Market Overview:

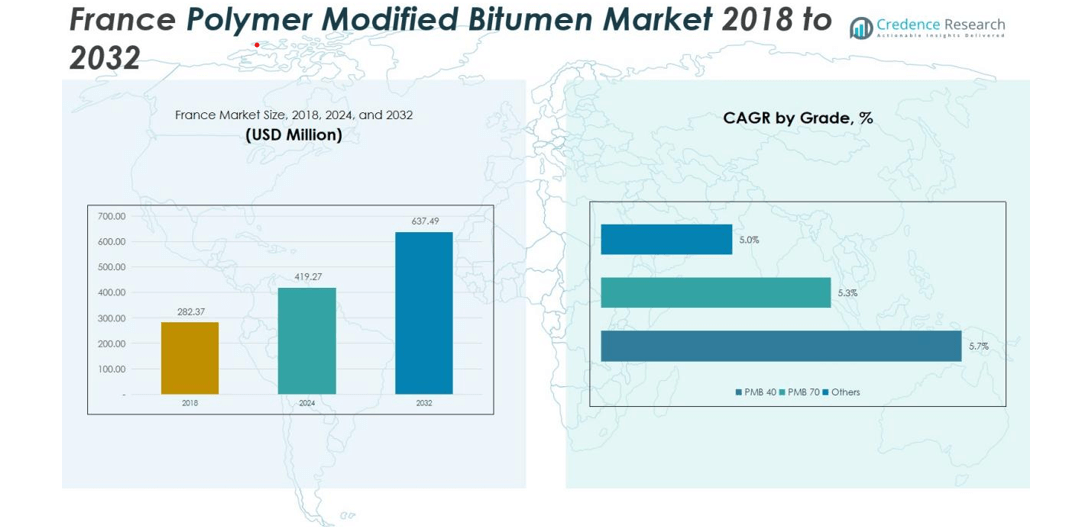

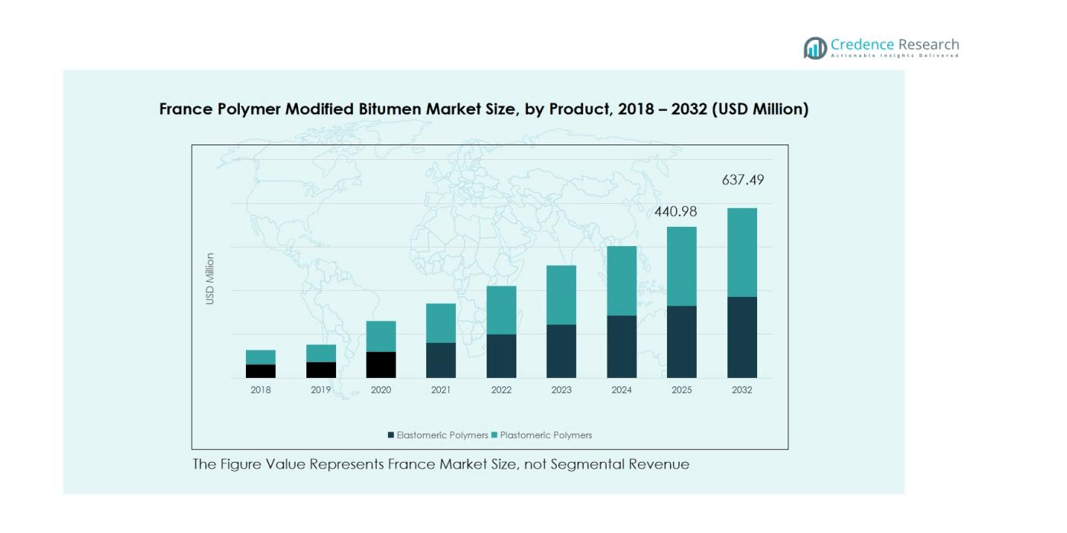

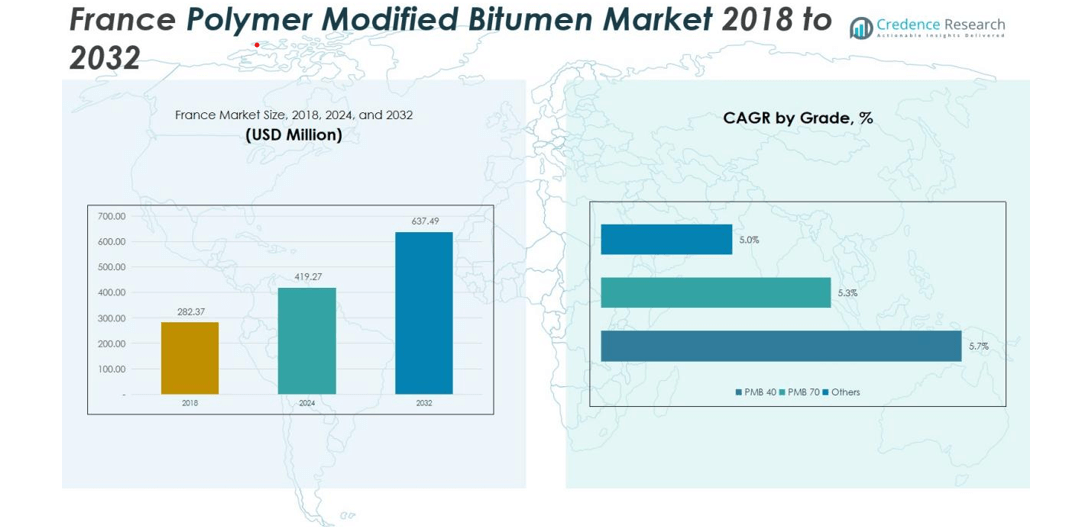

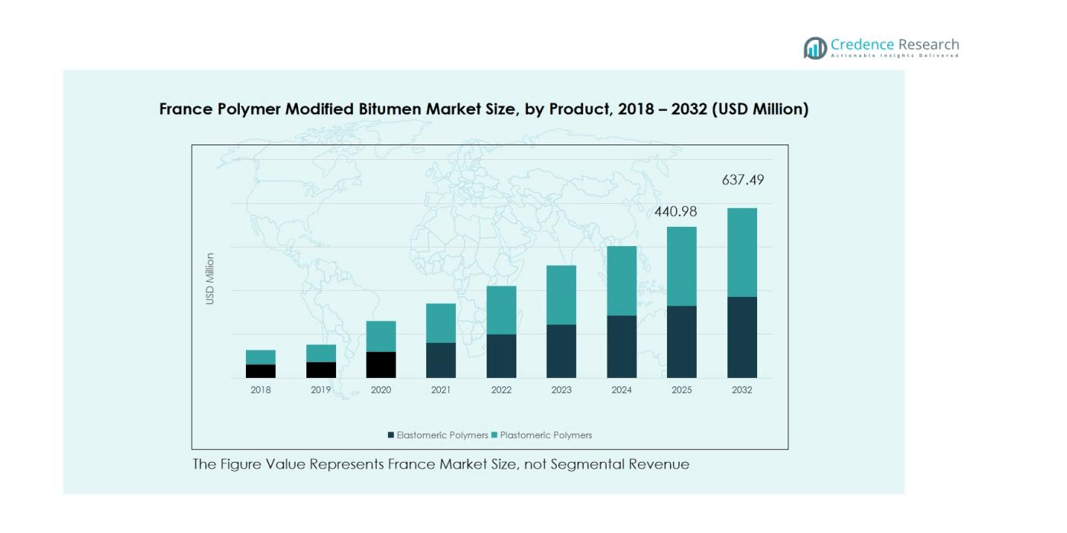

The France Polymer Modified Bitumen Market size was valued at USD 282.37 million in 2018 to USD 419.27 million in 2024 and is anticipated to reach USD 637.49 million by 2032, at a CAGR of 6.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Polymer Modified Bitumen Market Size 2024 |

USD 419.27 million |

| France Polymer Modified Bitumen Market, CAGR |

6.00% |

| France Polymer Modified Bitumen Market Size 2032 |

USD 637.49 million |

Market growth is primarily fueled by the rising need for long-lasting road surfaces capable of withstanding heavy traffic and changing climatic conditions. Polymer-modified bitumen (PMB) is preferred for its enhanced elasticity, resistance to cracking, and reduced maintenance needs. Growing emphasis on sustainable and energy-efficient construction practices has also increased the adoption of PMB in highway and airport projects. Further, initiatives supporting low-carbon infrastructure are influencing public and private sector demand for advanced asphalt materials.

Regionally, France remains one of Western Europe’s key contributors to the PMB market. Its aging road network and urban expansion projects create recurring opportunities for pavement rehabilitation and new construction. The nation’s commitment to environmental sustainability and technological innovation strengthens its regional competitiveness in advanced road materials.

Market Insights:

- The France Polymer Modified Bitumen Market was valued at USD 282.37 million in 2018, reached USD 419.27 million in 2024, and is projected to attain USD 637.49 million by 2032, growing at a CAGR of 6.00% during the forecast period.

- Western France held the largest share of 38% in 2024, supported by coastal infrastructure upgrades and major highway projects, while Northern France followed with 27% due to dense transport corridors and industrial development.

- Central France accounted for 18% share, driven by strong government investment in road rehabilitation and smart urban mobility programs.

- Southern France, with a 10% share, is the fastest-growing region owing to airport expansion, population growth, and rising demand for heat-resistant bitumen grades.

- By product, elastomeric polymers captured 64% share led by SBS-based formulations, while plastomeric polymers held 36% share, supported by growing applications in roofing and waterproofing systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expanding Road Infrastructure and Urban Development Programs

The France Polymer Modified Bitumen Market benefits from the country’s expanding infrastructure and urban development plans. The government continues to prioritize investments in highways, bridges, and airport runways to support economic growth. Large-scale projects such as the Grand Paris Express and national road maintenance initiatives have increased the demand for durable and high-performance bitumen. It plays a vital role in meeting France’s growing need for long-lasting and weather-resistant pavements. This sustained infrastructure spending ensures steady market growth across the construction sector.

- For instance, the Grand Paris Express project utilizes advanced construction techniques and materials throughout its extensive works, including the use of high-quality steel rails and concrete sleepers for its tracks. The Line 18 route will span approximately 33 to 35 kilometers.

Rising Demand for High-Performance and Sustainable Materials

The market experiences growing demand for materials that extend road lifespan and reduce repair frequency. Polymer-modified bitumen offers superior elasticity, flexibility, and crack resistance compared to conventional bitumen. The shift toward sustainable materials that reduce energy consumption and carbon emissions further supports adoption. Contractors and municipalities prefer PMB for its ability to withstand temperature variations and heavy traffic. It aligns with France’s environmental goals, which encourage the use of eco-friendly construction products.

- For instance, in 2025, TotalEnergies introduced its Styrelf ECO2 polymer-modified binder range in France, enabling asphalt mixing at temperatures reduced by up to 30°C while maintaining performance standards; this advancement reportedly lowered energy use during road surfacing by approximately 15% across pilot projects in Normandy and Brittany.

Government Initiatives for Road Safety and Quality Standards

France has strengthened its national road safety and quality regulations to ensure reliable transport infrastructure. Government agencies emphasize road surface durability, skid resistance, and load-bearing performance. These standards drive the adoption of advanced bitumen blends designed for better adhesion and performance consistency. The market benefits from mandatory compliance with EU infrastructure quality norms. It continues to expand through the government’s commitment to improving public safety and transport efficiency.

Technological Advancements and Local Manufacturing Expansion

Technological innovation in polymer modification and blending techniques supports market efficiency and competitiveness. French manufacturers invest in advanced production facilities to improve bitumen consistency and polymer integration. Collaboration between research institutions and industry players fosters product innovation suited to local climate conditions. It enables the development of PMB with customized formulations for regional needs. The growing domestic supply chain and innovation focus enhance France’s leadership in the European PMB landscape.

Market Trends:

Growing Adoption of Eco-Friendly and High-Performance Road Materials

The France Polymer Modified Bitumen Market is witnessing a growing shift toward sustainable and high-performance road surfacing materials. Construction companies and public authorities increasingly favor PMB due to its recyclability, energy efficiency, and reduced environmental footprint. The use of bio-based polymers and recycled additives is gaining traction to align with France’s carbon reduction and circular economy goals. It is being integrated into green infrastructure projects where long-term durability and environmental compliance are key. The emphasis on reducing maintenance cycles and lifecycle costs has reinforced PMB’s value in public tenders. Contractors are focusing on greener production methods to meet strict environmental standards. The move toward low-emission materials continues to strengthen the market’s sustainability-driven transformation.

- For instance, Eurovia developed the TRX100% mobile continuous asphalt plant in partnership with Marini-Ermont. The TRX100% plant was used on a 1-kilometer section of the A10 motorway between Pons and Saint-Aubin in October 2018 to successfully produce asphalt containing up to 100% recycled aggregates.

Technological Integration and Growing Role of Performance-Based Specifications

Rapid technological advancements in polymer chemistry and material testing are reshaping the market. The France Polymer Modified Bitumen Market benefits from innovations such as advanced polymer blends, nano-modifiers, and performance-based specifications (PBS). It allows producers to customize formulations for specific temperature ranges, traffic conditions, and load requirements. Road authorities are adopting PBS frameworks to ensure consistent pavement performance across varying climates. The use of smart quality control systems and predictive testing tools is improving product reliability and traceability. Manufacturers are also investing in digitalized production and automation to enhance efficiency and consistency. The integration of data-driven quality assurance and smart testing practices marks a key evolution in the country’s bitumen industry.

- For instance, TotalEnergies developed its Styrelf polymer-modified bitumen range through over 35 years of collaboration with the French Roads Administration Laboratory, achieving production and global sales of more than 20 million metric tons

Market Challenges Analysis:

High Production Costs and Raw Material Price Volatility

The France Polymer Modified Bitumen Market faces challenges linked to high production costs and unstable raw material prices. The polymers used in modification, such as SBS and EVA, depend heavily on crude oil derivatives, making the market sensitive to global oil price fluctuations. It increases operational expenses for manufacturers and limits pricing flexibility for contractors. Smaller producers struggle to maintain margins while meeting quality and regulatory standards. Import dependence for certain additives adds cost pressure and supply risks. Frequent price variations affect project budgeting for road and infrastructure developers. Managing cost efficiency while maintaining performance remains a critical challenge for the industry.

Regulatory Compliance and Environmental Constraints

The market operates under strict environmental and safety regulations set by French and EU authorities. It must comply with emission standards, recycling mandates, and waste management norms that require continuous investment in technology upgrades. Smaller companies often find these regulatory demands difficult to meet due to limited financial and technical capacity. Environmental audits and certification requirements extend project approval timelines. Strict rules on bitumen handling and polymer content also constrain manufacturing flexibility. The need for cleaner production and waste reduction technologies adds to capital costs. Compliance pressure continues to challenge both producers and contractors in the PMB sector.

Market Opportunities:

Rising Focus on Green Infrastructure and Recycled Bitumen Solutions

The France Polymer Modified Bitumen Market presents strong opportunities through the shift toward sustainable and recycled construction materials. France’s commitment to low-carbon infrastructure is encouraging the use of reclaimed asphalt pavement and polymer blends with reduced emissions. It supports government-funded initiatives focused on eco-friendly road networks and long-lasting materials. Research into bio-based and renewable polymer alternatives is gaining traction across universities and industrial labs. Manufacturers can benefit from offering PMB formulations designed for circular economy projects. Growing public awareness of sustainability standards is creating a favorable environment for environmentally responsible bitumen suppliers. The transition to green road construction opens a scalable growth path for domestic producers.

Expansion in Regional Infrastructure and Airport Modernization Projects

Upcoming national and regional projects across France offer new opportunities for PMB adoption. The France Polymer Modified Bitumen Market is expected to gain from increased airport runway expansions, port connectivity projects, and smart city developments. It aligns with the government’s plan to enhance logistics and transportation efficiency. The demand for high-performance materials that can endure heavy traffic and weather variation will continue to grow. Partnerships between public agencies and private contractors can help accelerate PMB integration into future projects. The expansion of transport corridors in Northern and Western France provides additional avenues for revenue growth. Infrastructure renewal under EU funding frameworks further supports the long-term opportunity landscape.

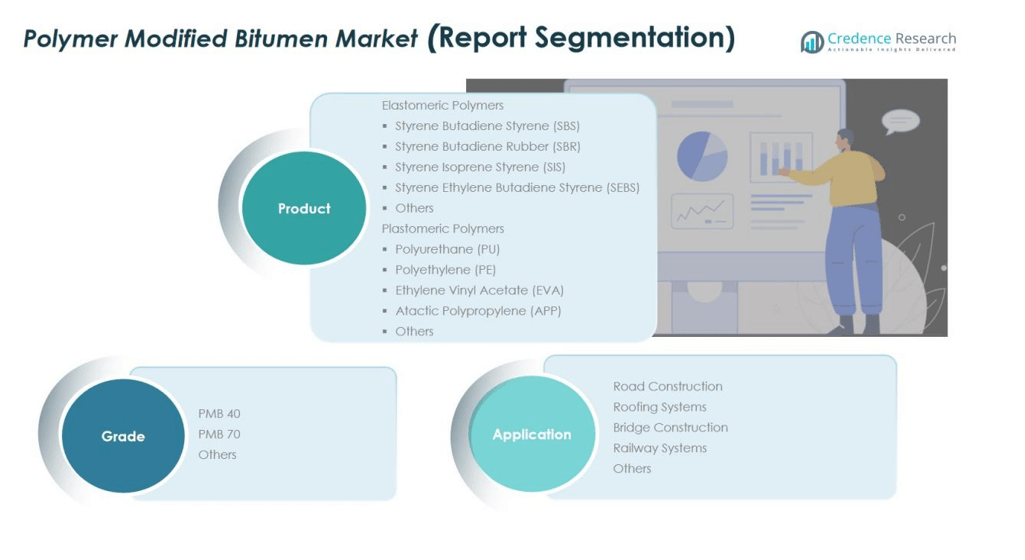

Market Segmentation Analysis:

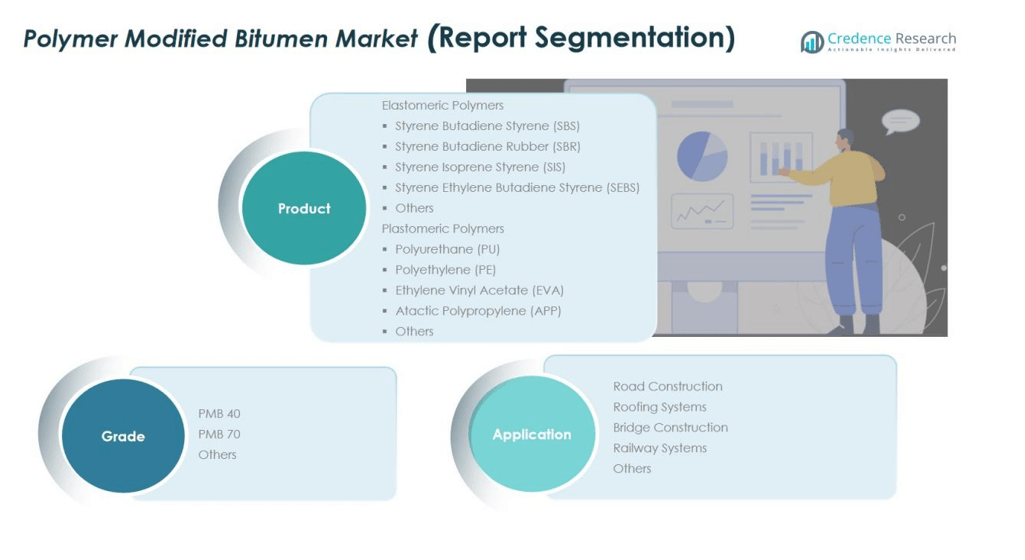

By Product

The France Polymer Modified Bitumen Market is segmented into elastomeric and plastomeric polymers. Elastomeric polymers, including SBS and SBR, dominate due to their superior flexibility and resistance to fatigue cracking. These materials are widely used in road construction and bridge applications where temperature variation is common. Plastomeric polymers, such as EVA and APP, are gaining preference for roofing and waterproofing applications because of their high stiffness and thermal stability. It continues to see innovation in polymer formulations aimed at improving weather tolerance and durability. The growing demand for long-life materials supports steady expansion in both polymer categories.

- For Instance, SBS-modified bitumen formulations used in the High Coast Bridge in Sweden achieved an elastic recovery of 95% at 10°C in the original state and maintained 85% elastic recovery after RTFOT aging, with a Fraass breaking point of -25°C, ensuring exceptional performance over 15 years of service with minimal rutting despite approximately 17,000 vehicles per day crossing the bridge.

By Grade

The market is categorized into PMB 40, PMB 70, and others, with PMB 40 holding a significant share due to its adaptability in moderate climatic conditions. PMB 70 is preferred in heavy-load roads and high-temperature regions for its enhanced rutting resistance. It benefits from consistent infrastructure upgrades requiring advanced material performance. The ongoing standardization of road specifications across France strengthens demand for high-grade PMB variants. The balance between cost-effectiveness and technical performance defines purchasing patterns among contractors.

- For Instance, VINCI Construction commenced initial work on the A69 highway project in southern France, a project that had been in planning for years. The project quickly met with fierce opposition from environmental activists, leading to widespread protests.

By Application

Key applications include road construction, roofing systems, bridge construction, railway systems, and others. Road construction remains the leading segment, supported by government-led highway modernization projects. Bridge and railway infrastructure use PMB for structural reinforcement and waterproofing benefits. Roofing applications are expanding due to rising adoption in commercial and industrial buildings. It demonstrates strong potential in maintenance and resurfacing projects across public infrastructure networks.

Segmentations:

By Product Type

By Elastomeric Polymers

- Styrene Butadiene Styrene (SBS)

- Styrene Butadiene Rubber (SBR)

- Styrene Isoprene Styrene (SIS)

- Styrene Ethylene Butadiene Styrene (SEBS)

- Others

By Plastomeric Polymers

- Polyurethane (PU)

- Polyethylene (PE)

- Ethylene Vinyl Acetate (EVA)

- Atactic Polypropylene (APP)

- Others

By Grade

By Application

- Road Construction

- Roofing Systems

- Bridge Construction

- Railway Systems

- Others

Regional Analysis:

Strong Market Presence Across Western and Northern France

The France Polymer Modified Bitumen Market shows strong dominance in Western and Northern regions due to dense transport networks and industrial activity. These areas host major highways, ports, and logistics hubs that demand high-performance road materials. It benefits from continuous maintenance and upgradation of urban and regional roadways connecting key economic centers. Northern France, including Normandy and Hauts-de-France, leads in heavy traffic infrastructure requiring durable and weather-resistant bitumen solutions. Western France’s coastal climate also drives the need for PMB formulations that resist moisture and temperature variation. The presence of established construction firms and bitumen suppliers supports steady regional demand growth.

Emerging Growth Opportunities in Southern and Central France

Southern and Central France are emerging growth zones driven by ongoing construction and smart city development. The France Polymer Modified Bitumen Market gains traction in these regions through public works projects focused on road expansion and sustainable urban mobility. It is supported by regional infrastructure budgets and public-private partnerships investing in advanced road materials. Cities such as Lyon, Marseille, and Toulouse are increasing PMB adoption in urban road rehabilitation and airport upgrades. Warm climatic conditions in southern regions promote demand for high-temperature-resistant PMB grades. The combination of population growth and urban modernization continues to strengthen market potential in these zones.

Infrastructure Renewal and Sustainability Focus in Eastern France

Eastern France is witnessing a growing shift toward sustainable infrastructure solutions integrating PMB in transport and industrial projects. The France Polymer Modified Bitumen Market benefits from EU-funded programs promoting green infrastructure and reduced maintenance costs. It supports rural and intercity connectivity projects, improving economic access across border regions with Germany and Switzerland. The regional preference for energy-efficient construction materials aligns with national sustainability policies. Manufacturers are expanding distribution networks to cater to infrastructure renewal and smart road projects. Eastern France is expected to contribute a rising share of market revenue through 2032.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The France Polymer Modified Bitumen Market features a moderately consolidated competitive landscape led by global and regional manufacturers. Key players include Roadway Solutions, Esha Strasse, FM Conway, CEPSA, MOL Group, NIS Group, and TotalEnergies. It is characterized by continuous innovation in polymer modification techniques, product quality, and sustainable formulations. Companies focus on enhancing production capacity and adopting eco-friendly processes to meet evolving construction standards. Strategic partnerships with government agencies and infrastructure developers strengthen market presence and distribution reach. Leading firms invest in R&D to develop high-performance PMB suited to France’s diverse climate conditions and regulatory demands. Competition remains centered on pricing efficiency, technical performance, and long-term material durability across transport and urban infrastructure projects.

Recent Developments:

- In July 2025, Roadway Solutions India Infra Limited formally proposed the acquisition of the same 25.02% stake in Soma Textiles & Industries Limited, marking the beginning of the acquisition process ahead of the September offer announcement.

- In August 2025, FM Conway was awarded Lots 2 and 3 of the Royal Borough of Kensington and Chelsea’s Highways Maintenance Contracts 2025, under which it will lead infrastructure upgrades and public works projects across key London districts.

Report Coverage:

The research report offers an in-depth analysis based on Product, Grade and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Polymer Modified Bitumen Market will experience consistent growth driven by infrastructure renewal and modernization projects.

- Government investments in road and transport infrastructure will continue to strengthen market demand.

- Sustainability goals will promote the use of recycled and bio-based polymers in bitumen production.

- Manufacturers will adopt advanced polymer blending technologies to improve performance and cost efficiency.

- Public-private partnerships will expand opportunities for PMB use in large-scale construction projects.

- Smart city initiatives and urban mobility programs will support steady application growth.

- The roofing and bridge construction segments will see rising demand for weather-resistant PMB materials.

- Domestic production capacity will expand through modernization of existing bitumen plants.

- Regional focus on low-carbon infrastructure will drive innovation in eco-friendly PMB formulations.

- Long-term growth will depend on regulatory alignment, cost management, and continued emphasis on road quality and sustainability.