Market Overview

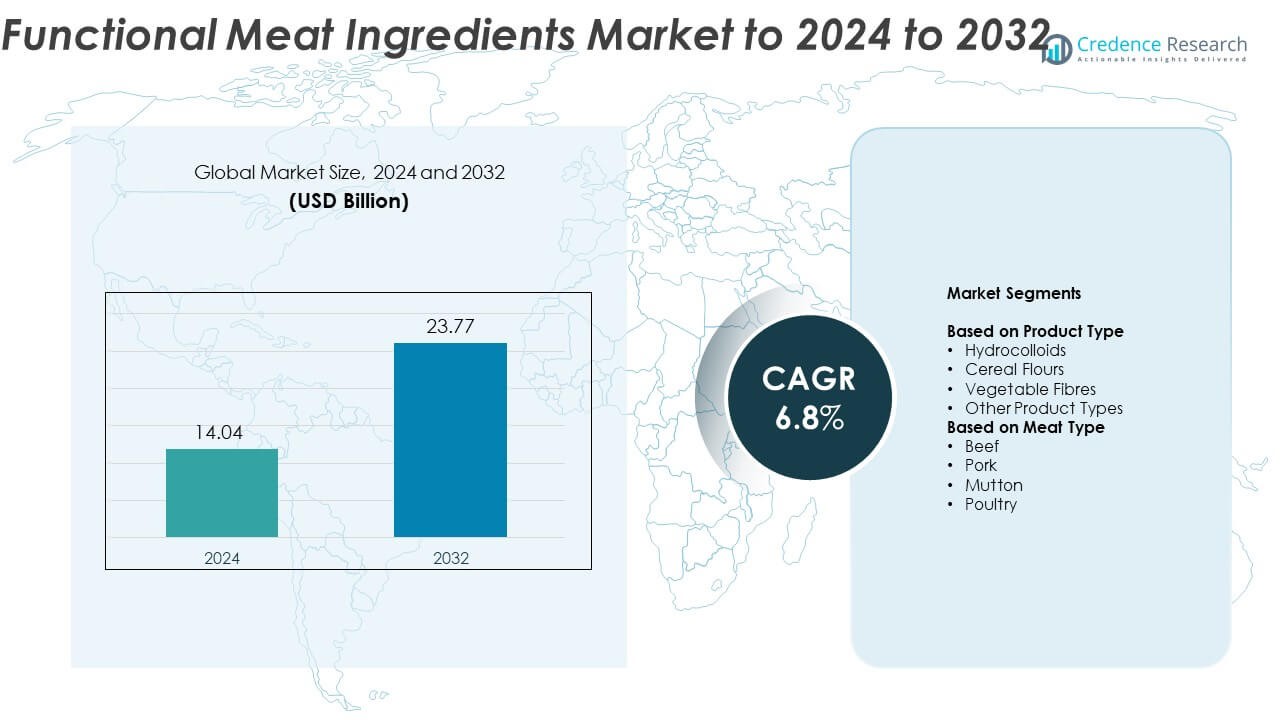

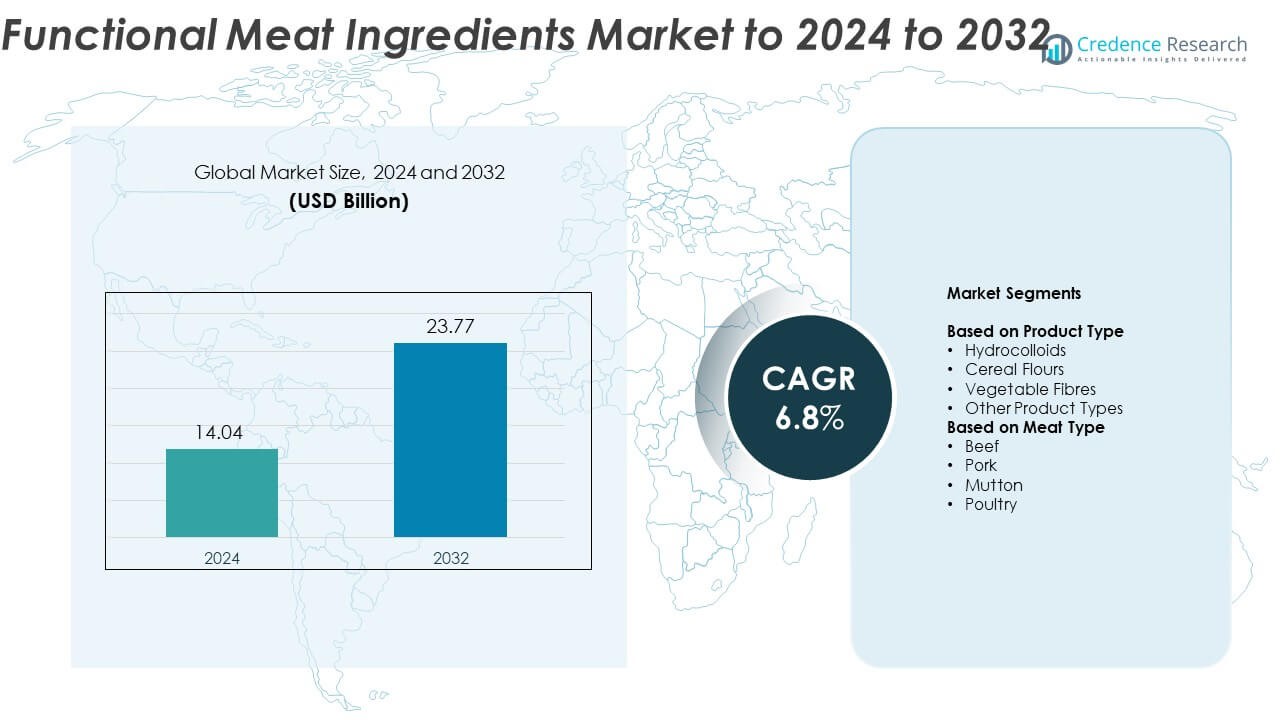

Functional Meat Ingredients Market size was valued at USD 14.04 Billion in 2024 and is anticipated to reach USD 23.77 Billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Meat Ingredients Market Size 2024 |

USD 14.04 Billion |

| Functional Meat Ingredients Market, CAGR |

6.8% |

| Functional Meat Ingredients Market Size 2032 |

USD 23.77 Billion |

The Functional Meat Ingredients Market is highly competitive, with major players such as Tyson Foods, Hormel Foods, JBS, Perdue Farms, Cargill, Kerry Group PLC, and others focusing on innovation and sustainable ingredient development. These companies emphasize product quality, safety, and functionality through the use of advanced technologies and clean-label formulations. Strategic mergers, acquisitions, and capacity expansions strengthen their global reach and manufacturing efficiency. Regionally, North America leads the market with a 35.2% share in 2024, followed by Europe at 27.6% and Asia-Pacific at 24.9%. The dominance of developed regions reflects strong consumption of processed meat and adoption of value-added ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Functional Meat Ingredients Market was valued at USD 14.04 Billion in 2024 and is projected to reach USD 23.77 Billion by 2032, expanding at a CAGR of 6.8%.

- Rising demand for processed and convenience meat products is a key growth driver, supported by the use of hydrocolloids and natural fibers to improve texture and shelf life.

- Clean-label trends and growing interest in low-fat, high-protein meat formulations are shaping ingredient innovation and product reformulation.

- The market is highly competitive, with global players focusing on sustainable production, R&D investments, and advanced processing technologies to enhance efficiency and flavor quality.

- North America leads with 35.2% share in 2024, followed by Europe at 27.6% and Asia-Pacific at 24.9%, while the hydrocolloids segment dominates with 41.6% share, reflecting broad applications in meat stabilization and texture enhancement.

Market Segmentation Analysis:

By Product Type

The hydrocolloids segment dominates the functional meat ingredients market, accounting for nearly 41.6% share in 2024. Its leadership is driven by extensive use in processed meat products for moisture retention, texture stabilization, and improved mouthfeel. Hydrocolloids such as carrageenan, xanthan gum, and guar gum enhance binding capacity and extend shelf life, making them vital for ready-to-eat and frozen meat formulations. The growing demand for cleaner labels and reduced-fat meat products further strengthens hydrocolloids’ dominance, as manufacturers adopt natural stabilizers and thickeners to maintain product quality and consistency.

- For instance, Gelymar expanded carrageenan capacity to about 10,000 metric tons per year.

By Meat Type

The poultry segment leads the functional meat ingredients market with approximately 46.3% share in 2024. Its dominance stems from the widespread consumption of chicken in processed forms such as sausages, nuggets, and patties. Poultry meat offers versatility and faster processing cycles, encouraging greater incorporation of binders, emulsifiers, and flavor enhancers to improve taste and texture. Rising global demand for lean protein sources and expanding quick-service restaurant chains support consistent growth in poultry-based processed products, driving steady utilization of functional ingredients in this category.

- For instance, Wayne-Sanderson Farms owns and operates 24 fresh and further-processing facilities across several states and produces a wide variety of poultry products, including those that use binders, emulsifiers, and flavor systems for items like chicken nuggets and patties.

Key Growth Drivers

Rising Demand for Processed and Convenience Meat Products

The growing global preference for ready-to-eat and convenience meat products fuels demand for functional ingredients that enhance texture, flavor, and shelf stability. Urbanization and changing lifestyles have accelerated processed meat consumption across emerging economies. Functional ingredients like binders, antioxidants, and flavor enhancers help manufacturers maintain product quality while meeting consumer expectations for taste and convenience, supporting sustained market expansion.

- For instance, Smithfield’s Tar Heel complex runs near 34,500 hogs per day capacity.

Increasing Focus on Clean Label and Natural Additives

Consumers are shifting toward meat products with recognizable, natural ingredients and fewer synthetic additives. This trend drives the use of plant-derived hydrocolloids, natural fibers, and enzyme-based functional agents that align with clean-label requirements. Manufacturers are reformulating meat products to replace artificial preservatives and emulsifiers with natural alternatives while maintaining texture and safety standards, reinforcing long-term market adoption.

- For instance, Givaudan operates 78 production sites and 62 creation/research centers, supporting clean-label solution rollouts.

Expansion of High-Protein and Low-Fat Meat Formulations

Rising awareness about health and nutrition supports the development of high-protein, low-fat meat products. Functional ingredients such as soy proteins, fibers, and collagen are widely used to enhance nutritional profiles and improve product binding. These innovations address growing consumer interest in fitness and balanced diets while providing manufacturers with cost-effective formulations that maintain taste and juiciness.

Key Trends & Opportunities

Growth of Plant-Based and Hybrid Meat Alternatives

Functional meat ingredients are finding new applications in hybrid products that combine plant and animal proteins. These formulations use emulsifiers, hydrocolloids, and fibers to replicate meat-like texture and improve sensory appeal. The rise of flexitarian diets and sustainability goals creates significant opportunities for producers to expand functional ingredient portfolios into next-generation meat substitutes.

- For instance, Impossible Foods’ products are available in approximately 25,000 grocery stores and appear on menus across more than 40,000 restaurants spanning multiple countries, by the year late 2022 and early 2023.

Adoption of Advanced Processing Technologies

Technologies such as high-pressure processing, encapsulation, and enzyme-assisted extraction are improving ingredient performance in processed meat. These methods enhance protein functionality, extend shelf life, and reduce oxidation without compromising sensory quality. As manufacturers pursue clean-label innovation, advanced processing supports higher efficiency, reduced waste, and greater stability in functional ingredient applications.

- For instance, Universal Pure operates 22 HPP machines across its national, strategic facility footprint of seven locations in California, Connecticut, Georgia, Nebraska, Ohio, Pennsylvania, and Texas, making it one of the largest users of HPP globally.

Key Challenges

Fluctuating Raw Material Prices and Supply Constraints

Dependence on agricultural commodities for hydrocolloids, starches, and fibers exposes manufacturers to price volatility. Climate variations, crop shortages, and transportation disruptions affect supply consistency. These fluctuations challenge producers to manage costs while maintaining ingredient quality, often leading to reformulation efforts or sourcing diversification to ensure stable supply chains.

Stringent Regulatory Compliance and Labeling Requirements

The functional meat ingredients market faces complex regulatory oversight concerning additive usage, safety standards, and labeling claims. Varying regional regulations on preservatives, flavor enhancers, and clean-label certifications create compliance challenges for global manufacturers. Meeting these evolving standards requires ongoing investment in product testing, documentation, and transparent labeling practices to ensure market acceptance.

Regional Analysis

North America

North America dominates the functional meat ingredients market with a 35.2% share in 2024. The region benefits from strong demand for processed meat, high consumer preference for convenience foods, and widespread adoption of natural additives. Major meat processors in the U.S. and Canada are reformulating products to meet clean-label and low-fat requirements, driving usage of hydrocolloids, fibers, and natural antioxidants. Growing awareness of protein-enriched diets further supports ingredient innovation, while technological advancements in meat processing and strict food safety standards continue to sustain regional growth momentum.

Europe

Europe holds a 27.6% share of the functional meat ingredients market in 2024. The region’s focus on quality standards, traceability, and regulatory compliance promotes the adoption of natural stabilizers, binders, and flavor enhancers. Manufacturers in Germany, France, and the U.K. are actively investing in sustainable and plant-based meat innovations. Demand for low-sodium and allergen-free formulations is increasing as consumers prioritize health-conscious options. Europe’s well-established meat processing infrastructure and growing emphasis on environmentally responsible production further support steady market expansion across the region.

Asia-Pacific

Asia-Pacific accounts for a 24.9% share of the functional meat ingredients market in 2024, driven by rapid urbanization and increasing consumption of processed poultry and pork products. Expanding middle-class populations in China, India, and Southeast Asia are fueling demand for affordable, protein-rich foods. Regional manufacturers are incorporating hydrocolloids and flavor enhancers to improve meat product appeal and shelf life. Government support for food processing and technological modernization strengthens industry competitiveness, while the growing preference for Western-style meat preparations contributes to rising ingredient utilization across the region.

Latin America

Latin America represents a 7.4% share of the global functional meat ingredients market in 2024. Countries such as Brazil, Argentina, and Mexico lead in processed meat production and export activities. Increasing adoption of stabilizers, emulsifiers, and antioxidants in sausages, cured meats, and frozen products drives regional demand. Local manufacturers are expanding capacity to meet domestic and export requirements, supported by growing investments in food processing infrastructure. Rising health awareness and preference for premium meat formulations further promote the use of functional ingredients across diverse applications.

Middle East & Africa

The Middle East & Africa region holds a 4.9% share of the functional meat ingredients market in 2024. Growth is supported by rising demand for packaged and halal-certified processed meats across the Gulf Cooperation Council countries and South Africa. Urbanization and increasing disposable incomes have boosted consumption of value-added meat products. Manufacturers are integrating binders, fibers, and clean-label additives to enhance texture and quality. While limited processing capacity remains a challenge, ongoing investments in cold-chain logistics and food manufacturing facilities are expected to improve long-term market penetration.

Market Segmentations:

By Product Type

- Hydrocolloids

- Cereal Flours

- Vegetable Fibres

- Other Product Types

By Meat Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The functional meat ingredients market features strong competition among leading players such as Tyson Foods, Hormel Foods, JBS, Perdue Farms, Cargill, Kerry Group PLC, Smithfield Foods, Marfrig Foods, OSI Group, Seaboard Foods, Tulip Food Company, Meyer Natural Foods, Sigma Alimentos, Pinnacle Foods, and Contact Food Group. The competitive landscape is marked by continuous product innovation, process optimization, and expansion into emerging markets. Companies focus on developing natural, clean-label, and high-performance ingredient solutions to meet shifting consumer demands. Strategic mergers, acquisitions, and collaborations are common as firms aim to strengthen distribution networks and expand portfolios. Investments in R&D for sustainable and health-oriented formulations are increasing, supporting long-term growth. The emphasis on improved shelf stability, flavor enhancement, and nutritional balance drives advancement in ingredient technology. Market participants also leverage digital manufacturing tools and traceability systems to enhance transparency, production efficiency, and compliance across regional and global supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tyson Foods

- Hormel Foods

- JBS

- Perdue Farms

- Cargill

- Kerry Group PLC

- Smithfield Foods

- Marfrig Foods

- OSI Group

- Seaboard Foods

- Tulip Food Company

- Meyer Natural Foods

- Sigma Alimentos

- Pinnacle Foods

- Contact Food Group

Recent Developments

- In 2025, OSI Group made a strategic acquisition of Karnova Food Group, a protein ingredients supplier, to enhance its portfolio in protein and functional meat ingredients.

- In 2025, Seaboard acquired three farms in Texas and Oklahoma with 57,000 market hog spaces to directly supply its pork processing plant in Guymon, Oklahoma, strengthening supply and quality control in its connected food system.

- In 2025, Kerry Group PLC Launched Smart Taste™, a platform blending flavour science with reformulation needs, relevant to meat systems.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Meat Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising preference for protein-rich diets will drive higher demand for functional meat ingredients.

- Clean-label and natural additive formulations will continue gaining strong traction among consumers.

- Expanding processed meat production in Asia-Pacific will support steady market growth.

- Manufacturers will adopt plant-based and hybrid ingredient solutions for sustainable meat alternatives.

- Technological advancements in meat processing will enhance ingredient functionality and shelf life.

- Increased focus on fat and sodium reduction will accelerate innovation in health-oriented ingredients.

- Strategic collaborations between ingredient suppliers and meat processors will strengthen product development.

- Regulatory alignment across regions will improve global trade and compliance efficiency.

- Rising investments in R&D will support novel enzyme and fiber-based functional solutions.

- Growing e-commerce and cold-chain logistics expansion will enhance product accessibility worldwide.