Market Overview:

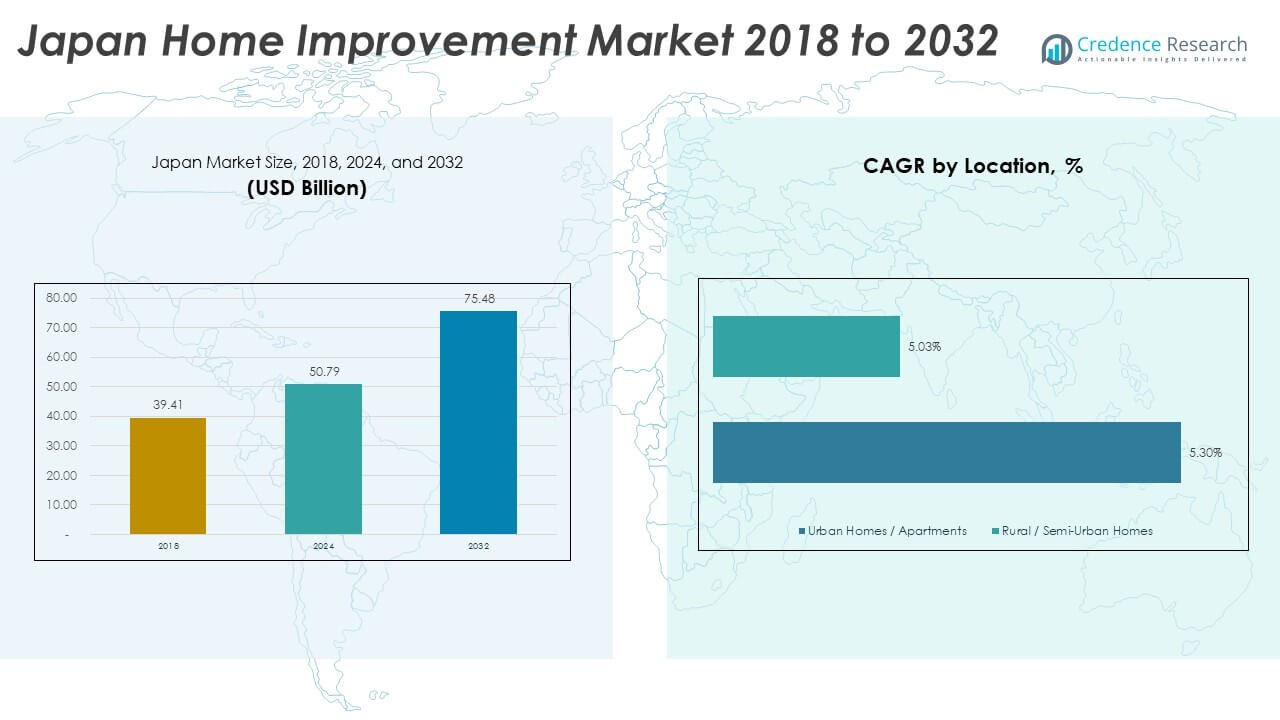

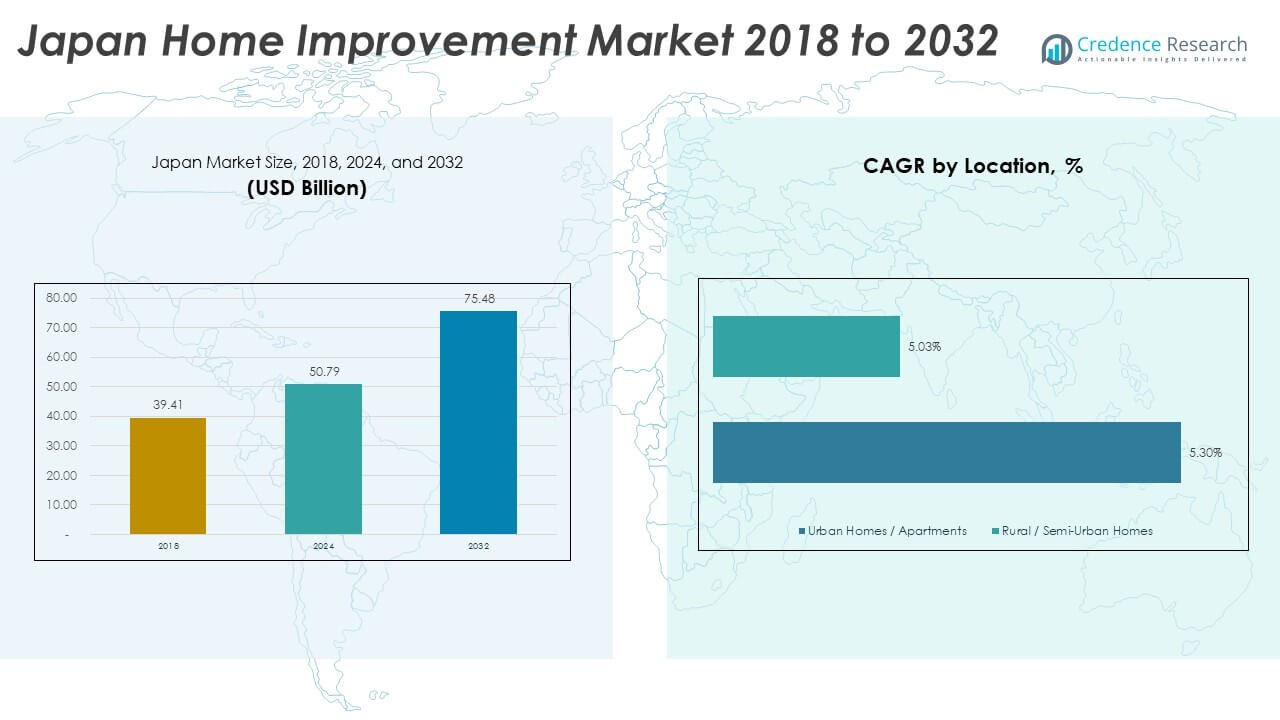

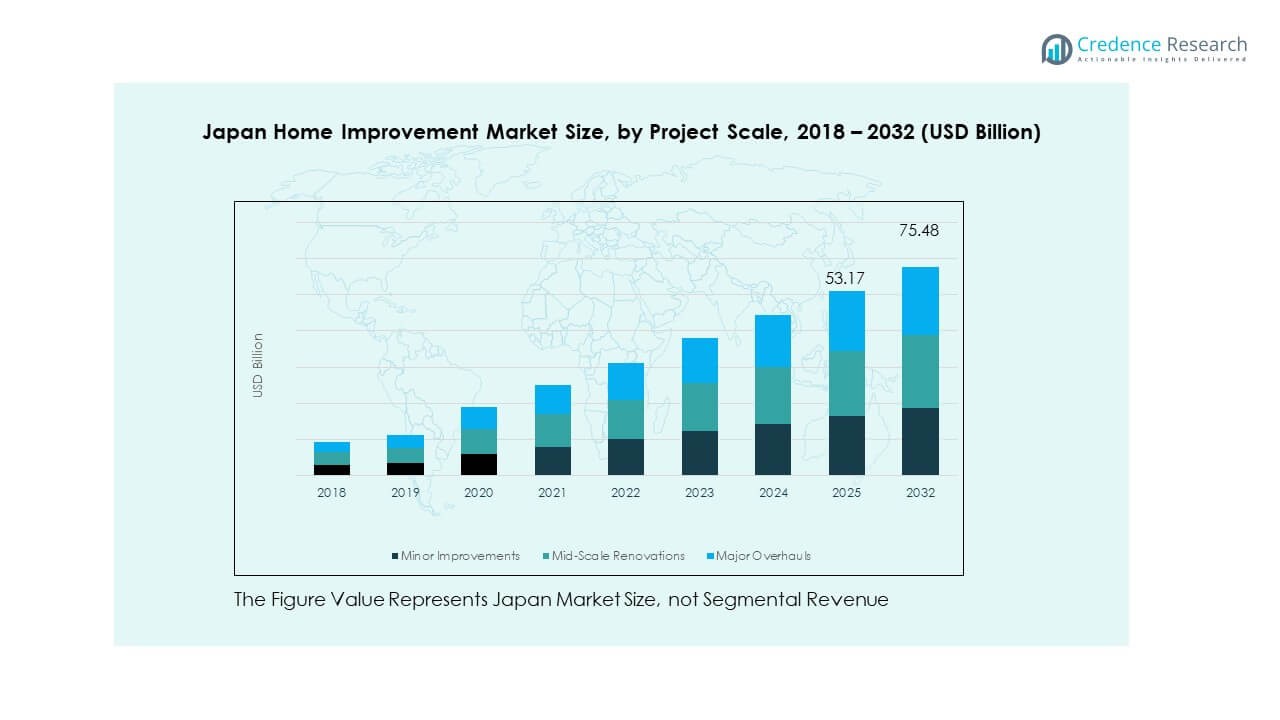

The Japan Home Improvement Market size was valued at USD 39.41 billion in 2018, rose to USD 50.79 billion in 2024 and is anticipated to reach USD 75.48 billion by 2032, at a CAGR of 5.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Home Improvement Market Size 2024 |

USD 50.79 Billion |

| Japan Home Improvement Market, CAGR |

5.02% |

| Japan Home Improvement Market Size 2032 |

USD 75.48 Billion |

Growth in the Japan home improvement market is being driven by homeowners who are modernising older homes, installing energy‑efficient systems and upgrading interiors to support new lifestyles such as remote working. Consumers are increasingly adopting smart home technologies, eco‑friendly materials and minimalistic design themes, which in turn spur renovation and value‑add investment rather than purely new builds. Aided by government incentives and rising awareness of sustainability, renovation activity is gaining momentum across both urban and suburban segments.

Regionally, the Japanese market remains concentrated in major metropolitan areas such as Tokyo and Osaka where housing stock is dense and older units require refurbishment, while smaller cities and regional areas are emerging growth zones thanks to government encouragement of renovation over demolition. As the domestic market matures, international suppliers and niche specialist providers are seeing opportunity in regional Japan where home improvement activity is less saturated. This creates a landscape where established urban hubs lead in volume while secondary regions offer accelerated growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Home Improvement Market was valued at USD 39.41 billion in 2018 and is projected to reach USD 75.48 billion by 2032, with a CAGR of 5.02% during the forecast period.

- The Kanto Region leads the market with approximately 35‑40% market share, primarily due to the large urban population and high renovation demand in Tokyo. Kansai and Chūbu regions follow closely, contributing 20‑25% share, with strong demand for both interior and exterior renovations.

- The Kyushu and Okinawa regions are the fastest-growing, accounting for 35‑40% of the market. This growth is driven by the demand for aging-in-place renovations and smaller, more affordable home improvements in rural and semi-urban areas.

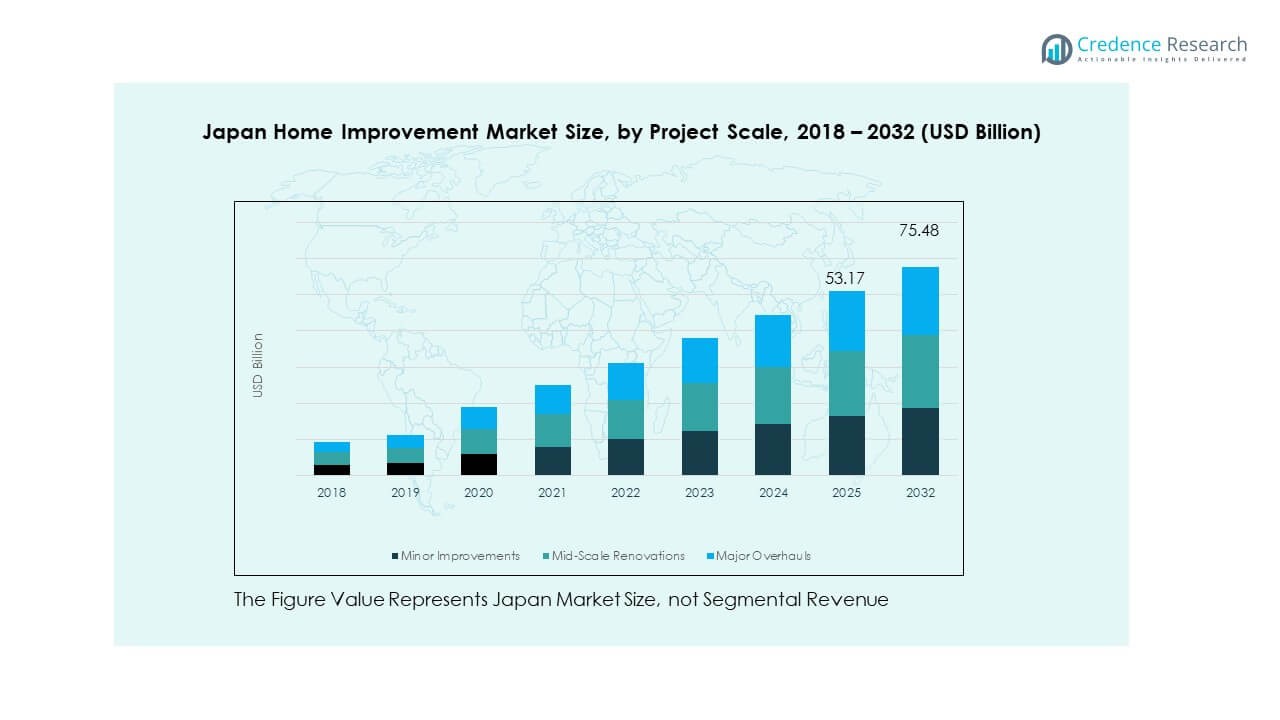

- In the segment analysis, Minor Improvements account for the largest share, contributing significantly to the overall market due to its lower cost and high frequency. Mid-Scale Renovations and Major Overhauls follow, with mid-scale projects seeing steady growth due to urban lifestyle trends.

- The market is dominated by interior renovations and structural additions, reflecting strong consumer demand for home functionality, modernity, and energy efficiency upgrades. These segments are expected to drive the majority of market growth during the forecast period.

Market Drivers:

Market Drivers:

Rising Demand for Energy Efficiency

The Japan Home Improvement Market has seen significant growth driven by the increasing demand for energy-efficient homes. Homeowners are investing in upgrades such as improved insulation, energy-saving appliances, and eco-friendly materials. Government incentives and subsidies for energy-efficient improvements encourage renovations that reduce energy consumption and carbon footprints. The adoption of green technologies is becoming a priority, particularly in urban areas where sustainability is emphasized in construction and remodeling projects. Consumers are also more aware of the long-term cost savings associated with energy-efficient upgrades. As energy prices fluctuate, the demand for more efficient, low-energy homes continues to rise.

- For instance, Panasonic Corporation’s OASYS residential central air‑conditioning system can reduce energy consumption for heating and cooling by over 50% compared to conventional systems.

Smart Home Technology Integration

Another key driver in the Japan Home Improvement Market is the growing interest in smart home technology. Consumers are integrating advanced technologies like home automation systems, voice-controlled devices, and security solutions into their renovations. These upgrades offer convenience, energy control, and enhanced security, which are major considerations for homeowners. The increasing availability of affordable smart devices has also made these innovations more accessible to a broader market. As a result, homeowners are seeking to future-proof their homes by incorporating technology that enhances both functionality and comfort. The Japanese market is seeing a high uptake of smart home systems in cities, where tech adoption is faster.

- For instance, Sharp Corporation showcased in February 2024 smart kitchen appliances that allow voice commands (e.g., “Alexa, start the dishwasher”) and WiFi‑based remote control through its kitchen app.

Home Renovation for Lifestyle Changes

In Japan, changing lifestyle preferences, particularly due to the COVID-19 pandemic, have also fueled the demand for home renovations. With more people working from home, there is a shift toward creating home offices and spaces that enhance work-life balance. Renovations aimed at improving living spaces for comfort and functionality have become a priority. This shift has led to greater investments in interior upgrades like modern kitchens, bathrooms, and multifunctional spaces. The desire for a personalized living environment that supports the demands of remote work is driving the market’s growth.

Market Trends:

Increased Focus on Sustainability

In the Japan Home Improvement Market, sustainability is becoming a key trend. Homeowners are increasingly opting for eco-friendly materials, such as bamboo, recycled wood, and low-VOC paints, in their renovations. Energy-efficient products, like solar panels, LED lighting, and energy-efficient appliances, are also gaining traction. The growing demand for sustainable living aligns with government regulations and incentives promoting green building practices. The market is experiencing a shift toward zero-energy homes and environmentally friendly solutions that reduce environmental impact. Sustainable home design is no longer a niche market but is moving toward mainstream adoption.

- For instance, Daiwa House Industry Co., Ltd. reported a ZEH (net‑zero‑energy‑house) rate of 97% for single‑family housing starts in FY2023.

Rising Popularity of DIY Projects

Another emerging trend in the Japan Home Improvement Market is the increasing popularity of DIY (Do-It-Yourself) home improvement projects. Consumers are becoming more involved in their home renovations, choosing to tackle smaller projects themselves to save costs. The availability of online tutorials, tools, and home improvement kits has made DIY projects more accessible. This trend is particularly noticeable in the suburban areas where consumers seek to personalize their living spaces affordably. Retailers and manufacturers are capitalizing on this trend by offering DIY-friendly products, such as pre-assembled furniture, toolkits, and design software.

- For instance, major electronics and appliance retailers provide step‑by‑step support and kits targeted at first‑time renovators, although specific numeric metrics are less publicly reported. The trend is most visible in suburban areas, and manufacturers are clearly positioning products for DIY use.

Emphasis on Outdoor Living Spaces

As people spend more time at home, there is a growing emphasis on enhancing outdoor living spaces. Homeowners in Japan are increasingly investing in garden renovations, outdoor kitchens, and patio installations to create functional, enjoyable outdoor areas. This trend is driven by the desire to extend the usable living space of homes and improve the quality of life through outdoor activities. The growing interest in sustainable living also aligns with this trend, as homeowners seek eco-friendly outdoor features like water-efficient landscaping, green roofs, and rainwater harvesting systems.

Interest in Home Office Renovations

With remote working becoming a permanent feature for many employees, home office renovations have surged in popularity in Japan. Homeowners are creating dedicated workspaces in their homes to support productivity and comfort. These renovations often include ergonomic furniture, enhanced lighting, soundproofing, and upgraded technology setups. There is also a growing trend toward multifunctional spaces, where rooms are designed to accommodate both work and leisure. This trend reflects a larger shift in the way people live and work, emphasizing the importance of a home environment that supports professional and personal needs.

Market Challenges Analysis:

Market Challenges Analysis:

High Renovation Costs

The Japan Home Improvement Market faces challenges, particularly due to the high costs associated with home renovations. The costs of labor, materials, and specialized equipment are often higher compared to other regions. Although demand for renovations is high, many homeowners find the financial barriers to large-scale projects prohibitive. The rising cost of raw materials, such as wood and steel, and supply chain disruptions, have further escalated expenses. As a result, consumers are often opting for smaller, more budget-conscious projects, which may limit the potential market for large-scale home improvements.

Limited Skilled Labor Availability

Another challenge faced by the Japan Home Improvement Market is the shortage of skilled labor. The demand for renovation services is growing rapidly, but there are not enough skilled professionals to meet this demand. As Japan’s population ages, many experienced tradespeople are retiring, and there is a shortage of younger workers entering the construction and renovation fields. This labor shortage is causing delays in projects and contributing to rising costs. Many homeowners are seeking DIY alternatives or opting for professional services that may be less specialized, impacting the overall quality and timing of renovations.

Market Opportunities:

Growing Demand for Aging-in-Place Renovations

One significant opportunity in the Japan Home Improvement Market is the increasing demand for aging-in-place renovations. Japan has one of the highest elderly populations in the world, and many seniors wish to stay in their homes as they age. This demographic shift has created a rising demand for home modifications that make homes safer and more accessible for older individuals. Renovations like installing ramps, wider doorways, and stairlifts are becoming more common, creating a specialized market for products and services that support aging in place.

Expansion of Smart Home Offerings

Another opportunity lies in the growing expansion of smart home offerings. The rising demand for smart home technologies creates an avenue for home improvement companies to tap into this trend. Products such as smart thermostats, security systems, lighting, and voice-controlled devices are becoming increasingly popular. With more consumers looking to integrate technology into their homes, there is an opportunity for businesses to offer specialized services that cater to smart home upgrades. This trend is expected to continue growing as technology becomes more affordable and accessible to the average consumer.

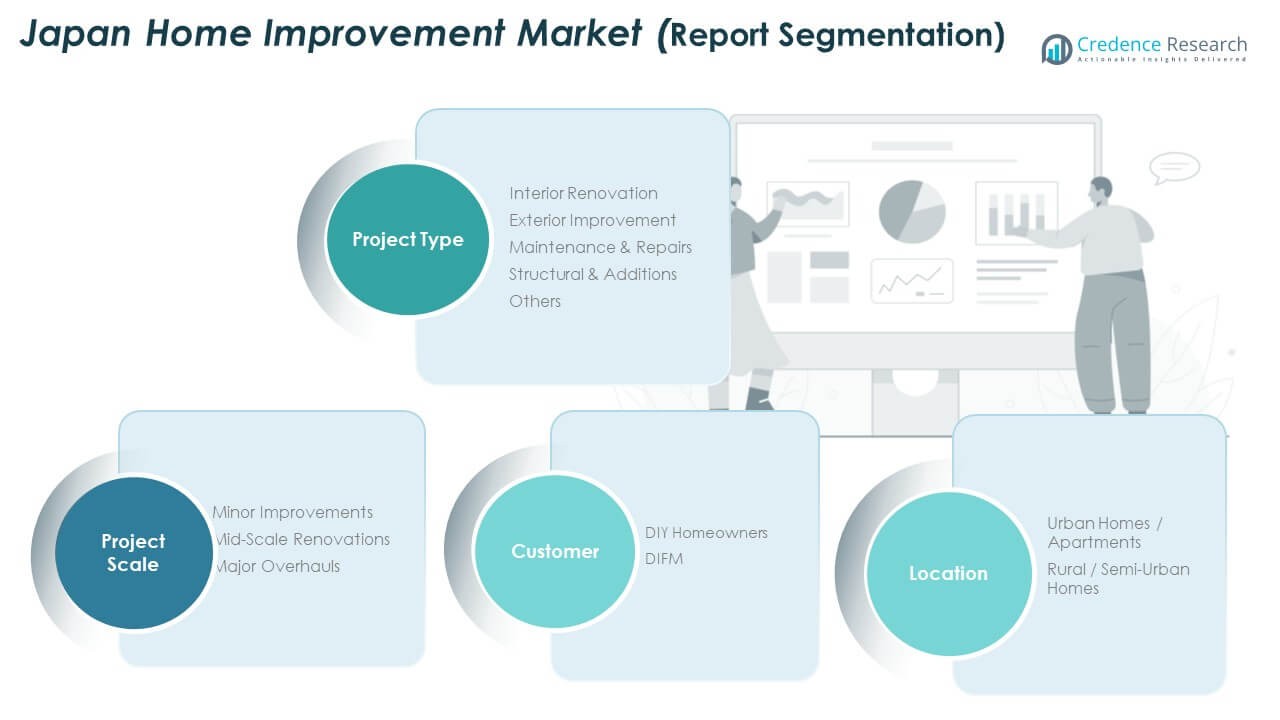

Market Segmentation Analysis:

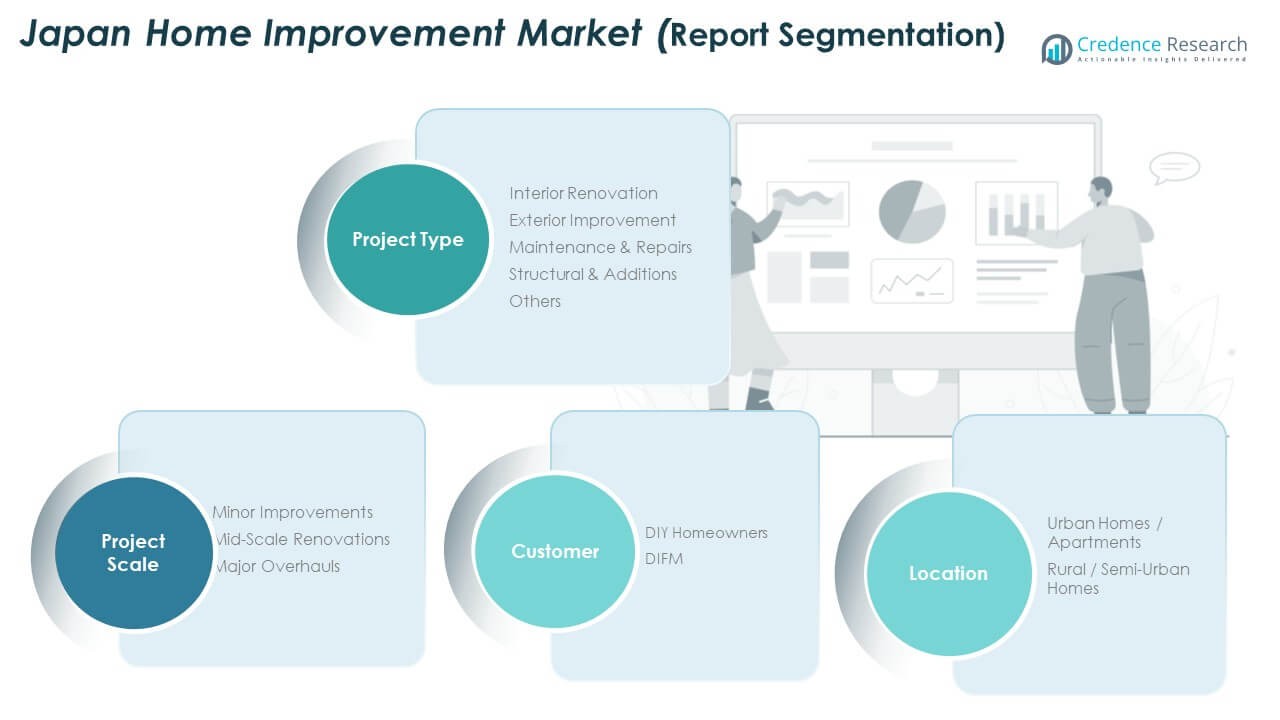

Project Type

The Japan Home Improvement Market is segmented into various project types that cater to different renovation needs. Interior renovation, including kitchen and bathroom upgrades, is the most prominent segment, driven by consumer preferences for modern living spaces. Exterior improvements focus on enhancing curb appeal through landscaping, facades, and roofing projects. Maintenance and repairs, such as plumbing and electrical work, hold a substantial market share due to the aging housing stock. Structural and addition projects, which include expanding living spaces or adding new rooms, are also on the rise, particularly in growing urban areas. Other miscellaneous projects include aesthetic and non-structural enhancements, which attract a specific consumer base.

- For instance, some companies report double‑digit sales growth for upgraded kitchen equipment, reflecting strong demand. Exterior upgrades (landscaping, facades) and maintenance/repair work (plumbing, electrical) remain substantial given aging housing stock.

Project Scale

The market is also categorized by project scale. Minor improvements, such as painting, flooring, and small-scale upgrades, dominate the lower-end market segment. Mid-scale renovations, which include significant updates like kitchen remodels and room additions, are increasingly popular as homeowners look to enhance functionality without full-scale overhauls. Major overhauls, which involve extensive home transformations, are less frequent but contribute significantly to the overall market due to the high costs and complexity involved. These larger-scale projects typically appeal to affluent homeowners or those investing in long-term value improvements.

Customer Type

The customer type segment includes DIY homeowners and DIFM (Do-It-For-Me) customers. The DIY segment is driven by cost-conscious consumers who prefer hands-on involvement in their renovations, aided by the increasing availability of tools and online resources. The DIFM segment, on the other hand, represents homeowners who seek professional services for more complex or time-consuming projects, relying on contractors and specialists for high-quality results. Both segments are growing, with DIY enthusiasts focusing on minor improvements and DIFM customers opting for larger, more intricate renovations.

Segmentation:

Project Type Segment:

- Interior Renovation

- Exterior Improvement

- Maintenance & Repairs

- Structural & Additions

- Others

Project Scale Segment:

- Minor Improvements

- Mid-Scale Renovations

- Major Overhauls

Customer Type Segment:

- DIY Homeowners

- DIFM (Do-It-For-Me)

Location Segment:

- Urban Homes / Apartments

- Rural / Semi-Urban Homes

Import/Export Segment:

- Japan Home Improvement Market Import Revenue By Region

- Japan Home Improvement Market Export Revenue By Region

Competitive Landscape Segment:

- Company Market Share

- Company Revenue Market Share

- Strategic Developments (Acquisitions & Mergers, New Project Type Launch, Regional Expansion)

Regional Analysis:

Regional Analysis:

Dominance of the Kanto Region

The Kanto Region, home to Tokyo and its neighbouring prefectures, commands the largest share in the Japan Home Improvement Market. It accounts for approximately 35‑40% of total market revenue, driven by dense urban housing stock, strong purchasing power, and frequent renovation demand. Many homeowners in this region opt for interior upgrades and structural expansion to optimise limited space. Professional contractors and premium services dominate there, reflecting the high value attached to quality and speed. Project sizes tend to skew mid‑scale or major overhauls, given higher disposable incomes. It forms the strategic heart for national market players seeking consistent returns.

Growth in Kansai and Central Regions

The Kansai Region (including Osaka‑Kobe) and the Chūbu Region (Central Japan, including Nagoya) jointly hold about 20‑25% of the Japan Home Improvement Market. These regions exhibit strong demand for both interior renovations and exterior improvements as aging suburban homes require updates. The presence of manufacturing hubs in Chūbu supports access to innovative materials and shorter supply chains, driving mid‑scale project growth. In Kansai, homeowners increasingly invest in lifestyle‑oriented upgrades, such as smart home integrations and outdoor living spaces. These regions offer balanced opportunities between high‑volume urban renovations and cost‑sensitive suburban transformations.

Emerging Demand in Peripheral Regions

The remaining share of the Japan Home Improvement Market spans the Kyushu‑Okinawa Region, Hokkaido Region, Tohoku Region and Chūgoku Region, together contributing roughly 35‑45% of revenue. These regions demonstrate slower growth but rising opportunities tied to ageing housing stock and population shifts. Renovations here lean toward maintenance and repairs, minor improvements, and structural refurbishments of older homes damaged by weather or seismic events. Regional government incentives promote accessibility upgrades and energy‑efficient retrofits in rural and semi‑urban areas. Market entrants focused on value‑based solutions find traction in these zones, where competitive pricing and local partnerships matter most.

Key Player Analysis:

- DCM Holdings (Japan)

- Kohnan Shoji Co., Ltd. (Japan)

- Komeri Co., Ltd. (Japan)

- Nitori Holdings Co., Ltd. (Japan)

- Kingfisher plc (UK)

- Sekisui House Ltd. (Japan)

Competitive Analysis:

The Japan Home Improvement Market is competitive, with a mix of local players and international brands offering diverse products and services. Large companies like Nitori, DCM Holdings, and Sekisui House dominate the market through their expansive product portfolios and strong distribution networks. Nitori, in particular, leads in home furnishings, while Sekisui House focuses on sustainable and eco-friendly home solutions. Smaller regional companies and DIY retailers also contribute to market diversity, focusing on niche demands like maintenance and repairs. Innovation and quality remain key competitive factors, with firms investing in smart home technology and energy-efficient solutions. Increasing consumer demand for premium renovation services, alongside cost-efficient DIY products, forces companies to adapt to a wide range of customer preferences. These competitive dynamics push companies to continuously innovate and expand their offerings.

Recent Developments:

- In September 2024, DCM Holdings completed a strategic merger with Keiyo Co., Ltd., marking a significant consolidation in the Tokyo metropolitan region. The merger, finalized on September 1, 2024, transformed Keiyo Co., Ltd. into a merged entity with DCM Co., Ltd.

- In November 2024, DCM Holdings announced its acquisition of Hometech Co., Ltd., a Tokyo-based renovation company specializing in renovation services. The share transfer agreement was signed on November 4, 2025, with Hometech becoming a wholly-owned subsidiary of DCM Holdings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on project type, scale, customer segments, and regional distribution. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan Home Improvement Market will continue to be driven by the demand for energy-efficient and sustainable home solutions.

- Urbanization trends in Japan will create significant opportunities in interior renovations and structural improvements.

- The rise in homeownership and renovation confidence will lead to steady market expansion.

- Smart home technologies will become more integrated into renovation projects, contributing to increased consumer demand.

- Growing disposable income will fuel investments in larger-scale home improvement projects, particularly in metropolitan areas.

- DIY trends will continue to dominate, especially for minor renovations and home décor upgrades.

- The aging population will drive demand for aging-in-place home modifications, creating a niche market.

- The expansion of home improvement retail outlets and e-commerce platforms will increase market accessibility.

- Companies will focus on developing modular, customizable renovation solutions to meet diverse customer needs.

- Competitive pressure will rise, leading to continuous innovation in products, services, and customer experience.

Market Drivers:

Market Drivers: Market Challenges Analysis:

Market Challenges Analysis: Regional Analysis:

Regional Analysis: