Market Overview

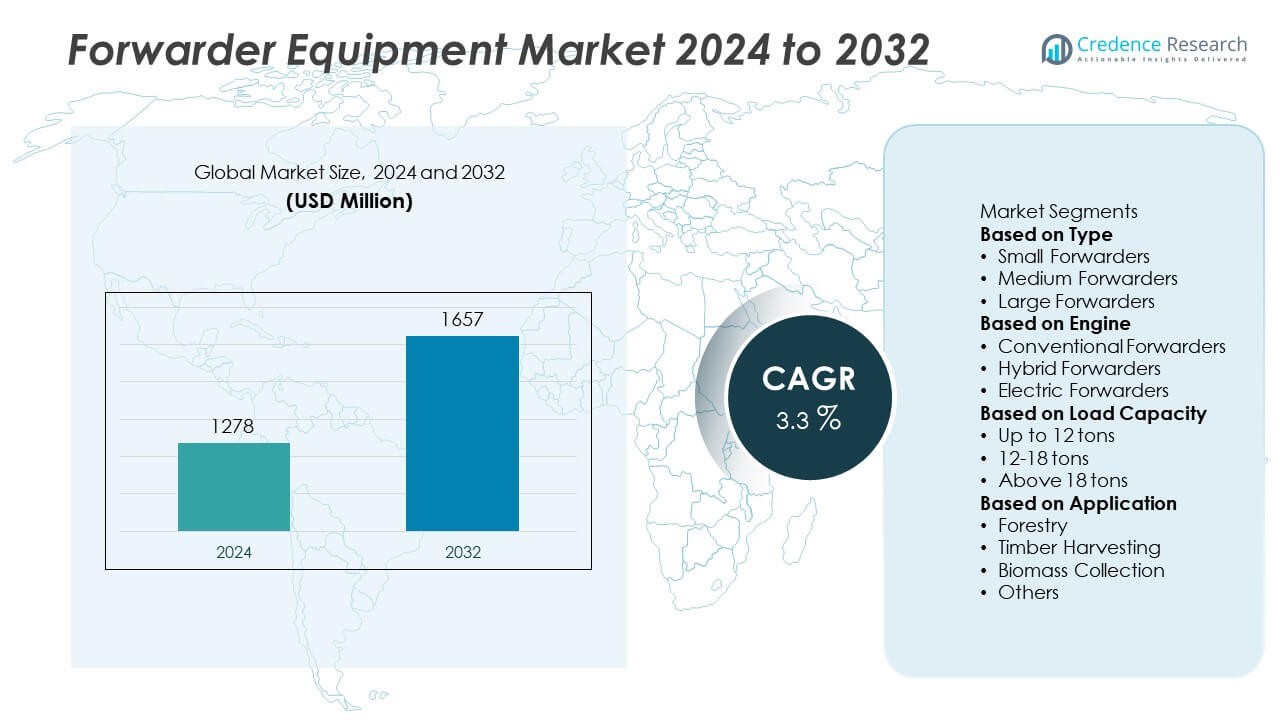

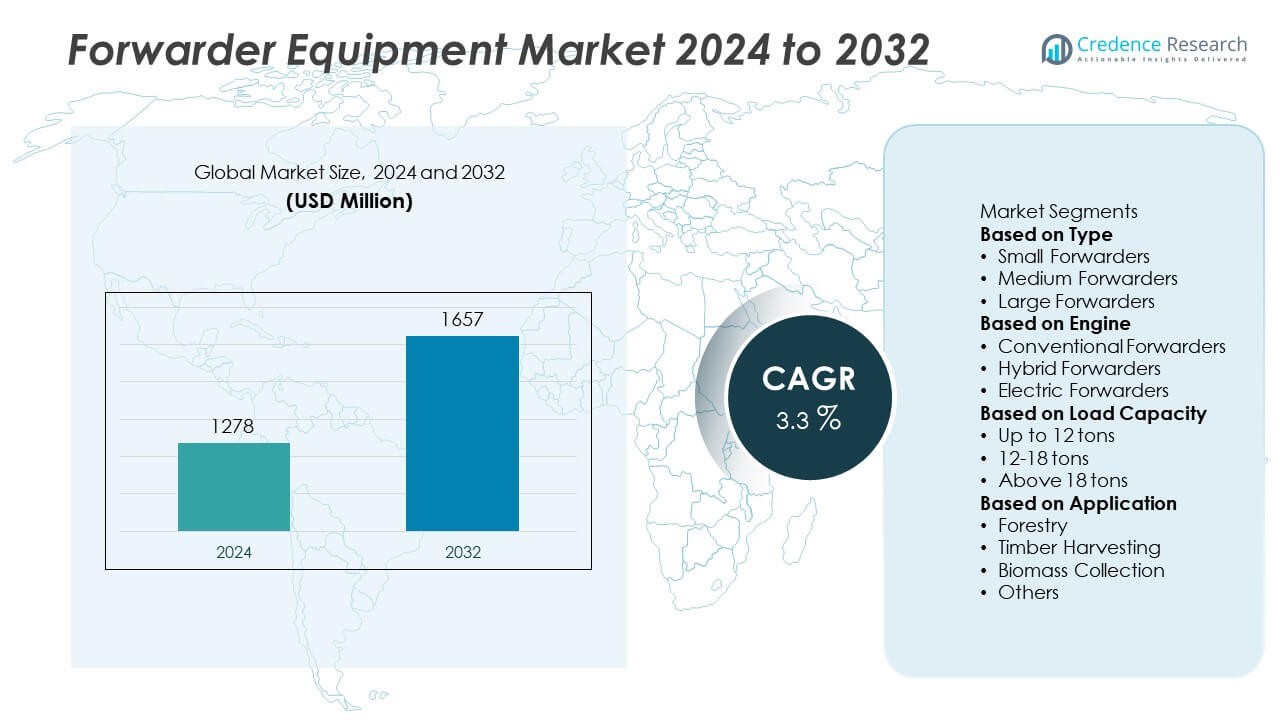

The global forwarder equipment market was valued at USD 1,278 million in 2024 and is projected to reach USD 1,657 million by 2032, expanding at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Forwarder Equipment Market Size 2024 |

USD 1,278 Million |

| Forwarder Equipment Market, CAGR |

3.3% |

| Forwarder Equipment Market Size 2032 |

USD 1,657 Million |

Forwarder Equipment Market grows with rising mechanization of forestry operations and emphasis on sustainable harvesting practices. Demand increases for machines that reduce soil compaction and improve operational efficiency. Manufacturers focus on hybrid and electric forwarders to meet emission regulations and lower fuel costs.

North America leads the Forwarder Equipment Market with strong adoption of mechanized logging and advanced forestry practices, supported by high replacement demand for modern forwarders. Europe follows closely, driven by strict environmental regulations and high preference for low-impact equipment, particularly in Scandinavian countries known for sustainable forestry. Asia-Pacific emerges as the fastest-growing region, fueled by rising timber demand and increasing mechanization across China, India, and Southeast Asia. Latin America and Middle East & Africa present steady opportunities with growing investments in pulp, paper, and reforestation projects. Key players such as Komatsu Ltd., John Deere, Tigercat Industries Inc., and Ponsse focus on product innovation, hybrid and electric forwarders, and telematics integration to enhance productivity and meet emission norms. Companies expand service networks and offer financing solutions to support fleet upgrades and boost adoption across emerging and mature forestry markets. It strengthens global competition and drives continuous product development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Forwarder Equipment Market was valued at USD 1,278 million in 2024 and is projected to reach USD 1,657 million by 2032, growing at a CAGR of 3.3% during the forecast period.

- Rising mechanization in forestry operations and demand for efficient timber transportation drive market growth. Government support for sustainable logging practices further accelerates equipment adoption.

- Key trends include growing adoption of hybrid and electric forwarders, integration of telematics, and modular machine designs for flexible use across diverse terrains. Ergonomic cabins and operator-friendly features enhance safety and workforce retention.

- The market is competitive with global players such as Komatsu Ltd., John Deere, Tigercat Industries Inc., Ponsse, and Caterpillar Inc. focusing on product innovation, fleet management solutions, and low-emission equipment to strengthen market presence.

- High initial investment and maintenance costs restrain adoption among small and medium forestry operators, slowing fleet modernization. Shortage of skilled operators creates additional challenges for advanced equipment utilization.

- North America leads the market due to mature forestry operations and strong demand for replacement equipment, while Europe remains a hub for innovation with a focus on sustainability. Asia-Pacific is the fastest-growing region, supported by rising timber demand and government-backed mechanization programs.

- Emerging opportunities lie in developing regions such as Latin America, Africa, and Southeast Asia, where rising timber exports, reforestation projects, and access to financing encourage equipment upgrades. Manufacturers offering affordable and durable forwarders can expand market share in these cost-sensitive regions.

Market Drivers

Rising Mechanization of Forestry Operations Driving Demand

Forwarder Equipment Market benefits from the increasing shift toward mechanized forestry operations worldwide. Governments encourage sustainable forestry practices that require efficient material handling equipment. Mechanized forwarders help reduce labor dependency and improve productivity in timber extraction. They enable faster loading and transport cycles, reducing time spent on-site. Operators prefer forwarders for their ability to minimize environmental damage during harvesting. Growing demand for efficient, low-impact operations supports the use of advanced forwarder models.

- For instance, the Ponsse Elephant King forwarder has a 20-tonne payload capacity and an 8-wheel configuration, is engineered for heavy-duty operations, and enables efficient timber forwarding in demanding logging sites, with its ground pressure significantly reduced when equipped with tracks.

Technological Advancements Enhancing Efficiency and Safety

Forwarder Equipment Market experiences strong growth through innovations in digital monitoring and automation. Manufacturers integrate telematics systems to track machine performance and optimize routes. Automated loading assistance and ergonomic cabins improve operator comfort and reduce fatigue. Advanced designs enhance payload capacity without increasing soil compaction. Companies develop hybrid and low-emission engines to meet stricter environmental rules. Technology adoption strengthens operational efficiency and lowers total cost of ownership.

- For instance, Komatsu Forest introduced MaxiVision digital planning software in June 2019, allowing operators to visualize stand maps and optimize forwarder routes to increase productivity by avoiding unnecessary detours.

Expansion of Sustainable Forestry Practices Worldwide

Equipment Market grows with global emphasis on certified sustainable forestry. Certification programs such as FSC and PEFC create demand for low-impact and fuel-efficient forwarders. Forest owners and logging companies invest in equipment that meets compliance standards. Forwarders help maintain soil health by distributing weight evenly, reducing site disturbance. Equipment that supports selective harvesting techniques gains market preference. This focus on sustainability strengthens forwarder adoption across Europe, North America, and emerging forestry regions.

Replacement Demand and Fleet Modernization Stimulating Sales

Forwarder Equipment Market witnesses steady demand from replacement cycles in mature markets. Logging companies replace outdated machines with advanced, fuel-efficient forwarders. Fleet modernization helps lower maintenance costs and improve operational uptime. Manufacturers offer financing options and leasing programs to support equipment upgrades. Customers prefer forwarders with digital connectivity and lower fuel consumption. Continuous product development encourages repeat purchases and keeps the market competitive.

Market Trends

Growing Adoption of Hybrid and Electric Forwarders

Forwarder Equipment Market shows a clear shift toward hybrid and electric powertrains. Manufacturers launch models with reduced emissions to meet global climate targets. Electric drivetrains lower fuel costs and noise levels, supporting operations near urban or protected areas. Battery technology improvements extend operating hours and reduce charging downtime. Companies test hydrogen-powered prototypes to explore next-generation solutions. This transition supports operators aiming to meet sustainability commitments and lower operational expenses.

- For instance, Komatsu Forest unveiled its hybrid-electric forwarder (HEV) concept prototype in June 2025, which features a smaller, efficient engine connected to a generator and is equipped with a battery pack to balance the engine load and improve function coordination. The prototype was announced as a first step in electrification and will undergo further testing and evaluation.

Integration of Telematics and Digital Fleet Management

Forwarder Equipment Market benefits from rapid adoption of telematics and connected solutions. Telematics platforms provide real-time machine data on fuel use, location, and productivity. Fleet managers use analytics to improve route planning and reduce idle time. Remote diagnostics enable predictive maintenance, lowering repair costs and unplanned downtime. Connectivity improves compliance tracking for certified forestry operations. This trend strengthens overall efficiency and profitability for logging companies.

- For instance, John Deere’s JDLink telematics system allows operators to monitor fuel burn and track idle hours in real time on equipped forestry machines, which enables management to identify inefficiencies and reduce unnecessary engine idling.

Focus on Ergonomics and Operator Comfort

Forwarder Equipment Market sees increasing attention to cabin design and user experience. Manufacturers introduce climate-controlled cabins with noise insulation to reduce operator fatigue. Advanced joystick controls and adjustable seating improve precision and reduce strain. Panoramic visibility enhances safety during loading and unloading cycles. Digital displays offer machine status and performance data in real time. Comfort-focused design helps retain skilled operators in a competitive labor market.

Customization and Modular Design for Diverse Applications

Forwarder Equipment Market moves toward modular and customizable equipment offerings. Customers demand forwarders with flexible payload capacity and axle configurations. Modular components allow easier maintenance and quicker part replacement. Manufacturers design models that adapt to different terrains and timber types. Compact forwarders gain traction in thinning operations and smaller forest plots. This trend allows operators to maximize machine utilization across multiple project types.

Market Challenges Analysis

High Initial Investment and Operating Costs Restraining Adoption

Forwarder Equipment Market faces a challenge from high upfront purchase costs and maintenance expenses. Many small and mid-sized logging companies hesitate to invest in advanced forwarders due to budget constraints. Expensive spare parts and skilled labor requirements add to total ownership costs. Fuel consumption remains a major expense for conventional models, limiting profitability for operators. Volatile raw material prices also impact manufacturing costs and equipment pricing. It creates pressure on buyers to delay fleet modernization and extend the life of existing machines.

Shortage of Skilled Operators and Complex Training Requirements

Forwarder Equipment Market is affected by a shortage of trained operators in many regions. Modern forwarders require specialized training for efficient and safe operation. Limited availability of skilled personnel slows adoption of advanced features and digital systems. Companies face higher costs to recruit and retain qualified operators. Training programs add downtime for businesses, reducing short-term productivity. It creates a gap between technology development and practical implementation on forestry sites.

Market Opportunities

Rising Demand for Sustainable and Low-Impact Forestry Solutions

Forwarder Equipment Market holds strong opportunities through the growing focus on sustainable forestry. Governments and certification bodies encourage equipment that minimizes soil disturbance and emissions. Manufacturers can expand product lines with hybrid, electric, and low-compaction models. Demand for forwarders supporting selective harvesting and reforestation projects is increasing. It allows operators to meet regulatory compliance while improving operational efficiency. Companies that invest in eco-friendly technology gain a competitive edge in regulated markets.

Expansion into Emerging Forestry Regions and Untapped Markets

Forwarder Equipment Market can grow by targeting developing regions with expanding forestry industries. Rising timber demand in Asia-Pacific, Africa, and South America creates new equipment needs. Manufacturers can introduce mid-range and compact forwarders tailored to smaller operators. Leasing and financing options help increase adoption among cost-sensitive buyers. It also opens opportunities for aftersales services and digital fleet management solutions. Growth in infrastructure and housing projects further drives timber harvesting, supporting forwarder sales.

Market Segmentation Analysis:

By Type

Forwarder Equipment Market is segmented by type into tracked forwarders and wheeled forwarders. Wheeled forwarders dominate the market due to their higher speed, lower fuel consumption, and ability to operate efficiently on firm ground. These machines offer cost-effective transport and require less maintenance compared to tracked models. Tracked forwarders, while slower, are preferred in soft soil and challenging terrains where stability and traction are crucial. Demand for hybrid models is rising as operators seek equipment that balances fuel efficiency and performance. It creates opportunities for manufacturers to expand their portfolios with versatile machines suitable for multiple forestry conditions.

- For instance, Tigercat’s 1055D wheeled forwarder launched in August 2025 features a 15-ton payload, a top speed of 22 km/h, and a choice of three wagon lengths for different terrain conditions.

By Engine

Forwarder Equipment Market by engine includes conventional diesel-powered forwarders and alternative fuel or hybrid forwarders. Diesel models hold the majority share due to their proven reliability and availability of refueling infrastructure in remote areas. However, hybrid forwarders are gaining attention due to lower emissions and reduced operational costs. Manufacturers are working on integrating battery-electric drivetrains to meet stricter emission standards in Europe and North America. Hybrid systems also appeal to operators focused on sustainability and fuel savings. It drives investment toward next-generation propulsion systems, aligning with global decarbonization goals.

- For instance, the Eco Log 584F forwarder is equipped with a 6-cylinder Volvo Penta Stage V engine, providing a 16-ton payload capacity. The engine is known for its reliability and efficiency.

By Load Capacity

Forwarder Equipment Market is segmented by load capacity into small (8–12 tons), medium (12–16 tons), and large (above 16 tons) forwarders. Medium-capacity forwarders dominate due to their versatility and suitability for a wide range of forestry operations. They strike a balance between payload capacity and maneuverability, making them ideal for thinning and clear-cutting projects. Large forwarders are in demand for industrial-scale logging operations where high productivity is required. Small forwarders gain traction in selective harvesting and in regions with narrow forest paths. It enables operators to match machine capacity with project scale, improving efficiency and reducing operating costs.

Segments:

Based on Type

- Small Forwarders

- Medium Forwarders

- Large Forwarders

Based on Engine

- Conventional Forwarders

- Hybrid Forwarders

- Electric Forwarders

Based on Load Capacity

- Up to 12 tons

- 12-18 tons

- Above 18 tons

Based on Application

- Forestry

- Timber Harvesting

- Biomass Collection

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Forwarder Equipment Market, accounting for 34% of global revenue in 2024. The region benefits from well-established forestry operations in the United States and Canada, where mechanization levels are among the highest globally. Rising demand for sustainable logging equipment and replacement of aging fleets drives strong forwarder sales. Government regulations supporting sustainable forestry management encourage the adoption of low-emission and fuel-efficient machines. The presence of key players offering advanced forwarders, combined with financing programs, helps operators upgrade equipment regularly. Digital adoption is also high, with telematics and predictive maintenance becoming standard features across most fleets. It creates a favorable ecosystem for continued investment and innovation in forwarder technology.

Europe

Europe represents 29% of the Forwarder Equipment Market and is a major hub for forwarder manufacturing and innovation. Scandinavian countries such as Finland and Sweden lead in mechanized logging and adopt advanced forwarders with high payload capacity. Strict environmental regulations and certification requirements like FSC and PEFC drive demand for low-impact equipment. European operators focus on reducing soil compaction and fuel consumption, creating opportunities for hybrid and electric forwarders. The region also benefits from strong government initiatives that promote sustainable forestry and reforestation. Leading manufacturers in Europe set global benchmarks for quality and technology adoption. It supports the market’s long-term growth through continuous product development and sustainability-focused designs.

Asia-Pacific

Asia-Pacific accounts for 21% of the Forwarder Equipment Market and is the fastest-growing regional segment. Rising timber demand from construction, furniture, and paper industries drives forwarder adoption in countries such as China, India, and Indonesia. The region’s forestry sector is undergoing mechanization, supported by investments in modern equipment and operator training. Governments encourage sustainable forest management, which boosts sales of forwarders with low ground pressure and efficient engines. Compact forwarders are gaining popularity in countries with smaller forest plots and challenging terrain. The growing availability of leasing and financing programs helps smaller operators access advanced machinery. It positions Asia-Pacific as a key growth engine for manufacturers over the coming decade.

Latin America

Latin America holds 10% of the Forwarder Equipment Market, driven by forestry operations in Brazil, Chile, and Uruguay. Expanding pulp and paper production supports steady demand for forwarders in large-scale harvesting projects. Operators increasingly invest in medium and high-capacity forwarders to improve efficiency and reduce labor costs. Regional growth is supported by foreign equipment manufacturers establishing sales and service networks. Adoption of telematics remains in the early stages but is expected to rise with growing awareness of productivity benefits. It presents opportunities for players to introduce cost-effective forwarders tailored for local operating conditions.

Middle East & Africa

Middle East & Africa capture 6% of the Forwarder Equipment Market, reflecting a smaller but steadily developing forestry sector. Growth is concentrated in countries with expanding timber exports and reforestation projects. Demand for forwarders is gradually increasing as governments focus on sustainable forest management. Most operators prefer small and mid-sized forwarders due to limited mechanization budgets. Global manufacturers are exploring partnerships to improve distribution networks and service availability in this region. It represents a potential growth area for affordable and durable forwarder solutions over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komatsu Ltd.

- Logset O.Y.

- Tigercat Industries Inc.

- Eco Log Group

- John Deere

- Caterpillar Inc.

- Ponsse

- Rottne Industri AB

- Kesla Oyj

- HSM (Hohenloher Spezial-Maschinenbau GmbH & Co. KG)

Competitive Analysis

Competitive landscape of the Forwarder Equipment Market is shaped by leading players such as Komatsu Ltd., John Deere, Tigercat Industries Inc., Ponsse, Caterpillar Inc., Logset O.Y., Eco Log Group, Rottne Industri AB, Kesla Oyj, and HSM. These companies compete through continuous product innovation, expansion of distribution networks, and integration of advanced digital technologies. They focus on hybrid and electric forwarders to meet global emission standards and reduce fuel consumption. Telematics systems, remote diagnostics, and fleet management tools are widely adopted to improve productivity and lower downtime. Strategic collaborations with forestry contractors and financing partners help boost equipment accessibility for operators. Product portfolios are regularly updated with forwarders offering higher payload capacity, improved traction, and ergonomic cabins to meet regional requirements. Manufacturers invest in research and development to strengthen market position and address rising demand for sustainable and efficient forestry operations, ensuring a competitive and technology-driven environment.

Recent Developments

- In August 2025, Tigercat launched the TCi 1055D forwarder at FOREXPO in France. Features include 15-tonne capacity, multiple transmission choices, various wagon frame lengths, and upgraded cabin ergonomics.

- In June 2025, Logset released a new 3.3 update package for its 4F GT forwarder. The update includes a heavier-duty bogie capable of supporting 24-inch wheels.

- In 2025, John Deere announced its new H Series forestry machinery line (including forwarders 2010H and 2510H) scheduled to arrive in Chile in Q4 2025.

- In August 2024, At FinnMETKO 2024, Ponsse showcased new forwarders Elk and Wisent, and new features like better visibility, Active Cabin suspension etc.

Report Coverage

The research report offers an in-depth analysis based on Type, Engine, Load Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for forwarders will rise with increasing mechanization of global forestry operations.

- Hybrid and electric forwarders will gain traction to meet emission reduction goals.

- Telematics and predictive maintenance adoption will expand to improve fleet efficiency.

- Compact and modular forwarders will see higher use in selective harvesting and small plots.

- Operator comfort and safety features will remain a focus to retain skilled workforce.

- Manufacturers will invest in R&D to enhance payload capacity and reduce soil compaction.

- Asia-Pacific will remain the fastest-growing region with rapid forestry sector modernization.

- Financing and leasing options will support small operators in upgrading fleets.

- Digital integration will enable real-time monitoring and improve compliance with sustainability standards.

- Global competition will intensify, pushing companies to differentiate through innovation and service networks.