Market Overview:

Demand grows due to the rising number of individuals with swallowing disorders linked to aging, neurological conditions, and post-stroke recovery. Healthcare providers use thickening agents to reduce choking risks and improve nutrition intake for patients with dysphagia. Product innovation, such as starch-free or xanthan-based blends, improves texture stability and ease of preparation. Home-care adoption rises as more patients manage dysphagia outside hospitals. Growing clinical preference for products that maintain consistency helps drive brand differentiation across the market.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dysphagia Diet Thickening Agents Market Size 2024 |

USD 460.02 million |

| Dysphagia Diet Thickening Agents Market, CAGR |

3.8% |

| Dysphagia Diet Thickening Agents Market Size 2032 |

USD 619.95 million |

North America leads due to strong clinical awareness, higher diagnosis rates, and robust adoption across hospitals and nursing homes. Europe follows with structured dysphagia management programs and wide use of standardized texture-modified diets. Asia Pacific emerges as a fast-growing region as aging populations expand, especially in Japan, China, and South Korea. Growth in emerging markets is supported by improving healthcare access and rising attention to elderly nutrition. Latin America and the Middle East & Africa show steady adoption as care facilities upgrade dysphagia management practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

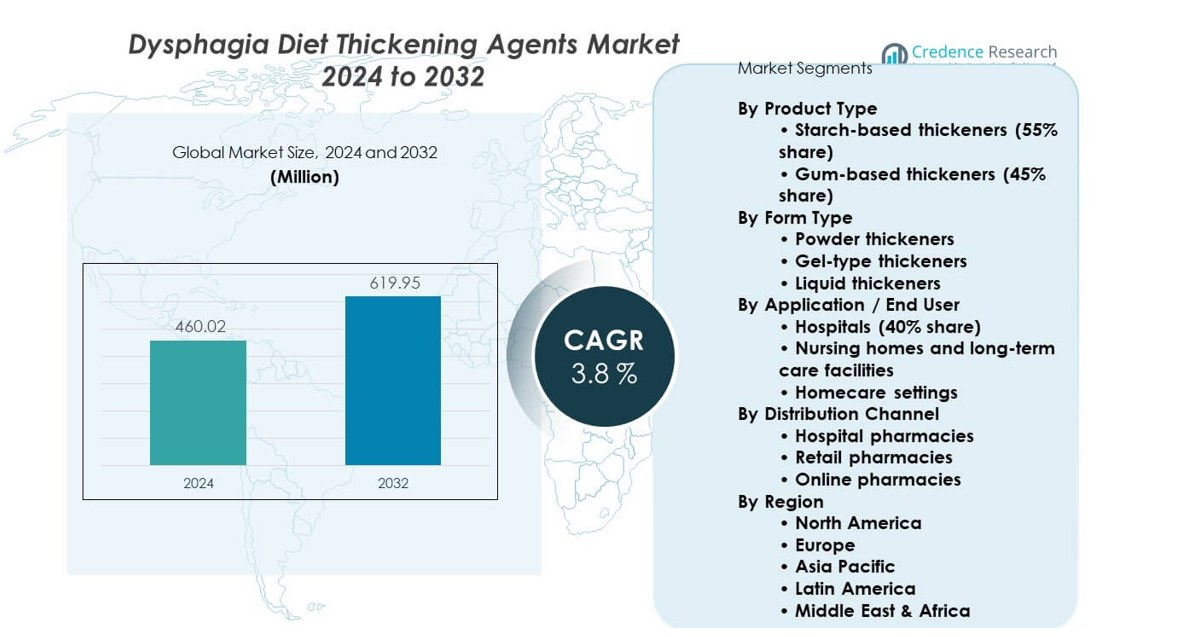

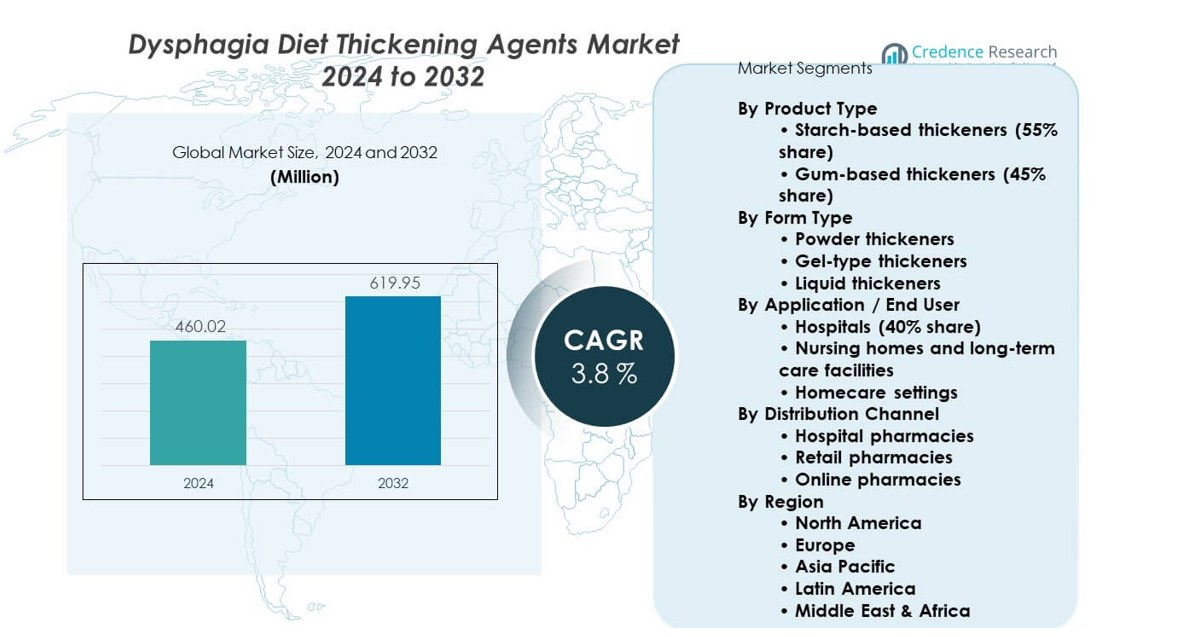

- The market was valued at USD 460.02 million in 2024 and is projected to reach USD 619.95 million by 2032, growing at a 3.8% CAGR, supported by rising dysphagia management needs across clinical and home settings.

- North America leads with 38% share, Europe follows with 30%, and Asia Pacific holds 22%, driven by strong diagnosis rates, structured diet protocols, and higher adoption of standardized texture diets.

- Asia Pacific remains the fastest-growing region with 22% share, supported by expanding elderly populations and increasing awareness of safe swallowing practices.

- By product type, starch-based thickeners dominate with 55% share, while gum-based thickeners hold 45% due to higher stability.

- Hospitals account for 40% share, with nursing homes and homecare segments expanding as demand rises for controlled-texture nutrition.

Market Drivers:

Rising Clinical Need Due to Swallowing Disorders Among Aging Populations

Growth accelerates due to a rising number of elderly people with swallowing problems. The Dysphagia diet thickening agents market benefits from wider diagnosis of neurological and age-linked conditions. Hospitals adopt advanced thickening solutions to improve patient safety. Care providers focus on lowering choking risks through stable texture control. The aging population drives stronger procurement across nursing facilities. It creates sustained demand from long-term rehabilitation centers. Home-care use expands due to longer patient recovery cycles. Product manufacturers respond with user-friendly blends for daily intake.

- For instance, the prevalence of dysphagia (swallowing disorders) was reported as [ranged from 5% to 72% in studies] for community-dwelling elderly and as high as 58.69% for nursing home residents.

Increasing Adoption of Standardized Texture-Modified Diets Across Healthcare Settings

Standardized texture diets gain acceptance across hospitals and senior care homes. These diets help maintain patient safety during oral feeding. The Dysphagia diet thickening agents market benefits from structured guidelines set by clinical bodies. Providers rely on consistent textures to reduce aspiration risks. Growth expands as staff training improves diet accuracy. It encourages wider use of commercial thickeners over kitchen-based methods. Dieticians promote ready-to-mix agents for better compliance. This shift strengthens product penetration across institutional care networks.

- For instance, the International Dysphagia Diet Standardisation Initiative (IDDSI) provides a standardized framework that has achieved global engagement with 128 countries worldwide engaged with IDDSI and translations into over 50 languages.

Technological Advancement in Formulations for Improved Stability and Consistency

Innovation focuses on xanthan-based and starch-free blends that offer stable viscosity. These formulations maintain thickness in hot and cold liquids. The Dysphagia diet thickening agents market gains support from research on sensory quality. Manufacturers design agents that dissolve faster and deliver smooth textures. It helps caregivers prepare diets with higher accuracy. Improved formulations enhance patient acceptance across varied age groups. Healthcare workers value products that keep consistency during prolonged feeding times. Technology also supports flavored variants that help improve nutrient intake.

Expansion of Home-Care Usage Supported by Patient Awareness and Ease of Preparation

Home-care demand rises as patients manage dysphagia outside clinical settings. The Dysphagia diet thickening agents market benefits from simple-to-mix powders and pre-thickened drinks. Families seek products that reduce preparation effort. It encourages repeat purchases across retail and online channels. Awareness programs guide caregivers on proper product use. Rising preference for self-managed recovery expands household adoption. Product packaging supports better portion control for daily feeding. Home users rely on branded agents for reliable consistency.

Market Trends:

Growing Shift Toward Clean-Label and Natural Thickening Solutions

Clean-label demand rises among patients who prefer natural components. Brands develop formulations without artificial additives. The Dysphagia diet thickening agents market sees strong interest in plant-based ingredients. It drives launches that use minimal processing. Healthcare buyers respond well to transparent labelling practices. Patients grow more aware of ingredient sources. Manufacturers highlight safety and purity in new variants. Clean-label appeal strengthens global product reach.

- For instance, xanthan gum-based thickeners represent the primary natural gum-based ingredient used in dysphagia products, functioning as a natural polysaccharide derived from bacterial fermentation that does not break down into simple sugars when consumed.

Rising Availability of Ready-To-Use Pre-Thickened Beverages and Foods

Pre-thickened drinks gain traction in hospitals and long-term care homes. These products ensure stable consistency for direct consumption. The Dysphagia diet thickening agents market benefits from easy-serve packaging. It reduces preparation workload for caregivers. Beverage makers expand into nectar-thick and honey-thick levels. Growth increases due to improved shelf-life stability. Providers rely on pre-thickened meals during peak patient load. Ready options support faster service in clinical feeding schedules.

- For instance, Hydra+ Thickened Drinks are available in 1 L Tetra Pak formats with documented 365-day shelf life from date of manufacture when stored in cool, dry conditions. The dysphagia diet thickening agents market benefits from easy-serve packaging, with unit-dose ready-to-drink formats supporting standardized hydration protocols across clinical environments.

Integration of Digital Tools for Diet Standardization and Patient Monitoring

Digital tools help clinicians track feeding safety and texture compliance. Apps guide staff on correct viscosities for prescribed diets. The Dysphagia diet thickening agents market aligns with platforms that support training. It enhances consistency in food preparation. Digital content helps families understand swallowing risks. Care teams follow standardized steps through online modules. Hospitals adopt digital audits to prevent diet variation. Technology supports more accountable feeding practices.

Rising Customization of Product Lines for Pediatric and Special-Needs Patients

Manufacturers expand lines for infants and children with swallowing issues. Pediatric diets require smoother textures and mild flavors. The Dysphagia diet thickening agents market grows with tailored blends for sensitive groups. It reflects rising diagnosis among premature infants. Care centers seek products that fit diverse developmental needs. Pediatricians prefer controlled-viscosity solutions for safety. Families rely on gentle formulations that reduce feeding stress. Custom variants improve acceptance in younger patients.

Market Challenges Analysis:

Limited Patient Acceptance and Variability in Sensory Preferences

Patient acceptance remains a challenge due to taste and texture differences. The Dysphagia diet thickening agents market faces issues where users dislike thickened liquids. It affects adherence to prescribed diets. Hospitals struggle to maintain compliance during long-term feeding. Sensory variation affects acceptance across age groups. Some patients find preparation inconsistent when handled by untrained staff. Flavor fatigue reduces enthusiasm for repeated intake. Limited product personalization deepens acceptance barriers across home-care settings.

High Dependence on Training and Correct Preparation Across Care Facilities

Proper mixing depends on trained staff in hospitals and care homes. The Dysphagia diet thickening agents market encounters errors linked to manual preparation. It raises concerns when viscosity falls outside recommended levels. Inconsistent mixing increases aspiration risks. Care homes with staff shortages struggle to maintain accuracy. Training programs require time and structured materials. Facilities need continuous audits to maintain diet control. Variation across providers creates uneven feeding safety outcomes.

Market Opportunities:

Expansion Potential in Underserved Regions With Growing Elderly Populations

Emerging regions show demand for better dysphagia management. The Dysphagia diet thickening agents market can expand through awareness programs. It gains support from rising investments in senior-care infrastructure. Countries with rapid aging trends need reliable thickening solutions. Hospitals in these regions adopt texture-modified diets faster. Retail distribution strengthens access for home-care users. New entrants can position affordable solutions for wider penetration.

Innovation Pathways Through Premium Formulations and Product Differentiation

Premium blends offer smoother textures and improved mouthfeel. The Dysphagia diet thickening agents market benefits from high-quality xanthan-based variants. It opens space for flavored options and fortified products. Technology supports stable viscosity across beverages. Brands can differentiate through easy-mix formats. Healthcare buyers value products that reduce preparation errors. Growth accelerates when innovation aligns with clinical feeding protocols.

Market Segmentation Analysis:

By Product Type

Starch-based thickeners hold a 55% share due to wide acceptance in clinical diets and strong compatibility with common food items. These products support quick preparation and predictable viscosity levels across hospitals and care facilities. Gum-based thickeners capture 45% and gain traction for smoother textures, better stability, and consistent performance in hot and cold liquids. The Dysphagia diet thickening agents market benefits from growing clinical preference for gum-based blends that improve patient compliance. It expands as providers shift toward formulations that maintain texture for longer feeding periods and reduce variability during daily use.

- For instance, according to Persistence Market Research (2025), gum-based formulations are gaining significant traction for smoother textures, better stability, and consistent performance in hot and cold liquids.

By Form Type

Powder thickeners dominate due to long shelf life, simple storage, and reliable mixing across beverages and meals. Caregivers prefer powders for their dosing flexibility and stable performance. Gel-type thickeners grow steadily among facilities that need quick, uniform preparation for high-volume feeding schedules. Liquid thickeners serve patients who require ready-to-use options with minimal handling. These formats support faster service in hospitals and long-term care centers. It gains traction across regions where convenience and accuracy guide product selection. The form segment supports diverse feeding needs across clinical and home settings.

- For instance, Thick & Easy Hydrolyte Thickened Water in honey-thick formulation provides shelf-stable pre-thickened liquid beverages maintaining 365-day shelf life and immediate service capabilities in clinical settings.

By Application / End User

Hospitals lead with a 40% share due to strict swallowing safety protocols and continuous demand from acute care patients. Long-term care and nursing homes maintain strong adoption, driven by a high concentration of elderly residents who require texture-managed diets. Homecare settings expand rapidly as families manage dysphagia with structured feeding routines. Growth reflects rising awareness about choking risks and the need for controlled viscosity at home. It supports broader use across non-clinical environments where easy preparation is essential for daily nutrition.

By Distribution Channel

Hospital pharmacies drive significant volume due to direct supply for inpatient care and clinician-supervised diets. Retail pharmacies serve caregivers who manage dysphagia outside institutional settings and require frequent restocking. Online pharmacies grow quickly with expanding demand for doorstep access and wider product availability. They support patients who prefer recurring deliveries and brand variety. It strengthens distribution reach across regions with increasing homecare adoption. The channel mix ensures consistent access for both clinical and household users.

Segmentation:

By Product Type

- Starch-based thickeners (55% share)

- Gum-based thickeners (45% share)

By Form Type

- Powder thickeners

- Gel-type thickeners

- Liquid thickeners

By Application / End User

- Hospitals (40% share)

- Nursing homes and long-term care facilities

- Homecare settings

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the dysphagia diet thickening agents market, accounting for roughly 38% of global demand. Strong diagnosis rates of swallowing disorders and established clinical protocols drive steady use across hospitals and long-term care facilities. The market benefits from structured diet management programs and high adoption of ready-to-use formulations. It expands through wider use in homecare settings supported by caregiver training. Retail and online channels gain traction due to higher patient awareness. Manufacturers introduce advanced blends that meet clinical expectations for consistency and safety.

Europe

Europe captures close to 30% share, supported by broad acceptance of texture-modified diets across healthcare systems. The region benefits from strong clinical guidelines that encourage standardized viscosity levels in patient feeding. The dysphagia diet thickening agents market grows here through expanding aging populations and rising demand from residential care facilities. It gains support from dieticians who promote controlled texture management for safer swallowing. Pre-thickened beverages see strong use in rehabilitation centers. Online pharmacies strengthen access for home users seeking regular supplies.

Asia Pacific

Asia Pacific holds about 22% share and stands out as the fastest-growing regional market. Growth accelerates due to expanding elderly populations in Japan, China, and South Korea. The dysphagia diet thickening agents market gains momentum through rising diagnosis of neurological and post-stroke swallowing disorders. It benefits from improving healthcare infrastructure and broader adoption of clinical nutrition guidelines. Local and international brands expand distribution through retail and hospital networks. Homecare adoption rises as awareness about safe feeding practices increases across urban populations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Dysphagia diet thickening agents market features strong competition driven by formulation quality, clinical acceptance, and distribution reach. Global brands compete through product innovation focused on stability, taste, and ease of preparation. Companies strengthen portfolios with xanthan-based blends that improve consistency across liquids and meals. It gains momentum as manufacturers expand into pre-thickened beverages and ready-to-use formats. Firms differentiate through clean-label claims and targeted solutions for hospitals, nursing homes, and homecare. Strategic pricing, caregiver training support, and multichannel distribution shape competitive positioning. Key players invest in regional expansion, ensuring wider product access through retail and online pharmacies.

Recent Developments:

- Danone Nutricia announced in May 2025 that it had entered into a definitive agreement to acquire a majority stake in Kate Farms, a fast-growing U.S. business specializing in plant-based, organic nutrition products for both medical and everyday needs. The acquisition was successfully completed on June 30, 2025. This partnership brings together Kate Farms’ complementary product portfolio with Danone Nutricia’s specialized nutrition offerings, combining the Kate Farms, Nutricia, Real Food Blends, and Functional Formularies brands to serve a wider range of patients and consumers with health-related nutritional solutions.

- Hormel Health Labs underwent a significant transition when Lyons Magnus, a subsidiary of Paine Schwartz Partners, completed the acquisition on October 23, 2024. This acquisition resulted in the creation of Lyons Health Labs, which now focuses on nutritional products for dysphagia (difficulty swallowing), unintended weight loss, digestive health, and hydration. The business continues to market best-selling products including ReadyCare, Thick & Easy, MightyShakes, and Magic Cup to healthcare centers, special care facilities, and other providers.

Report Coverage:

The research report offers an in-depth analysis based on By Product Type (starch-based thickeners, gum-based thickeners), By Form Type (powder, gel-type, liquid), By Application/End User (hospitals, nursing homes and long-term care facilities, homecare settings), and By Distribution Channel (hospital pharmacies, retail pharmacies, online pharmacies). It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise with growing diagnosis of swallowing disorders in aging populations.

- Hospitals and nursing facilities will adopt more standardized texture-modified diets.

- Clean-label and natural thickener formulations will gain wider acceptance.

- Online pharmacies will expand reach for homecare users seeking easy product access.

- Ready-to-use and pre-thickened beverages will increase their market penetration.

- Pediatric-focused formulations will emerge as awareness grows among caregivers.

- Digital training tools will support better diet consistency and patient safety.

- Global players will strengthen distribution networks in emerging regions.

- Innovation will focus on improving dissolving performance and mouthfeel.

- Clinical education programs will expand to support safer feeding practices worldwide.