Market Overview

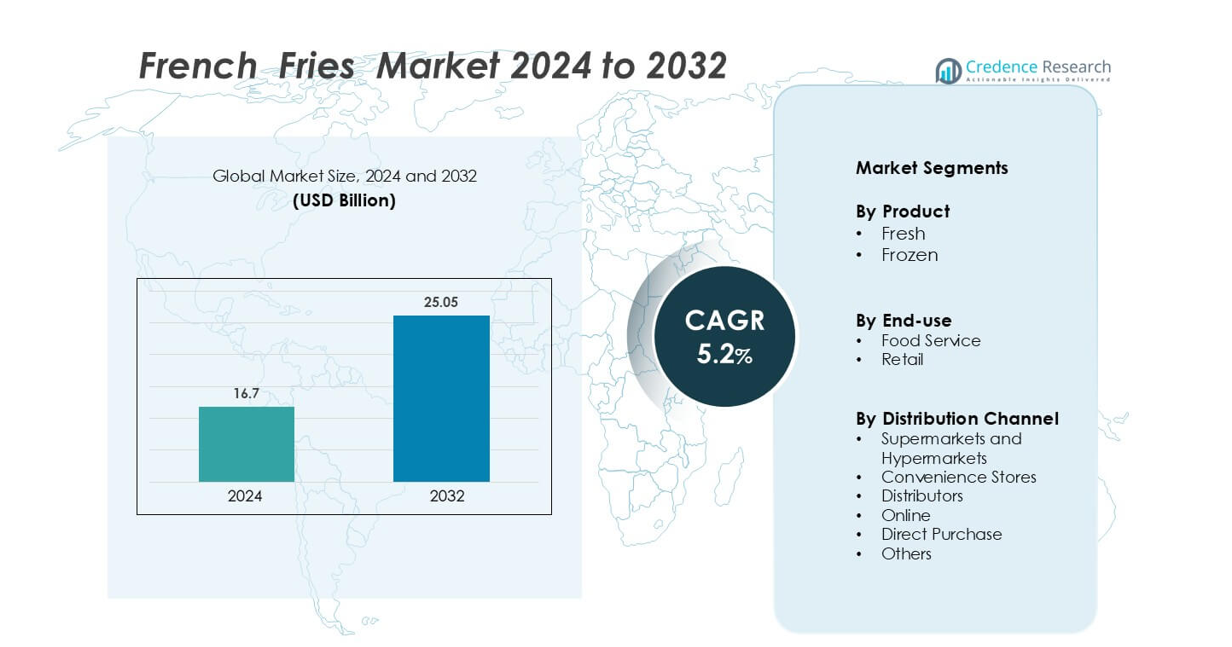

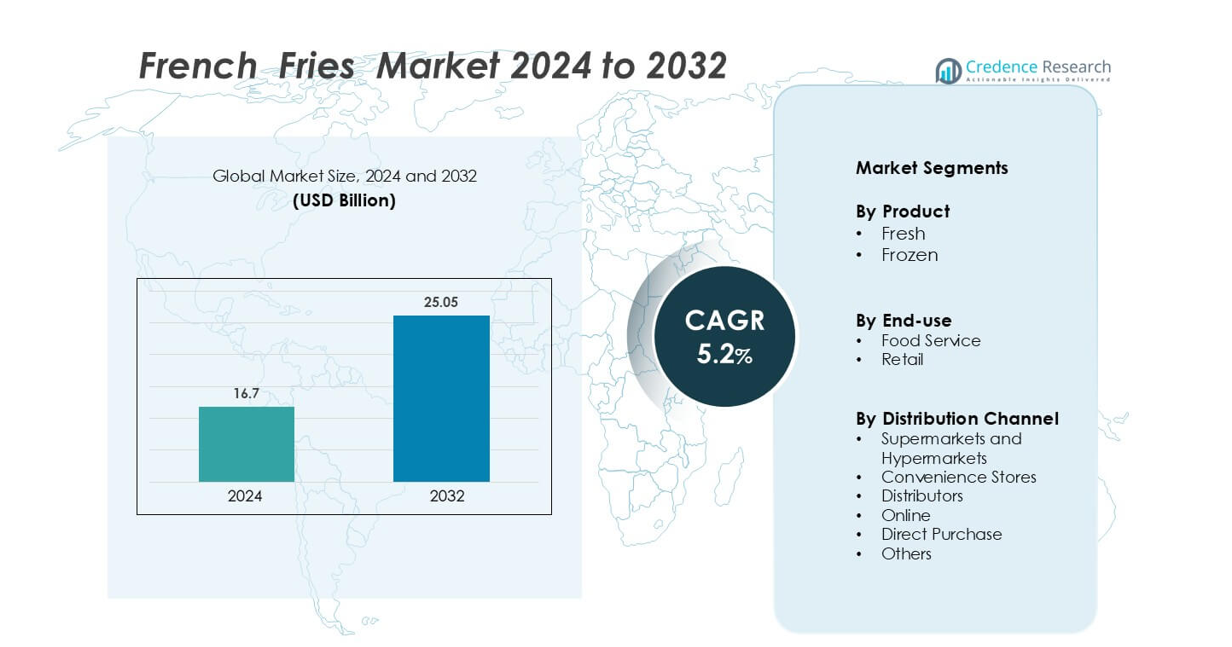

French Fries Market size was valued USD 16.7 billion in 2024 and is anticipated to reach USD 25.05 billion by 2032, at a CAGR of 5.2% during the forecast period

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| French Fries Market Size 2024 |

USD 16.7 billion |

| French Fries Market, CAGR |

5.2% |

| French Fries Market Size 2032 |

USD 15.56 billion |

The French fries market is led by major players focusing on large-scale production, innovation, and distribution efficiency. Key companies include Lamb Weston, Aviko, Checkers Rally’s, McCain Foods Limited, Ore-Ida, Farm Frites International B.V., Alexia Foods, J.R. Simplot Company, Arby’s IP Holder, and Cascadian Farm Organics. These companies strengthen their market position through advanced freezing technologies, product diversification, and strategic partnerships with QSR chains and retailers. North America leads the global market with a 36% share, supported by its established fast-food culture, strong cold chain infrastructure, and wide retail reach. Europe follows with a 29% share, while Asia Pacific holds 22% and shows rapid growth potential.

Market Insights

- The French fries market was valued at USD 16.7 billion in 2024 and is projected to grow at a CAGR of 5.2% during the forecast period, driven by increasing global consumption across food service and retail sectors.

- Rising demand from QSR chains and growing preference for frozen convenience foods strongly drive market growth, with the frozen segment holding the largest share.

- Product innovation, healthier variants, and sustainable packaging trends are shaping the competitive strategies of leading players such as Lamb Weston, McCain Foods Limited, and Aviko.

- Volatility in potato supply, rising raw material costs, and health-related regulations act as key restraints, challenging consistent market expansion.

- North America leads with 36% share, followed by Europe at 29% and Asia Pacific at 22%, while supermarkets and hypermarkets remain the dominant distribution channel globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The frozen segment dominates the French fries market, holding the largest market share. Frozen fries are preferred for their longer shelf life, consistent quality, and easy storage. Food chains and quick-service restaurants rely on frozen products to ensure uniform taste and quick preparation. The growing demand for ready-to-eat and convenient foods also supports this dominance. Consumers favor frozen options for at-home preparation, boosting retail sales. The fresh segment continues to serve niche consumers seeking minimally processed products but remains smaller due to limited preservation time and higher distribution costs.

- For instance, McCain Foods Limited operates over 50 processing plants globally, producing more than 1 million tons of frozen fries annually to supply fast-food chains and retailers.

By End-use

The food service segment leads the market with a major share, driven by strong demand from quick-service restaurants, cafes, and fast-food chains. Rising urbanization and the popularity of Western-style fast foods fuel consistent orders for French fries. Restaurants prefer frozen fries to reduce preparation time and labor costs while maintaining product quality. The retail segment is expanding with the growth of frozen food sections in supermarkets and rising at-home consumption trends. However, food service remains the dominant buyer due to volume purchasing and year-round demand.

- For instance, McDonald’s Corporation sources over 3.4 billion pounds of potatoes annually to supply its global outlets with frozen fries.

By Distribution Channel

Supermarkets and hypermarkets dominate the distribution channel segment, holding the largest market share. These stores offer a wide product range, bulk discounts, and easy accessibility, making them the top choice for both fresh and frozen French fries. Their strong cold storage infrastructure ensures proper product handling and extended shelf life. Online channels are growing rapidly as consumers seek convenient home delivery options. Convenience stores and distributors also play key roles in localized supply, but supermarkets and hypermarkets lead in total sales volume.

Key Growth Drivers

Rising Demand from Quick-Service Restaurants (QSRs)

The rapid expansion of quick-service restaurants is a key driver of the French fries market. Consumers are increasingly adopting fast-food culture due to busy lifestyles and changing dietary habits. QSRs rely heavily on frozen French fries because of their easy storage, consistent quality, and fast preparation time. Global chains such as McDonald’s, KFC, and Burger King are expanding their outlets in urban and semi-urban regions, driving bulk demand for processed potatoes. The increasing use of automated fryers in QSRs also improves operational efficiency, supporting higher sales volumes. Alongside this, the growing preference for takeaway and delivery services further boosts French fries consumption in the food service sector, strengthening market growth.

- For instance, KFC’s supply chain operates through a network of warehouses that replenish individual branches, which contrasts with a singular centralized network.

Growing Popularity of Frozen Convenience Foods

The strong shift toward frozen food consumption drives the French fries market significantly. Consumers value frozen products for their longer shelf life, reduced preparation time, and consistent taste. This shift is particularly evident among urban households and working professionals who prefer easy-to-prepare meals. Manufacturers are launching new frozen French fry products with enhanced crispiness, flavor retention, and innovative packaging to attract more consumers. Improved cold chain infrastructure and wider distribution in supermarkets and online channels ensure product availability throughout the year. This convenience-driven demand aligns with changing lifestyle patterns, making frozen fries a staple in many households and food outlets.

- For instance, Lamb Weston introduced a proprietary Crispy on Delivery technology that maintains fry texture for up to 30 minutes after frying, supporting delivery demand at scale.

Expansion of Retail and E-commerce Distribution Channels

Retail and e-commerce expansion plays a major role in boosting the French fries market. Supermarkets, hypermarkets, and online platforms now offer a broad selection of frozen potato products, increasing accessibility and sales. Modern retail provides bulk discounts and promotional offers, encouraging higher consumer spending. E-commerce platforms enable doorstep delivery, appealing to tech-savvy and convenience-oriented consumers. Manufacturers also invest in better cold storage and packaging solutions to maintain product quality during transportation. This extensive distribution network helps reach both urban and rural markets more efficiently. As retail infrastructure grows, brands gain better market visibility, increasing overall product adoption and market penetration.

Key Trends & Opportunities

Product Innovation and Premium Offerings

Manufacturers are focusing on innovation to meet changing consumer preferences. Premium French fry varieties, including seasoned, crinkle-cut, waffle, and sweet potato fries, are gaining traction. These products cater to consumers seeking unique textures and flavors. Clean-label and low-oil frozen fries are also emerging as healthier alternatives. Investments in advanced freezing technologies preserve crispiness and taste, making products more appealing to health-conscious buyers. Brands are introducing eco-friendly and microwave-safe packaging to align with sustainability goals. This trend of diversification and value-added offerings creates opportunities for differentiation and higher margins in a competitive market.

- For instance, in addition to the plastic reduction, Aviko also reduced its annual cardboard consumption by 100 tonnes by using thinner cardboard for products packaged in boxes.

Rising Globalization of Fast-Food Chains

The rapid globalization of fast-food chains creates major growth opportunities for the French fries industry. Leading QSR brands are expanding aggressively in emerging markets such as India, China, and Southeast Asia. This expansion directly drives large-scale bulk orders of frozen French fries. Franchise models and supply chain integration enable consistent product quality across outlets worldwide. As more local chains adopt Western-style menus, demand for fries as a side dish grows steadily. This expansion allows suppliers to scale production, build regional processing units, and strengthen distribution networks, unlocking new revenue streams.

- For Instance, Burger King passed 500 locations in China years ago and has been closer to 1,500 locations since at least 2023.

Increasing Focus on Healthier Alternatives

Health-conscious consumers are reshaping product innovation in the French fries market. Companies are developing low-fat, air-fried, and baked variants to reduce oil content while maintaining taste and texture. The use of alternative oils, reduced sodium, and organic potatoes appeals to nutrition-focused buyers. Brands are also investing in advanced processing techniques to reduce acrylamide formation during frying. This health-driven product differentiation offers strong growth opportunities, especially in developed markets where wellness trends dominate purchasing behavior. Such innovation helps expand the consumer base beyond traditional fast-food lovers.

Key Challenges

Volatility in Potato Supply and Pricing

Fluctuating raw material availability is a major challenge for French fries manufacturers. Potato production is highly sensitive to climate variations, water availability, and pest outbreaks. Any disruption in harvest directly affects supply stability and pricing. Rising input costs such as energy, transportation, and cold storage further strain profit margins. Inconsistent supply leads to production delays, forcing companies to depend on imports, which increases overall costs. This volatility also impacts contract negotiations with QSRs and retailers. Maintaining long-term supply security requires strong agricultural partnerships and efficient procurement strategies, which can be difficult for smaller producers.

Rising Health Concerns and Regulatory Pressure

Growing consumer awareness regarding high-calorie fast foods poses a challenge to the French fries market. Frequent consumption of fried foods is linked to obesity and cardiovascular risks, leading to negative public perception. Several countries are tightening food labeling and nutrition regulations to encourage healthier eating habits. Increased scrutiny on trans fats, sodium levels, and acrylamide content pressures manufacturers to reformulate products without compromising taste. Meeting these health standards requires investments in R&D and advanced processing technologies. Failure to adapt can lead to reduced demand, stricter regulatory barriers, and reputational risks for brands.

Regional Analysis

North America

North America holds the largest share in the French fries market at 36%. The region’s dominance is driven by a well-established fast-food culture, high consumption of frozen snacks, and a strong retail infrastructure. Leading QSR chains such as McDonald’s and Burger King generate steady bulk demand. Consumers prefer frozen French fries for their convenience and consistent quality. Advanced cold chain logistics ensure year-round product availability. The rising trend of home deliveries and online grocery shopping further boosts sales. Strong brand presence, product innovation, and widespread distribution networks sustain North America’s market leadership.

Europe

Europe accounts for a 29% share of the French fries market. The region benefits from a long-standing potato processing industry and high per capita consumption of fries. Countries like Belgium, the Netherlands, and Germany are major producers and exporters. Premium and specialty fries, such as crinkle-cut and seasoned variants, are increasingly popular. Retail channels, especially supermarkets and hypermarkets, dominate distribution. Healthier product variants and sustainable packaging solutions align with the region’s consumer preferences. The presence of established processing facilities and expanding foodservice sectors further strengthens Europe’s position in the global market.

Asia Pacific

Asia Pacific represents 22% of the French fries market, showing the fastest growth globally. Rising urbanization, changing dietary patterns, and expanding QSR chains drive demand. Major fast-food brands are increasing their presence in India, China, and Southeast Asia. Consumers are adopting Western eating habits, fueling frozen fries consumption. Growing cold chain investments support better product storage and distribution. E-commerce platforms also contribute to wider product reach. Domestic potato processing is expanding to meet local demand. The region’s young population and rapid retail development make Asia Pacific a key growth center in the coming years.

Latin America

Latin America holds a 7% share of the French fries market. The region is experiencing steady growth due to increasing urbanization and rising acceptance of Western fast-food trends. Countries such as Brazil and Mexico are key markets with growing QSR penetration. Expanding retail networks, particularly supermarkets and convenience stores, support product availability. Manufacturers are investing in improving cold storage infrastructure to handle frozen products efficiently. Local processing capacity is also growing to reduce import dependency. The region’s increasing middle-class population and growing preference for convenient food options are expected to sustain future market expansion.

Middle East & Africa

The Middle East & Africa account for a 6% share of the French fries market. Growing urbanization and increasing fast-food restaurant penetration are key demand drivers. International QSR chains are expanding in countries like the UAE, Saudi Arabia, and South Africa, boosting frozen French fries consumption. Retail modernization, supported by better cold chain infrastructure, is improving product accessibility. Rising disposable incomes and changing dietary habits contribute to demand growth. However, the region still relies on imports for large volumes, which affects pricing and supply stability. Strategic local production initiatives may strengthen its future market position.

Market Segmentations:

By Product

By End-use

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Distributors

- Online

- Direct Purchase

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The French fries market features strong competition among key global players focused on product innovation and large-scale distribution. Leading companies include Lamb Weston, Aviko, Checkers Rally’s, McCain Foods Limited, Ore-Ida, Farm Frites International B.V., Alexia Foods, J.R. Simplot Company, Arby’s IP Holder, and Cascadian Farm Organics. These players emphasize expanding their product portfolios, enhancing freezing technologies, and strengthening supply chain efficiency. North America leads the market with a 36% share, driven by robust QSR networks and advanced cold chain infrastructure. Europe follows with a 29% share, supported by its established potato processing industry. Asia Pacific holds a 22% share and shows the fastest growth, creating expansion opportunities for global and regional brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lamb Weston (U.S.)

- Aviko (Netherlands)

- Checkers Rally’s (U.S.)

- McCain Foods Limited (Canada)

- Ore-Ida (U.S.)

- Farm Frites International B.V. (Netherlands)

- Alexia Foods (U.S.)

- R. Simplot Company (U.S.)

- Arby’s IP Holder (U.S.)

- Cascadian Farm Organics (U.S.)

Recent Developments

- In November 2022, Lamb Weston Co. recently launched a novel potato-based product in Belgium and the Netherlands in partnership with Sergio Herman: Atelier-Frites. The fast-casual food concept, Frites Atelier established the product with Lamb Weston Co. to ensure growth in scale, make Frites Atelier-Frites accessible to restaurants, and allow chefs to serve these exclusive Frites to their guests in a unique way.

- In February 2022, Simplot Food Group, a division of J.R. Simplot Co. and Kraft Heinz, made a new agreement to select Boise, Idaho, as the exclusive producer and supplier of the Ore-Ida, which is owned by Kraft Heinz. This agreement is done for a business to produce greater efficiency via vertical integration, including supplying potatoes for the brand beginning with the 2023-24 crop season.

- In January 2022, Simplifine, a food processing company based in Kenya, has expanded by adding an Individual Quick Freezing processing line to produce frozen French fries. The expansion will help the company to serve the broader base of Kenyan consumers with frozen fries. In addition, this development has helped the company to enter the frozen food segment

Report Coverage

The research report offers an in-depth analysis based on Product, End-Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global QSR expansion will continue to drive steady French fries demand.

- Frozen fries will remain the dominant product category across all regions.

- Asia Pacific will emerge as a key high-growth market with rising urbanization.

- Retail and online distribution will strengthen market accessibility and reach.

- Product innovation will focus on healthier, low-oil, and clean-label options.

- Advanced freezing and packaging technologies will enhance product quality.

- Sustainable and eco-friendly packaging will gain stronger consumer preference.

- Strategic partnerships between QSR chains and suppliers will expand.

- Investments in cold chain logistics will support efficient global supply.

- Premium and value-added French fry variants will drive higher margins.