Market Overview:

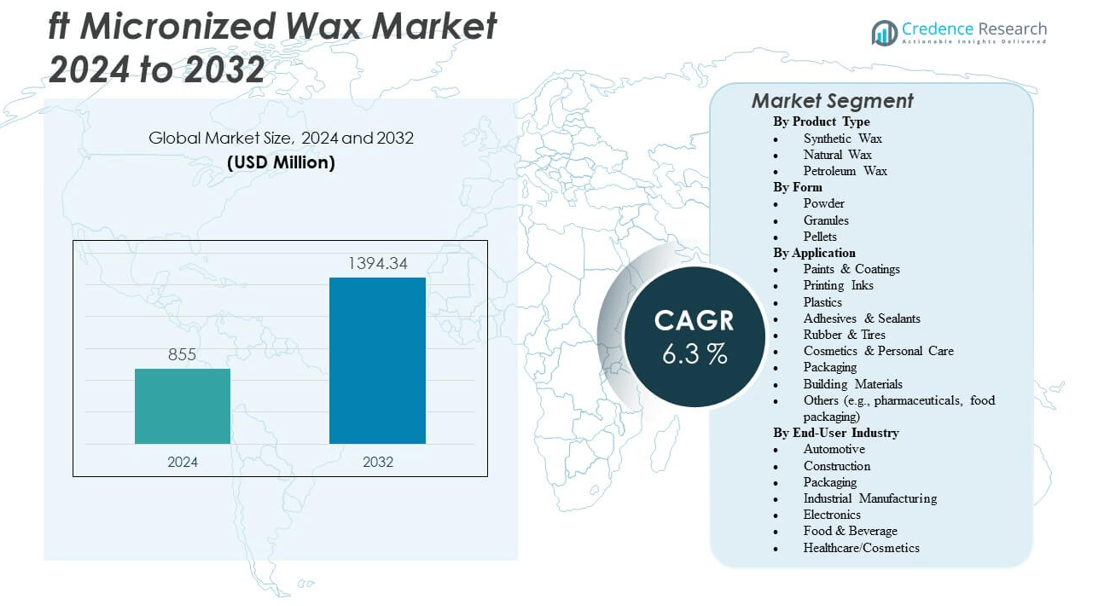

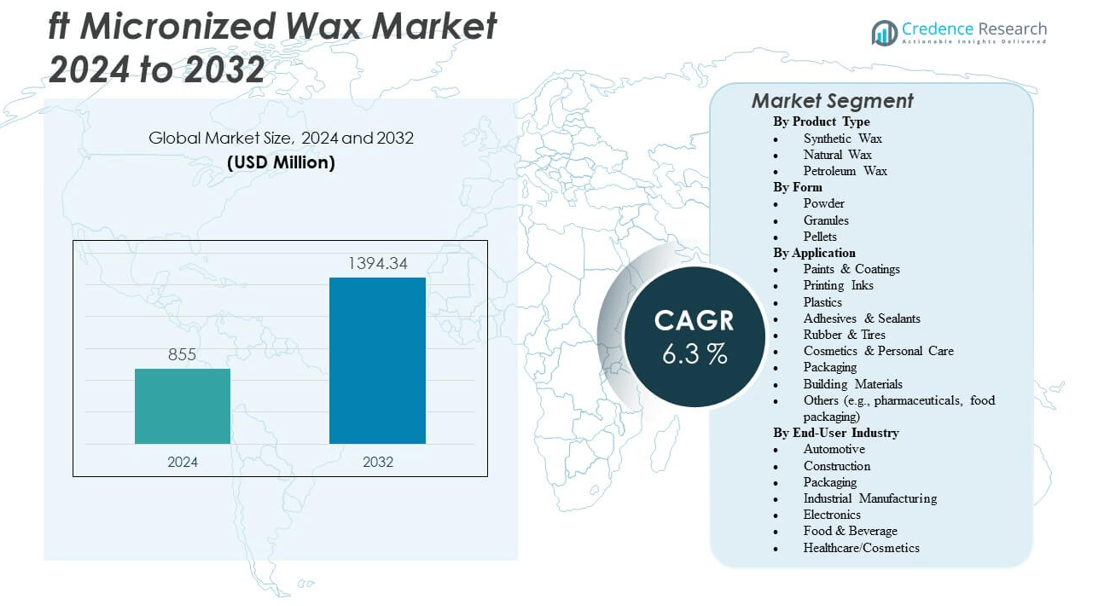

The FT Micronized Wax Market is projected to grow from USD 855 million in 2024 to an estimated USD 1394.34 million by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| FT Micronized Wax Market Size 2024 |

USD 855 million |

| FT Micronized Wax Market , CAGR |

6.3% |

| FT Micronized Wax Market Size 2032 |

USD 1394.34 million |

Key market drivers include the adoption of advanced coatings, eco-friendly waterborne systems, and durable ink formulations for packaging and printing. Industrial buyers shift toward premium pigments and additives, which increase the requirement for consistency and anti-blocking properties. The automotive and construction industries use modified plastics and protective coatings that benefit from wax-based enhancements. Innovation in polymer compounding strengthens use cases, supported by manufacturers offering customized particle sizes, melt points, and surface effects that suit diverse processing needs.

Regionally, Asia-Pacific leads due to strong manufacturing growth, expanding packaging demand, and the presence of large polymer and coating industries. North America and Europe show steady consumption driven by high-performance requirements, technological advancement, and established industrial infrastructure. Emerging growth in Latin America and the Middle East comes from rising investment in building materials, industrial coatings, and local production facilities. Markets with strong consumer goods, automotive output, and flexible packaging continue to generate the highest demand for micronized wax solutions.

Market Insights:

- The FT Micronized Wax Market is projected to rise from USD 855 million in 2024 to USD 1394.34 million by 2032, registering a 3% CAGR.

- Demand grows in coatings, printing inks, plastics, adhesives, and rubber, driven by scratch resistance, surface enhancement, and stable dispersion.

- Water-based and low-VOC formulations increase adoption as industries shift to sustainable and regulatory-compliant materials.

- Innovation in polymer compounding and customized wax grades strengthens integration into automotive, packaging, and construction applications.

- High production cost and feedstock challenges restrain smaller manufacturers and create pricing pressure.

- Asia-Pacific leads due to strong industrial expansion and packaging demand, while North America and Europe maintain steady consumption with advanced coatings and inks.

- Emerging regions in Latin America and the Middle East gain momentum through infrastructure growth and increasing industrial coatings usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand From Coatings and Printing Ink Manufacturers

The FT Micronized Wax Market benefits from strong use in coatings and printing inks. Global producers demand consistent performance in scratch resistance and surface finish. Industrial paints, automotive coatings, and protective layers integrate micronized wax to enhance life and appearance. Printing ink manufacturers use it to improve rub resistance during high-speed printing. Digital printing growth creates a larger requirement for surface durability. Water-based coatings gain attention because they support low-VOC standards. Wax producers supply grades tailored for dispersibility and fine particle control. These properties increase adoption across industrial end users.

- For example, Clariant AG launched Ceridust 1310 in April 2025, a micronized rice bran wax designed to address the supply volatility of carnauba wax in printing ink applications. This product achieves a high melting point of 125°C, delivers excellent rub resistance, and provides consistent performance for both premium packaging and water-based topcoats enhancing durability and surface finish in high-speed printing lines.

Rising Use of Wax in Polymer Modification and Plastic Compounding

Demand grows across polymer processing due to wax improving flow, dispersion, and molding efficiency. Manufacturers of plastics and engineered polymers use it to improve surface quality. The automotive sector uses plastic components that need scratch resistance and better dimensional stability. Compounding facilities integrate micronized wax to support faster mixing with pigments and fillers. Packaging firms shift to modified polymers for food and consumer goods. High purity grades reduce odor and discoloration issues. Wax suppliers invest in production upgrades to increase uniformity and reduce contamination. The FT Micronized Wax Market strengthens its position in polymer processing.

- For example, Sasol Chemicals introduced SASOLWAX LC Spray 30 G and LC Spray 30 G-EF in February 2025, new grades of micronised wax produced using advanced Gas-to-Liquid (GTL) Fischer-Tropsch processing. These new products offer a 32% lower product carbon footprint than their predecessors and maintain exceptional rub resistance, gloss control, and surface protection meeting high standards for polymer compounding and industrial coatings worldwide.

Increased Adoption Across Adhesives, Sealants, and Rubber Processing

Adhesive manufacturers expand usage to improve anti-blocking, viscosity control, and durability. Hot-melt adhesives gain value from wax because it supports smooth application and stable melting behavior. Rubber processors add wax to reduce friction and provide better release properties during molding. Sealant producers need better weather resistance for construction and automotive joints. Industrial rubber goods require improved flexibility and surface performance. Custom grades of wax serve silicone, polyurethane, and epoxy-based chemistries. Local suppliers offer specialty blends for niche industrial needs. These factors expand commercial demand.

Shift Toward Sustainable and Low-Emission Formulations

Industries focus on safer and cleaner formulations in paints, inks, plastics, and coatings. Producers replace solvent-heavy materials with water-based systems. Micronized wax meets regulatory pressure for low VOC levels. It offers stable dispersion without hazardous additives. End users in consumer goods and packaging demand safer chemical profiles. Eco-friendly coatings in toys, furniture, and household products gain wider use. Demand increases for biodegradable and non-toxic wax grades. Regulatory agencies enforce strict compliance, encouraging wider adoption across manufacturers.

Market Trends

Advancement in Ultra-Fine Particle Size Production Technologies

Manufacturers invest in controlled micronization technologies that create finer and more uniform particle sizes. Precise size control improves dispersion in coatings and inks. Producers use advanced grinding and spray-crystallization methods. Ultra-fine grades support matte and high-gloss effects in finishing. The FT Micronized Wax Market observes stronger customer demand for tailored particle ranges. High-performance coatings need uniformity for smooth film formation. Suppliers market waxes that reduce settling issues in stored products. These improvements boost product reliability.

Growing Popularity of Water-Based and Solvent-Free Systems

Industries shift toward eco-friendly systems in paints, inks, sealants, and packaging. Water-based coatings gain space in furniture and architectural coatings. Wax improves slip, abrasion resistance, and anti-blocking performance. It offers compatibility with common resin systems. Solvent-free printing inks use wax to improve rub resistance on flexible packaging. Brands focus on low-odor and safe-handling materials. Regulatory frameworks support this transition in major industrial markets. Green chemistry trends influence procurement decisions.

- For instance, BASF’s portfolio of Joncryl® water-based acrylic dispersions, including Joncryl 953X, enables coatings manufacturers to meet VOC content targets of 250 g/L or less, as confirmed by regional regulatory compliance data and highlighted in ongoing industry adoption in 2024 regulatory documents and manufacturer statements.

Increased Customization for Performance-Driven Industrial Formulations

Buyers require wax types tailored for hardness, melt point, and dispersion behavior. Suppliers create customized blends to meet these requirements. High-temperature coatings use wax grades that maintain surface integrity. Printing inks for high-speed presses need consistent slip and anti-blocking strength. Plastics manufacturers choose specialty grades that limit haze and improve clarity. The FT Micronized Wax Market gains growth from product innovation. End users request samples for lab trials before bulk orders. This supports long-term supplier relationships.

- For instance, Michelman offers its Hydrosize® Carbon Series, allowing industrial composite manufacturers to select resin compatibility, mechanical performance, and thermal resistance suited to end-use—these tradeoffs and product features are detailed in the official product bulletin for Hydrosize Carbon 260, confirming wide customization options for nylon composites.

Integration of Micronized Wax in Emerging Application Segments

New opportunities arise in personal care, pharmaceuticals, textiles, and metal coatings. Wax offers smooth texture in cosmetic formulations. Textile processing uses it to enhance fabric glide and reduce friction. Metal packaging coatings require improved corrosion resistance. Food packaging inks need safe and stable additives. Wax suppliers expand into these segments to diversify revenue. Industrial research explores new melting behaviors and chemical compatibility. These application shifts increase attention from specialty chemical companies.

Market Challenges Analysis

Higher Production Cost Due to Controlled Micronization Standards

Controlled micronization technologies require advanced equipment and high precision. Many producers struggle with energy consumption and machinery cost. Wax must maintain narrow particle distribution and high purity. Any contamination lowers end-use performance. The FT Micronized Wax Market faces pricing pressure from low-cost substitutes. Local manufacturers compete with established global suppliers. Transportation and storage add operational costs. Buyers often negotiate long-term pricing, which affects margins.

Limited Awareness in Small-Scale Industries and Volatile Feedstock Supply

Small manufacturers lack technical knowledge about performance benefits. Some continue using conventional wax types due to lower cost. Volatile raw material supply affects production planning. Market participants face delays caused by logistics disruptions. Strict environmental rules in certain countries limit traditional feedstocks. Chemical regulations require safety approvals, increasing timelines for new products. Substitute polymer additives create competition. These constraints slow broad adoption.

Market Opportunities

Rising Demand From Food Packaging and Consumer Goods Industries

Brand owners want high print quality, surface protection, and safe additive systems. Micronized wax supports these requirements for flexible packaging. The FT Micronized Wax Market gains new prospects from health-focused packaging rules. Wax adds barrier properties without harmful chemicals. Consumer product labels and printed packs require durable and smudge-free surfaces. Growing e-commerce accelerates demand for high-quality prints. Local converters look for reliable supply networks. These conditions attract investment in capacity expansion.

Expansion Potential Across Developing Industrial Economies

Asia-Pacific, Latin America, and parts of Africa move toward advanced coatings and polymer systems. Industries in these regions upgrade production lines. Wax suppliers can set regional blending units to lower logistics cost. Local manufacturing support increases buyer confidence. Government projects in construction and infrastructure increase coating demand. Packaging firms expand capacity for food and pharmaceutical sectors. More producers enter the market with cost-efficient technologies. Growth prospects remain strong for new entrants.

Market Segmentation Analysis:

By Product Type

Synthetic wax holds a significant share in the ft Micronized Wax Market due to its purity, controlled particle size, and strong performance in coatings, inks, and plastics. It supports high-quality surface effects and slip properties needed in automotive and packaging. Natural wax shows steady uptake in cosmetics and food packaging where safe and bio-based content matters. Petroleum wax remains important in industrial applications that require cost efficiency and stable melting behavior. Diverse product choices help manufacturers match performance needs with application demand.

- For instance, Sasol’s SASOLWAX C105 Fischer-Tropsch wax delivers a drop melting point of 117°C and penetration at 25°C below 1 (1/10 mm), as stated in official product sheets, supporting stable adhesive and packaging applications.

By Form

Powder remains the most widely used form due to easy dispersion in coatings and printing inks. Granules and pellets support bulk processing in plastics and rubber compounding. The ft Micronized Wax Market also benefits from emulsion and dispersion formats used in water-based formulations. It allows producers to meet VOC compliance and safe-handling standards. This flexibility supports fast integration across multiple industrial systems.

- For instance, BASF’s Luwax® A Powder is available as a fine, white powder with particle size distribution verified to be less than 500 microns for over 70% of the product, supporting uniform dispersion in coatings and inks.

By Application

Paints and coatings lead due to requirements for scratch resistance, anti-blocking, and improved gloss control. Printing inks use micronized wax for rub resistance and smooth transfer. Plastics and adhesives rely on controlled melting behavior for processing stability. Rubber, packaging, cosmetics, and building materials represent expanding demand. Safety-focused products such as food packaging and pharmaceuticals increase interest in high-purity grades.

By End-User Industry

Automotive and construction drive strong consumption through engineered coatings and modified plastics. Packaging uses wax for durable print surfaces and anti-scuff protection. Industrial manufacturing and electronics benefit from abrasion resistance and controlled friction. The ft Micronized Wax Market also gains volume from food, beverage, and healthcare sectors that prefer clean and consistent additives for sensitive products.

Segmentation:

By Product Type

- Synthetic Wax

- Natural Wax

- Petroleum Wax

By Form

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Adhesives & Sealants

- Rubber & Tires

- Cosmetics & Personal Care

- Packaging

- Building Materials

- Others (e.g., pharmaceuticals, food packaging)

By End-User Industry

- Automotive

- Construction

- Packaging

- Industrial Manufacturing

- Electronics

- Food & Beverage

- Healthcare/Cosmetics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds 22% share and leads with strong demand from coatings, inks, and engineered plastics. Industrial users prefer high-purity grades for automotive and construction applications. Producers in the United States invest in capacity upgrades to support consistent particle size control. The ft Micronized Wax Market gains stable revenue from packaging, electronics, and heavy industry. It benefits from a mature chemicals sector that values performance stability and regulatory compliance. Canada shows growing interest in water-based systems with low VOC levels.

Europe accounts for 28% share with strong consumption in Germany, Italy, France, and the United Kingdom. Local manufacturers focus on eco-friendly formulations in architectural coatings and printing inks. Sustainable packaging policies support increased use of micronized wax in food labels and flexible films. European buyers prefer specialty grades with narrow particle distribution. The ft Micronized Wax Market sees steady investment in research and technical services. It gains long-term supply contracts with regional adhesive and sealant producers.

Asia-Pacific commands the largest 40% share driven by China, India, South Korea, and Southeast Asia. Expanding polymer compounding, packaging, and industrial coatings industries boost consumption. Local converters demand labels and packaging films with higher rub resistance. Manufacturers set up regional units to reduce cost and ensure faster delivery. The ft Micronized Wax Market gains traction from high automotive production and infrastructure growth. It experiences interest from emerging markets in Latin America and the Middle East, which together contribute 10% share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE (Germany)

- Sasol Limited (South Africa)

- Clariant AG (Switzerland)

- Honeywell International Inc. (U.S.)

- Lubrizol Corporation (U.S.)

- MÜNZING Corporation (Germany)

- Micro Powders Inc. (U.S.)

- Nanjing Tianshi New Material Technologies (China)

- Michelman Inc. (U.S.)

- Shamrock Technologies Inc. (U.S.)

- Ceronas GmbH & Co. KG (Germany)

- Shell PLC (UK – base FT wax)

Competitive Analysis:

The ft Micronized Wax Market features global manufacturers focused on product grade variety, dispersion performance, and technical support. Leading players compete on particle size uniformity, purity levels, and application compatibility. Buyers request tailored grades for printing inks, polymer compounding, coatings, and adhesives. Producers invest in micronization technology to maintain reliability in high-speed industrial processes. It faces competition from substitutes such as PTFE, amide waxes, and specialty polymers, but micronized wax retains demand due to balanced cost and performance. Major companies work with distributors to reach packaging converters, plastics manufacturers, and ink suppliers. Regional players enter the market with competitive pricing and contract manufacturing services. Global firms expand through new capacity, product innovation, and partnerships with coating and ink formulators. This competition supports continuous quality upgrades and wider industrial adoption.

Recent Developments:

- In October 2025, Lubrizol expanded its strategic partnership with IMCD Group, commencing November 2025, to widen the distribution of Lubrizol’s specialty chemicals, including micronized waxes, particularly targeting key growth markets globally.

- In April 2025, Clariant AG launched Ceridust 1310, a bio-based micronized rice bran wax blend, designed to help printing ink formulators manage supply chain volatility associated with seasonal carnauba wax. Ceridust 1310 offers consistent production, high melting point, excellent rub resistance, and superior matting properties, addressing key formulation challenges in the high-end packaging and premium coatings segment.

- In February 2025, Sasol Chemicals introduced new micronized wax products: SASOLWAX LC Spray 30 G and LC Spray 30 G-EF. These innovative solutions feature a 32% lower product carbon footprint, achieved through optimizations in their Gas-to-Liquid (GTL) Fischer-Tropsch production process. The launch aligns with Sasol’s ongoing strategy to reduce greenhouse gas emissions while delivering top performance for inks, paints, and coatings, essential uses in the FT micronized wax market.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Form, Application and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand expands across coatings, inks, and polymer processing due to rising performance requirements in surface protection.

- Product innovation focuses on finer particle sizes, uniform dispersion, and compatibility with water-based systems.

- Manufacturers invest in cleaner formulations that support low-VOC and eco-friendly regulations in industrial markets.

- New opportunities emerge in food packaging and consumer goods that require durable and safe printing surfaces.

- Regional production facilities reduce logistics cost and improve supply reliability for fast-moving manufacturing hubs.

- Adhesive and sealant producers adopt tailored wax grades that improve durability, weather stability, and anti-blocking behavior.

- Digital and high-speed printing increases demand for abrasion resistance and smooth film formation.

- Packaging firms shift toward flexible films and labels that require stable slip and anti-blocking performance.

- Growth in automotive and construction industries drives wider use in polymer modification and engineered plastics.

- Research into emerging uses in textiles, pharmaceuticals, and metal finishing broadens commercial scope for manufacturers.