Market Overview

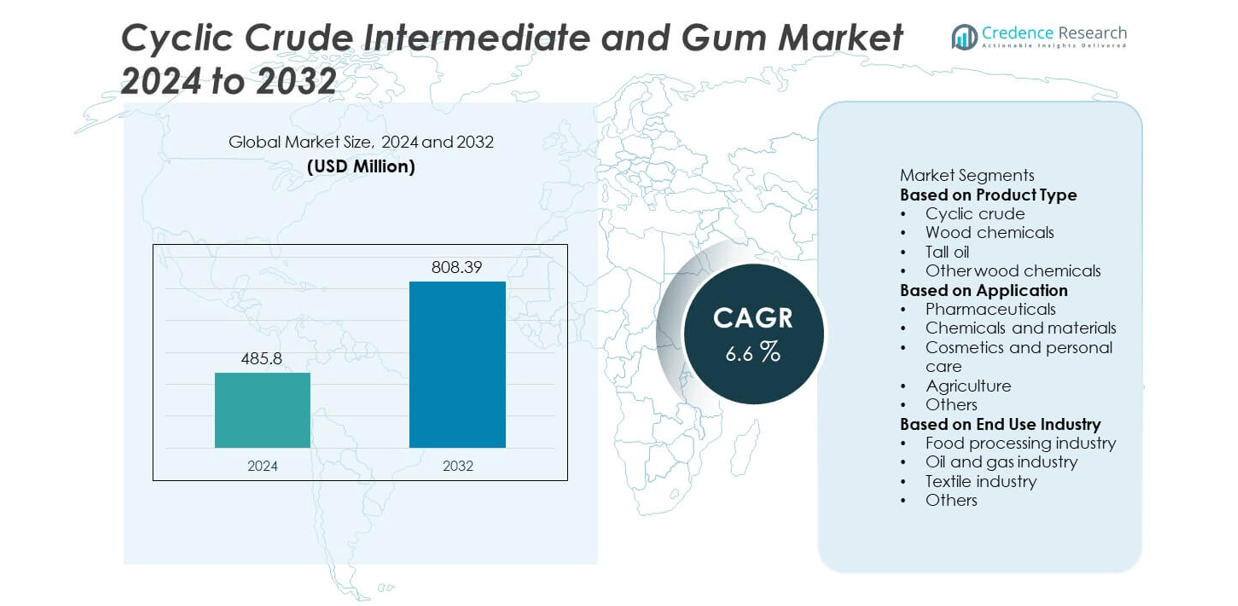

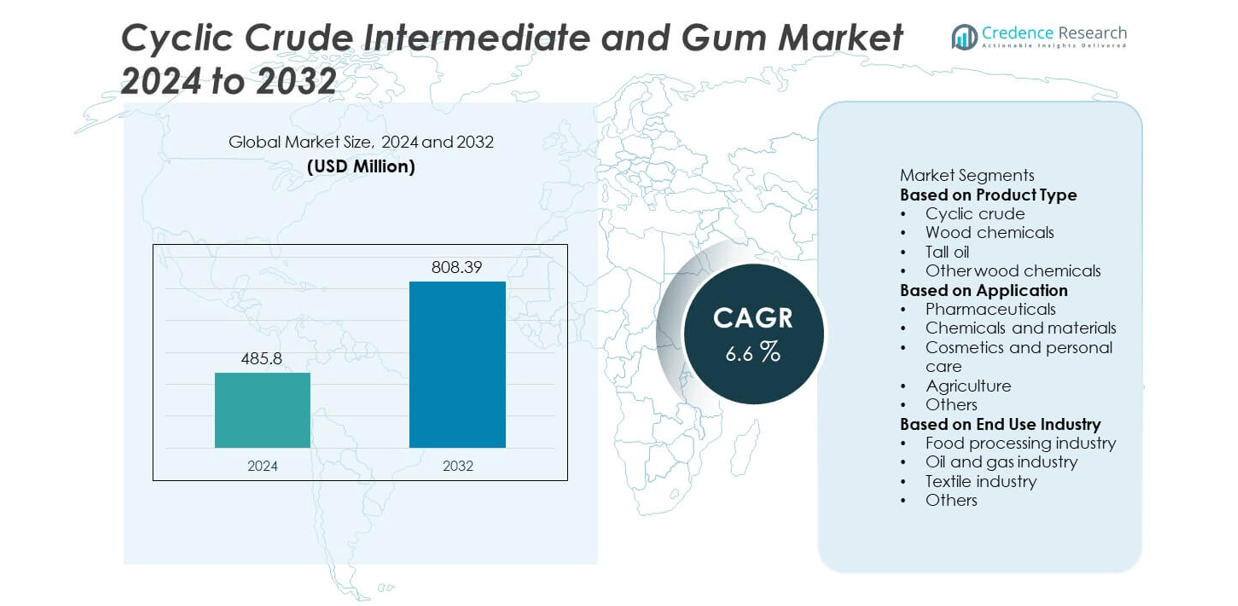

The Cyclic Crude Intermediate and Gum market was valued at USD 485.8 million in 2024 and is projected to reach USD 808.39 million by 2032, growing at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyclic Crude Intermediate and Gum Market Size 2024 |

USD 485.8 million |

| Cyclic Crude Intermediate and Gum Market, CAGR |

6.6% |

| Cyclic Crude Intermediate and Gum Market Size 2032 |

USD 808.39 million |

The Cyclic Crude Intermediate and Gum market is led by major players including Kraton Corporation, Harima Chemicals Group, Inc., Georgia-Pacific Chemicals LLC, Ingevity Corporation, Eastman Chemical Company, DRT (Les Dérivés Résiniques et Terpéniques), Foreverest Resources Ltd., Arakawa Chemical Industries, Ltd., Resinas Brasil Group, and Lawter Inc. These companies dominate through innovation in bio-based resin production, advanced refining technologies, and sustainable sourcing of wood and tall oil derivatives. North America led the market with a 34% share in 2024, driven by strong chemical and polymer manufacturing activity, while Europe followed with 29%, supported by green chemistry initiatives and advanced wood chemical processing capabilities.

Market Insights

- The Cyclic Crude Intermediate and Gum market was valued at USD 485.8 million in 2024 and is projected to reach USD 808.39 million by 2032, growing at a CAGR of 6.6% during the forecast period.

- Rising demand for bio-based chemicals, adhesives, and resins across industrial applications is driving market growth, supported by advancements in refining and extraction technologies.

- The market is witnessing a shift toward sustainable production practices and circular economy models, with increasing adoption of tall oil and wood-based derivatives.

- Key players such as Kraton Corporation, Ingevity Corporation, and Eastman Chemical Company are focusing on capacity expansion, renewable sourcing, and strategic partnerships to strengthen market presence.

- North America led the market with a 34% share, followed by Europe at 29%, while the cyclic crude segment dominated with a 46% share, driven by its broad use in resins, solvents, and polymer production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The cyclic crude segment dominated the Cyclic Crude Intermediate and Gum market in 2024, holding a 46% share. Its dominance stems from its extensive use as a precursor in resin, adhesive, and solvent manufacturing. Cyclic crude plays a vital role in producing terpenes, pine chemicals, and aromatic intermediates used across multiple industries. The growing demand for bio-based and sustainable raw materials is further supporting segment growth. Meanwhile, wood chemicals and tall oil segments are gaining traction due to their applications in coatings, lubricants, and surfactants within the industrial and construction sectors.

- For instance, Eastman Chemical has integrated cyclic crude derivatives in its industrial solvents, improving resin compatibility and sustainability profiles.

By Application

The chemicals and materials segment accounted for the largest share of 52% in 2024, driven by the extensive use of cyclic intermediates in polymerization and resin synthesis. These materials are essential for producing adhesives, sealants, and coatings used across various industrial applications. The pharmaceuticals and cosmetics segments are also growing rapidly due to rising adoption of bio-based ingredients and natural compounds. Increasing demand for sustainable formulations and expanding chemical manufacturing capacities worldwide are driving higher consumption of cyclic intermediates within the materials and specialty chemical industries.

- For instance, BASF utilizes cyclic intermediates to produce high-performance epoxy resins for automotive coatings, enhancing durability and corrosion resistance.

By End Use Industry

The oil and gas industry led the market with a 39% share in 2024, driven by the rising utilization of cyclic intermediates in refining processes and lubricant formulations. These compounds improve processing efficiency and serve as additives in drilling and recovery operations. The food processing industry follows as a notable segment, using cyclic derivatives for flavoring agents and emulsifiers. Additionally, the textile industry is witnessing moderate growth due to the use of resins and solvents derived from cyclic crude in fabric treatment and dyeing processes, supporting overall market expansion.

Key Growth Drivers

Rising Demand for Bio-Based and Sustainable Chemicals

The increasing global shift toward eco-friendly and renewable materials is driving demand for cyclic crude intermediates and gum products. Industries such as adhesives, coatings, and polymers are replacing petrochemical-based inputs with bio-based alternatives derived from cyclic crude and tall oil. Growing regulatory pressure to reduce carbon emissions further supports this transition. Manufacturers are investing in green chemistry and sustainable refining processes to meet consumer and industrial sustainability goals, thereby fueling the market’s long-term expansion across multiple end-use sectors.

- For instance, UPM introduced BioVerno naphtha derived from crude tall oil, a residual product of pulp production, offering a bio-based raw material for plastics, textiles, and adhesives with physical properties identical to fossil-based equivalents.

Expanding Applications Across Industrial Sectors

Cyclic crude intermediates and gums are gaining traction across various industries including oil and gas, food processing, and pharmaceuticals. These compounds are vital for producing resins, emulsifiers, solvents, and surfactants. The rising use in lubricant formulations, coatings, and industrial cleaners is boosting market penetration. Additionally, ongoing infrastructure development and industrial expansion in emerging economies are increasing the demand for specialty chemicals and intermediates, strengthening the market’s growth potential in both developed and developing regions.

- For instance, CP Kelco, a leading producer of natural gums such as xanthan and carrageenan, has expanded sustainable sourcing programs to support food and beverage emulsification and pharmaceutical suspension formulations.

Technological Advancements in Extraction and Refining

Innovations in extraction and refining technologies are enhancing the efficiency and yield of cyclic crude and wood chemical products. Advanced distillation and fractionation processes allow manufacturers to recover high-purity intermediates with improved performance characteristics. Automation and process optimization have reduced production costs and environmental impact, supporting wider adoption. Continuous R&D in refining tall oil and other wood derivatives has also enabled production of value-added chemicals, improving profitability and market competitiveness for global players in the cyclic crude intermediate and gum industry.

Key Trends & Opportunities

Integration of Circular and Green Manufacturing Practices

Companies are increasingly adopting circular economy models by utilizing waste from wood processing and oil refining to produce cyclic intermediates. This approach supports sustainable sourcing while reducing overall waste generation. Green manufacturing practices are gaining momentum, aligning with corporate sustainability commitments and environmental standards. The growing focus on carbon-neutral production and renewable feedstocks provides opportunities for manufacturers to expand product portfolios and attract environmentally conscious clients across industrial and consumer markets.

- For instance, Neste produces renewable hydrocarbons by refining waste and residue oils, helping clients transition to low-carbon manufacturing.

Rising Adoption in Specialty and High-Performance Applications

The market is witnessing a growing trend toward high-performance and specialty applications of cyclic crude intermediates. These include advanced polymers, sealants, and coatings that require enhanced thermal and chemical stability. Demand from the construction, automotive, and aerospace sectors is creating opportunities for tailored formulations. Moreover, the use of natural and bio-derived cyclic compounds in personal care and pharmaceutical formulations continues to rise, driven by consumer preference for clean-label, non-toxic, and sustainable ingredient sources.

- For instance, 3M’s Aerospace Sealant AC-735 is a polysulfide fuselage sealant designed for long-lasting corrosion control and weight savings, providing 25% lower density than traditional sealants while maintaining resistance to aviation fuel and extreme conditions.

Key Challenges

High Production and Refining Costs

The complex refining and purification processes associated with cyclic crude intermediates lead to high production costs. Manufacturers face challenges in maintaining cost competitiveness due to fluctuating raw material prices and energy expenses. The need for advanced equipment and process controls further adds to capital investment. These cost pressures can limit adoption, particularly in cost-sensitive markets, and may affect profitability unless companies enhance process efficiency or develop scalable green technologies that balance sustainability with affordability.

Limited Raw Material Availability and Supply Chain Constraints

The availability of quality raw materials, such as pine resins and wood derivatives, remains a key challenge for market stability. Dependence on specific geographic regions for sourcing and seasonal variations in raw material yield can disrupt production cycles. Supply chain inefficiencies and transportation delays further impact timely distribution. Additionally, environmental restrictions on forestry activities can limit the supply of natural feedstocks. To overcome these challenges, companies are exploring alternative sourcing strategies and synthetic substitutes to ensure a steady production flow.

Regional Analysis

North America

North America held a 34% market share in 2024, driven by strong demand from the chemical, oil and gas, and polymer industries. The United States leads the region due to well-established refining infrastructure and advancements in bio-based chemical manufacturing. Increased adoption of sustainable raw materials and renewable feedstocks supports market expansion. Canada contributes to growth through the rising use of tall oil derivatives in adhesives and coatings. Favorable regulatory policies promoting eco-friendly industrial practices and continuous R&D investments further reinforce North America’s position as a leading producer and consumer of cyclic crude intermediates.

Europe

Europe accounted for a 29% share in 2024, supported by the region’s growing focus on green chemistry and circular manufacturing practices. Countries such as Germany, Finland, and Sweden dominate due to their robust pulp and paper industries, which supply key raw materials for cyclic crude and gum extraction. Stringent environmental regulations and the EU’s commitment to reducing carbon footprints are driving adoption of renewable intermediates. Expanding applications in coatings, adhesives, and specialty chemicals are also contributing to steady growth. Technological advancements and industrial collaborations are further strengthening Europe’s presence in this market.

Asia-Pacific

Aused in polymers, resins, and surfactants. Rapid industrialization, expanding manufacturing bases, and favorable government initiatives promoting bio-based materials drive growth. Rising investments in refinery modernization and wood chemical processing enhance production capacity. The shift toward sustainable sourcing and high-performance specialty chemicals positions Asia-Pacific as a key growth hub, with strong opportunities for both domestic producers and international investors targeting industrial and consumer end-use sectors.

Latin America

Latin America held a 7% market share in 2024, driven by the expansion of the chemical and oil refining industries in Brazil and Mexico. The region is increasingly adopting cyclic crude intermediates for coatings, lubricants, and adhesives. Growing investments in renewable resource extraction and industrial modernization are supporting market development. The food processing sector also contributes to demand through the use of natural resins and gum derivatives. Despite economic fluctuations, supportive trade policies and emerging local manufacturing facilities are fostering gradual adoption of sustainable industrial chemicals across key Latin American economies.

Middle East & Africa

The Middle East & Africa accounted for a 4% share in 2024, supported by growing industrial diversification and infrastructure development. Gulf countries such as Saudi Arabia and the United Arab Emirates are investing in refining technologies and specialty chemical production. The availability of petroleum by-products enhances feedstock supply for cyclic crude manufacturing. In Africa, South Africa remains a major market due to expanding industrial and construction sectors. Increasing partnerships with global manufacturers and rising demand for eco-friendly materials are expected to strengthen the region’s role in the cyclic crude intermediate and gum market.

Market Segmentations:

By Product Type

- Cyclic crude

- Wood chemicals

- Tall oil

- Other wood chemicals

By Application

- Pharmaceuticals

- Chemicals and materials

- Cosmetics and personal care

- Agriculture

- Others

By End Use Industry

- Food processing industry

- Oil and gas industry

- Textile industry

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cyclic Crude Intermediate and Gum market is shaped by leading players such as Kraton Corporation, Harima Chemicals Group, Inc., Georgia-Pacific Chemicals LLC, Ingevity Corporation, Eastman Chemical Company, DRT (Les Dérivés Résiniques et Terpéniques), Foreverest Resources Ltd., Arakawa Chemical Industries, Ltd., Resinas Brasil Group, and Lawter Inc. These companies focus on expanding their product portfolios through advanced refining technologies, bio-based feedstock integration, and sustainable manufacturing practices. Strategic mergers, acquisitions, and partnerships strengthen their global footprint and enhance value chain efficiency. Key players are investing in process optimization, renewable resin development, and specialty chemical innovation to meet evolving industrial needs. Continuous R&D efforts and a shift toward circular production models enable manufacturers to reduce environmental impact while maintaining cost efficiency. The growing demand for high-performance adhesives, coatings, and polymers further encourages market consolidation and long-term strategic collaborations among major participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kraton Corporation

- Harima Chemicals Group, Inc.

- Georgia-Pacific Chemicals LLC

- Ingevity Corporation

- Eastman Chemical Company

- DRT (Les Dérivés Résiniques et Terpéniques)

- Foreverest Resources Ltd.

- Arakawa Chemical Industries, Ltd.

- Resinas Brasil Group

- Lawter Inc.

Recent Developments

- In May 2025, DuPont revealed that he incurred large tariff burdens which are directly related to exports of goods which are shipped to subsidiaries located in China. These shipments formed a large part of an estimated five hundred million dollars’ worth of tariffs schemed around exported goods.

- In October 2024, BASF intended to continue development of his Neopor insulation padding by an additional 50.000 ton per year located at ludwigshafen from the BASF site.

- In June 2025, Hims & Hers Health acquired Zava, a telehealth provider operating in the UK, Germany, France, and Ireland. This acquisition allows Hims & Hers to expand its European operations, offering personalized weight-loss treatments and other healthcare services.

- In September 2025, Aptar CSP inaugurated a cGMP facility in New Jersey to advance oral solid dose and dry powder inhaler packaging using Activ-Blister technology. While based in the U.S., this facility’s innovations are expected to influence packaging practices and standards within the European market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of bio-based and renewable raw materials in chemical production.

- Increasing investments in refining technologies to enhance yield and purity levels.

- Rising demand for cyclic intermediates in adhesives, coatings, and polymer industries.

- Expansion of applications in pharmaceuticals, personal care, and agricultural formulations.

- Strengthening focus on sustainable and circular manufacturing practices by producers.

- Integration of automation and process optimization in wood chemical extraction.

- Growing collaborations between chemical manufacturers and research institutions.

- Expanding industrial base in Asia-Pacific supporting regional production growth.

- Rising use of tall oil derivatives in lubricants and specialty chemical formulations.

- Continuous R&D efforts to develop high-performance and low-emission resin solutions.