Market Overview

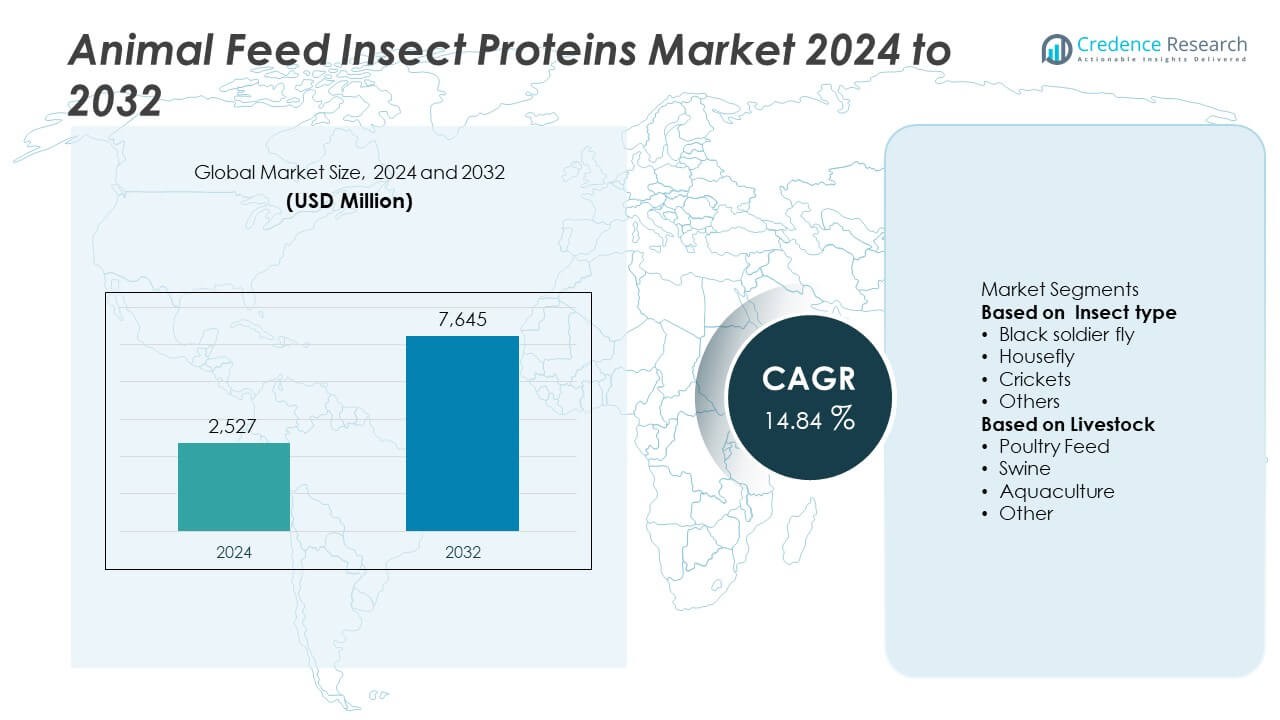

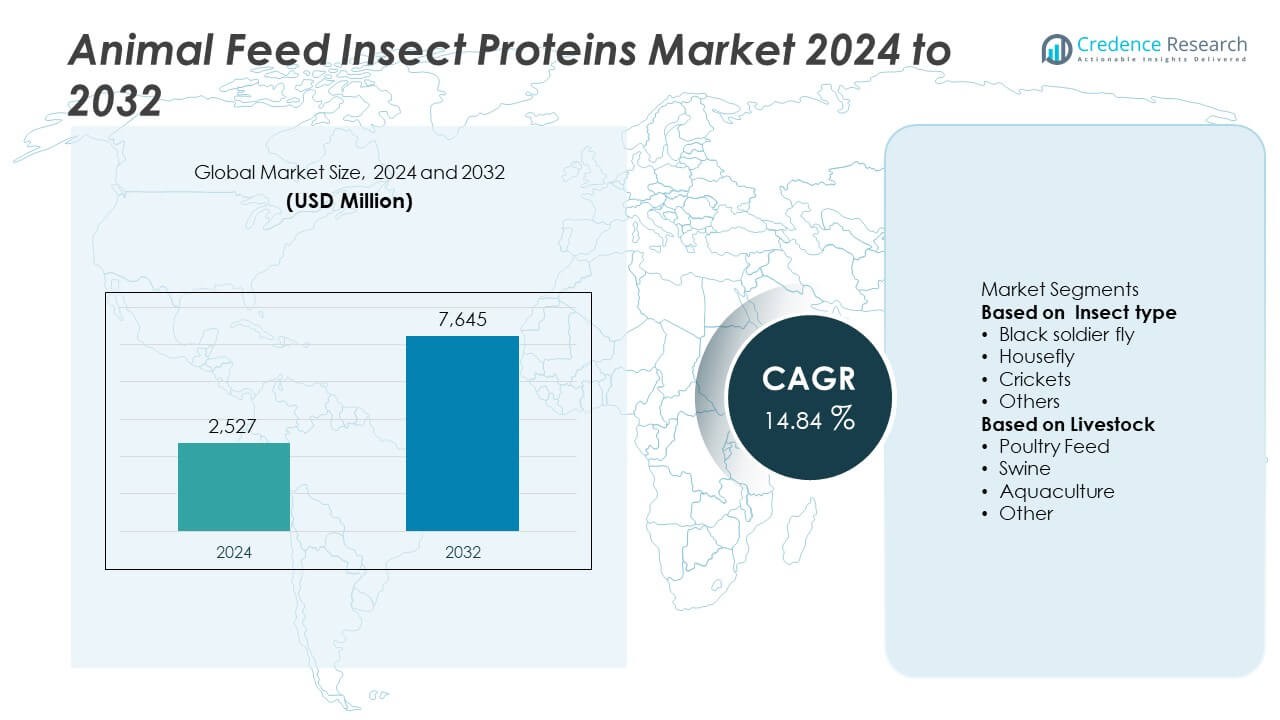

The Animal Feed Insect Proteins market was valued at USD 2,527 million in 2024 and is projected to reach USD 7,645 million by 2032, expanding at a CAGR of 14.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Feed Insect Proteins Market Size 2024 |

USD 2,527 Million |

| Animal Feed Insect Proteins Market, CAGR |

14.84% |

| Animal Feed Insect Proteins Market Size 2032 |

USD 7,645 Million |

The Animal Feed Insect Proteins market is led by prominent companies including Protix, Ynsect SAS, Innovafeed, Nutrition Technologies, Enviroflight, HiProMine S.A, Hexafly Biotech, INSECTIFii, NextProtein, and BETA HATCH. These players dominate through advanced bioconversion technologies, sustainable protein extraction methods, and expansion of insect farming facilities. Europe led the global market with a 42.3% share in 2024, driven by strong regulatory support, large-scale production in France and the Netherlands, and growing integration of insect protein in aquafeed and poultry diets. Asia-Pacific followed with a 33.7% share, supported by rapid adoption in animal nutrition and waste valorization projects across China, Vietnam, and Malaysia.

Market Insights

- The Animal Feed Insect Proteins market was valued at USD 2,527 million in 2024 and is projected to reach USD 7,645 million by 2032, expanding at a CAGR of 14.84% during the forecast period.

- Rising demand for sustainable and high-protein feed ingredients is driving large-scale adoption across poultry, aquaculture, and swine sectors.

- Black soldier fly protein led the market with a 46.5% share in 2024, supported by its strong amino acid composition, high digestibility, and eco-friendly production cycle.

- Key players such as Protix, Ynsect SAS, Innovafeed, and Nutrition Technologies are investing in automation, large-scale production facilities, and feed-grade product innovation to strengthen market positioning.

- Europe dominated with a 42.3% share, followed by Asia-Pacific with 33.7%, driven by favorable regulations, rapid insect farming development, and increasing inclusion of insect protein in commercial feed formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Insect Type

The black soldier fly segment dominated the Animal Feed Insect Proteins market in 2024 with a 46.8% share, driven by its high protein content, efficient feed conversion, and sustainable cultivation practices. It is widely used in aquaculture and poultry feed due to its balanced amino acid profile and digestibility. Black soldier fly larvae production is expanding rapidly across Asia-Pacific and Europe, supported by technological advances in insect rearing and waste bioconversion. Other species, such as houseflies and crickets, are gaining traction as complementary protein sources for niche applications in pet food and specialty livestock diets.

- For instance, research found that dried larvae of Hermetia illucens (black soldier fly) achieved a protein content of 45.29 g per 100 g dry-matter, lipid content of 4.12 g per 100 g dry-matter and ash content of 9.03 g per 100 g dry-matter in one trial.

By Livestock

The aquaculture segment held the largest 49.2% share in 2024, emerging as the leading consumer of insect protein-based feed. Increasing demand for sustainable fish farming and the rising cost of fishmeal have accelerated the use of insect-derived proteins as an alternative. Aquafeed manufacturers are adopting black soldier fly and mealworm-based formulations to enhance feed efficiency and promote growth performance. Poultry feed follows closely, driven by rising meat consumption and the need for natural protein enrichment. Continuous R&D in nutrient optimization and scalable production reinforces insect protein adoption across livestock categories.

- For instance, trials by Ÿnsect showed that shrimp fed a diet containing 50% mealworm-derived insect meal experienced a significantly lower mortality rate after a bacterial challenge compared to the control group, with a 76.9% lower mortality rate than the control.

Key Growth Drivers

Rising Demand for Sustainable Protein Sources

The growing need for sustainable and cost-effective protein alternatives in animal feed is a major growth driver for the Animal Feed Insect Proteins market. Insect-based proteins provide a high nutritional value and reduce reliance on traditional sources such as soy and fishmeal. The use of insect farming also promotes waste recycling and lower carbon emissions, aligning with global sustainability goals. Increasing environmental awareness and regulatory support for insect-derived feeds are accelerating the adoption of these protein solutions across poultry, aquaculture, and livestock industries.

- For instance, Protix reported that a commercial trial with its ProteinX® black soldier fly meal led to an average body weight of 4,669 g in Atlantic salmon, compared to 4,260 g in the control group.

Expansion of Aquaculture and Poultry Industries

The rapid expansion of aquaculture and poultry farming is fueling the demand for insect protein feed. These sectors require high-quality, digestible proteins to enhance growth and feed conversion rates. Insect proteins such as black soldier fly meal provide balanced amino acid content, improving animal health and performance. The rising global consumption of seafood and poultry products is encouraging feed manufacturers to adopt sustainable alternatives, boosting large-scale insect protein production and incorporation into commercial feed formulations.

- For instance, HiProMine S.A. deployed a production line in their Karkoszów plant in 2024 with the capacity to produce up to 30,000 tonnes of larva and 30,000 tonnes of insect frass per year, making it one of the largest suppliers of insect components in Europe.

Technological Advancements in Insect Farming

Automation, vertical farming, and controlled rearing systems are improving insect farming efficiency, lowering production costs, and ensuring consistent protein yields. The use of bioconversion technology enables large-scale waste recycling into high-protein insect meal. Companies are integrating AI-based monitoring and precision feeding systems to optimize larvae growth and nutrient composition. These advancements are strengthening the scalability and profitability of insect protein production, driving broader adoption in feed manufacturing and promoting long-term industry growth.

Key Trends & Opportunities

Growing Investment and Regulatory Support

Investments in insect-based protein production facilities and government support for sustainable feed alternatives present strong opportunities. The European Union, North America, and Asia-Pacific are implementing favorable regulations for insect-derived feed inclusion. Public-private partnerships are fostering research on nutrient optimization and feed safety. This growing policy support and financial backing are helping manufacturers expand capacity and develop regionally compliant, nutrient-rich insect feed formulations for different livestock applications.

- For instance, Innovafeed announced a production scale-up involving over 10 billion black soldier fly maggots at its factory in France, converting these larvae into protein and oil for animal and pet nutrition.

Emerging Use in Pet and Specialty Animal Feed

The growing popularity of high-protein, sustainable pet food formulations creates a new growth opportunity for insect protein suppliers. Insect meal provides hypoallergenic and easily digestible protein suitable for companion animals. Brands are marketing insect-based feed as premium, eco-friendly alternatives that align with ethical consumer trends. Increasing demand from specialty animal nutrition sectors such as aquariums and zoos further expands market potential for tailored insect protein applications.

- For instance, Ÿnsect SAS introduced its “Sprÿng” insect-based ingredient line for pet-food manufacturers, offering ingredient batches with protein content up to 71 g per 100 g dry-matter and ash content below 5 g per 100 g.

Key Challenges

High Production and Processing Costs

The high cost of insect rearing, processing, and protein extraction remains a major challenge. Specialized infrastructure and energy requirements increase operational expenses compared to conventional protein sources. This cost gap limits large-scale adoption, especially among small feed producers. To address this, industry players are investing in automation, waste valorization, and co-product utilization to improve cost efficiency and achieve economies of scale in commercial insect protein production.

Regulatory and Consumer Acceptance Barriers

Despite growing recognition, insect protein still faces regulatory and consumer acceptance hurdles in several regions. Complex approval procedures and inconsistent international standards delay market entry for new products. Some consumers and farmers remain hesitant due to limited awareness of insect protein benefits. Continuous education, transparent labeling, and safety validation are essential to building trust and achieving widespread market acceptance across livestock and aquaculture feed applications.

Regional Analysis

North America

North America accounted for a 34.7% share of the Animal Feed Insect Proteins market in 2024, driven by strong demand for sustainable and high-quality protein sources in aquaculture and poultry feed. The United States leads the region, supported by government initiatives promoting circular agriculture and waste-to-protein technologies. Feed manufacturers are adopting black soldier fly-based ingredients to reduce dependency on fishmeal imports. Increasing consumer awareness of sustainable livestock production and the presence of advanced insect farming infrastructure further strengthen market growth across the region.

Europe

Europe held a 30.2% share in 2024, supported by early regulatory approvals and strong policy backing for insect-derived proteins in feed applications. Countries such as France, the Netherlands, and Belgium lead innovation in large-scale insect production facilities. The European Union’s sustainable feed initiatives and restrictions on traditional fishmeal usage drive greater adoption of insect meal. The aquaculture and poultry sectors are key contributors, while growing investment in R&D and commercialization of high-protein insect products continue to enhance market competitiveness.

Asia-Pacific

Asia-Pacific captured a 25.4% share in 2024, emerging as the fastest-growing regional market. Rising meat and seafood consumption, coupled with high feed costs, has encouraged feed producers to adopt insect proteins as cost-effective alternatives. China, Vietnam, and Thailand are expanding insect farming operations to support aquaculture and poultry production. Government programs promoting food security and waste management are boosting regional output. Increasing collaborations between local insect protein firms and global feed manufacturers are expected to further accelerate growth across this region.

Latin America

Latin America represented a 5.6% share in 2024, with growing adoption of insect-based feed ingredients in aquaculture and livestock farming. Brazil and Mexico dominate the regional market due to rising demand for sustainable animal nutrition and expanding aquafeed industries. The region benefits from favorable climate conditions and abundant organic waste resources for insect cultivation. However, limited technological infrastructure and investment still restrain large-scale commercialization. Ongoing partnerships with international insect protein producers are expected to strengthen regional production capabilities over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for a 4.1% share in 2024, driven by increasing efforts to achieve feed self-sufficiency and promote sustainable agriculture. Countries such as South Africa and the United Arab Emirates are investing in pilot insect farming projects for poultry and aquaculture applications. The region’s growing dependence on imported feed proteins is encouraging local production of insect-based alternatives. While market development is still in early stages, supportive government initiatives and international collaborations are paving the way for gradual expansion of insect protein feed usage.

Market Segmentations:

By Insect type

- Black soldier fly

- Housefly

- Crickets

- Others

By Livestock

- Poultry Feed

- Swine

- Aquaculture

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Animal Feed Insect Proteins market features key players such as Nutrition Technologies, Protix, HiProMine S.A, Ynsect SAS, NextProtein, Hexafly Biotech, Enviroflight, INSECTIFii, Innovafeed, and BETA HATCH. These companies are driving market growth through large-scale production of black soldier fly and mealworm-based protein ingredients tailored for poultry, aquaculture, and swine feed. Leading manufacturers focus on scaling up automated bioconversion systems, enhancing protein yields, and ensuring compliance with feed safety regulations. Strategic collaborations with feed producers and research institutions are accelerating innovation in nutrient optimization and sustainable sourcing. Expansion of regional production facilities and circular economy models using organic waste as feedstock are also key strategies adopted by market leaders to reduce production costs and strengthen supply chain resilience. The competition remains intense as companies prioritize eco-efficient production technologies and long-term partnerships with agribusinesses to meet rising global demand for alternative protein sources.

Key Player Analysis

- Nutrition Technologies

- Protix

- HiProMine S.A

- Ynsect SAS

- NextProtein

- Hexafly Biotech

- Enviroflight

- INSECTIFii

- Innovafeed

- BETA HATCH

Recent Developments

- In February 2025, HiProMine S.A. announced a partnership with Brenntag to distribute its insect-derived proteins, fats and functional feed ingredients under GMP+ certification across the EMEA region via Brenntag’s animal-nutrition portfolio.

- In May 2024, HiProMine opened an additional plant in Europe dedicated to insect-protein and fat production for aquaculture and livestock feed, significantly increasing its manufacturing capacity.

- In April 2024, Protix publicly reported that its ProteinX® insect meal reduces CO₂ emissions by 78 % compared to poultry meal and up to 89 % compared to soy protein concentrate, marking a major sustainability data milestone for insect-based feed ingredients.

- In October 2023, Tyson Foods, Inc., one of the world’s largest food companies, has reached an agreement for a two-fold investment with Protix, the leading global insect ingredients company. The strategic investment will support the growth of the emerging insect ingredient industry and expand the use of insect ingredient solutions to create more efficient sustainable proteins and lipids for use in the global food system.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Insect type, Livestock and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for insect-based proteins will increase due to the need for sustainable animal nutrition.

- Black soldier fly protein will remain dominant because of its high digestibility and efficient waste conversion.

- Expansion in aquaculture feed production will boost adoption of insect-derived ingredients.

- Large-scale investments in insect farming technology will enhance production capacity and cost efficiency.

- Regulations supporting alternative protein use in livestock feed will accelerate global market growth.

- Integration of automation and AI in insect rearing facilities will improve yield consistency.

- Collaborations between feed manufacturers and insect protein producers will strengthen supply chains.

- Asia-Pacific will emerge as a key growth hub driven by rising poultry and aquafeed demand.

- Research in nutritional optimization will enhance the amino acid balance of insect-based feeds.

- Consumer preference for eco-friendly and circular economy feed solutions will shape future industry expansion.