Market Overview

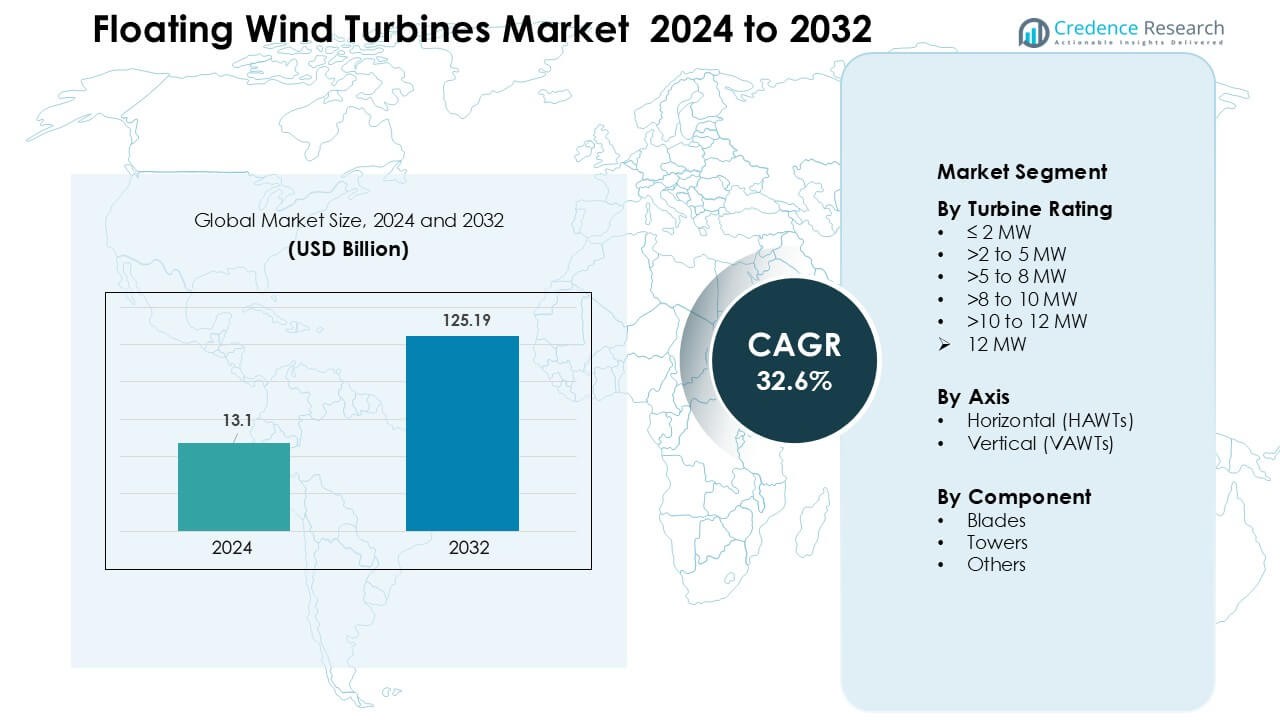

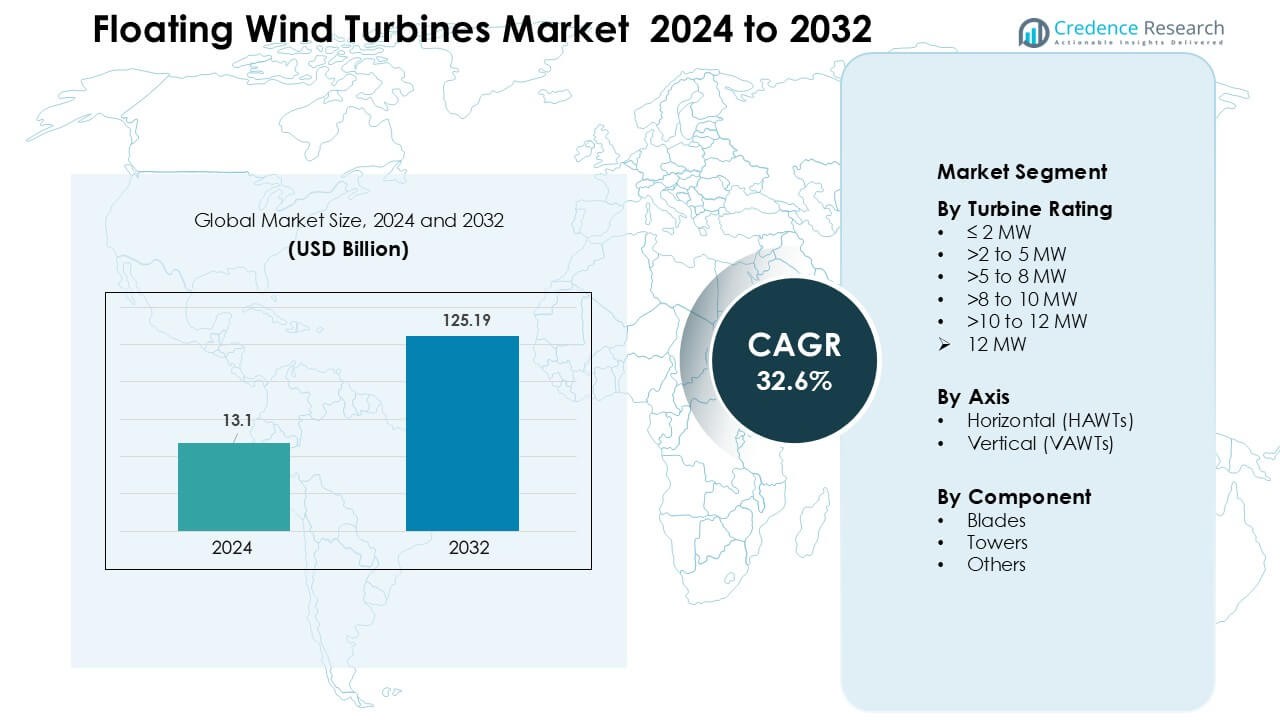

Floating Wind Turbines Market was valued at USD 13.1 billion in 2024 and is anticipated to reach USD 125.19 billion by 2032, growing at a CAGR of 32.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floating Wind Turbines Market Size 2024 |

USD 13.1 Billion |

| Floating Wind Turbines Market, CAGR |

32.6 % |

| Floating Wind Turbines Market Size 2032 |

USD 125.19 Billion |

The floating wind turbines market is shaped by major players such as Simply Blue Group, RWE, Hexicon, Prysmian Group, General Electric, Sumitomo Electric Industries, Global Energy Group Limited, Ørsted A/S, Equinor ASA, and Nexans, each expanding project pipelines and advancing deep-water turbine and platform technologies. These companies strengthen competitiveness through joint ventures, long-term offshore leases, and investment in next-generation cabling, mooring, and high-capacity turbine systems. Europe remained the leading region in 2024 with about 46% share, supported by early adoption, strong policy frameworks, and well-developed offshore infrastructure that enabled faster transition from pilot projects to commercial-scale floating wind farms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The floating wind turbines market reached USD 13.1 billion in 2024 and is projected to hit USD 125.19 billion by 2032, growing at a CAGR of about 32.6 % during the forecast period.

- Growth is driven by rising demand for deep-water renewable energy, strong government decarbonization targets, and rapid adoption of 8–12 MW floating turbine systems that improve power output and reduce installation costs.

- Key trends include large commercial floating wind farms, digital monitoring technologies, and expanding use of hybrid offshore systems that integrate subsea substations and energy storage for grid stability.

- The market features active competition from Simply Blue Group, RWE, Hexicon, Prysmian Group, General Electric, Ørsted A/S, Equinor ASA, Nexans, and Sumitomo Electric, each focusing on platform innovation and deeper offshore capabilities.

- Europe led with about 46% share, supported by early adoption and strong offshore policies, while the >8–10 MW turbine rating segment held around 34% share, reflecting industry preference for higher-capacity systems.

Market Segmentation Analysis:

By Turbine Rating

The >8 to 10 MW turbine class dominated the rating segment in 2024 with about 34% share, driven by strong deployment in deep-water European projects and faster scaling of next-generation platforms. Developers preferred this rating because the turbines offer higher energy yield per unit, reduce balance-of-plant costs, and support commercial-scale wind farms. Growth accelerated as OEMs advanced large-rotor designs and floating platforms that handle high-capacity machines. The >10 to 12 MW class is rising quickly due to pilot launches in Norway, France, and the U.S., supported by robust policy incentives.

- For instance, Siemens Gamesa Renewable Energy (SGRE) deployed its SG 8.0-167 DD model on the floating Hywind Tampen project the farm consists of 11 turbines each with a 167‑metre rotor and 8.0 (upgraded to 8.6) MW rating, generating a total of 88 MW from floating platforms in water depths of 260–300 metres.

By Axis

Horizontal-axis floating turbines (HAWTs) dominated the axis segment in 2024 with nearly 88% share, supported by their mature supply chain, proven aerodynamics, and strong track record in harsh offshore conditions. Up-wind HAWTs held the larger share as developers favored their lower tower-shadow impact and higher efficiency during variable wind directions. HAWTs also benefit from widespread OEM designs from Siemens Gamesa, Vestas, and GE, enabling easier certification and volume manufacturing. Vertical-axis turbines gained interest for stability and lower center of gravity but remained at early-stage demonstration levels due to limited scalability.

- For instance, the company SeaTwirl plans to deploy a 1 MW vertical-axis floating turbine (S2x) off Norway, following its earlier 30 kW prototype showing that VAWT usage is still at the pilot / demonstration stage rather than commercial scale.

By Component

Blades led the component segment in 2024 with around 46% share, supported by rising demand for longer composite blades that increase energy capture in deep-water installations. Manufacturers expanded carbon fiber and hybrid material use to enhance stiffness-to-weight ratios, which improved floating platform stability. Tower components showed steady growth with new corrosion-resistant steel designs designed for dynamic loading. Other components—including nacelles, mooring lines, and subsea cables—advanced due to digital monitoring and modular systems, yet blades remained dominant because they directly influence turbine performance and annual energy production.

Key Growth Drivers

Expansion of Deep-Water Offshore Wind Projects

Growing demand for renewable power is pushing developers toward deep-water sites where wind speeds are stronger and more stable. Fixed-bottom turbines cannot operate in depths beyond 60 meters, which makes floating platforms the only viable option for vast untapped offshore zones. Europe, Japan, South Korea, and the U.S. West Coast are leading new leasing rounds in deep-water regions, accelerating investments in large-scale floating arrays. Governments support these deployments through subsidies, long-term PPAs, and green industrial policies that promote local manufacturing. Higher capacity factors in deep-water locations also improve the economic case for floating wind, while large energy utilities scale pilot projects into commercial phases. This shift unlocks multi-gigawatt potential, enabling higher grid reliability and supporting national decarbonization targets.

- For instance, the floating wind farm Hywind Tampen in Norway sits in water depths between 260 m and 300 m, at a distance of 140 km from shore, with an installed capacity of 88 MW.

Rapid Advancement in Turbine and Floating Platform Technologies

Innovation in turbine rating, rotor diameter, and platform stability is a major driver shaping market growth. New 10–15 MW floating-compatible turbines allow higher yield per installation, reducing Levelized Cost of Energy over time. OEMs are developing advanced materials, dynamic control systems, and hybrid composite blades to enhance performance under variable ocean conditions. Platform technologies such as semi-submersibles, spars, and tension-leg platforms are being optimized to handle larger turbines with improved buoyancy and reduced mooring stress. Digital twins, predictive analytics, and automated maintenance systems further cut operational costs, making floating wind more competitive against other renewables. Faster prototyping and certification processes are also enabling quicker project approvals. Together, these advancements are accelerating commercial viability and expanding deployment pipelines across major offshore markets.

- For instance, researchers recently proposed a novel 15 MW semi‑submersible floating platform named VolturnX which through optimized design of its heave‑plate reduced average heave motion by 17.85% compared with earlier platform designs, enhancing stability under ocean conditions.

Strong Policy Support and Decarbonization Targets

Governments are accelerating floating wind adoption through aggressive climate commitments, renewable portfolio standards, and offshore leasing incentives. Many countries have set net-zero timelines and require large-scale renewable expansion to meet rising demand for green electricity. Floating wind fits these policies by supplying high-capacity, low-intermittency energy near coastal consumption centers. Financial incentives, such as tax credits, capital grants, and capacity auctions, improve the bankability of early-stage floating projects. Regulatory frameworks are also evolving to streamline permitting and expand transmission corridors for offshore energy. Public-private partnerships, strategic alliances, and port modernization programs further strengthen supply chains. As nations compete for offshore wind leadership, floating wind benefits from long-term visibility that supports investments in manufacturing, workforce development, and grid integration.

Key Trends & Opportunities

Shift Toward Large Commercial-Scale Floating Wind Farms

The market is moving from small demonstration units to full commercial floating wind farms exceeding 100 MW capacity. Countries such as Norway, France, the U.K., and South Korea have opened large leasing rounds specifically for floating technologies, signaling strong confidence in market scalability. Developers are forming global consortia to secure financing, localize supply chains, and build multi-gigawatt project pipelines. Ports and fabrication yards are being upgraded to support serial production of floating platforms, blades, and towers. This trend creates major opportunities for technology suppliers, engineering firms, and grid solution providers. As more commercial projects move into construction, economies of scale will reduce installation time, logistics cost, and platform manufacturing expenses supporting competitive LCOE and faster mainstream adoption.

- For instance, Ocean Winds a 50:50 joint venture between EDP Renewables and ENGIE recently secured seabed lease rights in the Celtic Sea for a floating wind project with potential capacity of up to 1.5 GW.

Growing Integration of Hybrid Energy Systems and Green Hydrogen Production

Floating wind turbines are increasingly seen as a key enabler for offshore hybrid systems that combine battery storage, subsea substations, and hydrogen electrolyzers. These systems allow operators to store excess energy or convert it into green hydrogen for industrial use, fuel cells, or export. Countries with limited land availability such as Japan and the U.K. are prioritizing offshore hydrogen hubs to meet clean energy goals. Floating wind’s ability to operate in high-wind regions far from shore makes it an ideal power source for offshore electrolyzers. Companies are exploring pilot projects involving direct wind-to-hydrogen pathways, creating opportunities for equipment manufacturers, subsea engineering firms, and hydrogen logistics providers. This trend strengthens floating wind’s role in broader energy transition strategies.

- For instance, Sealhyfe a floating offshore hydrogen production facility near Saint-Nazaire, France uses a 1 MW electrolyser connected to a floating wind turbine platform. Sealhyfe reportedly produces up to 400 kg of green hydrogen per day from seawater, demonstrating the feasibility of offshore wind-to-hydrogen conversion on a small but real scale.

Rising Digitalization and Predictive Maintenance Adoption

Developers are increasingly adopting advanced digital tools to improve turbine performance and reduce maintenance costs. Predictive analytics, AI-based condition monitoring, and digital twins help optimize energy output and reduce downtime in harsh offshore environments. Remote inspection technologies such as drones, autonomous vessels, and robotic crawlers reduce operational risks and enable real-time fault detection. These innovations offer large opportunities for software developers, sensor manufacturers, and automation companies. Enhanced digital capabilities also enable more accurate resource assessment and modeling of platform behavior under dynamic ocean conditions. As offshore wind farms expand in size and distance from shore, digital solutions will become essential for cost-efficient and safe operations.

Key Challenges

High Capital Costs and Complex Supply Chain Requirements

Floating wind projects require higher upfront investments compared to fixed-bottom offshore turbines. Large floating platforms, mooring systems, subsea cables, and deep-water installation vessels significantly raise capital expenditure. The supply chain is still emerging, with limited global capacity for large-scale platform fabrication, dynamic cables, and specialized port infrastructure. These constraints often lead to delays, cost overruns, and logistical bottlenecks. Financing remains challenging because lenders view floating wind as a developing technology with limited long-term performance data. Without stronger supply chain localization and larger commercial orders, cost reductions may progress slower than expected, hindering rapid deployment in emerging markets.

Environmental, Regulatory, and Grid Integration Constraints

Floating wind projects face long permitting cycles due to environmental assessments, marine spatial planning, and community engagement requirements. Concerns about marine biodiversity, visual impact, fishing interference, and shipping lanes can delay approvals. Grid integration also poses a challenge because many deep-water sites lack adequate transmission links, requiring expensive subsea cables and grid upgrades. Regulatory frameworks remain inconsistent across regions, making cross-border project planning difficult. Weather risks, such as extreme storms and strong swell conditions, require robust engineering designs and raise insurance costs. These hurdles slow development timelines and reduce investor confidence, especially in early-stage markets.

Regional Analysis

North America

North America accounted for about 21% share in 2024, driven by strong momentum across the U.S. West Coast and emerging interest in Hawaii and Alaska. The region advanced floating wind through deep-water leasing rounds, robust incentives, and offshore grid modernization efforts. California’s deep-water basins, with depths exceeding 800 meters, positioned the U.S. as a leading market for large-scale deployments. Partnerships among utilities, turbine manufacturers, and global developers helped accelerate pilot-to-commercial transitions. Canada explored floating wind for remote coastal communities, but the U.S. remained the dominant contributor to regional growth.

Europe

Europe dominated the global floating wind turbines market with around 46% share in 2024, supported by early technology adoption and strong policy frameworks. The U.K., Norway, France, and Spain led large-scale deployments through auctions, green industrial strategies, and rapid port infrastructure upgrades. The region’s proven demonstration sites transitioned into commercial projects exceeding 100 MW, enhancing investor confidence. Europe also benefited from a mature offshore supply chain and advanced engineering capabilities that lowered installation and maintenance risks. Growth is further driven by national decarbonization plans and multi-gigawatt floating wind targets announced for 2030.

Asia-Pacific

Asia-Pacific held nearly 27% share in 2024, propelled by high energy demand and strong government backing for offshore renewable expansion. Japan, South Korea, China, and Taiwan advanced floating wind through grid reforms, technology trials, and local manufacturing programs. Japan’s deep-water coastlines created significant demand for floating platforms, while South Korea pursued large commercial clusters in Ulsan Bay. China invested heavily in next-generation floating turbines and supply chain scaling to reduce dependence on imports. The region’s long coastlines, deep-water potential, and strong industrial capabilities position Asia-Pacific as the fastest-growing floating wind market.

Latin America

Latin America captured around 4% share in 2024, driven by initial feasibility studies and small-scale demonstration activity. Brazil and Chile explored floating wind to complement hydropower and meet rising clean-energy commitments. Brazil’s deep-water offshore basins, supported by existing marine infrastructure from the oil and gas sector, offer strong long-term potential. Chile evaluated floating wind for industrial decarbonization and future hydrogen production in high-wind regions. Despite early-stage progress, permitting gaps, financing constraints, and limited supply chain readiness slowed rapid scaling. However, long-term opportunities remain strong as regional energy diversification accelerates.

Middle East & Africa

The Middle East & Africa region held about 2% share in 2024, mainly driven by exploratory projects rather than commercial-scale deployments. Countries such as Morocco, South Africa, and Saudi Arabia assessed floating wind potential to support green hydrogen ambitions and diversify energy portfolios. High wind resources along the Atlantic and Red Sea coastlines create strong technical feasibility, but limited offshore infrastructure and regulatory frameworks pose challenges. Regional investment is rising as governments pursue renewable targets and engage international developers. While still nascent, MEA is expected to gain momentum as energy transition plans accelerate.

Market Segmentations:

By Turbine Rating

- ≤ 2 MW

- >2 to 5 MW

- >5 to 8 MW

- >8 to 10 MW

- >10 to 12 MW

- > 12 MW

By Axis

- Horizontal (HAWTs)

- Vertical (VAWTs)

By Component

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the floating wind turbines market features leading players such as Simply Blue Group, RWE, Hexicon, Prysmian Group, General Electric, Sumitomo Electric Industries, Global Energy Group Limited, Ørsted A/S, Equinor ASA, and Nexans, each strengthening global presence through technology innovation and large project pipelines. Companies focus on scaling turbine ratings, improving platform stability, and deploying advanced cabling and mooring systems for deep-water environments. Strategic alliances between developers, utilities, and engineering firms support faster commercialization and reduce development risks. Investments in digital monitoring, localized fabrication, and port upgrades further enhance competitiveness. Firms also compete through multi-gigawatt offshore wind bids, supply chain expansion, and partnerships aimed at reducing installation time and lifecycle costs. As floating wind moves from pilot to commercial scale, competition intensifies across turbine manufacturing, platform design, subsea infrastructure, and integrated offshore solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Simply Blue Group

- RWE

- Hexicon

- Prysmian Group

- General Electric

- Sumitomo Electric Industries, Ltd.

- Global Energy (Group) Limited

- Ørsted A/S

- Equinor ASA

- Nexans

Recent Developments

- In November 2025, Hexicon reported project-level and corporate updates in November 2025 progress and safety clearances for the Munmu Baram floating project (South Korea) and a Q3 2025 update describing portfolio consolidation and strategic focus amid market challenges reflecting active permitting and stepping-up toward commercial development.

- In October 2025, Simply Blue Group KEPCO (Kansai Electric Power) agreed to invest in Simply Blue Group’s offshore wind arm (Simply Blue Energy OSW), signalling fresh capital and a strategic partner to help scale Simply Blue’s floating and fixed-bottom offshore pipeline. This follows broader portfolio activity after earlier partnership changes in the U.S.

- In April 2025, RWE publicly paused offshore wind activity in the United States amid regulatory and political uncertainty, a move that affects its U.S. offshore pipeline (including some floating opportunities) while the company continues to push floating-wind development elsewhere and targets commercial-scale floating projects (aiming for ~1 GW operational/under construction by 2030).

Report Coverage

The research report offers an in-depth analysis based on Turbine Rating, Axis, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Floating wind will expand rapidly as more countries open deep-water offshore leasing rounds.

- Turbine ratings will rise further, with 12–15 MW models becoming standard in commercial projects.

- Platform designs will stabilize, enabling faster serial manufacturing and lower installation costs.

- Digital twins, predictive maintenance, and automation will reduce downtime and strengthen operational reliability.

- Supply chains will scale globally, with new fabrication yards and component hubs near major ports.

- Hybrid offshore systems combining wind, storage, and hydrogen production will see wider deployment.

- Financing conditions will improve as more commercial projects reach final investment decisions.

- Governments will strengthen permitting frameworks to shorten approval timelines for floating projects.

- Grid upgrades and long-distance subsea transmission lines will support higher offshore power integration.

- New markets in Asia-Pacific, North America, and Latin America will accelerate adoption beyond Europe.