Market Overview

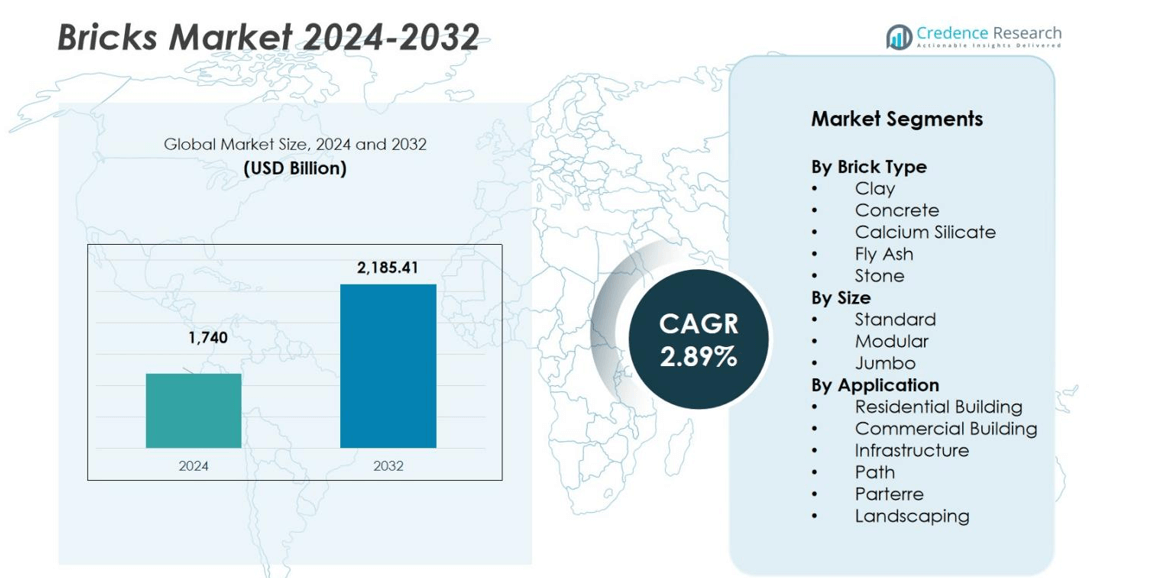

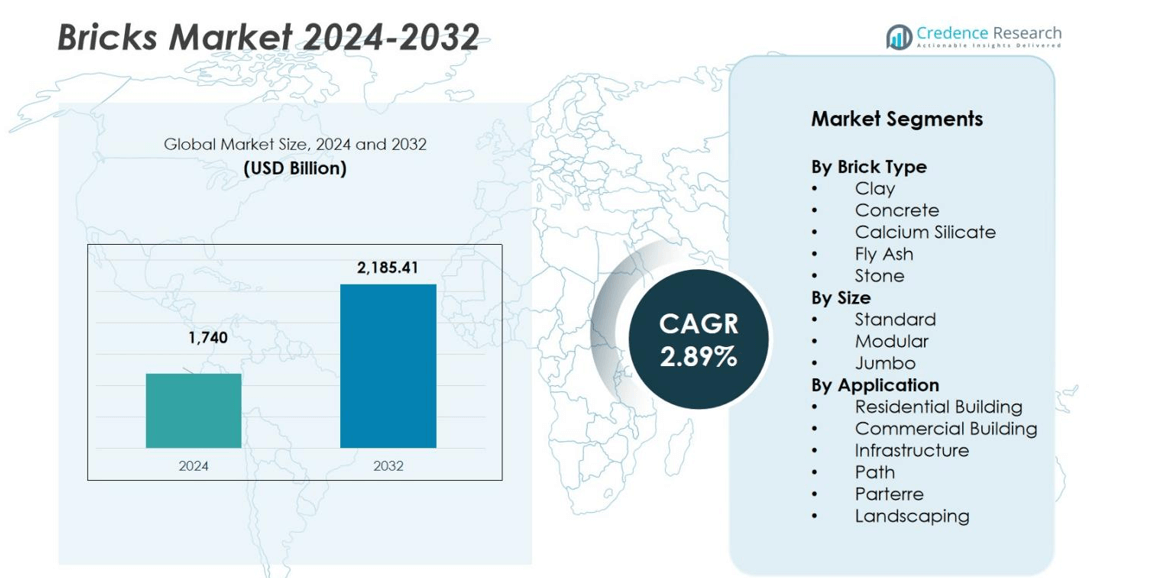

The Bricks Market size was valued at USD 1,740 billion in 2024 and is anticipated to reach USD 2,185.41 billion by 2032, at a CAGR of 2.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bricks Market Size 2024 |

USD 1,740 billion |

| Bricks Market, CAGR |

2.89% |

| Bricks Market Size 2032 |

USD 2,185.41 billion |

The competitive landscape of the bricks market prominently features companies such as Wienerberger AG, Boral Limited, CRH plc, Ibstock plc, Acme Brick Company, Hanson Building Products, General Shale, Glen‑Gery Corporation, Redland Brick Inc. and Brickworks Limited. These firms combine global scale, geographic reach and diversified product lines to shape market dynamics. They differentiate through technological advancement, sustainable production practices and strategic acquisitions. The leading region in this market is the Asia Pacific region, which holds a market share of 48% of the global bricks market.

Market Insights

- The Bricks Market size was valued at USD 1,740 billion in 2024 and is expected to reach USD 2,185.41 billion by 2032, growing at a CAGR of 2.89% during the forecast period.

- Urbanisation and large-scale infrastructure projects are driving the demand for bricks, especially in emerging markets like Asia-Pacific and Latin America.

- Sustainability and eco-friendly bricks made from recycled materials are gaining traction, responding to increasing environmental regulations and consumer demand for green construction.

- The market is competitive, with major players such as Wienerberger AG, CRH plc, and Ibstock plc, focusing on technological advancements and sustainable production practices to maintain market leadership.

- The Asia-Pacific region leads the global market with a 48% share, followed by North America with 39%. The growing urban populations and infrastructure demand in these regions contribute significantly to market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Brick Type

The brick‑type segment is dominated by the clay bricks sub‑segment, which held 41% of the market share in 2024. Clay bricks benefit from strong demand due to their durability, thermal insulation properties, and long‑standing acceptance in residential and commercial construction. Drivers include urbanization, growth in mid‑rise housing, and strong heritage construction needing traditional materials. Meanwhile, concrete and fly‑ash bricks are gaining traction as eco‑friendly alternatives, supported by regulatory emphasis on low‑carbon materials and construction efficiency.

- For instance, Wienerberger AG, a leading clay brick manufacturer, expanded its product range of hollow clay bricks in Europe, promoting high-performance bricks with excellent insulation properties.

By Size

Within the size classification, the standard bricks sub‑segment leads with 48% market share in 2024, indicating wide adoption of conventional sizes. Standard bricks are preferred due to compatibility with existing masonry methods, cost‑effectiveness, and ease of sourcing. Demand is driven by home‑building and renovation activity in mature markets, where contractors favor established sizing. Modular and jumbo sizes are emerging, propelled by modular construction trends and demand for faster build times in infrastructure and high‑rise segments.

- For instance, India’s “Housing for All” initiative is fueling demand for construction adhesives in flooring and panel bonding projects.

By Application

In the application segment, the residential building sub‑segment held 32% of revenue in 2024, making it the dominant usage area. This reflects continuing global demand for housing, rising urban populations, and renovation activity in established markets. The driver is demographic growth and mortgage‑financed housing starts, especially in Asia‑Pacific and North America. Infrastructure and commercial building applications are forecast to grow faster, as government stimulus and logistics‑center development accelerate non‑residential brick demand.

Key Growth Drivers

Urbanisation and Infrastructure Expansion

Rapid shifts in population from rural to urban areas significantly boost demand for housing, commercial buildings, and public works. Large-scale infrastructure projects such as roads, bridges, and mass-housing programs drive higher brick consumption. Manufacturers in the Bricks Market benefit from increased volume and stable demand due to this urban-driven construction surge. This has positioned brickmakers as strategic suppliers in growing economies that are expanding their built environment at pace.

- For instance, Oldcastle APG, a CRH subsidiary, boosted masonry block output with the acquisition of Master Block, Inc. in Arizona, positioning to meet infrastructure demands linked to urban growth in the southwestern United States.

Sustainability and Eco-friendly Construction Practices

Environmental regulations and green building standards are reshaping material choices in construction. Builders increasingly prefer low-carbon, recycled, or waste-derived bricks, prompting manufacturers to adopt greener production methods. This sustainability push strengthens the bricks market by positioning bricks as viable alternatives to more energy-intensive materials. The trend supports product innovation and premium pricing for eco-certified bricks.

- For instance, Michelmersh Group has initiated a feasibility study to replace natural gas with hydrogen in their brick-making process to decarbonize production, demonstrating an advanced commitment to sustainability.

Technological Innovation and Modern Production Techniques

Advances in manufacturing, automation, and materials science are improving brick quality, reducing costs, and enhancing performance characteristics. Innovations such as high-precision kilns, 3D-printed brick forms, or smart bricks are opening new applications in construction. As production becomes more efficient, industry players can scale output and respond more flexibly to architectural demands. This technological evolution helps bricks maintain competitiveness.

Key Trends & Opportunities

Emerging Use of Recycled and Alternative-material Bricks

A clear opportunity lies in bricks made from recycled industrial waste, fly ash, or slag. Such materials reduce environmental footprint and appeal to green-aware builders. The market for these alternative bricks is expanding in regions with strict sustainability mandates. Manufacturers that leverage waste streams are positioned to capture new segments and differentiate from conventional clay or concrete bricks.

- For instance, Vedanta Limited’s Lanjigarh unit launched a fly-ash brick manufacturing scheme for local entrepreneurs. The company provides fly-ash free of cost and offers subsidized transportation to the entrepreneurs, which helps create sustainable livelihoods.

Growth in Modular and Large-format Brick Sizes for Fast-track Construction

Construction methods favoring speed and efficiency are driving demand for modular and jumbo brick units. These larger formats reduce labor time and align with off-site and prefabricated systems. Brick manufacturers that offer standardized, large-size units can tap into emerging markets where rapid build-up of housing and commercial structures is needed. This trend opens doors to broader applications in both residential and infrastructure projects.

- For instance, Mahaluxmi Bricks (India) employs advanced wire-cut technology to produce high-quality modular bricks that are fire and pest resistant, designed to enhance speed and durability in large construction projects.

Key Challenges

Environmental and Regulatory Pressures on Traditional Brick Production

Conventional brick manufacturing involves high energy consumption and carbon emissions, which attract regulation in many jurisdictions. Compliance with emission standards and kiln upgrades raise production costs and capital investment. Manufacturers that cannot modernize face margin pressure or regulatory constraints. This challenge forces industry adaptation or risk imposition by policy.

Competition from Alternative Building Materials and Supply-chain Constraints

The bricks market contends with substitute materials such as concrete blocks, panels, and lightweight composites that offer faster installation or better thermal performance. Additionally, sourcing quality clay, sand, or fly ash is becoming tougher and more expensive due to environmental limitations and mining restrictions. These supply-chain issues and material competition erode some of the traditional bricks market advantage.

Regional Analysis

Asia Pacific

The Asia Pacific region holds a market share of 48% in the global bricks market, making it the largest contributor. Rapid urbanisation in countries such as China and India, together with major government‑funded infrastructure projects, have boosted demand for bricks. Growth is further supported by the low cost of raw materials, growth in affordable housing, and increasing commercial constructions. Manufacturers benefit from economies of scale and local supply chains, while sustainability pressures drive innovation in low‑carbon bricks across this region.

North America

North America commands 39% of the global bricks market share. The presence of a mature construction sector, strong regulatory standards for building materials, and high investments in renovation and infrastructure underpin market stability. Demand is driven by the replacement of ageing housing stock, emphasis on energy‑efficient bricks, and commercial development in the US and Canada. Growth rates are moderate but steady, as manufacturers focus on premium materials and sustainable production methods.

Europe

Europe accounts for an estimated 8% of the global bricks market share. The region’s growth stems from stringent building codes, high focus on sustainability and renovation of older housing stock. Expansion is largely in Western Europe, with eco‑friendly bricks gaining preference. Despite slower new construction compared to emerging markets, Europe offers high value per unit, with manufacturers leveraging advanced manufacturing technologies and recycling practices. The region’s mature market means the emphasis is on efficiency and compliance rather than rapid volume growth.

Latin America

In Latin America, the bricks market holds a smaller but growing share of 5% of global revenue. Rapid urban population growth, infrastructure expansion, and government housing schemes in countries such as Brazil and Argentina fuel demand. The region faces supply‑chain and regulatory challenges, but offers opportunities for low‑cost production and localised manufacturing. Manufacturers positioned to serve rising demand for affordable housing and urbanisation benefit from this upward trend.

Middle East & Africa

The Middle East & Africa region contributes 8% of the global bricks market share. Growth is driven by expansion in Gulf‑region construction, residential development in Africa, and large‑scale infrastructure projects. However, the region faces obstacles including raw‑material scarcity, higher energy costs for brick production, and political instability in certain markets. Firms that manage logistics and establish local production bases are best placed to capitalise on this region’s emerging growth potential.

Market Segmentations:

By Brick Type

- Clay

- Concrete

- Calcium Silicate

- Fly Ash

- Stone

By Size

By Application

- Residential Building

- Commercial Building

- Infrastructure

- Path

- Parterre

- Landscaping

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the bricks market features major players such as Wienerberger AG, Boral Limited, CRH plc, Ibstock plc, Acme Brick Company, Hanson Building Products, General Shale, Glen‑Gery Corporation, Redland Brick Inc., and Brickworks Limited. The market demonstrates both consolidation among established global manufacturers and fragmentation across regional players pursuing niche segments and local supply chains. Key firms differentiate via advanced manufacturing technologies, sustainable product portfolios, and strategic acquisitions that extend geographic and channel reach. Strong players invest in automation, digital production monitoring and carbon‑reduction initiatives to meet evolving regulatory and customer standards. Smaller regional firms often compete on cost, local raw‑material access and rapid responsiveness. Overall, incumbents that combine scale, innovation and sustainability leadership hold distinct competitive advantage in this evolving sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Acme Brick Company

- Ibstock plc

- Brickworks Limited

- Glen‑Gery Corporation

- CRH plc

- General Shale

- Boral Limited

- Redland Brick Inc.

- Hanson Building Products

- Wienerberger AG

Recent Developments

- In June 2024, BigBloc Construction Ltd and SCG International Corporation launched an AAC wall plant in Gujarat, marking a significant shift towards alternative brick technologies in India.

- In May 2024, InnoCSR, Good Bricks, and TARA formed a partnership to introduce low-carbon, non-fired bricks in India.

- In February 2024, Wienerberger further strengthened its position in North America by acquiring Summitville Tiles, Inc., which added prefabricated façade bricks to its product line

Report Coverage

The research report offers an in-depth analysis based on Brick Type, Size, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing urbanisation and infrastructure development will continue to drive brick demand across emerging and mature markets.

- Increasing adoption of eco‑friendly bricks made from fly ash, recycled materials, and alternative cementitious resources will expand market segments.

- Modular and large‑format bricks will gain traction due to faster build cycles and prefabricated construction methods.

- Manufacturers will invest more in automation, digital monitoring and smart manufacturing to reduce costs and improve quality.

- Stringent environmental regulations and carbon‑emission targets will push brick producers to upgrade kilns and adopt low‑carbon production.

- Expansion into high‑growth regions like Asia‑Pacific, Africa and Latin America will offer new revenue opportunities for global players.

- Customised aesthetic bricks for architectural facades and landscaping will increase in demand as design trends evolve.

- Entry of alternative materials such as concrete blocks, panels and composites will intensify competition and drive innovation in the bricks segment.

- Supply‑chain disruptions and raw‑material constraints will force manufacturers to diversify sourcing, invest in recycling and optimise logistics.

- Consolidation through mergers, acquisitions and partnerships will continue as large players aim to scale, access technology and expand geographic reach.