Market Overview:

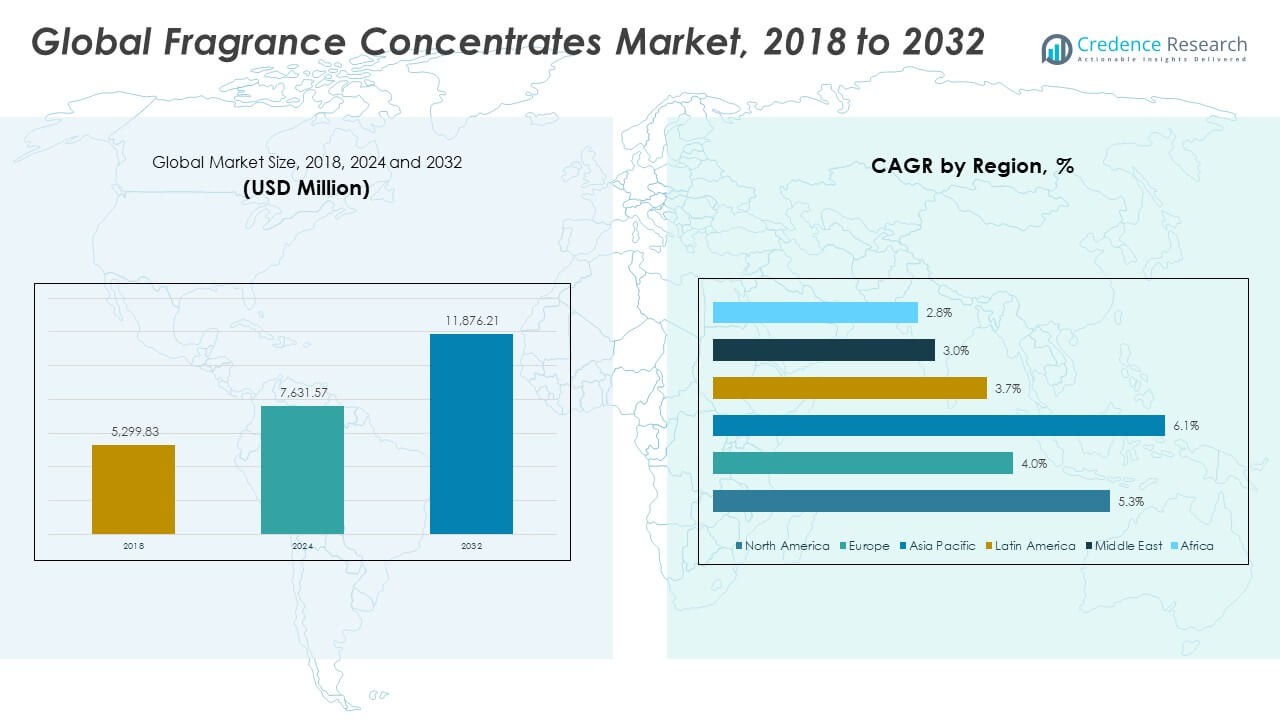

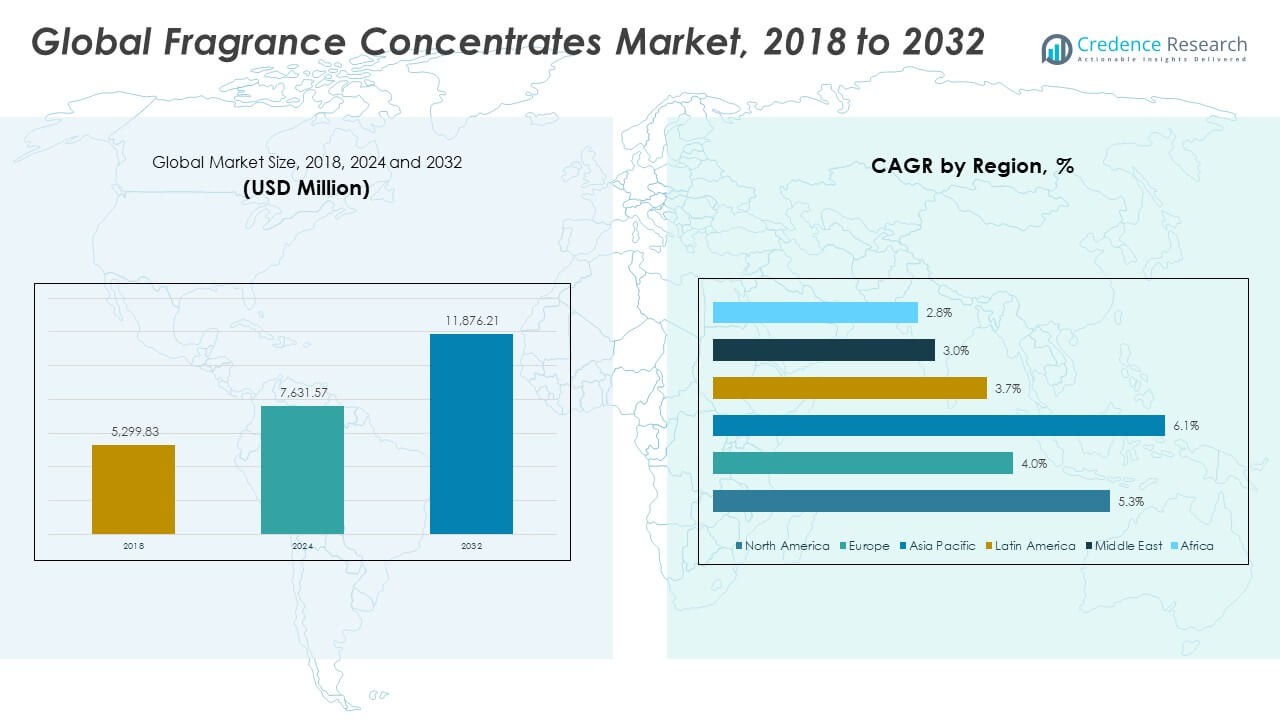

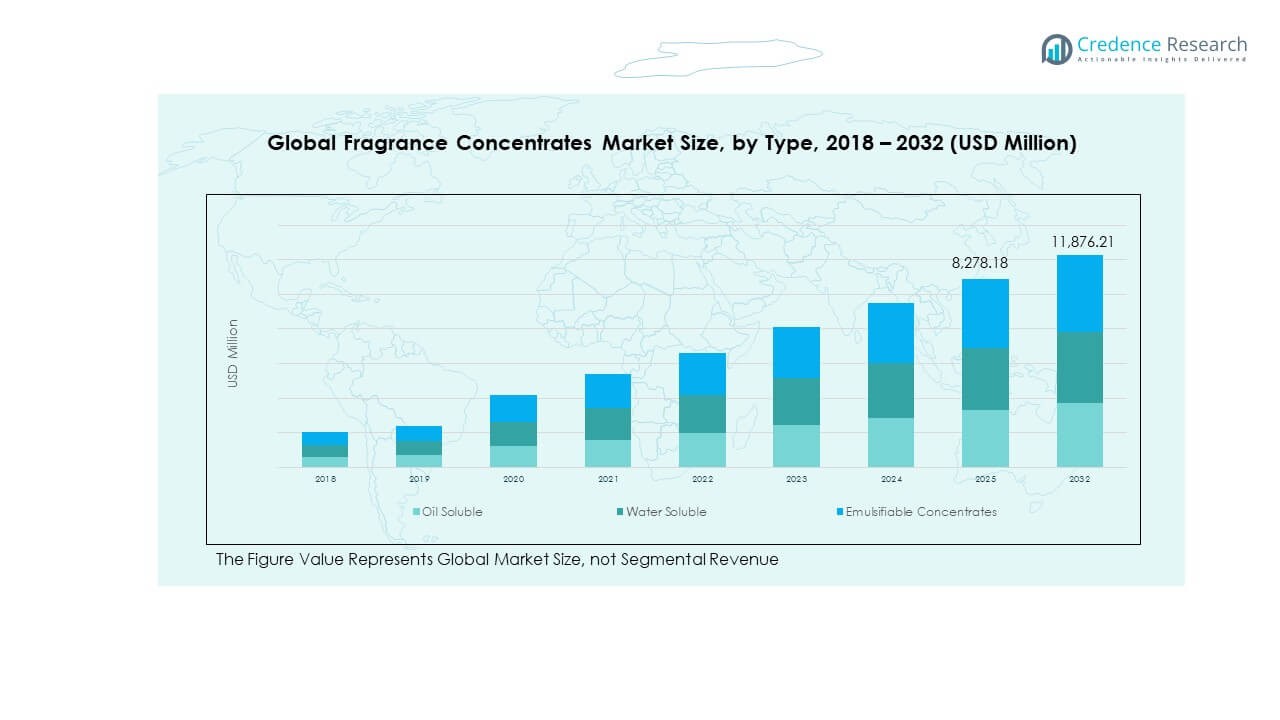

The Global Fragrance Concentrates Market size was valued at USD 5,299.83 million in 2018, reaching USD 7,631.57 million in 2024, and is anticipated to attain USD 11,876.21 million by 2032, registering a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fragrance Concentrates Market Size 2024 |

USD 7,631.57 Million |

| Fragrance Concentrates Market, CAGR |

5.29% |

| Fragrance Concentrates Market Size 2032 |

USD 11,876.21 Million |

The market is expanding due to rising consumer preference for premium fragrances and personal care products. Manufacturers are investing in natural and sustainable ingredients to meet clean-label demand. Growth in the cosmetics, home care, and fine fragrance industries further supports market development. Technological advancements in extraction and encapsulation enhance product stability and scent longevity, driving innovation and premiumization across segments.

Europe leads the Global Fragrance Concentrates Market, supported by a strong luxury perfume industry and well-established brands in France and Italy. North America shows steady demand from personal and home care sectors, driven by evolving lifestyle preferences. The Asia-Pacific region is emerging rapidly, fueled by urbanization, rising disposable income, and expanding cosmetics production in China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Fragrance Concentrates Market was valued at USD 5,299.83 million in 2018, reached USD 7,631.57 million in 2024, and is projected to reach USD 11,876.21 million by 2032, expanding at a CAGR of 5.29%.

- Asia Pacific (45%), North America (28%), and Europe (18%) hold the highest shares due to strong demand for personal care, fine fragrances, and home care applications. Asia Pacific dominates owing to its growing cosmetics industry, while North America and Europe lead in premium and sustainable fragrance production.

- Asia Pacific is the fastest-growing region, supported by expanding consumer bases in China, India, and Japan. Growth is driven by urbanization, rising disposable income, and increasing investments in natural and long-lasting fragrance formulations.

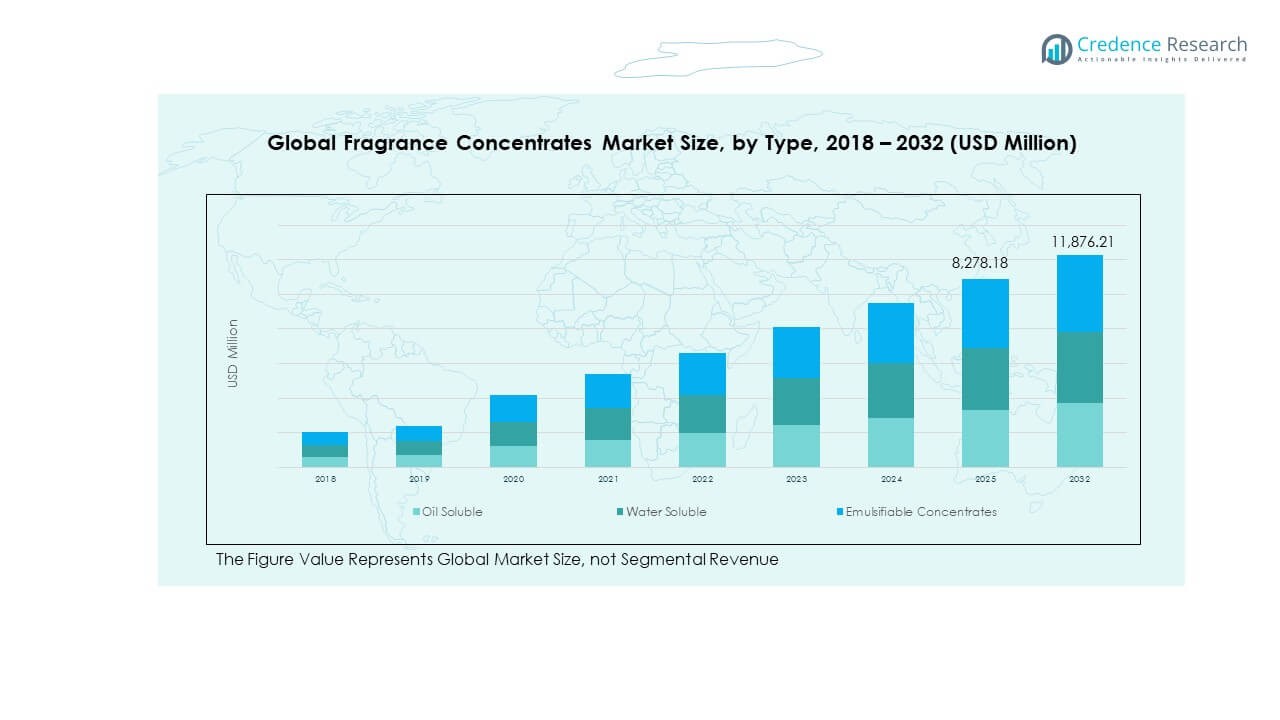

- By type, oil-soluble concentrates account for around 55% of the total share due to their superior scent longevity and compatibility with essential oils across personal care and perfume applications.

- Water-soluble and emulsifiable concentrates collectively represent about 45%, driven by their adoption in home care, fabric fresheners, and industrial products for cost-effectiveness and versatility.

Market Drivers:

Rising Demand for Premium and Natural Fragrances Across Personal Care and Home Care Industries

Growing consumer awareness of ingredient quality is driving the Global Fragrance Concentrates Market. Consumers prefer fragrances derived from essential oils, plant extracts, and sustainable sources. The shift toward clean-label and vegan products supports innovation in natural scent profiles. It benefits both premium and mass-market segments. Beauty, cosmetics, and home fragrance manufacturers increasingly adopt eco-friendly ingredients to meet demand. Advances in extraction technologies improve product consistency and scent retention. The industry continues to see partnerships with botanical suppliers. It is leading toward more sustainable and diverse formulations.

- For instance, Givaudan developed a biotechnology-derived molecule Ambrofix™ that uses sugar-cane fermentation to produce a fully naturally-derived, biodegradable ambery note. The shift toward clean-label and vegan products supports innovation in natural scent profiles, and this benefits both premium and mass-market segments.

Technological Advancements Enhancing Fragrance Formulation and Performance Efficiency

The market benefits from technological progress in microencapsulation, controlled release systems, and digital scent technologies. These innovations extend fragrance longevity and enable precise application in multiple product types. The Global Fragrance Concentrates Market sees strong investment in R&D to improve olfactory performance and formulation stability. Manufacturers use advanced chemistry to balance volatile and base notes effectively. Smart scent diffusion systems in air care and personal products enhance user experience. Companies are integrating AI for predictive blending and consumer preference mapping. These advances streamline production, reduce waste, and raise customization levels. It promotes efficiency and creative differentiation among brands.

- For instance, dsm-Firmenich’s Popscent® eco range introduced a 100% biodegradable fragrance capsule technology in 2023 that extends scent from wash to wear. These innovations extend fragrance longevity and enable precise application in multiple product types.

Growing Influence of Lifestyle and Fashion Trends on Fragrance Consumption Patterns

Changing consumer lifestyles drive interest in niche and signature scents. The growing popularity of designer perfumes and custom blends supports market expansion. The Global Fragrance Concentrates Market is influenced by fashion cycles and brand collaborations. Personalized and limited-edition fragrances attract younger consumers seeking exclusivity. Retailers and fashion houses invest in private-label collections to strengthen customer loyalty. Seasonal launches and influencer marketing campaigns amplify brand visibility. Fragrance layering and mood-based scent trends create new consumer experiences. It strengthens long-term engagement and market retention.

Expanding Applications in Industrial, Automotive, and Household Sectors

Beyond cosmetics, fragrance concentrates now serve multiple non-personal segments. The Global Fragrance Concentrates Market benefits from use in detergents, air fresheners, and automotive interiors. Companies adopt strong scent diffusion systems to enhance comfort and cleanliness perception. Fragrance integration in packaging materials and textiles further broadens commercial potential. Demand from hospitality, healthcare, and spa industries grows rapidly. Scent branding and environment enhancement drive product development. Manufacturers emphasize formulation stability under varying temperature and humidity. It supports wider industrial adaptation and market growth.

Market Trends:

Rising Popularity of Eco-Conscious and Biodegradable Fragrance Ingredients

Environmental awareness and stricter regulations are reshaping fragrance formulations. The Global Fragrance Concentrates Market is witnessing a shift toward biodegradable and renewable raw materials. Brands are eliminating phthalates, parabens, and synthetic musk compounds. The trend promotes transparency and aligns with global sustainability goals. Bio-based and solvent-free formulations are gaining preference in personal care and home care. Consumers favor eco-certified products that reflect responsible sourcing. Major fragrance houses collaborate with biotech firms to create bioengineered scent molecules. It reduces environmental impact while maintaining product quality.

- For instance, Givaudan uses biocatalytic processes in its Ambrofix™ production. It reduces environmental impact while maintaining product quality.

Growing Role of AI and Data Analytics in Fragrance Creation and Testing

AI tools and big data are transforming fragrance design and development. The Global Fragrance Concentrates Market benefits from predictive modelling that helps identify scent preferences and market gaps. Virtual simulation reduces development time and testing costs. AI-driven analytics assess consumer mood, geography, and lifestyle data to optimize product appeal. Machine learning enables formulation precision and faster decision-making. Companies adopt digital testing platforms to streamline product evaluation. Virtual reality integration in scent testing enhances user experience. It supports efficient R&D and higher customization levels.

- For instance, dsm-Firmenich’s OptiBloom® max uses AI-powered performance modelling to guide scent creation. The Global Fragrance Concentrates Market benefits from predictive modelling that helps identify scent preferences and market gaps—companies analyse geography, lifestyle and mood data. Virtual simulation reduces development time and testing costs—digital fragrance-creation platforms allow perfumers to test olfactive profiles in silico.

Increasing Influence of E-Commerce and Direct-to-Consumer Sales Models

Digital retail expansion is redefining fragrance distribution networks. The Global Fragrance Concentrates Market leverages online platforms for global reach and brand exposure. Direct-to-consumer channels allow customized offerings and faster feedback. Digital sampling, subscription boxes, and virtual try-on tools boost sales conversions. Social media campaigns and influencer endorsements enhance visibility among younger demographics. Online fragrance communities shape consumer awareness and loyalty. Brands use data-driven marketing for personalized recommendations. It accelerates digital transformation across the fragrance sector.

Integration of Fragrance in Smart and Wearable Technologies

Smart devices are introducing new sensory experiences. The Global Fragrance Concentrates Market is exploring opportunities in wearable scent devices and smart diffusers. IoT-enabled fragrance systems allow users to adjust scent intensity through mobile applications. This integration enhances convenience and personalization. Tech companies collaborate with perfumers to develop interactive scent-based gadgets. These innovations redefine how consumers experience fragrance daily. New formats such as portable diffusers and scent capsules are emerging. It opens a futuristic dimension for scent delivery and user engagement.

Market Challenges Analysis:

High Cost of Natural Ingredients and Regulatory Compliance Pressure

The Global Fragrance Concentrates Market faces significant challenges in maintaining affordability and compliance. Natural raw materials, including essential oils and plant extracts, are costlier and prone to supply fluctuations. Regulatory frameworks such as IFRA standards and REACH regulations demand strict adherence. Compliance with allergen labeling, testing, and environmental restrictions adds operational complexity. Smaller manufacturers struggle to match the cost-efficiency of large corporations. Synthetic substitutes often raise consumer concern regarding safety and purity. Variations in regional regulations further complicate international trade. It creates hurdles for consistent product development and market expansion.

Environmental Concerns and Shifting Consumer Perceptions of Synthetic Fragrances

Growing environmental sensitivity impacts how consumers perceive synthetic fragrances. The Global Fragrance Concentrates Market must balance between cost efficiency and ecological responsibility. Waste management, chemical disposal, and sustainability reporting increase corporate accountability. Environmental groups pressure manufacturers to adopt eco-friendly materials and reduce emissions. Consumer skepticism toward chemical ingredients limits acceptance of synthetic formulations. Industry players face the challenge of ensuring quality while cutting harmful compounds. Transitioning to green chemistry demands investment in research and production upgrades. It tests financial resilience across the supply chain.

Market Opportunities:

Emerging Demand for Customized and Functional Fragrance Solutions Across Industries

The Global Fragrance Concentrates Market holds vast potential through product personalization and sensory innovation. Custom blends tailored to individual moods, identities, or settings attract new customers. Functional fragrances with mood-enhancing or wellness benefits gain traction in wellness products. Cross-sector integration in textiles, packaging, and automotive interiors expands usage scope. Partnerships with lifestyle and technology brands create fresh applications. This diversification supports long-term revenue stability and market reach. It enables stronger brand positioning and consumer loyalty.

Rapid Growth of Fragrance Consumption in Emerging Economies

Developing regions present significant growth opportunities for fragrance manufacturers. The Global Fragrance Concentrates Market benefits from rising disposable incomes and evolving beauty standards. Expanding urban populations in Asia-Pacific, Latin America, and the Middle East increase product demand. Localized production and culturally adapted scents strengthen regional competitiveness. E-commerce access and aggressive marketing enhance brand visibility. Rising investments in regional manufacturing facilities improve supply chain resilience. It accelerates adoption across personal care, home care, and industrial segments.

Market Segmentation Analysis:

By Type

The Global Fragrance Concentrates Market is divided into oil soluble, water soluble, and emulsifiable concentrates. Oil soluble fragrances dominate due to their wide use in perfumes, cosmetics, and personal care items, offering longer scent retention and better blending with essential oils. Water soluble concentrates are preferred in home care and industrial cleaning products for easy dilution and cost-effectiveness. Emulsifiable concentrates gain traction in multifunctional formulations requiring both oil and water compatibility. It demonstrates versatility in diverse product categories, supporting expansion across personal and commercial applications.

- For emulsifiable concentrates, International Flavors & Fragrances (IFF) launched “ENVIROCAP™”, a fragrance-encapsulation system that is fully biodegradable and vegan-suitable for fabric-care applications, showcasing multifunctional oil-and-water compatibility in formulations.

By Application

The market is segmented into personal care and cosmetics, household products, fine fragrances, and others. Personal care and cosmetics represent the largest share due to strong demand for perfumes, skincare, and haircare products featuring natural and long-lasting scents. Household products, including detergents and air fresheners, show steady growth supported by lifestyle improvement and hygiene awareness. Fine fragrances continue to attract premium consumers seeking exclusive blends. The others segment includes industrial and automotive use, where scent branding is gaining attention. It reflects the market’s adaptability to both luxury and functional applications.

- For household products, IFF’s fabric-care segment uses its fragrance encapsulation technology to deliver long-lasting scent from wash to wear; the company notes its “Mindful Fragrance Design” covers nearly 70 % of its catalog with Life Cycle Analysis. For fine fragrances and luxury blends, IFF unveiled its “Science of Performance” suite combining AI-powered fragrance creation, where the platform uses consumer-preference data from tens of thousands of records to support formulation precision.

Segmentation:

- By Type

- Oil Soluble

- Water Soluble

- Emulsifiable Concentrates

- By Application

- Personal Care & Cosmetics

- Household Products

- Fine Fragrances

- Others

- By Country (Regional Breakdown)

- North America:S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Global Fragrance Concentrates Market size was valued at USD 1,522.88 million in 2018, reaching USD 2,158.29 million in 2024, and is anticipated to attain USD 3,372.97 million by 2032, at a CAGR of 5.3% during the forecast period. North America holds approximately 28% of the global market share, supported by a mature fragrance and personal care industry. Strong consumer inclination toward premium and organic products drives consistent growth. The United States dominates due to its advanced manufacturing capabilities and demand for sustainable fragrances. Canada shows increasing adoption of eco-friendly ingredients in home and personal care products. The region benefits from high spending on beauty and lifestyle goods. Strategic partnerships between global fragrance houses and regional brands enhance innovation. It continues to witness product diversification and sustainable reformulation across key segments.

Europe

The Europe Global Fragrance Concentrates Market size was valued at USD 987.60 million in 2018, reaching USD 1,344.06 million in 2024, and is anticipated to attain USD 1,901.60 million by 2032, at a CAGR of 4.0% during the forecast period. Europe accounts for around 18% of the total market share, supported by strong demand from luxury fragrance manufacturers. France, Italy, and the UK lead the region with deep-rooted perfume traditions and advanced R&D infrastructure. The market benefits from consumer interest in natural, artisanal, and sustainable scents. Stringent regulations encourage transparency and clean labeling, promoting trust among end users. Local fragrance producers collaborate with fashion and cosmetic houses to expand product portfolios. Innovation in biodegradable and low-VOC formulations supports environmental goals. It remains a hub for creative scent development and export activities.

Asia Pacific

The Asia Pacific Global Fragrance Concentrates Market size was valued at USD 2,296.66 million in 2018, reaching USD 3,430.24 million in 2024, and is anticipated to attain USD 5,666.39 million by 2032, at a CAGR of 6.1% during the forecast period. Asia Pacific dominates with an estimated 45% market share, driven by rapid urbanization and rising disposable incomes. Expanding cosmetic and home care industries in China, India, and Japan contribute significantly to demand. Local manufacturers increasingly invest in high-quality scent formulations for mass and premium products. Growing youth population and changing grooming habits foster fragrance adoption. The region attracts global players due to low production costs and large consumer bases. E-commerce expansion enhances accessibility and product visibility. It continues to show strong potential across both personal and industrial fragrance segments.

Latin America

The Latin America Global Fragrance Concentrates Market size was valued at USD 250.92 million in 2018, reaching USD 356.84 million in 2024, and is anticipated to attain USD 491.66 million by 2032, at a CAGR of 3.7% during the forecast period. Latin America represents around 5% of the global market share, supported by growing urbanization and evolving lifestyle preferences. Brazil and Mexico lead consumption in personal care and air freshener products. Demand for natural and affordable fragrances grows among middle-income consumers. Local fragrance production gains traction through regional partnerships and government support. Product diversification and private-label expansion strengthen competitiveness. Global brands increase investments to localize product offerings. It benefits from the rising influence of beauty and wellness culture across emerging cities.

Middle East

The Middle East Global Fragrance Concentrates Market size was valued at USD 144.93 million in 2018, reaching USD 190.32 million in 2024, and is anticipated to attain USD 248.68 million by 2032, at a CAGR of 3.0% during the forecast period. The region captures about 3% of the global market share, led by traditional and high-end fragrance demand. The UAE and Saudi Arabia are major contributors, emphasizing luxury perfumes and oud-based scents. Rising tourism and retail expansion support fragrance product sales. Local manufacturers combine traditional attar heritage with modern formulations. International fragrance houses establish partnerships with regional brands to cater to cultural preferences. Demand for personalized and oil-based fragrances continues to rise. It remains an attractive hub for niche and premium fragrance brands.

Africa

The Africa Global Fragrance Concentrates Market size was valued at USD 96.84 million in 2018, reaching USD 151.82 million in 2024, and is anticipated to attain USD 194.92 million by 2032, at a CAGR of 2.8% during the forecast period. Africa accounts for roughly 2% of the global market share, driven by rising awareness of personal hygiene and grooming. South Africa leads the region with established cosmetic and home care industries. Nigeria and Egypt show growing interest in affordable fragrance solutions. Increasing retail penetration and social media influence drive product demand among younger consumers. Local startups are entering the market with cost-effective and culturally inspired scent lines. Import reliance remains high, yet manufacturing investments are slowly increasing. It offers long-term growth potential through regional diversification and economic development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Fragrance Concentrates Market is highly competitive, driven by product innovation, sustainability initiatives, and brand differentiation. It features a mix of global leaders and regional players competing through advanced formulations, customized scent profiles, and clean-label ingredients. Companies focus on research collaboration, technological advancement, and diversification across personal care, home care, and fine fragrance sectors. Strategic mergers and acquisitions strengthen global supply chains and distribution capabilities. Leading firms invest heavily in R&D to develop bio-based and long-lasting scents. It continues to evolve toward ethical sourcing, transparency, and eco-friendly production standards to meet consumer expectations.

Recent Developments:

- In September 2025, Givaudan announced its intent to acquire Belle Aire Creations, a prominent US-based fragrance creations house. The deal aims to strengthen Givaudan’s offering for local and regional customers in North America, tapping significant potential in the market through enhanced creative resources and deeper regional expertise.

- On November 4, 2024, Robertet Group revealed the acquisition of Phasex Corporation, a pioneer in CO₂ extraction technology in the US. This acquisition enables Robertet to boost its production capabilities and develop new ranges of high-value natural ingredients for flavor and fragrance clients, cementing its position as a sustainability leader in extraction technology.

Report Coverage:

The research report offers an in-depth analysis based on type and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for natural and biodegradable fragrance concentrates will continue to rise across industries.

- Manufacturers will expand sustainable ingredient sourcing to meet environmental and ethical standards.

- AI and machine learning will drive personalization and predictive fragrance design.

- Digital commerce and direct-to-consumer channels will gain importance for fragrance brands.

- Innovation in encapsulation and controlled-release systems will enhance scent longevity.

- Collaborations between fragrance makers and biotech firms will increase bio-based scent production.

- Emerging markets in Asia-Pacific will offer high-growth potential through localized product strategies.

- Premiumization trends will boost demand for exclusive and long-lasting fragrance profiles.

- Regulatory reforms will encourage safer formulations and transparent labeling.

- R&D investments will focus on functional and mood-enhancing fragrance applications.