Market Overview

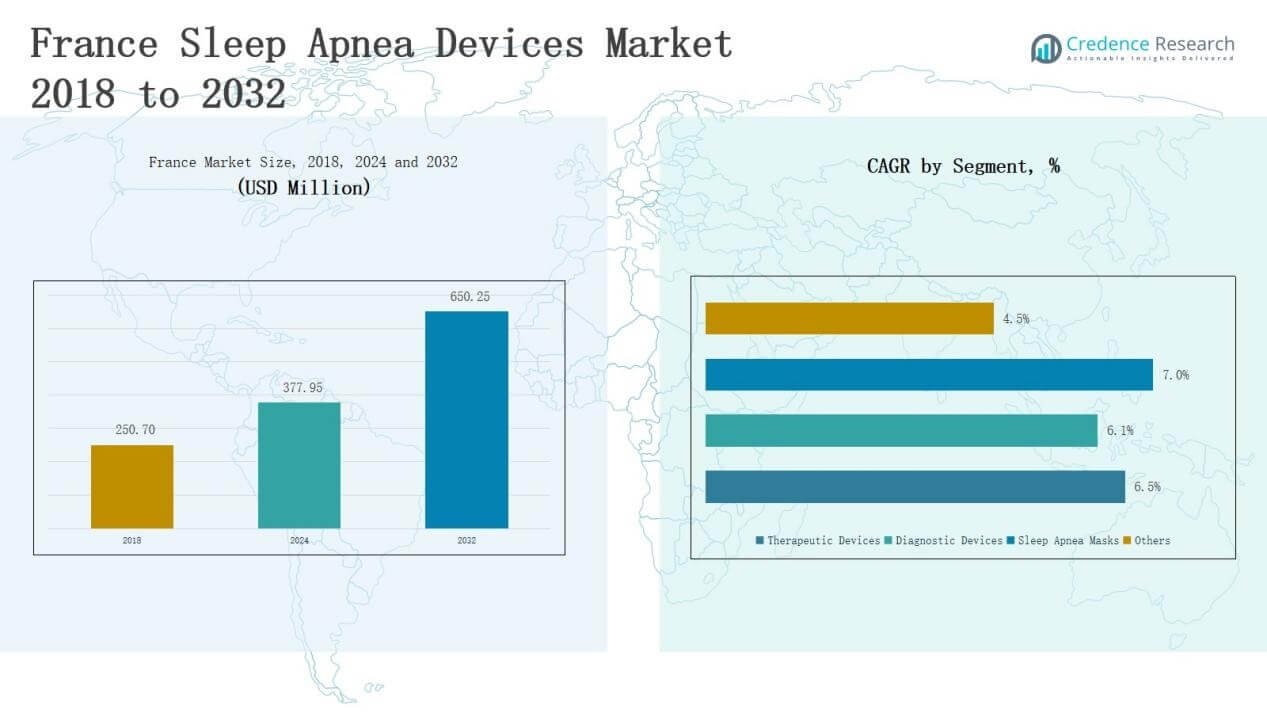

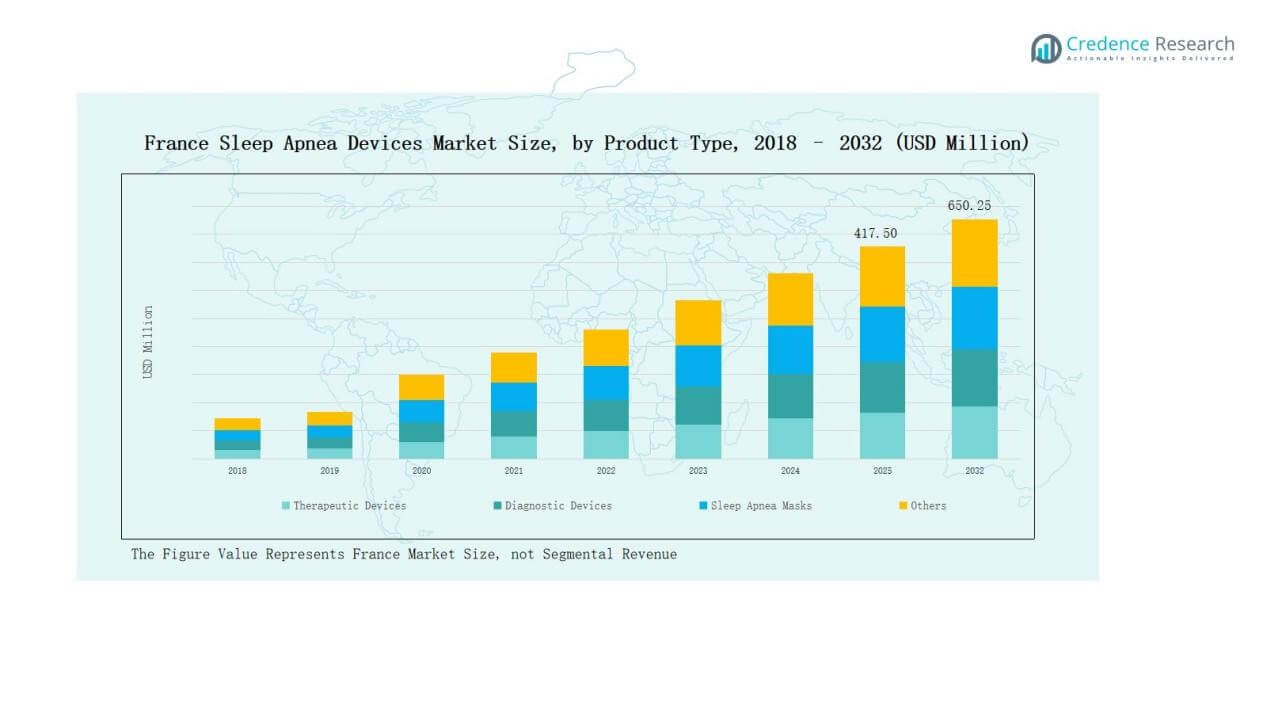

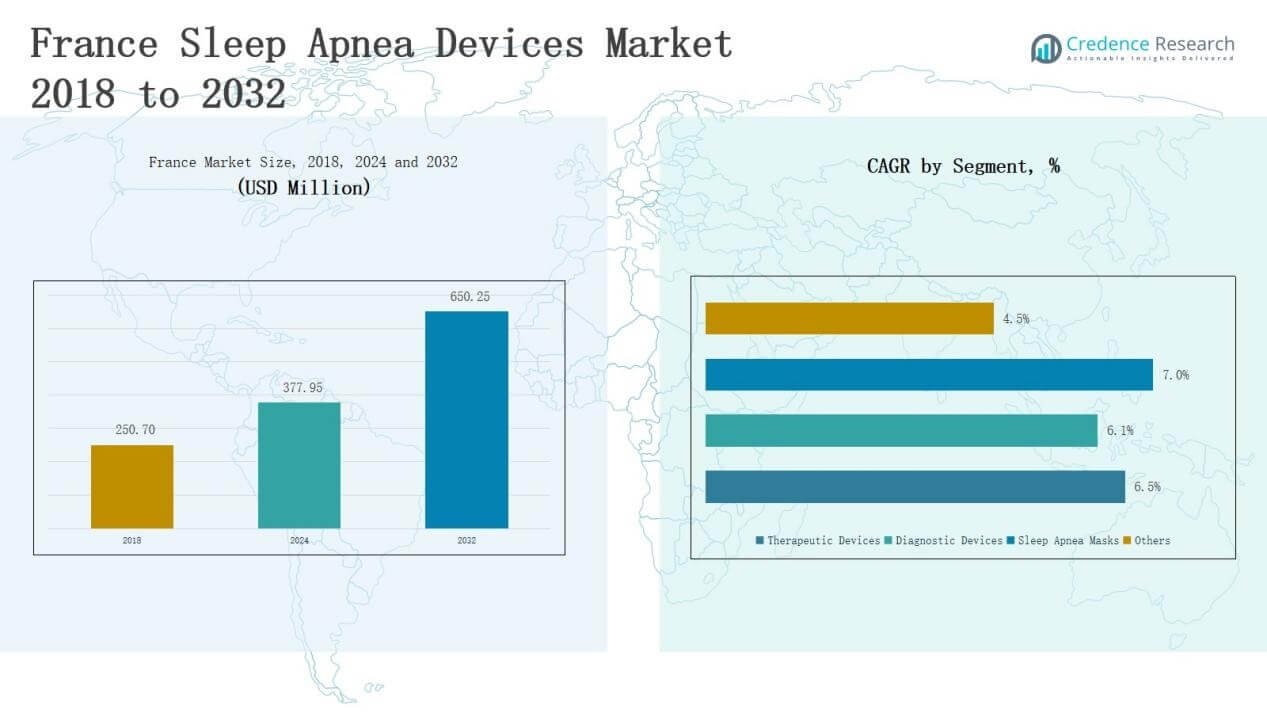

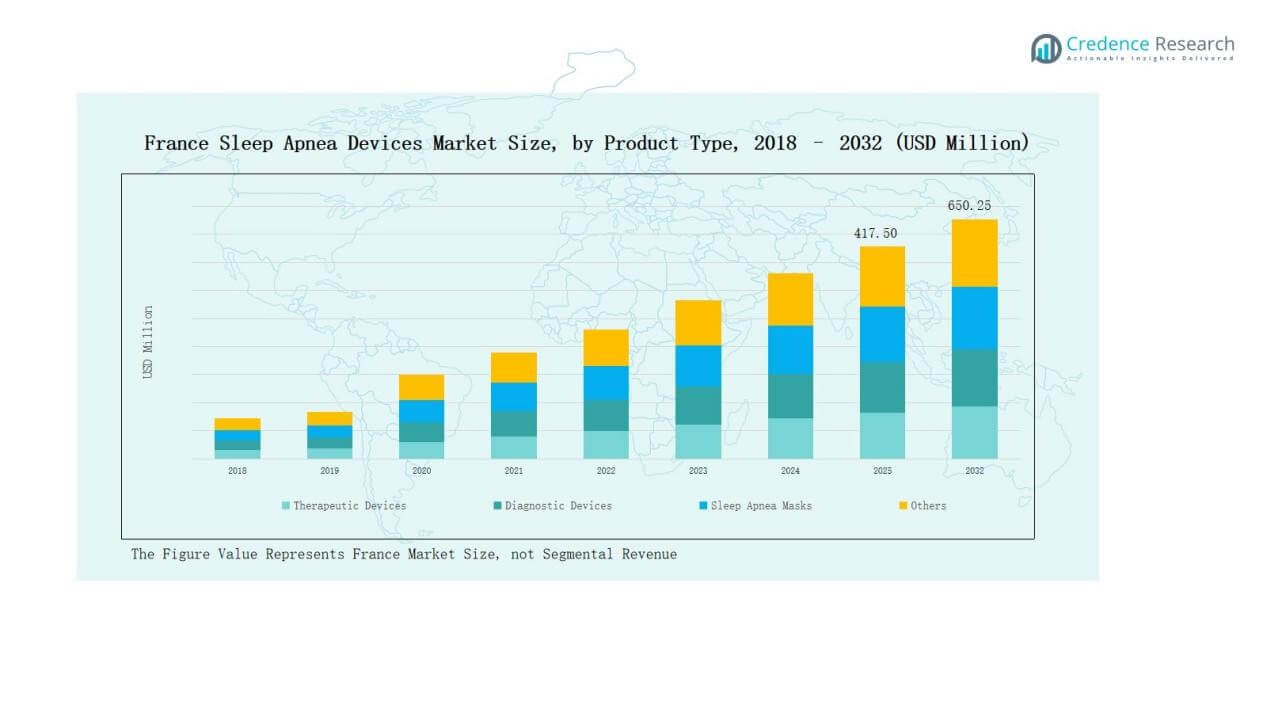

France Sleep Apnea Devices Market size was valued at USD 250.70 million in 2018, reached USD 377.95 million in 2024, and is anticipated to reach USD 650.25 million by 2032, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Countertops Market Size 2024 |

USD 377.95 Million |

| France Quartz Countertops Market, CAGR |

6.53% |

| France Quartz Countertops Market Size 2032 |

USD 650.25 Million |

The France Sleep Apnea Devices Market is shaped by strong competition among global and domestic players, with ResMed France and Philips Respironics France leading through advanced PAP systems and cloud-connected solutions. SomnoMed France and BMC Medical France strengthen the therapeutic portfolio with oral appliances and cost-effective devices, while Inspire Medical Systems France focuses on implantable neurostimulation therapies. Löwenstein Medical France and LivaNova PLC France enhance diagnostic and therapeutic adoption, supported by established clinical networks. Sicat France, Drive DeVilbiss France, and Zephyr Sleep Technologies France contribute with innovative masks, wearables, and digital solutions. Southern France leads regionally with 34% market share in 2024, driven by advanced healthcare infrastructure, strong diagnostic capacity, and widespread adoption of connected treatment technologies.

Market Insights

Market Insights

- The France Sleep Apnea Devices Market grew from USD 250.70 million in 2018 to USD 377.95 million in 2024 and is expected to reach USD 650.25 million by 2032.

- Therapeutic devices dominated with 62% share in 2024, led by Positive Airway Pressure (PAP) devices, supported by physician preference and expanding home-based treatment options.

- Diagnostic devices held 25% share in 2024, with Polysomnography (PSG) devices leading, while Home Sleep Test (HST) kits gained traction due to convenience and lower costs.

- Hospitals and clinics captured 48% share in 2024, supported by advanced diagnostic facilities, while home care settings expanded rapidly with rising adoption of portable PAP devices.

- Southern France led regionally with 34% share in 2024, driven by advanced medical facilities, higher diagnosis rates, and strong adoption of connected health technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Therapeutic devices dominate the France Sleep Apnea Devices Market, holding nearly 62% share in 2024. Within this category, Positive Airway Pressure (PAP) devices lead due to their proven effectiveness in managing obstructive sleep apnea. Rising diagnosis rates and physician preference for PAP therapy drive adoption. Oral appliances and nasal masks also contribute steadily, supported by demand for less invasive options. Expanding home-based treatment, coupled with innovation in mask design, strengthens the therapeutic devices segment’s long-term market position.

For instance, ResMed introduced the AirFit F40 full-face mask in Europe, designed with a smaller seal and soft silicone cushion to improve patient comfort and adherence.

By Diagnostic Devices

Diagnostic devices account for around 25% share in 2024, with Polysomnography (PSG) devices leading as the gold standard in sleep testing. PSG adoption is supported by widespread use in hospitals and specialized sleep laboratories. However, Home Sleep Test (HST) kits are gaining traction due to their convenience and lower cost, particularly among patients preferring at-home diagnosis. The shift toward portable diagnostic tools, combined with growing awareness of sleep disorders, enhances segment growth and supports early detection.

For instance, Itamar Medical reported increased global adoption of its WatchPAT ONE disposable HST device, reflecting rising preference for portable diagnostic tools that facilitate early detection and broader patient reach.

By End User

Hospitals and clinics represent the largest end-user segment, capturing about 48% share in 2024. Strong infrastructure, advanced diagnostic facilities, and reimbursement support reinforce their dominance. Sleep laboratories maintain a vital role in offering in-depth testing, while the home care setting is expanding rapidly, driven by the rising use of portable PAP devices and HST kits. Increasing patient preference for convenient and cost-effective care at home supports this trend, creating growth opportunities for manufacturers targeting individual users.

Key Growth Drivers

Key Growth Drivers

Rising Prevalence of Sleep Apnea

The growing prevalence of sleep apnea in France is a significant driver of device adoption. An aging population, obesity, and lifestyle-related risk factors continue to increase the diagnosed patient pool. Higher awareness among both patients and healthcare providers accelerates screening and early intervention. Hospitals, clinics, and sleep laboratories report steady increases in diagnosis volumes, which directly support higher demand for therapeutic devices such as PAP systems and oral appliances. This trend ensures consistent growth for the market over the forecast period.

For instance, Löwenstein Medical expanded its PrismaLINE PAP device portfolio in 2023, tailoring therapy options to European clinical requirements, including sleep laboratories and hospitals in France.

Expansion of Home-Based Treatment

The shift toward home-based care strongly supports market growth in France. Patients increasingly prefer portable PAP devices, home sleep test kits, and remote monitoring solutions that enable treatment outside hospitals. The convenience, cost-effectiveness, and privacy of home management improve therapy adherence and satisfaction. Insurance coverage and government focus on reducing hospital burden further strengthen this shift. As device manufacturers launch compact, user-friendly products, the adoption of homecare solutions is expected to accelerate, expanding access and supporting long-term revenue growth.

For instance, Koninklijke Philips launched its NightBalance device, a non-invasive positional therapy solution tailored for at-home use, in select countries including the United States, United Kingdom, Austria, Germany, Switzerland, Belgium, the Netherlands, and Luxembourg.

Technological Advancements in Devices

Continuous innovation in sleep apnea devices enhances their effectiveness, comfort, and usability. Advanced PAP machines with auto-adjusting pressure, quiet operation, and cloud connectivity improve patient compliance. Oral appliances are becoming more customized, while masks are designed for greater comfort and reduced leakage. Diagnostic tools such as portable PSG devices and wearable sensors offer more efficient testing and faster results. These advancements not only expand product adoption but also encourage replacement purchases, ensuring that technological upgrades remain a strong growth driver.

Key Trends & Opportunities

Integration of Digital Health Solutions

Digital connectivity is becoming a major trend in France’s sleep apnea devices market. Cloud-based platforms and mobile applications allow real-time data sharing between patients and physicians. This integration supports better monitoring, timely intervention, and improved adherence rates. Manufacturers are leveraging artificial intelligence to analyze sleep patterns, optimize therapy, and personalize treatment. The growing acceptance of telehealth and digital healthcare ecosystems presents an opportunity for companies to strengthen their offerings, build stronger relationships with patients, and drive competitive differentiation in the market.

For instance, SENSAPNEA offers a home-use diagnosis solution using a chin sensor paired with a mobile app and cloud-based platform, allowing seamless communication between patients and physicians, which enhances care access and management.

Growing Demand for Customized and Comfortable Masks

Patient comfort is increasingly shaping purchasing decisions for sleep apnea devices. Demand for lightweight, flexible, and customizable nasal and full-face masks is rising in France. Manufacturers are investing in advanced materials, ergonomic designs, and improved airflow systems to reduce discomfort and leakage. The opportunity lies in catering to diverse patient needs, from mild to severe apnea cases, through tailored mask solutions. As adherence strongly depends on comfort, this trend supports both higher compliance and broader adoption, creating strong growth potential.

For instance, Fisher & Paykel Healthcare expanded its Evora Full mask line, which incorporates headgear technologies designed for stability and freedom of movement, improving comfort for long-term use.

Key Challenges

Low Diagnosis and Treatment Rates

Despite increasing awareness, underdiagnosis remains a key challenge in the French market. Many patients with mild to moderate sleep apnea go untreated due to lack of awareness, misdiagnosis, or reluctance to undergo testing. Limited outreach in rural areas and social stigma associated with sleep disorders further reduce treatment rates. This gap in diagnosis slows market penetration for both diagnostic and therapeutic devices. Addressing this challenge requires targeted awareness campaigns, broader access to screening, and improved patient education.

High Cost of Advanced Devices

The cost of advanced sleep apnea devices remains a barrier, particularly for uninsured or underinsured patients. While hospitals and clinics invest in high-end PSG systems and advanced PAP devices, affordability limits adoption in homecare settings. Reimbursement frameworks do not always cover the latest technologies, restricting patient access. This challenge affects penetration of innovative solutions in lower-income groups. Manufacturers need to balance innovation with affordability and work with policymakers to ensure reimbursement systems adapt to evolving device offerings.

Compliance and Adherence Issues

Poor patient compliance continues to hinder the effectiveness of sleep apnea treatment in France. Many patients discontinue PAP therapy due to discomfort, mask leakage, noise, or lifestyle inconvenience. Oral appliances and other alternatives face similar adherence issues. Non-compliance not only reduces clinical outcomes but also impacts replacement sales and long-term market growth. Device makers are focusing on comfort-driven designs, education programs, and digital monitoring to address this barrier, but adherence remains a significant challenge for market expansion.

Regional Analysis

Northern France

Northern France accounted for 21% share in 2024, supported by strong healthcare infrastructure and the presence of specialized sleep centers in metropolitan areas such as Lille. The region benefits from rising awareness campaigns and government-backed diagnostic programs. Hospitals and clinics dominate adoption, while home care devices are gradually gaining momentum. Local demand for PAP devices remains strong, driven by increasing diagnosis rates. The France Sleep Apnea Devices Market in this region shows steady growth, supported by investments in digital health solutions and expanding patient outreach.

Southern France

Southern France held the largest share at 34% in 2024, driven by advanced medical facilities and higher diagnosis rates. Cities such as Marseille and Lyon serve as key hubs for specialized treatment centers and sleep laboratories. The region benefits from strong adoption of therapeutic devices, particularly PAP systems and customized masks. Home sleep testing is expanding rapidly due to patient preference for convenience. It continues to attract significant investments in connected health technologies, making Southern France a leader in sleep apnea device adoption and usage.

Western France

Western France represented 19% share in 2024, supported by growing investments in healthcare infrastructure across cities like Nantes and Rennes. The region shows rising demand for diagnostic devices, particularly PSG systems and home test kits. Hospitals and clinics remain the leading end users, while home-based care adoption is growing with increased awareness. Oral appliances are gaining traction in this region, appealing to patients seeking non-invasive solutions. It demonstrates stable growth supported by expanding healthcare accessibility and targeted awareness programs on sleep disorders.

Eastern France

Eastern France captured 16% share in 2024, with Strasbourg and nearby cities emerging as important centers for diagnostic and therapeutic solutions. Strong cross-border healthcare collaborations with Germany drive innovation adoption. Sleep laboratories dominate usage, while portable PAP devices are recording rising demand in homecare settings. The market here is supported by favorable reimbursement policies and wider insurance coverage. The France Sleep Apnea Devices Market in Eastern France benefits from both public and private initiatives that improve access to advanced treatment technologies.

Central France

Central France accounted for 10% share in 2024, marking the smallest regional contribution. Limited healthcare infrastructure and lower diagnosis rates restrict growth compared to other regions. However, adoption of home sleep test kits and portable PAP devices is increasing as awareness improves. Regional hospitals and clinics are focusing on expanding diagnostic facilities to meet growing demand. Patient outreach programs and collaborations with national health agencies aim to improve accessibility. It is expected to gradually strengthen its role in the overall market growth.

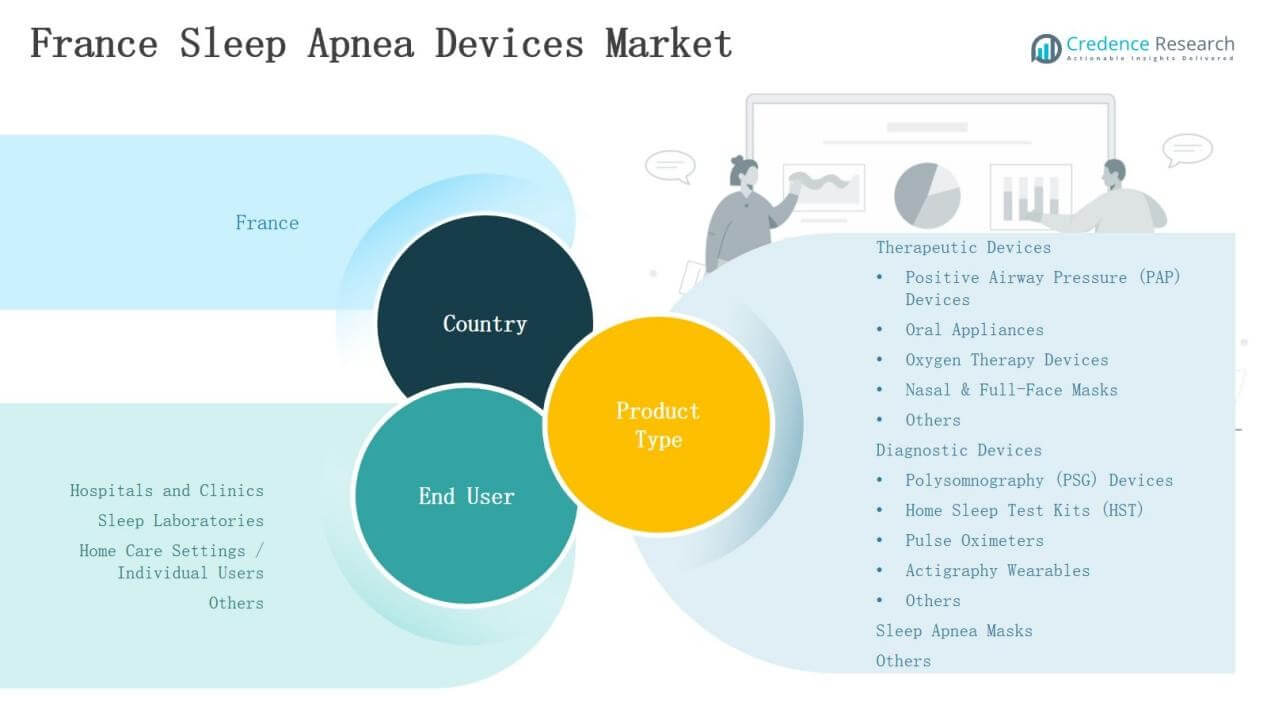

Market Segmentations:

Market Segmentations:

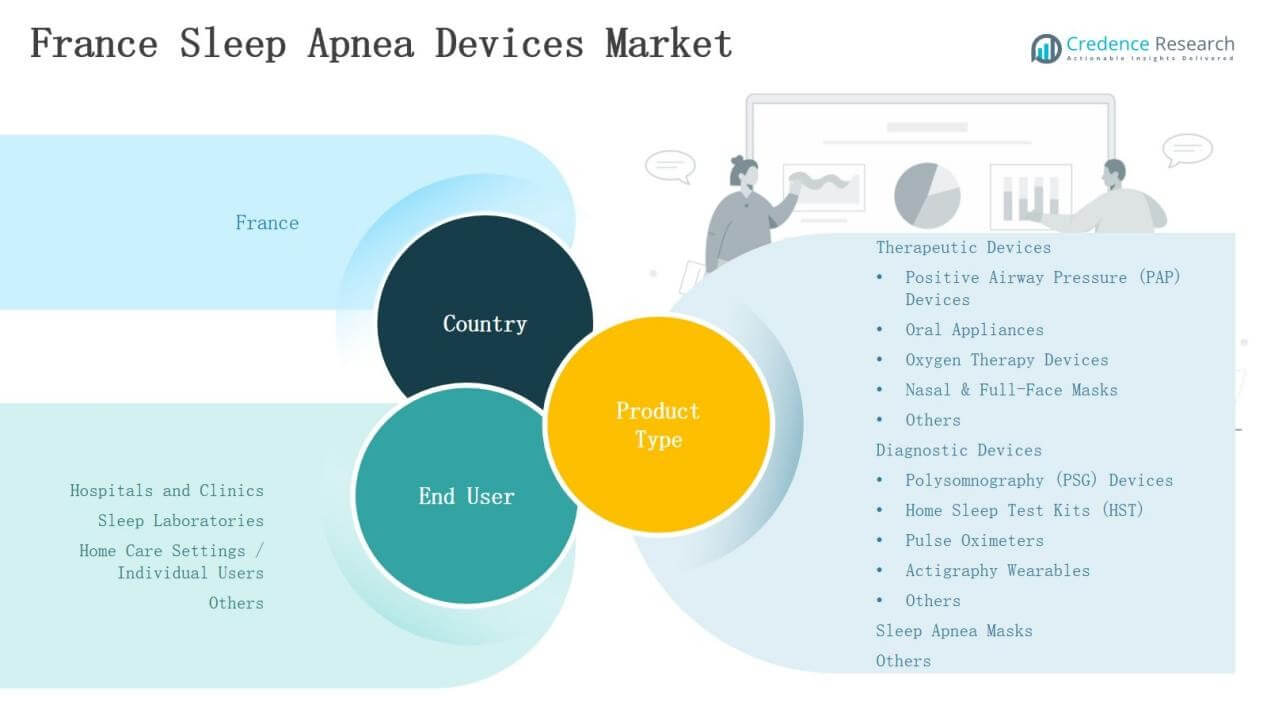

By Product Type

Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- Oral Appliances

- Oxygen Therapy Devices

- Nasal & Full-Face Masks

- Others

Diagnostic Devices

- Polysomnography (PSG) Devices

- Home Sleep Test Kits (HST)

- Pulse Oximeters

- Actigraphy Wearables

- Others

- Sleep Apnea Masks

By End User

- Hospitals and Clinics

- Sleep Laboratories

- Home Care Settings / Individual Users

- Others

By Region

- Northern France

- Southern France

- Western France

- Eastern France

- Central France

Competitive Landscape

The France Sleep Apnea Devices Market is characterized by strong competition between global leaders and domestic players, each aiming to strengthen their presence through innovation and strategic expansion. ResMed France and Philips Respironics France lead the market with advanced PAP devices, cloud-connected solutions, and broad distribution networks. SomnoMed France and BMC Medical France compete by offering oral appliances and cost-effective therapeutic options, appealing to patients seeking alternatives to traditional PAP therapy. Inspire Medical Systems France focuses on implantable neurostimulation devices, addressing patients with severe obstructive sleep apnea who fail conventional therapies. Löwenstein Medical France and LivaNova PLC France play vital roles in diagnostic and therapeutic equipment supply, supported by strong clinical networks. Drive DeVilbiss France, Sicat France, and Zephyr Sleep Technologies France contribute with innovative product lines in masks, diagnostic wearables, and software-based platforms. The competitive environment emphasizes patient comfort, digital integration, and home-based solutions, shaping growth strategies across all leading participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- ResMed France

- Philips Respironics France

- SomnoMed France

- BMC Medical France

- Inspire Medical Systems France

- Löwenstein Medical France

- LivaNova PLC France

- Sicat France

- Drive DeVilbiss France

- Zephyr Sleep Technologies France

Recent Developments

- In May 2025, ResMed acquired VirtuOx, a provider of home sleep testing services. This acquisition aims to enhance ResMed’s diagnostic capabilities and expand its presence in the French market.

- In July 2024, Inspire Medical Systems announced that its Inspire therapy for obstructive sleep apnea is now fully reimbursed in France. This development is expected to increase patient access to this treatment option.

- In April 2025, Apnimed expanded its portfolio by acquiring global rights to sulthiame from Desitin Arzneimittel GmbH, aiming to develop new oral therapies for sleep apnea and related breathing disorders in Europe.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for PAP devices will continue to grow due to high treatment efficacy.

- Home sleep testing will gain wider adoption supported by patient convenience.

- Oral appliances will expand as non-invasive alternatives gain patient acceptance.

- Connected health solutions will strengthen remote monitoring and therapy adherence.

- Customized and comfortable masks will drive higher patient compliance rates.

- Hospitals and clinics will maintain leadership in diagnostics and treatment adoption.

- Home care settings will grow faster with the spread of portable devices.

- Local manufacturers will focus on affordable solutions to expand rural access.

- Partnerships between medtech and digital health firms will accelerate product innovation.

- Awareness campaigns will reduce underdiagnosis and expand the treated patient pool.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: