Market Overview

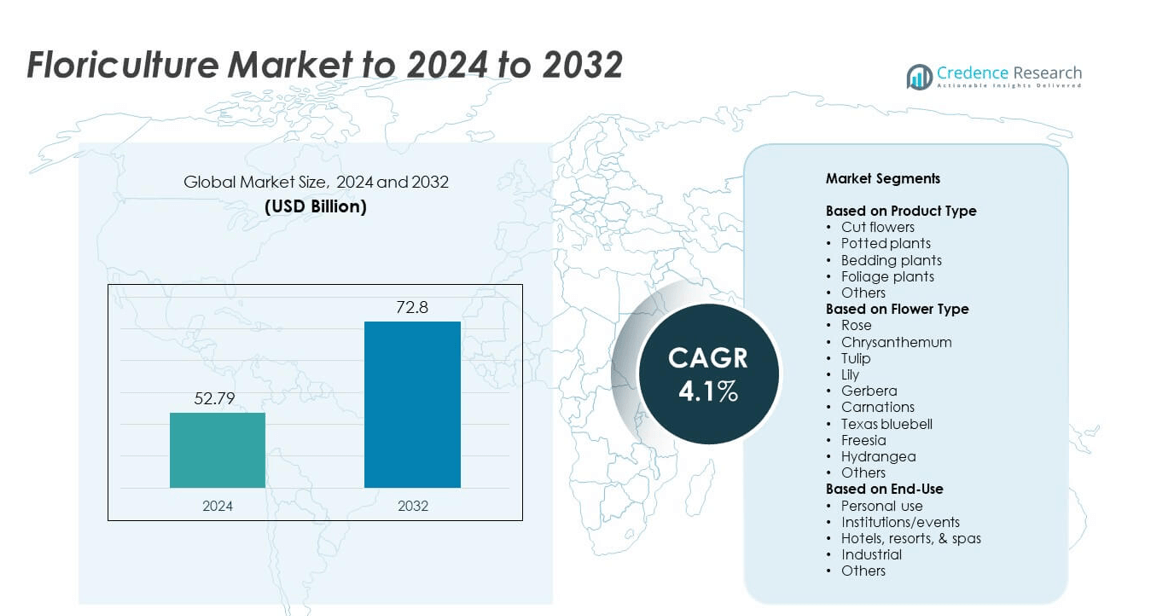

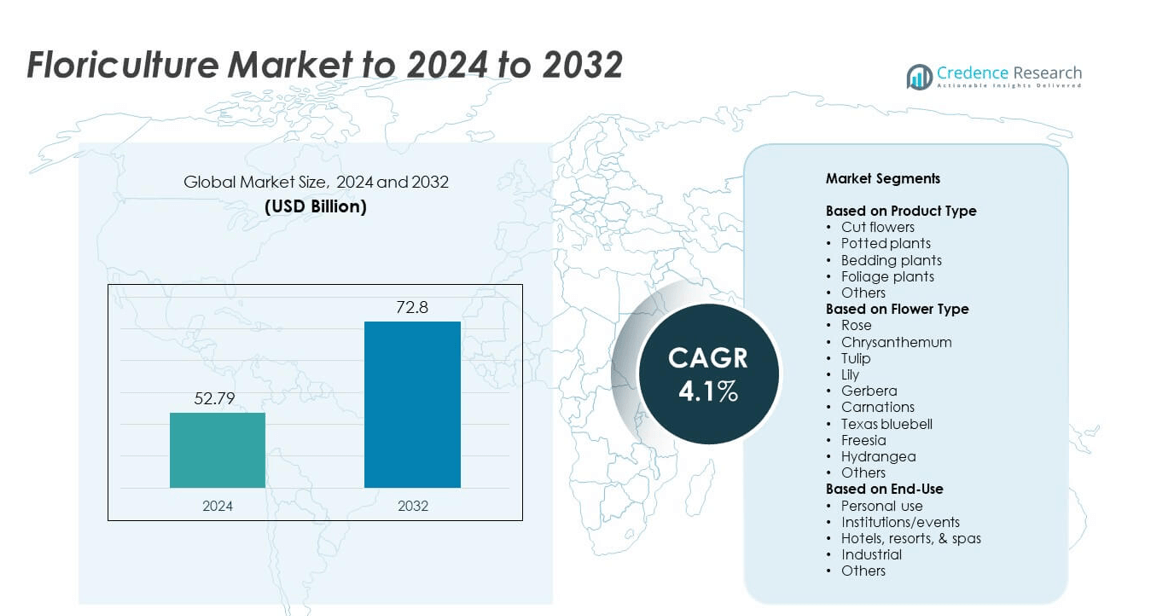

Floriculture Market size was valued at USD 52.79 billion in 2024 and is anticipated to reach USD 72.8 billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floriculture Market Size 2024 |

SD 52.79 billion |

| Floriculture Market, CAGR |

4.1% |

| Floriculture Market Size 2032 |

USD 72.8 billion |

The floriculture market is led by major players including Dümmen Orange, Florensis Flower Seeds UK, Selecta One, Syngenta Flowers, Flamingo Horticulture, Marginpar, and Oserian Group. These companies drive global market growth through advancements in greenhouse technology, hybrid flower development, and sustainable cultivation practices. Strategic collaborations with distributors and digital platforms enhance product accessibility across key markets. Europe remains the leading region, commanding approximately 35% of the global market share in 2024, supported by strong export networks, advanced logistics, and high consumer preference for decorative and sustainable floral products across the Netherlands, Germany, and the United Kingdom.

Market Insights

- The floriculture market was valued at USD 52.79 billion in 2024 and is projected to reach USD 72.8 billion by 2032, growing at a CAGR of 4.1%.

- Rising demand for ornamental plants and decorative flowers across households, events, and commercial sectors is driving market expansion globally.

- Growing adoption of sustainable cultivation, greenhouse automation, and e-commerce-based flower delivery are key trends shaping industry growth.

- Market competition remains strong with companies focusing on hybrid flower development, climate-controlled production, and eco-friendly packaging to gain an advantage.

- Europe leads the market with a 35% share in 2024, followed by North America at 28% and Asia Pacific at 23%, while the cut flowers segment dominated with 46% of the total share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The cut flowers segment dominated the floriculture market in 2024, holding around 46% of the total share. The high demand for decorative and gifting purposes across weddings, corporate events, and personal occasions drives this dominance. Global trade networks and growing e-commerce platforms enhance access to fresh-cut flowers worldwide. Rising consumer preference for aesthetic home décor and emotional expression through floral gifts supports steady sales growth. Advancements in cold-chain logistics and preservation technology also improve export potential, strengthening the cut flower segment’s leadership across key international markets.

- For instance, Royal FloraHolland sold 398,798,851 items via the auction clock in June 2025, illustrating the global scale of cut-flower trading.

By Flower Type

The rose segment accounted for the largest market share of approximately 38% in 2024, leading the floriculture market by flower type. Roses remain the most preferred flower globally due to their association with love, luxury, and celebration. High production volumes, especially from countries such as the Netherlands, Kenya, and Ecuador, sustain strong export demand. Increasing use of hybrid rose varieties with longer shelf life and vibrant colors further supports this growth. Expanding online floral gifting platforms and event-based consumption trends continue to reinforce the segment’s market dominance.

- For instance, Nini Herburg Roses produces more than 200,000,000 rose stems each year across Kenya and Ethiopia.

By End-Use

The institutions and events segment held the dominant position in 2024, contributing about 42% of the market share. Demand is driven by large-scale floral requirements in weddings, corporate functions, exhibitions, and festivals. Hotels, resorts, and event planners are increasingly investing in floral decorations to enhance ambience and guest experience. Seasonal events and cultural ceremonies significantly boost bulk purchases of fresh flowers. Growing urbanization and higher disposable incomes in developing regions have further expanded demand for ornamental arrangements in both formal and informal gatherings, reinforcing the segment’s market leadership.

Key Growth Drivers

Rising Demand for Ornamental and Decorative Plants

Growing consumer preference for aesthetic and natural décor in homes, offices, and commercial spaces is driving market expansion. Urban residents are increasingly adopting ornamental plants and floral décor to enhance indoor air quality and visual appeal. The rising popularity of gifting flowers and the growing event management sector further boost demand. Expansion of retail flower chains and online platforms has made floral products more accessible, contributing significantly to the overall market’s sustained growth across developed and emerging economies.

- For instance, Costa Farms grows over 1,500 plant varieties on 5,200 acres and produces more than 150,000,000 potted plants annually.

Expansion of International Floriculture Trade

Global trade liberalization and improved logistics networks have enabled seamless cross-border flower supply. Nations such as Kenya, Colombia, and the Netherlands are major exporters meeting rising global demand. Enhanced air freight infrastructure and advanced cold storage systems maintain freshness and quality during long-distance transport. Government incentives for floriculture exports further promote production growth. This expanding trade network has made exotic and premium flower varieties available year-round, increasing the international competitiveness of the floriculture industry.

- For instance, Dutch Flower Group trades an estimated 75,000,000 cut-flower stems per week through its family of companies.

Technological Advancements in Cultivation and Post-Harvest Management

Innovations in greenhouse automation, precision irrigation, and LED-based lighting systems have optimized flower yield and quality. Modern hydroponic and tissue culture techniques ensure consistent production of disease-free varieties. Automation in sorting and packaging has improved supply efficiency and reduced waste. Controlled-environment agriculture allows year-round cultivation regardless of climatic conditions. These advancements lower operational costs and enhance export readiness, making technology integration a key enabler of productivity and profitability within the floriculture market.

Key Trends and Opportunities

Growing Popularity of Sustainable and Eco-Friendly Floriculture

The market is witnessing a shift toward environmentally sustainable practices, including organic cultivation and reduced pesticide usage. Eco-conscious consumers prefer flowers grown through sustainable methods with minimal carbon footprint. Producers are adopting biodegradable packaging and renewable energy sources to enhance sustainability credentials. Certifications such as Fairtrade and Florverde Sustainable Flowers are gaining prominence among exporters. This green transformation offers new business opportunities for companies emphasizing ethical sourcing and responsible production.

- For instance, Sher Ethiopia produces over 1,000,000,000 carbon-neutral rose stems each year and reuses over 3,000,000 m³ of its process and sanitary water annually, avoiding discharge into local lakes.

Rising Influence of E-Commerce and Digital Gifting Platforms

Online retail channels have transformed how consumers purchase and send flowers worldwide. E-commerce platforms enable quick customization, real-time tracking, and same-day delivery, enhancing customer convenience. Global brands and local florists are leveraging digital marketing to expand reach and boost online floral gifting sales. Subscription-based flower delivery services are also gaining traction among urban consumers. The growing digital ecosystem presents strong opportunities for floriculture businesses to strengthen brand presence and customer loyalty.

- For instance, Porta Nova’s rose greenhouses run LED toplighting trials over 1,300 m² at 205 µmol/m²/s, and the site streams data from 800 electricity meters to balance grid demand.

Key Challenges

High Sensitivity to Climate Variability and Supply Chain Disruptions

Floriculture depends heavily on favorable climatic conditions for quality production. Unpredictable weather patterns, rising temperatures, and frequent droughts impact flower yield and quality. Supply chain disruptions due to transportation delays or geopolitical tensions further affect export reliability. Small-scale growers in developing nations often lack access to advanced storage and irrigation systems, making them more vulnerable. Addressing these challenges requires investment in resilient infrastructure and climate-smart cultivation methods.

Short Shelf Life and Post-Harvest Losses

Flowers are perishable commodities with limited shelf life, making efficient logistics and storage essential. Inadequate cold-chain infrastructure and delays in handling can result in significant product wastage. Maintaining freshness from cultivation to delivery remains a key operational challenge. High transportation costs and fluctuating fuel prices further strain profitability. Investments in advanced refrigeration, packaging innovation, and supply coordination are crucial to reducing post-harvest losses and sustaining market competitiveness.

Regional Analysis

North America

North America held a market share of around 28% in 2024, driven by high consumer spending on ornamental plants and floral décor. The United States leads the regional market with strong demand from residential and event sectors. Seasonal celebrations, weddings, and corporate gifting continue to fuel consumption. Technological advancements in greenhouse farming and widespread use of e-commerce platforms have improved product availability. Rising interest in sustainable floriculture and indoor gardening trends supports ongoing growth. Canada contributes through expanding local flower cultivation and increasing adoption of eco-friendly production methods.

Europe

Europe accounted for approximately 35% of the global floriculture market share in 2024, making it the largest regional contributor. The Netherlands dominates as a leading exporter, supported by advanced logistics and the world’s largest flower auction system. Countries such as Germany, France, and the United Kingdom show consistent growth in ornamental and decorative plant consumption. Growing emphasis on sustainability and fair-trade flowers is reshaping regional trade practices. High-income consumers and the popularity of floral gifting traditions across European nations further strengthen regional demand and export performance.

Asia Pacific

Asia Pacific captured around 23% of the floriculture market share in 2024, fueled by increasing urbanization and growing middle-class populations. China, India, and Japan are leading markets supported by expanding domestic demand and rising exports. Rapid development in greenhouse infrastructure and favorable climatic conditions support large-scale production. Government incentives for horticulture and expanding e-commerce channels enhance accessibility. Cultural festivals and weddings contribute to continuous flower consumption, while growing investments in hybrid and high-yield varieties sustain the region’s upward market trajectory.

Latin America

Latin America represented about 8% of the global floriculture market share in 2024, with Colombia and Ecuador serving as major exporters. The region benefits from ideal climatic conditions that allow year-round flower cultivation. Export-oriented production, particularly of roses and carnations, drives economic contribution. Improved logistics and free trade agreements with North American and European countries strengthen export networks. However, dependence on international demand makes the region vulnerable to global market fluctuations. Ongoing infrastructure development and investment in cold-chain facilities are expected to enhance supply reliability and product quality.

Middle East and Africa

The Middle East and Africa held a market share of nearly 6% in 2024, with Kenya and Ethiopia emerging as key flower-producing nations. The region’s proximity to major European markets gives it a strategic export advantage. Increasing investment in modern greenhouses and irrigation technologies is improving yield and quality. Domestic demand is also rising due to urban lifestyle changes and growing hospitality sectors. However, limited cold-chain infrastructure and climatic challenges restrict large-scale expansion. Supportive government initiatives and private investments continue to position the region as a developing floriculture hub.

Market Segmentations:

By Product Type

- Cut flowers

- Potted plants

- Bedding plants

- Foliage plants

- Others

By Flower Type

- Rose

- Chrysanthemum

- Tulip

- Lily

- Gerbera

- Carnations

- Texas bluebell

- Freesia

- Hydrangea

- Others

By End-Use

- Personal use

- Institutions/events

- Hotels, resorts, & spas

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The floriculture market is characterized by the presence of prominent players such as Dümmen Orange, Florensis Flower Seeds UK, Selecta One, Syngenta Flowers, Flamingo Horticulture, Marginpar, Native Floral Group, Oserian Group, Esmeralda Farms, Selecta Cut Flowers, Danziger Group, Florance Flora, Tropical Foliage Plants, DOS Gringos, Verbeek Export, and Forest Produce. These companies focus on expanding their product portfolios, enhancing greenhouse cultivation efficiency, and improving supply chain resilience through automation and cold-chain integration. Strategic collaborations with distributors and online retailers have strengthened global reach and brand visibility. Market participants emphasize innovation in hybrid flower varieties, sustainability certifications, and climate-controlled cultivation systems to meet rising consumer demand. Continuous investment in R&D for pest-resistant and longer-lasting floral varieties supports competitive differentiation. The market is further shaped by mergers, acquisitions, and capacity expansions aimed at improving export potential and maintaining leadership in both premium and mass-market floral segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dümmen Orange

- Florensis Flower Seeds UK

- Selecta One

- Syngenta Flowers

- Flamingo Horticulture

- Marginpar

- Native Floral Group

- Oserian Group

- Esmeralda Farms

- Selecta Cut Flowers

- Danziger Group

- Florance Flora

- Tropical Foliage Plants

- DOS Gringos

- Verbeek Export

- Forest Produce

Recent Developments

- In 2024, Dümmen Orange Collaborated with the Naturalis Biodiversity Center to create a breeding and testing system for pollinator-friendly plants, reflecting a growing industry focus on sustainability and biodiversity.

- In 2024, Syngenta Flowers Expanded its breeding center in the Netherlands to accelerate the creation of premium flowers.

- In 2024, Selecta one acquired 100% of Moraglia´s breeding program including the complete breeding program of carnation cut flowers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Flower Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainably grown flowers will continue to rise due to eco-conscious consumers.

- Expansion of online flower delivery services will strengthen global market accessibility.

- Smart greenhouse technologies will enhance yield and reduce resource consumption.

- Export opportunities will grow as logistics and cold-chain infrastructure improve.

- Hybrid and genetically improved flower varieties will gain market preference.

- Urbanization and lifestyle shifts will boost indoor and ornamental plant adoption.

- Event management and hospitality sectors will remain major floral consumers.

- Automation in sorting and packaging will reduce waste and improve efficiency.

- Emerging economies will increase production through government horticulture support.

- Integration of digital platforms and data analytics will optimize supply chain operations.