Market Overview:

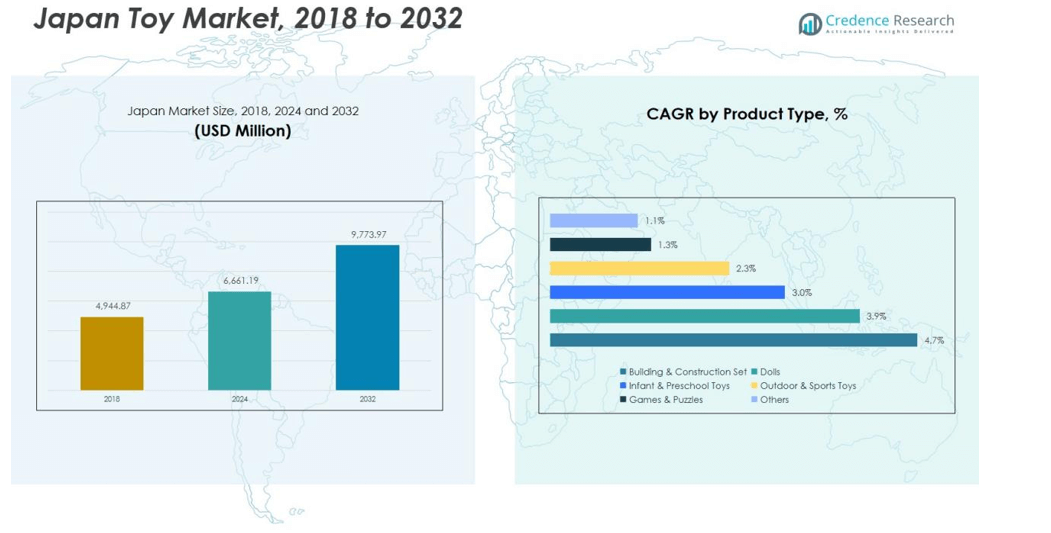

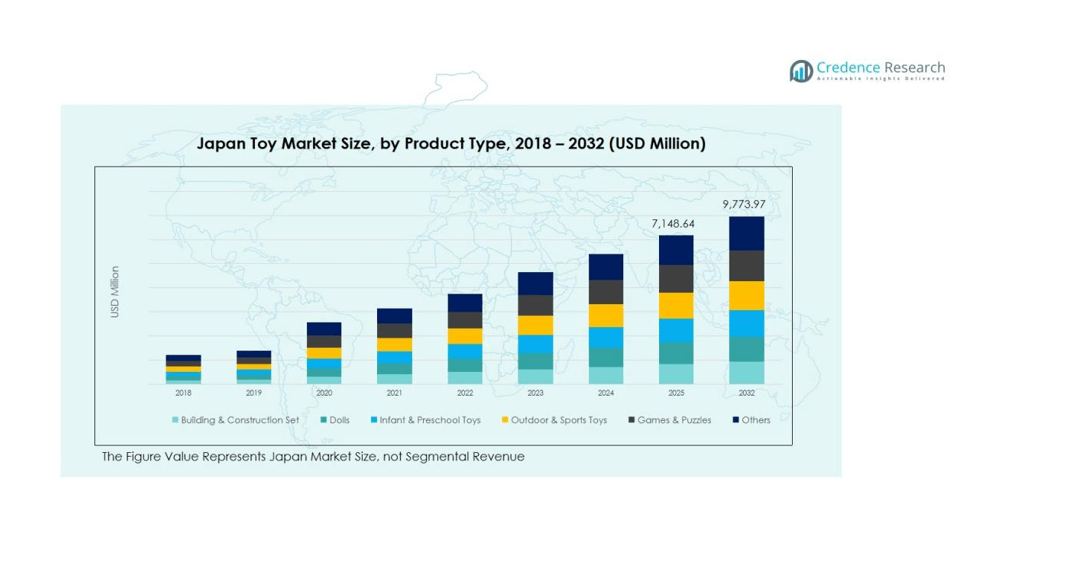

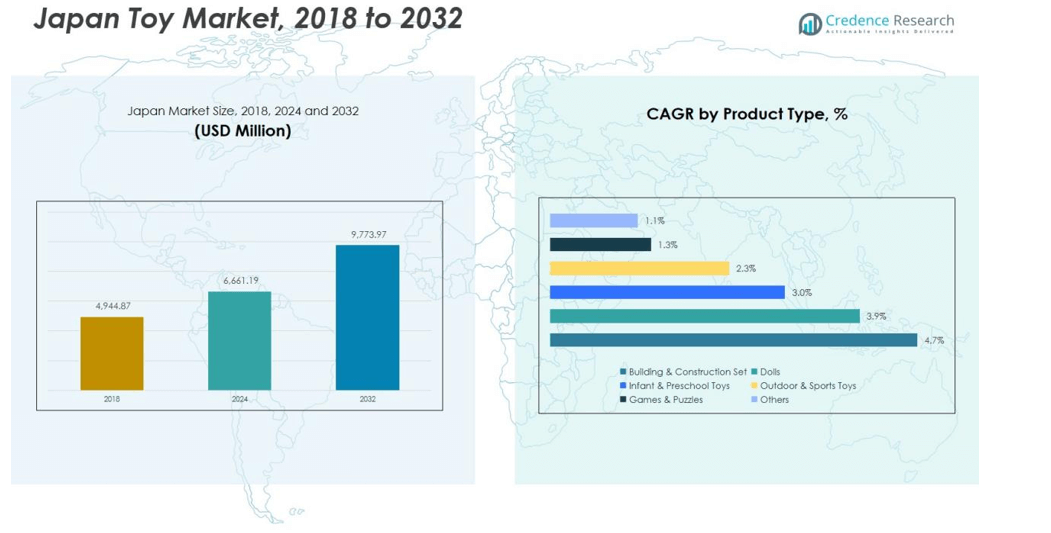

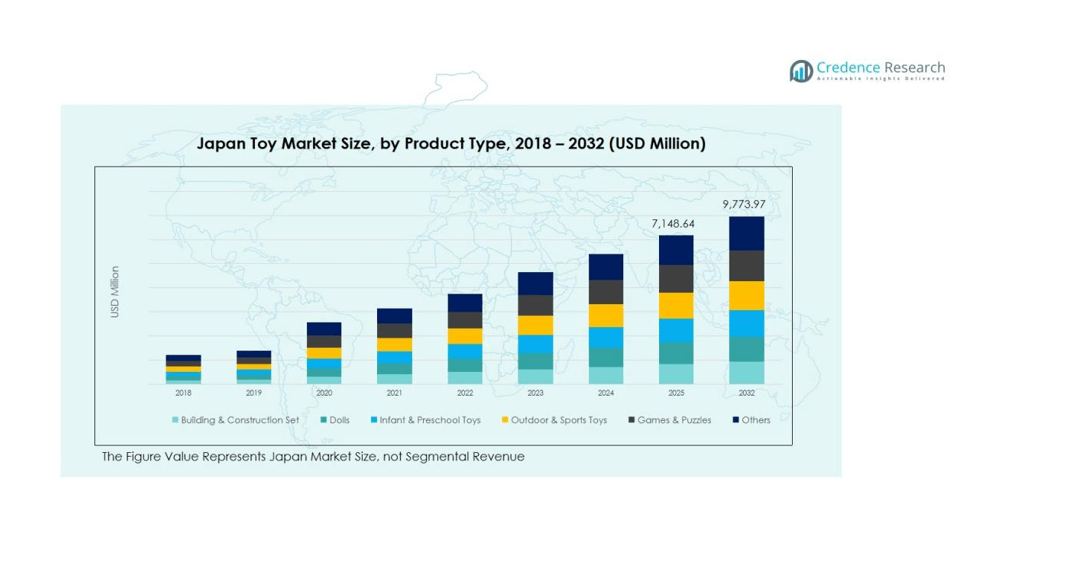

The Japan Toy Market size was valued at USD 4,944.87 million in 2018 to USD 6,661.19 million in 2024 and is anticipated to reach USD 9,773.97 million by 2032, at a CAGR of 4.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Toy Market Size 2024 |

USD 6,661.19 million |

| Japan Toy Market , CAGR |

4.57% |

| Japan Toy Market Size 2032 |

USD 9,773.97 million |

Market expansion is primarily driven by the rising popularity of educational and STEM-focused toys, integration of digital and interactive play experiences, and the strong cultural influence of anime and gaming franchises. Increasing adoption of e-commerce and growth in the adult-collector segment also contribute to sustained demand, as consumers seek nostalgic and premium-quality products.

Within Japan, urban centers such as Tokyo, Osaka, and Nagoya dominate toy sales due to higher disposable incomes and advanced retail infrastructure. Although declining birth rates create long-term challenges, the market benefits from growing interest in high-end collectibles, character merchandise, and cross-media entertainment tie-ins that appeal to a broad demographic beyond children.

Market Insights:

- The Japan Toy Market was valued at USD 4,944.87 million in 2018, USD 6,661.19 million in 2024, and is projected to reach USD 9,773.97 million by 2032, at a CAGR of 4.57%.

- Tokyo holds the largest regional share at 38%, followed by Osaka with 25% and Nagoya with 14%, driven by strong retail infrastructure, high disposable income, and dense urban populations.

- The fastest-growing region is Fukuoka, with an estimated 9% share, supported by anime production hubs and rising interest in character-based merchandise.

- By product type, building and construction sets account for 28% of total market revenue, driven by demand for STEM-based and creativity-enhancing play.

- Dolls and action figures contribute around 22%, benefiting from Japan’s pop-culture and anime influence that attracts both children and adult collectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Educational and STEM-Based Toys

The Japan Toy Market is experiencing strong growth due to rising interest in educational and STEM-based toys. Parents are prioritizing cognitive skill development, problem-solving, and creativity in early childhood learning. Products that combine fun with structured learning—such as coding kits, robotics sets, and puzzle-based toys—are seeing higher adoption. Companies are introducing interactive models that align with Japan’s emphasis on academic excellence. This shift from pure entertainment to purposeful play continues to redefine the country’s toy preferences.

- For instance, Sony’s toio platform features two cubic robots (called “toio Core Cubes”) and two ring-shaped controllers. The cubes are equipped with absolute position sensors to detect their location on special playmats and can communicate with each other using a six-axis positioning system and real-time geolocation.

Integration of Digital and Interactive Technologies

Digital transformation has become a major catalyst for innovation within the market. It encourages manufacturers to merge physical play with augmented reality (AR), virtual reality (VR), and mobile applications. Smart toys that connect to gaming platforms or offer app-based interactions attract tech-savvy children and adults. This trend supports engagement across multiple age groups and enhances the overall play experience. It also opens new opportunities for cross-platform licensing and brand collaborations.

- For Instance, VTech’s KidiZoom Snap Touch device features a dual 5.0-megapixel camera combined with integrated app connectivity through the KidiConnect platform, allowing children to capture photos, record videos, and share multimedia content with parental-approved contacts across multiple devices.

Cultural Influence of Anime, Gaming, and Character Merchandise

The country’s rich pop culture drives sustained demand for anime and gaming-inspired toys. Popular franchises such as Pokémon, Gundam, and One Piece influence purchasing patterns across both children and adult collectors. Character-based merchandise plays a vital role in maintaining brand loyalty and expanding product lifecycles. Licensing partnerships between global toy makers and Japanese media studios further strengthen this ecosystem. It keeps domestic production vibrant while supporting export potential.

Expansion of E-Commerce and Collectible Toy Segments

E-commerce platforms have transformed distribution strategies by offering broader product access and convenience. The rise of online marketplaces enables small and niche toy brands to reach national audiences. Collectible figures, limited-edition releases, and premium toy lines are gaining traction among adult consumers. It reflects Japan’s evolving consumer landscape, where nostalgia and craftsmanship drive repeat purchases. The expanding digital retail network continues to sustain steady market growth.

Market Trends:

Rising Popularity of Adult Collectibles and Character-Based Merchandise

The Japan Toy Market is witnessing a major shift toward adult collectibles, premium figures, and anime-themed merchandise. Consumers aged 20–40 are driving strong demand for high-quality, limited-edition models tied to nostalgic franchises such as Gundam, Dragon Ball, and Pokémon. Manufacturers are investing in craftsmanship, detailing, and licensing collaborations with entertainment brands to enhance value perception. It reflects a cultural appreciation for artistry and storytelling that extends beyond childhood. Department stores and online platforms now feature dedicated sections for adult collectors, reinforcing the expansion of this profitable niche. The growing overlap between gaming, anime, and toys also boosts brand engagement across multiple consumer segments.

- For instance, the Gundam series generated record-high net sales of 145.7 billion yen (approximately 934.78 million USD) in fiscal 2024, reflecting a marked surge among adult collectors and validating Bandai Namco Holdings’ strategic focus on high-detail product lines, including its various premium Gunpla model kits.

Adoption of Sustainable Materials and Digital Play Integration

Sustainability is becoming a defining trend, with manufacturers adopting biodegradable plastics, recycled materials, and eco-friendly packaging. It aligns with Japan’s environmental policies and growing consumer preference for responsible products. Toy producers are re-engineering designs to minimize waste while maintaining durability and safety standards. At the same time, digital integration continues to reshape the market through app-connected toys, AR/VR features, and interactive learning tools. These innovations attract younger generations accustomed to technology-driven entertainment. Hybrid play experiences combining tangible toys with digital content strengthen customer retention and create new monetization channels. The trend reflects an industry adapting to modern values of sustainability and immersive engagement.

- For Instance, Bandai Namco has expanded its sustainability efforts, which include a “Plastic Environmental Consideration Policy” formulated in April 2025 and a long-standing “Gunpla Recycling Project

Market Challenges Analysis:

Declining Birth Rate and Shrinking Child Demographic

The Japan Toy Market faces persistent pressure from the country’s declining birth rate, which directly affects toy demand among children. Fewer births translate into a smaller customer base for traditional play categories. It forces manufacturers to diversify toward adult and collector segments to maintain growth. Companies must adapt product portfolios to appeal to broader age groups, including family-oriented and educational toys. This demographic challenge also impacts long-term retail planning and store expansions. Sustaining profitability requires continuous innovation and strong brand differentiation.

Rising Competition and Changing Consumer Preferences

Intense competition from global and domestic brands challenges local manufacturers to remain relevant in a fast-evolving market. Consumers are increasingly shifting toward digital entertainment, reducing time spent on physical toys. It pushes toy producers to integrate technology and storytelling into product design to maintain engagement. Price sensitivity among parents further limits margins for traditional toys. Companies must balance affordability with quality to retain market share. The rapid growth of e-commerce platforms heightens price transparency, creating pressure on established retail chains to improve value and service standards.

Market Opportunities:

Expansion into Adult and Collector Segments

The Japan Toy Market presents significant growth potential through expanding adult and collector-focused segments. Rising nostalgia among millennials and growing interest in anime, gaming, and pop-culture merchandise are fueling this shift. It encourages brands to launch limited-edition figures, model kits, and high-end replicas that appeal to hobbyists. Collaborations with popular entertainment franchises strengthen consumer engagement and drive premium pricing. Specialty retail stores and online platforms are capitalizing on this demand by curating exclusive collections. This segment offers sustained revenue potential beyond the traditional child-focused market.

Adoption of Sustainable and Tech-Integrated Toy Solutions

Growing awareness of environmental responsibility creates opportunities for eco-friendly and tech-integrated toys. It motivates manufacturers to adopt recyclable materials, biodegradable plastics, and energy-efficient production processes. Digital integration through AR, VR, and app-connected features can enhance play experiences and attract tech-savvy consumers. Companies investing in educational and interactive designs can gain strong market positioning. Sustainability-focused innovations also align with Japan’s national green policies and corporate ESG goals. Expanding product lines that combine technology and sustainability can strengthen brand reputation and long-term market share.

Market Segmentation Analysis:

By Product Type

The Japan Toy Market features a diverse product mix led by building and construction sets, dolls, and games. Building sets remain popular due to their educational value and creativity-focused play. Dolls and action figures drive strong revenue through anime and gaming-inspired franchises. Infant and preschool toys maintain steady demand for developmental learning. Outdoor and sports toys are gaining interest with growing health awareness among families. The category diversification enables companies to serve different age groups and play preferences.

- For instance, the Mobile Suit Gundam franchise achieved record-high revenue of ¥145.7 billion worldwide in the fiscal year ending March 2024.

By Age Group

Toys for children aged 5 to below 12 years account for the largest market share, supported by school-related play learning and peer-driven trends. The 12–18 years segment benefits from growing interest in collectibles and strategy-based games. The 18+ segment is expanding quickly due to adult collectors seeking premium and nostalgic items. Infant and preschool toys maintain stable performance in early education products. It reflects a balanced market catering to lifelong play engagement.

- For Instance, the LEGO Group saw a 12% revenue increase to DKK 34.6 billion in the first half of 2025, outpacing the overall toy market and increasing its market share.

By Distribution Channel

Offline retail stores, including department chains and specialty outlets, remain the dominant sales channel. Consumers value product quality and direct interaction before purchase. Online sales are rising rapidly due to convenience, variety, and promotional discounts. E-commerce platforms provide exposure to smaller brands and niche products. The hybrid retail approach supports broader consumer access and consistent revenue growth.

Segmentations:

By Product Type:

- Building & Construction Sets

- Dolls

- Infant & Preschool Toys

- Outdoor & Sports Toys

- Games & Puzzles

- Others

By Age Group:

- 18+ Years

- 12 to 18 Years

- 5 to Below 12 Years

- 3 to Below 5 Years

- 0 to Below 3 Years

By Distribution Channel:

- Online

- Offline

- By Country:

- Japan

Regional Analysis:

Dominance of Urban Centers in Toy Consumption

The Japan Toy Market is heavily concentrated in major metropolitan areas such as Tokyo, Osaka, and Nagoya. These cities contribute the largest share of sales due to higher disposable incomes, dense populations, and access to premium retail outlets. Toy manufacturers often launch new products in these regions to gauge consumer response before nationwide release. It benefits from advanced retail infrastructure and well-established distribution networks that ensure consistent product availability. Urban families also display a strong preference for educational and tech-integrated toys, supporting steady revenue generation.

Emerging Demand from Regional and Suburban Markets

Suburban and regional areas are experiencing growing toy demand driven by expanding e-commerce access and improved logistics networks. Consumers outside metropolitan centers now have easier access to global brands and domestic innovations. It allows mid-tier retailers to capture market share through localized marketing and community-based sales. Rising interest in outdoor and family-oriented toys is more pronounced in these areas due to larger living spaces. The steady shift toward digital retail has helped bridge the gap between regional and urban consumption. Manufacturers targeting these regions gain exposure to untapped consumer groups.

Impact of Demographics and Cultural Influence on Regional Preferences

Demographic differences strongly influence toy preferences across regions in Japan. Regions with younger populations exhibit higher demand for preschool and educational toys, while older demographics favor collectible figures and cultural merchandise. The strong presence of anime production hubs in Tokyo and Fukuoka drives themed product launches that attract nationwide attention. It also creates cross-regional interest through character-based toys tied to local media franchises. The combination of cultural influence and regional diversity ensures stable long-term growth potential across multiple consumer segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Japan Toy Market is highly competitive, with global and domestic brands vying for market leadership. Key players include Hasbro, Inc., Mattel, Inc., Lego Group, and Spin Master, each leveraging strong brand portfolios and product innovation to capture consumer attention. It focuses on blending creativity, technology, and educational value to meet evolving consumer expectations. Hasbro and Mattel dominate licensed character toys, while Lego maintains strength in construction sets that promote learning through play. Spin Master continues to expand its reach through digital integration and cross-media franchises. Local manufacturers such as Takara Tomy and Bandai Co., Ltd. reinforce market depth with culturally rooted product lines. The competitive landscape emphasizes innovation, sustainability, and franchise collaboration to sustain market share and profitability.

Recent Developments:

- In September 2025, Hasbro expanded its partnership with Disney by launching Play-Doh products themed after Disney Jr. Mickey Mouse Clubhouse characters.

- In June 2025, Mattel unveiled a strategic partnership with OpenAI to develop AI-powered toys and experiences, with first product launches projected for later in 2025.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Age Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan Toy Market will keep shifting toward adult collectors and hobby buyers. Premium figures and limited runs will stay in focus.

- Sustainability will shape product design. Brands will adopt recycled plastics, low-waste packaging, and traceable sourcing to meet buyer expectations.

- Tech-integrated play will grow. Smart toys that link with AR, apps, and gaming ecosystems will drive engagement with older kids.

- STEM and learning toys will gain more share. Parents will continue to choose products that build problem-solving, logic, and creativity.

- E-commerce will expand reach nationwide. Direct-to-consumer online channels will help niche brands compete with legacy retail.

- Licensed IP will stay powerful. Anime, gaming, and film-linked toys will guide launch calendars and cross-media marketing.

- Local players will deepen partnerships with global studios. Co-branded lines will shorten time from screen debut to toy shelf.

- Demographic pressure will push companies to serve wider age brackets. Adult wellness, desk toys, and stress-relief play will see stronger positioning.

- Retailers will lean on exclusives and loyalty programs. In-store events, capsule drops, and bundled sets will protect foot traffic.

- Export potential will strengthen. Japan-origin characters and craft-style toys will gain more presence in North America and Europe.