Market overview

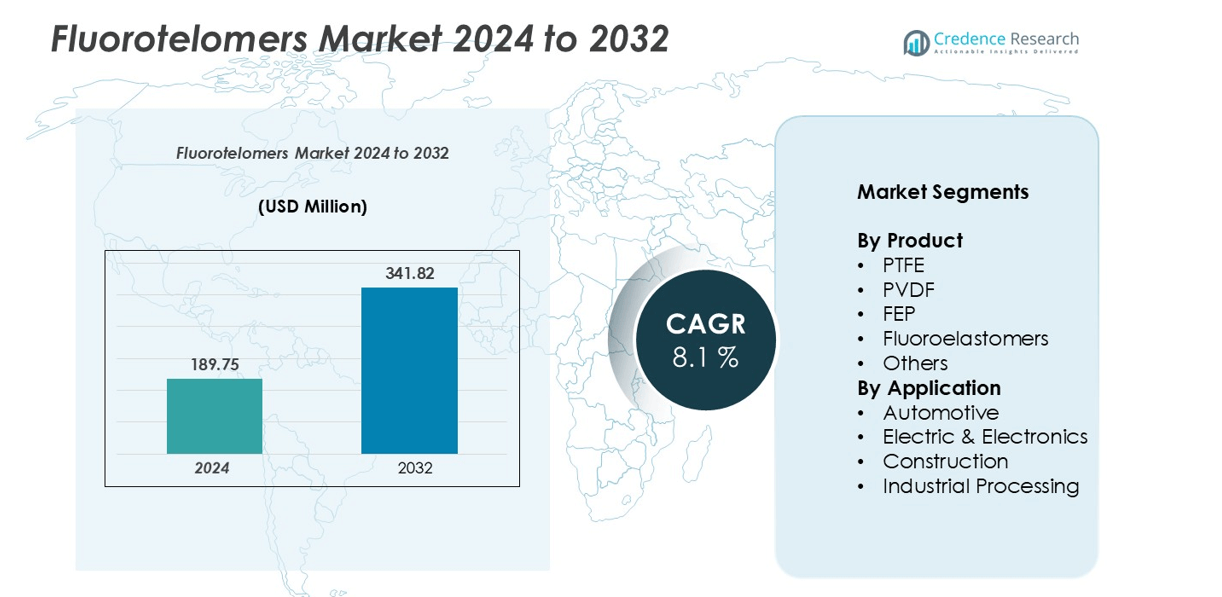

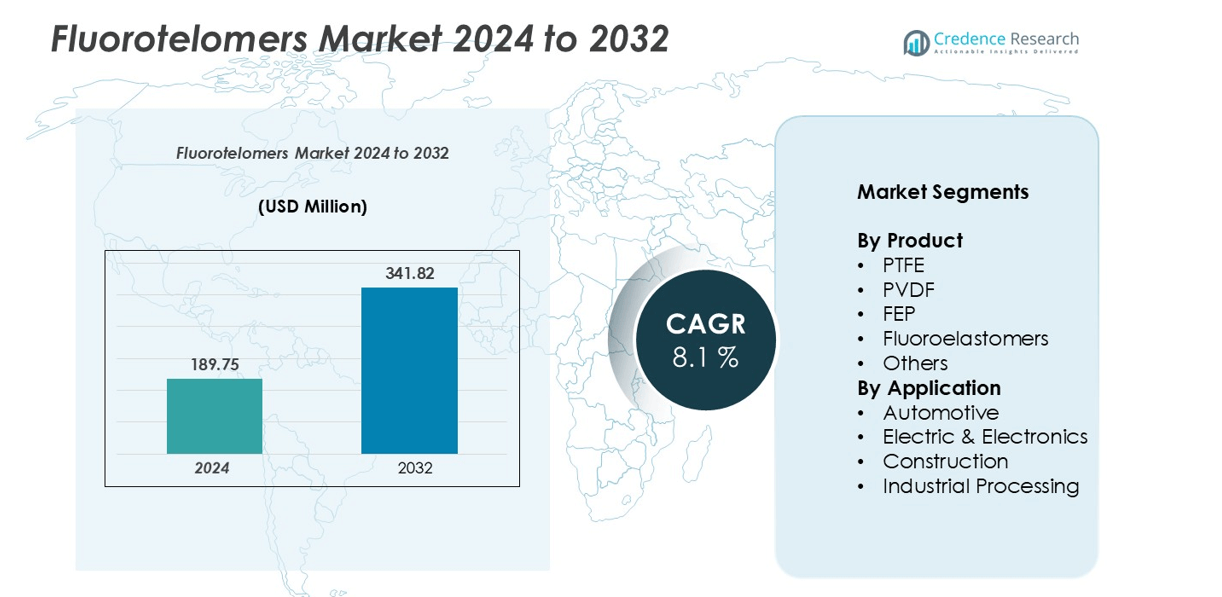

Fluorotelomers market size was valued at USD 189.75 million in 2024 and is anticipated to reach USD 341.82 million by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorotelomers Market Size 2024 |

USD 189.75 million |

| Fluorotelomers Market, CAGR |

8.1% |

| Fluorotelomers Market Size 2032 |

USD 341.82 million |

The fluorotelomers market is led by major players including 3M, Chemours, Daikin Industries, Solvay, Arkema, AGC Chemicals, Dongyue Group, Gujarat Fluorochemicals, Halopolymer, and Kureha Corporation. These companies maintain a strong competitive edge through continuous innovation, strategic partnerships, and expansion of production capacities to meet growing end-use demand. North America emerges as the leading region, holding approximately 35% of the global market, driven by advanced automotive and electronics industries. Europe follows with around 30% market share, supported by stringent environmental regulations and high adoption in industrial applications. Asia-Pacific accounts for roughly 25%, fueled by rapid industrialization, electric vehicle production, and electronics manufacturing. Collectively, these regions shape the global market dynamics, while top players leverage technological expertise and regional growth trends to consolidate their market leadership.

Market Insights

- The fluorotelomers market was valued at USD 189.75 million in 2024 and is projected to reach USD 341.82 million by 2032, growing at a CAGR of 8.1%.

- Market growth is driven by increasing demand in automotive and electronics applications, supported by thermal stability, chemical resistance, and durability of fluorotelomers, particularly PTFE, which holds the largest product share.

- Key trends include the integration of fluorotelomers into sustainable and eco-friendly products, expansion in electric vehicles and advanced electronics, and the development of low-emission, high-performance polymer formulations.

- The competitive landscape is dominated by global players such as 3M, Chemours, Daikin Industries, Solvay, Arkema, and AGC Chemicals, with regional players like Dongyue Group and Gujarat Fluorochemicals capturing emerging markets; market growth is constrained by high production costs and environmental regulations on fluorinated compounds.

- North America leads with a 35% market share, followed by Europe at 30%, Asia-Pacific at 25%, and the Rest of the World at 10%, reflecting strong regional demand in automotive, electronics, and industrial processing sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The PTFE segment dominates the fluorotelomers market, holding the largest market share due to its exceptional chemical resistance, low friction, and high-temperature stability. Manufacturers favor PTFE for its versatility in coatings, films, and sealants, driving its widespread adoption across industries. PVDF and FEP follow closely, offering strong thermal and chemical performance for specialized applications. The market growth is driven by increasing demand for advanced materials in industrial processing and electronics, coupled with the need for durable, non-reactive polymers in harsh environments, supporting PTFE’s continued leadership in the product landscape.

- For instance, a proprietary fluorination process to modify the surface of high-density polyethylene (HDPE) and other plastics, which creates a stable, barrier layer that enhances chemical resistance and reduces product permeation. This process, however, unintentionally generates trace amounts of per- and polyfluoroalkyl substances (PFAS) as impurities.

By Application

The automotive segment leads the fluorotelomers application market, benefiting from stringent emission regulations and the growing adoption of lightweight, high-performance materials. Fluorotelomers enhance fuel efficiency, corrosion resistance, and component longevity in vehicles, making them a preferred choice for coatings, gaskets, and wiring insulation. The electric & electronics segment is also expanding rapidly, driven by rising demand for reliable, thermally stable components in batteries and semiconductors. Construction and industrial processing applications contribute to steady growth, supported by the use of fluorotelomers in protective coatings, sealants, and chemical-resistant surfaces.

- For instance,Fluorotherm Industries has integrated fluoropolymers into automotive components, and fluoropolymers generally enhance vehicle performance and safety.

Key Growth Drivers

Increasing Demand in Automotive and Electronics Industries

The rising adoption of fluorotelomers in automotive and electronics sectors is a primary growth driver. In the automotive industry, fluorotelomers are increasingly used in coatings, gaskets, and wiring insulation due to their exceptional chemical resistance, thermal stability, and durability. The shift toward electric vehicles further amplifies demand, as batteries, connectors, and electronic components require thermally stable and corrosion-resistant materials. In electronics, fluorotelomers enhance performance in semiconductors, circuit boards, and displays, supporting miniaturization and higher operational efficiency. Manufacturers benefit from the dual advantage of improving product reliability while meeting stringent environmental and safety standards. This cross-industry demand is driving significant market expansion, encouraging innovation in high-performance polymer formulations and boosting adoption across both established and emerging markets.

- For instance, Daikin Industries Ltd. produced an estimated 23,000 metric tons of PTFE and exported to more than 70 countries. In the electronics sector, Daikin’s fluoropolymer coatings are utilized in a variety of applications, such as wires, cables, and circuit boards, to improve electrical properties, durability, and resistance to harsh environmental factors.

Regulatory Support and Environmental Compliance

Stringent environmental and safety regulations globally are fueling the fluorotelomers market growth. Regulatory frameworks targeting chemical safety, emission reduction, and non-toxic materials encourage the adoption of advanced fluoropolymers in coatings, industrial processing, and consumer products. Fluorotelomers are valued for their non-reactivity, chemical stability, and long service life, which align with these compliance requirements. Manufacturers are increasingly integrating these compounds into eco-friendly, durable solutions for applications such as water-resistant coatings, protective films, and industrial machinery components. Compliance-driven demand also incentivizes research in safer, low-molecular-weight fluorotelomer variants, enabling companies to expand product portfolios. As industries face mounting pressure to meet regulatory standards without compromising performance, fluorotelomers become a preferred material choice, reinforcing sustained growth in both mature and developing markets.

- For instance, Inhance Technologies uses a proprietary fluorination process to permanently modify the surface of plastics like high-density polyethylene (HDPE). However, this process has been subject to legal action from the EPA because it unintentionally creates per- and polyfluoroalkyl substances (PFAS).

Advancements in Material Science and Formulation Technologies

Technological advancements in polymer science and material engineering are accelerating fluorotelomer adoption. Innovations in synthesis processes, molecular design, and surface treatment techniques allow manufacturers to tailor fluorotelomers for high-performance applications, including heat-resistant coatings, chemical-resistant films, and low-friction components. Improved formulations enhance product efficiency, durability, and environmental compatibility, expanding usage across automotive, electronics, and industrial sectors. Companies investing in R&D benefit from the ability to develop specialty products meeting precise end-use requirements, driving differentiation and market competitiveness. Additionally, the evolution of hybrid polymers and composite materials incorporating fluorotelomers supports lightweight, high-performance solutions for emerging technologies, such as electric mobility and advanced electronics. These technological breakthroughs serve as a significant driver, fueling innovation and broadening market applications.

Trend & Opportunity

Integration into Sustainable and Eco-Friendly Products

The integration of fluorotelomers into sustainable and eco-friendly products presents a growing market opportunity. Manufacturers are focusing on reducing environmental impact by developing low-emission coatings, chemical-resistant films, and non-toxic sealants while maintaining high performance. Growing consumer awareness and regulatory encouragement toward sustainable materials are accelerating demand for fluorotelomer-based solutions in construction, automotive, and electronics. Companies are also exploring bio-based formulations and recycling technologies to align with circular economy principles. This trend enables fluorotelomers to capture new market segments by combining environmental responsibility with superior functional properties. The opportunity extends to end-use applications requiring durable, long-lasting materials that reduce maintenance costs, enhance energy efficiency, and support green building standards.

- For instance, Inhance Technologies’ fluorination process, which is used to treat plastics like high-density polyethylene (HDPE) for barrier properties, has processed tens of millions of pounds of plastic annually. However, this process unintentionally creates trace amounts of per- and polyfluoroalkyl substances (PFAS), including PFOA, as byproducts. This has led to legal and regulatory issues with the U.S. Environmental Protection Agency (EPA), though a court later blocked the EPA’s order to halt the process.

Expanding Applications in Electric Vehicles and Advanced Electronics

The rising proliferation of electric vehicles (EVs) and advanced electronic devices offers significant opportunities for fluorotelomers. Their thermal stability, chemical resistance, and electrical insulation properties make them ideal for battery components, connectors, wiring, and circuit boards. As EV production accelerates globally, the demand for high-performance, long-lasting polymer materials is increasing, driving fluorotelomer adoption. Similarly, in consumer electronics, fluorotelomers support miniaturized, heat-resistant, and durable components in smartphones, laptops, and wearable devices. Companies can capitalize on this trend by innovating specialized fluorotelomer formulations optimized for energy efficiency, reliability, and environmental compliance, unlocking new revenue streams while addressing critical performance challenges in cutting-edge technologies.

Key Challenge

High Production Costs and Complex Manufacturing Processes

The high production cost and complexity of manufacturing fluorotelomers remain a significant market challenge. Synthesis of high-purity fluorotelomers requires specialized equipment, strict process control, and advanced chemical handling, leading to elevated operational expenses. These factors increase the final product cost, limiting adoption, particularly in price-sensitive markets. Additionally, scaling production for large industrial applications without compromising quality presents technical and economic hurdles. Companies must invest in process optimization, waste management, and energy-efficient manufacturing methods to mitigate costs. The challenge of balancing quality, performance, and affordability can constrain market growth unless technological innovations reduce production complexity and improve overall process efficiency.

Environmental and Regulatory Restrictions on Fluorinated Compounds

Fluorotelomers face challenges due to increasing regulatory scrutiny over fluorinated compounds, particularly per- and polyfluoroalkyl substances (PFAS). Governments worldwide are implementing stricter limits on the use and disposal of persistent fluorochemicals due to environmental and health concerns. These restrictions may impact product formulation, manufacturing processes, and market availability. Companies must invest in alternative chemistries, safer derivatives, or compliance strategies to sustain operations, which can slow growth and increase costs. Additionally, public perception and pressure from sustainability initiatives influence product acceptance. Navigating these regulatory and environmental constraints remains a critical challenge for the fluorotelomers market, requiring strategic adaptation while maintaining performance standards.

Regional Analysis

North America

North America holds a significant share of the fluorotelomers market, driven primarily by the United States and Canada, accounting for approximately 35% of the global market. Strong demand in automotive, electronics, and industrial processing sectors fuels regional growth, supported by advanced manufacturing capabilities and stringent environmental compliance standards. The adoption of electric vehicles and high-performance coatings is accelerating fluorotelomer utilization. The presence of leading chemical manufacturers investing in R&D for specialty polymers further strengthens market dominance. Regulatory support and infrastructure for innovative material development contribute to sustained market expansion in North America.

Europe

Europe contributes nearly 30% to the global fluorotelomers market, with Germany, France, and the UK as key contributors. The region benefits from high adoption in automotive, construction, and electronics industries, alongside regulatory mandates for environmentally safe and durable materials. Fluorotelomers are widely used in coatings, films, and industrial processing due to their chemical resistance and thermal stability. Increasing focus on electric mobility, renewable energy infrastructure, and sustainable building materials drives demand. European manufacturers actively invest in advanced polymer technologies and low-emission fluorotelomer formulations, reinforcing the region’s strong market presence and fostering innovation across multiple end-use applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing around 25% of the global fluorotelomers market. Rapid industrialization, urbanization, and the surge in automotive and electronics manufacturing in China, Japan, South Korea, and India drive robust demand. Expansion in electric vehicle production, semiconductor manufacturing, and construction sectors is fueling fluorotelomer consumption. The region’s cost-competitive manufacturing base attracts global chemical companies to establish production facilities, enhancing supply chain efficiency. Growing environmental awareness and adoption of advanced materials in industrial processing and consumer products further stimulate market growth. Asia-Pacific is expected to continue leading in volume growth due to rising end-use adoption.

Rest of the World (RoW)

The Rest of the World (RoW), including Latin America, the Middle East, and Africa, accounts for roughly 10% of the fluorotelomers market. Steady demand in industrial processing, automotive, and construction sectors supports regional growth. Brazil, Mexico, and South Africa are emerging as notable markets due to increasing infrastructure development and manufacturing activities. Fluorotelomers are being adopted for chemical-resistant coatings, protective films, and insulation applications. Market expansion is aided by growing foreign investments and collaborations with global chemical manufacturers. However, slower industrialization compared to North America, Europe, and Asia-Pacific limits immediate market share, though long-term growth potential remains substantial.

Market Segmentations:

By Product

- PTFE

- PVDF

- FEP

- Fluoroelastomers

- Others

By Application

- Automotive

- Electric & Electronics

- Construction

- Industrial Processing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fluorotelomers market is highly competitive, characterized by the presence of several global and regional players focusing on innovation, strategic partnerships, and capacity expansion to strengthen their market position. Leading companies such as 3M, Chemours, Daikin Industries, Solvay, Arkema, and AGC Chemicals dominate the market, leveraging advanced polymer technologies, robust R&D capabilities, and strong distribution networks. Regional players like Dongyue Group, Gujarat Fluorochemicals, Halopolymer, and Kureha Corporation contribute to localized growth and cater to emerging markets with cost-effective solutions. Companies are increasingly investing in sustainable formulations, low-emission products, and specialty fluorotelomers for automotive, electronics, and industrial applications to differentiate themselves. Strategic initiatives such as mergers, acquisitions, and joint ventures enable firms to expand geographic presence and enhance production capacity, while continuous innovation ensures alignment with evolving end-use requirements and regulatory compliance, maintaining competitive advantage in the global market.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M

- AGC Chemicals

- Arkema

- Chemours

- Daikin Industries

- Dongyue Group

- Gujarat Fluorochemicals

- Halopolymer

- Kureha Corporation

- Solvay

Recent Developments

- In August 2024, AGC, a manufacturer of glass, chemicals, and advanced materials, introduced a groundbreaking method for producing fluoropolymers without relying on surfactants. With this new technology, AGC intends to ensure a consistent and reliable supply of fluoropolymers, which are essential for the development of a carbon-neutral and digital society.

- In August 2023, The Kureha Group announced plans to increase its production capacity for polyvinylidene fluoride (PVDF) at its Iwaki Plant in Fukushima, Japan. The expansion has been planned to align with the growing demand for PVDF, used as an adhesive material for lithium-ion batteries (LiB) and as an engineering plastic for various industrial applications.

- In January 2022, Arkema announced plans to revise its previously planned fluoropolymer capacity expansion from 35% to 50% at its Changshu site in China to meet the strong demand for lithium-ion batteries.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Fluorotelomers are expected to see growing adoption in automotive and electric vehicle applications.

- Demand will increase in electronics for high-performance, heat-resistant components.

- Development of eco-friendly and low-emission fluorotelomer formulations will gain momentum.

- PTFE will continue to dominate the product segment due to its durability and versatility.

- Emerging markets in Asia-Pacific and Latin America will drive significant volume growth.

- Leading players will invest in R&D to develop specialty fluorotelomers for niche applications.

- Strategic collaborations and joint ventures will expand regional presence and production capacity.

- Regulatory compliance and environmental safety will shape product innovation and market strategies.

- Integration into construction and industrial processing applications will provide new growth avenues.

- Market competition will intensify as companies focus on technological advancements and sustainable solutions.