Market Overview

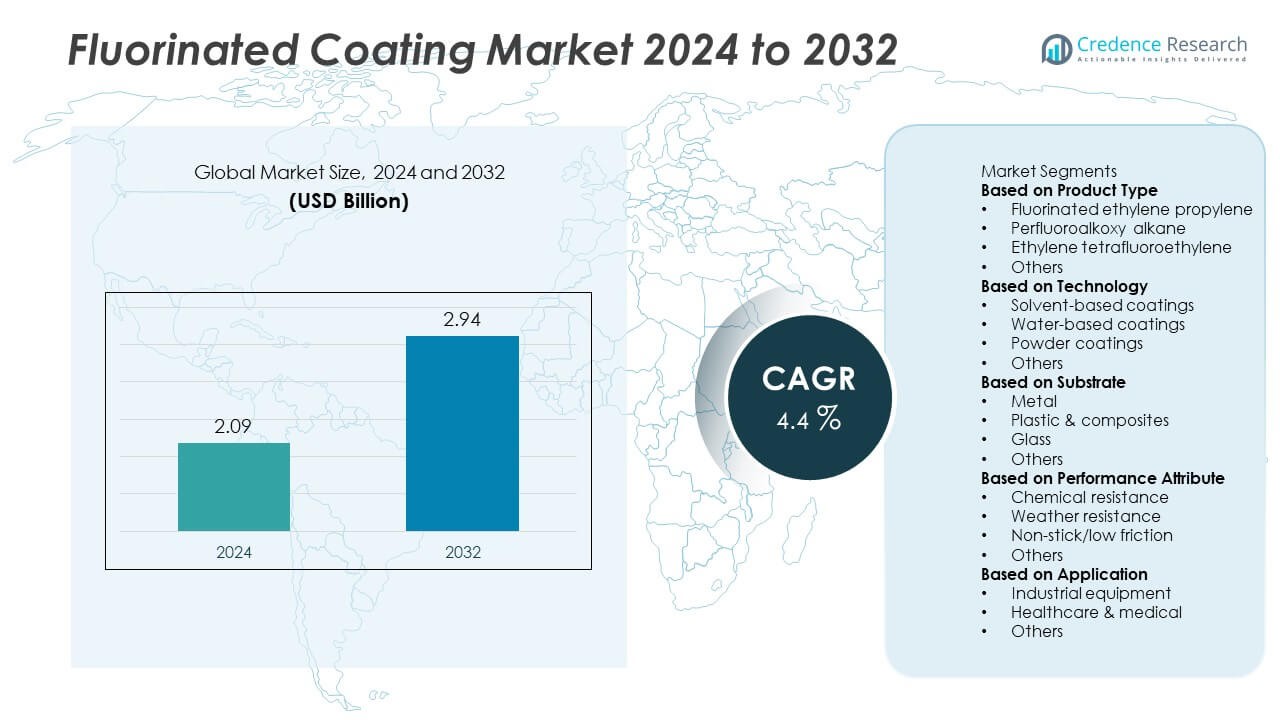

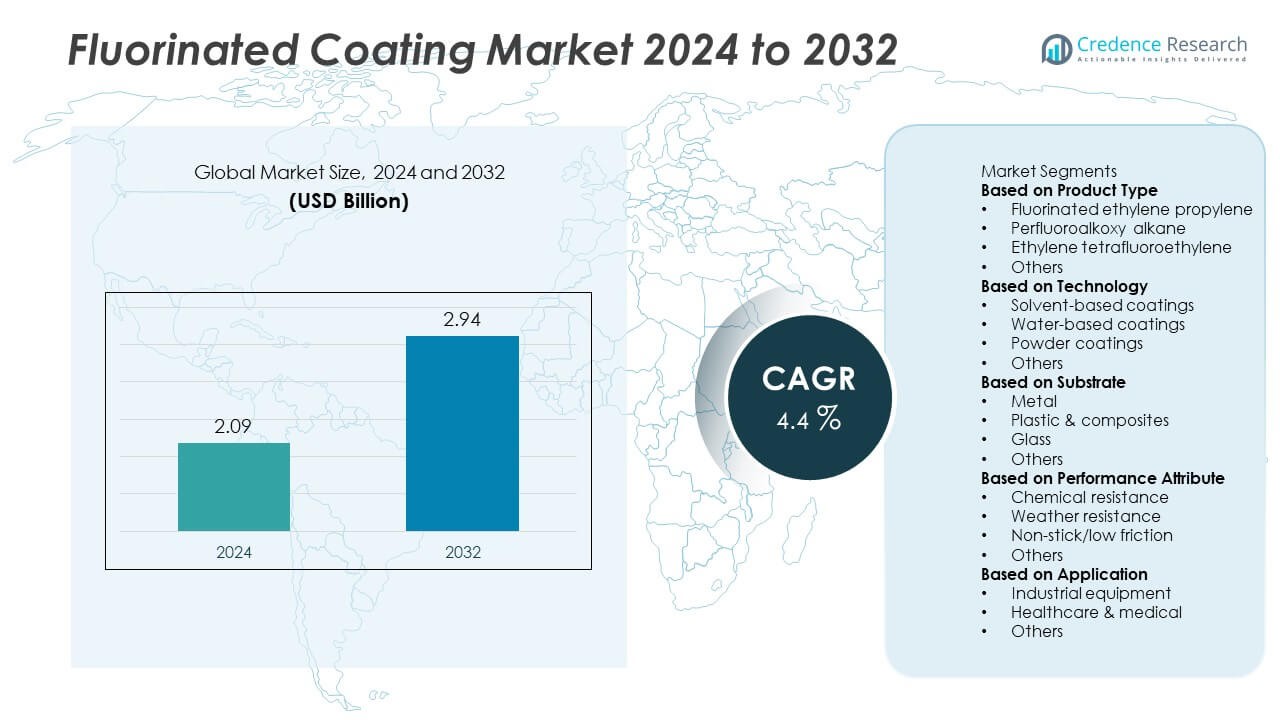

The Fluorinated Coating market was valued at USD 2.09 billion in 2024 and is projected to reach USD 2.94 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorinated Coating market Size 2024 |

USD 2.09 Billion |

| Fluorinated Coating market, CAGR |

4.4% |

| Fluorinated Coating marketSize 2032 |

USD 2.94 Billion |

The fluorinated coating market is led by major players such as Akzo Nobel N.V., PPG Industries, Inc., The Chemours Company, Daikin Industries, Ltd., Whitford Corporation, AGC Inc., Solvay S.A., Arkema S.A., DuraCoat Products, Inc., and Asahi Glass Co., Ltd. These companies dominate through product innovation, sustainable coating technologies, and strong global distribution networks. Chemours and Daikin focus on advanced fluoropolymer formulations, while Akzo Nobel and PPG emphasize durable, eco-friendly coatings for industrial and architectural use. Regionally, Asia-Pacific held 30% of the global market share in 2024, driven by robust manufacturing growth in China, Japan, and South Korea, supported by rapid industrialization and expanding automotive and electronics production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fluorinated coating market was valued at USD 2.09 billion in 2024 and is projected to reach USD 2.94 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

- Increasing demand from automotive, industrial, and construction sectors drives growth, as fluorinated coatings offer superior corrosion, heat, and chemical resistance in harsh environments.

- A key trend includes the shift toward water-based and eco-friendly formulations that meet global sustainability standards while maintaining high performance and durability.

- Leading players such as Akzo Nobel N.V., PPG Industries, and The Chemours Company focus on R&D investments, product diversification, and partnerships to strengthen global market presence.

- Asia-Pacific held 30% of the market share in 2024, while the fluorinated ethylene propylene (FEP) segment led with 38%, supported by expanding manufacturing industries and rising adoption in architectural, automotive, and electronic coating applications.

Market Segmentation Analysis:

By Product Type

The fluorinated ethylene propylene (FEP) segment dominated the fluorinated coating market in 2024, accounting for 38% of the total share. FEP coatings are favored for their superior chemical resistance, non-stick properties, and high-temperature stability, making them ideal for industrial and cookware applications. Their low friction and excellent dielectric strength enhance performance in electronic components and chemical processing equipment. Growing use in architectural and automotive coatings for corrosion protection further supports segment growth. The rising focus on durable, long-lasting coatings continues to drive the demand for FEP-based products worldwide.

- For instance, Daikin supplies an FEP dispersion (ND-110) that is used in industrial heat exchangers to create a corrosion-resistant coating with excellent electrical insulating and non-stick properties.

By Technology

The solvent-based coatings segment held the largest market share of 41% in 2024, driven by their strong adhesion, smooth finish, and high resistance to abrasion and extreme temperatures. These coatings are widely used in industrial machinery, chemical tanks, and pipelines where robust protection is essential. Although environmental regulations are promoting alternatives, solvent-based variants remain preferred for their performance consistency. The ongoing adoption in aerospace and oil & gas applications supports continued dominance, while hybrid formulations are emerging to balance efficiency with lower environmental impact.

- For instance, Chemours offers high-performance fluoropolymers, like Teflon™ surface protector technology, that enhance the durability of interior and exterior architectural paints to repel stains and dirt.

By Substrate

The metal substrate segment led the fluorinated coating market in 2024 with a 46% share, supported by its extensive use in automotive, construction, and heavy equipment industries. Fluorinated coatings on metals provide exceptional corrosion resistance, UV protection, and weather durability, extending equipment lifespan in harsh environments. The segment benefits from growing use in architectural panels, cookware, and heat exchangers. Manufacturers increasingly adopt these coatings for improved surface performance and reduced maintenance. Rising investments in industrial infrastructure and renewable energy equipment are expected to sustain demand across global markets.

Key Growth Drivers

Rising Demand from Industrial and Automotive Applications

The fluorinated coating market is expanding due to high demand across automotive and industrial equipment sectors. These coatings offer exceptional resistance to corrosion, heat, and chemicals, making them suitable for harsh operating environments. Automakers use them for exterior protection, while manufacturers rely on them to enhance machinery durability. The growing need for long-lasting, low-maintenance coatings in transport and manufacturing drives steady adoption. This performance advantage ensures fluorinated coatings remain essential in sectors requiring reliability and surface protection under extreme conditions.

- For instance, Daikin Industries developed its ZEFFLE series fluoropolymer coatings for automotive and industrial applications, including on metal substrates like aluminum, for improved corrosion and chemical resistance.

Growing Use in Architectural and Construction Coatings

The construction industry’s focus on durability and weather protection fuels market growth. Fluorinated coatings provide excellent UV stability, anti-fouling properties, and extended lifespan for building exteriors and metal facades. Architects prefer them for their gloss retention and resistance to color fading. Increasing urbanization and sustainable building practices are boosting the use of such coatings in infrastructure and commercial projects. The shift toward eco-friendly formulations also aligns with regulatory goals, enhancing product demand in long-term protective applications.

- For instance, AGC Inc. supplied its LUMIFLON FEVE resin for the Tokyo Skytree’s steel structure, which was completed in 2012. The coating, known for its exceptional UV and weather resistance, provides long-term protection in demanding climates and has demonstrated excellent gloss retention in decades-long field exposure tests on other structures.

Rising Adoption in Consumer Electronics and Cookware

Fluorinated coatings are widely used in electronics and cookware due to their non-stick, anti-corrosive, and thermal-resistant qualities. Electronics manufacturers use these coatings to protect delicate components from moisture and dust. In cookware, their smooth surface ensures easy cleaning and reduced food adhesion. The increasing demand for premium, durable consumer products supports this growth trend. As consumers prioritize performance and longevity, the adoption of fluorinated coatings in daily-use goods continues to expand across global markets.

Key Trends and Opportunities

Shift Toward Water-based and Eco-friendly Coatings

Environmental regulations and sustainability goals are driving the transition to water-based fluorinated coatings. Manufacturers are investing in formulations that maintain high durability and adhesion without relying on solvents. This shift reduces emissions and improves workplace safety, aligning with global green standards. The opportunity lies in developing low-VOC coatings that perform equally well in industrial and consumer applications. These advancements are expected to attract environmentally conscious buyers and expand market penetration in regulated regions.

- For instance, AkzoNobel offers the Interpon EC series, a polyurethane powder coating with zero volatile organic compounds (VOCs) that provides high scratch and chemical resistance for metal substrates.

Expansion in Renewable Energy and Aerospace Sectors

The adoption of fluorinated coatings is increasing in renewable energy and aerospace industries. Wind turbines, solar panels, and aircraft components benefit from these coatings’ anti-corrosive and weather-resistant properties. They extend equipment lifespan while minimizing maintenance costs. The growing global investment in clean energy and advanced aerospace systems presents significant opportunities for specialized coating manufacturers. As performance requirements become more demanding, these coatings are expected to play a key role in next-generation engineering applications.

- For instance, PPG Industries’ Aerocron electrocoat primer, a chrome-free and water-based technology, provides near-zero waste and enhanced corrosion protection for aircraft parts supplied to manufacturers like Airbus.

Key Challenges

High Production and Material Costs

Manufacturing fluorinated coatings involves complex processes and costly raw materials like fluoropolymers. These high input costs increase overall production expenses, limiting their adoption in price-sensitive industries. Smaller manufacturers struggle to balance performance standards with cost control. Despite their superior properties, fluorinated coatings often face competition from cheaper alternatives such as epoxy or polyurethane coatings. Ongoing R&D efforts aim to optimize formulations and reduce costs without compromising durability or resistance performance.

Environmental and Regulatory Compliance Issues

Stringent environmental regulations pose challenges for fluorinated coating producers. Concerns over fluorinated compounds’ persistence and potential environmental impact have led to tighter controls on emissions and chemical use. Companies must invest in developing safer, compliant products and upgrading manufacturing processes to meet global standards. These changes increase operational costs and extend product development timelines. Balancing environmental responsibility with product efficiency remains a major challenge for coating manufacturers seeking sustainable growth.

Regional Analysis

North America

North America held a 33% share of the fluorinated coating market in 2024, driven by strong demand from automotive, aerospace, and industrial sectors. The United States leads the region due to its established manufacturing base and technological advancements in surface treatment applications. Fluorinated coatings are widely used for corrosion protection, thermal resistance, and durability enhancement. Growing adoption of eco-friendly coating solutions in line with strict environmental regulations supports continued growth. Expanding renewable energy projects and infrastructure investments further strengthen market opportunities across key industries in the region.

Europe

Europe accounted for a 28% share of the global fluorinated coating market in 2024, supported by expanding automotive production and construction activities. Germany, France, and the United Kingdom are key contributors, with strong emphasis on high-performance and sustainable coatings. The region’s regulatory focus on low-VOC formulations drives innovation in water-based and powder coating technologies. Fluorinated coatings are increasingly used in industrial machinery and architectural panels for enhanced weather resistance. The European Union’s green building initiatives and energy-efficiency goals are boosting long-term demand for durable coating materials.

Asia-Pacific

Asia-Pacific captured a 30% share of the fluorinated coating market in 2024, making it the fastest-growing region globally. China, Japan, South Korea, and India drive the market through large-scale production of automotive components, electronics, and industrial machinery. Rapid urbanization and infrastructure development fuel demand for durable, weather-resistant coatings. Manufacturers in the region benefit from lower production costs and growing export capabilities. Increasing investments in semiconductor and renewable energy industries are also enhancing application potential. Strong government support for manufacturing expansion positions Asia-Pacific as a leading hub for fluorinated coating production.

Latin America

Latin America represented a 5% share of the global fluorinated coating market in 2024, supported by gradual industrial development and rising automotive manufacturing in Brazil and Mexico. Expanding construction projects and infrastructure upgrades are boosting the need for protective coatings. The region’s shift toward durable, corrosion-resistant materials drives adoption across oil & gas, transport, and metal processing sectors. Although economic constraints limit large-scale investments, improving trade partnerships and local manufacturing growth contribute to steady market progress. Demand for long-lasting coatings in industrial applications continues to strengthen regional adoption.

Middle East & Africa

The Middle East & Africa accounted for a 4% share of the fluorinated coating market in 2024, primarily driven by growth in construction, oil & gas, and defense sectors. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are investing in infrastructure that requires durable and corrosion-resistant coatings. Increasing use in energy facilities and industrial machinery supports market expansion. While the region relies heavily on imports, ongoing diversification efforts are promoting local production. Rising focus on high-performance materials for harsh climates continues to create steady demand across key industries.

Market Segmentations:

By Product Type

- Fluorinated ethylene propylene

- Perfluoroalkoxy alkane

- Ethylene tetrafluoroethylene

- Others

By Technology

- Solvent-based coatings

- Water-based coatings

- Powder coatings

- Others

By Substrate

- Metal

- Plastic & composites

- Glass

- Others

By Performance Attribute

- Chemical resistance

- Weather resistance

- Non-stick/low friction

- Others

By Application

- Industrial equipment

- Healthcare & medical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fluorinated coating market is defined by continuous innovation, strategic expansions, and sustainability-driven developments among leading players such as Akzo Nobel N.V., PPG Industries, Inc., The Chemours Company, Daikin Industries, Ltd., Whitford Corporation, AGC Inc., Solvay S.A., Arkema S.A., DuraCoat Products, Inc., and Asahi Glass Co., Ltd. These companies compete through advancements in coating formulations, improved fluoropolymer performance, and eco-friendly technologies. Akzo Nobel and PPG Industries focus on expanding their high-performance industrial coating portfolios with enhanced weather resistance and lower VOC emissions. Chemours and Daikin emphasize material innovation, developing next-generation fluoropolymers for demanding applications in automotive, aerospace, and electronics. Solvay and Arkema are investing in sustainable manufacturing and product efficiency to meet global environmental standards. Strategic mergers, regional expansions, and R&D collaborations continue to strengthen market positioning, enabling these players to cater to diverse end-use sectors and maintain long-term competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Akzo Nobel N.V.

- PPG Industries, Inc.

- The Chemours Company

- Daikin Industries, Ltd.

- Whitford Corporation

- AGC Inc.

- Solvay S.A.

- Arkema S.A.

- DuraCoat Products, Inc.

- Asahi Glass Co., Ltd.

Recent Developments

- In May 2025, Daikin Chemicals announced its participation in K Show 2025 (plastics & rubber fair), highlighting its fluorochemical presence.

- In April 2025, AGC Chemicals Americas reported the commercialization of FibraLAST; a non-fluorinated coating technology that is more oil, water and isopropyl alcohol repellent than any other coating for industrial fabrics.

- In July 2024, Alfa Chemistry launched new PTFE, PCTFE, ETFE fluoropolymers and specialty coatings which increased their product offering. This new addition furthered the capabilities of the company to address the automotive, aerospace, electronics, and chemical processing industries.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Substrate, Performance Attribute, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fluorinated coatings will rise with expanding industrial and automotive applications.

- Development of eco-friendly and water-based formulations will drive product innovation.

- Increased use in architectural and construction projects will enhance market penetration.

- Growth in electronics manufacturing will boost adoption for protective component coatings.

- Advancements in fluoropolymer technology will improve coating performance and lifespan.

- Strategic collaborations among key manufacturers will strengthen global distribution networks.

- Asia-Pacific will continue leading production due to rapid industrialization and export growth.

- Sustainability goals will push companies to adopt low-VOC and energy-efficient coatings.

- Rising defense and aerospace investments will increase demand for high-durability coatings.

- Ongoing R&D in cost-effective manufacturing will support wider application and market expansion.