Market Overview

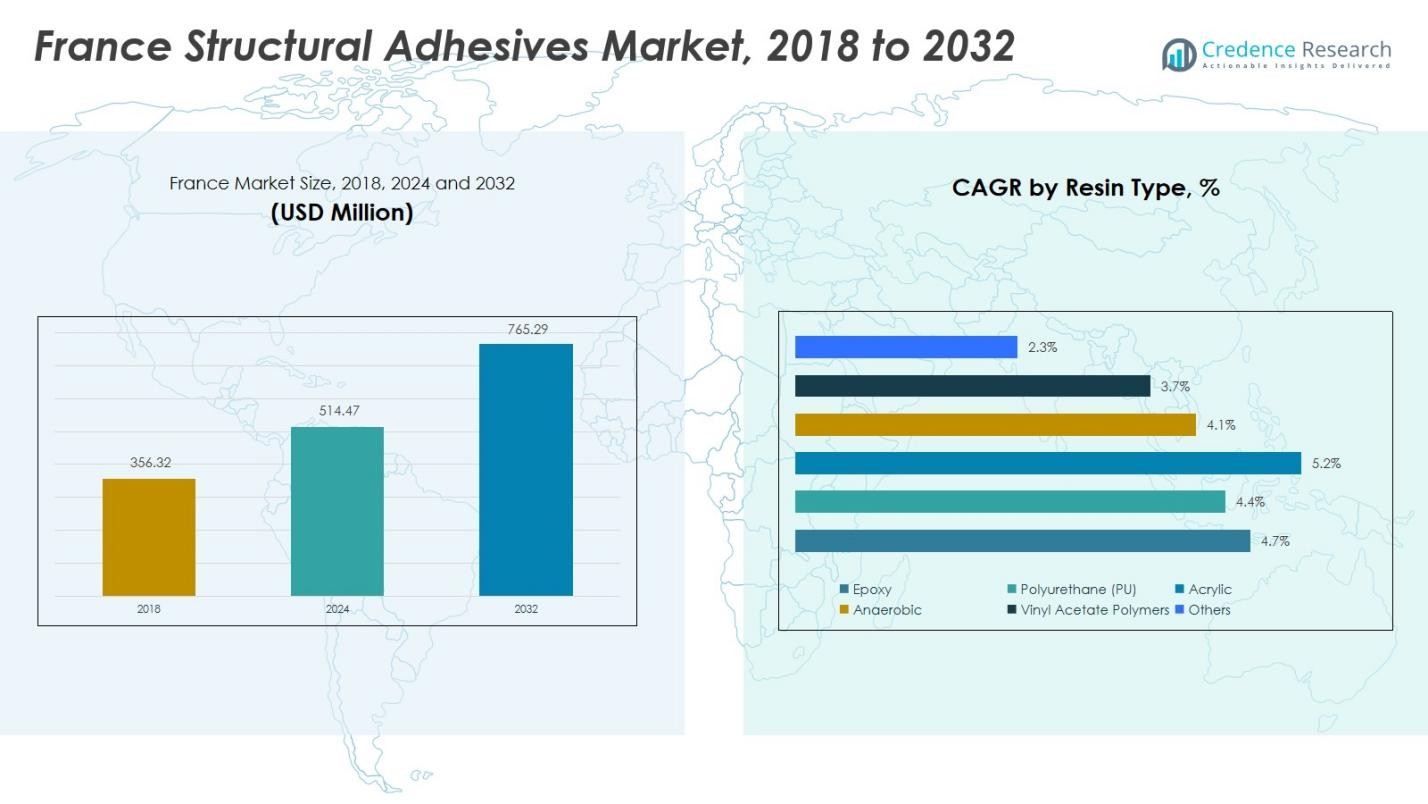

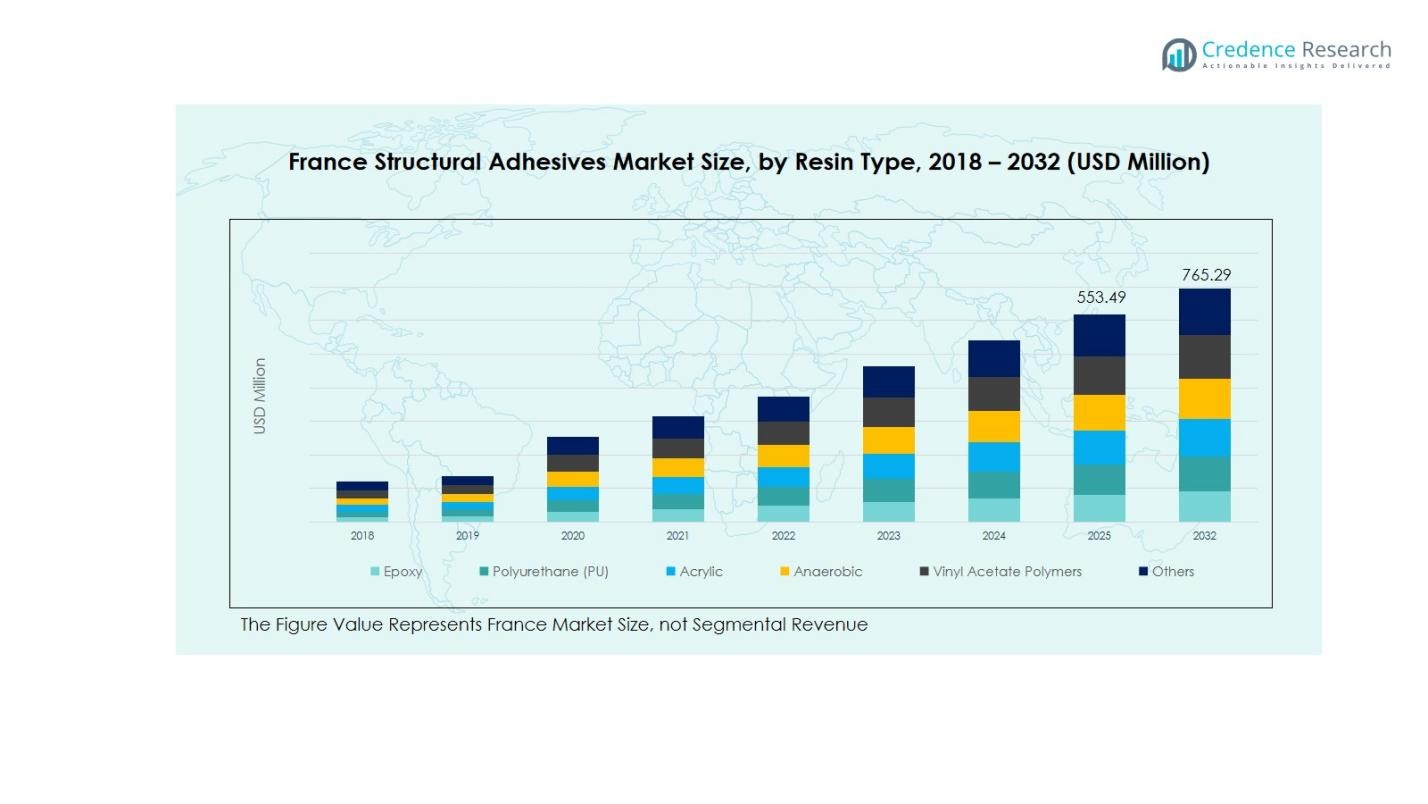

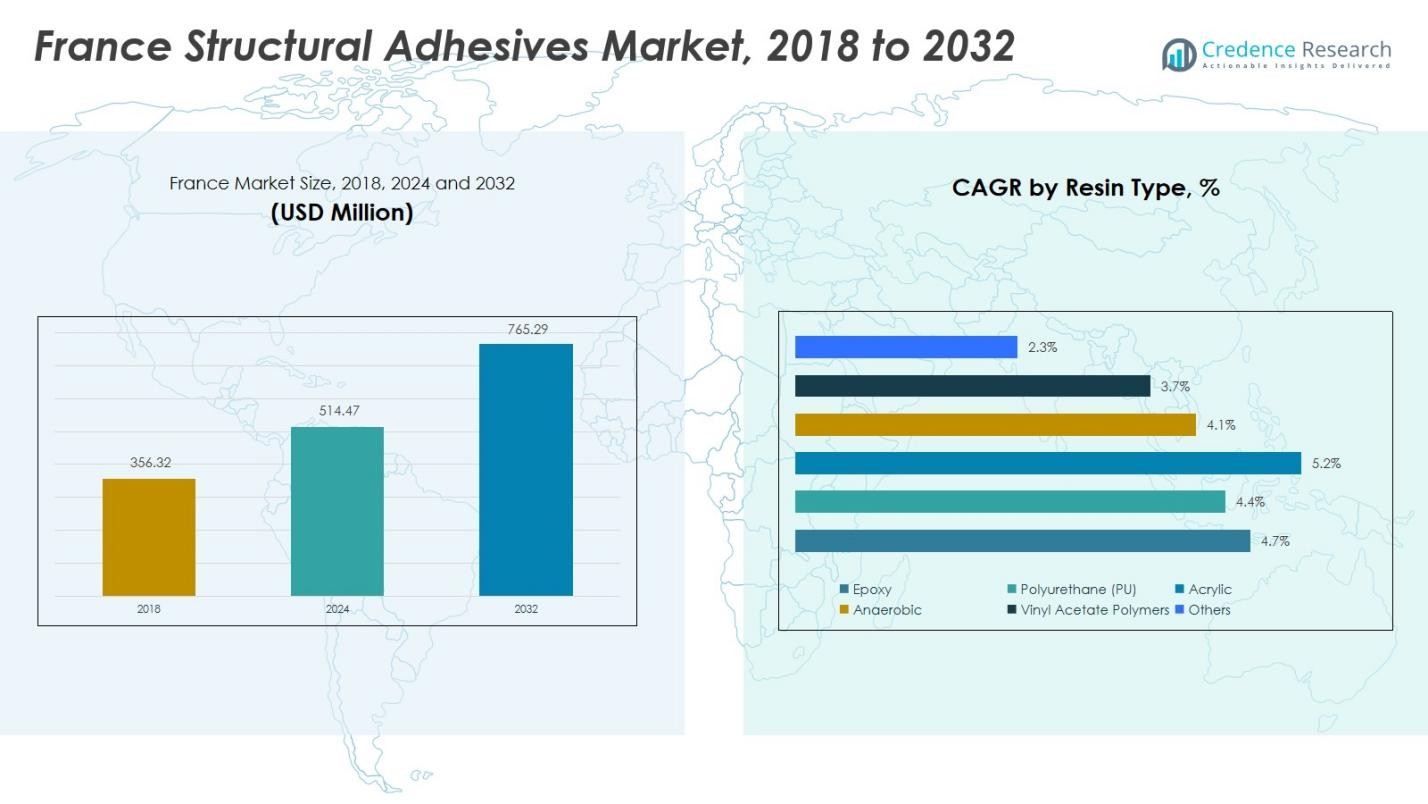

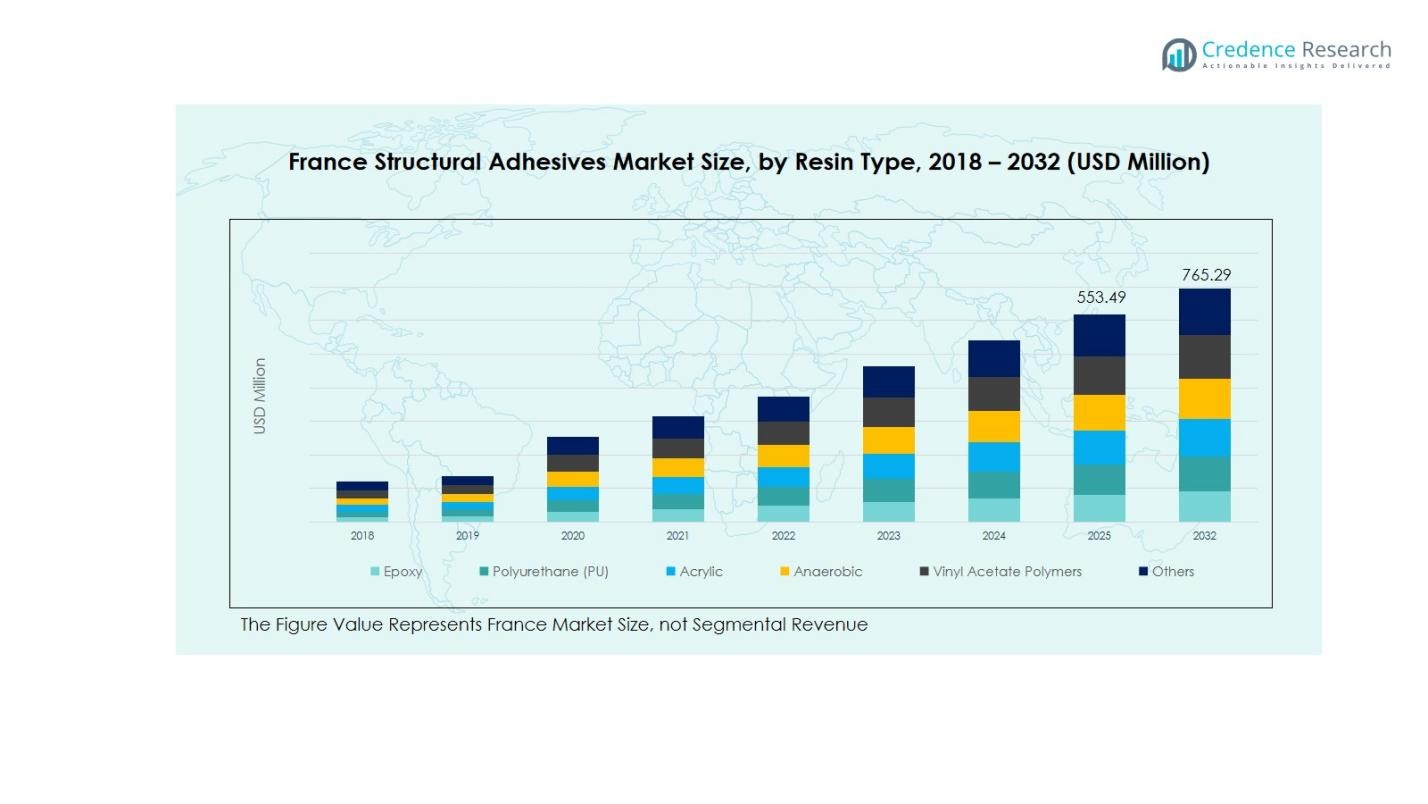

France Structural Adhesives Market size was valued at USD 356.32 Million in 2018, rising to USD 514.47 Million in 2024, and is anticipated to reach USD 765.29 Million by 2032, at a CAGR of 4.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Structural Adhesives Market Size 2024 |

USD 514.47 Million |

| France Structural Adhesives Market, CAGR |

4.74% |

| France Structural Adhesives Market Size 2032 |

USD 765.29 Million |

The France Structural Adhesives Market is highly competitive, with leading players including Arkema S.A., Henkel AG & Co. KGaA, Compagnie de Saint-Gobain S.A., Sika AG, RPM International Inc., BASF SE, H.B. Fuller Company, Jowat SE, Huntsman Corporation, and Dow Inc. These companies leverage strong product portfolios, technological innovation, and strategic partnerships to maintain market dominance, particularly in automotive, aerospace, and industrial applications. Île-de-France emerges as the leading region, commanding 28% of the market, driven by a concentration of automotive, aerospace, and industrial manufacturing hubs. Auvergne-Rhône-Alpes follows with 19% share, supported by high industrial and construction activity, while Provence-Alpes-Côte d’Azur holds 14%, benefiting from aerospace and electronics production. The combined focus on high-performance adhesives, eco-friendly solutions, and R&D initiatives strengthens the positions of these top players while reinforcing regional market growth across France.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Structural Adhesives Market was valued at USD 514.47 Million in 2024 and is projected to reach USD 765.29 Million by 2032, growing at a CAGR of 4.74%.

- Rising demand from the automotive and aerospace sectors, coupled with the adoption of lightweight and high-performance materials, is driving market growth.

- Market trends include increasing use of eco-friendly water-based adhesives, expansion of composite applications, and innovation in epoxy and polyurethane formulations for enhanced bonding and durability.

- The competitive landscape is dominated by key players such as Arkema S.A., Henkel AG & Co. KGaA, Compagnie de Saint-Gobain S.A., Sika AG, RPM International Inc., and BASF SE, focusing on R&D, strategic partnerships, and eco-friendly solutions to maintain market leadership.

- Île-de-France leads with 28% market share, followed by Auvergne-Rhône-Alpes (19%) and Provence-Alpes-Côte d’Azur (14%), while epoxy resins and metal substrates dominate segment shares, reflecting high demand in automotive and industrial applications.

Market Segmentation Analysis:

By Resin Type

Epoxy resins dominate the France Structural Adhesives Market by resin type, accounting for approximately 38% of the market share in 2024. Their superior mechanical strength, chemical resistance, and versatility across automotive and construction applications drive this preference. Polyurethane (PU) follows, valued for flexibility and impact resistance, particularly in industrial manufacturing. Acrylic and anaerobic adhesives hold moderate shares, while vinyl acetate polymers and other specialty resins cater to niche applications. Increasing demand for lightweight and durable materials in automotive and aerospace sectors continues to fuel epoxy’s prominence in the French market.

For instance, Sicomin’s SR1700 epoxy system was chosen for the ENATA Aerospace flying car concept due to its high-performance composite capabilities and lightweight carbon fiber frame integration.

By Substrate

Metal substrates lead the France Structural Adhesives Market, capturing around 42% share due to strong demand from automotive and aerospace industries. Adhesives for composites rank second, driven by lightweighting initiatives and structural efficiency. Wood and plastic substrates account for smaller portions, primarily used in construction and consumer goods. The growth in manufacturing of hybrid assemblies and lightweight components promotes the adoption of adhesives across multiple substrates, reinforcing the dominance of metal adhesives. The ongoing push for improved load-bearing and corrosion-resistant bonding solutions further supports the metal segment’s growth.

For instance, Airbus applies epoxy-based structural adhesives in its composite fuselage of the A350 XWB to achieve lightweight and durable joints.

By Technology

Solvent-based adhesives hold the dominant share at 46% in the French market, favored for strong bonding and long-term durability across industrial and construction applications. Water-based adhesives follow, gaining traction due to environmental regulations and reduced VOC emissions. Other technologies, including hot-melt and reactive adhesives, serve niche applications with moderate adoption. Drivers for solvent-based dominance include high-performance requirements in automotive and aerospace sectors, coupled with cost-effectiveness and process reliability. Increasing regulatory pressure for eco-friendly alternatives is gradually boosting the adoption of water-based systems.

Key Growth Drivers

Rapid Automotive & Aerospace Industry Expansion

The growth of France’s automotive and aerospace sectors is a major driver for structural adhesives demand. Manufacturers increasingly rely on high-performance adhesives to reduce vehicle weight, enhance fuel efficiency, and improve structural integrity. Epoxy and polyurethane-based adhesives are widely adopted for metal-to-composite bonding, while advanced adhesive formulations enable precision assembly in aerospace components. Rising production of electric vehicles and expansion of aerospace manufacturing facilities fuel demand for durable, lightweight bonding solutions, strengthening market growth and reinforcing the need for innovation in resin types and adhesive technologies.

For instance, Huntsman supplies advanced epoxy and polyurethane adhesives such as Araldite® and Epibond® widely used by major aerospace companies including Airbus and Boeing for assembly and bonding of structural parts and panels in aircraft, ensuring durability under extreme conditions.

Demand for Lightweight & High-Performance Materials

The push for lightweight materials across automotive, aerospace, and industrial applications is accelerating structural adhesives adoption. Traditional mechanical fasteners are being replaced by adhesives that maintain strength while reducing overall component weight. Epoxy and acrylic adhesives are favored for their load-bearing capacity and environmental resistance. Increasing regulatory emphasis on fuel efficiency, emissions reduction, and structural durability compels manufacturers to adopt advanced adhesive solutions. This shift toward high-performance materials is expected to sustain steady market growth, especially in metal and composite substrate applications.

For instance, 3M’s epoxy-based Structural Adhesive Tape SAT1010M is used in automotive chassis assembly to bond dissimilar materials and reduce application variability, helping with weight reduction without compromising strength.

Expansion of Construction & Industrial Manufacturing

Structural adhesives are witnessing rising demand in France’s construction and industrial manufacturing sectors. Adhesives offer efficient bonding for metal, wood, and plastic components, reducing assembly time and maintenance costs. Innovations in solvent-based and water-based adhesives enable versatility across diverse applications, including prefabricated building components and industrial machinery. Growth in commercial infrastructure, renovation projects, and industrial automation drives the adoption of reliable bonding solutions. Increasing preference for adhesives over traditional fasteners further solidifies their role as essential materials for durable, high-performance construction and manufacturing assemblies.

Key Trends & Opportunities

Trend Toward Eco-Friendly Adhesives

Sustainability is shaping the France Structural Adhesives Market, with manufacturers increasingly adopting water-based and low-VOC formulations. Regulatory initiatives and environmental awareness are encouraging the shift from solvent-based adhesives to eco-friendly alternatives. These adhesives reduce emissions, comply with strict European standards, and support circular economy initiatives. Companies investing in green adhesive technologies gain competitive advantages, as end-users prioritize sustainable solutions without compromising performance. The trend toward environmentally responsible adhesives is creating opportunities for innovation and market differentiation across automotive, construction, and industrial sectors.

For instance, Henkel Adhesive Technologies has developed the Technomelt Supra ECO, a hotmelt adhesive for packaging with up to 98% bio-based raw materials, significantly reducing environmental footprint while maintaining production efficiency.

Growth Opportunities in Advanced Composite Applications

The increasing use of composites in aerospace, automotive, and renewable energy industries presents substantial opportunities for structural adhesives. Advanced adhesives enable bonding of dissimilar materials, enhance load distribution, and maintain durability under extreme conditions. Expansion of lightweight electric vehicles, wind turbines, and high-performance aircraft drives adoption of specialized epoxy and polyurethane adhesives. Companies offering customized adhesive solutions for composites can capture a larger market share, positioning themselves as key partners in high-growth segments. The evolving composite landscape is expected to sustain long-term demand for innovative adhesive technologies.

For instance, Henkel offers advanced adhesives like Loctite MAX resin series designed for automotive composite wheels, known for high-temperature resistance beyond 200°C and fast curing speeds that support high-volume production of lightweight vehicle parts.

Key Challenges

Challenge of Stringent Regulatory Compliance

France’s structural adhesives market faces challenges from stringent environmental and safety regulations. Adhesives containing high levels of volatile organic compounds (VOCs) and hazardous chemicals are subject to strict compliance requirements, increasing production costs and limiting formulation options. Manufacturers must invest in research to develop low-emission, eco-friendly alternatives without compromising performance. Meeting European REACH and other local regulations requires ongoing monitoring and product adaptation. Non-compliance risks financial penalties and market exclusion, posing a significant hurdle for companies operating in the French adhesive landscape.

High Competition & Price Sensitivity

The France Structural Adhesives Market is highly competitive, with global and regional players vying for market share. Intense competition pressures companies to maintain competitive pricing while delivering high-performance adhesives. Price-sensitive segments, particularly in industrial and construction applications, demand cost-effective solutions without compromising quality. Additionally, rapid technological advancements require continuous investment in R&D to sustain differentiation. Balancing cost efficiency with performance innovation remains a key challenge, as market players must navigate both competitive pressures and evolving end-user expectations to maintain profitability and growth.

Regional Analysis

Île-de-France

Île-de-France dominates the France Structural Adhesives Market with a 28% market share, driven by its high concentration of automotive, aerospace, and industrial manufacturing hubs. The region’s strong infrastructure and presence of major adhesive end-users foster consistent demand for epoxy, polyurethane, and acrylic adhesives. Growth in electric vehicle production and aerospace component manufacturing fuels adoption of lightweight, high-performance adhesives. Additionally, investments in industrial automation and modern construction projects support solvent-based and water-based adhesive utilization. Increasing environmental regulations and a focus on sustainable bonding solutions further shape the market, reinforcing Île-de-France as a strategic region for structural adhesives.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes holds a 19% share of the French structural adhesives market, supported by robust industrial and construction activities. The region is home to multiple automotive component manufacturers and industrial machinery producers that rely on advanced adhesive technologies for bonding metal, composite, and plastic substrates. Solvent-based adhesives dominate this region, complemented by water-based formulations in eco-sensitive projects. The expansion of commercial infrastructure and high-tech manufacturing facilities drives demand for high-performance adhesives. Ongoing adoption of lightweight and durable materials across automotive and industrial applications strengthens growth, making Auvergne-Rhône-Alpes a key contributor to the national structural adhesives market.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur captures 14% of the France Structural Adhesives Market, propelled by its aerospace, construction, and electronics industries. The region benefits from significant investments in high-value manufacturing and advanced construction projects that require epoxy and acrylic adhesives. Water-based adhesive solutions are increasingly adopted due to environmental regulations and sustainability initiatives. Demand for lightweight composites in aerospace and automotive applications further boosts market growth. The combination of industrial expansion, infrastructure development, and regulatory compliance pressures drives the region’s adhesive consumption. Manufacturers in Provence-Alpes-Côte d’Azur continue to focus on high-performance and durable bonding solutions to meet diverse industry requirements.

Hauts-de-France

Hauts-de-France accounts for 12% of the structural adhesives market in France, driven primarily by automotive manufacturing, metal fabrication, and construction activities. The region relies on epoxy and polyurethane adhesives for high-strength bonding and metal-to-composite applications. Growth in electric vehicle assembly and industrial automation has increased demand for solvent-based and water-based adhesives. Regional infrastructure projects and industrial modernization efforts contribute to steady adoption. Manufacturers are also addressing environmental compliance through low-VOC and eco-friendly adhesive solutions. Hauts-de-France’s strategic position as a manufacturing hub ensures sustained demand, reinforcing its significance in the country’s structural adhesives market.

Nouvelle-Aquitaine

Nouvelle-Aquitaine holds 10% of the France Structural Adhesives Market, with growth supported by automotive, aerospace, and industrial manufacturing sectors. The region favors epoxy adhesives for durability and resistance in structural applications, with acrylic and polyurethane adhesives used in niche segments. Solvent-based adhesives dominate, while water-based options are gaining traction in eco-sensitive projects. Expansion of industrial facilities, increased focus on lightweight materials, and adoption of composites drive regional demand. Growth in infrastructure development, industrial machinery, and renewable energy projects reinforces adhesive consumption. Companies in Nouvelle-Aquitaine continue to invest in innovative adhesive solutions to cater to evolving market requirements.

Occitanie

Occitanie contributes 8% to the French structural adhesives market, primarily fueled by aerospace, automotive, and electronics sectors. The region’s aerospace industry, centered around Toulouse, drives significant demand for epoxy and polyurethane adhesives suitable for metal-to-composite bonding. Solvent-based adhesives dominate, though water-based alternatives are increasingly adopted to meet environmental regulations. Infrastructure projects and industrial manufacturing expansions further boost demand for high-performance adhesives. The region benefits from technological advancements in lightweight materials and composite applications, creating opportunities for specialized adhesive solutions. Occitanie’s strategic industrial clusters make it a key growth region for structural adhesives in France.

Grand Est

Grand Est represents 7% of the France Structural Adhesives Market, with its industrial and automotive sectors driving consumption. Epoxy and acrylic adhesives are widely used for metal, wood, and composite bonding applications, while solvent-based adhesives dominate high-strength industrial processes. The region benefits from modern manufacturing facilities and growing adoption of lightweight materials in automotive and construction projects. Demand is further supported by infrastructure development and industrial modernization programs. Environmental compliance encourages the use of water-based adhesives, providing sustainable alternatives. Grand Est continues to show steady growth due to its strong manufacturing base and increasing need for durable bonding solutions.

Bretagne

Bretagne holds 5% of the structural adhesives market in France, driven by aerospace, marine, and electronics manufacturing. The region relies on epoxy and anaerobic adhesives for high-performance applications in lightweight and composite assemblies. Solvent-based adhesives dominate, while water-based formulations gain traction due to sustainability initiatives. Aerospace component production, marine vessel assembly, and electronics manufacturing increase demand for durable, versatile adhesive solutions. Adoption of advanced adhesive technologies supports lightweighting and structural efficiency. Bretagne’s focus on innovation and sustainable manufacturing practices ensures continued growth in structural adhesives consumption, despite its relatively smaller market share compared to industrial hubs.

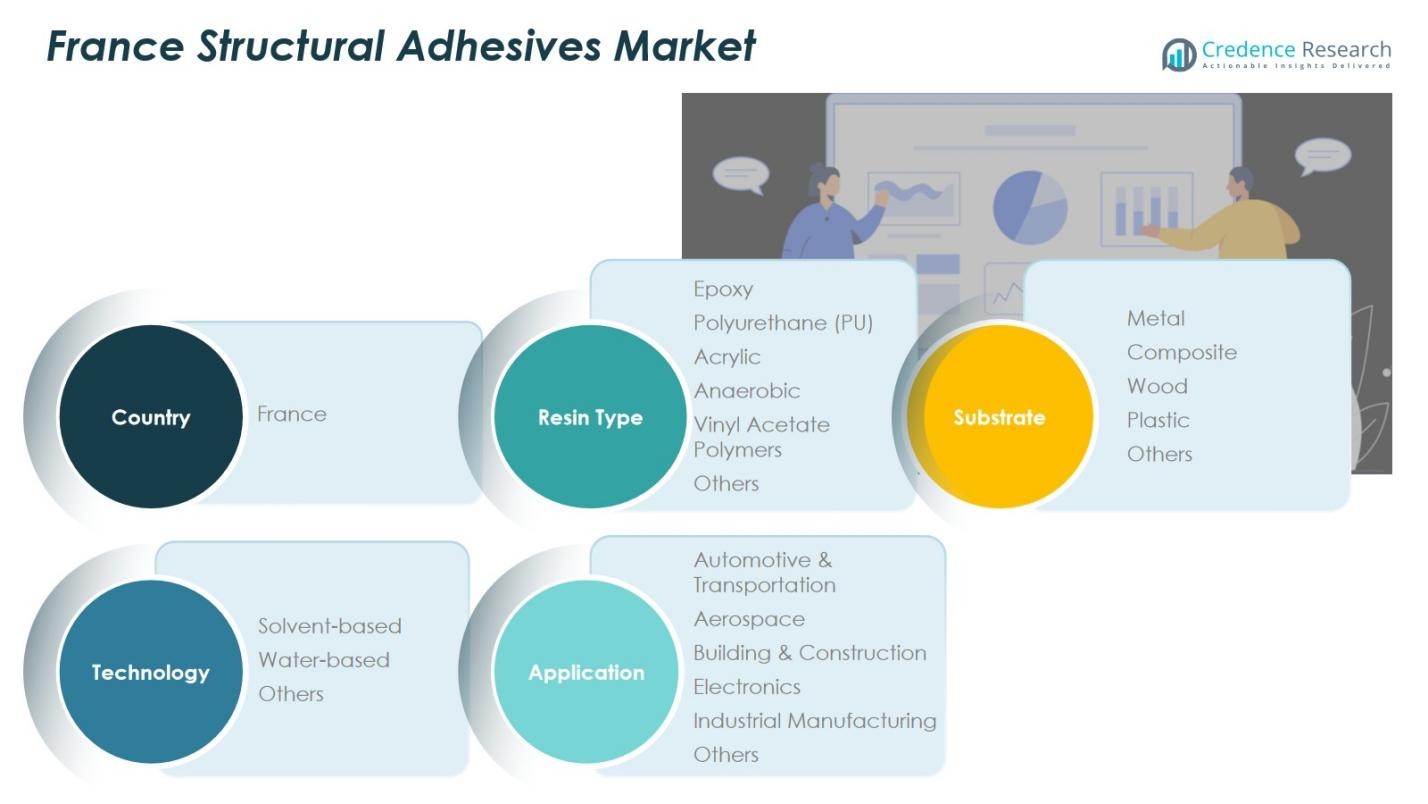

Market Segmentations:

By Resin Type:

- Epoxy

- Polyurethane (PU)

- Acrylic

- Anaerobic

- Vinyl Acetate Polymers

- Others

By Substrate:

- Metal

- Composite

- Wood

- Plastic

- Others

By Technology:

- Solvent-based

- Water-based

- Others

By Application:

- Automotive & Transportation

- Aerospace

- Building & Construction

- Electronics

- Industrial Manufacturing

- Others

By Region:

- Île-de-France

- Auvergne-Rhône-Alpes

- Provence-Alpes-Côte d’Azur

- Hauts-de-France

- Nouvelle-Aquitaine

- Occitanie

- Grand Est

- Bretagne

Competitive Landscape

The competitive landscape of the France Structural Adhesives Market is dominated by key players including Arkema S.A., Henkel AG & Co. KGaA, Compagnie de Saint-Gobain S.A., Sika AG, RPM International Inc., BASF SE, H.B. Fuller Company, Jowat SE, Huntsman Corporation, and Dow Inc. These companies leverage strong product portfolios, technological innovations, and strategic partnerships to maintain and expand their market presence. Emphasis on high-performance adhesives for automotive, aerospace, and industrial applications drives competitive differentiation, while investments in eco-friendly and water-based formulations align with regulatory compliance and sustainability trends. Companies are focusing on expanding production capacities, regional distribution networks, and R&D capabilities to capture emerging opportunities in composite bonding and lightweight materials. Intense competition also encourages continuous product improvement and cost optimization to meet growing demand and evolving end-user requirements, making the market highly dynamic and innovation-driven.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema S.A.

- Henkel AG & Co. KGaA

- Compagnie de Saint-Gobain S.A.

- Sika AG

- RPM International Inc.

- BASF SE

- B. Fuller Company

- Jowat SE

- Huntsman Corporation

- Dow Inc.

Recent Developments

- On September 17, 2025, Huntsman launched a new range of safer and more sustainable ARALDITE® epoxy adhesives, enhancing their product portfolio in structural adhesives.

- In February 2022, H.B. Fuller acquired Fourny NV, strengthening its Construction Adhesives business in Europe and expanding its high-performance adhesive offerings for the construction sector.

- In June 2024, Arkema S.A. acquired Ashland Performance Adhesives, significantly broadening its structural adhesive product lines and global manufacturing capabilities, particularly for the aerospace and industrial sectors.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Substrate, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand from automotive and aerospace industries.

- Adoption of lightweight and high-performance materials will continue to drive structural adhesive consumption.

- Growth in electric vehicle production will increase the need for advanced epoxy and polyurethane adhesives.

- Expansion of industrial manufacturing and construction sectors will support steady adhesive demand.

- Water-based and low-VOC adhesives will gain traction due to environmental regulations.

- Increasing use of composites in automotive and aerospace applications will create new opportunities.

- Companies will focus on R&D to develop innovative, high-strength, and durable adhesives.

- Technological advancements in bonding solutions will enhance product performance and reliability.

- Strategic collaborations and partnerships among key players will strengthen market presence.

- Regulatory compliance and sustainability initiatives will shape future product development and market strategies.