Market Overview

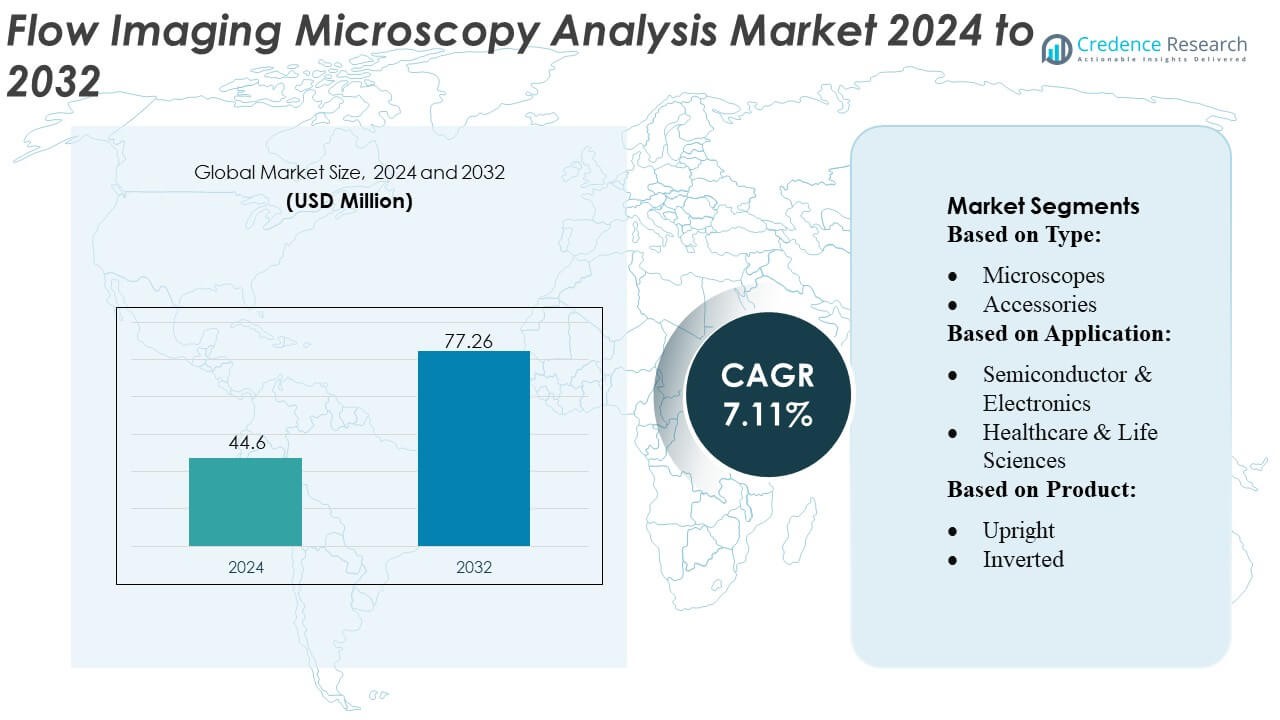

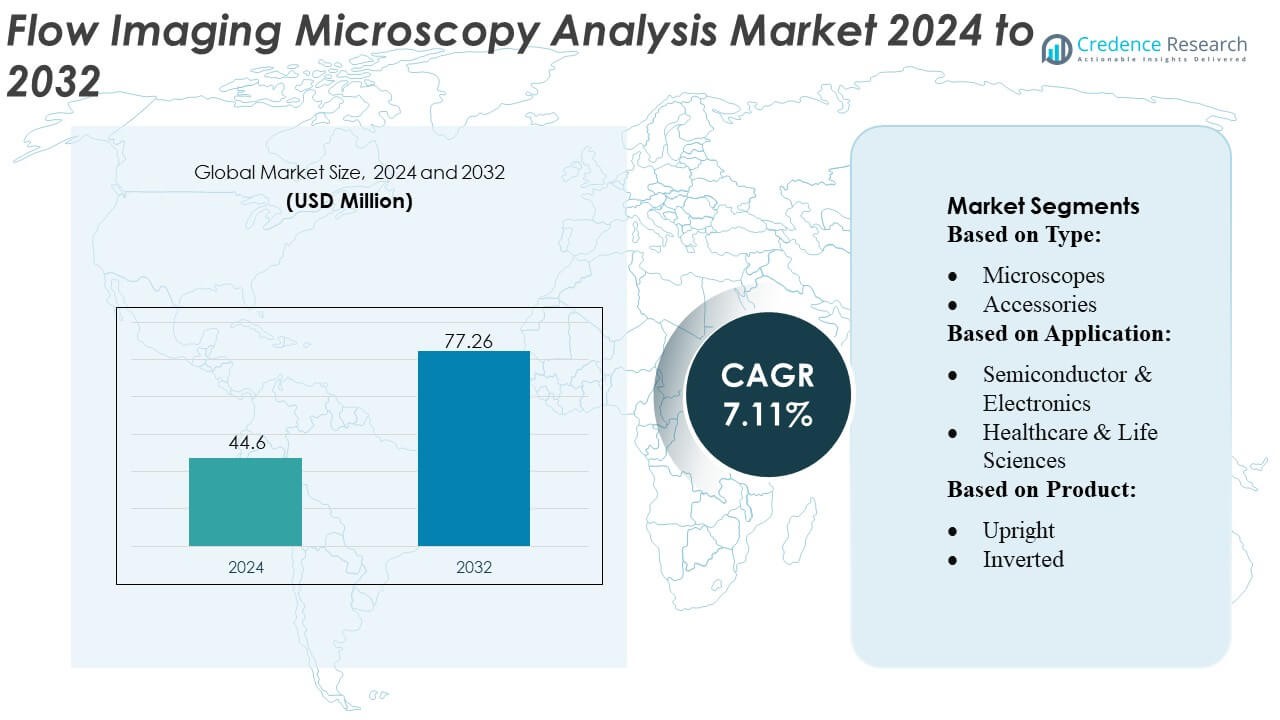

Flow Imaging Microscopy Analysis Market size was valued USD 44.6 million in 2024 and is anticipated to reach USD 77.26 million by 2032, at a CAGR of 7.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flow Imaging Microscopy Analysis Market Size 2024 |

USD 44.6 Million |

| Flow Imaging Microscopy Analysis Market, CAGR |

7.11% |

| Flow Imaging Microscopy Analysis Market Size 2032 |

USD 77.26 Million |

The Flow Imaging Microscopy Analysis Market features several advanced imaging solution providers that compete through innovation in high-resolution optics, automated flow-cell systems, and AI-driven particle analysis platforms. These companies strengthen their positions by expanding application reach across biopharmaceutical production, clinical research, nanomaterials characterization, and semiconductor contamination control. North America leads the global market with an exact 39% share, driven by strong bioprocessing infrastructure, stringent regulatory requirements, and high adoption of automated analytical technologies across research institutions and manufacturing facilities. The region’s sustained investment in digital laboratories and biologics development further reinforces its dominant position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Flow Imaging Microscopy Analysis Market was valued at USD 44.6 million in 2024 and is projected to reach USD 77.26 million by 2032, reflecting a 11% CAGR during the forecast period.

- Market growth is driven by rising demand for high-resolution particle characterization across biologics, vaccines, nanomaterials, and semiconductor manufacturing.

- Trends highlight the rapid adoption of automated imaging, AI-enabled particle classification, and integrated digital workflows that enhance analytical accuracy and throughput.

- Competitive activity intensifies as vendors invest in advanced optics, cloud-based image processing, and modular systems tailored for R&D and GMP environments.

- North America leads with 39% market share, while microscopes account for the dominant segment share at about 48–50%, supported by widespread use in biopharma quality control, academic research, and precision manufacturing.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Microscopes dominate the Flow Imaging Microscopy Analysis Market with an estimated 48–50% share, driven by their essential role in high-resolution particle characterization and real-time morphology assessment across scientific and industrial workflows. Demand rises as manufacturers integrate advanced optical systems, automation, and AI-based image analytics to improve throughput and reproducibility. Accessories account for a steady share due to increasing adoption of flow cells, illumination modules, and precision stages that enhance operational accuracy. Software grows as laboratories prioritize automated image recognition, cloud-enabled data interpretation, and regulatory-compliant reporting for complex particle analysis.

- For instance, NT-MDT SI’s integrated optical module in the NEXT scanning system features a resolution of 2 µm for optical viewing. When integrated with advanced techniques such as Tip-Enhanced Raman Spectroscopy (TERS) as part of the NTEGRA Spectra II system, it can achieve a much finer nanometer-scale spatial resolution, typically down to 10 nm or 20 nm, for chemical analysis and morphology classification, far surpassing the diffraction limit of light.

By Application

Pharma-biopharma manufacturing leads the application landscape with a 32–34% market share, supported by strict regulatory demands for subvisible particle detection in biologics, vaccines, and injectable formulations. The need for continuous process monitoring, contamination control, and quality assurance drives rapid deployment of flow imaging platforms in GMP environments. Healthcare and life sciences applications expand as research institutions adopt high-resolution particle imaging for cells, proteins, and extracellular vesicles. Semiconductor and electronics applications gain relevance with precision particle monitoring in wafer processing and component fabrication. Materials science and other sectors benefit from rising adoption in polymer, metal, and nanomaterial dispersion analysis.

- For instance, ZEISS LSM 910 combines high-speed super-resolution imaging with volumetric 4D capture — enabling researchers to acquire complete 3-D volumes of living samples in a single snapshot, facilitating dynamic process tracking in cells, organoids, or tissues.

By Product

Optical microscopes represent the dominant product category with a 44–46% share, driven by their versatility, cost efficiency, and compatibility with continuous flow-cell imaging for particles ranging from submicron to millimeter scale. Upright and inverted configurations remain preferred in R&D and QC labs due to ease of integration with automated imaging systems. Confocal and fluorescence variants gain traction for high-contrast visualization of biological samples and fluorescent markers. Electron microscopes maintain specialized use for nanoscale characterization, while digital and stereo microscopes experience rising adoption in industrial inspections requiring rapid, operator-independent documentation.

Key Growth Drivers

1. Rising Demand for High-Resolution Particle Characterization

The market grows as industries prioritize high-resolution particle imaging to ensure accuracy in size, shape, and morphology assessment across biologics, nanomaterials, and advanced pharmaceuticals. Flow imaging microscopy enables real-time, label-free evaluation of heterogeneous particle populations, improving product quality and regulatory compliance. Adoption accelerates in R&D and quality control settings where subvisible particle detection remains critical. The increasing complexity of formulations, including biologics, vaccines, and lipid-based delivery systems, further drives demand for advanced imaging platforms capable of delivering rapid, quantitative, and reproducible analytical insights.

- For instance, JEOL Ltd.’s JEM-ARM300F GRAND ARM achieves a point resolution of 63 pm and supports an accelerating voltage of 300 kV for atomic-level morphology analysis, while its automated particle analysis workflow in the JSM-IT800 Schottky Field Emission SEM enables high-speed acquisition at up to 100 frames per second with a probe current reaching 300 nA, facilitating precise, reproducible characterization of nanoscale particulate systems.

2. Expansion of Biologics and Biopharma Manufacturing

Biopharmaceutical companies fuel market growth by adopting flow imaging systems for monitoring protein aggregates, liposomes, viral vectors, and cell-based therapies. Regulatory agencies emphasize stringent characterization of subvisible particles, prompting manufacturers to implement advanced microscopy tools to support GMP-compliant workflows. The surge in monoclonal antibodies, gene therapies, and mRNA-based formulations strengthens the need for continuous monitoring during upstream and downstream processing. Growing investments in automated quality testing, contamination control, and formulation stability assessment reinforce the integration of high-throughput flow imaging technologies in commercial-scale manufacturing.

- For instance, Oxford Instruments’ Asylum Research Cypher ES atomic force microscope achieves sub-80 picometer vertical noise and maintains imaging stability at temperatures up to 250 °C while enabling high-speed scanning at 625 Hz line rates; these capabilities allow precise nanoscale characterization of protein aggregates, lipid nanoparticle structures, and viral vector capsids under controlled environmental conditions.

3. Growing Adoption of Integrated Digital and AI-Enhanced Platforms

The market gains momentum as vendors introduce software-driven imaging solutions with automated particle classification, machine learning models, and real-time data analytics. AI-enabled systems improve detection accuracy, reduce operator dependency, and accelerate result interpretation, making them attractive for laboratories managing large datasets. Cloud-based platforms support remote analysis, collaborative workflows, and regulatory-ready reporting, increasing operational efficiency. As research environments shift toward digital transformation, integrated imaging-analytics ecosystems become critical for achieving higher throughput, standardized measurements, and faster decision-making in complex particle characterization studies.

Key Trends & Opportunities

1. Integration of Automation and High-Throughput Workflow Solutions

A major trend involves automated sample handling, automated image capture, and centralized data management, enabling laboratories to improve throughput and reduce manual interventions. Automated flow imaging systems offer consistent measurements, faster cycle times, and improved reproducibility for continuous quality monitoring. This expansion of automation creates opportunities for instrument manufacturers to develop modular platforms adaptable to biopharma, semiconductor, and materials science settings. The rising preference for integrated workflows also encourages collaborations between imaging vendors and LIMS or digital lab solution providers.

- For instance, Thermo Fisher Scientific’s Tundra Cryo-TEM incorporates an automated loading system that reduces sample handling steps and maintains a cryogenic temperature during transfers, while compatible detectors such as the Falcon 4i (typically used on higher-end Krios systems) can deliver a maximum frame rate of 320 frames per second with a 4k × 4k resolution, enabling high-throughput acquisition of nanoparticle and biomolecular structures with minimal operator intervention.

2. Growing Use in Advanced Materials, Nanotechnology, and Semiconductor Applications

Opportunities expand as flow imaging microscopy gains adoption in nanomaterials characterization, ceramic and polymer dispersion analysis, and particulate control in semiconductor manufacturing. High-precision imaging supports defect detection, slurry quality monitoring, and contamination control, enabling manufacturers to maintain high yield and reliability. Demand increases for systems capable of characterizing increasingly smaller particles with high contrast and dimensional accuracy. This shift opens new revenue streams beyond life sciences, encouraging vendors to develop specialized optical modules and high-sensitivity detectors for industrial and advanced materials applications.

- For instance, Hitachi High-Tech’s SU9000 UHR FE-SEM achieves a 0.4 nm spatial resolution at 30 kV and maintains ultra-low-noise imaging with an extremely stable beam current from its cold field emission (CFE) gun, allowing for high-resolution analysis over extended periods.

3. Increasing Investments in Biotech Startups and Academic Research

Academic institutions and emerging biotech firms drive new opportunities as they adopt flow imaging tools for exploratory studies involving extracellular vesicles, cell therapy vectors, lipid nanoparticles, and protein aggregates. Public and private funding accelerates research in personalized medicine and biologics development, supporting wider instrument penetration. The need for rapid, quantitative, and real-time imaging capabilities positions flow imaging microscopy as a preferred tool for multidisciplinary research. This broadening user base stimulates demand for compact, budget-friendly systems and flexible software platforms tailored for educational and early-stage research environments.

Key Challenges

1. High System Costs and Budget Constraints in Research Settings

High acquisition and maintenance costs remain key barriers, particularly for academic laboratories and small biotech companies with limited capital expenditure capacity. Advanced systems with automated imaging, AI-driven analytics, and high-sensitivity detectors require significant upfront investment. Consumables, calibration accessories, and software upgrades further elevate operational costs. These budget constraints hinder widespread adoption, prompting many researchers to rely on traditional microscopy methods. Without cost-effective models or flexible financing options, market penetration slows in cost-sensitive regions and resource-limited research environments.

2. Technical Complexity and Need for Skilled Operators

Flow imaging microscopy involves complex workflows including sample preparation, flow-cell handling, imaging optimization, and data interpretation, creating reliance on trained personnel. Misalignment, improper flow rates, or suboptimal illumination can lead to inaccurate particle classification or inconsistent results. The steep learning curve challenges new users, especially in environments without structured training programs. Data-heavy workflows also require proficiency in advanced analytics and image processing software. This complexity limits adoption in small laboratories and industrial settings where staffing shortages and limited technical expertise remain persistent concerns.

Regional Analysis

North America

North America holds the leading market share of 38–40%, driven by strong biopharmaceutical manufacturing, advanced research infrastructure, and stringent regulatory requirements for subvisible particle detection. The region benefits from high adoption of automated flow imaging systems across biologics development, vaccine production, and clinical research. Major biopharma companies and academic institutions continuously invest in high-resolution imaging platforms to support process monitoring, stability testing, and quality control. Expanding use in nanomaterials research, semiconductor applications, and government-funded scientific programs further strengthens regional demand, positioning North America as the most established and technology-forward market globally.

Europe

Europe accounts for 27–29% of the Flow Imaging Microscopy Analysis Market, supported by strong pharmaceutical manufacturing, robust academic research networks, and increasing compliance with EMA-driven quality standards. The region adopts flow imaging tools to enhance biologics characterization, detect particulate contamination, and support GMP-aligned analytical workflows. Germany, the U.K., and Switzerland anchor demand through advanced R&D activity and well-funded biopharma pipelines. Rising interest in nanotechnology, polymer science, and materials engineering expands application diversity. Initiatives promoting digital laboratories and automation strengthen adoption further, while collaborations between universities and industry accelerate method development and validation.

Asia Pacific

Asia Pacific captures 22–24% of the market, with rapid growth driven by expanding biopharmaceutical production, increasing investment in academic research, and rising adoption of advanced particle analysis technologies. China, Japan, South Korea, and India accelerate demand as they enhance biologics manufacturing capacity and support cutting-edge research in cell therapies, vaccines, and nanomaterials. Regional laboratories increasingly deploy automated and AI-integrated imaging systems to improve throughput and analytical accuracy. Growing semiconductor and electronics industries further stimulate adoption for contamination control and defect detection. Favorable government funding and rising local instrument manufacturing improve accessibility and strengthen market penetration.

Latin America

Latin America secures a 6–7% market share, supported by growing pharmaceutical production and increased modernization of analytical laboratories across Brazil, Mexico, and Argentina. Adoption of flow imaging microscopy rises as regional manufacturers strengthen quality assurance practices for injectables, biologics, and generics. Academic institutions and government research centers gradually adopt advanced imaging systems for studies involving polymers, nanomaterials, and biological samples. However, budget constraints and limited availability of specialized training programs slow high-end system penetration. Despite these barriers, expanding clinical research activity and rising imports of analytical equipment support steady growth across the region.

Middle East & Africa

The Middle East & Africa region holds 4–5% of the global market, driven by emerging investments in healthcare diagnostics, bioprocessing, and academic research facilities. Countries such as the UAE, Saudi Arabia, and South Africa increase adoption of analytical imaging systems to improve laboratory standards and support biologics and vaccine research. Rising interest in materials science and petrochemical particle analysis contributes to diversified use cases. However, high capital costs and limited local expertise constrain widespread adoption. Gradual expansion of research clusters and growing partnerships with global analytical instrument suppliers support long-term market development.

Market Segmentations:

By Type:

By Application:

- Semiconductor & Electronics

- Healthcare & Life Sciences

By Product:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Flow Imaging Microscopy Analysis Market features leading innovators such as NT-MDT SI, Nikon Corporation, Zeiss Group, JEOL Ltd., Oxford Instruments (Asylum Corporation), Thermo Fisher Scientific, Inc., Hitachi High-Tech Corporation, CAMECA, Olympus Corporation, and Bruker Corporation. the Flow Imaging Microscopy Analysis Market is defined by continuous innovation in advanced imaging systems, automated workflows, and AI-driven analytics. Manufacturers focus on enhancing particle detection sensitivity, improving image resolution, and enabling real-time morphology quantification to meet rising demand from biopharmaceutical, semiconductor, and materials science applications. Companies increasingly invest in integrated software platforms that support machine learning–based particle classification, standardized reporting, and high-throughput data processing. Strategic collaborations with research institutions and bioprocessing facilities strengthen product validation and accelerate adoption across regulated environments. Rising interest in nanomaterials, biologics characterization, and digital laboratory transformation drives competition, prompting ongoing development of compact, automated, and high-performance imaging solutions tailored for R&D and quality control workflows.

Key Player Analysis

- NT-MDT SI

- Nikon Corporation

- Zeiss Group

- JEOL Ltd.

- Oxford Instruments (Asylum Corporation)

- Thermo Fisher Scientific, Inc.

- Hitachi High-Tech Corporation

- CAMECA

- Olympus Corporation

- Bruker Corporation

Recent Developments

- In May 2025, Leica Microsystems launched the Visoria series of upright microscopes for life science, clinical, and industrial applications. The series is designed to improve the efficiency and comfort of routine microscopy tasks through ergonomic features and digital capabilities.

- In March 2025, optics giant Zeiss launched Lightfield 4D, a new microscopy system designed for instant volumetric high-speed fluorescence imaging by using a light-field principle. The technology captures entire 3D volumes in a single shot, eliminating the time delays of traditional sequential Z-stacks and enabling the study of dynamic biological processes in real-time at speeds up to 80 volumes per second.

- In February 2025, Bruker Corporation Leader of the Post-Genomic Era, announced the launch of the new X4 POSEIDON, a high-performance 3D X-ray microscope (XRM) using micro-Computed Tomography. This innovation offers advanced resolution and is applicable in industrial applications and scientific research.

- In January 2024, Bruker acquired the privately-held company Nion, which specializes in high-end scanning transmission electron microscopes (STEM). The acquisition enhances Bruker’s materials science research portfolio by adding Nion’s expertise, which includes being the first company to offer aberration correction for ultra-high-resolution STEMs and being a leader in high-resolution electron energy-loss spectroscopy (EELS).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as biopharma manufacturers adopt advanced imaging tools for continuous monitoring of biologics, vaccines, and cell-based therapies.

- AI-driven particle classification will become a core feature, improving analytical accuracy and reducing operator dependency.

- Automated, high-throughput systems will gain wider use in quality control and GMP-regulated environments.

- Semiconductor and nanomaterials sectors will strengthen demand for precise particle detection and contamination control.

- Cloud-enabled image management platforms will support remote analysis and multi-lab collaboration.

- Miniaturized and modular imaging systems will increase adoption in academic and startup research settings.

- Integration with digital labs and LIMS platforms will enhance workflow efficiency and regulatory readiness.

- Growth in lipid nanoparticles, viral vectors, and protein formulations will drive greater reliance on flow imaging for stability assessment.

- Emerging economies will adopt advanced imaging technologies as research capabilities and bioprocessing infrastructure expand.

- Vendors will prioritize hybrid imaging systems that combine optical, fluorescent, and AI-enhanced analysis for comprehensive particle characterization.

Market Segmentation Analysis:

Market Segmentation Analysis: