Market Overview

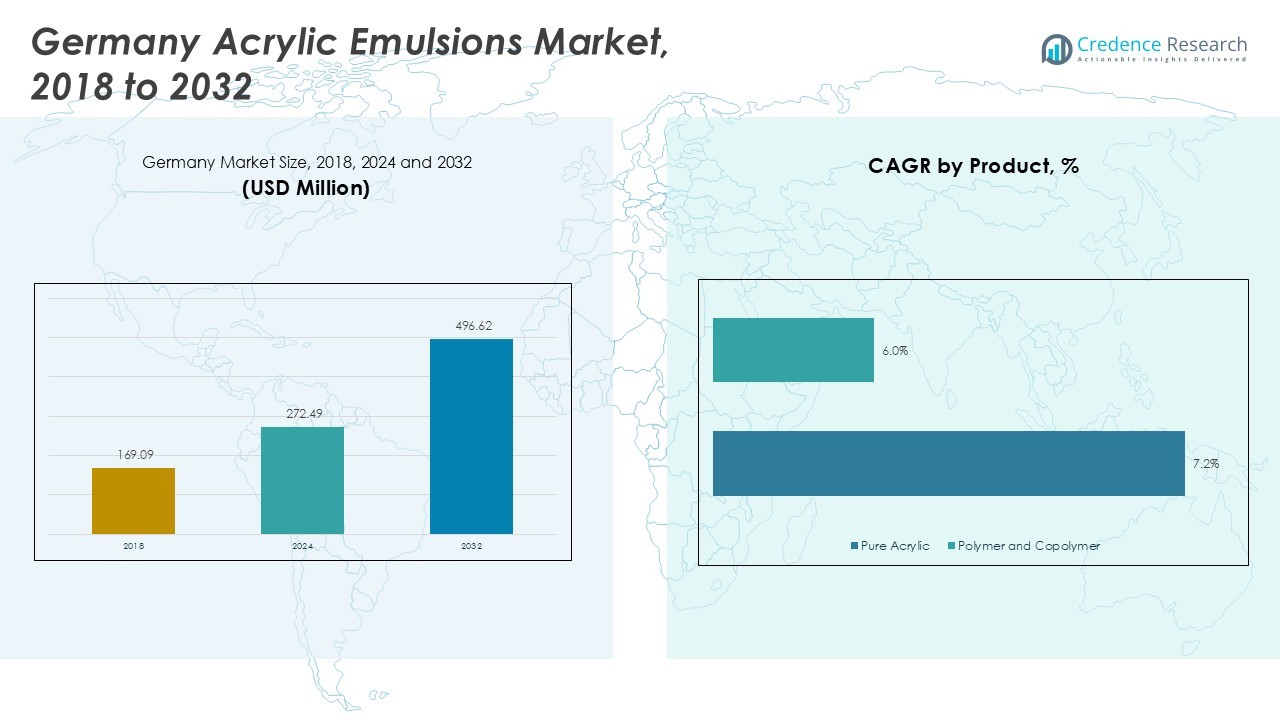

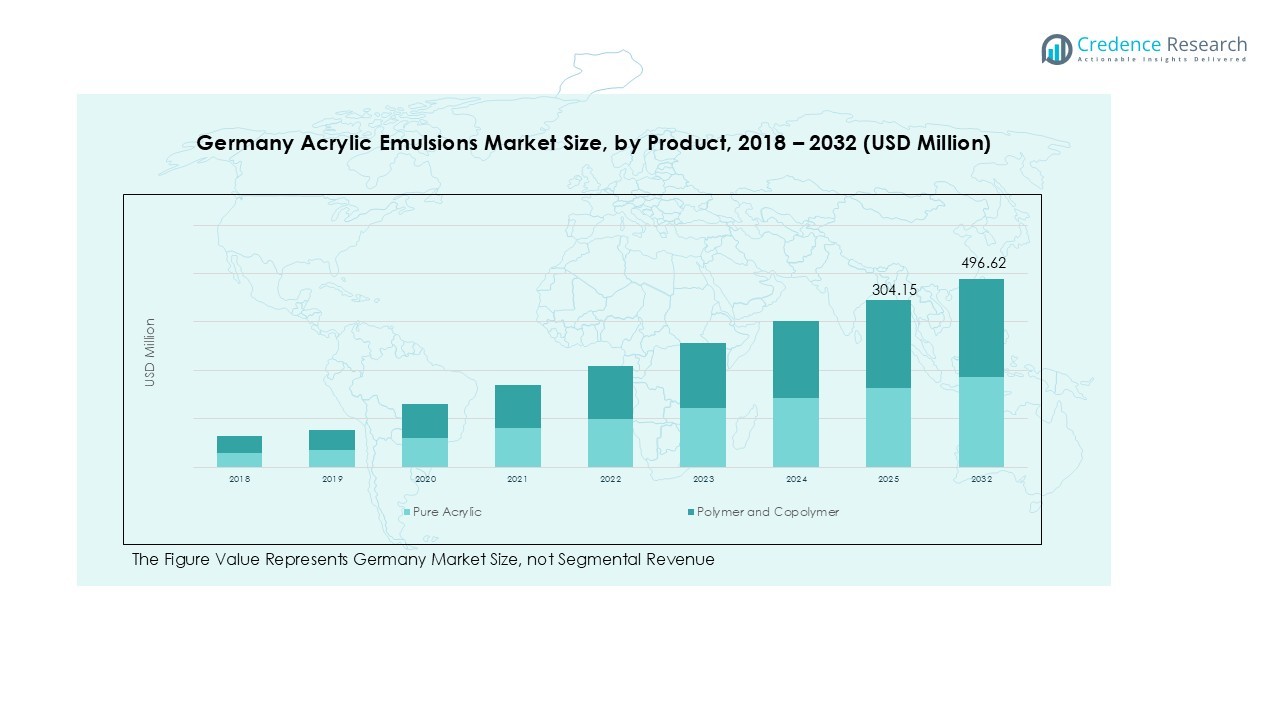

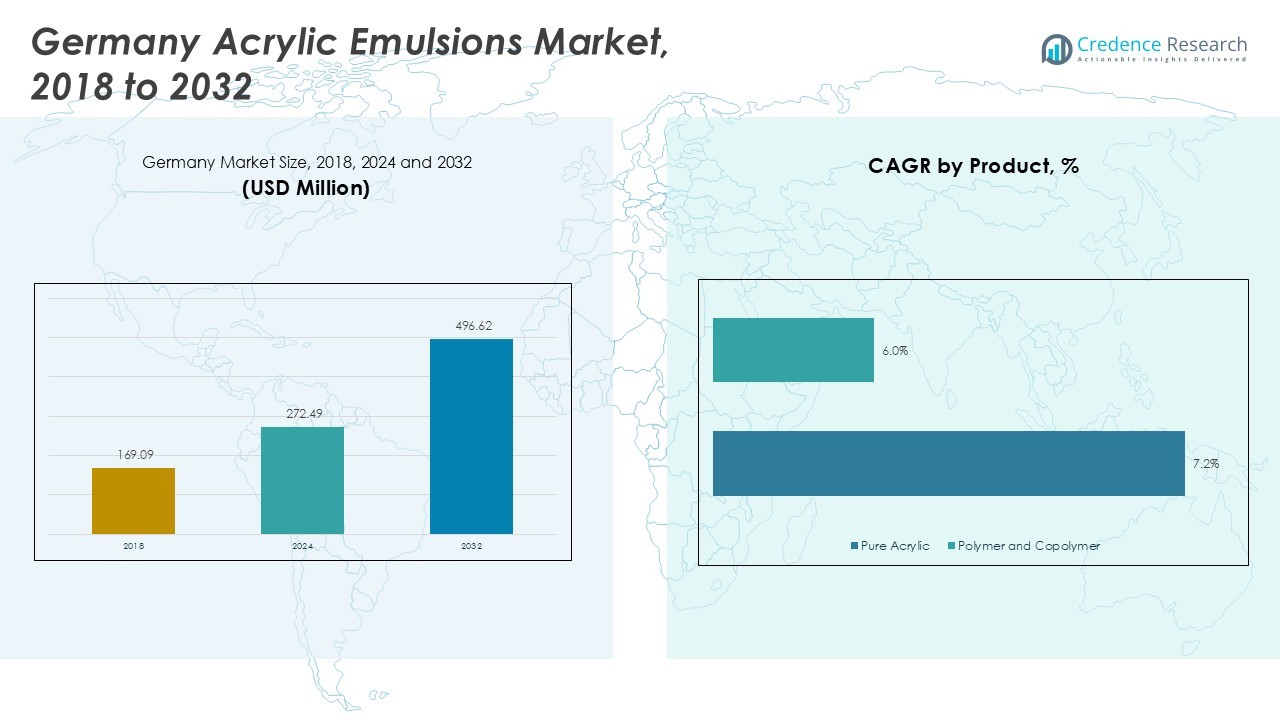

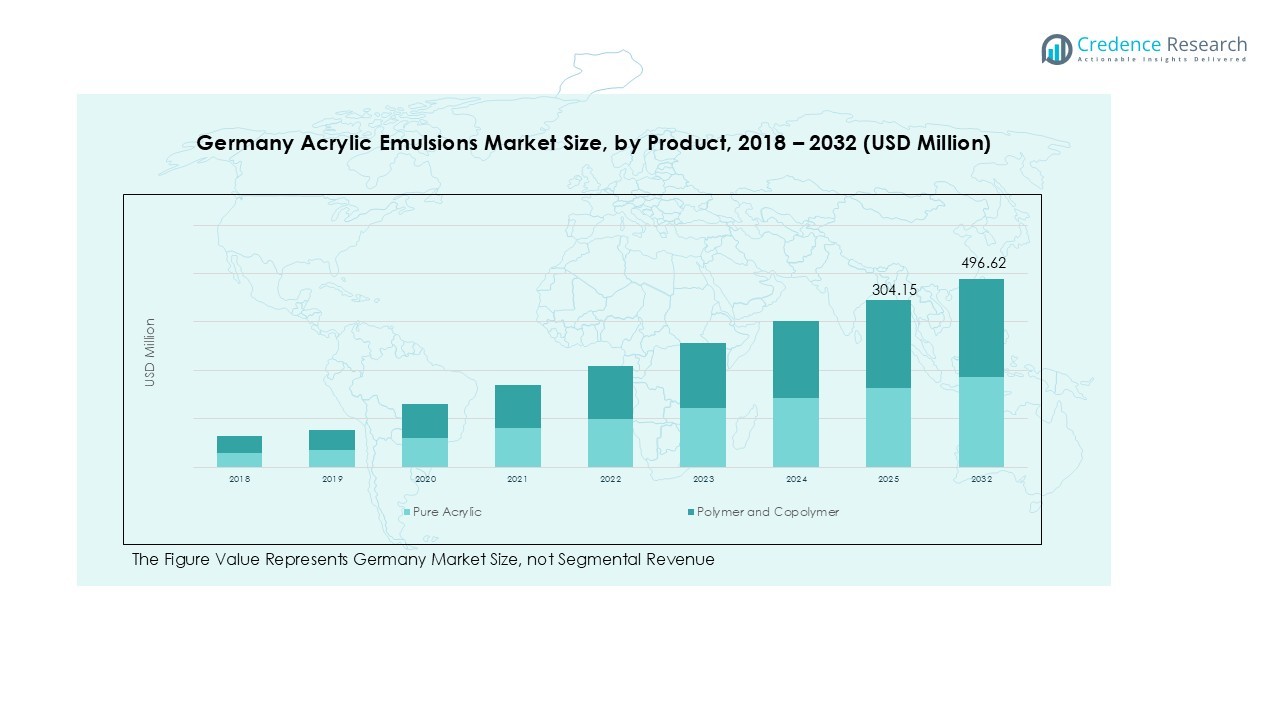

Germany Acrylic Emulsions market size was valued at USD 169.09 Million in 2018, growing to USD 272.49 Million in 2024, and is anticipated to reach USD 496.62 Million by 2032, at a CAGR of 7.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Acrylic Market Size 2024 |

USD 272.49 Million |

| Germany Acrylic Market, CAGR |

7.26% |

| Germany Acrylic Market Size 2032 |

USD 496.62 Million |

The Germany Acrylic Emulsions market is highly competitive, led by key players such as BASF SE, Covestro AG, Wacker Chemie AG, Synthomer plc, Trinseo PLC, Akzo Nobel N.V., Arkema, DIC Group, Clariant AG, and Avery Dennison. These companies focus on innovation, eco-friendly formulations, and high-performance products to meet stringent environmental standards and evolving customer demands. Investment in R&D, advanced manufacturing facilities, and specialized product portfolios allows these players to maintain strong market positions and drive adoption across industrial, architectural, and commercial applications. South Germany emerges as the leading region, accounting for 32% of the market, supported by robust demand from the automotive, construction, and coatings sectors, as well as concentrated industrial hubs and ongoing urbanization projects that fuel consistent growth in acrylic emulsion consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Acrylic Emulsions market was valued at USD 272.49 Million in 2024 and is projected to reach USD 496.62 Million by 2032, growing at a CAGR of 7.26%.

- Growth is driven by rising construction and renovation activities, increasing demand for eco-friendly coatings, and technological advancements in high-performance and low-VOC acrylic emulsions.

- Key trends include expansion into specialty applications such as adhesives, paper coatings, and construction additives, along with strategic collaborations, mergers, and acquisitions to strengthen market presence and enhance innovation.

- The market is highly competitive, led by companies such as BASF SE, Covestro AG, Wacker Chemie AG, Synthomer plc, Trinseo PLC, Akzo Nobel N.V., Arkema, DIC Group, Clariant AG, and Avery Dennison, focusing on product differentiation and regulatory compliance. Challenges include volatility in raw material prices and stringent environmental regulations that increase production complexity and cost.

- South Germany leads regional demand with a 32% share, while Pure Acrylic holds the largest product segment share at 58%, and Paints and Coatings dominate applications with 62%.

Market Segmentation Analysis:

By Product:

In the Germany Acrylic Emulsions market, the Pure Acrylic segment dominates with an estimated market share of around 58% in 2024. The segment’s growth is driven by its superior film-forming properties, excellent adhesion, and durability, which make it highly suitable for premium paints and coatings applications. Meanwhile, the Polymer and Copolymer segment holds a significant share due to its cost-effectiveness and versatility in industrial and construction applications. Rising demand for high-performance coatings and sustainable, low-VOC solutions is further propelling product adoption across various industries.

- For instance, BASF SE utilizes pure acrylic emulsions in its advanced architectural coatings, delivering enhanced weather resistance and durability.

By Application:

Among applications, Paints and Coatings lead the Germany Acrylic Emulsions market with a dominant share of 62%, fueled by the country’s robust construction and decorative coatings industry. The segment benefits from growing urbanization, infrastructure development, and increased preference for eco-friendly, water-based formulations. Construction Material Additives and Paper Coating also contribute substantially, supporting the demand for durable surfaces and enhanced product performance. Rising investments in commercial and residential building projects, along with stringent environmental regulations, are driving the adoption of acrylic emulsions in diverse coating applications.

- For instance, Evonik has developed PROTECTOSIL®, a silane-based additive that enhances water repellency and corrosion protection for concrete structures, improving longevity and sustainability in construction materials.

By End-User:

The Architectural end-user segment holds the largest share at approximately 55%, reflecting strong demand from residential and commercial construction projects across Germany. Superior aesthetic appeal, weather resistance, and long-term performance of acrylic-based paints drive adoption in interior and exterior architectural applications. The Industrial and Commercial segments are also growing steadily, fueled by increasing use of emulsions in adhesives, coatings, and specialty applications. The rising focus on energy-efficient and sustainable building solutions continues to support the penetration of acrylic emulsions across all end-user categories.

Key Growth Drivers

Growing Construction and Renovation Activities

The surge in residential, commercial, and infrastructure projects across Germany is a major driver for the acrylic emulsions market. Rising urbanization, coupled with government initiatives to modernize public infrastructure, has increased demand for durable, water-based coatings. Acrylic emulsions are preferred for their excellent adhesion, weather resistance, and low-VOC properties, making them ideal for both interior and exterior applications. Continuous investments in renovation and refurbishment projects further bolster demand, positioning the segment for steady growth throughout the forecast period.

- For instance, Evonik operates one of Germany’s largest chemical sites at Marl, producing specialty acrylic acids and emulsion polymers that serve multiple sectors including construction coatings, contributing key raw materials for durable and eco-friendly acrylic emulsions used in refurbishment and public infrastructure projects.

Increasing Demand for Eco-Friendly Coatings

Environmental regulations and rising consumer awareness of sustainable products are fueling the adoption of low-VOC, water-based acrylic emulsions. These formulations reduce harmful emissions and comply with Germany’s stringent environmental standards. Manufacturers are increasingly innovating to offer bio-based or energy-efficient coating solutions, which are driving market growth. The shift from solvent-based coatings to eco-friendly alternatives in paints, adhesives, and construction additives is a critical factor supporting the sustained expansion of the acrylic emulsions market.

- For instance, AkzoNobel developed a waterborne wood coating containing 20% bio-based content to enhance sustainability while maintaining performance.

Technological Advancements and Product Innovation

Continuous R&D and product innovation are enhancing the performance characteristics of acrylic emulsions, such as improved film formation, durability, and chemical resistance. Advanced copolymer and hybrid formulations are enabling manufacturers to meet evolving application requirements across paints, coatings, adhesives, and paper industries. Integration of smart additives and specialized polymers allows emulsions to deliver superior performance under varied environmental conditions. Such technological advancements are strengthening market competitiveness and increasing adoption across industrial, architectural, and commercial segments.

Key Trends & Opportunities

Expansion of Specialty Applications

The German acrylic emulsions market is witnessing growing adoption in specialty applications, including high-performance adhesives, paper coatings, and construction additives. Manufacturers are leveraging product versatility to develop tailored solutions for niche industrial and commercial needs. Rising demand for multifunctional coatings that offer durability, flexibility, and environmental compliance presents new revenue opportunities. Expanding into emerging end-use segments, such as automotive and packaging, can further enhance market potential, making the specialty applications segment a significant growth avenue for manufacturers.

- For instance, BASF’s Joncryl® acrylic emulsions are used extensively in automotive coatings and flexible packaging, providing high gloss and durability combined with low VOC emissions.

Strategic Collaborations and Mergers

Strategic partnerships, joint ventures, and acquisitions are creating opportunities for companies to expand product portfolios and strengthen market presence. Collaboration with raw material suppliers and research institutions allows faster development of high-performance and eco-friendly formulations. Market players can leverage synergies to enhance distribution networks and penetrate new industrial and architectural applications. Such strategies not only boost revenue potential but also enable firms to maintain competitive advantage in a market increasingly driven by innovation, sustainability, and performance differentiation.

- For instance, HB Chemical acquired Lianda Corporation to expand its geographic reach and distribution capabilities while maintaining Lianda’s R&D for continued technical innovation and customer support.

Key Challenges

Volatility in Raw Material Prices

The Germany acrylic emulsions market faces challenges from fluctuating raw material costs, particularly acrylic monomers derived from petroleum. Price volatility impacts production costs, profit margins, and end-product pricing, potentially affecting demand in price-sensitive segments. Companies must invest in supply chain optimization and alternative sourcing strategies to mitigate risks. Additionally, regulatory constraints and global market dynamics influence raw material availability, posing operational challenges for manufacturers while striving to maintain consistent quality and competitive pricing.

Stringent Environmental Regulations

Although eco-friendly products drive growth, compliance with Germany’s strict environmental and safety regulations poses a challenge for manufacturers. Adhering to low-VOC, solvent-free, and sustainable formulation requirements increases production complexity and costs. Failure to comply can result in penalties or restricted market access. Companies must invest in R&D and process optimization to align with environmental standards while ensuring product performance, creating a delicate balance between innovation, compliance, and profitability in a highly regulated market.

Regional Analysis

North Germany:

North Germany holds a significant share of 28% in the acrylic emulsions market, driven by high industrial activity and a strong presence of manufacturing hubs. The region benefits from advanced infrastructure, well-established chemical industries, and robust demand from paints, coatings, and adhesives sectors. Urbanization and residential construction projects in major cities such as Hamburg and Bremen further support market growth. The presence of leading regional players and R&D centers encourages innovation in high-performance and eco-friendly acrylic emulsions, reinforcing North Germany’s position as a key contributor to the overall market expansion.

South Germany:

South Germany commands a market share of 32%, led by strong architectural and industrial demand in Bavaria and Baden-Württemberg. The region’s thriving automotive, construction, and coatings sectors drive adoption of high-quality acrylic emulsions. Manufacturers focus on premium, durable, and environmentally compliant products to meet stringent local standards. Investment in industrial parks and technological innovation enhances production efficiency and product diversification. South Germany also benefits from rising commercial and residential projects, further increasing demand for paints, adhesives, and specialty coatings. The combination of industrial strength and innovation makes South Germany the dominant regional contributor in the acrylic emulsions market.

West Germany:

West Germany accounts for a 22% market share, supported by robust industrial and commercial activities across North Rhine-Westphalia and Hesse. The region’s extensive construction projects, combined with high adoption of water-based and low-VOC coatings, drive growth in acrylic emulsions. Strong presence of chemical manufacturers and supply chain infrastructure ensures timely production and distribution. Urbanization and modern architectural trends further fuel demand in residential and commercial sectors. West Germany also benefits from government initiatives promoting sustainable building materials, making it a critical region for market players seeking to expand their reach and capitalize on increasing demand for high-performance emulsion products.

East Germany:

East Germany contributes 18% to the acrylic emulsions market, with demand primarily from emerging industrial zones and regional construction activities. The region’s growth is supported by increasing investments in infrastructure, renovations, and urban development projects. Manufacturers focus on cost-effective and versatile acrylic emulsion solutions to meet local industrial and architectural needs. Smaller cities and expanding commercial hubs present opportunities for regional suppliers to increase penetration. While the market is less concentrated than in South and North Germany, East Germany offers consistent growth potential, particularly in industrial applications and construction material additives, strengthening its position as a steadily growing regional market.

Market Segmentations:

By Product

- Pure Acrylic

- Polymer and Copolymer

By Application

- Paints and Coatings

- Construction Material Additives

- Paper Coating

- Adhesives

- Others

By End-User

- Architectural

- Industrial

- Commercial

- Residential

By Region

- North Germnay

- South Germany

- West Germany

- East Germany

Competitive Landscape

The Germany Acrylic Emulsions market is led by key players such as BASF SE, Covestro AG, Wacker Chemie AG, Synthomer plc, Trinseo PLC, Akzo Nobel N.V., Arkema, DIC Group, Clariant AG, and Avery Dennison. The market exhibits high competitiveness due to continuous innovation, strategic partnerships, and product differentiation. Leading companies focus on developing eco-friendly, low-VOC, and high-performance emulsions to meet stringent environmental regulations and evolving customer demands. Investment in R&D, advanced manufacturing facilities, and specialized product portfolios strengthens their market position. Smaller and regional players compete by offering cost-effective and tailored solutions for niche applications. Additionally, mergers, acquisitions, and collaborations are commonly pursued to expand market presence, enhance technological capabilities, and optimize supply chains. Overall, competition is driven by product innovation, regulatory compliance, and strategic growth initiatives, shaping the dynamic Germany acrylic emulsions landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, Trinseo PLC launched LIGOS C 9031, a styrene acrylic emulsion for interior wall paints, offering high scrub resistance and improved durability for architectural coatings.

- In September 2025, DKSH entered a strategic partnership with Organik Kimya to distribute high-performance polymer emulsions in Germany, aiming to meet growing demand for sustainable and innovative coatings solutions.

- In March 2023, Wacker Chemie AG introduced new heat-resistant silicone resin binders for industrial coatings, not an acrylic emulsion. The products, named SILRES® M 51 E and SILRES® IC 900, were designed for high-temperature applications, offering improved heat and chemical resistance.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and low-VOC acrylic emulsions will continue to rise across architectural and industrial sectors.

- Expansion in residential and commercial construction projects will drive consistent market growth.

- Technological advancements in copolymer and hybrid emulsions will enhance product performance and adoption.

- Specialty applications in adhesives, paper coatings, and construction additives will create new revenue opportunities.

- Regulatory focus on sustainability and environmental compliance will influence product innovation and formulation trends.

- Strategic collaborations, mergers, and acquisitions will strengthen market presence and competitive positioning.

- Industrial and automotive sectors will increasingly adopt high-performance emulsions for durable applications.

- Regional demand in South and North Germany will remain dominant due to industrial hubs and urbanization.

- Manufacturers will focus on cost optimization and supply chain efficiency to manage raw material volatility.

- Growth in smart and multifunctional coating solutions will drive long-term market expansion.