Market Overview

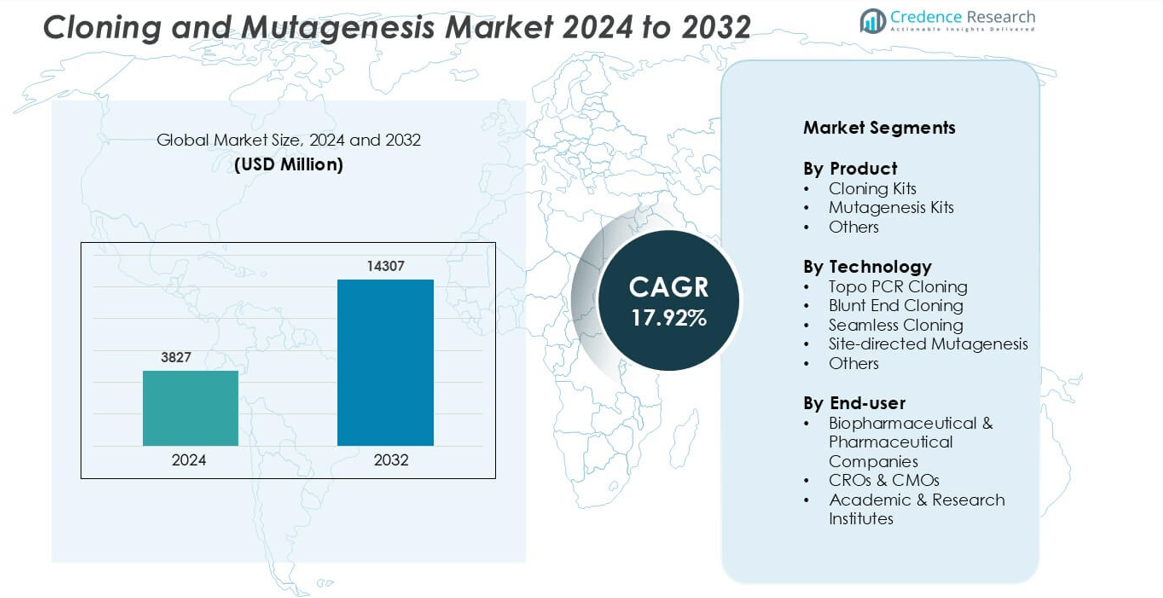

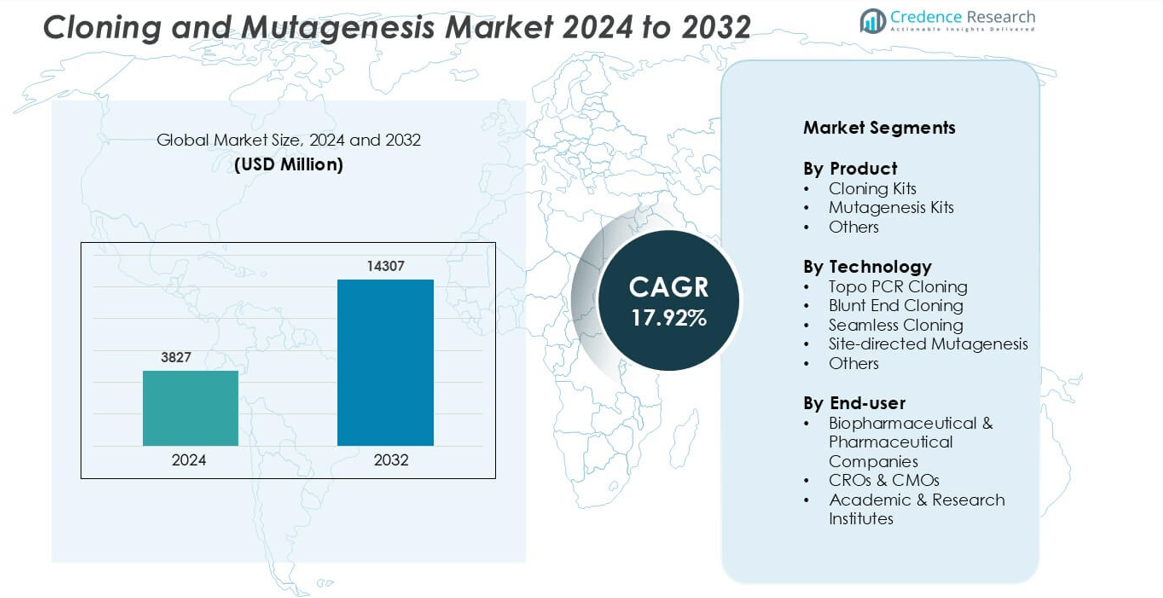

Cloning and Mutagenesis Market was valued at USD 3827 million in 2024 and is anticipated to reach USD 14307 million by 2032, growing at a CAGR of 17.92 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloning and Mutagenesis Market Size 2024 |

USD 3827 million |

| Cloning and Mutagenesis Market, CAGR |

17.92% |

| Cloning and Mutagenesis Market Size 2032 |

USD 14307 million |

The Cloning and Mutagenesis Market is driven by key players including Thermo Fisher Scientific, Merck KGaA, Agilent Technologies, New England Biolabs, Promega Corporation, Takara Bio Inc., Bio-Rad Laboratories, Danaher, Jena Bioscience, and Assay Genie. These companies compete through high-fidelity enzymes, seamless cloning kits, automated platforms, and advanced site-directed mutagenesis solutions used across pharmaceutical research, synthetic biology, and academic labs. North America leads the global market with 38% share, supported by strong biotechnology infrastructure, high R&D spending, and widespread use of automated cloning workflows in gene expression studies, drug discovery, and protein engineering programs.

Market Insights

- The Cloning and Mutagenesis Market stands at USD 3827 million in 2024 and is set to reach USD 14307 million by 2032, growing at a CAGR of 17.92% during the forecast period.

- Rising demand for gene expression studies, recombinant protein production, and synthetic biology research drives widespread adoption of cloning and site-directed mutagenesis kits in biopharmaceutical and academic labs.

- Seamless cloning, enzyme-free workflows, and automation are key market trends, as labs prefer faster assembly, higher accuracy, reduced contamination risk, and scalable high-throughput capabilities.

- Strong competition exists among Thermo Fisher Scientific, Merck KGaA, Agilent Technologies, New England Biolabs, Promega, Takara Bio, Bio-Rad Laboratories, Danaher, Jena Bioscience, and Assay Genie, each expanding product portfolios with high-fidelity enzymes and ready-to-use kits.

- North America leads with 38% regional share, supported by high R&D spending and advanced lab infrastructure, while cloning kits hold the largest segment share due to rapid use in gene insertion, vector construction, and protein engineering.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Cloning kits hold the dominant share in the product segment due to widespread adoption in gene insertion, library construction, and protein expression studies. Their high share comes from ready-to-use reagents, improved efficiency, and faster turnaround times compared to conventional cloning methods. Demand rises as labs focus on scalable workflows for recombinant DNA production and functional genomics research. Mutagenesis kits also show steady growth as researchers modify gene sequences to study protein structure or develop improved expression systems. The “others” category includes specialized buffers, enzymes, and consumables that support advanced molecular biology workflows in labs worldwide.

- For instance, Thermo Fisher’s TOPO® PCR Cloning Kit enables ligation-independent cloning with a reported insertion success rate of up to 95%, and the cloning reaction is complete within 5 minutes of setup, followed by an overnight incubation period for colonies to form.

By Technology

Site-directed mutagenesis leads the technology segment with the highest market share, driven by its precision in altering specific DNA sequences without affecting the rest of the genome. Its dominance comes from applications in protein engineering, drug discovery, and foundational genetic studies. Topo PCR cloning and seamless cloning gain traction as labs move to faster, enzyme-based systems that reduce hands-on work and error rates. Blunt end cloning remains relevant for simple insertions with minimal sequence changes. The “others” category includes emerging hybrid and automated approaches that support synthetic biology, CRISPR research, and advanced vector engineering.

- For instance, Agilent QuikChange Lightning Kit perform site-directed mutagenesis in as little as 3 hpurs and supports fragment lengths up to 14 kb with high-fidelity amplification.

By End-user

Biopharmaceutical and pharmaceutical companies hold the dominant share in the end-user segment due to high investment in recombinant proteins, vaccine development, and targeted therapeutics. Their lead is supported by large-scale R&D budgets, automated cloning workflows, and partnerships with genomics solution providers. CROs and CMOs adopt cloning and mutagenesis tools to deliver contract-based services involving gene expression studies and protein manufacturing. Academic and research institutes remain vital users, especially in basic biology, synthetic biology, and medical research. Rising funding for gene therapy, precision medicine, and advanced molecular diagnostics continues to expand usage across all segments.

Key Growth Drivers

Rising Demand for Gene Expression and Protein Engineering

Growth in gene expression studies and protein engineering strengthens market demand, as scientists seek advanced tools to modify DNA sequences with high accuracy and shorter turnaround times. Pharmaceutical and biopharmaceutical companies use cloning and mutagenesis to create recombinant proteins, optimize biologic drugs, and develop next-generation vaccines. Expanding genomic research, synthetic biology programs, and biosimilar manufacturing further accelerate kit usage in commercial and academic labs. Automated PCR-based cloning, enzyme-free seamless workflows, and error-reduction technologies support faster project completion and scalable research output. Increasing funding for gene therapy, oncology research, and precision medicine makes cloning and mutagenesis essential for target validation and lead molecule development.

- For instance, the ÄKTA pure system comes in different models. The ÄKTA pure 25 model has a maximum normal flow rate of up to 25 mL/min. However, the ÄKTA pure 150 model supports a flow rate of up to 150 mL/min.

Growing Investment in Synthetic Biology and Gene Editing

The market benefits from large-scale investment in synthetic biology, genome engineering, and CRISPR-based research. Scientists need precise mutagenesis and cloning to design artificial DNA constructs, control gene circuits, and develop engineered cell systems. Start-ups, research institutes, and pharmaceutical firms invest in new cloning systems that handle complex DNA fragments, high-throughput screening, and programmable vector assembly. Site-directed mutagenesis supports optimization of enzyme activity, stability, and binding efficiency, enabling new industrial and therapeutic applications. Expanding applications in agriculture, microbiome editing, biofuel production, and molecular diagnostics widen the market base. Government funding and private capital continue to boost growth in advanced molecular engineering platforms.

- For instance, Integrated DNA Technologies (IDT) offers various gRNA formats, including sgRNAs that are typically around 100 nucleotides long. They have optimized manufacturing protocols for long RNA oligonucleotides, so 120 nucleotides is a reasonable length they could offer.

Expansion of Contract Research and Outsourcing Models

Contract research organizations (CROs) and contract manufacturing organizations (CMOs) increasingly adopt cloning and mutagenesis platforms to support outsourced drug development, genetic analysis, and protein production. Outsourcing improves cost efficiency for pharmaceutical companies while enabling faster project turnaround. CROs provide specialized gene construction, mutagenesis libraries, and expression system optimization for academic and commercial clients. High demand for recombinant antibodies, cell-based assays, and engineered plasmids drives continuous adoption of advanced kits and automation tools. Growth in global biotech start-ups and personalized medicine projects encourages outsourcing of cloning and mutagenesis operations rather than developing in-house facilities.

Key Trends & Opportunities

Shift Toward High-Throughput and Automated Workflows

Automation and high-throughput cloning platforms create major opportunities, as researchers move away from traditional manual workflows. Advanced systems reduce contamination risks, lower experimental error rates, and support seamless DNA assembly. Automated mutagenesis enables large variant library creation for enzyme engineering, antibody development, and protein optimization. Cloud-based data analysis, robotics, and AI-assisted primer design also enhance efficiency in labs handling large sample volumes. Emerging digital inventory, LIMS integration, and real-time monitoring create new service opportunities for vendors. As drug discovery, vaccine development, and synthetic biology projects scale, automated cloning becomes an essential part of modern lab infrastructure.

- For instance, The MCA 384 head can accurately and precisely pipette volumes as low as 0.5 µl with a CV <4% (using 15 µl tips), and volumes of 2.0 µl with a CV <3% (using 125 µl tips).

Growing Adoption of Seamless and Enzyme-Free Cloning

Seamless cloning, enzyme-free recombination, and ligation-independent technologies gain momentum due to their speed, simplicity, and ability to assemble multiple DNA fragments without unwanted sequence scars. These approaches eliminate the need for restriction digestion and ligase reactions, reducing workflow steps and improving efficiency. Researchers in gene therapy, metabolic engineering, and CRISPR vector development use seamless tools to build complex constructs quickly. Adoption also rises among start-ups and teaching labs due to simplified protocols and minimal specialized equipment requirements. Vendors offering multi-fragment kits, high-efficiency primers, and error-correction enzymes have strong growth opportunities as labs transition from traditional cloning methods.

- For instance, Gibson Assembly, commercialized by New England Biolabs, supports the assembly of up to 15 DNA fragments in a single reaction and constructs up to 100 kb in size with verified sequence accuracy.

Key Challenges

High Cost of Advanced Kits and Reagents

Despite strong adoption, the high cost of mutagenesis kits, cloning enzymes, reagents, and consumables remains a barrier for small labs and academic institutions. Complex enzyme mixes, multi-fragment assembly tools, and premium error-free kits increase operational budgets. Emerging markets struggle with pricing differences, import duties, and limited supplier availability. Some researchers continue using traditional restriction-based cloning to reduce expenditure, slowing the transition to seamless and automated systems. Vendors must balance innovation with affordability to serve price-sensitive users and maintain long-term adoption.

Technical Limitations and Workflow Complexity

Commercial kits reduce manual effort, but cloning and mutagenesis still demand skilled execution, precision primer design, and optimization of PCR conditions. Failed assemblies, mutation errors, off-target effects, and low cloning efficiency impact project timelines. Complex constructs with long DNA fragments or multiple inserts pose additional challenges. Limited automation in small facilities and lack of standardized workflows create variability in experimental success. These technical hurdles highlight the need for improved high-fidelity enzymes, AI-supported design tools, and integrated validation systems to ensure reproducible results across diverse research environments.

Regional Analysis

North America

North America leads the Cloning and Mutagenesis Market with 38% share, driven by strong biotechnology infrastructure and high adoption of advanced molecular cloning systems. The United States contributes the majority of revenue due to well-funded pharmaceutical research, gene therapy trials, and widespread automation in lab workflows. CROs and CMOs support demand with outsourced gene construction and recombinant protein services. Strong university networks, federal research grants, and early access to innovative kits reinforce market dominance. Canada adds steady contribution through growing investments in biopharmaceutical development and academic molecular biology programs.

Europe

Europe holds 29% market share, supported by active academic research, strong pharmaceutical manufacturing, and government-backed genomics initiatives. Germany, the United Kingdom, and France account for the highest regional usage of site-directed mutagenesis, seamless cloning, and CRISPR-based vector assembly. EU funding supports synthetic biology start-ups and cross-border research collaborations involving recombinant proteins and vaccine development. Regional CROs provide gene modification services to international clients, strengthening market expansion. Strong regulatory focus on biologics and precision medicine ensures sustained adoption across research institutes and commercial labs.

Asia Pacific

Asia Pacific accounts for 24% market share and records the fastest growth rate, supported by rising biotechnology investment and expanding pharmaceutical manufacturing capacity. China, Japan, India, and South Korea lead in adoption of PCR-based cloning, synthetic biology workflows, and mutagenesis platforms for protein engineering. Government grants, start-up funding, and academic research partnerships drive large-scale genomics and vaccine research. Competitive pricing and strong CRO presence attract outsourcing from Western biopharma companies. Rapid expansion of molecular diagnostics strengthens long-term demand.

Latin America

Latin America represents 6% market share, with gradual growth led by Brazil, Mexico, and Argentina. Regional universities and public health institutes adopt cloning and mutagenesis for infectious disease research, agricultural biotechnology, and recombinant vaccine studies. Increasing partnerships with multinational biotech suppliers support technology transfer and training. Budget constraints limit high-end automation adoption, but low-cost mutagenesis and PCR cloning kits see rising demand. Growing biotech incubators and academic collaboration with North American and European institutions contribute to steady market development.

Middle East & Africa

The Middle East & Africa region holds 3% market share, with demand concentrated in Saudi Arabia, the UAE, and South Africa. Investments in healthcare modernization, academic genomics centers, and diagnostic research drive interest in molecular cloning tools. International joint research programs and medical university expansion expand market access. Adoption remains limited by infrastructure gaps and high cost of advanced kits, but procurement through centralized research organizations supports gradual penetration. Continued investment in biopharma and precision medicine is expected to improve long-term growth.

Market Segmentations:

By Product

- Cloning Kits

- Mutagenesis Kits

- Others

By Technology

- Topo PCR Cloning

- Blunt End Cloning

- Seamless Cloning

- Site-directed Mutagenesis

- Others

By End-user

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cloning and Mutagenesis Market includes global biotechnology suppliers, specialized reagent manufacturers, and companies offering integrated molecular biology platforms. Leading participants such as Thermo Fisher Scientific, Merck KGaA, Agilent Technologies, New England Biolabs, Promega Corporation, Takara Bio Inc., Bio-Rad Laboratories, Danaher, Jena Bioscience, and Assay Genie compete through product innovation, high-fidelity enzymes, seamless cloning kits, and advanced mutagenesis systems. Many companies focus on ready-to-use kits that reduce manual workload, speed up DNA assembly, and improve accuracy to meet the needs of biopharma, CROs, and research institutes. Strategic partnerships with genomic research labs and academic institutions support new product validation and accelerate technology adoption. The market also sees increased demand for automation, high-throughput cloning, and enzyme-free systems, encouraging vendors to expand product lines. Companies invest in R&D activities, supply chain strengthening, and customer training to retain competitive advantage in a rapidly advancing molecular biology environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Takara Bio Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- Assay Genie

- Bio-Rad Laboratories, Inc.

- New England Biolabs

- Jena Bioscience GmbH

- Danaher

- Thermo Fisher Scientific, Inc.

- Promega Corporation

Recent Developments

- In Oct 2025, Agilent Technologies updated Quik Change guidance for complex primer designs. The note covers multi-insert primers and links to its web-based design tool. This supports faster, cleaner site-directed mutagenesis workflows.

- In Aug 2025, Merck KGaA reported Life Science growth and Process Solutions strength. Capacity and portfolio expansion support recombinant DNA, cloning, and editing applications.

- In September 2024, Takara Bio USA launched the Smart Chip ND real-time PCR system. High-throughput validation supports mutagenesis and cloning verification steps.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as biopharmaceutical companies expand recombinant protein and vaccine development.

- High-throughput and automated cloning platforms will replace manual procedures in many labs.

- Seamless and enzyme-free cloning methods will gain wider adoption for multi-fragment assembly.

- Site-directed mutagenesis will remain essential for protein engineering and therapeutic antibody optimization.

- More CROs and CMOs will offer outsourced gene construction and mutagenesis services.

- Academic institutes will increase usage due to rising investment in genomics and synthetic biology.

- AI-supported primer design and error-correction tools will improve cloning accuracy and workflow speed.

- CRISPR research will boost demand for precision vector design and mutagenesis kits.

- Emerging markets in Asia Pacific will experience rapid growth as lab infrastructure expands.

- Companies will invest in lower-cost kits to support smaller labs and teaching institutions.