Market Overview

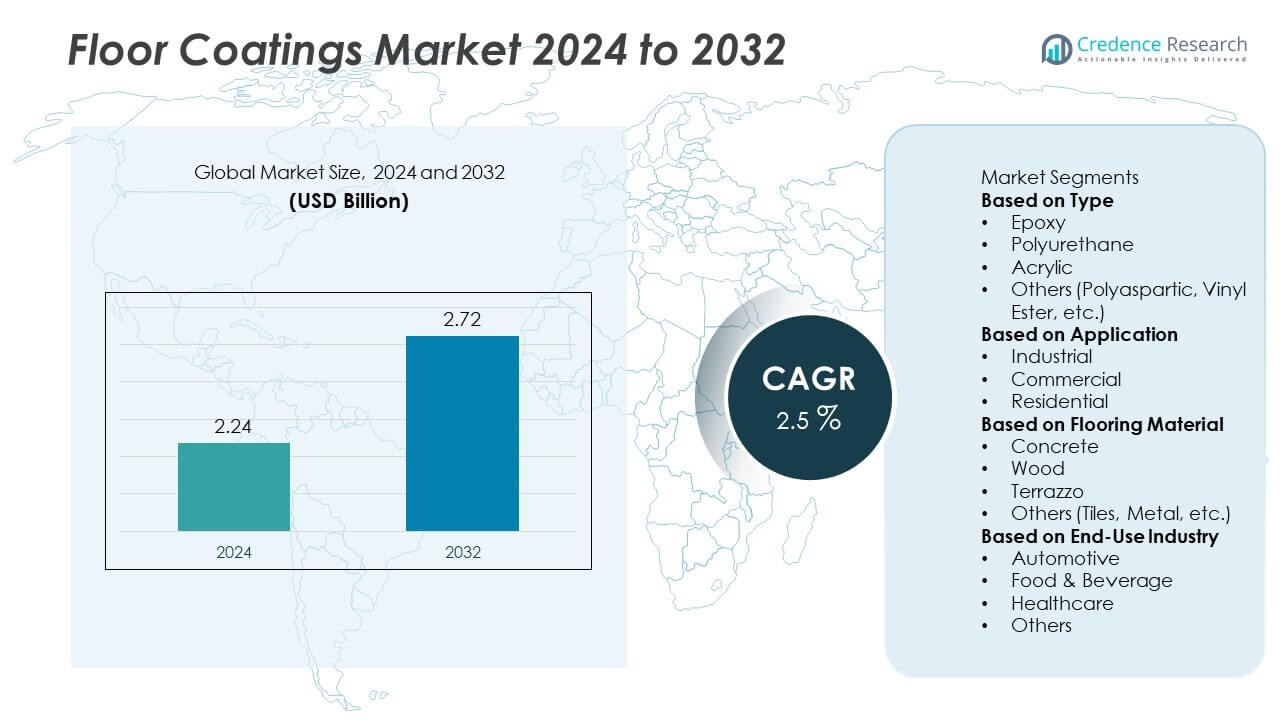

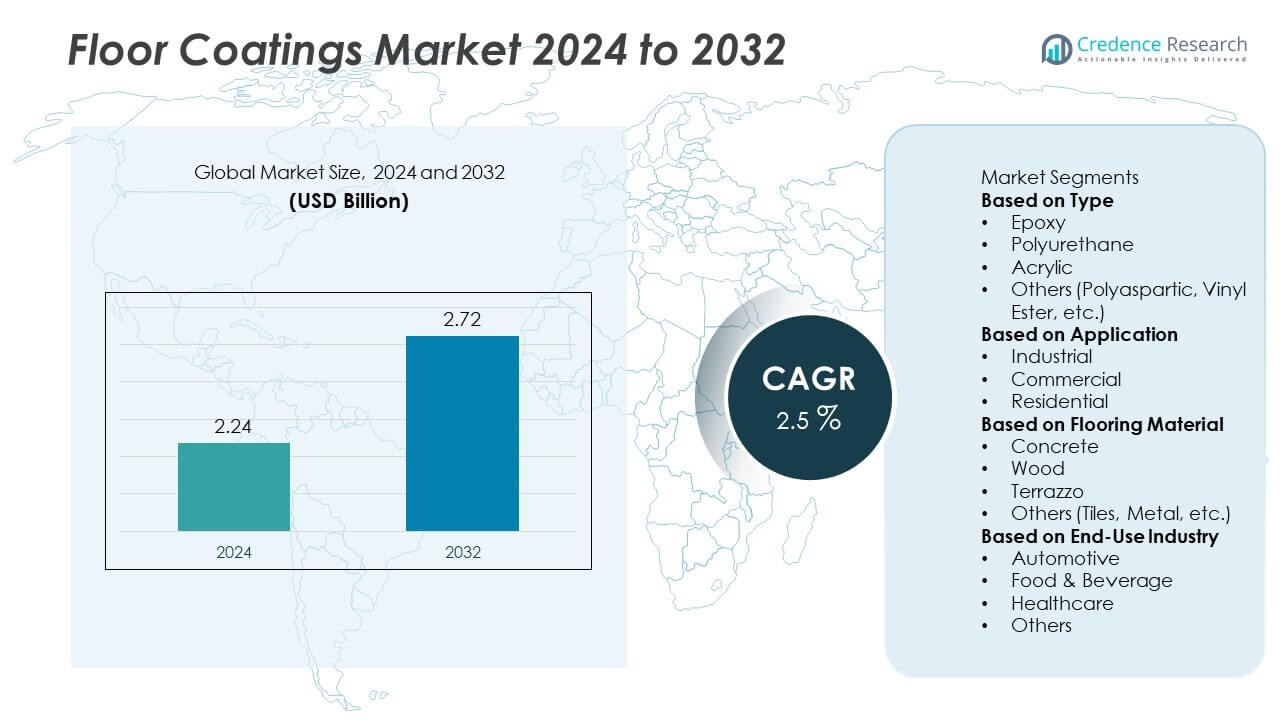

The Floor Coatings Market was valued at USD 2.24 billion in 2024 and is projected to reach USD 2.72 billion by 2032, registering a CAGR of 2.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floor Coatings Market Size 2024 |

USD 2.24 Billion |

| Floor Coatings Market, CAGR |

2.5% |

| Floor Coatings Market Size 2032 |

USD 2.72 Billion |

The floor coatings market is led by major companies including PPG Industries, Optical Coatings Japan, 3M Precision Optics, Janos Technology Inc., Ophir Optronics, Ltd. (MKS Instruments), Abrisa Technologies, JDSU (VIAVI Solutions), Denton Vacuum LLC, Inrad Optics, and Materion Corporation. These companies are driving innovation through advanced epoxy, polyurethane, and acrylic formulations that enhance floor durability, chemical resistance, and sustainability. North America dominated the market in 2024 with a 37% share, supported by strong industrial and commercial infrastructure development. Europe followed with a 30% share, driven by strict environmental regulations and green building initiatives, while Asia-Pacific held 25%, fueled by rapid urbanization, construction expansion, and increasing adoption of protective and decorative coating technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The floor coatings market was valued at USD 2.24 billion in 2024 and is projected to reach USD 2.72 billion by 2032, growing at a CAGR of 2.5% during the forecast period.

- Increasing demand for durable, chemical-resistant, and easy-to-maintain flooring in industrial and commercial spaces is a key driver of market growth.

- The market is witnessing trends toward eco-friendly, low-VOC, and water-based coating technologies that enhance performance and environmental compliance.

- Key players such as PPG Industries, 3M Precision Optics, and Materion Corporation are focusing on R&D, product innovation, and sustainability to maintain competitiveness in global markets.

- North America held a 37% share, followed by Europe with 30% and Asia-Pacific with 25%; by type, epoxy coatings dominated with a 42% share, supported by widespread use in industrial and commercial flooring for superior durability and cost efficiency.

Market Segmentation Analysis:

By Type

The epoxy segment dominated the floor coatings market in 2024, holding a 42% share, driven by its superior durability, chemical resistance, and cost-effectiveness. Epoxy coatings are widely used across industrial and commercial facilities due to their high adhesion and easy maintenance. Their ability to withstand heavy loads and harsh environments makes them ideal for warehouses, factories, and garages. Additionally, innovations in water-based and low-VOC epoxy formulations are enhancing environmental performance. Growing construction activity and increasing demand for long-lasting flooring protection continue to strengthen the segment’s leadership globally.

- For instance, PPG Industries offers a range of high-performance Envirocron HTE powder coatings. These high-transfer-efficiency polyester coatings can achieve first-pass efficiency rates of up to 85% or higher, with some formulations providing up to 3,000 hours of salt-spray resistance in ASTM B117 testing.

By Application

The industrial segment accounted for a 48% share of the floor coatings market in 2024, owing to extensive use in manufacturing plants, logistics centers, and automotive facilities. Industrial applications require coatings that provide resistance to abrasion, corrosion, and chemical exposure while maintaining smooth and safe surfaces. Rising investments in industrial infrastructure and the need for efficient, low-maintenance flooring solutions are fueling demand. The growth of the manufacturing sector, particularly in Asia-Pacific and North America, further supports the dominance of industrial floor coatings.

- For instance, Sherwin-Williams’ ArmorSeal 1000 HS epoxy floor coating provides an abrasion loss of 64.8 mg under ASTM D4060 testing. This test result is indicative of its abrasion resistance.

By Flooring Material

The concrete flooring segment led the floor coatings market in 2024 with a 55% share, attributed to its wide use in both industrial and commercial structures. Concrete floors benefit greatly from protective coatings that enhance durability, prevent cracking, and improve aesthetics. Epoxy and polyurethane coatings are particularly favored for their ability to resist moisture and wear in high-traffic environments. Rapid urbanization, along with increased construction of warehouses, malls, and residential complexes, continues to boost concrete coating applications. The segment’s versatility and low maintenance make it a preferred choice across multiple industries.

Key Growth Drivers

Rising Demand for Durable and Protective Flooring Solutions

The increasing need for long-lasting and low-maintenance flooring in industrial, commercial, and residential spaces is driving market growth. Floor coatings provide excellent resistance against abrasion, impact, and chemical spills, extending the lifespan of flooring systems. Industries such as automotive, manufacturing, and food processing rely on coated floors for safety and hygiene compliance. Growing construction activity and rising refurbishment of old industrial floors are further fueling adoption, as organizations seek durable and cost-efficient protection against heavy wear and environmental damage.

- For instance, the Master Builders Solutions MasterTop 1327 system is an elastic polyurethane flooring with crack-bridging properties. The MasterTop 1327-20dB variant provides impact noise reduction of up to 20 dB.

Expansion of Construction and Infrastructure Development

Rapid urbanization and large-scale infrastructure projects are boosting the demand for advanced floor coatings globally. Emerging economies in Asia-Pacific and the Middle East are witnessing significant investments in manufacturing, logistics, and commercial real estate. Floor coatings play a vital role in improving floor aesthetics and load-bearing capacity in modern facilities. Increasing public and private construction spending, coupled with government investments in industrial corridors and smart cities, continues to create strong growth opportunities across various sectors.

- For instance, Sika AG is a supplier of a variety of construction materials, including Sikafloor epoxy and polyurethane coatings, and their products are known for high technical performance. Sika has been active in large-scale projects in Saudi Arabia and has supplied materials for use in airport and metro construction.

Technological Advancements in Coating Materials

Innovation in coating technologies, such as waterborne, solvent-free, and UV-cured formulations, is reshaping the floor coatings market. These advanced coatings provide faster curing times, lower VOC emissions, and improved adhesion properties. The development of hybrid materials that combine epoxy and polyurethane benefits enhances performance under extreme conditions. Growing emphasis on sustainability and energy efficiency is encouraging manufacturers to focus on eco-friendly solutions. These technological improvements are expanding application possibilities while aligning with stricter environmental and safety regulations.

Key Trends and Opportunities

Growing Adoption of Green and Low-VOC Coatings

The shift toward environmentally friendly flooring solutions is emerging as a key trend in the market. Manufacturers are introducing low-VOC and water-based coatings that minimize harmful emissions while maintaining strong adhesion and durability. The demand for sustainable building materials in both residential and industrial sectors supports this trend. Government initiatives promoting green construction practices and regulatory compliance are accelerating adoption. This transition creates significant opportunities for companies focusing on innovative, eco-friendly formulations and certifications under sustainable building standards.

- For instance, AkzoNobel introduced its Interchar 1120 water-based epoxy intumescent coating, featuring VOC emissions below 35 grams per liter. The formulation achieved certification under the Environmental Product Declaration (EPD) and demonstrated fire protection performance up to 120 minutes in structural steel testing. This development aligns with global sustainability standards for green building projects.

Rising Preference for Aesthetic and Functional Flooring

Consumers are increasingly prioritizing floor coatings that offer both durability and visual appeal. Advanced coatings now feature decorative finishes, anti-slip properties, and customizable colors to enhance interior design. The trend is particularly strong in commercial and residential spaces, where design flexibility and performance are equally valued. Rapid growth in renovation projects and modern architecture is boosting the use of aesthetic coatings that combine functionality with enhanced surface protection, driving new market opportunities for premium and specialized flooring solutions.

- For instance, Rust-Oleum manufactures the RockSolid Metallic Garage Floor Coating, a polycuramine-based product with metallic pigments. This durable, high-gloss coating resists chemicals and is suitable for interior concrete surfaces like garage floors and basements.

Key Challenges

Fluctuating Raw Material Prices

Volatility in the prices of key raw materials such as epoxy resins, solvents, and additives poses a significant challenge for manufacturers. Dependence on petrochemical-derived inputs exposes producers to supply chain disruptions and cost instability. These fluctuations directly impact profit margins and pricing strategies. To mitigate risks, companies are exploring bio-based alternatives and developing strategic sourcing partnerships. However, maintaining consistent product quality while controlling costs remains a major challenge in the competitive floor coatings market.

Stringent Environmental and Safety Regulations

Tightening environmental regulations regarding VOC emissions and chemical usage continues to challenge the floor coatings industry. Compliance with global sustainability standards requires reformulation of traditional coatings, increasing R&D and production costs. Manufacturers must invest in new technologies to meet eco-label certifications and worker safety standards. Although these regulations drive innovation, they also slow down product approvals and market entry for smaller firms. Balancing environmental compliance with affordability and performance remains a key hurdle for long-term growth.

Regional Analysis

North America

North America dominated the floor coatings market in 2024 with a 37% share, driven by strong demand from the industrial and commercial construction sectors. The United States leads the region due to the widespread use of epoxy and polyurethane coatings in manufacturing plants, warehouses, and logistics facilities. The focus on energy-efficient, low-VOC, and durable flooring materials supports market growth. Ongoing infrastructure modernization and renovation projects, coupled with technological innovations in coating formulations, are enhancing regional competitiveness. Canada also contributes significantly through its expanding residential and commercial construction activities emphasizing sustainable building practices.

Europe

Europe accounted for a 30% share of the global floor coatings market in 2024, supported by growing investments in industrial infrastructure and renovation projects. Countries such as Germany, France, and Italy lead the regional market, driven by advanced manufacturing bases and stringent environmental regulations promoting low-VOC coatings. The presence of established coating manufacturers and high adoption of sustainable materials strengthen Europe’s position. Increasing demand for aesthetically appealing and chemical-resistant flooring in industrial and commercial facilities is fueling growth. The region’s shift toward energy-efficient buildings further drives innovation in eco-friendly floor coating technologies.

Asia-Pacific

Asia-Pacific held a 25% share of the global floor coatings market in 2024 and is expected to experience the fastest growth during the forecast period. Rapid industrialization, expanding construction sectors, and rising urbanization in China, India, and Japan are driving demand for durable and protective coatings. Government initiatives promoting industrial development and infrastructure modernization support further expansion. The growing adoption of epoxy and hybrid coatings in automotive and manufacturing facilities enhances market prospects. Increasing disposable income and urban housing projects also contribute to higher demand across both commercial and residential applications.

Latin America

Latin America captured a 5% share of the global floor coatings market in 2024, supported by rising construction activities and economic recovery in key countries such as Brazil and Mexico. Industrial expansion and government investments in infrastructure are driving adoption, particularly in logistics and manufacturing facilities. The demand for cost-effective, easy-to-maintain flooring solutions continues to rise across commercial and residential buildings. However, economic instability and fluctuating raw material costs limit large-scale adoption. Increasing presence of global coating brands and local partnerships are gradually strengthening market penetration across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the global floor coatings market in 2024, fueled by rapid urban development and growth in commercial infrastructure. Countries such as the UAE and Saudi Arabia are leading with large-scale construction and industrial projects under national modernization programs. Demand for high-performance, chemical-resistant coatings is increasing in oil and gas and hospitality sectors. Africa is witnessing gradual growth due to industrialization and infrastructure development. Although market penetration remains limited, rising foreign investments and smart city initiatives are expected to create long-term opportunities.

Market Segmentations:

By Type

- Epoxy

- Polyurethane

- Acrylic

- Others (Polyaspartic, Vinyl Ester, etc.)

By Application

- Industrial

- Commercial

- Residential

By Flooring Material

- Concrete

- Wood

- Terrazzo

- Others (Tiles, Metal, etc.)

By End-Use Industry

- Automotive

- Food & Beverage

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the floor coatings market includes major players such as PPG Industries, Optical Coatings Japan, 3M Precision Optics, Janos Technology Inc., Ophir Optronics, Ltd. (MKS Instruments), Abrisa Technologies, JDSU (VIAVI Solutions), Denton Vacuum LLC, Inrad Optics, and Materion Corporation. These companies focus on developing advanced epoxy, polyurethane, and acrylic coating formulations to enhance durability, chemical resistance, and environmental performance. Strategic initiatives such as mergers, partnerships, and capacity expansions are strengthening their global market presence. Many players are investing in sustainable and low-VOC products to align with green building standards and regulatory requirements. Continuous innovation in coating technologies, particularly for industrial and commercial flooring, is driving competition. The market remains moderately consolidated, with leading companies leveraging R&D capabilities and distribution networks to capture demand across construction, automotive, and manufacturing sectors while regional players focus on affordable, application-specific coating solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PPG Industries

- Optical Coatings Japan

- 3M Precision Optics

- Janos Technology Inc.

- Ophir Optronics, Ltd. (MKS Instruments)

- Abrisa Technologies

- JDSU (VIAVI Solutions)

- Denton Vacuum LLC

- Inrad Optics

- Materion Corporation

Recent Developments

- In October 2025, Inrad Optics was referenced in Luxium’s sale announcement. The release noted Luxium had acquired Inrad Optics in 2024. The deal with Excelitas advanced.

- In 2025, PPG Industries highlighted new industrial coatings at FABTECH. The showcase featured PPG PRIMERON powder primers and ENVIROLUXE powder coatings. PPG framed the lines as durability and sustainability upgrades.

- In July 2024, Sherwin-Williams introduced a new line of high-performance flooring systems designed for giga factories producing electric vehicle (EV) batteries. These flooring solutions offer chemical resistance, electrostatic discharge protection, moisture vapor control, and enhanced slip resistance.

- In April 2023, Dur-A-Flex launched Vent-E-A, a breathable epoxy flooring system. This new product is designed to improve floor durability and performance by allowing moisture to escape, which helps prevent damage and prolongs the lifespan of the flooring.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Flooring Material, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing construction and infrastructure projects will continue to drive demand for advanced floor coatings.

- Increasing adoption of eco-friendly and low-VOC coating solutions will shape future product development.

- Technological innovations in hybrid and waterborne coatings will enhance performance and reduce curing time.

- Rising demand from industrial and manufacturing facilities will strengthen long-term market growth.

- Expansion of commercial real estate and smart city initiatives will boost application opportunities.

- Manufacturers will focus on sustainability and recyclability to meet green building standards.

- Rapid industrialization in emerging economies will create new opportunities for coating suppliers.

- Integration of nanotechnology will improve coating durability, chemical resistance, and aesthetic finish.

- Strategic collaborations and mergers will help key players expand product portfolios and regional presence.

- Growing preference for decorative and multifunctional coatings will diversify applications in both residential and commercial sectors.