Market overview

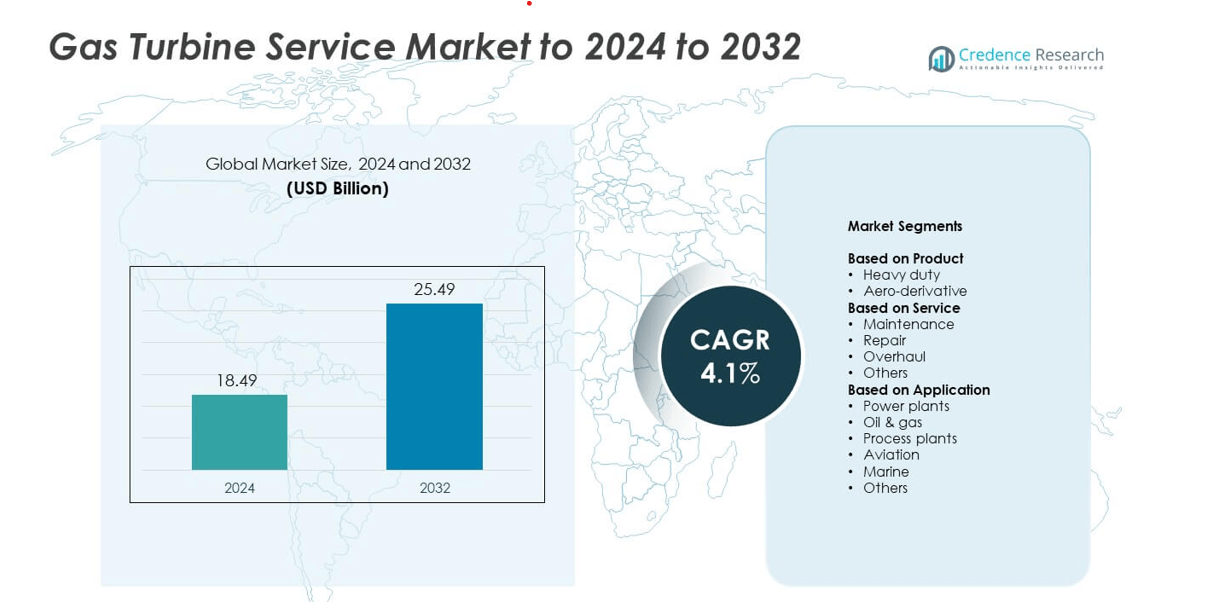

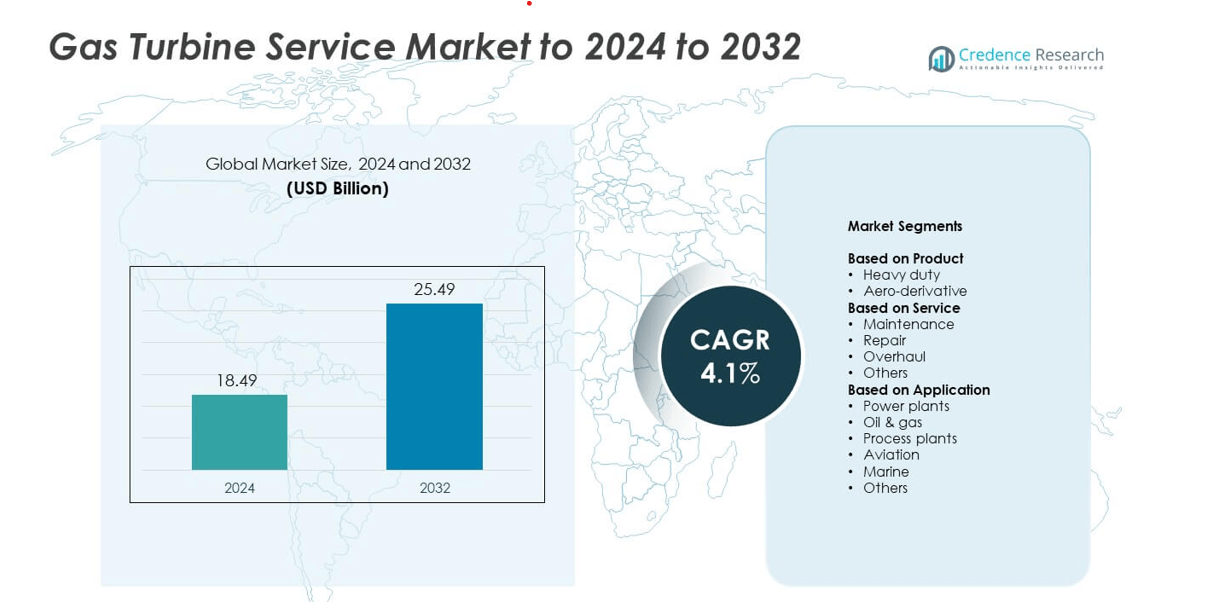

Gas Turbine Service Market size was valued USD 18.49 Billion in 2024 and is anticipated to reach USD 25.49 Billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Turbine Service Market Size 2024 |

USD 18.49 Billion |

| Gas Turbine Service Market, CAGR |

4.1% |

| Gas Turbine Service Market Size 2032 |

USD 25.49 Billion |

The Gas Turbine Service Market is dominated by leading players such as General Electric, Siemens, Mitsubishi Heavy Industries, MAN Energy Solutions, and Baker Hughes, which together hold a significant portion of the global market. These companies focus on long-term service contracts, predictive maintenance, and advanced digital monitoring solutions to strengthen operational reliability. The market is highly competitive, with companies investing in AI-driven analytics, remote diagnostics, and turbine retrofitting technologies. North America leads the market with a 35% share, followed by Europe at 27% and Asia-Pacific at 28%, driven by rising demand for efficient gas-based power generation systems.

Market Insights

- The gas turbine service market was valued at USD 18.49 billion in 2024 and is projected to reach USD 25.49 billion by 2032, growing at a CAGR of 4.1%.

- Rising adoption of combined cycle power plants and increasing oil and gas exploration activities are driving steady service demand across industrial and utility sectors.

- Digitalization, predictive maintenance, and AI-based monitoring are emerging as key trends enhancing operational efficiency and reducing downtime in turbine operations.

- The market is moderately consolidated, with major players focusing on long-term service contracts, retrofitting, and remote diagnostics to strengthen competitiveness.

- North America leads with a 35% share, followed by Asia-Pacific at 28% and Europe at 27%, while the heavy-duty turbine segment dominates the market with a 62% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The heavy-duty gas turbine segment dominated the market with over 62% share in 2024. These turbines are widely adopted in large-scale power generation due to their higher efficiency, durability, and cost-effectiveness for continuous operations. The segment benefits from increasing demand for combined cycle power plants and capacity expansion projects in Asia-Pacific and the Middle East. Rising global electricity demand and modernization of aging thermal plants further drive growth in this category. Aero-derivative turbines, though smaller in share, are gaining traction in mobile and offshore applications due to quick start-up capability.

- For instance, Mitsubishi Power’s M701J series has logged over 2.7 million operating hours, with single units delivering 448–574 MW output.

By Service

The maintenance segment accounted for the largest share of around 48% in 2024. Regular maintenance ensures turbine efficiency, reduces downtime, and extends operational lifespan, making it a critical cost-optimization measure for utilities and industrial operators. Growing emphasis on predictive maintenance using AI-based analytics is also supporting this segment’s dominance. The overhaul and repair services are expanding steadily, driven by aging infrastructure in developed regions. Increasing service contracts from OEMs such as Siemens Energy and GE Vernova further strengthen the market’s recurring revenue potential.

- For instance, Baker Hughes is supplying six Frame 7 gas turbines and 18 centrifugal compressors across the first three LNG trains at Rio Grande.

By Application

The power plant segment held the dominant share of approximately 55% in 2024. Growing electricity consumption, coupled with expanding combined cycle projects, has strengthened the demand for gas turbine services in utility-scale operations. Major economies such as the United States, China, and India are investing heavily in gas-fired capacity to balance renewable energy intermittency. The oil and gas sector also represents a key application area, with offshore and midstream projects requiring high-performance turbines. Process industries and aviation sectors are gradually increasing adoption, supported by reliability and reduced emission advantages.

Key Growth Drivers

Increasing Adoption of Combined Cycle Power Plants

The rising preference for combined cycle gas turbine (CCGT) systems is a major growth driver for the market. These systems offer higher thermal efficiency and lower emissions compared to conventional plants, making them attractive amid global decarbonization targets. Governments and utilities are investing in upgrading older plants to CCGT configurations, boosting service demand for maintenance and component replacement. Continuous investments in flexible power generation infrastructure further strengthen this segment’s contribution to the overall gas turbine service market growth.

- For instance, GE Vernova’s 9HA.01 at EDF Bouchain independently demonstrated 605 MW net output.

Expanding Oil and Gas Exploration Activities

Growing oil and gas exploration, especially in offshore regions, is fueling demand for reliable gas turbine services. Turbines are essential for powering compressors and generators in upstream and midstream operations. Increasing energy demand and the need for stable operations in harsh environments drive service contracts for overhaul and predictive maintenance. Companies are investing in digital service platforms to improve turbine performance monitoring, ensuring higher operational uptime and efficiency across exploration and production sites worldwide.

- For instance, Siemens Energy’s SGT-A35 fleet counts 850+ units with over 50 million operating hours in service.

Rising Focus on Lifecycle Cost Optimization

The focus on reducing lifecycle costs and improving turbine efficiency is a critical driver for the market. Operators are adopting long-term service agreements and condition-based maintenance strategies to manage costs and extend asset life. Technological innovations such as remote diagnostics and AI-enabled predictive tools enhance performance while minimizing unplanned outages. These solutions support utilities and industrial users in maximizing return on investment, making service partnerships vital for long-term operational sustainability and profitability.

Key Trends & Opportunities

Integration of Digital and Predictive Maintenance Solutions

Digitalization is transforming the gas turbine service market through predictive maintenance, IoT integration, and real-time performance analytics. Advanced sensors and AI models help detect faults before failures occur, reducing downtime and maintenance costs. OEMs and independent service providers are increasingly offering cloud-based platforms for remote monitoring. The trend is creating new opportunities for service differentiation, especially among operators seeking higher reliability and improved turbine efficiency under flexible operating conditions.

- For instance, Solar Turbines reports 16,000+ units operating in 100+ countries with over 3 billion operating hours, enabling large-scale data-driven service.

Shift Toward Cleaner and Hybrid Energy Systems

The shift toward cleaner energy systems is opening opportunities for gas turbine service providers. Many power producers are adopting hybrid configurations combining gas turbines with renewables or hydrogen-ready turbines. This shift demands specialized servicing and upgrades to support flexible operations. The trend aligns with global emission reduction goals and energy transition strategies. Service companies offering decarbonization-oriented retrofits and efficiency upgrades are expected to benefit most from this evolving market landscape.

- For instance, Kawasaki began demonstrating a 1 MW hydrogen and natural gas co-fired cogeneration turbine at the Minatojima demonstration plant in 2018, and in 2023, launched the world’s first 1.8 MW class 100% hydrogen-fueled, dry-combustion cogeneration system using a new MMX combustor.

Key Challenges

High Maintenance Costs and Capital Investment

High service and replacement part costs remain a key challenge in the gas turbine service market. Maintenance and overhaul operations require specialized components, skilled labor, and advanced diagnostic tools, leading to significant expenses for operators. Smaller power producers often face budget constraints, delaying service schedules and affecting efficiency. Managing these costs while ensuring consistent performance remains a major hurdle for both service providers and end-users, especially in price-sensitive emerging markets.

Dependence on Skilled Workforce and Technical Expertise

The market faces a shortage of skilled technicians and engineers required for turbine servicing and diagnostics. Complex turbine designs and advanced digital monitoring systems demand highly trained professionals. The lack of technical expertise can lead to maintenance delays, increased operational risks, and lower system reliability. Companies are investing in training programs and automation technologies to address this gap, but workforce availability continues to challenge the scalability of global service operations.

Regional Analysis

North America

North America held the largest share of 35% in the gas turbine service market in 2024. The region benefits from a well-established power generation infrastructure and high adoption of combined cycle gas turbines. The United States dominates with strong investments in grid modernization and capacity upgrades for aging power plants. Growing use of natural gas for cleaner energy generation further drives maintenance and retrofit services. Key service providers, including GE Vernova and Siemens Energy, are expanding digital service contracts, supporting continuous operational optimization and long-term service agreements across industrial and utility applications.

Europe

Europe accounted for around 27% share in 2024, driven by the region’s transition toward cleaner and more efficient gas-fired power generation. Countries such as Germany, the United Kingdom, and Italy are focusing on replacing coal-based plants with gas-powered units to meet emission goals. Increased renewable energy integration has raised the demand for flexible turbine operations, boosting maintenance and control system upgrades. The aging turbine fleet and stringent environmental regulations are creating steady service opportunities. Service providers are investing in predictive maintenance tools to align with Europe’s sustainability objectives and regulatory frameworks.

Asia-Pacific

Asia-Pacific captured nearly 28% of the market share in 2024 and is expected to record the fastest growth through 2032. Rapid industrialization, urbanization, and rising energy demand in China, India, and Southeast Asia are key factors supporting market expansion. Regional governments are prioritizing gas-based generation as a cleaner alternative to coal, resulting in new service contracts for turbine installation and maintenance. Increasing foreign investments in power infrastructure and gas exploration further support market growth. OEMs are partnering with regional utilities to enhance service accessibility and operational reliability in large-scale power projects.

Middle East & Africa

The Middle East and Africa region accounted for 7% of the market share in 2024. Growth is fueled by rising investments in oil and gas exploration and the expansion of gas-fired power plants. Countries such as Saudi Arabia and the United Arab Emirates are increasing turbine service contracts to ensure reliable energy generation and optimize downstream operations. African nations are gradually expanding gas turbine adoption for industrial power needs, supporting maintenance and overhaul demand. The region’s focus on diversification of energy sources and efficiency upgrades continues to strengthen long-term service prospects.

Latin America

Latin America represented about 3% of the market share in 2024, supported by growing demand for reliable and flexible energy generation systems. Brazil, Mexico, and Argentina are leading markets, investing in natural gas infrastructure and combined cycle plants. Increased focus on industrial growth and electrification in remote areas has expanded service opportunities for turbine maintenance and performance upgrades. However, limited technical infrastructure and dependency on imported components slightly restrict rapid growth. Continued energy transition efforts and foreign investment partnerships are expected to improve the region’s gas turbine service outlook.

Market Segmentations:

By Product

- Heavy duty

- Aero-derivative

By Service

- Maintenance

- Repair

- Overhaul

- Others

By Application

- Power plants

- Oil & gas

- Process plants

- Aviation

- Marine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The gas turbine service market features strong competition among global and regional players such as MAN Energy Solutions, EthosEnergy, Mitsubishi Heavy Industries, PROENERGY, Ansaldo Energia, Siemens, Zorya-Mashproekt, Solar Turbines, Centrax Gas Turbines, MTU Aero Engines, VERICOR, Sulzer, Baker Hughes, Opra Turbines, Kawasaki Heavy Industries, UEC-Saturn, MJB International, and General Electric. The market is driven by technological advancements, long-term service agreements, and the expansion of digital monitoring solutions. Companies focus on enhancing turbine performance through predictive maintenance and AI-enabled diagnostics to reduce downtime. Strategic collaborations, acquisitions, and service network expansions remain key competitive approaches. Growing demand for efficiency optimization and lifecycle cost reduction encourages innovation in component upgrades and retrofitting solutions. Service providers are also increasing investments in remote operation capabilities and digital twin technology to strengthen operational efficiency. Competition is expected to intensify as global energy transition initiatives accelerate the shift toward cleaner, gas-based power generation systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MAN Energy Solutions

- EthosEnergy

- Mitsubishi Heavy Industries

- PROENERGY

- Ansaldo Energia

- Siemens

- Zorya-Mashproekt

- Solar Turbines

- Centrax Gas Turbines

- MTU Aero Engines

- VERICOR

- Sulzer

- Baker Hughes

- Opra Turbines

- Kawasaki Heavy Industries

- UEC-Saturn

- MJB International

- General Electric

Recent Developments

- In 2025, GE Vernova and Saudi Electricity Company (SEC) completed their first joint Saudi-led gas turbine maintenance project, which was executed by GE Vernova’s Saudi engineers and specialists at SEC’s 8th power plant in Riyadh

- In 2023, GE launched a new digital monitoring system for gas turbine services to enhance predictive maintenance and reduce client downtime.

- In 2023, Mitsubishi Power successfully operated an advanced-class gas turbine with 30% hydrogen fuel co-firing at its T-Point 2 validation facility in Japan.

- In 2023, Kawasaki launched the world’s first 1.8 MW class, 100% hydrogen-fueled, dry-combustion gas turbine cogeneration system.

Report Coverage

The research report offers an in-depth analysis based on Product, Service, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for long-term service agreements will increase as utilities focus on cost efficiency.

- Predictive maintenance using AI and IoT will become a standard industry practice.

- Gas turbine retrofitting and modernization projects will rise in developed markets.

- Expansion of gas-based power generation in Asia-Pacific will drive regional service growth.

- Hydrogen-ready turbine upgrades will create new service opportunities worldwide.

- Digital twin technology will enhance operational efficiency and reduce downtime.

- Independent service providers will gain market share through flexible contract models.

- Lifecycle optimization strategies will guide investment decisions in turbine operations.

- Integration of renewables with gas turbines will increase demand for hybrid system maintenance.

- Sustainability goals and emission regulations will accelerate adoption of cleaner turbine technologies.