Market Overview

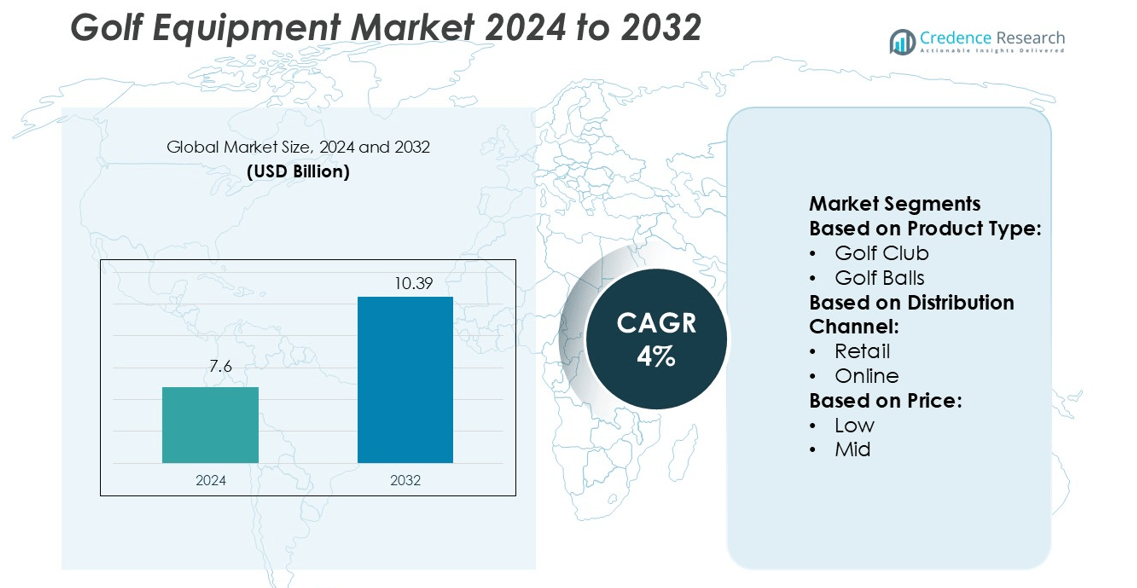

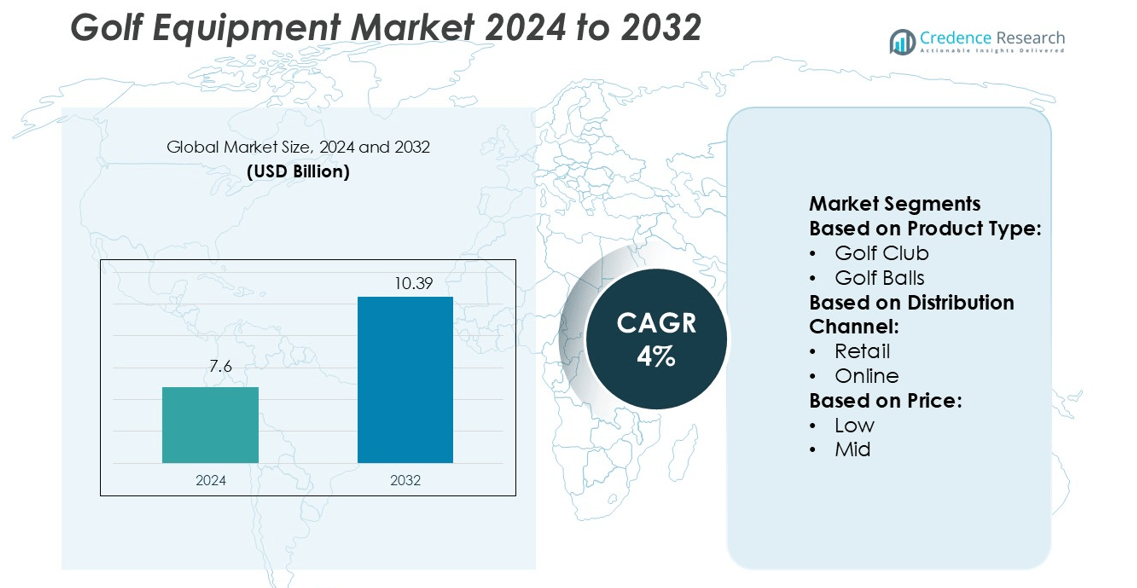

Golf Equipment Market size was valued USD 7.6 billion in 2024 and is anticipated to reach USD 10.39 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Golf Equipment Market Size 2024 |

USD 7.6 billion |

| Golf Equipment Market, CAGR |

4% |

| Golf Equipment Market Size 2032 |

USD 10.39 billion |

The golf equipment market is driven by top players such as Bridgestone Corporation, TaylorMade Golf Company, Yonex Co., Ltd., Nike, Inc., PING Inc., Acushnet Holdings Corporation (Titleist), Mizuno Corporation, Wilson Sporting Goods, SRI Sports Limited (Dunlop, Cleveland, Srixon), and Callaway Golf Company. These companies focus on innovation, performance enhancement, and expanding global distribution networks. Their strategies include advanced material use, smart technology integration, and personalized product offerings to strengthen market presence. North America leads the global market with a 36% share, supported by strong golf infrastructure, high participation rates, and a well-established tournament ecosystem. This leadership position reflects the region’s mature consumer base and high spending on premium golf equipment.

Market Insights

- The golf equipment market was valued at USD 7.6 billion in 2024 and is expected to reach USD 10.39 billion by 2032, growing at a CAGR of 4%.

- Strong demand is driven by rising participation, premium product adoption, and technological advancements across key equipment categories.

- Leading companies focus on innovation, smart technology, and personalization to strengthen their market position and expand their global footprint.

- High equipment costs and limited infrastructure in emerging regions act as key restraints to wider market penetration.

- North America leads with a 36% share, followed by Europe at 28% and Asia Pacific at 22%, with golf clubs dominating the product segment due to strong demand from both professional and recreational players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Golf clubs hold the largest share of the golf equipment market at 41%. This dominance comes from steady demand among both professional and amateur players. High-quality drivers, irons, and putters drive sales due to performance improvements and customization features. Brands invest in advanced materials such as carbon composites and titanium to enhance swing control and accuracy. Frequent product launches and replacement cycles also support growth. The increasing number of golf courses and tournaments globally strengthens this segment’s position, making golf clubs the key revenue driver in the overall market structure.

- For instance, TaylorMade’s Stealth and Stealth 2 drivers use a 60-layer “60X Carbon Twist Face” that is 44 % lighter than an equivalent titanium face, enabling engineers to shift mass low and deep in the clubhead (adding ~15 % more MOI relative to Stealth Plus).

By Distribution Channel

Retail channels account for 46% of the total market share, making it the leading distribution segment. Physical stores allow consumers to test products, receive fitting services, and gain expert guidance, which improves purchase confidence. Specialty golf retailers and large sports chains also enhance visibility through promotional activities and seasonal offers. This segment benefits from premium and mid-range product sales, which rely on in-store experiences. While online channels are growing fast, retail remains dominant due to its trust factor and personalized customer service.

- For instance, PING’s research labs use advanced Vicon motion capture systems with 16 cameras and capture swings at 800 Hz. The company uses this data to build a proprietary database of 1.2 million swings.

By Price

Mid-range products lead the market with a 52% share, reflecting strong demand from regular golfers seeking balanced performance and cost. These products offer advanced features without premium pricing, appealing to a broad consumer base. Golf clubs, balls, and accessories in this range attract both beginners and seasoned players who value quality and durability. Manufacturers focus on mid-tier pricing strategies to capture volume sales while maintaining margins. Expanding participation in amateur tournaments and recreational golf supports steady growth in this segment.

Key Growth Drivers

Rising Global Participation in Golf

The growing popularity of golf worldwide is fueling demand for equipment. Increasing participation among youth and women is expanding the customer base. International tournaments, improved accessibility to golf courses, and golf tourism also support this rise. Developing countries are investing in new courses and training facilities, boosting equipment sales. Initiatives from golf associations to make the sport more inclusive further strengthen market growth. This participation trend is driving consistent demand for clubs, balls, and accessories across key regions.

- For instance, Acushnet’s Titleist ball plants in New Bedford can produce up to 300,000 golf balls per day. As part of its quality control process, every ball undergoes X-ray inspection to ensure the core is perfectly centered.

Technological Advancements in Equipment

Manufacturers are introducing advanced materials and smart technology in golf gear. Lightweight carbon composites, adjustable club heads, and aerodynamic designs enhance player performance. Smart sensors and connected devices are gaining popularity among professionals and amateurs. These innovations improve accuracy, swing analysis, and ball trajectory tracking. Premium equipment with better durability and precision attracts high-spending golfers. Continuous R&D investments by leading brands are fueling product upgrades and accelerating market growth.

- For instance, Mizuno’s new JPX 925 Forged irons incorporate a Chromoly 4120 face that is 0.45 mm thinner in impact zones compared to prior models, enabling extra face flex and increased ball speed.

Growing Sports Tourism and Lifestyle Demand

Golf is becoming a lifestyle activity linked to wellness and travel. Golf resorts and luxury travel packages are drawing more players, increasing demand for equipment. Major countries are investing in golf tourism infrastructure, supporting market expansion. Corporate tournaments and leisure golfing activities also boost purchases. The premium segment benefits from this trend, with rising sales of high-end clubs and accessories. This lifestyle integration is broadening market reach beyond professional players.

Key Trends & Opportunities

Sustainability and Eco-Friendly Materials

Brands are shifting to sustainable and recycled materials for golf equipment. Eco-conscious consumers prefer biodegradable tees, recycled balls, and ethically sourced apparel. Golf courses are also adopting greener practices, aligning with sustainable equipment use. This trend opens new opportunities for innovative product lines. Companies adopting circular economy models and green packaging gain a competitive edge. Regulatory encouragement for sustainable products further strengthens this shift.

- For instance, Wilson produces the Wilson Staff Eco-Carry golf bag from recycled polyester. Depending on the specific model and vintage, a bag is made from the equivalent of either 12 one-gallon plastic bottles or over 50 recycled plastic water bottles.

Growth of Online Retail Channels

E-commerce platforms are transforming the golf equipment market. Consumers prefer online platforms for variety, discounts, and convenience. Manufacturers are enhancing direct-to-consumer sales with better digital experiences. Virtual fitting tools and online product customization are improving customer engagement. Global players are expanding reach through partnerships with major online retailers. This trend is particularly strong in emerging markets, where online shopping is rising rapidly.

- For instance, Adidas has largely replaced virgin polyester with recycled polyester, achieving 99% recycled polyester usage in its products in 2024. This achievement fulfilled the company’s 2024 goal to replace all virgin polyester with recycled where technically possible.

Rising Demand for Custom-Fitted Equipment

Golfers increasingly seek equipment tailored to their playing style. Custom-fitted clubs and personalized gear improve comfort and performance. Brands are using data analytics and fitting technologies to offer precision products. This trend is prominent among mid to premium segments, driving higher margins. Pro shops and online fitting tools are making customization accessible to a broader audience. Growing awareness of performance benefits further accelerates demand.

Key Challenges

High Cost of Premium Equipment

Golf equipment, especially in the premium segment, remains expensive. High prices limit accessibility for beginners and casual players. Advanced materials and smart technologies increase production costs, raising retail prices. This creates a gap between professional and entry-level users. Cost sensitivity in emerging markets further restricts mass adoption. Price challenges may slow market penetration despite growing interest in the sport.

Limited Access to Golf Infrastructure

The sport’s growth depends on accessible courses and training facilities. Many regions lack sufficient infrastructure, restricting new player participation. Building and maintaining courses requires significant investment and land resources. This limitation affects demand for golf equipment in developing areas. Urbanization and land scarcity further add to the challenge. Expanding infrastructure remains crucial to sustaining market growth.

Regional Analysis

North America

North America holds a 36% market share in the global golf equipment market. The region benefits from a strong golf culture, a high number of courses, and established tournaments such as the PGA Tour. High disposable income supports spending on premium clubs, balls, and apparel. Technological adoption in equipment design and customization drives strong consumer engagement. The U.S. remains the largest market, with Canada contributing steady growth through increased participation. Expanding youth golf programs and well-developed retail networks further support demand. The region continues to set industry trends and dominate global sales volumes.

Europe

Europe accounts for 28% of the global golf equipment market share. Countries such as the UK, Germany, France, and Sweden lead in participation rates and equipment demand. The region has a well-developed golf infrastructure, with a large base of amateur and professional players. Popular European tournaments and golf tourism destinations strengthen the market. Consumers show a strong preference for high-quality and eco-friendly equipment, driving premium segment growth. Manufacturers benefit from strong retail networks and established golf associations, ensuring consistent sales performance. Increased investment in sustainable golf course development also supports market expansion.

Asia Pacific

Asia Pacific holds a 22% market share and is the fastest-growing region in the golf equipment market. Rising incomes and expanding golf tourism in countries like Japan, South Korea, China, and Australia are driving rapid adoption. Governments and private players are investing in golf course development and youth training programs. The popularity of golf as a luxury lifestyle activity is rising among the urban population. Online retail expansion is improving accessibility to premium brands. Increasing interest among younger demographics and strong participation growth are positioning Asia Pacific as a key growth engine for the global market.

Latin America

Latin America represents 8% of the global golf equipment market share. Brazil, Argentina, and Mexico lead regional growth, supported by a growing sports tourism sector. Golf is gaining popularity among affluent consumers and tourists visiting established resort destinations. Infrastructure development is slower compared to North America and Europe but improving gradually. International brands are increasing their presence through online platforms and local partnerships. Economic growth and rising interest in recreational sports are supporting steady equipment demand. Greater investment in training facilities and tournaments can further unlock regional potential in the coming years.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the global golf equipment market share. The market is growing due to rising luxury tourism, major golf events, and investments in premium resorts. The UAE and South Africa lead regional adoption, with increasing participation among tourists and local elites. Governments are promoting sports tourism, which boosts equipment demand. Limited course availability in some areas remains a constraint but is improving with new developments. Global brands are expanding through premium retail outlets, capitalizing on demand for high-end clubs, apparel, and accessories across the region.

Market Segmentations:

By Product Type:

By Distribution Channel:

By Price:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the golf equipment market is shaped by key players including Bridgestone Corporation, TaylorMade Golf Company, Yonex Co., Ltd., Nike, Inc., PING Inc., Acushnet Holdings Corporation (Titleist), Mizuno Corporation, Wilson Sporting Goods, SRI Sports Limited (Dunlop, Cleveland, Srixon), and Callaway Golf Company. The golf equipment market is characterized by strong innovation, brand differentiation, and strategic market positioning. Companies focus heavily on developing advanced equipment that enhances performance and user experience. Investments in research and development support the launch of lightweight materials, smart sensors, and customizable products. Digital transformation plays a key role, with brands expanding direct-to-consumer sales through e-commerce platforms and online fitting tools. Sponsorship deals, professional tournament tie-ins, and brand partnerships strengthen global presence and customer engagement. Increasing emphasis on sustainability and eco-friendly product lines further drives market competitiveness and brand value.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bridgestone Corporation

- TaylorMade Golf Company

- Yonex Co., Ltd.

- Nike, Inc.

- PING Inc.

- Acushnet Holdings Corporation (Titleist)

- Mizuno Corporation

- Wilson Sporting Goods

- SRI Sports Limited (Dunlop, Cleveland, Srixon)

- Callaway Golf Company

Recent Developments

- In April 2025, Callaway Apparel has introduced the Callaway Legacy Collection, an all-new golf clothing range that seamlessly blends heritage with contemporary versatility, featuring refined details like collegiate-inspired badges, sporty contrast blocking, and jacquard fabrics for enhanced performance and breathability.

- In February 2025, Srixon has introduced the latest generation of SOFT FEEL golf balls, featuring an updated FastLayer Core that delivers increased ball speeds for enhanced distance while maintaining an irresistibly soft feel at impact.

- In February 2024, Yonex Co., Ltd., a major sports equipment manufacturer, launched a brand-new 4th Generation EZONE GT Series driver. These drivers are manufactured using proprietary 2G-Namd Speed, an advanced graphite composite that assists the club head compressing and provides superior rebound on impact.

- In July 2023, Adidas launched the X CRAZYFAST, its latest boot featuring “AERO” technology aimed at enhancing speed during play. The new boots were released in three different versions: “P+,” “P1 Laced,” and “P1 Laceless.”

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and customized golf equipment will continue to rise globally.

- Technological innovation will drive performance-focused product development.

- Online retail channels will expand and capture a larger market share.

- Youth and female participation in golf will grow steadily across regions.

- Sustainable and eco-friendly product lines will gain strong consumer preference.

- Golf tourism and luxury resort developments will boost equipment demand.

- Brands will invest more in smart wearables and connected golf gear.

- Strategic partnerships and sponsorships will strengthen brand visibility worldwide.

- Emerging markets in Asia and Latin America will offer new growth opportunities.

- Digital fitting and virtual shopping experiences will enhance consumer engagement.