Market Overview:

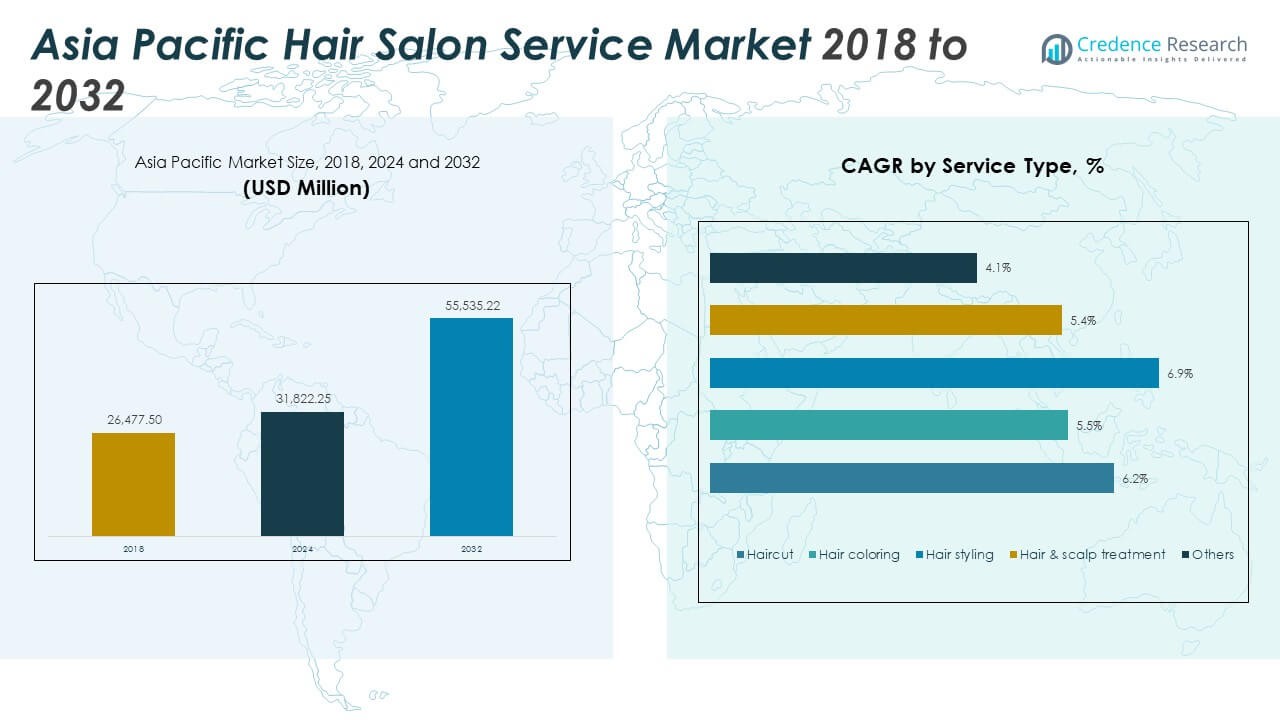

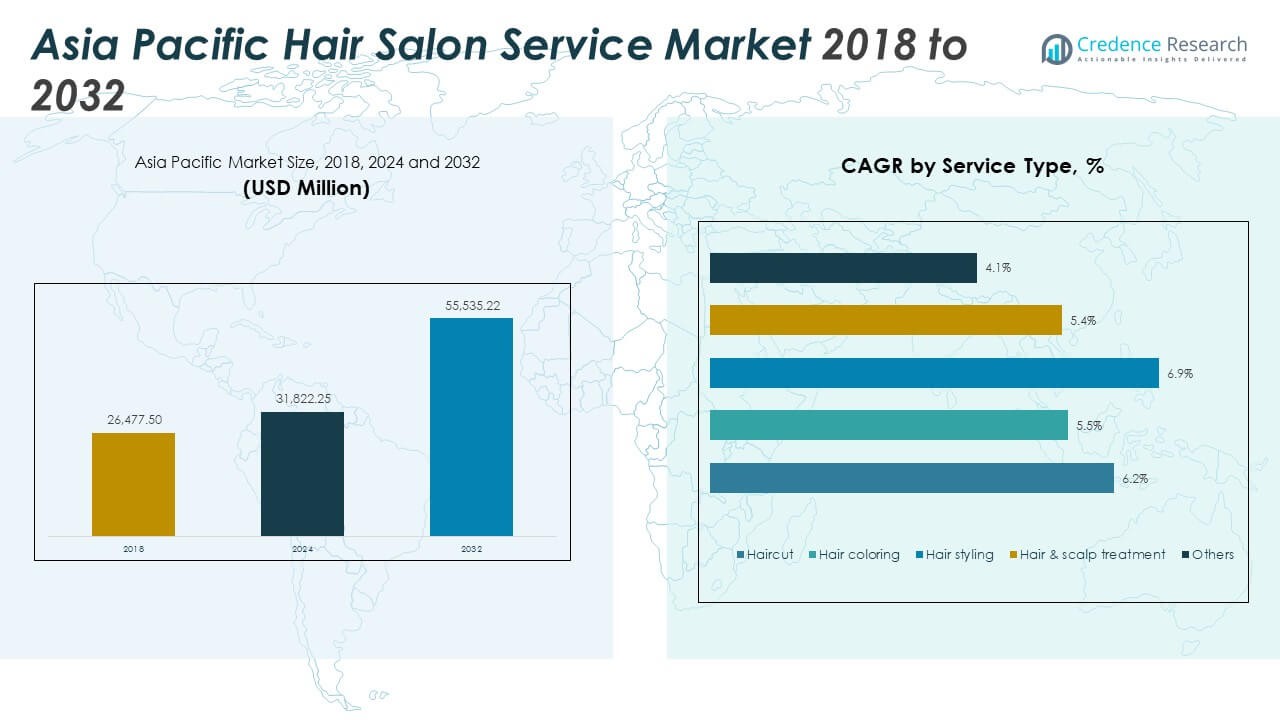

The Asia Pacific Hair Salon Service Market size was valued at USD 26,477.50 million in 2018, grew to USD 31,822.25 million in 2024, and is anticipated to reach USD 55,535.22 million by 2032, at a CAGR of 7.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Hair Salon Service Market Size 2024 |

USD 31,822.25 Million |

| Asia Pacific Hair Salon Service Market, CAGR |

7.30% |

| Asia Pacific Hair Salon Service MarketSize 2032 |

USD 55,535.22 Million |

Rising consumer disposable income, increased urbanization, and the widespread adoption of Western beauty trends are actively driving growth in the Asia Pacific Hair Salon Service Market. The increasing influence of social media, celebrity culture, and a growing young population have further boosted demand for professional haircare, styling, and customized beauty services. Additionally, expansion of organized retail and premium salon chains is helping transform industry standards and enhance service quality, making premium and specialized salon services accessible to a wider demographic.

Within the region, countries such as China, Japan, and India are taking the lead in terms of market share due to their large urban populations, evolving lifestyles, and rapid economic progress. Southeast Asian nations like Indonesia, Thailand, and Vietnam are emerging rapidly, propelled by a rising middle class and expanding number of branded salons targeting aspirational consumers. Meanwhile, developed markets remain strong thanks to an established culture of grooming and frequent salon visits, while emerging markets see dynamic growth fueled by increasing consumer awareness and demand for modern services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific Hair Salon Service Market was valued at USD 26,477.50 million in 2018, reached USD 31,822.25 million in 2024, and is projected to attain USD 55,535.22 million by 2032, registering a CAGR of 7.30% during the forecast period.

- China leads the driven by its large urban population, rising disposable incomes, and robust digital commerce infrastructure. Japan and India follow closely, fueled by strong cultural grooming practices and rapid economic growth.

- South Korea is the fastest-growing market powered by innovations in beauty technology and the influence of K-beauty trends on regional consumer preferences.

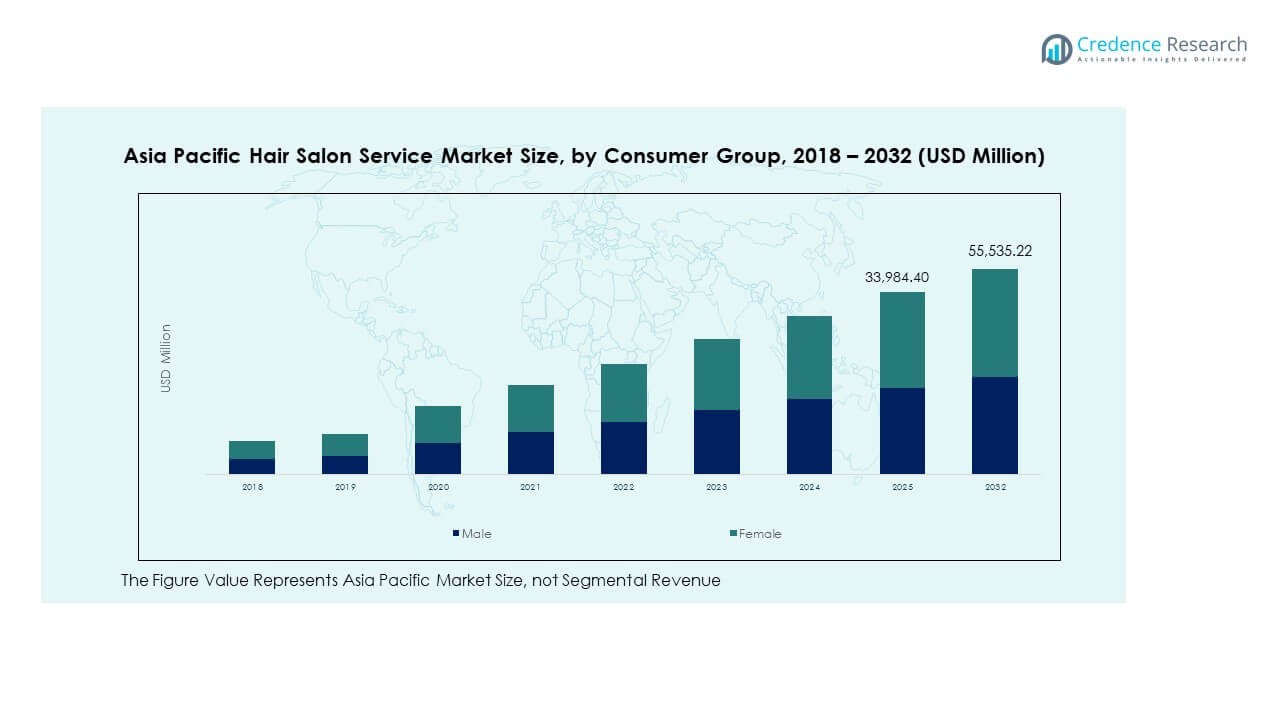

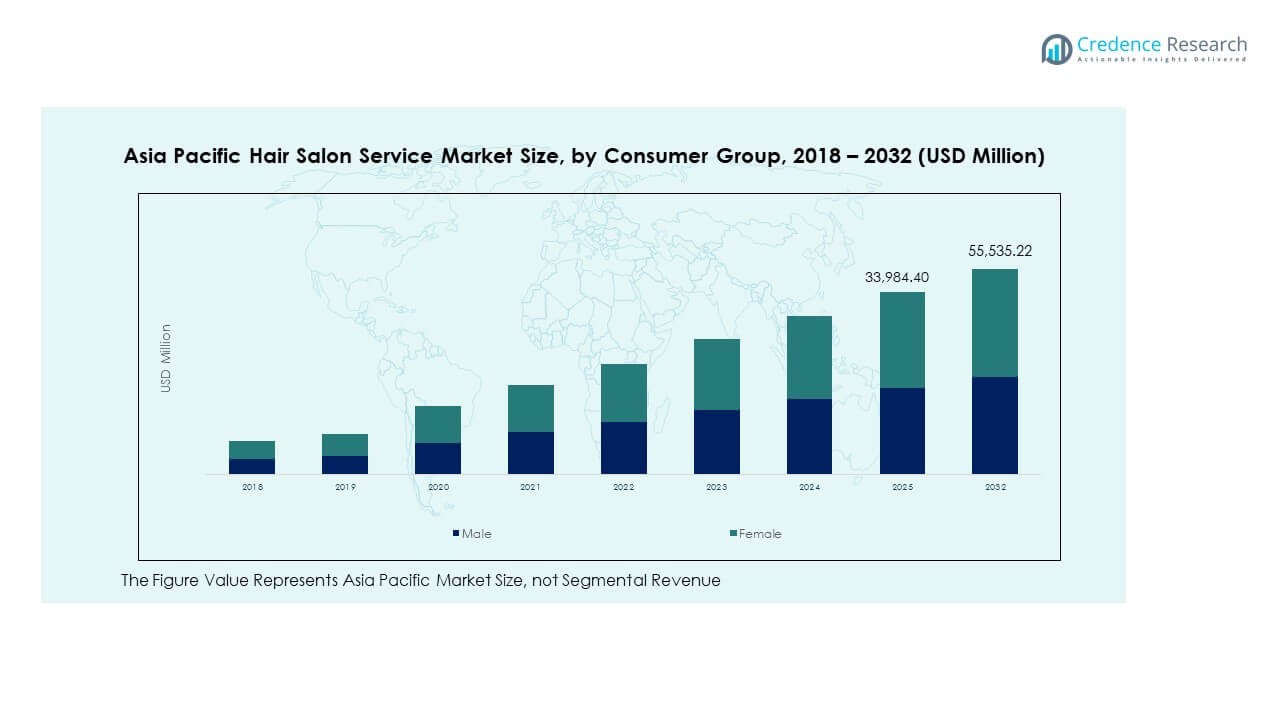

- Female consumers contribute approximately 65% of total market revenue, while male consumers account for the remaining 35%, reflecting broader demographic engagement.

- Among services, haircutting dominates, representing over 40% of total service demand due to its universal appeal across genders, age groups, and regional markets. This segment continues to anchor growth while other services such as coloring, styling, and scalp treatments contribute to expanding market diversification.

Market Drivers

Rising Disposable Incomes and Urbanization

The Asia Pacific Hair Salon Service Market benefits from rising disposable incomes and rapid urban expansion, encouraging discretionary spending on personal care. China and India, driven by large young populations, show strong demand for international beauty trends. Increased awareness of grooming and wellness drives traffic to organized salons, while support for SMEs fuels network expansion across cities. Digital platforms simplify bookings, and targeted marketing reaches consumers seeking convenience and premium experiences. Growing female workforce participation and demand for organic beauty products further strengthen market growth, amplified by social media and celebrity influence.

- For example, Lakmé Salon operated over 470 franchise locations across India in early 2023, reflecting substantial network growth. The brand also strengthened digital capabilities through an online booking platform and expanded e-commerce offerings, as confirmed by official statements and industry reports.

Expanding Middle-Class Population and Lifestyle Shifts

The growing middle class and changing lifestyles increase salon visits, with consumers willing to invest in professional styling and appearance management. Urban migration exposes clients to branded salons and modern services. Millennials and Gen Z drive interest in personalized treatments and global hair trends. Busy lifestyles promote express services, mobile bookings, and loyalty programs, while heightened awareness of scalp and hair health supports specialty services. Rising men’s grooming demand and diversified offerings create new revenue streams for salons.

Technology Integration and Digital Transformation

Adoption of digital tools reshapes customer experiences and operational efficiency. Online booking systems, virtual consultations, mobile apps, and advanced payment solutions improve convenience, engagement, and retention. Data analytics enable targeted promotions and inventory optimization, while social commerce and influencer collaborations boost client acquisition. Technology-driven marketing strategies help salons reach niche segments, strengthen loyalty, and unlock new growth opportunities.

Social Media Influence and Celebrity Endorsements

Social media platforms accelerate beauty trend dissemination and amplify celebrity and influencer campaigns. Tutorials, livestreams, and shoppable content encourage adoption of premium services, while interactive content and events enhance client engagement. User-generated content and peer reviews extend market reach and credibility. Real-time interaction and educational series provide opportunities to showcase service innovation, strengthening brand visibility and conversion rates.

- For example, Nykaa’s Instagram account (@mynykaa) had approximately 3 million followers as of November 2025, establishing it as one of the leading beauty-focused social media platforms in the Asia Pacific region.

Market Trends

Sustainability and Eco-Friendly Practices

Growing health and environmental consciousness drives salons to adopt eco-friendly products, packaging, and waste management practices. Green certifications, clean formulations, cruelty-free products, and responsible sourcing gain consumer importance. Urban clients prioritize natural and allergen-free products, while regulatory standards encourage energy-efficient equipment and chemical-free services. Salons emphasize environmental stewardship to attract discerning clients, reflecting a broader shift toward sustainable operations.

- For example, Aveda manufactures all products at its primary facility using 100% wind power and has achieved over 85% of packaging made from post-consumer recycled PET. The brand is widely recognized for vegan formulations and carbon-neutral manufacturing, verified through company disclosures and independent audits.

Omnichannel Strategies and E-Commerce Integration

Salons increasingly adopt omnichannel strategies, integrating online booking, virtual consultations, and e-commerce product sales to enhance accessibility and convenience. Social commerce allows direct sales via livestreams and influencer collaborations, while specialty in-store experiences cater to high-value treatments. Mobile-first approaches support tech-savvy markets, enabling the market to expand reach, accelerate growth, and deliver seamless brand experiences.

- For example, Regis Corporation operates a large network of salons across the U.S. and internationally, leveraging digital platforms for appointments and customer engagement. The company emphasizes online booking and mobile app adoption to enhance convenience and client experience, reflecting its focus on technology-driven service delivery.

Personalization and Customized Services

Personalized care becomes central, with salons offering tailored treatments based on hair type, lifestyle, and preferences. Advanced consultations, scalp analysis, and data-driven recommendations improve client satisfaction and repeat visits. AI and machine learning support niche service design for specific age or ethnic segments. Focus on customized experiences strengthens customer relationships and promotes effective product usage.

Premium and Wellness-Oriented Offerings

Premiumization drives the introduction of luxury services, relaxation therapies, and holistic wellness solutions. Collaborations with global cosmetic brands elevate salon prestige, while wellness-focused packages appeal to health-conscious consumers. Integrated hair, scalp, and skin solutions position salons as destinations for luxury and well-being, differentiating them in competitive urban markets.

Market Challenges Analysis

Competition from Unorganized Sector and Budget Constraints

High competition from unorganized salons and budget-conscious clients pressures pricing and margins. Premium brands must invest in interiors, equipment, and branded products to attract clients, posing challenges for smaller operators. Continuous innovation in service quality, technology adoption, and customer experience is required to maintain market position.

Regulatory Complexity and Compliance Requirements

Diverse regulations across Asia Pacific countries complicate ingredient approvals, safety testing, labeling, and marketing claims. Compliance with evolving rules such as halal certification, microplastic limits, and chemical restrictions—requires investment in expertise to ensure smooth market entry, safeguard reputation, and maintain legal adherence.

Market Opportunities Analysis

Collaborations with Cosmetic and Retail Brands

Partnerships with established cosmetic brands allow salons to offer premium products and co-branded services. Exclusive treatment packages and loyalty programs attract discerning clients, drive revenue, and enhance brand credibility. Such collaborations foster innovation and provide competitive advantages in both mature and emerging markets.

Expansion into Emerging Urban and Semi-Urban Centers

Rapid urbanization in Tier II and Tier III cities creates opportunities for market expansion. Salons tailor services to local preferences while leveraging digital marketing, influencer campaigns, and online platforms to acquire new clients. Growth in these regions increases volumes, brand visibility, and accessibility, supporting the Asia Pacific Hair Salon Service Market’s long-term development.

Market Segmentation Analysis

By Service Type

Haircut services remain the core of the Asia Pacific Hair Salon Service Market, generating recurring demand from men and women seeking regular grooming and style updates. Hair coloring and styling attract fashion-conscious urban consumers looking for innovative looks and global trends. Hair and scalp treatments—including nourishing masks and clinical therapies—benefit from rising wellness awareness and hair health concerns. The “Others” category, encompassing hair extensions, bridal packages, and event-driven services, diversifies salon offerings and strengthens client retention.

- For example, L’Oréal’s Colorsonic device automates hair coloring using an oscillating nozzle that moves around 300 times per minute, ensuring even dye application. The device was demonstrated at CES 2022 and showcased L’Oréal’s innovation in haircare technology.

By Salon Type

Full-service salons dominate urban markets, providing end-to-end solutions with premium ambiance and convenience. Chain and franchise salons expand rapidly, leveraging brand recognition, standardized quality, and loyalty programs for broader reach. Modernized barbershops appeal to male consumers seeking traditional grooming fused with contemporary styles. Mobile and at-home salons cater to growing demand for personalized, on-demand services, while salon-spa formats combine hair care with holistic wellness experiences for health-conscious clientele.

- For example, Jean Louis David’s chain operated 1,000+ salons worldwide as of 2023, maintaining standardized service protocols and salon layouts confirmed on their official site.

By Consumer Group

The female segment drives the majority of revenue, with rising interest in experimental coloring, advanced treatments, and frequent salon visits aligned with evolving beauty standards. Male consumers are increasingly investing in grooming routines, beard care, and specialty hair services. Both segments benefit from targeted marketing, loyalty initiatives, and differentiated service menus, supporting inclusive market growth across demographics.

By Price Range

Premium salons lead in metropolitan areas, offering luxury services, exclusive products, and expert staff to clients seeking high-end, personalized experiences. Mid-market and value/economy salons drive footfall through affordable packages and promotions, catering to diverse income groups. This pricing mix ensures professional hair care remains accessible while maintaining aspirational appeal for premium offerings in the Asia Pacific market.

Segmentation

By Service Type

- Haircut

- Hair colouring

- Hair styling

- Hair & scalp treatment

- Others

By Salon Type

- Full-Service Salons

- Chain/Franchise Salons

- Barbershops

- Mobile/At-Home Salons

- Salon-Spas

By Consumer Group

By Price Range

- Premium

- Mid-Market

- Value/Economy

Regional Analysis

East Asia

East Asia leads the Asia Pacific Hair Salon Service Market, holding an estimated 36% share, largely driven by China’s dominance due to rapid urbanization, high disposable incomes, and advanced digital commerce infrastructure. Japan and South Korea also contribute significantly, with Japan showing the highest per-capita salon spending and strong demand for premium and anti-aging services. South Korea exhibits the fastest growth, fueled by innovative beauty technologies and the global influence of K-beauty trends. The subregion benefits from widespread salon chain expansion, advanced consumer awareness, and high adoption of premium services, shaping broader regional trends through digital integration and wellness-focused offerings.

Southeast Asia

Southeast Asia accounts for approximately 23% of the market, with Thailand, Singapore, Vietnam, and the Philippines driving growth through urbanization and a rising middle class. Economic development and increasing beauty consciousness boost salon visit frequency and support the expansion of both international and local brands. The younger population’s interest in new styling and coloring services fuels demand for mid-market and value-oriented salons. Regional diversity in hair types, coupled with tropical climates, drives specialized treatment offerings, while influencer marketing and digital platforms strengthen engagement with urban consumers.

South Asia and Oceania

South Asia, led by India, represents around 17% of the market, supported by expanding urban centers and rising incomes among aspirational middle-class consumers. India drives strong growth across both budget and premium salon segments. Oceania, comprising Australia and New Zealand, features mature markets with high standards for service, organic and sustainable product preferences, and steady premium segment expansion. These subregions collectively address distinct consumer demands and contribute to the overall dynamics and growth of the Asia Pacific Hair Salon Service Market.

Key Player Analysis

- Franck Provost

- Lakmé Salon

- Naturals Salon

- VLCC

- TAYA

- QB House

- Shiseido Beauty Salon

- Rizz Hair Salon

- Spa Esprit Group

- Hairloom

- The Edge Hairdressing

- Kim Robinson

Competitive Analysis

The Asia Pacific Hair Salon Service Market is marked by intense competition among established chains, boutique specialists, and emerging regional players. Leading operators such as Great Clips, Regis Corporation, Toni & Guy, and Ulta Beauty collectively capture approximately 20%–25% of the market, leveraging franchise models, consistent service quality, and extensive geographic coverage. These chains focus on urban shopping centers and residential areas, catering to convenience-oriented and style-conscious clients while strengthening loyalty through multi-location accessibility and reward programs. The market also faces competition from local chains, independent salons, and innovative startups, particularly in high-growth markets like China, South Korea, and India, where consumer tastes and service expectations shift rapidly. Boutique salons and regional franchises distinguish themselves with premium offerings, eco-friendly products, and specialized hair and scalp treatments. Meanwhile, the unorganized segment remains sizable in developing economies, providing flexible pricing and tailored services for budget-conscious consumers, though it lacks the scalability and brand recognition of larger chains. Digital transformation further intensifies competition, with online booking platforms, mobile payment systems, and influencer-driven campaigns enabling both major and smaller players to expand reach.

Recent Developments

- In March 2025, Lakmé Salon unveiled its newest hair and fashion collection titled ‘Alchemy’ at Lakmé Fashion Week X FDCI 2025, in partnership with iconic fashion label Satya Paul. The initiative not only showcased the creative synergy between beauty and fashion but also reiterated Lakmé Salon’s position at the forefront of trend-driven hair and makeup artistry in India.

- In March 2024, Franck Provost, the renowned European hair salon brand, officially launched its beauty salon in Bengaluru, India, marking a strategic expansion into the Asia Pacific region with a new upscale location that is expected to further consolidate its brand presence in the country’s premium haircare segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Salon Type, Consumer Group and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Asia Pacific Hair Salon Service Market will expand service portfolios with advanced treatments and wellness packages to meet evolving lifestyle and health-conscious preferences.

- Rapid urbanization will drive salon network growth into Tier II and Tier III cities, increasing accessibility for emerging consumer segments.

- Sustainability and eco-friendly products will influence competitive advantage, prompting salons to adopt green operations and clean beauty solutions.

- Digital transformation will accelerate through online booking, virtual consultations, loyalty apps, and targeted digital marketing for tech-savvy clients.

- Personalization will be a market differentiator, with customized services, advanced diagnostics, and tailored home-care recommendations.

- The premium segment will grow, fueled by rising incomes, aspirational lifestyles, and willingness to invest in luxury and holistic salon experiences.

- Male grooming services will see strong growth, driven by shifting cultural norms, targeted offerings, and innovative wellness and style solutions.

- Strategic collaborations with cosmetic and retail brands will expand offerings, co-branded services, and market reach.

- Organized chains and franchises will increase market share by standardizing quality, branding, and service consistency.

- Investments in staff training and advanced equipment will enhance service quality, client satisfaction, and repeat business.