Market Overview:

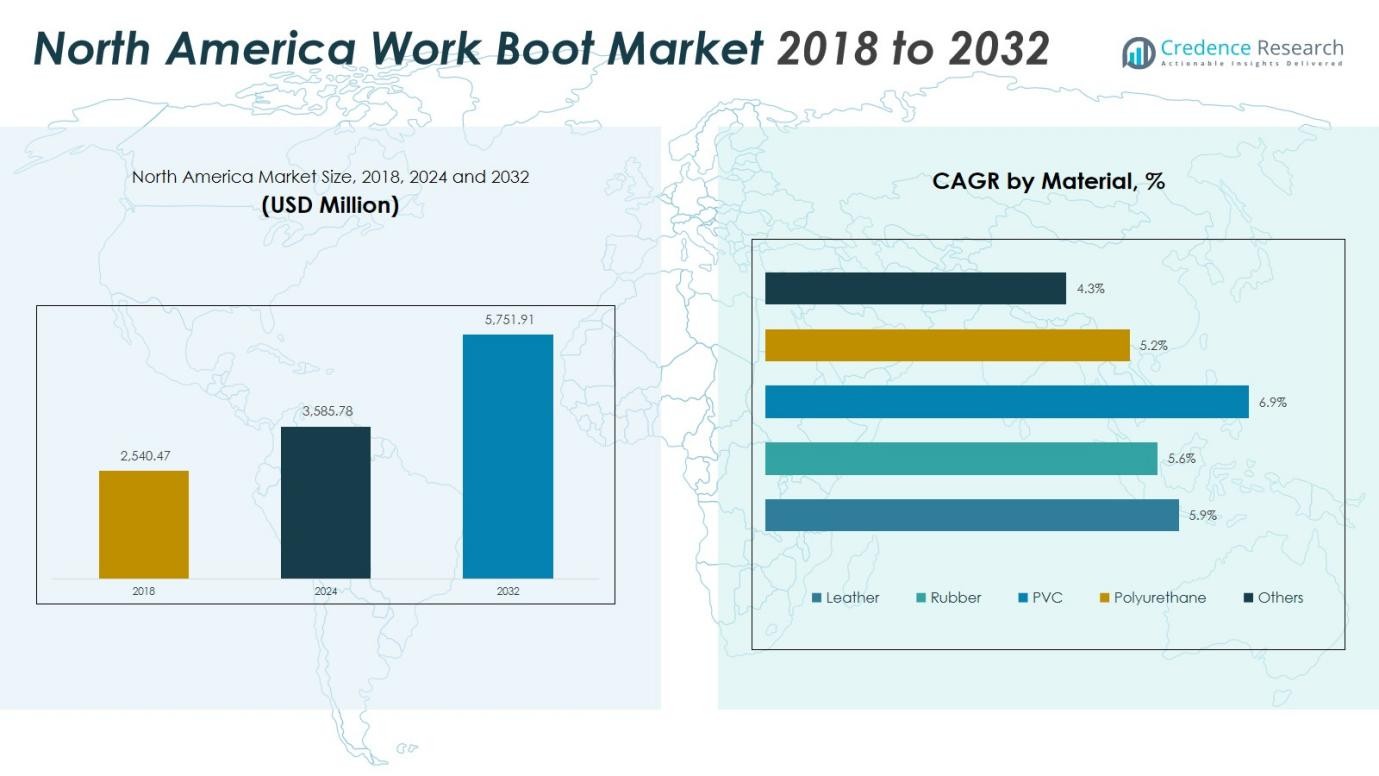

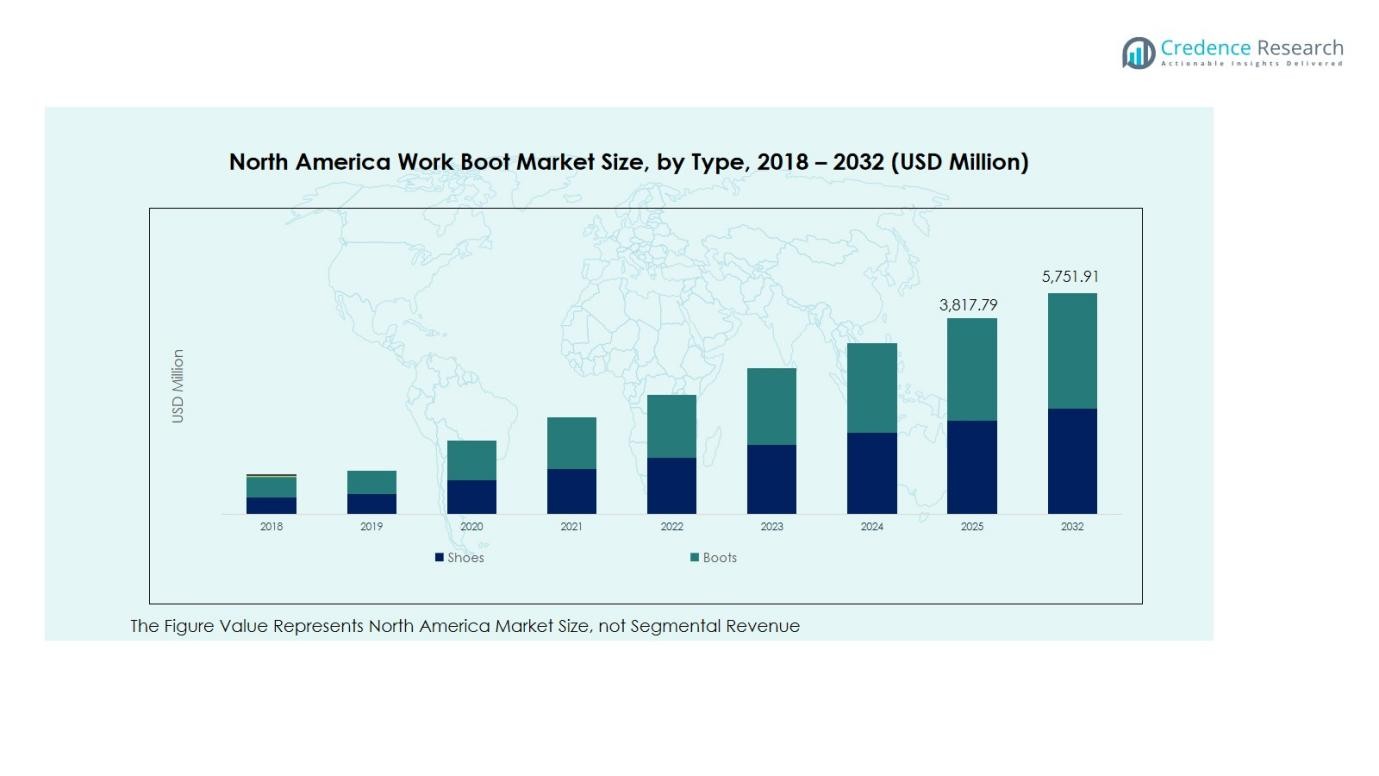

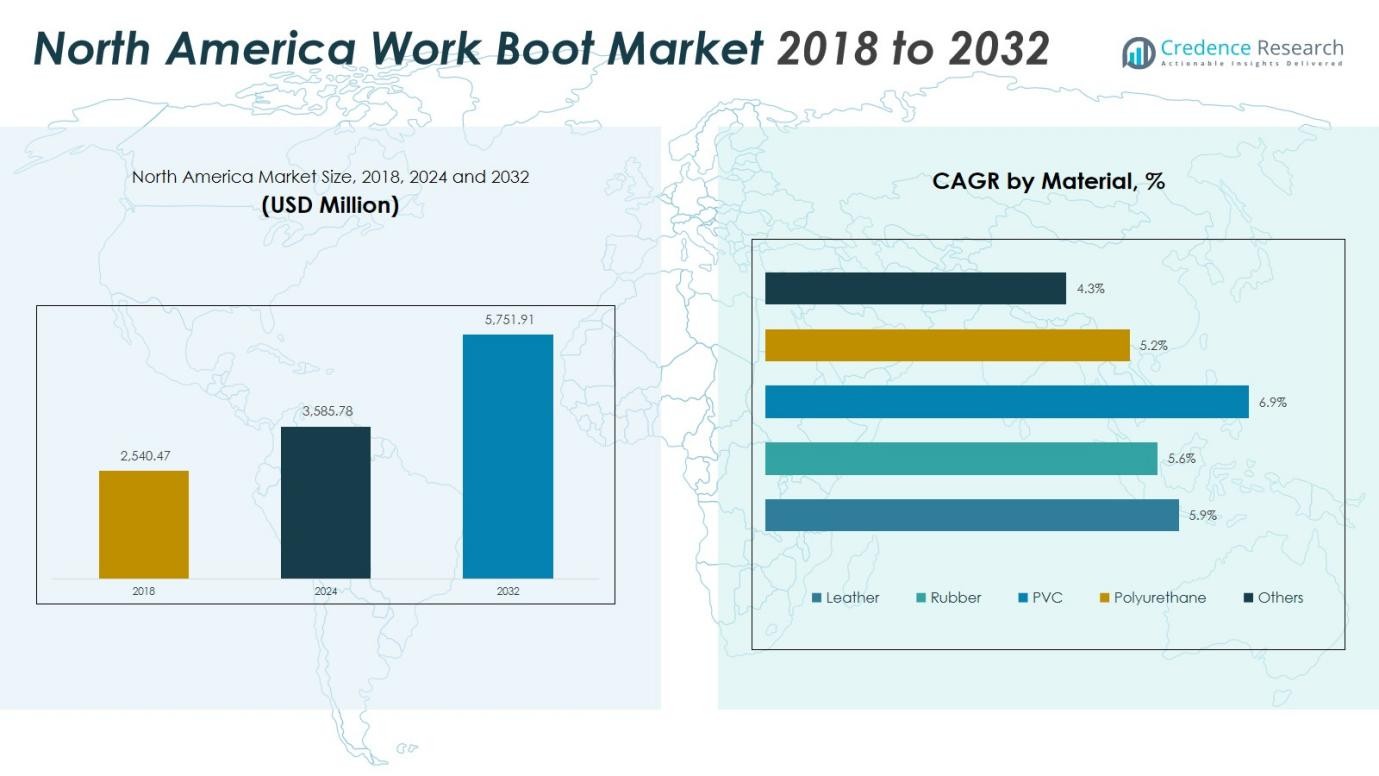

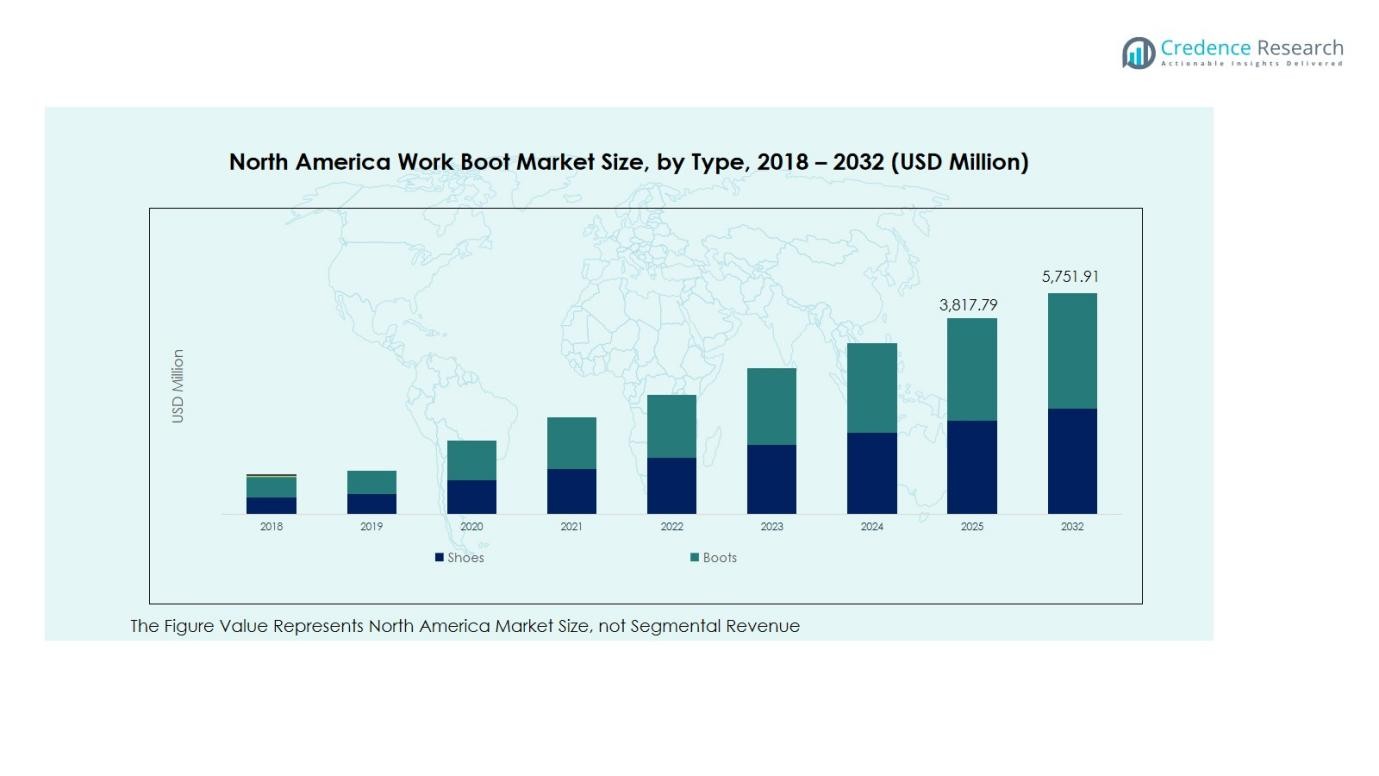

The North America Work Boot Market size was valued at USD 2,540.47 million in 2018 to USD 3,585.78 million in 2024 and is anticipated to reach USD 5,751.91 million by 2032, at a CAGR of 6.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Work Boot Market Size 2024 |

USD 3,585.78 Million |

| North America Work Boot Market, CAGR |

6.03% |

| North America Work Boot Market Size 2032 |

USD 5,751.91 Million |

Market growth is primarily driven by the rising awareness of employee safety, growing adoption of durable and ergonomic footwear, and advancements in material technologies offering enhanced comfort and protection. The expanding oil and gas, construction, and manufacturing sectors continue to generate significant demand for high-performance work boots designed to withstand harsh environments. Innovation in lightweight, waterproof, and slip-resistant materials further fuels consumer preference and brand differentiation.

Regionally, the United States dominates the North America Work Boot Market due to its large industrial base, stringent safety regulations, and strong presence of key manufacturers. Canada follows with robust demand from the mining and construction industries, while Mexico’s rapidly industrializing economy provides emerging growth opportunities for cost-effective and locally manufactured safety footwear solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Work Boot Market is growing steadily, driven by rising awareness of employee safety and increasing demand for durable, ergonomic, and high-performance footwear.

- Boots dominate the market due to superior protection, durability, and suitability for construction, oil and gas, and heavy industrial applications.

- Construction, manufacturing, and mining sectors continue to fuel demand, requiring steel-toe, puncture-resistant, and waterproof boots for worker protection.

- Leather remains the preferred material for premium work boots, while rubber, PVC, and polyurethane gain traction for affordability, waterproofing, and comfort-oriented designs.

- Technological advancements in lightweight composites, breathable materials, and slip-resistant soles enhance safety, comfort, and mobility, differentiating products in a competitive market.

- High production costs, raw material price volatility, and supply chain constraints challenge manufacturers to maintain quality and affordability while meeting safety standards.

- Intense competition, counterfeit product penetration, and growing consumer preference for ergonomic and hybrid designs push companies to innovate, expand regionally, and strengthen brand loyalty.

Market Drivers:

Rising Emphasis on Occupational Safety and Compliance Standards

Stringent workplace safety regulations continue to drive the demand for protective footwear across industrial sectors. The enforcement of standards by agencies such as the Occupational Safety and Health Administration (OSHA) and the Canadian Standards Association (CSA) compels employers to equip workers with certified safety gear. The North America Work Boot Market benefits significantly from this regulatory environment, with industries prioritizing boots that meet impact resistance, slip prevention, and electrical hazard protection requirements. It is supported by continuous government initiatives to reduce workplace injuries, encouraging widespread adoption of safety footwear.

- For instance, the Red Wing 2414 SuperSole 2.0 8-inch boot features a durable, slip-resistant, and oil/gas-resistant SuperSole 2.0 outsole.

Growth in Construction, Manufacturing, and Mining Activities

Rapid infrastructure development, expanding manufacturing capacity, and steady growth in the mining sector are major factors supporting market growth. Large-scale construction projects in the United States and Canada have heightened the need for durable and comfortable work boots. It is further strengthened by increased investments in energy and transportation infrastructure, creating sustained demand for safety footwear. The sector’s growth reinforces the importance of high-performance boots that ensure worker protection in demanding environments.

- For Instance, Caterpillar’s Resorption Waterproof Composite Toe work boot features a composite safety toe that meets ASTM F2413-11 protection standards. A size 11 boot weighs approximately 1 pound 14 ounces each.

Technological Advancements in Footwear Materials and Design

Continuous innovations in material technology have transformed the performance and comfort of work boots. Manufacturers are integrating lightweight composites, waterproof membranes, and breathable materials to enhance user experience. It is fostering product differentiation, attracting both industrial buyers and individual consumers seeking safety with comfort. The use of advanced manufacturing techniques also supports customization and durability, aligning with modern workforce requirements.

Rising Awareness of Ergonomics and Worker Comfort

Growing awareness of occupational health and long working hours in industrial environments are influencing purchasing decisions. Employers are prioritizing ergonomic designs that reduce fatigue and enhance mobility without compromising safety. It is driving demand for boots with improved cushioning, arch support, and temperature control features. The shift toward worker well-being underscores a broader trend toward integrating comfort, performance, and safety in professional footwear solutions.

Market Trends:

Integration of Smart and Sustainable Materials in Work Boot Design

The rising focus on sustainability and technology integration is reshaping product development within the safety footwear sector. Manufacturers are adopting eco-friendly materials such as recycled leather, biodegradable rubber, and plant-based components to align with corporate sustainability goals. The North America Work Boot Market is witnessing a steady transition toward smart boots equipped with embedded sensors that monitor fatigue, temperature, and step count for enhanced worker safety. It reflects the industry’s move toward combining functionality with environmental responsibility. Lightweight and durable composites are replacing traditional steel toes, offering equal protection with greater comfort. Brands are investing in research and development to introduce breathable fabrics and slip-resistant soles, reinforcing their commitment to performance and sustainability.

- For Instance, Will’s Vegan Shoes offers various boots made with different material specifications. Some of its products feature an Italian bio-based vegan leather containing 69% bio-oil from organic cereal crops.

Rising Demand for Aesthetic, Multi-Functional, and Gender-Inclusive Footwear

Consumer expectations are evolving beyond safety compliance, with growing interest in stylish and multi-functional work boots suitable for both job sites and casual wear. It is driving manufacturers to introduce designs that blend industrial durability with modern aesthetics. The increasing participation of women in construction, logistics, and manufacturing roles has created demand for gender-specific sizing and ergonomic designs. Companies are responding with collections that balance fit, protection, and style, expanding their customer base. Hybrid work boots that provide comfort, weather resistance, and visual appeal are gaining popularity among professionals. This trend underscores the industry’s shift toward merging safety standards with lifestyle preferences, positioning manufacturers to appeal to a broader market segment.

- For instance, Steel Blueintegrating Boa® Fit System technology that allows wearers to make micro-adjustments for improved comfort and performance precision of up to 1 millimeter during wear.

Market Challenges Analysis:

High Production Costs and Supply Chain Constraints

Rising raw material costs and disruptions in global supply chains remain major concerns for manufacturers. Leather, rubber, and synthetic materials continue to experience price volatility, directly affecting production margins. The North America Work Boot Market faces pressure from fluctuating transportation expenses and limited availability of high-grade protective materials. It challenges companies to maintain product affordability while ensuring quality and compliance with safety standards. Delays in material procurement and dependence on overseas suppliers often impact delivery schedules and inventory management. These factors collectively restrict smaller manufacturers from scaling efficiently in a competitive landscape.

Intense Market Competition and Counterfeit Product Penetration

The presence of numerous regional and global players has intensified competition, leading to price sensitivity and margin compression. It pushes companies to differentiate through innovation, branding, and customer engagement. The increasing influx of low-quality counterfeit products further threatens market credibility and consumer trust. Unregulated imports from low-cost manufacturing regions undermine genuine product sales and brand reputation. Companies are investing in authentication technologies and awareness campaigns to protect consumers and uphold quality standards. Maintaining brand loyalty in such a competitive and fragmented market remains an ongoing challenge for established players.

Market Opportunities:

Rising Adoption of Advanced Manufacturing Technologies

The growing integration of automation and digital production techniques presents a major growth avenue for manufacturers. The North America Work Boot Market benefits from innovations such as 3D printing, smart stitching, and automated assembly lines that enhance product consistency and reduce waste. It enables faster prototyping and customization to meet specific industrial and ergonomic requirements. The adoption of data-driven manufacturing allows companies to monitor quality and efficiency more effectively. These technological advancements support scalability while improving material utilization and reducing overall production costs. The trend positions manufacturers to deliver high-quality boots with shorter lead times and greater design flexibility.

Expanding Demand Across Emerging Industrial Sectors

Diversification of end-use industries is opening new opportunities for market expansion. It is driven by rising safety standards in logistics, warehousing, renewable energy, and e-commerce operations. The increasing workforce in these sectors fuels demand for durable and comfortable protective footwear. Growth in green construction and clean energy projects also supports the adoption of sustainable work boot materials. Companies offering eco-friendly and gender-inclusive designs can strengthen their market positioning and attract a wider customer base. The shift toward preventive safety measures across industrial applications further reinforces the market’s long-term growth potential.

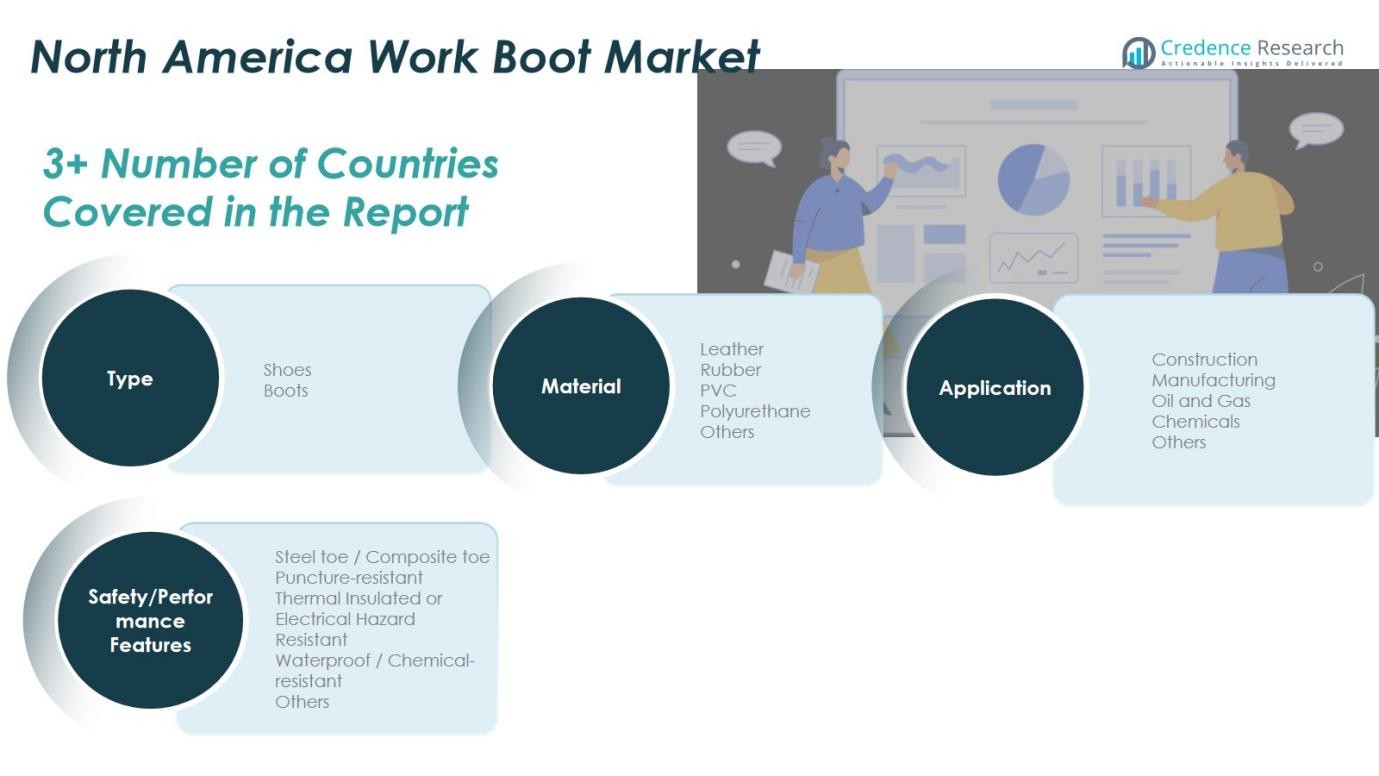

Market Segmentation Analysis:

By Type

The North America Work Boot Market is segmented into shoes and boots, with boots holding the dominant share due to their superior protection and durability in industrial environments. Demand for high-cut, reinforced boots is strong across construction and oil and gas industries, where safety and comfort are essential. It benefits from advancements in lightweight materials and slip-resistant soles that enhance mobility and reduce fatigue. Shoes are gaining traction in light manufacturing and service sectors where flexibility and comfort are prioritized. The segment continues to evolve with growing adoption of hybrid styles combining durability with modern aesthetics.

- For Instance, The Timberland PRO Ridgework Hiker with a composite safety toe weighs 684 grams per boot in a size 9, a weight that is significantly lighter than traditional steel-toe options and is highly competitive for a boot of its type.

By Application

The market is segmented into construction, manufacturing, oil and gas, chemicals, and others. Construction leads the segment, driven by ongoing infrastructure projects and regulatory emphasis on worker safety. It records high consumption of steel-toe and waterproof boots to prevent workplace injuries. Manufacturing follows closely, supported by the need for puncture-resistant and ergonomic footwear for extended wear. The oil and gas industry demands insulated and chemical-resistant boots, while the chemical and service sectors focus on lightweight and corrosion-resistant options.

- For Instance, Portwest’s Eden FD15 S3 steel-toe boots feature SRC-rated slip-resistant soles, HRO heat resistance up to 300°C, and thermal insulation.

By Material

The material segment includes leather, rubber, PVC, polyurethane, and others. Leather dominates due to its strength, comfort, and resistance to abrasion, making it ideal for heavy-duty applications. It remains preferred for premium safety footwear offering both durability and style. Rubber and PVC materials are expanding due to their waterproof properties and affordability, particularly in wet or chemical environments. Polyurethane’s flexibility and light weight make it suitable for modern, comfort-oriented designs.

Segmentations:

By Type:

By Application:

- Construction

- Manufacturing

- Oil and Gas

- Chemicals

- Others

By Material:

- Leather

- Rubber

- PVC

- Polyurethane

- Others

By Safety/Performance Features:

- Steel Toe / Composite Toe

- Puncture-Resistant

- Thermal Insulated or Electrical Hazard Resistant

- Waterproof / Chemical-Resistant

- Others

By Country:

- United States

- Canada

- Mexico

Regional Analysis:

United States: Dominant Contributor with Strong Industrial Demand

The United States holds 68% of the North America Work Boot Market, maintaining a clear leadership position across major industrial sectors. Its strong performance is supported by a well-established manufacturing base, strict workplace safety regulations, and the presence of global footwear brands. High demand from construction, oil and gas, and logistics sectors continues to drive consistent sales. It benefits from innovation in lightweight materials and ergonomic designs that enhance comfort and durability. Federal investments in infrastructure and an increased focus on worker protection further strengthen the market’s growth outlook.

Canada: Growing Adoption Driven by Safety Regulations and Resource Industries

Canada accounts for 21% of the regional market, supported by its extensive mining, construction, and energy operations. The enforcement of strict safety standards by the Canadian Centre for Occupational Health and Safety (CCOHS) continues to promote steady adoption. It experiences rising demand for insulated and waterproof work boots designed for extreme weather and rugged terrain. Growth in renewable energy projects and resource development initiatives fuels product demand across industrial sectors. The market benefits from a national commitment to employee safety and increasing awareness of protective footwear standards.

Mexico: Emerging Market with Expanding Industrial Base

Mexico represents 11% of the regional market, driven by expanding industrialization and growing adherence to workplace safety practices. It records increasing demand from the automotive, logistics, and manufacturing sectors, supported by foreign investments in production facilities. Local manufacturing capabilities and cost-effective labor are attracting international brands to strengthen regional supply chains. The government’s infrastructure development initiatives continue to enhance market conditions for safety footwear. Rising focus on worker protection and compliance supports Mexico’s emergence as a dynamic growth market in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Black Diamond

- Timberland PRO

- KEEN Utility

- Skechers Work

- Red Wing Shoes

- Wolverine

- Carhartt, Inc.

- Ariat

- Sievi

- Anbu Safety

- Carolina Shoe Company

- Honeywell International

Competitive Analysis:

The North America Work Boot Market is highly competitive, characterized by the presence of established global brands and regional manufacturers striving for product differentiation. Leading companies focus on innovation in materials, ergonomic designs, and safety features to maintain market position and attract industrial clients. It experiences intense competition in pricing, quality, and distribution channels, driving manufacturers to invest in research and development for advanced protective footwear. Strategic initiatives such as mergers, acquisitions, regional expansions, and new product launches enable companies to strengthen market presence and expand customer base. Brand loyalty, compliance with safety standards, and adoption of sustainable materials remain key factors influencing competitive advantage. The market’s dynamic nature encourages continuous improvement in product offerings and operational efficiency, positioning leading players to capitalize on growing industrial safety demands while responding effectively to evolving consumer preferences.

Recent Developments:

- In September 2025, Black Diamond formed a partnership with AllTrails to launch a collaborative gear collection and promote backcountry safety throughout the 2025/26 season.

- In September 2025, Black Diamond introduced the “Designed for the Deep” experiential event series in collaboration with AIARE and specialty retailers to kick off the 2025/26 ski season.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Material, Safety Performance, Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and UKeconomic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing focus on workplace safety will continue to drive demand for durable and protective work boots across industrial sectors.

- Advancements in lightweight and ergonomic materials will enhance worker comfort and support longer usage.

- Increasing adoption of sustainable and eco-friendly materials will influence product development and brand positioning.

- Expansion of infrastructure, construction, and renewable energy projects will create new market opportunities.

- Rising participation of women in industrial and construction roles will stimulate demand for gender-specific and ergonomic designs.

- Integration of smart features such as embedded sensors for fatigue and environmental monitoring will gain traction.

- Manufacturers will invest in research and development to introduce hybrid designs combining safety, style, and comfort.

- Regional expansion into emerging industrial hubs will strengthen market presence for leading brands.

- Growing awareness of ergonomic footwear benefits will influence purchasing decisions in both corporate and industrial segments.

- Strategic collaborations, acquisitions, and new product launches will continue to shape the competitive landscape and accelerate market growth.