Market Overview:

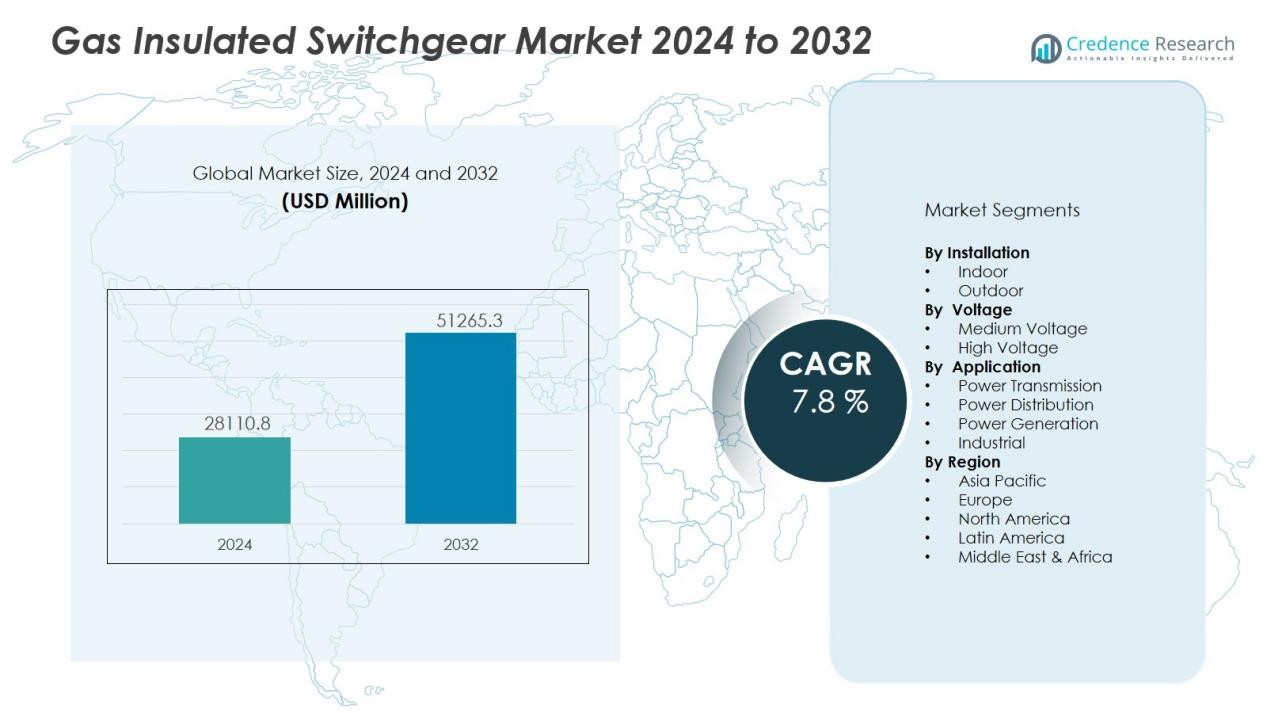

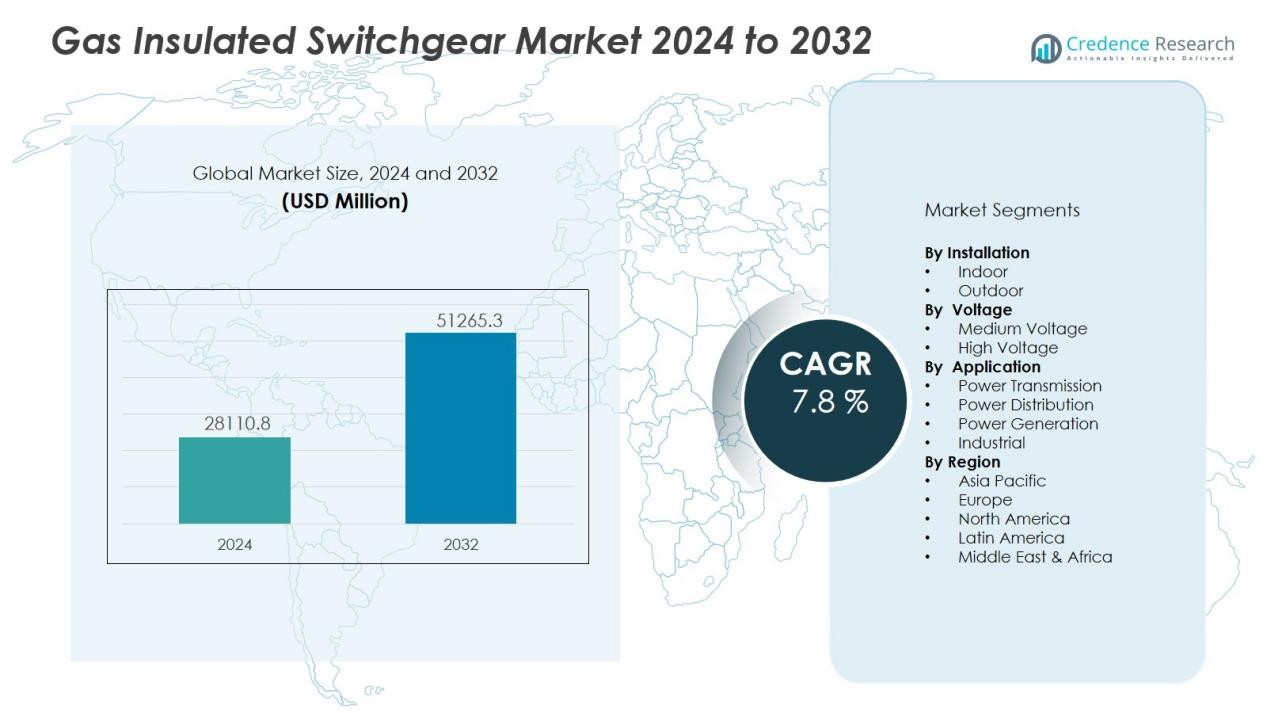

The gas insulated switchgear market size was valued at USD 28110.8 million in 2024 and is anticipated to reach USD 51265.3 million by 2032, at a CAGR of 7.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Insulated Switchgear Market Size 2024 |

USD 28110.8 Million |

| Gas Insulated Switchgear Market, CAGR |

7.8 % |

| Gas Insulated Switchgear Market Size 2032 |

USD 51265.3 Million |

Growth in the GIS market is fueled by the rising global demand for electricity, increasing focus on energy efficiency, and the need to minimize transmission losses. Utilities and industries are adopting GIS technology due to its smaller footprint, enhanced safety, and lower maintenance requirements. Environmental concerns are prompting advancements toward eco-friendly insulating gases as alternatives to SF₆, aligning with global climate commitments. Additionally, grid expansion in emerging economies and refurbishment of aging infrastructure in developed regions are accelerating market uptake.

Regionally, Asia-Pacific dominates the market, led by China, India, and Japan, owing to rapid urbanization, industrialization, and substantial grid investments. Europe follows, with strong emphasis on decarbonization, renewable energy integration, and regulatory compliance. North America shows steady growth through infrastructure upgrades and renewable integration, while the Middle East & Africa and Latin America present emerging opportunities supported by electrification projects and economic development initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The gas insulated switchgear market was valued at USD 28,110.8 million in 2024 and is projected to reach USD 51,265.3 million by 2032, driven by a CAGR of 7.8% during the forecast period.

- Rising global electricity demand and the need for efficient, compact power distribution systems are accelerating GIS adoption in utilities and industries.

- Eco-friendly insulating gas alternatives to SF₆ are gaining traction due to environmental regulations and corporate sustainability commitments.

- Grid modernization and renewable energy integration are key growth drivers, with GIS enabling high-voltage performance in limited spaces.

- Asia-Pacific holds 42% market share, supported by rapid urbanization, industrialization, and strong government-backed energy transition policies.

- High initial costs and complex installation requirements remain adoption challenges, particularly in cost-sensitive developing markets.

- Europe and North America, with 28% and 19% market shares respectively, are advancing GIS use through renewable integration, infrastructure upgrades, and eco-friendly technology innovations.

Market Drivers:

Rising Demand for Reliable and Compact Power Distribution Solutions:

The gas insulated switchgear market is expanding due to the increasing requirement for space-efficient and high-reliability power distribution systems. GIS offers a compact footprint compared to conventional air-insulated switchgear, making it ideal for urban substations, offshore platforms, and industrial facilities with space constraints. Its sealed design ensures minimal exposure to environmental factors, enhancing safety and operational stability. Utilities and large-scale industries are adopting GIS to ensure uninterrupted power supply in high-demand zones. This trend is reinforced by growing global electricity consumption and the need for infrastructure resilience.

- For instance, Siemens Energy’s DC GIS technology has enabled a reduction of switchyard space requirements by up to 95%, with installations requiring only 200 cubic meters compared to 4,000 cubic meters for equivalent air-insulated systems.

Accelerating Grid Modernization and Renewable Energy Integration:

Investments in grid modernization are driving the adoption of gas insulated switchgear to support renewable energy integration. Governments and utilities are upgrading transmission and distribution networks to handle variable renewable inputs while maintaining grid stability. GIS technology enables high-voltage performance within smaller installation spaces, making it suitable for wind, solar, and hydropower integration points. The shift toward smart grids further boosts demand for GIS due to its ability to integrate with digital monitoring and control systems. This makes it a preferred choice for meeting evolving energy transition requirements.

- For instance, ABB has deployed its IoT-based PLC SCADA automation solutions across more than 300 renewable energy projects in India, surpassing a cumulative milestone of 10 gigawatts of installed capacity.

Focus on Environmental Sustainability and SF₆ Alternatives:

Growing environmental regulations are influencing the shift toward eco-friendly insulating gases in GIS. Traditional SF₆ gas, while highly effective, has a high global warming potential, prompting manufacturers to develop alternative gas mixtures. The adoption of greener insulation technologies aligns with global climate goals and corporate sustainability commitments. It enhances brand positioning and compliance with stringent environmental standards. This development is becoming a significant driver of product innovation and replacement demand in mature markets.

Infrastructure Expansion in Emerging Economies:

Rapid urbanization and industrialization in Asia-Pacific, the Middle East, and Africa are generating strong demand for advanced electrical infrastructure. Governments are investing heavily in new power plants, transmission lines, and substations, with GIS often selected for its durability and reduced maintenance needs. It enables efficient operation in harsh environmental conditions, from extreme humidity to high dust levels. These advantages make GIS a preferred option in developing economies with challenging installation environments. This infrastructure growth provides long-term momentum for market expansion.

Market Trends:

Adoption of Eco-Friendly and Digitalized GIS Solutions:

The gas insulated switchgear market is experiencing a clear shift toward eco-friendly designs that replace SF₆ with low global warming potential gas mixtures or vacuum-based technologies. This transition is supported by stricter environmental regulations and corporate sustainability commitments. Manufacturers are investing in research and development to introduce GIS systems with enhanced operational safety, minimal maintenance requirements, and improved recyclability. Digitalization is another major trend, with GIS units increasingly equipped with sensors, IoT connectivity, and predictive analytics capabilities for real-time monitoring. These innovations improve fault detection, optimize maintenance schedules, and extend equipment lifespan. The combination of sustainability and digital intelligence is redefining product differentiation in the industry.

- For instance, Siemens Energy’s Blue GIS technology has delivered more than 3,000 clean air units contracted worldwide across all climate zones, with nearly 1,500 units and over 20 million operating hours successfully in operation, saving 2.6 million tons of CO₂ emissions through reduced SF₆ banking and leakages over the equipment lifetime.

Growing Demand from Renewable Energy and Urban Infrastructure Projects:

The global push for renewable energy integration and urban infrastructure development is expanding the demand for advanced GIS installations. Governments and utilities are deploying GIS in wind and solar farms due to its compact footprint and ability to handle high-voltage applications in constrained spaces. In densely populated cities, underground and indoor GIS substations are replacing traditional air-insulated systems to optimize land use. It offers superior performance in extreme weather conditions, making it suitable for coastal and remote renewable projects. The rising number of smart city initiatives worldwide is further driving demand for GIS as part of modernized, automated grid infrastructure. This convergence of energy transition goals and urban development needs is shaping long-term market growth.

- For instance, Hitachi Energy successfully delivered the world’s first SF₆-free 550 kV gas-insulated switchgear to China’s State Grid Corporation, serving over 1.1 billion people across 88 percent of China’s national territory.

Market Challenges Analysis:

High Initial Costs and Complex Installation Requirements:

The gas insulated switchgear market faces constraints due to the high upfront investment required for procurement and installation. GIS systems involve advanced technology, specialized materials, and precision engineering, which elevate costs compared to air-insulated alternatives. The installation process often requires skilled personnel, specialized tools, and extended lead times, adding to project expenses. In cost-sensitive markets, these factors can slow adoption, especially in small-scale or budget-limited infrastructure projects. It creates a barrier for utilities and industries in developing regions, despite the long-term operational benefits of GIS technology.

Environmental Concerns and Regulatory Compliance Pressures:

The continued use of SF₆ gas in many GIS systems remains a significant environmental challenge due to its high global warming potential. Governments and regulatory bodies are enforcing stricter limits on SF₆ emissions, compelling manufacturers to develop and adopt alternative insulating solutions. Transitioning to these alternatives can involve redesign costs, testing, and certification processes that impact timelines and budgets. It also requires utilities to adapt maintenance practices and ensure workforce training on new technologies. These regulatory and environmental pressures add complexity to market expansion strategies, particularly in regions with aggressive climate policies.

Market Opportunities:

Expansion of Renewable Energy Infrastructure and Smart Grids:

The gas insulated switchgear market holds strong potential from the rapid growth of renewable energy projects and smart grid development. GIS technology offers the compact design and high reliability needed for integrating wind, solar, and hydropower into existing grids. Governments are investing heavily in transmission upgrades to accommodate fluctuating renewable generation. GIS enables efficient operation in offshore wind farms, desert solar installations, and other challenging environments. Its compatibility with digital monitoring systems supports smart grid functionality, improving energy management and outage response. This synergy between renewable energy goals and advanced grid solutions is creating significant growth avenues.

Rising Urbanization and Modernization of Aging Infrastructure:

Accelerating urbanization and the need to replace outdated electrical infrastructure are opening new opportunities for GIS adoption. Densely populated cities require compact and low-maintenance substations, making GIS a preferred choice over traditional alternatives. It supports underground and indoor installations, optimizing land use in space-constrained areas. Aging grids in developed economies are driving replacement demand, while emerging markets are building new high-capacity networks. Integration of eco-friendly insulating gases in modern GIS designs enhances their appeal in environmentally conscious markets. These factors position GIS as a strategic investment for sustainable and efficient power distribution.

Market Segmentation Analysis:

By Installation:

In the gas insulated switchgear market, the installation segment is divided into indoor and outdoor systems. Indoor GIS is preferred in urban areas, industrial facilities, and high-density regions where space constraints require compact solutions. It offers enhanced safety and protection from environmental exposure, making it ideal for sensitive operations. Outdoor GIS is deployed in large-scale substations, renewable energy sites, and remote locations where high-voltage capacity and durability in extreme conditions are essential. Both segments are experiencing demand growth due to infrastructure expansion and grid modernization projects.

- For instance, ABB commissioned the world’s first eco-efficient GIS installation with its 170/24 kV switchgear bays for Swiss utility ewz in Zurich, featuring an underground installation that freed up 70 percent of the space occupied by the old substation.

By Application:

The market serves applications across power transmission, power distribution, generation, and industrial use. Transmission applications dominate due to the rising need for high-capacity systems that can reduce power losses over long distances. Distribution networks are increasingly adopting GIS to improve reliability in congested urban grids. Power generation plants, particularly renewable facilities, integrate GIS to manage output efficiently, while heavy industries leverage GIS for stable, uninterrupted operations.

- For instance, FirstEnergy integrated GIS with ADMS and mobile graphic design, benefiting 650 employees and achieving near real-time updates for improved network management efficiency.

By Voltage:

The voltage segment includes medium voltage and high voltage GIS systems. Medium voltage solutions are widely used in commercial, industrial, and urban distribution networks. High voltage GIS is critical for long-distance transmission, interconnectors, and large power projects. It provides operational stability, compact design, and minimal maintenance, making it the preferred choice for high-capacity infrastructure. Both segments are benefiting from global investments in energy transition and resilient grid development.

Segmentations:

By Installation:

By Application:

- Power Transmission

- Power Distribution

- Power Generation

- Industrial

By Voltage:

- Medium Voltage

- High Voltage

By Region:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- Latin America

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds the largest market share of 42% in the gas insulated switchgear market, driven by rapid industrialization, urbanization, and large-scale grid investments. Countries such as China, India, and Japan are at the forefront, implementing GIS technology in both new power projects and upgrades to existing networks. The expansion of renewable energy capacity and government-backed smart grid initiatives are further accelerating adoption. It meets the high demand for compact, reliable, and low-maintenance solutions in densely populated urban centers. Strong manufacturing capabilities in the region also support cost-effective production and faster deployment. Strategic energy transition policies and infrastructure modernization continue to strengthen the region’s dominance.

Europe :

Europe holds a significant market share of 28%, supported by stringent environmental regulations and a strong commitment to decarbonization. Countries like Germany, France, and the UK are integrating GIS into renewable energy projects, offshore wind farms, and urban substations. The transition to eco-friendly insulating gases is gaining momentum, aligning with EU climate targets. It enables compact and efficient power distribution in space-limited cities while ensuring compliance with emission standards. Investment in cross-border interconnectors and high-voltage transmission networks is expanding GIS demand. Continuous innovation by regional manufacturers enhances Europe’s competitive position in the global market.

North America :

North America holds a notable market share of 19%, driven by aging grid infrastructure replacement and renewable integration. The United States and Canada are investing in GIS for high-reliability applications in urban and industrial areas. It supports modernization programs aimed at enhancing resilience against extreme weather and increasing grid efficiency. Adoption is also fueled by offshore wind development along the East Coast and solar projects in the Southwest. Utility companies are leveraging GIS for underground installations in metropolitan regions. Strong research capabilities and collaborations between utilities and technology providers are fostering advanced GIS deployment in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Toshiba Energy Systems & Solutions Corporation

- Hyundai Electric & Energy Systems

- Hyosung Heavy Industries Corporation

Competitive Analysis:

The gas insulated switchgear market is competitive, with global leaders and regional players focusing on innovation, efficiency, and sustainability. Key companies include Hitachi Energy, GE, Siemens Energy, General Electric, Eaton Corporation, Schneider Electric, Mitsubishi Electric, Crompton Greaves, Toshiba Energy Systems & Solutions Corporation, and CHINT Electric. It is characterized by continuous advancements in eco-friendly insulating gases, compact designs, and digital monitoring capabilities to meet evolving regulatory and operational requirements. Leading manufacturers compete through strategic partnerships, large-scale infrastructure projects, and long-term contracts with utilities and industrial clients. Strong after-sales support, technical expertise, and customization capabilities are critical to maintaining market presence. Regional expansion into high-growth markets and investments in R&D further strengthen competitive positioning across the industry.

Recent Developments:

- In June 2025, Hitachi Energy launched its Compact Line Voltage Regulator, targeted at improving the controllability of distribution grids for utilities.

- In December 2024, Siemens Gamesa, a subsidiary of Siemens Energy, entered into an agreement to sell its power electronics business to ABB, with the transaction expected to close in the second half of 2025 and establishing a long-term supply partnership.

- In August 2025, Eaton Corporation completed the acquisition of Resilient Power Systems Inc., strengthening its position in medium voltage solid-state transformer technology for data centers and energy storage applications.

Market Concentration & Characteristics:

The gas insulated switchgear market is moderately concentrated, with a mix of global leaders and regional players competing through technological advancements and project expertise. It is characterized by high entry barriers due to the capital-intensive nature of production, stringent safety standards, and the requirement for specialized engineering skills. Leading manufacturers focus on innovation in eco-friendly insulating gases, digital monitoring capabilities, and compact designs to meet evolving regulatory and operational demands. Long-term contracts with utilities, infrastructure developers, and industrial clients provide a competitive advantage. The market also reflects strong after-sales service networks and strategic partnerships to expand presence in emerging regions. This combination of advanced technology, compliance requirements, and customer-specific solutions defines the competitive landscape.

Report Coverage:

The research report offers an in-depth analysis based on Installation, Application, Voltage and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising investments in renewable energy integration will drive demand for GIS solutions in both onshore and offshore projects.

- Urban infrastructure expansion will increase the need for compact and low-maintenance substations.

- Technological advancements will enhance digital monitoring, predictive maintenance, and real-time fault detection capabilities in GIS.

- The transition toward eco-friendly insulating gases will gain momentum due to global climate commitments and regulatory requirements.

- Upgrading aging transmission and distribution networks in developed economies will create replacement demand.

- Smart grid initiatives will boost the deployment of GIS in automated and high-efficiency power systems.

- Emerging economies will invest heavily in GIS for industrial zones, commercial hubs, and new residential developments.

- Manufacturers will focus on modular and scalable designs to meet varied voltage and capacity requirements.

- Strategic collaborations between utilities, equipment suppliers, and technology providers will accelerate product innovation and market penetration.

- Enhanced resilience against extreme weather conditions will position GIS as a preferred choice for critical infrastructure applications.