Market Overview:

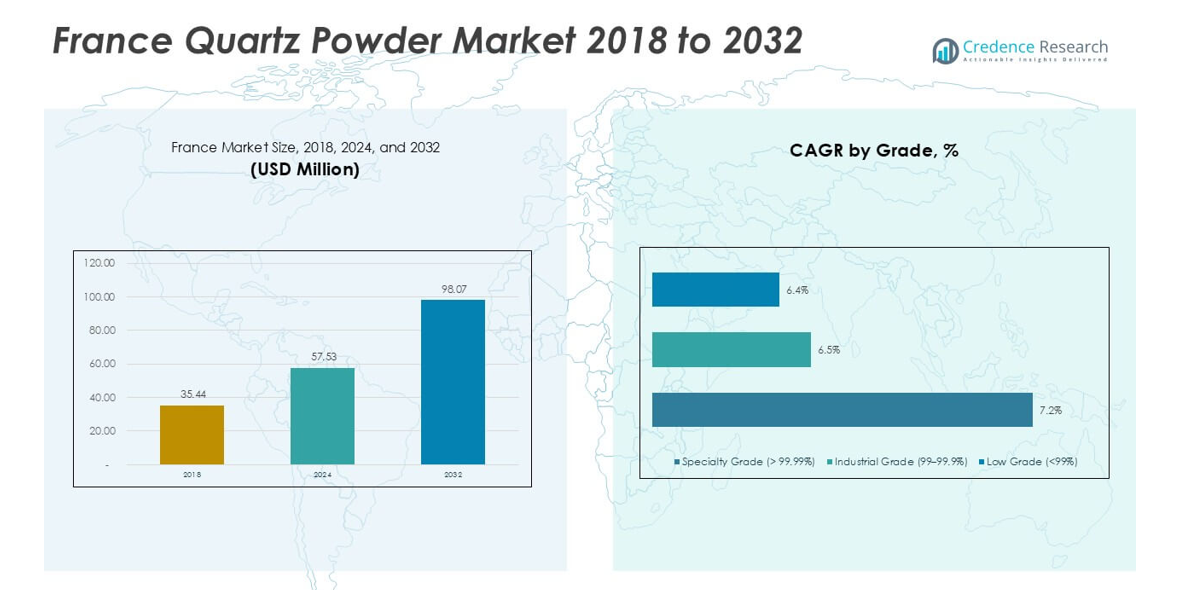

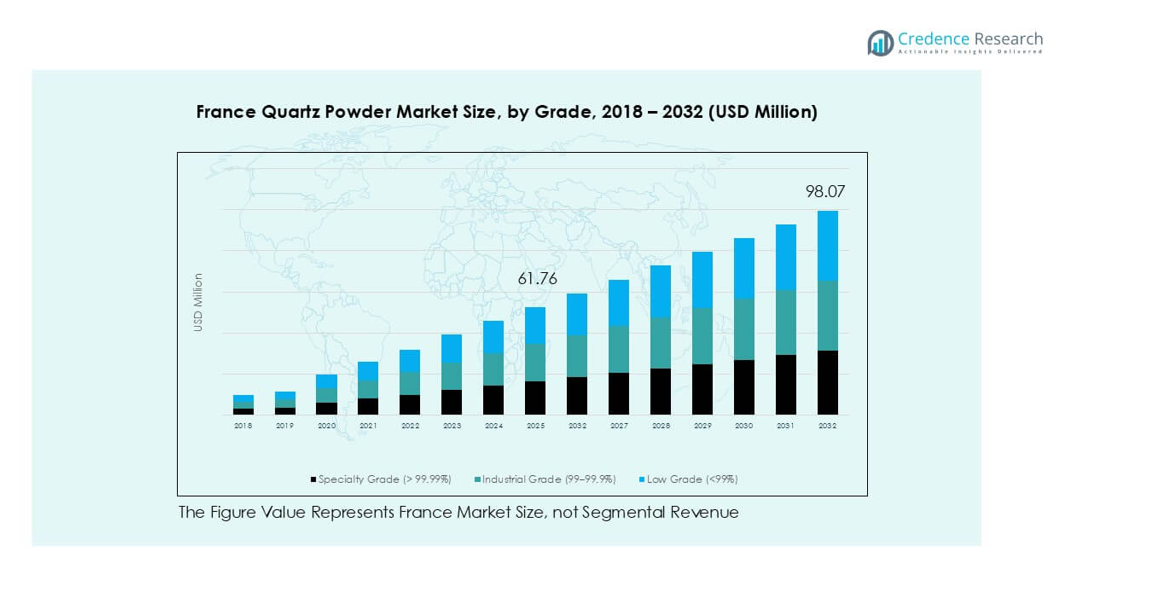

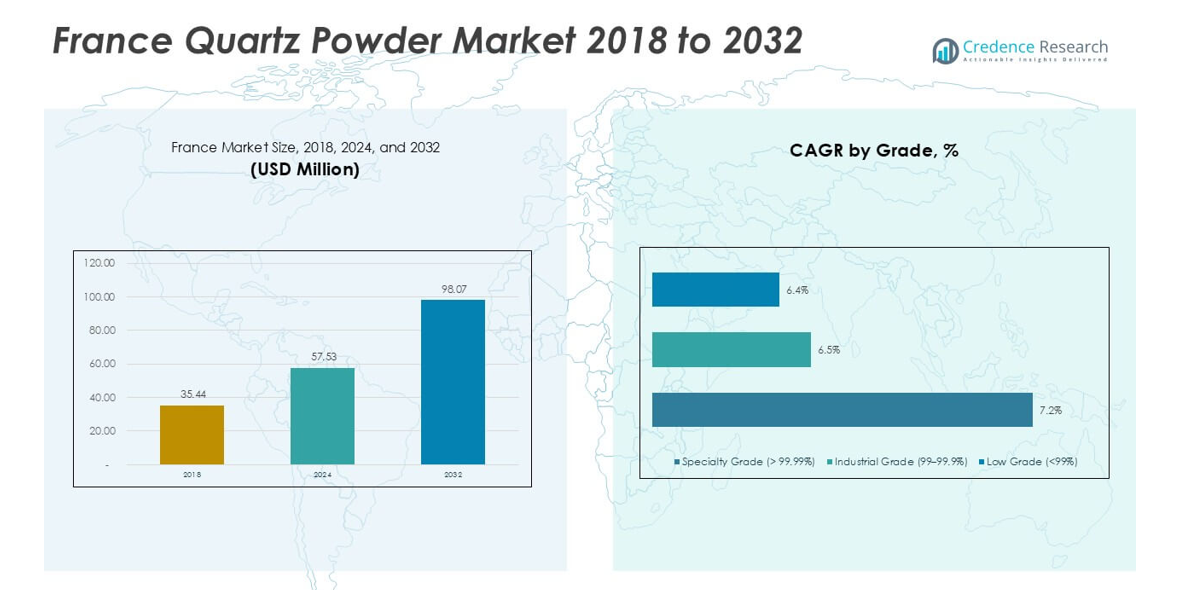

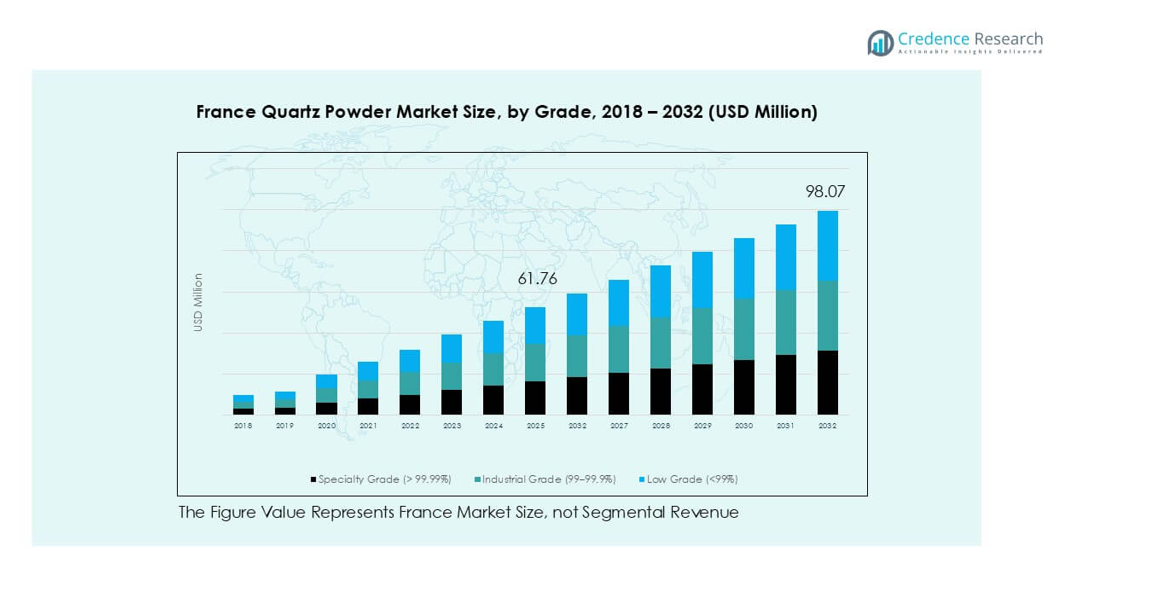

France Quartz Powder market size was valued at USD 35.44 million in 2018, reaching USD 57.53 million in 2024, and is anticipated to reach USD 98.07 million by 2032, at a CAGR of 7.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Powder Market Size 2024 |

USD 57.53 million |

| France Quartz Powder Market, CAGR |

7.02% |

| France Quartz Powder Market Size 2032 |

USD 98.07 million |

The France quartz powder market is led by key players such as Sibelco, Imerys S.A., Quarzwerke Group, ENDURA IPNR, and Eon Enterprises, supported by regional producers including The Sharad Group, Speciality Geochem, and PAL Quartz. These companies dominate through strong distribution networks, advanced refining technologies, and diversified end-use portfolios. Sibelco and Imerys maintain leadership in high-purity quartz production for electronics and glass manufacturing. Geographically, Northern France accounted for the largest 29% market share in 2024, driven by its strong semiconductor and photovoltaic industries. Western and Southern France followed, supported by expanding ceramics and solar applications.

Market Insights

- The France quartz powder market was valued at USD 57.53 million in 2024 and is projected to reach USD 98.07 million by 2032, growing at a CAGR of 7.02%.

- Growth is driven by rising demand in semiconductor manufacturing and solar photovoltaic applications, supported by France’s renewable energy and technology initiatives.

- The market is witnessing trends toward ultra-high-purity quartz production and sustainable processing, with manufacturers adopting advanced beneficiation and recycling methods.

- Leading players such as Sibelco, Imerys S.A., and Quarzwerke Group dominate the competitive landscape through technological advancements and strategic capacity expansions.

- Northern France held the largest 29% regional share in 2024, followed by Western (22%) and Southern France (19%), while by grade, specialty grade quartz accounted for the highest 46% segment share, driven by electronics and solar industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The specialty grade segment (>99.99%) dominated the France quartz powder market with a 46% share in 2024. Its leadership is driven by high purity requirements in electronics, semiconductors, and optical applications. Specialty-grade quartz provides exceptional thermal stability and low electrical conductivity, meeting the strict standards of chip manufacturing. Growth is supported by expanding silicon wafer and photovoltaic production across France’s tech clusters. Rising investments in precision electronics manufacturing further enhance demand for ultra-pure quartz materials used in semiconductor crucibles and microelectronic components.

- For instance, Ferroglobe refines silicon metal in France, using carbothermic reduction of quartz feedstock to support France’s growing renewable energy sector. A high-purity silicon metal powder product, reaching 99.995% purity, has been developed for advanced applications like batteries.

By Application

The electronics and semiconductors segment held the largest 38% market share in 2024. Strong demand comes from integrated circuit fabrication and photovoltaic applications, where quartz powder ensures high dielectric strength and low impurity levels. France’s growing semiconductor ecosystem, supported by European Chips Act initiatives, continues to boost consumption. Increasing use in silicon wafer production and optical fiber preforms also contributes to steady growth. Moreover, the shift toward renewable energy systems is expanding quartz powder use in solar cell manufacturing and advanced electronic components.

- For instance, Soitec’s Bernin facility produces silicon-on-insulator (SOI) wafers using its proprietary Smart Cut™ technology, which is a layer-transfer process.

Key Growth Drivers

Rising Adoption in Semiconductor Manufacturing

The expanding semiconductor sector in France is a primary growth driver for quartz powder demand. High-purity quartz is vital in producing crucibles, wafer tubes, and optical components used in integrated circuits. The increasing local and EU investments in semiconductor fabs are strengthening material consumption. Quartz powder ensures high thermal resistance and chemical purity, which supports precision wafer processing. With France’s push toward technological self-reliance under the European Chips Act, domestic manufacturing capacities are expanding. This strategic emphasis on chip production enhances the use of specialty-grade quartz, driving sustained market growth across the electronics supply chain.

- For instance, in advanced semiconductor manufacturing facilities (fabs), including those supplied by companies like Air Liquide, ultra-high-purity (UHP) process gases are delivered to wafer etching and deposition tools. This is accomplished using specialized gas delivery systems, most commonly high-grade, electropolished stainless steel piping.

Growing Use in Solar Photovoltaic Applications

The growing shift toward renewable energy has boosted quartz powder consumption in solar photovoltaic manufacturing. High-purity quartz is essential in producing silicon for solar cells and photovoltaic glass. France’s renewable energy targets under the National Low-Carbon Strategy are driving solar capacity additions. This has increased demand for refined quartz in solar panel fabrication and encapsulation materials. Quartz’s optical clarity, high melting point, and low impurity levels make it ideal for high-efficiency solar modules. The rise of domestic solar projects and EU sustainability directives further enhance quartz powder utilization in France’s clean energy infrastructure.

- For instance, the former Ferropem facility in La Léchère closed permanently in 2021. While it produced silicon, it did not produce solar-grade silicon with an impurity level of 0.05 ppm.

Expanding Demand in Glass and Ceramics Industry

Quartz powder plays a critical role in the glass and ceramics industry due to its superior thermal and chemical stability. The expanding construction and automotive sectors in France are creating strong demand for high-performance glass products. In ceramics, quartz improves surface finish, strength, and resistance to thermal shock. Manufacturers are adopting fine-grade quartz to produce advanced tableware, sanitaryware, and architectural glass. The trend toward energy-efficient and durable materials in building and automotive applications continues to drive market expansion. Increasing R&D investments in specialty ceramics and architectural coatings further contribute to sustained growth in this segment.

Key Trends & Opportunities

Shift Toward Ultra-High-Purity Quartz Production

Manufacturers in France are shifting toward ultra-high-purity quartz (>99.99%) to meet stringent requirements from semiconductor and photovoltaic industries. This trend supports local value addition and reduces dependence on imported raw materials. Companies are investing in advanced beneficiation and purification technologies to achieve sub-ppm impurity levels. The development of automated refining and optical sorting processes enhances product uniformity and purity. As demand for precision manufacturing grows, this technological advancement offers a key opportunity for French producers to establish themselves as suppliers of critical materials in Europe’s high-tech value chain.

- For instance, Saint-Gobain Advanced Ceramic Composites (formerly Saint-Gobain Quartz) produces ultra-pure fused quartz fibers under the Quartzel brand, with a silica content of 99.95%. These products serve high-tech industries, including the semiconductor and optical fiber markets, with manufacturing sites in Nemours, France, and Louisville, Kentucky.

Increased Focus on Sustainable Extraction and Processing

Sustainability is becoming a strategic priority in France’s quartz mining and processing sector. Companies are adopting water-efficient beneficiation systems and dust control technologies to minimize environmental impact. Circular economy practices, such as recycling quartz waste from glass and ceramic production, are also gaining traction. Government policies promoting green mining and carbon-neutral operations further support this shift. Producers focusing on sustainable sourcing and traceable supply chains can access premium markets and improve competitiveness. The combination of eco-friendly mining practices and clean production technologies presents a strong growth opportunity in the France quartz powder industry.

Key Challenges

High Energy Consumption in Refining and Processing

The quartz powder refining process involves high-temperature melting and purification stages that consume significant energy. France’s increasing electricity costs and carbon taxes create operational challenges for producers. Maintaining consistency in ultra-pure quartz grades requires advanced thermal and chemical treatment, further raising production costs. Small and mid-sized manufacturers face difficulties adopting energy-efficient systems due to high capital requirements. Balancing cost efficiency with quality standards is a persistent issue. The industry’s ability to adopt renewable energy solutions and modern furnaces will determine competitiveness and long-term profitability.

Supply Chain Dependence on Imported Raw Quartz

Despite domestic reserves, France remains partly dependent on imported quartz from regions like Norway and Spain for high-purity grades. Supply fluctuations and geopolitical risks affect raw material availability and pricing stability. Transportation bottlenecks and global shipping costs also impact margins for manufacturers. Limited domestic refining facilities add to the supply chain vulnerability. Developing local beneficiation infrastructure and ensuring raw material traceability are critical to overcoming this challenge. Strengthening local sourcing and integrating upstream processing could enhance France’s resilience and support self-sufficiency in quartz-based industries.

Regional Analysis

Northern France

Northern France held the largest 29% share of the France quartz powder market in 2024. The region’s dominance is driven by its strong semiconductor and photovoltaic manufacturing base, particularly around Normandy and Hauts-de-France. Presence of advanced glass and electronics industries boosts the demand for high-purity quartz. Investments in clean energy and electronic materials manufacturing under regional innovation programs further enhance growth. Expanding production of solar cells, optical fibers, and precision glass strengthens Northern France’s position as a key consumer of specialty-grade quartz powder in the country.

Western France

Western France accounted for around 22% of the France quartz powder market in 2024. The region benefits from a thriving ceramics and glass industry, particularly in Brittany and Pays de la Loire. Strong demand from architectural glass, sanitaryware, and construction materials sectors supports consumption. Availability of local mineral resources and established glass producers enhances regional self-sufficiency. The presence of sustainable manufacturing initiatives and R&D centers focused on material science also contribute to ongoing growth. Rising investments in eco-friendly ceramics and advanced glazing materials continue to drive Western France’s quartz powder usage.

Southern France

Southern France captured a 19% share of the quartz powder market in 2024. The region’s growth is linked to its expanding construction and solar energy sectors, especially in Provence-Alpes-Côte d’Azur and Occitanie. Increasing installations of photovoltaic systems and growing demand for high-quality building materials are key drivers. The region’s favorable climate for solar projects supports consumption of high-purity quartz in panel manufacturing. Additionally, industrial ceramics and coatings applications are expanding in regional manufacturing hubs. Government-supported green energy projects are further stimulating quartz demand in advanced energy and infrastructure developments.

Central France

Central France accounted for nearly 16% of the national quartz powder market in 2024. The region is characterized by strong activity in foundry, industrial ceramics, and refractories manufacturing. Its strategic location supports efficient raw material transport and distribution to nearby industrial zones. Quartz powder demand is also supported by local automotive glass and insulation material producers. Investments in mineral processing and cleaner manufacturing technologies are improving efficiency. Growth in industrial applications, coupled with infrastructure modernization, continues to strengthen Central France’s role in the overall quartz powder value chain.

Eastern France

Eastern France represented 14% of the France quartz powder market in 2024. The region’s consumption is largely driven by advanced ceramics, chemical processing, and high-precision optical industries. Alsace and Grand Est serve as major hubs for electronic and glass component manufacturing. Cross-border trade with Germany and Switzerland enhances access to high-grade quartz materials and technology collaboration. The region’s focus on specialty applications, such as laboratory glassware and high-performance coatings, fuels steady demand. Ongoing investments in innovation-driven industrial projects sustain Eastern France’s competitive position within the national quartz powder landscape.

Market Segmentations:

By Grade

- Specialty Grade (> 99.99%)

- Industrial Grade (99–99.9%)

- Low Grade (<99%)

By Application

- Electronics & Semiconductors

- Glass & Ceramics

- Paints, Coatings & Adhesives

- Construction Materials

- Oil and Gas

- Others

By Geography

- Northern France

- Western France

- Southern France

- Central France

- Eastern France

Competitive Landscape

The France quartz powder market is moderately consolidated, with leading players such as Sibelco, Imerys S.A., Quarzwerke Group, and ENDURA IPNR dominating through advanced production capabilities and extensive product portfolios. These companies focus on producing high-purity quartz to serve critical industries like semiconductors, solar energy, and specialty glass. Strategic collaborations and capacity expansions remain central to their growth strategies. For instance, major producers are investing in refining and beneficiation technologies to achieve sub-ppm impurity levels. Emerging domestic players like Eon Enterprises and Speciality Geochem are strengthening their presence through eco-efficient processing and regional distribution networks. Competition is intensifying as sustainability, quality assurance, and supply chain traceability become key differentiators. Innovation in high-purity quartz for electronics and renewable applications continues to shape market dynamics, with French manufacturers aligning closely with the European Union’s initiatives for advanced material self-sufficiency and reduced import dependence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ENDURA IPNR

- Eon Enterprises

- Advanced Ceramics

- Sibelco

- The Sharad Group

- Speciality Geochem

- Quarzwerke Group

- Imerys S.A

- PAL Quartz

- HTMC Group

- Other Key Player

Recent Developments

- In August 2024, Caesarstone introduced The Time Collection, which included ten new items, seven of which were new Porcelain colors and three Mineral Surfaces. These Mineral Surfaces represent a big step forward in surface design and are a testament to Caesarstone’s latest innovation. Using its vast expertise and advanced technology, the company has developed surfaces that combine minerals like Feldspar and Quartz with recycled content to create surfaces that are better performing and better for the environment.

- In January 2023, Caesarstone Ltd. declared the launch of its line of multi-material surfaces, which includes porcelain and natural stone in addition to outdoor quartz.

- In December 2022, Kyocera Corporation announced its purpose to invest 1.3 trillion yen ($9.78 billion), or through March 2026, in novel chip component manufacturing and the evolution of other sectors of its capabilities.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz will grow with expanding semiconductor and solar industries in France.

- Local manufacturers will increase investments in refining and purification technologies to improve product quality.

- The market will benefit from government incentives promoting renewable energy and sustainable materials.

- Specialty-grade quartz will continue to dominate due to its critical role in electronics applications.

- Rising adoption of automation in mineral processing will enhance production efficiency and consistency.

- Sustainable extraction and recycling practices will become key competitive differentiators among producers.

- Regional players will focus on strategic partnerships to reduce import dependency and strengthen supply chains.

- Growing use of quartz in advanced glass, ceramics, and coatings will support steady demand.

- Digitalization and traceability systems will improve quality control and market transparency.

France will strengthen its position within the European quartz value chain through technological innovation and capacity expansion.