Market Overview

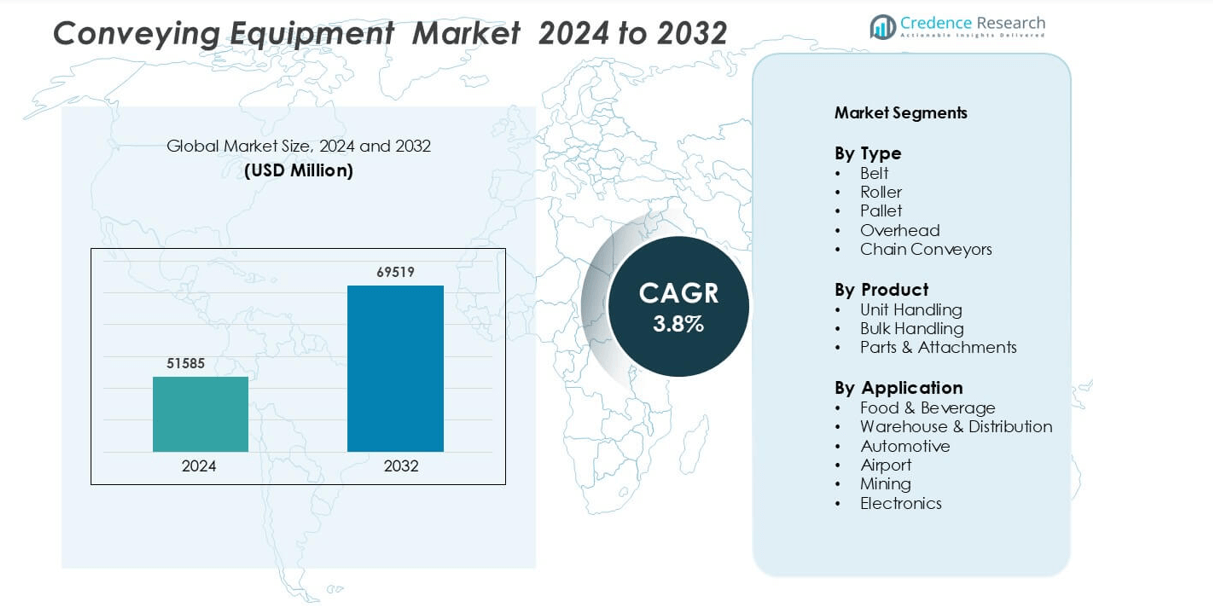

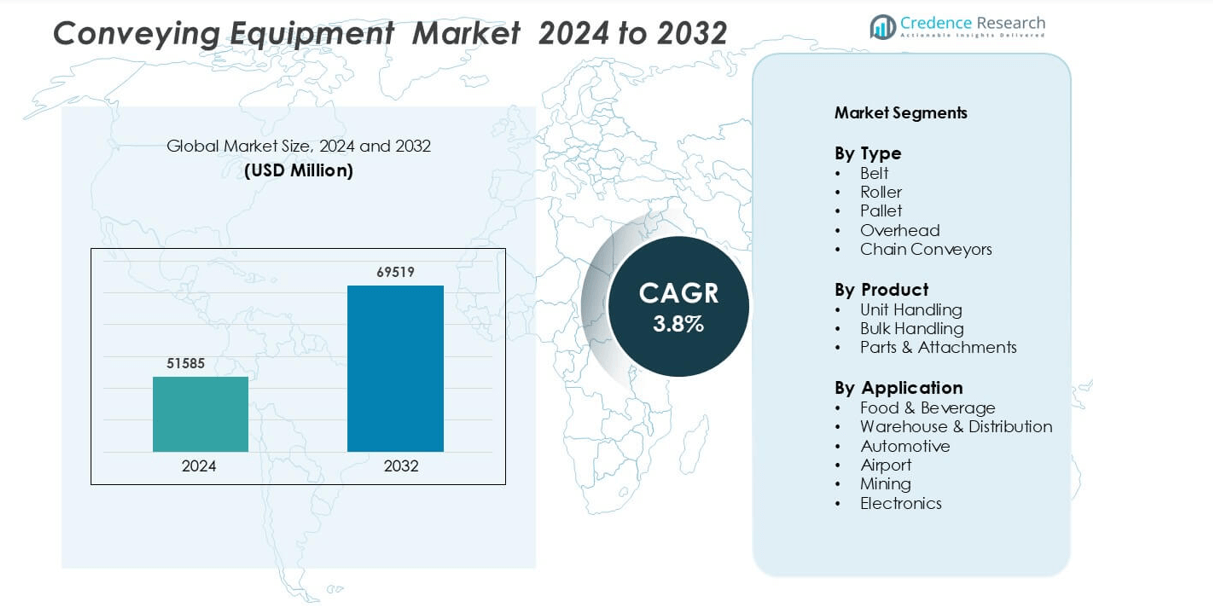

Conveying Equipment Market was valued at USD 51585 million in 2024 and is anticipated to reach USD 69519 million by 2032, growing at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conveying Equipment Market Size 2024 |

USD 51585 million |

| Conveying Equipment Market, CAGR |

3.8% |

| Conveying Equipment Market Size 2032 |

USD 69519 million |

The conveying equipment market is highly competitive, with major players including BEUMER Group, Daifuku Co., Ltd., Kion Group AG, KUKA AG, Murata Machinery, Ltd., Jungheinrich AG, Kardex, Fives Group, FlexLink, and Phoenix Conveyor Belt Systems. These companies focus on automation, digital integration, and energy-efficient conveyor designs to enhance operational performance across logistics, automotive, and manufacturing sectors. Asia-Pacific leads the global market with a 34% share, driven by rapid industrialization, expanding e-commerce logistics, and government-backed smart manufacturing initiatives. Continuous innovation, partnerships, and regional expansion strategies enable these players to maintain strong global competitiveness and sustain long-term market growth.

Market Insights

- The conveying equipment market was valued at USD 51585 million in 2024 and is projected to reach USD 69519 million by 2032, registering a CAGR of 3.8% during the forecast period.

- Market growth is driven by rising automation in manufacturing, warehouse modernization, and increased investment in smart logistics infrastructure.

- Trends include the integration of IoT-enabled and energy-efficient conveyor systems, modular designs, and AI-based predictive maintenance for enhanced productivity.

- The competitive landscape features BEUMER Group, Daifuku Co., Ltd., Kion Group AG, KUKA AG, and Murata Machinery, Ltd., focusing on digital innovation and sustainable system design.

- Regionally, Asia-Pacific leads with a 34% share, followed by North America at 31% and Europe at 27%. Among segments, the belt conveyor type dominates with 38% share, while unit handling holds 46%, highlighting strong adoption in warehouse and distribution applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

Belt conveyors dominate the market, holding a 38% share due to their efficiency in handling diverse materials. Their versatility across packaging, food processing, and mining operations drives strong demand. The adoption of automated belt systems with real-time monitoring improves operational reliability and reduces downtime. For instance, Siemens and Honeywell offer smart belt control systems with integrated sensors to track speed and load variations. The rising use of energy-efficient and low-maintenance belts in warehousing and manufacturing further reinforces this segment’s leadership.

- For instance, Siemens’ SINAMICS G115D distributed drive system supports belt conveyor applications with a rated power output of up to 7.5 kW and integrated condition monitoring.

By Product

The unit handling segment leads with a 46% market share, supported by its wide use in packaging, e-commerce, and automotive assembly. These conveyors provide precise handling of discrete products, enhancing process speed and safety. Advanced designs by companies such as Dematic and Daifuku include modular rollers and motor-driven units that improve load control and energy efficiency. The expansion of automated warehouses and distribution centers accelerates adoption, as unit handling conveyors enable seamless integration with robotics and warehouse management systems.

- For instance, Dematic’s MDR conveyor systems are capable of handling a wide range of loads, which can include items up to approximately 110 pounds (50 kilograms) per zone for standard applications.

By Application

Warehouse and distribution applications account for 41% of the market share, driven by the rapid growth of e-commerce and third-party logistics. Automated conveying lines help streamline order fulfillment and reduce manual intervention. Major logistics hubs deploy sensor-enabled conveyors with predictive maintenance tools to ensure continuous operation. Key players like Interroll and BEUMER Group focus on scalable conveyor systems supporting high-speed sorting and material tracking. The demand for space-efficient, energy-optimized systems strengthens this segment’s dominance across global supply chains.

Key Growth Drivers

Rising Automation in Manufacturing and Warehousing

The growing shift toward automation across manufacturing and warehousing sectors drives strong demand for conveying equipment. Industries seek to enhance operational efficiency, reduce human error, and improve material flow through automated systems. Smart conveyors integrated with sensors, PLCs, and IoT enable real-time monitoring and predictive maintenance, reducing downtime by up to 30%. Companies such as Siemens and Honeywell offer automated control solutions that optimize energy consumption and speed adjustment. The expanding use of robotics and automated storage systems in logistics hubs and production facilities further amplifies the adoption of advanced conveying systems, supporting lean manufacturing and continuous operations.

- For instance, Siemens promotional and technical documents emphasize the system’s high scalability and capacity, with the ability to manage plants with 100 to 300,000 I/Os (input/output points).

Expansion of E-commerce and Logistics Infrastructure

The surge in global e-commerce and third-party logistics operations significantly boosts demand for conveying equipment. Online retail growth has accelerated warehouse automation, prompting large-scale investment in high-speed material handling systems. According to industry assessments, automated conveyors can increase fulfillment center throughput by nearly 40%, reducing delivery times and operational costs. Companies like Interroll and Daifuku have introduced modular conveyor lines for sorting and tracking large parcel volumes efficiently. Additionally, expanding distribution networks in emerging economies create lucrative opportunities for system integrators offering customized conveyor layouts. This expansion trend strengthens the market’s role in improving supply chain reliability and responsiveness.

- For instance, Interroll’s Crossbelt Sorter systems operate at speeds up to 2.5 meters per second and handle up to 20,000 items per hour, improving sorting efficiency for major logistics players.

Rising Demand from Food & Beverage and Automotive Industries

The food & beverage and automotive sectors represent key demand hubs for conveying equipment due to stringent hygiene standards and high production throughput requirements. In food processing, stainless-steel belt conveyors with washdown capability are essential for safety and contamination control. In the automotive sector, chain and roller conveyors are widely used for assembly lines and component handling, reducing manual operations. Companies such as Bosch Rexroth and FlexLink design conveyors with variable speed drives and modular flexibility to suit dynamic production setups. The continuous modernization of manufacturing plants, along with investments in automated packaging and assembly lines, reinforces the segment’s steady growth trajectory.

Key Trends & Opportunities

Integration of Smart and Energy-Efficient Conveyor Technologies

Smart and energy-efficient conveyor technologies are reshaping the market as companies prioritize sustainability and cost efficiency. Conveyors embedded with energy recovery systems and motion sensors optimize power use during low-load operations. For instance, Interroll’s EC5000 drives and BEUMER’s intelligent energy management systems significantly lower operational costs and carbon footprints. The integration of cloud-based monitoring platforms also enables predictive analytics, ensuring consistent equipment health. This trend aligns with Industry 4.0 objectives and provides opportunities for manufacturers to offer data-driven maintenance solutions. The demand for low-noise, modular conveyors with plug-and-play capability continues to grow in modern logistics and manufacturing environments.

- For instance, Interroll’s EC5000 RollerDrive system operates at 24V or 48V DC and reduces energy consumption by up to 50% compared to conventional conveyors, while BEUMER Group’s BG Sorter Compact CB integrates a regenerative braking system that recovers up to 15 kW of energy during peak operations.

Growth of Modular and Customizable Conveyor Solutions

The trend toward modular, customizable conveyors is gaining traction as industries aim for flexibility in production layouts. Modular conveyors allow quick reconfiguration, scalability, and lower installation costs, making them ideal for SMEs and large-scale manufacturers alike. Companies such as Dematic and Dorner have launched quick-assembly belt and pallet systems that can be adapted for various load capacities and production speeds. This flexibility supports just-in-time manufacturing and accommodates diverse product types. The growing preference for compact, mobile, and reconfigurable conveyor systems creates new market opportunities, especially in fast-changing sectors like packaging, automotive, and electronics assembly.

Expansion of AI-Driven Predictive Maintenance and Digital Twin Systems

AI-enabled predictive maintenance and digital twin systems are becoming key differentiators in the conveying equipment market. By simulating equipment behavior and analyzing performance data, manufacturers can predict wear patterns and schedule maintenance proactively. Siemens and Honeywell have developed digital twin models that reduce equipment failure rates and maintenance costs by up to 25%. The adoption of these technologies enhances uptime and extends system life, particularly in high-volume industries. As enterprises move toward data-driven decision-making, AI-based analytics for conveyor operations create long-term opportunities for operational optimization and service-based business models.

Key Challenges

High Initial Investment and Integration Costs

Despite clear operational benefits, the high capital expenditure required for installing automated conveying systems remains a major barrier, especially for small and medium enterprises. The cost of integrating conveyors with existing manufacturing or warehouse management systems adds to the financial burden. Complex installations often demand custom engineering, software synchronization, and specialized maintenance personnel. Additionally, upgrading traditional conveyor setups to support IoT or robotic systems involves downtime and retraining. While return on investment improves over time, the steep upfront costs slow adoption in developing markets. Vendors are increasingly offering leasing models and modular designs to address these affordability challenges.

Maintenance Complexity and System Downtime Risks

Conveying equipment requires consistent maintenance to prevent breakdowns that can disrupt entire production lines. Mechanical wear, misalignment, and belt slippage are common issues, particularly in bulk handling and high-speed applications. Unplanned downtime leads to significant productivity and financial losses for operators. The integration of multiple components—motors, drives, and control units—also increases system complexity. Skilled technicians are needed for calibration and troubleshooting, which can be scarce in some regions. Although predictive maintenance technologies are emerging, many facilities still rely on reactive maintenance practices. This challenge underscores the need for operator training and robust monitoring frameworks to ensure continuous operation efficiency.

Regional Analysis

North America

North America holds a 31% share of the global conveying equipment market, driven by advanced automation in manufacturing and logistics. The United States dominates regional demand, supported by established automotive, food processing, and e-commerce sectors. Investments in warehouse modernization and integration of IoT-enabled conveyor systems by companies such as Honeywell and Dematic strengthen regional competitiveness. Canada’s mining and packaging industries also contribute to steady growth. Rising adoption of energy-efficient conveyors and predictive maintenance technologies further enhances productivity, positioning North America as a key innovation hub for smart material handling systems.

Europe

Europe accounts for 27% of the market share, supported by strong industrial automation and sustainability initiatives. Germany, Italy, and France lead demand with extensive adoption in automotive assembly and food production facilities. The region’s focus on energy-efficient and modular conveyors aligns with strict environmental regulations and EU decarbonization goals. Companies like Interroll and BEUMER Group are prominent players offering advanced material handling solutions integrated with digital control systems. Growing logistics infrastructure and the shift toward circular manufacturing strengthen Europe’s market position, emphasizing precision engineering and low-maintenance conveyor technologies across multiple industries.

Asia-Pacific

Asia-Pacific dominates the conveying equipment market with a 34% share, driven by large-scale industrialization and rapid growth in e-commerce. China, Japan, and India lead regional expansion, supported by strong manufacturing output and warehouse automation investments. Government-backed smart factory initiatives further accelerate adoption of automated conveyor solutions. Companies such as Daifuku and Mitsubishi Electric deploy high-capacity systems tailored for electronics, automotive, and logistics sectors. The growing demand for cost-effective, energy-efficient equipment in production and distribution hubs solidifies Asia-Pacific’s leadership, making it the fastest-growing regional market in the global material handling landscape.

Latin America

Latin America holds a 5% share of the conveying equipment market, with growth supported by expanding mining, food processing, and logistics industries. Brazil and Mexico are key contributors, focusing on infrastructure modernization and warehouse automation. The adoption of belt and chain conveyors in material transport helps improve operational efficiency across industrial facilities. Global suppliers are increasingly collaborating with local integrators to deliver flexible and affordable systems. Despite economic fluctuations, rising investments in e-commerce distribution centers and manufacturing upgrades position Latin America for gradual yet sustainable market expansion over the forecast period.

Middle East & Africa

The Middle East & Africa region accounts for a 3% market share, driven by ongoing industrial diversification and construction projects. Countries such as the UAE, Saudi Arabia, and South Africa invest heavily in logistics hubs, mining, and manufacturing facilities. Demand for heavy-duty and bulk-handling conveyors is increasing, particularly in ports and energy sectors. Companies are introducing corrosion-resistant and heat-tolerant systems suitable for harsh environments. Although adoption is slower compared to developed regions, ongoing smart city and infrastructure projects are expected to accelerate market penetration, enhancing the region’s role in global material flow networks.

Market Segmentations:

By Type

- Belt

- Roller

- Pallet

- Overhead

- Chain Conveyors

By Product

- Unit Handling

- Bulk Handling

- Parts & Attachments

By Application

- Food & Beverage

- Warehouse & Distribution

- Automotive

- Airport

- Mining

- Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The conveying equipment market features strong competition among global and regional players focusing on automation, sustainability, and system integration. Leading companies such as BEUMER Group, Daifuku Co., Ltd., Kion Group AG, KUKA AG, and Murata Machinery, Ltd. dominate through extensive product portfolios and advanced technological solutions. These firms invest heavily in smart conveying systems with IoT connectivity, modular design, and energy-efficient drives to optimize performance across industries. For instance, BEUMER emphasizes sustainable intralogistics solutions, while Daifuku continues expanding in warehouse automation through AI-driven control systems. European players like Jungheinrich AG and Kardex focus on integrated storage and handling systems, enhancing operational efficiency for logistics and manufacturing clients. Continuous innovation, mergers, and regional expansion strategies define the competitive dynamics, with companies targeting high-growth sectors such as e-commerce, automotive, and food processing to strengthen market presence and deliver end-to-end automated conveying solutions globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BEUMER GROUP

- Daifuku Co., Ltd.

- Fives Group

- FlexLink

- Jungheinrich AG

- Kardex

- Kion Group AG

- KUKA AG

- Murata Machinery, Ltd.

- Phoenix Conveyor Belt Systems

Recent Developments

- In July 2023, Jungheinrich AG disclosed that by October 2024, it would be building a new logistics warehouse in Freilassing for Hawle Armaturen GmbH. The scope of delivery from Jungheinrich AG includes a full conveyor system featuring order-picking workstations, five stacker cranes with SPS, and silo steel rack constructions with roof and wall cladding.

- In June 2023, TGW Logistics Group announced that it would be building a high-performance e-commerce system for SKECHERS USA, Inc., a manufacturer of premium-quality shoes, about 50 km north of Shanghai. The automated system is expected to go active in the summer of 2025. The core element of the TGW Logistics Group offers is a 13-kilometer-long network of energy-effective KingDrive conveyors that not only link every part of the system to one another but also ensure that they are connected to the current fulfillment center.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by automation in manufacturing and logistics.

- Integration of IoT and AI technologies will enhance conveyor system efficiency and reliability.

- Modular and reconfigurable conveyors will gain traction across flexible production environments.

- Energy-efficient and low-maintenance conveyor designs will become a key industry focus.

- Smart sensors and predictive maintenance tools will minimize operational downtime.

- E-commerce expansion will continue to boost demand for warehouse and distribution conveyors.

- Emerging economies will see rapid adoption of automated material handling solutions.

- Sustainability initiatives will encourage the development of eco-friendly conveyor materials.

- Collaboration between global suppliers and regional integrators will expand market reach.

- Asia-Pacific will maintain dominance due to industrial growth and large-scale automation investments.