Market Overview

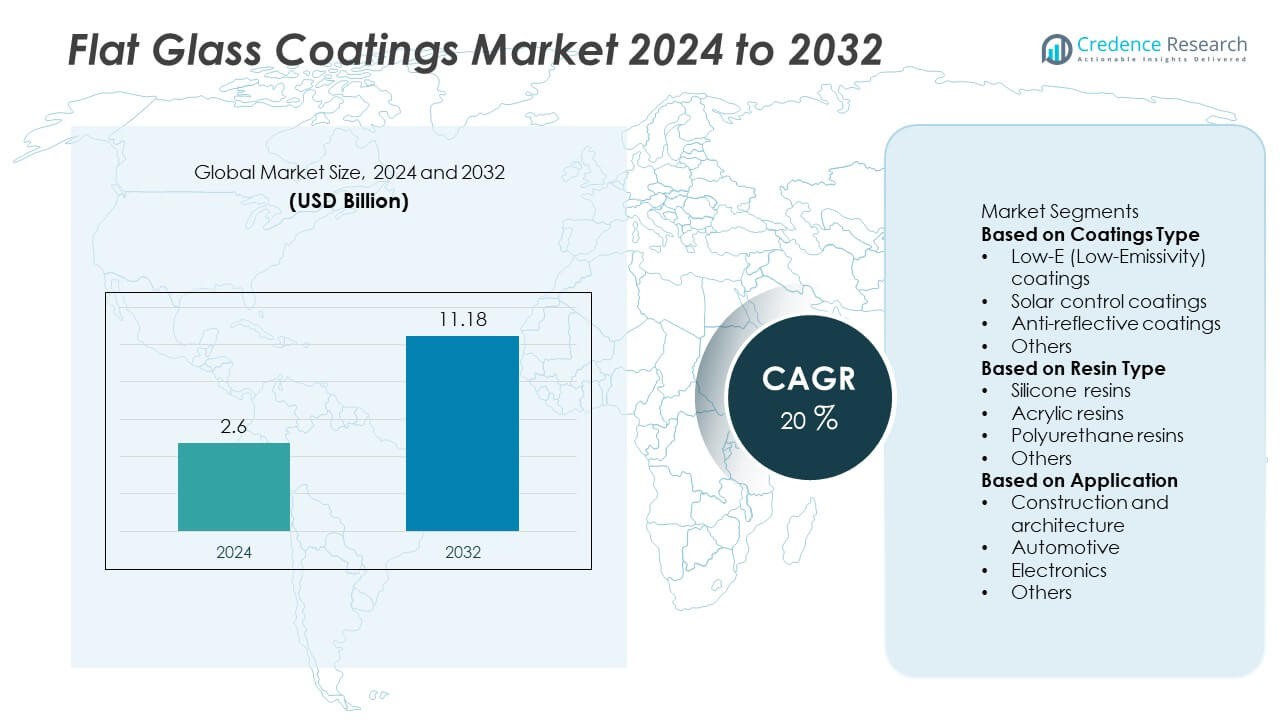

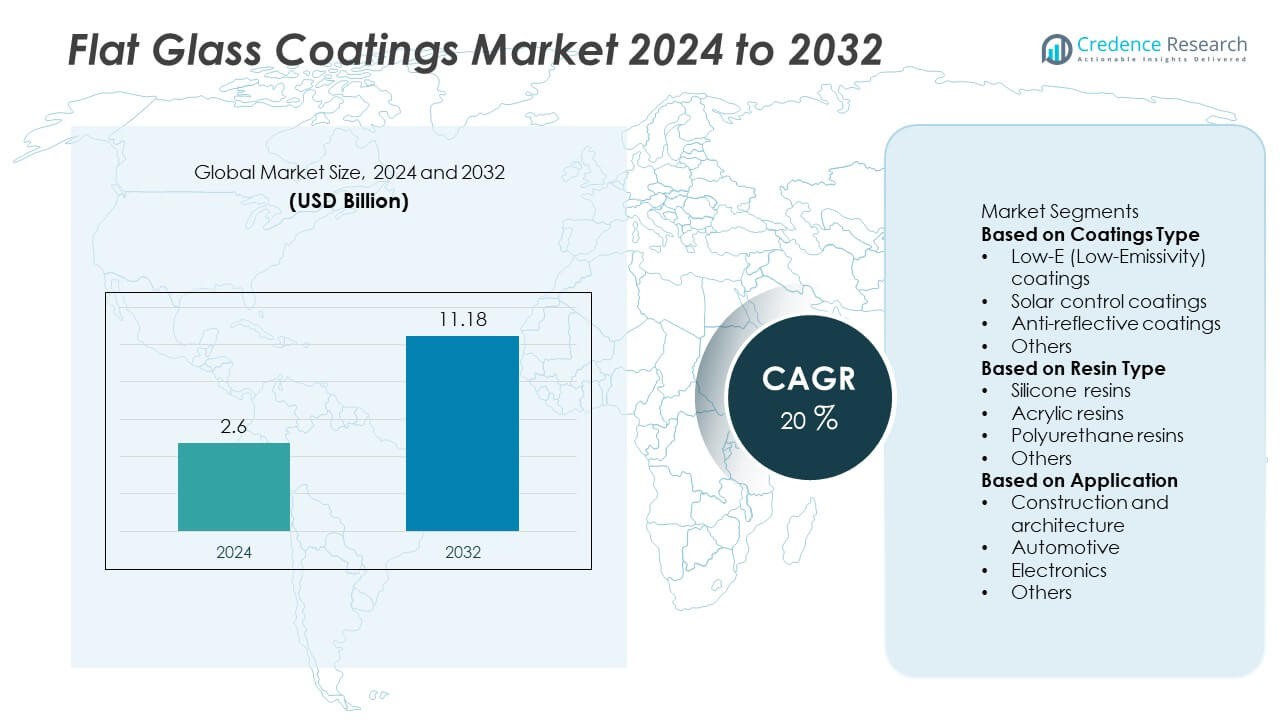

The Flat Glass Coatings Market was valued at USD 2.6 billion in 2024 and is projected to reach USD 11.18 billion by 2032, expanding at a CAGR of 20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flat Glass Coatings Market Size 2024 |

USD 2.6 Billion |

| Flat Glass Coatings Market, CAGR |

20% |

| Flat Glass Coatings Market Size 2032 |

USD 11.18 Billion |

The flat glass coatings market is shaped by major players including Guardian Glass, Hesse, Viracon, Corning, Vitro Architectural Glass, Nippon Sheet Glass, The Sherwin-Williams Company, Ferro Corporation, Arkema, and Fenzi Group. These companies drive growth through advanced coating technologies, eco-friendly product innovations, and strong regional distribution strategies. Asia-Pacific emerged as the leading region in 2024 with a 34% market share, supported by rapid urbanization, infrastructure development, and rising demand in automotive and solar applications. North America followed with 32% share, driven by green building regulations and adoption of energy-efficient glazing, while Europe accounted for 28%, benefiting from strict carbon reduction policies and advanced architectural projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The flat glass coatings market was valued at USD 2.6 billion in 2024 and is projected to reach USD 11.18 billion by 2032, growing at a CAGR of 20% during the forecast period.

- Rising demand for energy-efficient buildings and eco-friendly glazing solutions is a primary driver, with Low-E coatings holding over 45% share due to their insulation benefits.

- Market trends highlight increasing adoption of solar control coatings in automotive and anti-reflective coatings in electronics and solar panels, supported by technological advancements in nanocoatings and multifunctional surfaces.

- The competitive landscape features key players such as Guardian Glass, Corning, Vitro Architectural Glass, Nippon Sheet Glass, The Sherwin-Williams Company, and Arkema, focusing on sustainable innovations and expansion into high-growth regions.

- Asia-Pacific led with 34% share in 2024, followed by North America at 32% and Europe at 28%, while construction and architecture applications dominated globally with over 60% share.

Market Segmentation Analysis:

By Coatings Type

Low-E (Low-Emissivity) coatings dominated the market in 2024, accounting for over 45% share. Their leadership stems from strong adoption in energy-efficient windows for commercial and residential construction, driven by building codes and green certifications. Rising demand for improved insulation and lower carbon footprints further boosts their uptake across Europe and North America. Solar control coatings follow, supported by expanding automotive glazing and high-rise building applications, while anti-reflective coatings gain traction in electronics and solar panels. Other coatings address niche uses but remain secondary to Low-E’s energy-saving performance.

- For instance, Guardian Glass introduced its SunGuard SNX 70+ low-E coated glass, which transmits 68% of visible light and maintains 14% exterior reflectivity.

By Resin Type

Silicone resins held the largest share of the market in 2024 at around 38%. Their dominance is linked to superior weather resistance, durability, and protective properties, making them the preferred choice in architectural glass and automotive windshields. Acrylic resins follow, favored for cost-effectiveness and optical clarity in electronics and decorative glass. Polyurethane resins are expanding in specialized applications, such as flexible coatings in consumer electronics. Other resin types, including hybrids, remain smaller in scale but serve tailored needs. Silicone’s high-performance advantages sustain its leadership across long-life cycle applications.

- For instance, Ferro Corporation (now Vibrantz Technologies) provides high-performance ceramic and inorganic enamels for glass coatings, which are used in architectural applications like spandrel glass for high chemical and weather resistance.

By Application

Construction and architecture was the dominant application segment in 2024, capturing over 60% share. Demand is driven by rapid urbanization, energy-efficient building mandates, and the adoption of green infrastructure projects worldwide. Low-E and solar control coatings play a critical role in reducing heat gain and enhancing indoor comfort, directly aligning with sustainability targets. The automotive sector ranks second, leveraging solar control and anti-reflective coatings for enhanced safety and passenger comfort. Electronics, though smaller in share, continue to grow due to rising use of anti-reflective coatings in displays and photovoltaic panels.

Key Growth Drivers

Rising Demand for Energy-Efficient Buildings

Energy-efficient construction practices remain the primary driver of the flat glass coatings market, with Low-E and solar control coatings gaining prominence. Governments across North America, Europe, and Asia enforce green building codes, pushing adoption of coated glass in commercial and residential projects. Increasing urbanization and infrastructure investments further accelerate demand. These coatings help reduce energy consumption by limiting heat transfer, aligning with global decarbonization goals. Strong alignment with sustainability regulations ensures long-term growth momentum for coated glass solutions in the construction industry.

- For instance, Nippon Sheet Glass (NSG) started operations on a newly converted transparent conductive oxide (TCO) float line at its Rossford, Ohio, facility in March 2025 to produce glass for solar panels. The company also brought a new float glass plant online in Luckey, Ohio, in 2020, with a melting capacity of 600 tons per day.

Expanding Automotive Applications

Automotive manufacturers are increasingly integrating coated glass for safety, comfort, and fuel efficiency. Solar control coatings reduce glare and heat inside vehicles, enhancing passenger experience while supporting air-conditioning efficiency. Lightweight glazing with advanced coatings contributes to emission reduction targets in electric and conventional vehicles. Growth in EV production worldwide further stimulates the use of coated glass to improve energy efficiency. Leading automakers invest in advanced glazing solutions, positioning the automotive segment as a key demand driver for flat glass coatings over the forecast period.

- For instance, Corning supplies its Gorilla Glass for Automotive, with more than 8 million square feet installed across windshields and sunroofs, reducing vehicle weight by up to 30 kg per car.

Technological Advancements in Glass Coatings

Continuous innovation in glass coating technologies strengthens market expansion. Anti-reflective and multifunctional coatings are being developed for electronics, solar panels, and high-performance buildings. Advanced deposition techniques enhance durability, transparency, and thermal insulation properties, making coatings suitable for diverse applications. Investments in nanotechnology also unlock opportunities for self-cleaning and hydrophobic coatings, adding functional value. Manufacturers are leveraging R&D to balance performance with cost-effectiveness, ensuring broader adoption. These advancements create a pathway for expanding applications beyond traditional construction and automotive uses into renewable energy and high-tech electronics.

Key Trends and Opportunities

Integration with Renewable Energy Solutions

The rapid growth of solar energy provides new opportunities for flat glass coatings, particularly anti-reflective and self-cleaning variants. Coatings improve the efficiency of photovoltaic panels by maximizing light transmission and minimizing energy losses. As governments provide incentives for renewable adoption, the role of coated glass in solar farms and rooftop installations expands. This trend aligns with the global shift toward sustainable energy, allowing manufacturers to diversify offerings and capture emerging markets. Renewable energy integration remains a strong growth catalyst in the near to medium term.

- For instance, anti-reflective coatings can enhance solar panel efficiency by 2%–3% or more, depending on the specific technology used. These coatings work by reducing the amount of sunlight that reflects off the panel’s surface, allowing more light to be absorbed by the photovoltaic cells.

Sustainability-Driven Innovation

The market is experiencing a shift toward eco-friendly coating formulations and recyclable substrates. Companies focus on reducing volatile organic compound (VOC) content in coatings while improving lifecycle performance. Circular economy initiatives encourage the recycling of coated glass, particularly in Europe, where stringent regulations drive compliance. These sustainability-centered innovations not only meet regulatory standards but also align with consumer preferences for green materials. Growing demand for environmentally responsible construction and automotive solutions positions sustainable coatings as a major opportunity for market leaders.

- For instance, The Sherwin-Williams Company supplies architectural coatings, some of which are low-VOC, and conducts extensive durability testing under accelerated weathering conditions to demonstrate long-term performance.

Key Challenges

High Production and Processing Costs

The complex deposition processes and advanced materials used in flat glass coatings increase production costs significantly. Manufacturers face challenges in balancing performance improvements with affordability, particularly for large-scale construction projects in emerging economies. High initial investment in coating equipment and limited economies of scale further restrict adoption in price-sensitive markets. Cost competitiveness remains a barrier, especially compared to uncoated glass alternatives. This challenge could slow penetration in certain regions unless technological advancements or subsidies help reduce the cost burden.

Fluctuations in Raw Material Supply

The market faces volatility in raw material prices, especially metals like silver and titanium dioxide, which are critical for high-performance coatings. Supply chain disruptions, geopolitical tensions, and resource constraints increase uncertainty for manufacturers. Rising costs impact profitability and force companies to explore alternative formulations, sometimes at the expense of performance. Additionally, dependency on specific suppliers for specialized resins and chemicals amplifies vulnerability. Ensuring raw material stability and supply chain resilience remains essential to sustaining long-term market growth for flat glass coatings.

Regional Analysis

North America

North America held a market share of 32% in 2024, driven by rising demand for energy-efficient buildings and advanced glazing solutions in the United States and Canada. Strong adoption of Low-E and solar control coatings is supported by strict environmental regulations and LEED-certified construction practices. The automotive industry also contributes significantly, with coated glass used for solar control and safety features. Continuous investment in smart city projects and sustainable infrastructure further boosts demand. Manufacturers in the region focus on innovation and green coatings to meet government mandates and consumer preference for sustainable building solutions.

Europe

Europe accounted for a market share of 28% in 2024, supported by stringent energy efficiency directives and carbon neutrality goals across major economies such as Germany, France, and the United Kingdom. Widespread adoption of Low-E glass coatings in residential and commercial construction is driven by EU regulations on thermal insulation and building performance. Solar control coatings are also gaining momentum due to high demand for modern glazing in automotive and urban infrastructure. The region’s strong emphasis on circular economy practices and recycling initiatives further reinforces adoption, making Europe a critical hub for sustainable flat glass coating technologies.

Asia-Pacific

Asia-Pacific emerged as the largest and fastest-growing region with a market share of 34% in 2024. Rapid urbanization, infrastructure expansion, and rising disposable incomes in China, India, and Southeast Asia fuel strong demand for coated flat glass in construction and automotive applications. Government-backed renewable energy initiatives also drive adoption of anti-reflective coatings in solar panels. The automotive sector benefits from increasing EV production, particularly in China, where advanced glazing solutions are a priority. Cost-efficient manufacturing capabilities, coupled with expanding domestic consumption, position Asia-Pacific as a key growth engine for the global flat glass coatings market.

Middle East and Africa

The Middle East and Africa region held a market share of 3% in 2024, supported by large-scale infrastructure and construction projects in countries such as the United Arab Emirates and Saudi Arabia. Rising investment in commercial complexes, smart cities, and luxury housing drives the demand for energy-efficient glazing solutions with solar control and Low-E coatings. High solar exposure in the region creates significant opportunities for solar control coatings in both buildings and automotive applications. However, limited domestic manufacturing capacity and reliance on imports constrain growth, although ongoing urbanization projects are expected to steadily increase adoption.

Latin America

Latin America captured a market share of 3% in 2024, with demand driven primarily by construction activities in Brazil and Mexico. Government-led housing initiatives and infrastructure upgrades support adoption of coated glass in residential and commercial projects. The automotive industry in Mexico plays an important role, with coated glass increasingly used in manufacturing for improved safety and passenger comfort. Growth is somewhat limited by economic instability and import dependency, but rising awareness of energy savings and sustainability is gradually boosting market penetration. Expanding urbanization and renewable energy projects present long-term opportunities for regional growth.

Market Segmentations:

By Coatings Type

- Low-E (Low-Emissivity) coatings

- Solar control coatings

- Anti-reflective coatings

- Others

By Resin Type

- Silicone resins

- Acrylic resins

- Polyurethane resins

- Others

By Application

- Construction and architecture

- Automotive

- Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the flat glass coatings market is defined by leading players such as Guardian Glass, Hesse, Viracon, Corning, Vitro Architectural Glass, Nippon Sheet Glass, The Sherwin-Williams Company, Ferro Corporation, Arkema, and Fenzi Group. These companies maintain strong positions through product innovation, technological expertise, and global distribution networks. The market is characterized by continuous investment in advanced coating technologies, including low-emissivity, solar control, and multifunctional solutions, to address the growing demand for energy efficiency and sustainability. Strategic partnerships and expansions are common, as players seek to strengthen market presence in high-growth regions like Asia-Pacific and North America. Many firms focus on eco-friendly and VOC-free formulations to comply with stringent environmental regulations, particularly in Europe. Rising emphasis on renewable energy applications, such as solar panels, is also driving innovation. Competitive intensity remains high, with differentiation increasingly linked to sustainability, durability, and multifunctional performance in glass coating solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Guardian Glass

- Hesse

- Viracon

- Corning

- Vitro Architectural Glass

- Nippon Sheet Glass

- The Sherwin-Williams Company

- Ferro Corporation

- Arkema

- Fenzi Group

Recent Developments

- In September 2025, Guardian Glass introduced CLARIA™, a generative AI assistant to guide customers on glass performance and coating selection.

- In April 2025, Sherwin-Williams won the 2025 MP Corrosion Innovation Award for its Heat-Flex CUI-mitigation coatings.

- In March 2025, Sherwin-Williams Protective & Marine expanded its Global Core coatings line to ensure consistent specifications and color matching globally.

- In 2025, Guardian Glass launched SunGuard SNX 60+, a new triple-silver low-E coated glass for North America.

Report Coverage

The research report offers an in-depth analysis based on Coatings Type, Resin Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly due to rising adoption of energy-efficient building solutions.

- Low-E coatings will continue to dominate as governments enforce stricter green building codes.

- Solar control coatings will gain traction in automotive applications to improve passenger comfort.

- Anti-reflective coatings will see growth with rising demand in electronics and solar panels.

- Asia-Pacific will remain the fastest-growing region, supported by urbanization and infrastructure development.

- North America and Europe will sustain strong demand through sustainability regulations and retrofit projects.

- Technological innovations such as nanocoatings will create multifunctional and self-cleaning glass surfaces.

- Companies will invest heavily in eco-friendly formulations to reduce VOC emissions.

- Renewable energy growth will boost usage of coated glass in photovoltaic installations.

- Competitive intensity will rise as players focus on expanding capacity in high-demand regions.