Market Overview

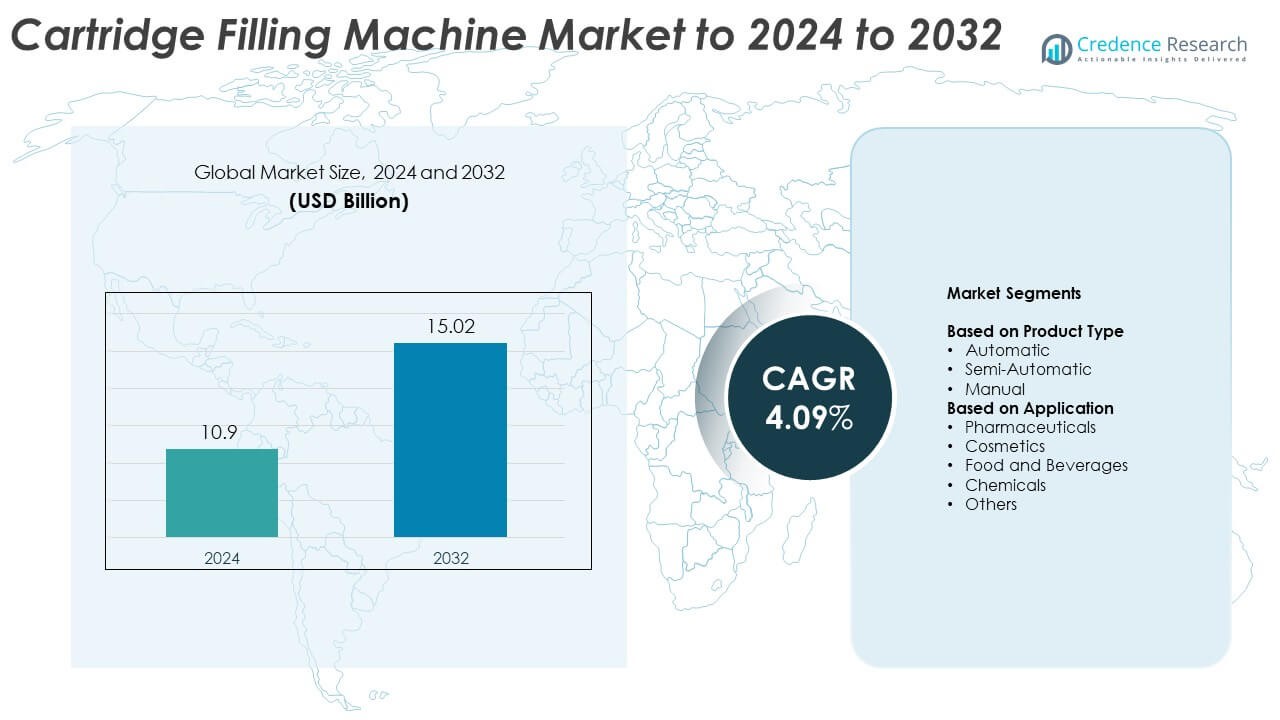

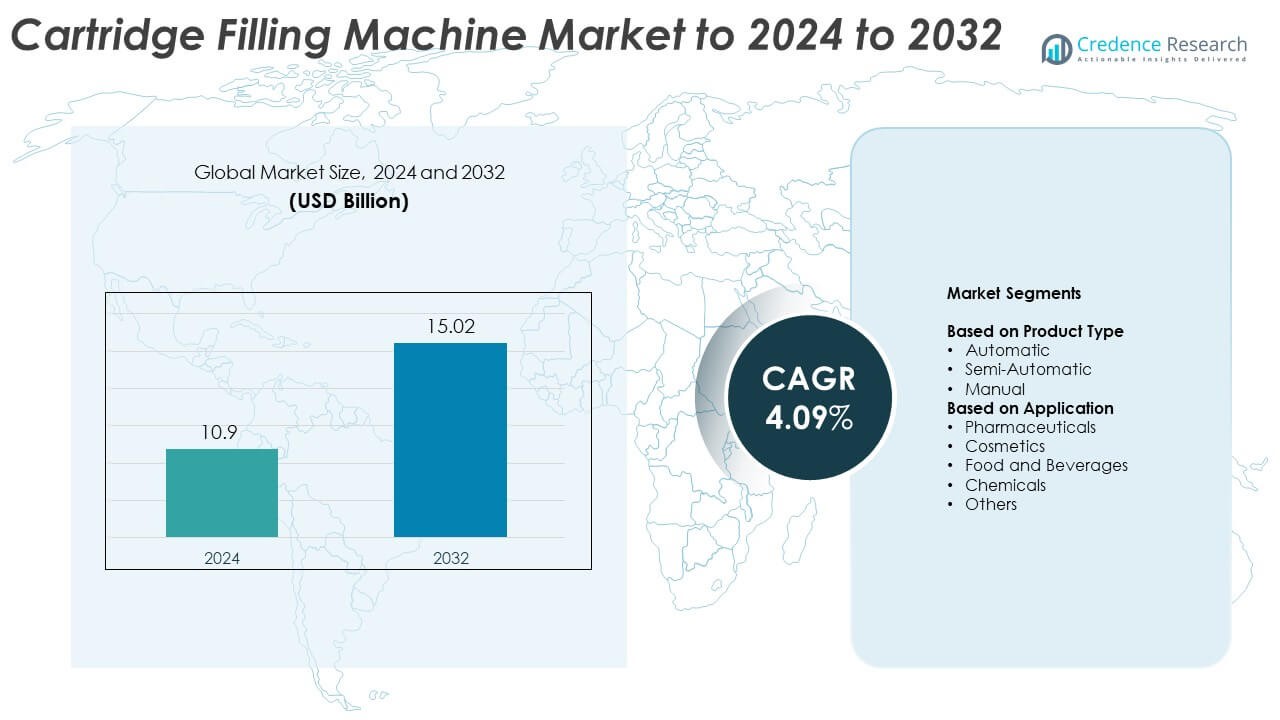

Cartridge Filling Machine market size was valued at USD 10.9 Billion in 2024 and is anticipated to reach USD 15.02 Billion by 2032, at a CAGR of 4.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cartridge Filling Machine Market Size 2024 |

USD 10.9 Billion |

| Cartridge Filling Machine Market, CAGR |

4.09% |

| Cartridge Filling Machine Market Size 2032 |

USD 15.02 Billion |

The Cartridge Filling Machine market features established players such as Dara Pharmaceutical Packaging, ProSys Servo Filling Systems, Coesia, Filamatic, Marchesini Group, Bosch Packaging Technology, IMA Group, Watson-Marlow Fluid Technology Group, Romaco Group, and Cozzoli Machine Company. These companies strengthen their positions through advanced automation, higher filling accuracy, and strong service networks across global pharmaceutical and cosmetics production lines. North America led the market in 2024 with about 37% share due to strong pharmaceutical manufacturing and rapid technology adoption. Europe followed with significant demand from regulated drug-packaging sectors, while Asia Pacific continued to expand at a faster pace driven by rising industrial investments and growing contract manufacturing activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cartridge Filling Machine market reached USD 10.9 Billion in 2024 and is projected to hit USD 15.02 Billion by 2032, growing at a CAGR of 4.09% during the forecast period.

• Rising automation demand in pharmaceuticals and cosmetics drives strong adoption, with automatic systems holding the largest segment share due to higher accuracy and output.

• Trends include rapid integration of servo controls, cleanroom-compatible designs, and IoT-enabled monitoring that improves efficiency and reduces product loss across high-volume filling lines.

• The competitive landscape features global players expanding through technology upgrades, modular machine platforms, and stronger after-sales networks to capture growing regulated sectors.

• North America led the market in 2024 with about 36% share, followed by Europe at around 29%, Asia Pacific with nearly 25%, while pharmaceuticals held the largest application share due to strict quality and safety standards.

Market Segmentation Analysis:

By Product Type

The product type segment in the Cartridge Filling Machine market is led by automatic systems with about 52% share in 2024. Automatic machines gained strong adoption because companies want higher filling accuracy, faster throughput, and reduced human error. Semi-automatic models continued to serve mid-scale units seeking flexibility, while manual systems were used in small operations with limited volumes. Growth in automatic units is driven by rising demand for sterile handling, compliance with regulatory standards, and expanding production lines across pharmaceuticals and cosmetics.

- For instance, Bausch+Ströbel’s KSF series filling and closing machines, such as the KSF 1025 model, have a maximum output of up to 4,200 items per hour, as documented on the company’s official Bausch+Ströbel KSF series page.

By Application

The pharmaceuticals segment dominated the Cartridge Filling Machine market in 2024 with nearly 46% share. Pharmaceutical firms relied on advanced filling machines to support sterile dosage production, injectable formulations, and precise multi-cartridge filling. Cosmetics followed due to rising demand for skincare serums and creams needing controlled filling. Food and beverages and chemical firms adopted these machines for paste, gel, and liquid packaging. Dominance of pharmaceuticals is driven by strict quality norms, rising biologics production, and expansion of GMP-certified manufacturing units.

- For instance, the Vanrx (Cytiva) SA25 Aseptic Workcell is publicly verified to fill up to 20,000 units per batch under ISO 5 conditions, according to Cytiva’s official product sheets and technical data available on the Cytiva website.

Key Growth Drivers

Rising automation demand

Automation demand grows across major industries because firms want faster production, higher accuracy, and reduced labor cost. Cartridge filling machines support this shift with stable output and safer handling of sensitive products. Automated systems also help reduce contamination risk, which keeps them preferred in regulated markets. Growing use in pharmaceuticals, cosmetics, and chemical packaging supports steady adoption. This trend helps companies maintain product quality during large-batch operations and ensures repeatable filling performance for high-volume production sites.

- For instance, Optima Pharma confirms that its high-speed systems for syringes, cartridges, and vials can reach capacities of up to 60,000 pieces per hour for filling sizes up to 50 milliliters.

Expansion of regulated industries

Strict rules in pharmaceuticals, cosmetics, and chemicals push companies to invest in reliable filling machines. These industries require consistent dosing, clean filling zones, and traceable processes. Cartridge filling machines match these needs because they offer sealed systems and controlled filling actions. Growth in injectable drugs, premium cosmetic serums, and lab-grade chemical cartridges increases machine demand. Firms choose these systems to meet compliance needs and reduce operational errors. This demand continues to rise as global safety rules tighten.

- For instance, Dara Pharma’s high-speed aseptic equipment is rated for output up to 24,000 units per hour while dosing liquid volumes from 0.1 to 250 milliliters in injectable applications.

Growing small-batch and custom production

More firms now produce small-batch items such as skincare serums, flavor cartridges, and specialty chemical blends. This shift increases the need for flexible filling machines that support quick changeovers and accurate micro-dosing. Cartridge filling machines help brands meet new product launches and niche market demand with easy setup and faster adjustments. Startups and mid-scale manufacturers prefer these machines because they manage multiple viscosities with stable precision. Growing demand for customized and premium goods supports market expansion.

Key Trends and Opportunities

Adoption of smart and connected machines

Smart fillers with sensors, data logging, and predictive maintenance features gain attention across high-volume industries. These systems give operators real-time control of fill weight, speed, and cycle efficiency. Connectivity supports remote monitoring and faster troubleshooting, which reduces downtime across production lines. Firms use digital features to achieve higher accuracy and meet quality audits. This trend opens strong opportunities for suppliers offering AI-ready controllers, advanced diagnostics, and automated calibration features. Adoption rises with rising digital transformation efforts.

- For instance, Stäubli’s TX Stericlean robot series, introduced for aseptic areas in 2008, evolved into the TX2 line that is Industry 4.0-compatible and able to collect and share production data between robots.

Growth of cosmetic, food, and wellness cartridges

Demand for cosmetic creams, flavor cartridges, nutraceutical gels, and wellness blends increases across global markets. Brands introduce more single-use and multi-dose cartridge products for clean and convenient use. This creates strong opportunities for filling machine makers who offer solutions for thick, thin, and sensitive formulations. Growth in premium beauty, functional food, and natural wellness products supports wider use of compact filling machines. The rise of e-commerce also boosts small production units that rely on cartridge formats for fast scaling.

- For instance, Marchesini Group’s AXO 1600 tube filling platform used in cosmetic and personal-care lines is documented with a maximum output of up to 6,000 pieces per hour (100 tubes per minute) and a filling range from 3 to 250 milliliters, extendable to 450 milliliters, according to the official specifications.

Shift toward clean-label and sterile packaging

More consumers prefer safe, preservative-free, and sterile products across healthcare and personal care. This trend pushes companies to adopt filling machines that maintain strict hygiene and cleanroom standards. Cartridge filling systems support sterile handling, reduced exposure, and precise sealing. Demand increases in biologics, dermatology serums, diagnostic reagents, and lab consumables. Machine makers gain opportunities by offering sealed chambers, automated cleaning cycles, and contamination-control systems. Growth in regulated clean-label segments strengthens this trend.

Key Challenges

High capital and integration cost

Cartridge filling machines require notable investment due to advanced controls, stainless steel construction, and precision components. Small manufacturers often delay purchases because the machines also need skilled operators and integration with existing production lines. Installation and validation costs rise in pharmaceutical and chemical facilities, which slows adoption in resource-limited regions. Firms with low production volumes struggle to justify the cost of high-end automated machines. This challenge remains strong for new entrants and small-scale producers.

Complex handling of diverse formulations

Different industries use thick gels, thin liquids, reactive chemicals, and sensitive bio-based materials. Filling these materials demands precise control of temperature, flow rate, and contamination risk. Machine adjustments take time, and improper settings can cause wastage or inconsistent fill levels. Multi-viscosity requirements also increase maintenance needs and raise the chance of downtime. Manufacturers face difficulty balancing flexibility and efficiency when running varied formulas. This challenge grows as companies introduce more specialized and diverse products.

Regional Analysis

North America

North America held the largest share in 2024 with about 37% due to strong adoption of automated filling systems across pharmaceutical and cosmetic production lines. The region benefited from strict filling accuracy standards and advanced manufacturing ecosystems that encouraged higher use of precision dispensing technologies. Growth remained supported by rising demand for sterile packaging and expanding biotech output. The U.S. led consumption, driven by large-scale production facilities and higher investment in automation upgrades. Canada contributed steady demand from mid-sized manufacturers prioritizing quality compliance and improved productivity.

Europe

Europe accounted for nearly 29% of the market share in 2024, driven by strong regulatory emphasis on product safety, clean dispensing, and controlled filling operations across pharmaceutical and cosmetic manufacturing. The region’s technologically mature machinery sector encourages greater use of semi-automatic and automatic cartridge filling machines. Germany, Italy, and the U.K. remained key adopters as companies invested in precision filling to meet GMP requirements. European demand also remained supported by rising cosmetic exports and the food sector’s shift toward accurate, contamination-free filling processes.

Asia Pacific

Asia Pacific captured around 24% share in 2024 and showed the fastest growth due to expanding pharmaceutical manufacturing, rising contract manufacturing activity, and increasing cosmetic production across China, India, South Korea, and Japan. Manufacturers preferred cost-effective and scalable filling systems to support rising output volumes. Strong industrialization, availability of lower-cost machinery, and growing investments in automated filling solutions supported rapid adoption. China led regional growth with higher production of cartridges for medical and chemical use, while India showed strong momentum in pharmaceutical and personal care segments.

Latin America

Latin America held nearly 6% of the market share in 2024 as demand rose steadily from pharmaceutical, cosmetic, and food industries seeking better filling accuracy and improved process efficiency. Brazil and Mexico remained major contributors due to expanding drug formulation activities and greater preference for semi-automatic machines among mid-sized producers. The region benefited from gradual industrial modernization and increasing adoption of hygienic filling systems. Growth remained moderate but supported by rising local production requirements and manufacturers focusing on reducing operational waste and enhancing cartridge consistency.

Middle East & Africa

Middle East & Africa accounted for about 4% share in 2024, driven by growing investments in healthcare infrastructure, food processing, and chemical packaging. Demand improved as pharmaceutical manufacturing capacity expanded in countries like Saudi Arabia, the UAE, and South Africa. Companies adopted cartridge filling machines to achieve better precision, meet safety standards, and support small-batch production. Although the market remained smaller than other regions, gradual industrialization and rising imports of automated equipment continued to push adoption. The region showed stable long-term potential due to increasing local manufacturing activity.

Market Segmentations:

By Product Type

- Automatic

- Semi-Automatic

- Manual

By Application

- Pharmaceuticals

- Cosmetics

- Food and Beverages

- Chemicals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cartridge filling machine market features leading companies such as Dara Pharmaceutical Packaging, ProSys Servo Filling Systems, Coesia, Filamatic, Marchesini Group, Bosch Packaging Technology, IMA Group, Watson-Marlow Fluid Technology Group, Romaco Group, and Cozzoli Machine Company. Competition grows as manufacturers invest in higher-speed lines, precise dosing systems, and improved automation to reduce errors in regulated industries. Many suppliers focus on modular platforms that support diverse cartridge formats and fast product changeovers. Vendors also strengthen global reach through service networks and localized production to meet rising demand across pharmaceuticals, cosmetics, and chemicals. Digital monitoring tools, predictive maintenance features, and integration with smart factory systems further define competitive differentiation, while sustainability goals push firms to design energy-efficient and waste-reduction-oriented filling solutions.

Key Player Analysis

- Dara Pharmaceutical Packaging

- ProSys Servo Filling Systems

- Coesia

- Filamatic

- Marchesini Group

- Bosch Packaging Technology

- IMA Group

- Watson-Marlow Fluid Technology Group

- Romaco Group

- Cozzoli Machine Company

Recent Developments

- In 2025, Watson-Marlow Fluid Technology Solutions (WMFTS) showcased their latest advances in hygienic pumping and fluid handling at PPMA and COMPAMED 2025.

- In 2025, Marchesini Group showcased flexible filling and capping machines that handle viscous and foam products through syringes, mass feeders, flow meters, or peristaltic pumps

- In 2025, Coesia Acquired Autoware, an Italian software company. Exhibited the Citus Kalix KX803, an automatic tube filling machine, at IPACK-IMA & Pharmintech.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as automated filling systems gain wider adoption.

- Demand will increase due to rising production needs in pharmaceuticals and cosmetics.

- Manufacturers will shift toward high-precision and low-waste filling technologies.

- Integration of smart sensors and IoT features will support real-time quality checks.

- Energy-efficient and compact machine designs will gain stronger preference.

- Customizable machines will see higher demand from small and mid-scale producers.

- Regulations on hygiene and safety will push investments in advanced filling lines.

- The rise of single-dose and ready-to-use cartridges will expand machine upgrades.

- Asia Pacific will become a major opportunity zone due to rapid industrial expansion.

- Long-term growth will be shaped by digital automation, robotics, and precision dosing systems.