL 10 lb test monofilament specifies a diameter of 0.28 mm (0.011 inches), and the rated break strength is 4.5 kg (10 lbs).

By Diameter

Medium-diameter lines lead the Fishing Line Market with a 36% share, offering a balance between strength, flexibility, and casting efficiency. These lines suit a wide range of freshwater and saltwater species, making them ideal for recreational and commercial fishing. Anglers prefer medium diameters for their versatility, handling ease, and reduced line memory. Advances in synthetic materials allow medium lines to provide higher tensile strength without increasing thickness, enhancing performance. The combination of durability, manageable stretch, and broad application drives continued adoption over light and heavy diameter options.

Key Growth Drivers

Rising Recreational Fishing Participation

Growing interest in recreational fishing drives the Fishing Line Market, as more individuals engage in sport and leisure angling. Expanding tourism and outdoor activity awareness contribute to increased demand for high-quality lines. Manufacturers respond with versatile, durable, and easy-to-use lines suitable for various water conditions. Government initiatives promoting recreational fishing zones and angling tournaments further stimulate market adoption. The accessibility of affordable fishing gear and beginner-friendly lines encourages hobbyists to invest in premium fishing lines, reinforcing recreational fishing as a major growth catalyst across global markets.

- For instance, Daiwa confirms its J-Braid x8 15 lb line achieves a certified 6.8 kg (15 lbs) break strength, supporting recreational anglers with higher precision and durability.

Technological Advancements in Line Materials

Innovations in monofilament, braided, and fluorocarbon lines enhance durability, tensile strength, and abrasion resistance. These advancements improve performance, casting distance, and handling, appealing to both professional and amateur anglers. Manufacturers continuously refine coatings, UV resistance, and low-stretch properties, expanding line usability across freshwater and saltwater applications. Enhanced material technology supports commercial and aquaculture operations by providing reliable, long-lasting solutions. This focus on high-performance materials enables differentiation in a competitive market and fuels adoption, making technological advancement a key growth driver in the fishing line industry.

- For instance, the Seaguar official website and product specifications for the Blue Label Fluorocarbon leader in 30 lb test list the official diameter as 0.52 mm (0.020 inches).

Expansion of Commercial and Aquaculture Fishing

Increasing global seafood demand drives commercial fishing and aquaculture growth, positively influencing the Fishing Line Market. Lines suitable for heavy-duty use and prolonged water exposure are essential for harvesting efficiency. Growth in sustainable aquaculture practices and industrial-scale fishing operations requires high-strength, low-stretch lines that ensure operational reliability. Manufacturers supply specialized products to meet these performance standards, supporting productivity and reducing material waste. Rising investments in commercial fisheries and aquaculture facilities create steady demand, positioning this factor as a crucial growth driver for the fishing line market globally.

Key Trends & Opportunities

Integration of Eco-Friendly Materials

Sustainability trends encourage adoption of biodegradable and environmentally safe fishing lines. Anglers increasingly prefer products that reduce environmental impact, particularly in protected water bodies. Manufacturers invest in research to develop recyclable or low-impact lines without compromising strength and performance. Growing awareness of aquatic ecosystem preservation provides opportunities for eco-conscious product lines. Marketing environmentally friendly lines to recreational and commercial users enhances brand value and expands market penetration. This trend offers a significant opportunity to align product innovation with environmental responsibility while attracting a new generation of responsible anglers.

- For instance, Bioline’s biodegradable monofilament 12 lb line is marketed as decomposing in approximately 5–7 years under environmental conditions, a rapid rate compared to traditional nylon’s estimated 600+ year persistence, reflecting significant eco-material progress.

Rising Demand for Specialized Lines

Anglers seek lines tailored for specific techniques, species, and water conditions, creating opportunities for innovation. High-visibility, low-stretch, and abrasion-resistant lines meet the needs of casting, trolling, and fly fishing enthusiasts. Customized diameter and material selections enhance targeting efficiency for freshwater and saltwater species. Manufacturers can capitalize on niche applications by providing premium, technique-specific products. Expanding interest in competitive fishing tournaments and sport angling further boosts demand. This trend allows brands to differentiate offerings, improve customer engagement, and strengthen market presence across recreational and professional segments.

- For instance, Sufix’s product specifications for the 832 Advanced Superline in 30 lb test list the diameter as 0.28 mm (0.011 inches).

Digital Retail and E-Commerce Expansion

Online sales channels facilitate access to fishing lines for global consumers, driving growth and adoption. E-commerce platforms offer detailed product descriptions, reviews, and competitive pricing, enhancing purchase confidence. Subscription models, bundles, and direct-to-consumer strategies improve accessibility and convenience for both recreational and commercial users. Brands can leverage digital marketing and targeted campaigns to reach new demographics and emerging markets. Expansion of online retail provides a scalable opportunity to increase sales, promote specialized product ranges, and strengthen brand recognition in the rapidly evolving fishing line market.

Key Challenges

Raw Material Price Volatility

Fluctuating prices of nylon, fluorocarbon, and other synthetic materials impact production costs and profit margins. Sudden supply shortages or geopolitical disruptions can increase line prices, affecting affordability for recreational and commercial users. Manufacturers must balance cost management with maintaining high-quality performance standards. Volatility limits predictable pricing strategies and may slow adoption in price-sensitive markets. Continuous monitoring of material markets and efficient supply chain management are necessary to mitigate this challenge, making raw material cost fluctuations a key obstacle in the fishing line industry.

Environmental Regulations and Compliance

Stringent regulations regarding aquatic pollution, line disposal, and product safety create compliance challenges for manufacturers. Lines must meet environmental standards, particularly in regions with protected water ecosystems. Failure to comply may result in penalties, restricted sales, or reputational damage. Balancing regulatory adherence with performance and cost-effectiveness requires careful design and testing. Manufacturers must invest in eco-friendly materials and sustainable production practices to remain competitive. Navigating complex regulatory frameworks presents a significant challenge for growth and innovation in the fishing line market.

Regional Analysis

North America

North America leads the Fishing Line Market with a 28% share, driven by strong recreational fishing culture and well-established commercial fishing activities. High disposable incomes and increasing participation in sport angling boost demand for premium and specialized fishing lines. Technological advancements in monofilament and braided lines, coupled with easy access through retail and e-commerce channels, support market growth. The U.S. and Canada dominate consumption, while government initiatives promoting sustainable fishing and aquaculture further enhance adoption. Rising interest in fishing tournaments, outdoor leisure activities, and eco-friendly lines contributes to steady expansion across both recreational and commercial segments.

Europe

Europe holds a 24% share in the Fishing Line Market, fueled by widespread recreational fishing and a growing focus on sport angling. Countries such as Germany, the U.K., and France lead adoption due to active angler communities and organized fishing competitions. Rising demand for eco-friendly, biodegradable lines aligns with regional environmental regulations and sustainability initiatives. Advanced distribution networks, including specialty stores and online platforms, ensure product accessibility. Technological innovations in line durability, tensile strength, and low-stretch properties encourage higher adoption across recreational and commercial applications, positioning Europe as a key growth region for fishing lines.

Asia Pacific

Asia Pacific accounts for a 30% share of the Fishing Line Market, supported by expanding commercial fisheries, aquaculture, and recreational angling in countries such as China, Japan, and Australia. Increasing seafood demand drives industrial-scale fishing operations requiring high-strength, low-stretch lines. Growth in tourism and leisure fishing promotes recreational use, while technological improvements in monofilament and fluorocarbon lines enhance performance. E-commerce and retail penetration improve accessibility for both urban and rural consumers. Favorable government policies supporting fisheries and sustainable aquaculture further stimulate demand, making Asia Pacific the largest regional contributor to the global fishing line market.

Latin America

Latin America contributes a 10% share in the Fishing Line Market, driven by growing commercial fishing and recreational angling in countries such as Brazil, Mexico, and Argentina. Expanding aquaculture operations and rising demand for seafood products support high-strength and durable line adoption. Increasing awareness of sustainable fishing practices encourages interest in eco-friendly monofilament and braided lines. Retail and online channels enhance accessibility, particularly in urban regions. Participation in local and regional fishing tournaments further stimulates demand. Despite limited technological penetration compared to North America and Europe, Latin America presents consistent growth opportunities in both recreational and commercial fishing line segments.

Middle East & Africa

The Middle East & Africa holds an 8% share in the Fishing Line Market, supported by commercial fishing hubs and recreational angling in coastal nations. Increasing aquaculture initiatives and seafood consumption drive adoption of strong, corrosion-resistant lines suitable for saltwater conditions. Rising tourism and leisure activities promote sport fishing, while specialty stores and online platforms enhance product accessibility. Government initiatives targeting sustainable fisheries and regulatory compliance encourage eco-friendly line usage. Investment in modern fishing techniques and improved distribution channels strengthens market growth, making Middle East & Africa a steadily expanding regional contributor to the global fishing line industry.

Market Segmentations:

By Technique

- Casting

- Trolling

- Bottom Fishing

- Fly Fishing

By Material Type

- Monofilament

- Braided

- Fluorocarbon

- Coated

By Diameter

By End Use

- Commercial Fishing

- Recreational Fishing

- Aquaculture

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Shimano, Rapala, Berkley, Daiwa, Okuma, Cabela’s, Seaguar, Sufix, Stren, Fenwick, Pline, TufLine, Zebco, Pure Fishing, and Eagle Claw are prominent competitors in the Fishing Line Market, driving innovation and shaping industry standards. These companies focus on developing high-performance lines with enhanced durability, tensile strength, and abrasion resistance to meet diverse fishing applications, including recreational, commercial, and aquaculture. Continuous investment in research and development enables the introduction of eco-friendly and biodegradable materials, aligning with growing environmental concerns. Companies leverage both retail and e-commerce channels to expand market reach and improve accessibility for global consumers. Strategic product diversification, including specialized lines for casting, trolling, fly fishing, and bottom fishing, strengthens brand portfolios and customer loyalty. Emphasis on marketing, sponsorships, and engagement with angler communities further reinforces competitive positioning. Overall, the market remains dynamic, with innovation, quality, and distribution efficiency serving as primary drivers of competitive advantage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Shimano

- Rapala

- Berkley

- Daiwa

- Okuma

- Cabela’s

- Seaguar

- Sufix

- Stren

- Fenwick

- Pline

- TufLine

- Zebco

- Pure Fishing

- Eagle Claw

Recent Developments

- In 2025, Okuma introduced the Pulse Wave Rod Series designed for all-purpose and inshore fishing with features optimized for braided lines.

- In 2025, Rapala, through its Sufix brand, launched the Sufix Revolve Ultra Thin Finesse Braid.

- In 2023, Daiwa Australia introduced J-Braid Expedition, described as its “most advanced” braid, using IZANAS fibres plus a new Silicon “Coating PE” to make the braid slicker, smoother, and more durable with hydrophobic properties

Report Coverage

The research report offers an in-depth analysis based on Technique, Material Type, Diameter, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising recreational fishing participation will continue to drive global demand.

- Technological advancements in monofilament, braided, and fluorocarbon lines will enhance performance.

- Growth in commercial fishing and aquaculture will sustain high-strength line adoption.

- Eco-friendly and biodegradable lines will gain traction due to environmental awareness.

- Online retail expansion will improve accessibility and increase consumer reach.

- Specialized lines for specific fishing techniques will attract hobbyists and professionals.

- Emerging markets in Asia Pacific and Latin America will show significant growth.

- Participation in sport fishing tournaments will boost premium line demand.

- Regulatory compliance and sustainable practices will influence product innovation.

- Continuous R&D will create durable, lightweight, and versatile fishing lines for diverse applications.