Market Overview

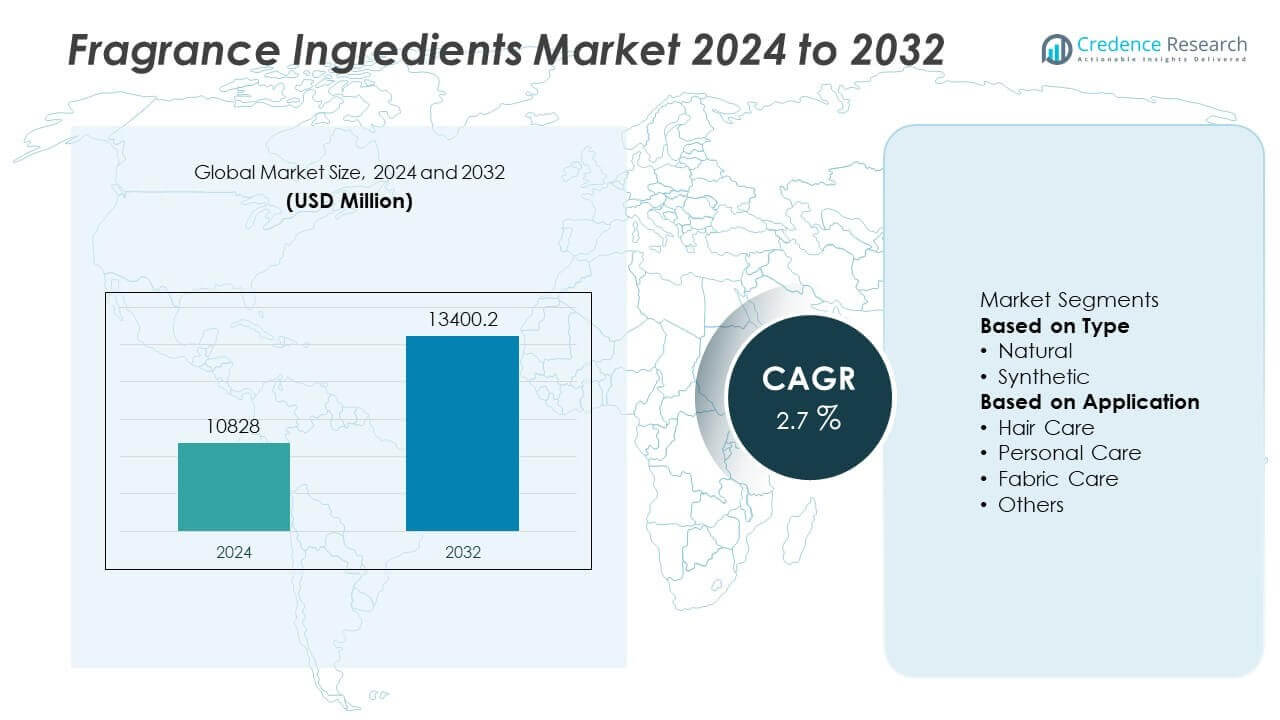

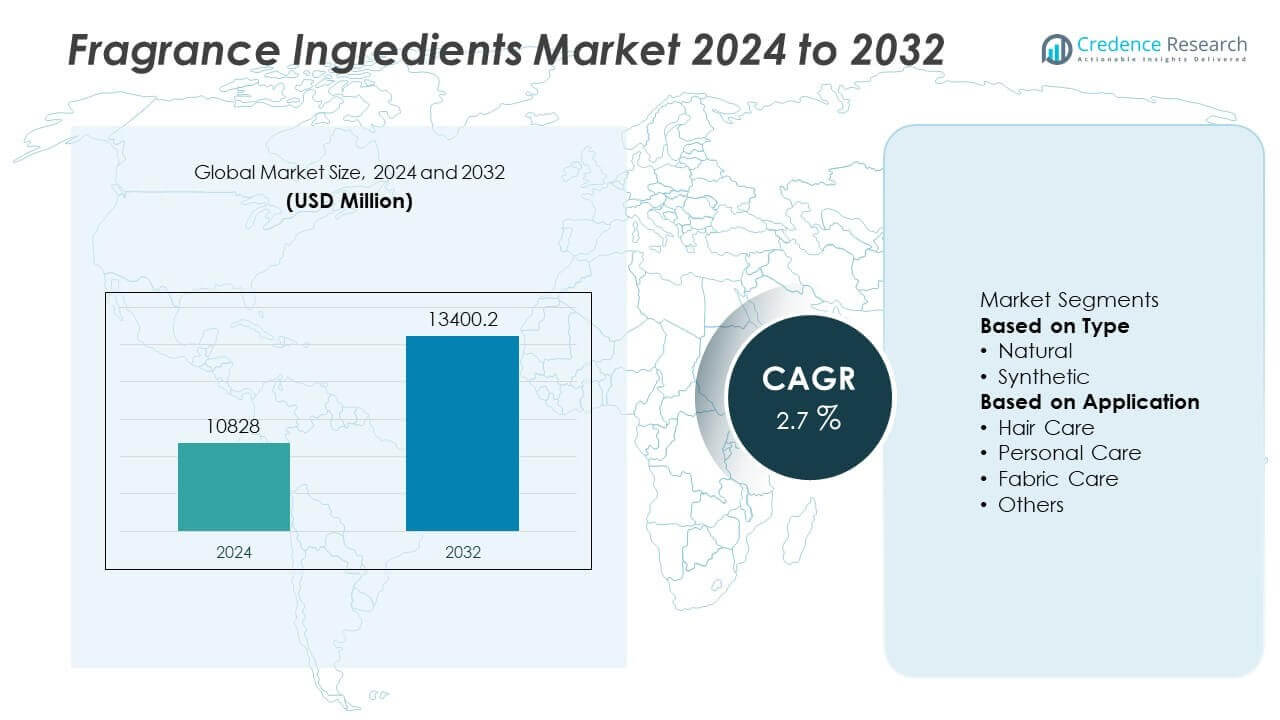

The fragrance ingredients market was valued at USD 10,828 million in 2024 and is projected to reach USD 13,400.2 million by 2032, growing at a CAGR of 2.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fragrance Ingredients Market Size 2024 |

USD 10,828 Million |

| Fragrance Ingredients Market, CAGR |

2.7% |

| Fragrance Ingredients Market Size 2032 |

USD 13,400.2 Million |

Fragrance Ingredients Market grows with rising demand for natural, clean-label, and sustainable formulations across personal care, cosmetics, and home care sectors. Consumers seek safer products with transparent ingredient lists, driving investments in plant-based and bio-derived aroma molecules.

Fragrance Ingredients Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with Europe leading due to its rich perfumery heritage and strict regulatory standards that drive innovation in safe and sustainable formulations. North America benefits from advanced R&D facilities and growing demand for clean-label, natural, and hypoallergenic products, while Asia-Pacific experiences rapid growth supported by urbanization, rising disposable incomes, and expanding personal care consumption. Latin America and Middle East & Africa witness increasing demand for fine fragrances, deodorants, and traditional scents, creating opportunities for global and regional suppliers. Key players such as Givaudan, Mane SA, Firmenich SA, and International Flavors & Fragrances Inc. focus on launching bio-based aroma molecules, expanding production capacity, and enhancing digital fragrance design platforms to meet evolving customer needs. Collaborations with local brands and investments in sustainable solutions strengthen their competitive positioning across these diverse regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Fragrance Ingredients Market was valued at USD 10,828 million in 2024 and is projected to reach USD 13,400.2 million by 2032, growing at a CAGR of 2.7%.

- Demand for natural, clean-label, and bio-based ingredients drives adoption across personal care, cosmetics, and home care products.

- Trends show rising popularity of niche perfumes, personalized fragrances, and sustainable formulations supported by green chemistry and biotech solutions.

- Competition remains strong with global leaders such as Givaudan, Firmenich SA, Mane SA, and International Flavors & Fragrances Inc. investing in innovation and expanding their portfolios.

- Price volatility of essential oils and petrochemical-derived aroma chemicals creates supply chain pressure and impacts margins for manufacturers.

- Europe leads in innovation and regulatory compliance, while Asia-Pacific shows the fastest growth with expanding middle-class demand and rising personal care consumption.

- Opportunities emerge from e-commerce expansion, increasing wellness product sales, and growing preference for eco-certified and biodegradable fragrance solutions worldwide.

Market Drivers

Rising Demand for Premium and Natural Fragrances

Fragrance Ingredients Market grows with increasing consumer preference for premium and natural formulations. Rising awareness of health and wellness encourages brands to use plant-based and bio-derived ingredients. Consumers seek products that avoid synthetic chemicals and allergens, driving demand for safe and transparent labels. Brands invest in natural essential oils, botanical extracts, and biodegradable compounds to meet these needs. The shift strengthens partnerships between suppliers and fragrance houses to create clean and sustainable solutions. It supports product differentiation in competitive beauty and personal care markets.

- For instance, The Robertet Group is a leading supplier of natural raw materials, including organic essential oils, sourced globally. This includes key sourcing activities in Grasse, France, where the company is headquartered, and Madagascar, where it specifically produces ingredients like Ylang-Ylang. The company’s ingredients and products are designed to be IFRA-compliant and feature processes to reduce allergens, such as its patented cleanRscent line of hexane-residue-free absolutes.

Expanding Applications Across Multiple Industries

Fragrance Ingredients Market benefits from its use in personal care, home care, and fine fragrances. Rising demand for air fresheners, detergents, and cosmetics fuels consumption of specialty aroma chemicals. Growth in household cleaning products and luxury perfumes supports stable ingredient demand. The market serves food and beverage sectors through flavor-enhancing ingredients for functional products. It also attracts interest from aromatherapy brands targeting relaxation and wellness segments. This broad application base ensures steady revenue streams for suppliers.

- For instance, T. Hasegawa provides more than 12,000 custom flavor and fragrance products for global food and beverage brands, offering a “high-mix, low-volume” approach. The company’s portfolio covers both sweet and savory applications and emphasizes responsiveness to customer needs.

Innovation in Sustainable and Biodegradable Solutions

Fragrance Ingredients Market advances with strong focus on sustainability and green chemistry. Companies develop biodegradable fixatives, bio-based solvents, and low-VOC compounds to meet regulatory expectations. It drives R&D investments into renewable feedstocks and energy-efficient production methods. Brands adopt eco-certified and IFRA-compliant ingredients to appeal to environmentally conscious consumers. Suppliers prioritize circular economy practices, including waste reduction and recycling initiatives. These innovations help manufacturers maintain compliance and gain a competitive edge.

Regulatory Compliance and Quality Standardization

Fragrance Ingredients Market is influenced by strict global regulations and quality standards. Governments enforce REACH, IFRA, and FDA guidelines to ensure consumer safety. It compels producers to maintain transparent sourcing and traceability across supply chains. Brands implement rigorous quality testing to reduce risk of allergens or harmful chemicals. Compliance supports trust among end users and retailers. Strong adherence to standards safeguards market reputation and encourages sustainable growth.

Market Trends

Market Trends

Shift Toward Clean Label and Transparency

Fragrance Ingredients Market shows a strong trend toward clean-label and transparent formulations. Consumers want detailed ingredient disclosure and safer options for daily use. Brands focus on allergen-free, phthalate-free, and paraben-free formulations to meet this demand. It encourages suppliers to invest in traceability and clear labeling practices. Retailers promote products with sustainability certifications to gain customer trust. This shift drives competition toward innovation in safe and natural fragrance molecules.

- For instance, in June 2024, International Flavors & Fragrances Inc. (IFF) unveiled three new ingredients, including a single new fragrance molecule called Ylanganate. In general, IFF and its LMR Naturals division focus on producing sustainable, IFRA-compliant, and phthalate-free ingredients

Growing Popularity of Niche and Personalized Scents

Fragrance Ingredients Market benefits from rising interest in niche and customized perfumes. Consumers seek unique scents that reflect individuality and lifestyle. Perfume houses develop limited-edition blends using rare and exotic ingredients. It supports small and artisanal fragrance brands in gaining market presence. Luxury brands expand personalization services, allowing customers to create signature fragrances. This trend strengthens demand for specialty aroma chemicals and natural extracts.

- For instance, in 2025, fragrance house Mane SA expanded its ingredient portfolio by launching new innovative extracts like ANTILLONE™, a 100% natural fruit ketone, and showcasing products that use its proprietary PURE JUNGLE ESSENCE™ technology, which is manufactured at its facilities including the Bar-sur-Loup site.

Adoption of Green Chemistry and Biotech Solutions

Fragrance Ingredients Market embraces green chemistry and biotechnology to meet sustainability goals. Companies use fermentation and enzyme-based processes to create bio-identical aroma molecules. It helps reduce reliance on petrochemical sources and lowers carbon footprint. Suppliers explore renewable feedstocks to ensure stable supply and cost efficiency. Brands highlight bio-based content on labels to attract eco-conscious consumers. These advances improve product safety and regulatory compliance.

Integration of Digital Tools in Fragrance Creation

Fragrance Ingredients Market is witnessing digital transformation in product design and testing. AI and data analytics help perfumers predict consumer preferences and create better blends. It accelerates the formulation process and shortens time-to-market for new products. Virtual reality tools enable customers to explore fragrance profiles online. Digital platforms allow faster collaboration between suppliers and fragrance houses. This adoption of technology enhances efficiency and product innovation.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

Fragrance Ingredients Market faces challenges due to fluctuating raw material costs and unstable supply chains. Natural ingredients like essential oils depend on agricultural yields, which vary with climate conditions. Price spikes for petrochemical-derived aroma compounds affect profit margins for manufacturers. It creates uncertainty for producers who must balance cost control with quality. Global logistics delays and geopolitical tensions add further complexity to sourcing. Companies invest in supplier diversification and inventory management to reduce these risks. Maintaining consistent quality while managing costs remains a key concern.

Regulatory Compliance and Allergen Restrictions

Fragrance Ingredients Market is impacted by stringent regulatory frameworks and evolving allergen guidelines. IFRA standards, REACH rules, and FDA requirements limit the use of several fragrance compounds. It forces companies to reformulate products and conduct extensive safety testing. These changes raise development costs and slow product launches. Brands face challenges in communicating compliance while maintaining scent performance. Small manufacturers struggle with the high cost of certification and documentation. Meeting global compliance while staying competitive requires significant investment in R&D and regulatory expertise.

Market Opportunities

Rising Demand for Sustainable and Bio-Based Ingredients

Fragrance Ingredients Market holds strong opportunities through the shift toward sustainable and bio-based solutions. Consumers prefer eco-friendly products with minimal environmental impact, driving adoption of renewable ingredients. It motivates suppliers to invest in plant-derived aroma molecules and biodegradable compounds. Brands highlight sustainability credentials to build loyalty and attract conscious buyers. Growing interest in carbon-neutral manufacturing creates scope for innovation in production processes. This trend allows manufacturers to differentiate offerings and expand into premium segments.

Expansion in Emerging Economies and E-Commerce Channels

Fragrance Ingredients Market gains growth potential from rising disposable incomes in Asia-Pacific, Latin America, and Middle East & Africa. Urbanization and lifestyle changes increase demand for personal care, cosmetics, and home care products. It opens new opportunities for suppliers to partner with local brands and formulators. E-commerce platforms accelerate product reach and support niche fragrance launches. Digital marketing and direct-to-consumer models enable faster market penetration. These opportunities encourage global players to expand operations and strengthen regional distribution networks.

Market Segmentation Analysis:

By Type

Fragrance Ingredients Market is segmented by type into essential oils, aroma chemicals, and synthetic ingredients. Essential oils dominate demand due to rising consumer interest in natural and plant-based solutions. Brands in personal care and aromatherapy use essential oils to promote wellness and relaxation. It also benefits from clean-label trends and preference for allergen-free formulations. Aroma chemicals play a critical role in delivering consistent and long-lasting scents for perfumes and household products. Synthetic ingredients remain relevant due to cost efficiency and ability to replicate rare natural aromas. The balance between natural and synthetic ingredients drives product innovation across the industry.

- For instance, doTERRA sources its lavender and peppermint oils through its Co-Impact Sourcing initiative, partnering with local growers in over 45 countries to supply its network of over 10 million customers and distributors worldwide. The company achieved annual sales of over $2 billion in 2024 through this direct-to-consumer model.

By Application

Fragrance Ingredients Market by application covers personal care, fine fragrances, home care, and cosmetics. Personal care leads adoption, driven by shampoos, soaps, and deodorants that rely on signature scents for brand identity. Fine fragrances represent a premium segment, using rare and high-quality ingredients to create luxury perfumes. It attracts steady demand from both niche perfume houses and global players. Home care products such as air fresheners, detergents, and candles contribute significantly to volume sales. Cosmetics use fragrance ingredients to enhance product appeal and consumer experience. Growth across these applications supports steady demand for both natural and specialty fragrance compounds, sustaining overall market expansion.

- For instance, S H Kelkar & Co. did experience business expansion and reported growth in its fragrance segment in both domestic and international markets in 2024. During this time, the company expanded its international operations by establishing a new subsidiary in Germany and another in the U.S., while also preparing to commission a new factory in Indonesia.

Segments:

Based on Type

Based on Application

- Hair Care

- Personal Care

- Fabric Care

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 28% market share in the Fragrance Ingredients Market, driven by strong demand for premium perfumes, cosmetics, and home care products. The region benefits from well-established fragrance houses and multinational personal care brands headquartered in the U.S. and Canada. It sees rising adoption of clean-label and natural fragrance formulations, reflecting consumer focus on safety and sustainability. Strict regulatory frameworks, including FDA and IFRA guidelines, ensure high product quality and compliance across supply chains. It encourages manufacturers to invest in transparent sourcing and innovative ingredients. Growth in e-commerce and direct-to-consumer fragrance brands strengthens accessibility and market penetration. The region continues to prioritize R&D for biodegradable and hypoallergenic fragrance solutions to cater to evolving preferences.

Europe

Europe accounts for 32% market share, making it the leading region for the Fragrance Ingredients Market. The region is home to several global fragrance and flavor giants and benefits from centuries of expertise in perfumery. Strong demand for luxury perfumes, artisanal scents, and eco-certified products drives steady growth. It also faces strict REACH regulations and IFRA standards, pushing suppliers toward safer, low-allergen formulations. Consumer interest in sustainable and traceable ingredients leads to significant investment in bio-based chemistry. Markets such as France, Germany, and the U.K. lead innovation in niche fragrance offerings and support export demand globally. The region remains a hub for fragrance research, sustainability initiatives, and creative product development.

Asia-Pacific

Asia-Pacific captures 24% market share, representing one of the fastest-growing regions for the Fragrance Ingredients Market. Rising disposable incomes, rapid urbanization, and growing personal care adoption fuel demand for fragrances across China, India, Japan, and Southeast Asia. Local brands expand product portfolios, while international companies increase investments in regional manufacturing and partnerships. It benefits from expanding retail infrastructure, with strong growth in e-commerce and specialty beauty stores. Demand for natural and plant-based ingredients is rising, particularly among younger consumers seeking safer alternatives. The market also gains traction from growth in wellness products and aromatherapy. With rising middle-class populations, Asia-Pacific is set to become a major driver of long-term market growth.

Latin America

Latin America holds 9% market share, supported by growing demand for affordable perfumes, deodorants, and household care products. Brazil and Mexico lead consumption due to strong cultural affinity for fragrances. It experiences increasing adoption of mid-range and premium scents, driven by rising disposable incomes. Local manufacturers collaborate with global fragrance houses to introduce new and innovative formulations. Distribution channels expand through supermarkets, specialty retailers, and online platforms, improving access to diverse product lines. Consumers show interest in sustainable and natural ingredients, pushing brands to adjust portfolios. The region’s expanding young population supports steady fragrance consumption across categories.

Middle East & Africa

Middle East & Africa represents 7% market share, characterized by a deep-rooted cultural tradition of fragrance use. Demand for concentrated perfumes, attars, and incense products remains robust across GCC countries. It sees growing interest in luxury and niche fragrances, attracting international perfume brands to expand presence. Increasing tourism, rising incomes, and development of modern retail formats contribute to steady growth. Suppliers focus on sourcing natural ingredients aligned with regional preferences for oud, musk, and amber-based scents. Local production facilities are expanding to reduce dependence on imports and meet domestic demand. The region continues to offer long-term growth potential through premiumization and tailored product offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mane SA

- Kalpsutra Chemicals Pvt. Ltd.

- Robertet Group

- BASF SE

- Firmenich SA (Sentarom SA)

- Hasegawa Co. Ltd.

- S H Kelkar & Co. Limited

- Fine Fragrance Pvt. Ltd

- Givaudan

- International Flavors & Fragrances Inc.

Competitive Analysis

Competitive landscape of the Fragrance Ingredients Market is shaped by leading players such as Givaudan, Firmenich SA, International Flavors & Fragrances Inc., Mane SA, BASF SE, Robertet Group, S H Kelkar & Co. Limited, T.Hasegawa Co. Ltd., Fine Fragrance Pvt. Ltd, and Kalpsutra Chemicals Pvt. Ltd. These companies compete through innovation, sustainable product development, and global distribution strength. They focus on expanding their portfolios with bio-based aroma molecules, biodegradable fixatives, and low-allergen formulations to meet clean-label and regulatory demands. Strategic investments in R&D enable them to leverage green chemistry, biotechnological synthesis, and advanced extraction techniques for consistent quality and cost efficiency. Partnerships with personal care, cosmetics, and home care brands help strengthen supply chain relationships and secure long-term contracts. Many players adopt digital platforms for fragrance design, predictive analytics, and consumer trend mapping to reduce time-to-market. Expansion into emerging regions and capacity upgrades support growing demand while maintaining competitive positioning worldwide.

Recent Developments

- In September 2025, Givaudan unveiled Labdanum Absolute SIGNATURE, a new natural ingredient derived from hand-harvested cistus plants in Andalusia, Spain.

- In August 2025, T. Hasegawa USA introduced HASECITRUS, a natural technology to stabilize citrus flavors in beverages to resist oxidation.

- In April 2025, Mane SA developed ANTILLONE™, a 100 % natural ketone with a bold fruity signature.

- In March 2025, BASF SE launched Isobionics® Natural beta-Sinensal 20 and alpha-Humulene 90, fermentation-based aroma/flavor ingredients.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and bio-based fragrance ingredients will continue to rise globally.

- Clean-label and allergen-free product formulations will become standard across industries.

- Biotechnology and green chemistry will play a key role in ingredient innovation.

- Personalized and niche fragrances will drive growth in premium and specialty segments.

- Digital fragrance design tools will speed up product development and customization.

- Sustainability and carbon-neutral production will gain priority for manufacturers.

- Emerging economies will witness rapid growth in personal care and home care demand.

- Strategic partnerships between global suppliers and local brands will expand distribution reach.

- Regulatory compliance will drive continuous reformulation and safer product development.

- Investment in R&D and capacity expansion will strengthen competitive positions worldwide.

Market Trends

Market Trends