Market Overview

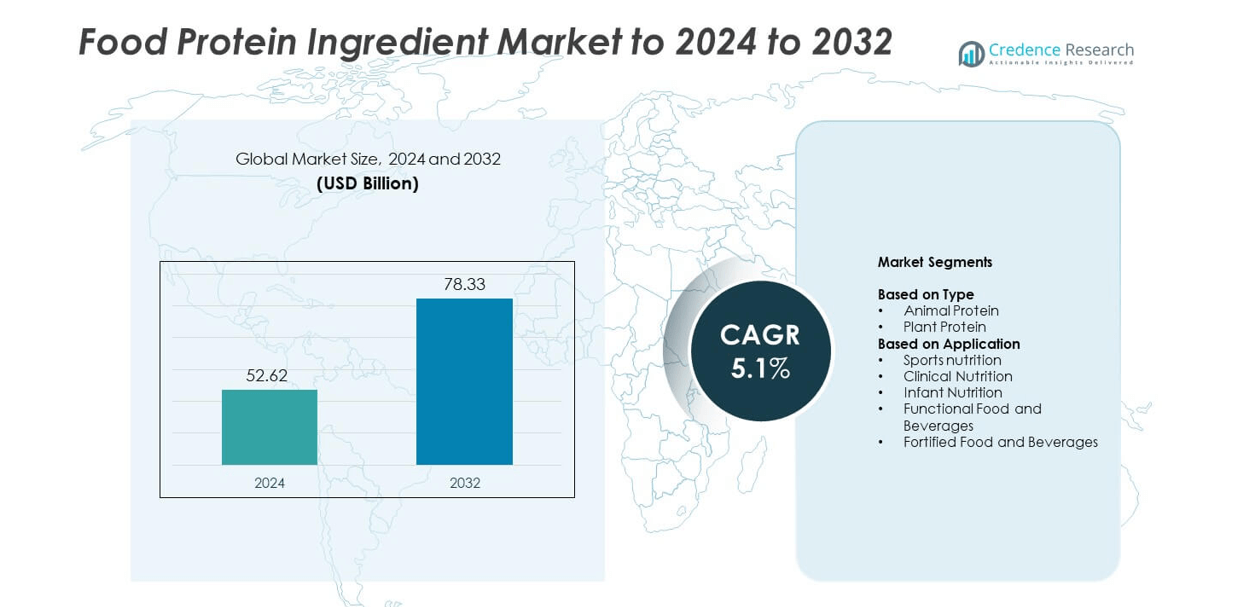

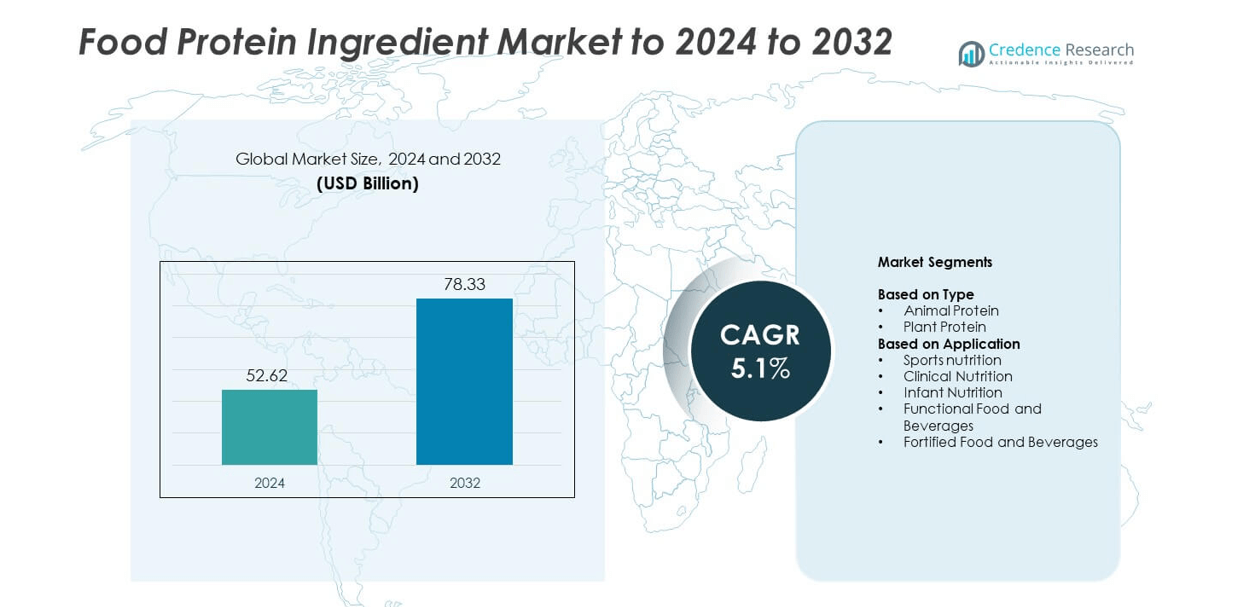

The Food Protein Ingredient Market size was valued at USD 52.62 billion in 2024 and is anticipated to reach USD 78.33 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Protein Ingredient Market Size 2024 |

USD 52.62 billion |

| Food Protein Ingredient Market, CAGR |

5.1% |

| Food Protein Ingredient Market Size 2032 |

USD 78.33 billion |

The Food Protein Ingredient Market is dominated by key players such as DSM-Firmenich, ADM, Cargill, Arla Foods Ingredients, and Tyson Foods. These companies focus on expanding production capacities, enhancing product functionality, and adopting sustainable sourcing methods to meet growing global protein demand. Continuous innovation in plant-based and clean-label formulations drives their competitive edge. Strategic mergers and partnerships further strengthen their market reach across major food and beverage applications. North America led the market in 2024 with a 38% share, supported by strong consumer awareness, advanced processing facilities, and high adoption of functional and fortified protein products.

Market Insights

- The Food Protein Ingredient Market was valued at USD 52.62 billion in 2024 and is projected to reach USD 78.33 billion by 2032, growing at a CAGR of 5.1%.

- Rising consumer demand for functional and fortified foods is fueling market expansion, with a strong shift toward plant-based and sustainable protein sources.

- Key trends include innovations in extraction technologies, increasing investments in clean-label formulations, and growing applications in sports and clinical nutrition.

- Market competition remains intense, with leading players focusing on product differentiation, capacity expansion, and strategic partnerships to strengthen global presence.

- North America led the market with a 38% share in 2024, followed by Europe at 29% and Asia-Pacific at 25%; by type, the animal protein segment dominated with 59% share, driven by its superior nutritional profile and functional benefits across food and beverage applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The animal protein segment dominated the Food Protein Ingredient Market with a 59% share in 2024. Its dominance is driven by high demand from dairy, meat, and bakery sectors. Animal proteins such as whey, casein, and gelatin provide superior amino acid profiles and functional benefits like solubility and emulsification. Growing use in sports and clinical nutrition further strengthens segment growth. Rising fitness awareness and increased demand for high-protein foods in developed regions continue to support animal protein consumption over plant-based alternatives.

- For instance, Gelita’s Liaoyuan site added a gelatin line producing 6,500 tonnes annually.

By Application

The functional food and beverages segment held the largest share of 37% in 2024. This dominance is supported by the rising consumer preference for nutrient-enriched products that promote health and wellness. Proteins are widely used to enhance texture, satiety, and nutritional value in snacks, beverages, and dairy alternatives. Rapid innovation in ready-to-drink protein beverages and fortified cereals has boosted usage. Increasing awareness of protein’s role in muscle recovery and energy maintenance drives adoption in both developed and emerging economies.

- For instance, fairlife’s Core Power shakes deliver 26 g or 42 g protein per bottle.

Key Growth Drivers

Rising Demand for Functional and Nutritional Foods

Consumers are increasingly turning toward high-protein foods for better health and wellness. Functional foods enriched with proteins are gaining attention for supporting muscle strength, weight management, and energy balance. Manufacturers are incorporating protein ingredients into bakery, snacks, and dairy products to meet nutritional needs. The growing fitness culture and preference for clean-label products continue to expand the market, driving higher adoption across retail and online channels globally.

- For instance, Danone’s Oikos Protein Shakes contain 30 g protein per serving.

Expansion of Sports and Clinical Nutrition Applications

The demand for protein ingredients in sports and clinical nutrition is rising rapidly. Athletes and fitness enthusiasts prefer protein-enriched supplements for faster recovery and improved endurance. In the clinical segment, proteins aid muscle maintenance and disease management among aging populations. Whey and soy proteins dominate due to their digestibility and amino acid composition. Expanding healthcare awareness and the popularity of protein-based supplements continue to strengthen market growth.

- For instance, Abbott’s Ensure Max Protein provides 30 g protein with 1 g sugar per serving.

Shift Toward Plant-Based Protein Alternatives

Growing environmental concerns and changing dietary habits are driving the demand for plant-based proteins. Consumers are seeking sustainable and allergen-free protein sources like pea, soy, and rice proteins. Food producers are reformulating traditional animal-based products to align with vegan and vegetarian preferences. The rising number of flexitarian consumers and innovation in texture and flavor enhancement are fueling market expansion for plant-based protein ingredients globally.

Key Trends and Opportunities

Innovation in Protein Extraction and Processing Technologies

Advancements in protein extraction and purification technologies are improving product quality and efficiency. Enzyme-assisted and membrane filtration methods enhance yield and maintain nutritional integrity. Companies are investing in research to produce high-solubility, neutral-tasting protein powders for wider food applications. These technological improvements are expanding the potential of both animal and plant proteins in fortified beverages and functional snacks.

- For instance, GEA reports saving up to 50,000 L of water per CIP on large whey plants.

Growing Penetration in Emerging Markets

Emerging economies in Asia-Pacific and Latin America are becoming major growth hubs for protein ingredients. Rising disposable incomes, urbanization, and changing dietary preferences are increasing protein consumption. Local food manufacturers are introducing affordable, high-protein options across bakery, dairy, and beverage categories. Governments promoting nutrition programs and health awareness campaigns further accelerate market penetration in developing regions.

- For instance, Parag Milk Foods processes up to 2.9 million liters of milk daily across three plants, following the acquisition of a new facility in Haryana in 2018.

Key Challenges

High Production Costs and Price Volatility

Protein ingredient production involves complex processes that increase operational costs. Fluctuating prices of raw materials like soy, milk, and peas affect overall market stability. Limited processing infrastructure in developing regions also contributes to cost variations. These challenges often result in higher product prices, restraining market access for low-income consumers and small-scale manufacturers.

Regulatory and Labeling Complexities

Strict food regulations and labeling requirements create hurdles for protein ingredient manufacturers. Differences in regional standards for nutritional claims and allergen disclosures complicate global trade. Companies face additional costs for compliance and certification, particularly for organic and non-GMO proteins. These factors delay product launches and limit market expansion across key international markets.

Regional Analysis

North America

North America held the largest share of 38% in the Food Protein Ingredient Market in 2024. Strong demand for dietary supplements, functional foods, and sports nutrition products drives market growth. The United States leads consumption, supported by a mature food processing industry and widespread protein awareness. Rising veganism and the adoption of plant-based proteins have further diversified the market. Major companies are investing in product innovation and sustainable sourcing, while the presence of key protein manufacturers strengthens the regional supply chain and technological development.

Europe

Europe accounted for 29% of the global market share in 2024, supported by growing demand for plant-based and fortified food products. Countries such as Germany, France, and the Netherlands are major consumers of protein-enriched dairy and bakery products. Strict regulatory standards promote clean-label and high-quality ingredients, driving innovation in non-GMO and organic protein formulations. Increasing awareness of protein-rich diets and rising investments in food biotechnology continue to support market expansion across Western and Central Europe.

Asia-Pacific

Asia-Pacific captured a 25% share of the Food Protein Ingredient Market in 2024, driven by rising disposable incomes and growing health consciousness. Expanding food processing industries in China, India, and Japan are boosting demand for both plant and animal protein ingredients. Consumers are shifting toward protein-enriched beverages and snacks, encouraged by government nutrition programs. Rapid urbanization and expanding retail infrastructure are accelerating product availability, while local manufacturers focus on affordable, high-protein solutions for mass-market adoption.

Latin America

Latin America held a 5% share in 2024, supported by the growing popularity of protein-enriched foods and dietary supplements. Brazil and Mexico are the key markets, driven by lifestyle changes and rising gym memberships. Regional food companies are incorporating soy and whey proteins into bakery and beverage products to meet consumer demand. Although production costs and economic instability pose challenges, increasing awareness of balanced nutrition supports steady market growth across the region.

Middle East and Africa

The Middle East and Africa accounted for 3% of the global market share in 2024. Rising health awareness, urbanization, and dietary diversification are driving demand for protein-fortified foods. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing growing adoption of sports nutrition and fortified beverages. Imports dominate supply due to limited local manufacturing, but new investments in food processing facilities are improving accessibility. Expanding retail networks and increasing disposable income are expected to boost future growth in this emerging region.

Market Segmentations:

By Type

- Animal Protein

- Plant Protein

By Application

- Sports nutrition

- Clinical Nutrition

- Infant Nutrition

- Functional Food and Beverages

- Fortified Food and Beverages

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Food Protein Ingredient Market is characterized by strong competition among major players such as DSM-Firmenich, ADM, Cargill, Arla Foods Ingredients, Tyson Foods, DuPont, Bunge Limited, Fonterra Co-Operative Group, Prinova Group, Mead Johnson & Company, Rousselot, CropEnergies AG, MGP, CHS, and Burcon. These companies focus on expanding production capacity, improving protein purity, and developing sustainable sourcing models. Strategic initiatives include mergers, acquisitions, and partnerships with food manufacturers to enhance product portfolios. Firms are investing heavily in research to create clean-label, allergen-free, and plant-based protein ingredients that meet evolving consumer preferences. Technological advances in protein extraction and enzymatic processing are enabling higher yields and better functional properties. Regional expansion and strong distribution networks help maintain competitive positioning across North America, Europe, and Asia-Pacific. Continuous innovation and adherence to regulatory standards remain central to strengthening market presence and achieving long-term growth within the global protein ingredient landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DSM-Firmenich

- ADM

- Cargill, Incorporated

- Arla Foods Ingredients

- Tyson Foods

- DuPont

- Bunge Limited

- Fonterra Co-Operative Group

- Prinova Group LLC

- Mead Johnson & Company, LLC

- Rousselot

- CropEnergies AG

- MGP

- CHS, Inc.

- Burcon

Recent Developments

- In 2023, DSM-Firmenich Launched a vitamin transformation program to improve profitability and reduce costs. The company’s Taste, Texture & Health segment showed strong growth, driven by demand for plant-based solutions.

- In 2023, Tyson Foods, Inc. partnered with Protix, a leading producer of insect-based ingredients, to advance sustainable protein production.

- In 2023, Arla Foods Ingredients Launched Lacprodan ALPHA-50, a whey protein ingredient for low-protein infant formulas, and showcased high-protein whey solutions for ice cream and fermented drinks in the Middle East and Africa.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising consumer awareness about protein-rich diets will continue to boost market demand.

- Plant-based protein ingredients will gain wider acceptance due to sustainability trends.

- Technological advances in protein extraction will enhance product quality and efficiency.

- Functional and fortified food applications will remain key growth drivers globally.

- Sports and clinical nutrition segments will expand with increasing health and fitness adoption.

- Clean-label and allergen-free formulations will attract health-conscious consumers.

- Emerging markets in Asia-Pacific and Latin America will present strong growth opportunities.

- Partnerships between food manufacturers and biotech firms will drive innovation.

- Companies will focus on traceable and ethically sourced protein supply chains.

- Rising investments in research and regulatory compliance will strengthen long-term market stability.