Market Overview

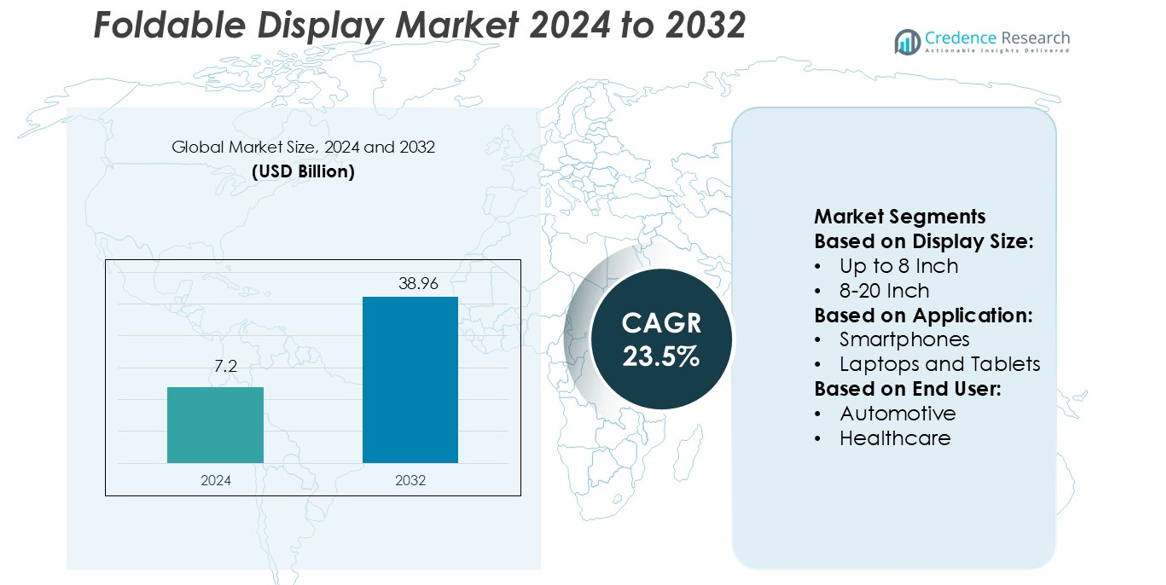

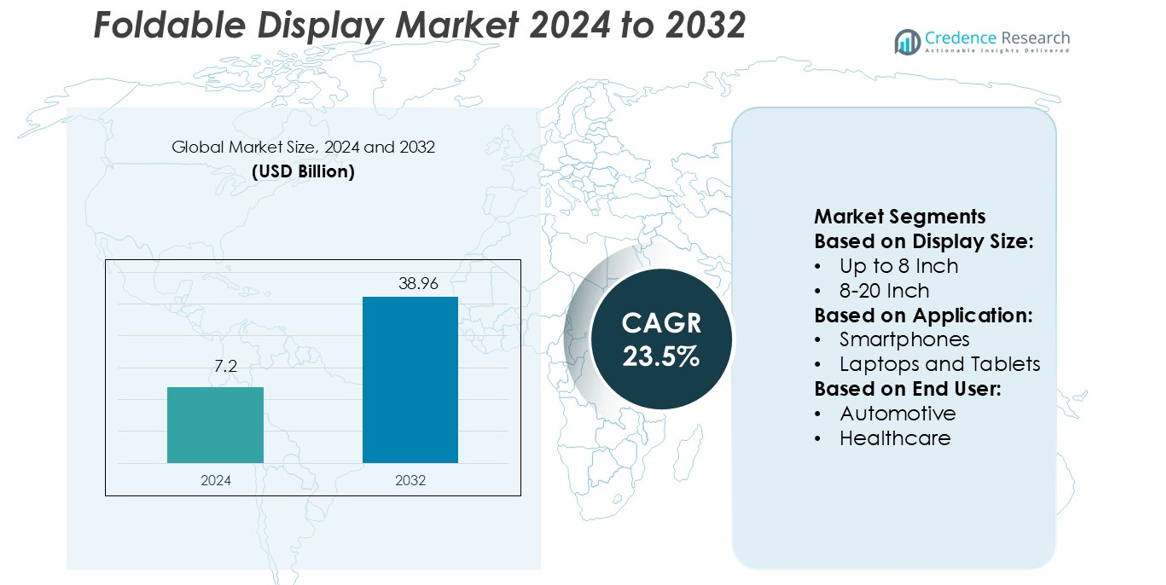

Foldable Display Market size was valued USD 7.2 billion in 2024 and is anticipated to reach USD 38.96 billion by 2032, at a CAGR of 23.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Foldable Display Market Size 2024 |

USD 7.2 billion |

| Foldable Display Market, CAGR |

23.5% |

| Foldable Display Market Size 2032 |

USD 38.96 billion |

The foldable display market is driven by leading players including SHARP CORPORATION, Royole Corporation, AUO Corporation, BOE Technology Group Co., Ltd., Corning Incorporated, SAMSUNG ELECTRONICS CO., LTD., LG DISPLAY CO., LTD., Visionox Company, Innolux Corporation, and Japan Display Inc. These companies focus on expanding OLED and AMOLED production, improving fold-cycle durability, and enhancing screen quality through advanced material innovation. Samsung, BOE, and LG Display hold strong positions due to their large-scale manufacturing capabilities and technological leadership. Asia Pacific leads the global market with a 38% share, supported by strong production infrastructure, high consumer demand for premium devices, and government-backed R&D initiatives. This regional strength ensures consistent innovation and cost-effective production.

Market Insights

- The foldable display market size was valued at USD 7.2 billion in 2024 and is projected to reach USD 38.96 billion by 2032, growing at a CAGR of 23.5%.

- Strong demand for premium smartphones and tablets is driving market expansion, supported by rising adoption of flexible OLED and AMOLED technologies.

- Leading companies focus on enhancing fold-cycle durability, ultra-thin glass integration, and efficient large-scale manufacturing to maintain a competitive edge.

- High production costs and yield challenges remain key restraints, limiting mid-range segment penetration despite growing consumer interest.

- Asia Pacific leads the market with a 38% share, supported by strong production infrastructure and R&D investment, while the 8–20 inch segment dominates display size share due to its wide use in smartphones and tablets.Top of Form

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Display Size

The 8–20 Inch segment holds the largest market share of 57% in the foldable display market. This segment’s dominance is driven by its widespread use in foldable smartphones and hybrid tablet devices. Manufacturers favor this size for balancing portability with enhanced viewing experiences. Demand is rising in premium consumer electronics, where brands focus on flexible OLED and AMOLED technology to boost display durability and color quality. This size range supports multitasking, making it popular among business and entertainment users. Continuous innovation in hinge design and screen protection also supports strong adoption rates.

- For instance, SHARP CORPORATION demonstrated a 6.18-inch foldable OLED prototype with a thickness suitable for flexible displays, and with an endurance of over 300,000 fold cycles.

By Application

The Smartphones segment dominates the foldable display market with a 62% share. Strong adoption is driven by increasing demand for large-screen, compact devices that enhance usability and design flexibility. Leading smartphone brands invest heavily in flexible OLED technology to deliver lightweight and durable products. Foldable smartphones offer improved multitasking features, immersive viewing, and better portability. These benefits align with the premium segment’s focus on advanced display technology. Rapid product launches and growing consumer acceptance are further accelerating growth, particularly in Asia Pacific and North America.

- For instance, Royole’s FlexPai used a 7.8-inch fully flexible AMOLED display (311 ppi) that, when folded, provided a dual-screen experience with two panels. This contrasts with the 7.8-inch display it offers when unfolded. Rapid product launches can drive adoption, especially in regions like Asia Pacific and North America.

By End-user

Consumer Electronics leads the foldable display market with a 69% market share. This segment benefits from rising use in smartphones, tablets, laptops, and wearable devices. Strong consumer demand for compact, multifunctional devices is driving product innovation. Companies are integrating flexible and ultra-thin display technologies to create new form factors that improve user experience. Expansion in retail availability and competitive pricing strategies are also strengthening adoption. Premium electronics brands continue to invest in R&D to enhance flexibility, color contrast, and screen durability, fueling sustained growth in this segment.

Key Growth Drivers

Rising Demand for Premium Consumer Electronics

Growing consumer interest in high-performance, sleek devices is driving foldable display adoption. Smartphone and tablet makers are integrating flexible OLED and AMOLED screens to deliver larger viewing areas without increasing device size. These displays support enhanced portability, durability, and immersive user experiences. Leading brands are investing in advanced hinge systems and ultra-thin glass to boost product longevity. Demand is strongest in Asia Pacific and North America, where premium smartphones and hybrid devices dominate. This trend is establishing foldable displays as a key differentiator in the consumer electronics market.

- For instance, AUO Corporation unveiled a 14.6-inch foldable MicroLED panel at Display Week 2023, featuring a 2.8K resolution and a hinge radius of only 4 mm. The prototype’s structure utilizes an ultra-thin glass panel.

Technological Advancements in Flexible Display Materials

Rapid improvements in flexible OLED and AMOLED technologies are increasing production efficiency and durability. Manufacturers are focusing on ultra-thin glass and plastic substrates to deliver lightweight, bendable displays with higher brightness and energy efficiency. Enhanced scratch resistance and fold-cycle endurance are encouraging wider use across applications like smartphones, tablets, and automotive displays. These innovations are also lowering manufacturing defects, supporting mass production. Strategic partnerships between material suppliers and device makers are accelerating commercialization and enabling new product designs in multiple industries.

- For instance, BOE Technology Group Co., Ltd. has developed various foldable and flexible AMOLED displays a 12.3-inch “N-shaped” display was demonstrated that could fold inward and outward, achieving a 5.6-inch form factor when fully folded.

Expansion Across New Industry Verticals

Foldable display technology is expanding beyond consumer electronics into automotive, healthcare, and retail applications. In automotive, curved and flexible screens enhance driver interaction and cockpit design. Healthcare providers use foldable displays for portable medical imaging and telemedicine devices. Retail and digital signage sectors adopt flexible panels for immersive advertising and dynamic installations. This cross-industry integration is creating steady revenue streams for display makers. The rising use of foldable displays in professional environments highlights their growing role in next-generation device ecosystems.

Key Trends & Opportunities

Growing Adoption of Hybrid Device Form Factors

The demand for devices that blend smartphone portability with tablet functionality is increasing sharply. Foldable displays enable manufacturers to offer dual-purpose products without compromising design. Companies are focusing on ultra-thin and rollable screens to enhance usability. Hybrid laptops and tablets are gaining traction among professionals and students, creating new growth avenues. This trend is expected to accelerate as prices fall and manufacturing efficiency improves, making foldable devices more accessible to a wider consumer base.

- For instance, Samsung Display recently increased its foldable panel durability benchmark from 200,000 to 500,000 folding cycles, validated by Bureau Veritas testing.

Surge in Investments for Mass Production

Major display manufacturers are increasing investment in flexible display fabrication facilities. Expansion of Gen 6 and Gen 8 OLED production lines is boosting output capacity and reducing costs. Companies are focusing on improving yield rates and scaling transparent and rollable panel manufacturing. Governments in Asia, particularly in China and South Korea, are supporting R&D and infrastructure development. This manufacturing shift is expected to lower unit costs and expand availability across mid-range devices, opening new market segments.

Integration with Advanced Technologies

Foldable displays are increasingly integrated with 5G, AI, and IoT features to enhance user experience. Smart devices equipped with foldable screens support real-time processing, cloud services, and advanced multitasking. Automotive OEMs are combining foldable panels with AR and HUD technologies for intelligent cockpit systems. This integration strengthens product value and drives premium market positioning. It also creates opportunities for strategic collaborations between display manufacturers, software developers, and electronics brands.

- For instance, JDI’s tactile sensors support a wide pressure sensing range, configurable to specific applications from 0.01 MPa to 4 MPa, and feature active-matrix TFT control on flexible material for high-resolution pressure mapping.

Key Challenges

High Production Costs and Yield Limitations

Manufacturing foldable displays involves complex processes, including precision layering of flexible substrates and hinge integration. These factors lead to higher production costs and lower yield rates compared to rigid displays. Defects like crease formation and surface cracking remain technical hurdles. This cost barrier limits adoption in mid-range and budget device segments. To sustain market growth, companies must optimize production efficiency, enhance durability, and reduce wastage through advanced process technologies and material innovations.

Limited Standardization and Durability Concerns

The foldable display industry faces a lack of standardized testing and design protocols. Different hinge mechanisms, protective coatings, and fold endurance levels create inconsistencies across products. Durability concerns, including crack resistance and screen longevity, affect consumer trust. Harsh usage environments, especially in automotive and industrial settings, amplify these issues. Establishing global durability standards and improving material strength are crucial to ensuring long-term adoption and broader integration across industries.

Regional Analysis

North America

North America holds a 27% share of the foldable display market in 2024. Strong demand for premium smartphones, tablets, and hybrid laptops drives regional growth. U.S.-based technology companies are integrating foldable OLED and AMOLED panels to deliver high-performance consumer electronics. Strategic R&D investments and early adoption of advanced materials strengthen market penetration. Rising interest in automotive and retail applications further supports adoption. Major brands leverage the region’s strong 5G infrastructure and AI integration to enhance product functionality. High consumer spending on advanced electronics continues to make North America a key revenue contributor in the global foldable display industry.

Europe

Europe accounts for 22% of the foldable display market in 2024. Regional growth is supported by increasing adoption of foldable smartphones and tablets in Germany, the UK, and France. OEMs are expanding their product portfolios with energy-efficient flexible display solutions. The automotive sector plays a major role as premium carmakers integrate foldable and curved displays for intelligent cockpit systems. Strict environmental regulations also encourage the use of advanced, sustainable materials. Rising consumer interest in luxury electronics and strong retail distribution networks further strengthen market expansion. Europe remains a strategic hub for technological collaborations and design innovation.

Asia Pacific

Asia Pacific leads the foldable display market with a 38% share in 2024. Countries such as China, South Korea, and Japan dominate production and innovation. Major display manufacturers invest heavily in Gen 6 and Gen 8 flexible OLED production lines, enhancing supply chain efficiency. Consumer demand for premium smartphones and hybrid devices is rapidly expanding in urban centers. Government support for display manufacturing and R&D drives large-scale production. Leading brands are also exploring rollable and stretchable display applications. This manufacturing and innovation strength positions Asia Pacific as the global leader in foldable display technology and volume output.

Latin America

Latin America captures 7% of the foldable display market in 2024. The region’s growth is supported by rising demand for mid-range foldable smartphones and increasing retail penetration in Brazil and Mexico. Expanding 5G coverage is improving connectivity and supporting advanced device adoption. International brands are introducing competitively priced foldable models to address growing consumer interest. While local manufacturing remains limited, import-driven availability is steadily increasing. Gradual economic recovery and growing interest in premium electronics strengthen market expansion. Strategic partnerships with global display manufacturers are expected to enhance market presence and distribution in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the foldable display market in 2024. Growth is driven by rising adoption of premium smartphones in the UAE, Saudi Arabia, and South Africa. Strong investment in digital transformation and 5G infrastructure is creating a favorable market environment. Global OEMs are targeting affluent consumer segments with high-end foldable devices. The retail and hospitality sectors are exploring foldable displays for immersive experiences and digital signage. While adoption is at an early stage, growing consumer purchasing power and expanding connectivity will strengthen market penetration over the forecast period.

Market Segmentations:

By Display Size:

By Application:

- Smartphones

- Laptops and Tablets

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the foldable display market is shaped by SHARP CORPORATION, Royole Corporation, AUO Corporation, BOE Technology Group Co., Ltd., Corning Incorporated, SAMSUNG ELECTRONICS CO., LTD., LG DISPLAY CO., LTD., Visionox Company, Innolux Corporation, and Japan Display Inc. The foldable display market is defined by rapid innovation, advanced production capabilities, and strong global partnerships. Companies are prioritizing R&D investments to improve panel flexibility, fold endurance, and display quality. The focus is shifting toward mass production of OLED and AMOLED technologies with higher yield rates and lower defect ratios. Manufacturers are also targeting cost optimization through automation and scalable production lines. Strategic alliances with smartphone, automotive, and electronics brands are helping strengthen market reach. Product differentiation relies on ultra-thin glass, hinge durability, and energy efficiency. As competition intensifies, continuous innovation, capacity expansion, and technology leadership remain key strategies for sustaining market position and driving long-term growth in the foldable display industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SHARP CORPORATION

- Royole Corporation

- AUO Corporation

- BOE Technology Group Co., Ltd.

- Corning Incorporated

- SAMSUNG ELECTRONICS CO., LTD.

- LG DISPLAY CO., LTD.

- Visionox Company

- Innolux Corporation

- Japan Display Inc.

Recent Developments

- In May 2024, Samsung Display (SDC) has partnered with Lenovo to develop and commercialize slidable display devices, aiming for a launch by early 2025. This collaboration focuses on creating devices with screens that can extend by sliding out, enhancing user experience by providing larger displays without increasing the device’s overall size.

- In April 2024, CARUX and Innolux expanded their business plan in the Smart Cockpit ecosystem to secure their key position in this field. The collaboration offers versatile energy-saving and innovative applications of automotive components to exploit the possibilities of intelligent vehicles.

- In January 2024, Sharp Corporation released the most innovative interactive AQUOS BOARD display series to date. The product provides a solution for business customers looking for the best possible performance, security, and durability.

- In November 2023, Sony declared the development of its BRAVIA 4K Professional Display range with the overview of the landmark EZ20L series, which completes the range suitable for commercial environments. The update supports advanced, mid-level, standard, and entry-level usage

Report Coverage

The research report offers an in-depth analysis based on Display Size, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for foldable smartphones and hybrid devices will increase steadily across global markets.

- Manufacturers will expand OLED and AMOLED production capacity to meet rising demand.

- Advancements in ultra-thin glass and hinge systems will improve product durability.

- Mid-range device adoption will grow as production costs decline.

- Automotive, healthcare, and retail sectors will accelerate commercial use of foldable displays.

- Integration with 5G, AI, and IoT technologies will enhance device functionality.

- Strategic collaborations will increase between display makers and electronics brands.

- Rollable and stretchable display formats will enter mainstream product portfolios.

- Consumer awareness and acceptance of foldable devices will continue to rise.

- Standardization and improved reliability will strengthen global market expansion.