Market Overview:

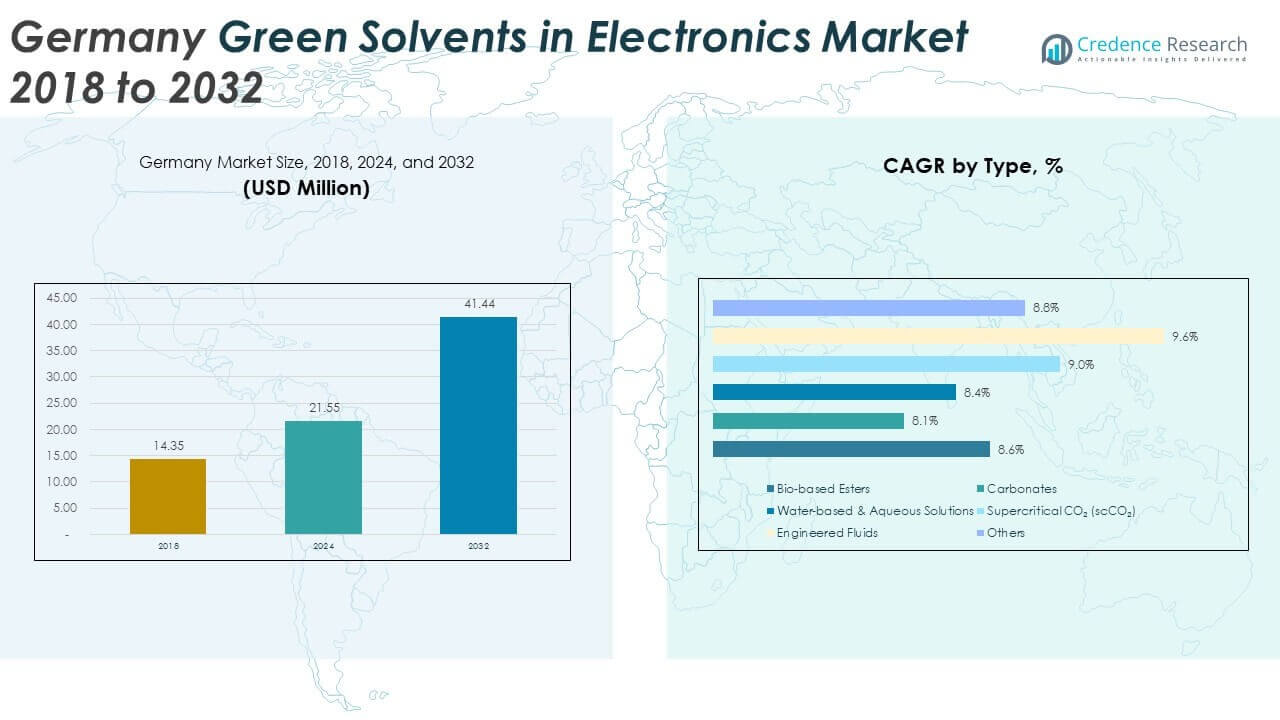

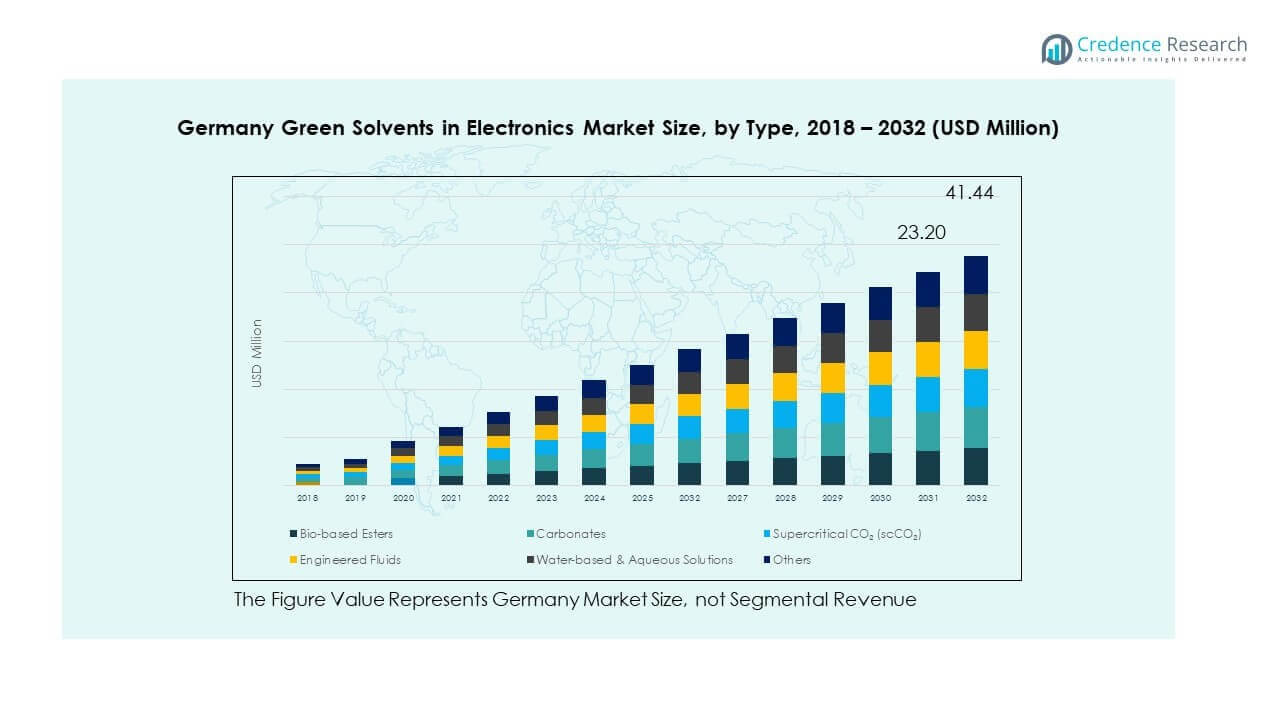

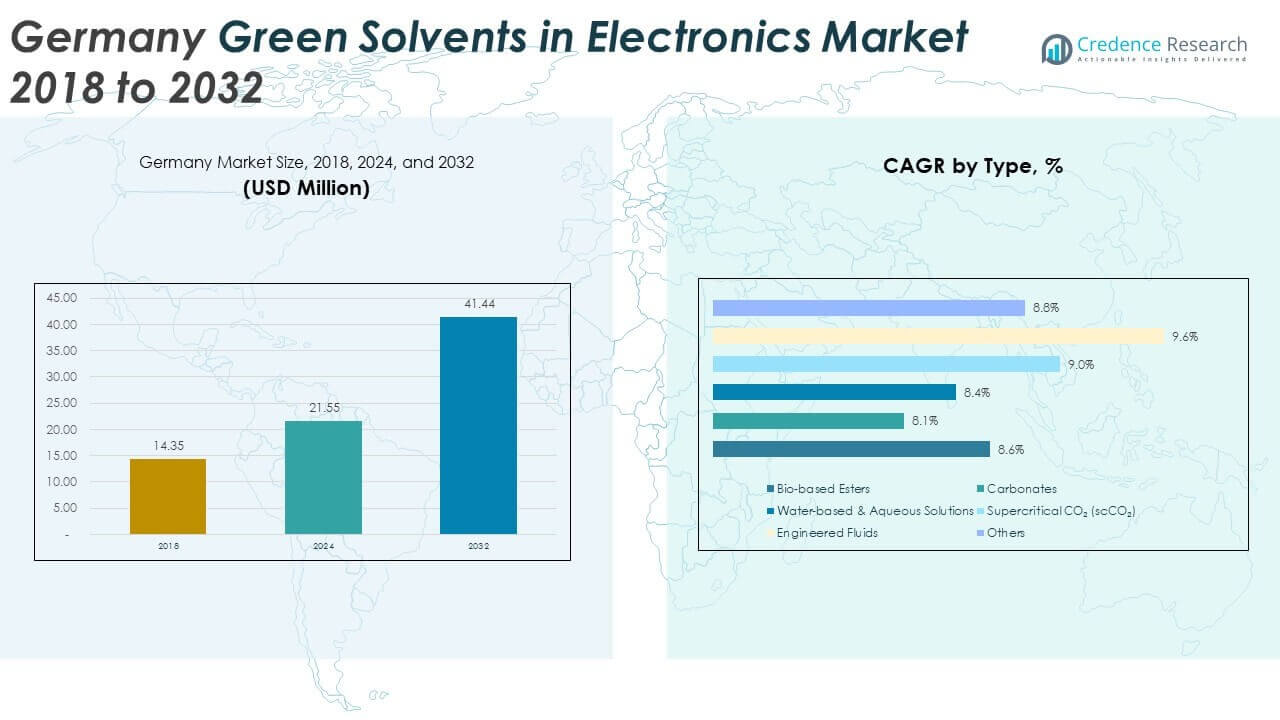

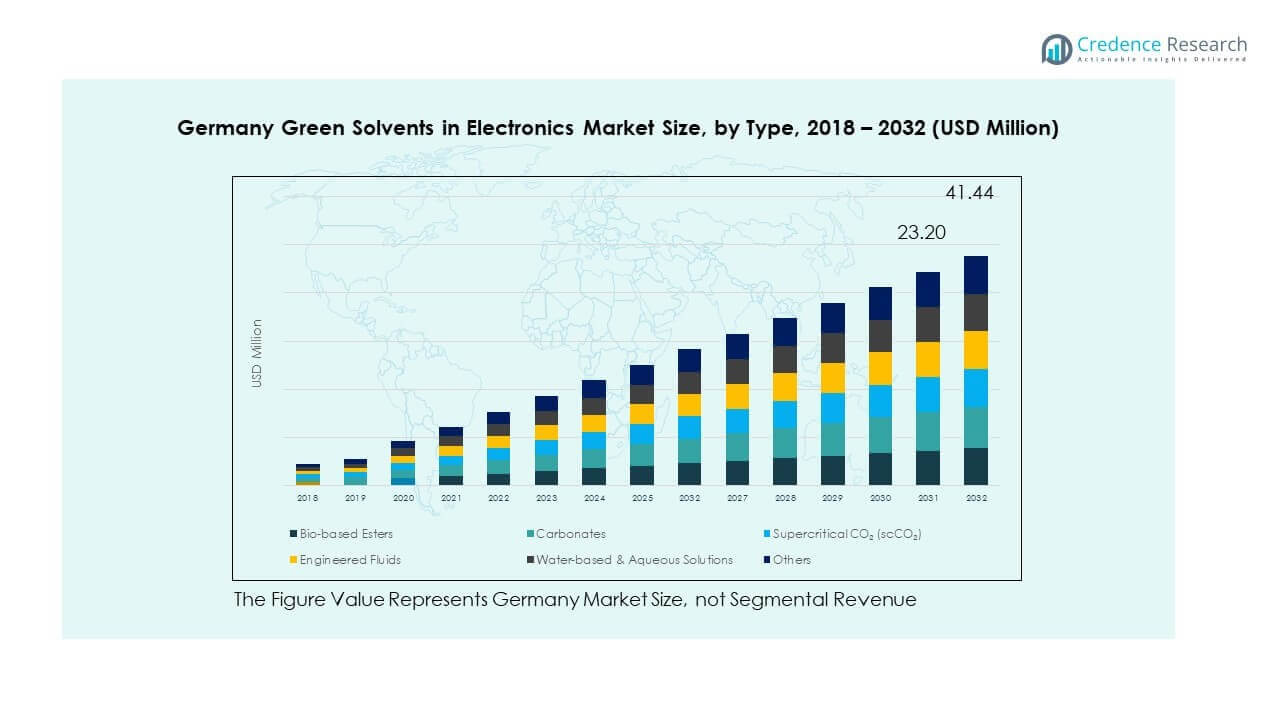

The Germany Green Solvents in Electronics Market size was valued at USD 14.35 million in 2018 to USD 21.55 million in 2024 and is anticipated to reach USD 41.44 million by 2032, at a CAGR of 8.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Green Solvents in Electronics Market Size 2024 |

USD 21.55 Million |

| Germany Green Solvents in Electronics Market, CAGR |

8.52% |

| Germany Green Solvents in Electronics Market Size 2032 |

USD 41.44 Million |

Rising environmental regulations and sustainability commitments are propelling demand for green solvents. Electronics manufacturers in Germany are shifting toward eco-friendly solvents to reduce VOC emissions and hazardous waste. Strong government support for green innovation and the EU’s strict compliance standards reinforce this transition. Increasing application in semiconductors, PCBs, and precision cleaning enhances its relevance. Growing consumer awareness of sustainable products also strengthens market momentum, making it a strategic area for investment and technology adoption.

The market benefits from Germany’s position as a European technology hub. Strong semiconductor, automotive electronics, and renewable energy sectors boost solvent demand. Europe leads the adoption, supported by regulatory frameworks and research investments. North America follows, driven by clean technology standards and innovation ecosystems. Asia Pacific emerges as the fastest-growing region due to rising electronics production and rapid urbanization. Latin America and the Middle East show potential through industrial growth, while Africa presents early opportunities driven by industrial electrification and urban expansion.

Market Insights:

- The Germany Green Solvents in Electronics Market was USD 14.35 million in 2018, USD 21.55 million in 2024, and is projected to reach USD 41.44 million by 2032 at a CAGR of 8.52%.

- Europe held the largest share at 42% in 2024, driven by Germany’s strong semiconductor and automotive electronics sectors, followed by North America at 28% and Asia Pacific at 21%, supported by advanced R&D and growing consumer electronics output.

- Asia Pacific is the fastest-growing region with 21% share, supported by expanding semiconductor, display, and EV battery production in China, Japan, and South Korea.

- Bio-based esters and carbonates together contributed nearly 46% of total solvent usage in 2024, reflecting strong preference for eco-friendly categories.

- Engineered fluids and water-based solutions accounted for over 32% combined share in 2024, highlighting their role in precision cleaning and specialty electronics manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising demand for eco-friendly solvents in semiconductor manufacturing:

The Germany Green Solvents in Electronics Market benefits from the strong demand for eco-friendly cleaning and processing materials in semiconductor fabrication. Manufacturers increasingly replace petroleum-based solvents with bio-based alternatives to comply with stringent environmental laws. The semiconductor sector requires solvents with high purity, low toxicity, and consistent performance. It provides opportunities for green solvents to capture wider applications in wafer cleaning and lithography processes. Growing R&D in nanotechnology and microelectronics further accelerates adoption. Companies invest heavily in formulations that balance sustainability with performance requirements. It allows German industries to reduce carbon emissions while enhancing compliance readiness.

- For instance, Merck KGaA in Darmstadt launched the AZ® 910 Remover, a new NMP-free solvent portfolio designed to deliver high throughput photoresist removal with environmentally friendly performance, demonstrating faster dissolution of photoresist patterns while meeting semiconductor purity standards in 24/7 production environments.

Regulatory push and sustainability commitments from the European Union:

The European Union’s Green Deal and strict environmental directives act as key growth levers for the Germany Green Solvents in Electronics Market. It compels manufacturers to minimize reliance on traditional hazardous solvents. Germany, as a technology leader, aligns strongly with these frameworks, pushing companies to adopt cleaner solutions. Regulations around VOC limits and hazardous waste disposal provide added impetus for solvent innovation. Sustainability has become an industry priority, making eco-compliance not just a necessity but a competitive differentiator. Companies leverage this regulatory environment to improve market positioning and brand value. Public pressure for environmentally safe electronics amplifies the demand trend.

- For example, BASF announced a high-purity semiconductor-grade sulfuric acid plant expansion in Ludwigshafen with cutting-edge purity specifications to support increasing local chip manufacturing, explicitly responding to EU chemical standards and reducing supply risks linked with imports.

Expansion of automotive electronics and EV manufacturing:

Germany’s dominance in automotive engineering drives strong growth in electronic component manufacturing. The shift toward electric vehicles and advanced driver assistance systems increases demand for PCB assembly and battery-related applications. Green solvents serve as crucial materials for cleaning, degreasing, and processing in these areas. It allows automakers and suppliers to align with sustainability goals while meeting technical standards. Battery manufacturing, in particular, requires solvents with high safety profiles and low environmental impact. Green solvents offer both, making them integral to EV production chains. This sectoral synergy significantly boosts market penetration across Germany’s industrial landscape.

Technological innovation in green chemistry and solvent engineering:

Continuous investment in green chemistry enables the development of advanced solvent formulations. German research institutions and companies focus on designing solvents that balance biodegradability, recyclability, and process efficiency. It fuels broader adoption across displays, semiconductors, and specialty cleaning applications. Engineered fluids and supercritical CO₂ are gaining ground due to their low toxicity and high performance. Partnerships between academia, chemical firms, and electronics players strengthen innovation pipelines. Companies capitalize on technology grants and research funding to pioneer new eco-friendly materials. This innovation culture ensures long-term growth and strengthens Germany’s leadership in sustainable electronics production.

Market Trends:

Market Trends:

Integration of bio-based solvents in precision cleaning:

The Germany Green Solvents in Electronics Market is witnessing greater use of bio-based solvents for precision cleaning. Manufacturers are transitioning away from hazardous chlorinated solvents to achieve higher safety and eco-compliance. These bio-based formulations improve cleaning efficiency without compromising sensitive electronics. Demand is growing across PCB and semiconductor assembly lines. It reflects a trend where sustainability goals align with operational efficiency. Research in natural ester and carbonate solvents drives this substitution. Consumer expectations for eco-labeled electronics amplify the adoption. This integration trend reflects broader green chemistry priorities across German manufacturing industries.

- For instance, Borregaard’s bio-based additives specifically formulated for electronic wet chemical solutions improve wafer cleaning and texturing times significantly in PV cell manufacturing, achieving homogeneous textured wafer surfaces with exceptionally low reflectance. This integration trend reflects broader green chemistry priorities across German manufacturing industries.

Increased focus on circular economy practices:

German electronics companies are embedding circular economy models in their production processes. The Germany Green Solvents in Electronics Market benefits as solvent recyclability and reusability become key value drivers. Recycling systems that reclaim solvents from cleaning and production processes reduce costs and waste. It allows manufacturers to align with EU waste management directives. Recovered solvents are being re-engineered for reuse, enhancing sustainability. Investment in closed-loop systems is accelerating across semiconductor and display plants. Companies also market their compliance achievements to enhance brand reputation. This circular approach creates long-term stability and competitive differentiation.

- For instance, Infineon Technologies AG applies solvent recovery and recycling technologies in its semiconductor fabs, reducing solvent waste streams by several thousand liters per month while maintaining process integrity. Companies also market their compliance achievements to enhance brand reputation. This circular approach creates long-term stability and competitive differentiation.

Adoption of supercritical CO₂ and engineered fluids:

Supercritical CO₂ and engineered green fluids are emerging as strong alternatives in electronics processing. These advanced solvents provide high performance, safety, and reduced environmental risks. It enables manufacturers to manage critical processes such as PCB cleaning and microelectronics fabrication. Supercritical fluids are gaining traction in Germany due to their non-toxic and reusable properties. Engineered solvents also support advanced applications in displays and battery manufacturing. Adoption reflects a trend toward specialized solutions that combine sustainability with precision. The high technical value of these solvents makes them attractive for research-intensive industries.

Growing collaboration between chemical firms and electronics manufacturers:

Collaborations between green chemistry companies and electronics manufacturers shape the Germany Green Solvents in Electronics Market. Joint projects enhance development of tailored solvents for advanced applications. It ensures alignment between technical requirements and sustainability objectives. Such partnerships accelerate commercialization and reduce innovation cycles. Companies use shared expertise to penetrate new segments like OLED displays and EV batteries. The trend also strengthens Germany’s position as a global innovation hub. Funding from the EU and federal government supports these alliances. The outcome is a dynamic ecosystem that fosters rapid growth in green solvents adoption.

Market Challenges Analysis:

High production costs and limited scalability of bio-based solvents:

The Germany Green Solvents in Electronics Market faces cost challenges due to the expensive production processes of bio-based solvents. Feedstock availability and refining complexities raise costs compared to conventional solvents. It limits scalability for mass adoption across price-sensitive manufacturers. Cost parity remains difficult to achieve in the short term. Smaller companies struggle to invest in large-scale adoption, slowing industry-wide penetration. Balancing environmental benefits with cost efficiency remains a major challenge. These financial pressures may restrict demand growth unless economies of scale are achieved.

Technical limitations in compatibility and performance consistency:

Another challenge in the Germany Green Solvents in Electronics Market lies in the technical performance of green solvents. Compatibility with existing equipment and consistency under high-stress conditions remain concerns. Manufacturers often hesitate to replace proven traditional solvents due to operational risks. Some bio-based solvents lack the stability required for precision microelectronics. This results in limited acceptance in advanced applications. The need for constant R&D investment slows down adoption cycles. It highlights the trade-off between sustainability and performance that companies must carefully manage. Overcoming these barriers is essential to long-term market expansion.

Market Opportunities:

Rising demand for green solvents in next-gen displays and energy storage:

The Germany Green Solvents in Electronics Market is poised to grow with the expansion of OLED and flexible display technologies. These advanced displays require specialized solvents with low toxicity and high stability. It creates opportunities for green formulations to gain higher penetration. Battery manufacturing for EVs and renewable energy storage also drives solvent demand. Green solvents meet stringent safety and environmental standards in these sectors. German manufacturers can capture competitive advantage by supplying eco-friendly solutions. Expanding applications create multiple growth opportunities in high-value electronics segments.

Government incentives and innovation funding:

Supportive policies and incentives strengthen opportunities in the Germany Green Solvents in Electronics Market. The government provides R&D grants and tax benefits to accelerate green chemistry innovation. It encourages collaboration between industry and academia for solvent breakthroughs. Incentives for clean technology investments improve adoption among manufacturers. Such policies enable faster scaling of sustainable production practices. Germany’s role in EU-wide environmental leadership also amplifies these opportunities. Companies that leverage this funding environment gain a strong foothold in emerging applications. This framework ensures consistent opportunities for growth and innovation.

Market Segmentation Analysis:

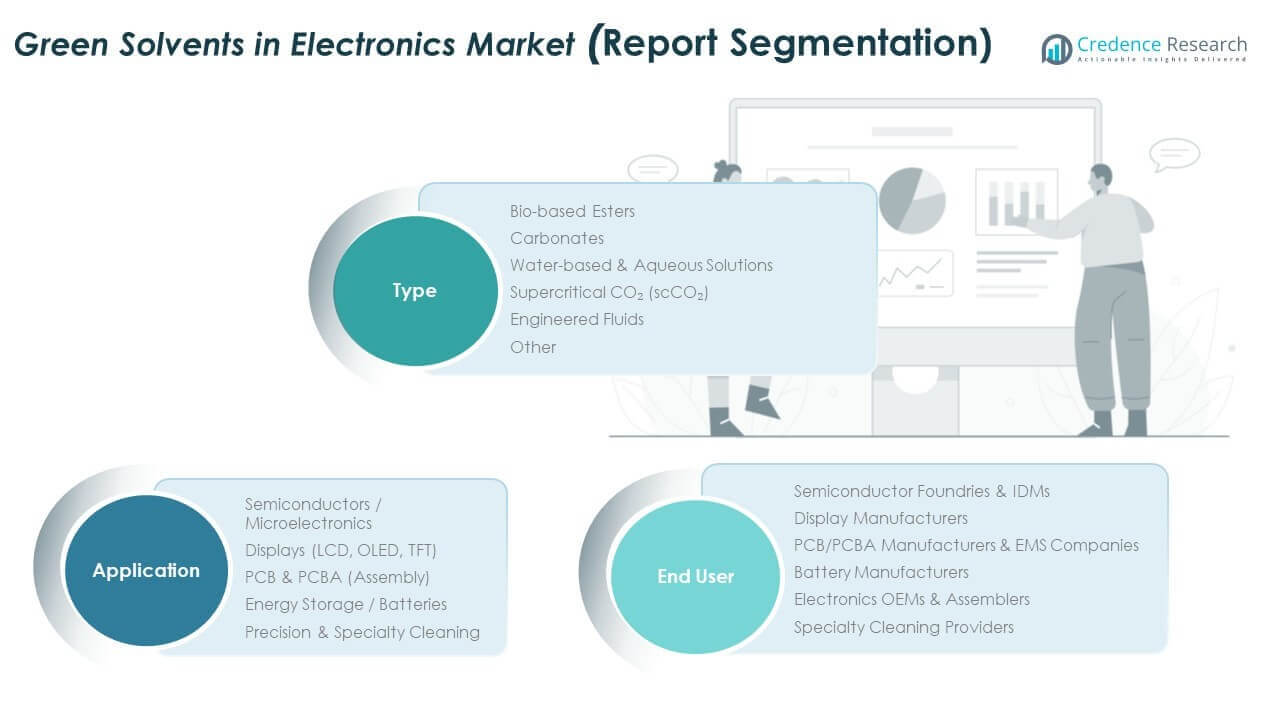

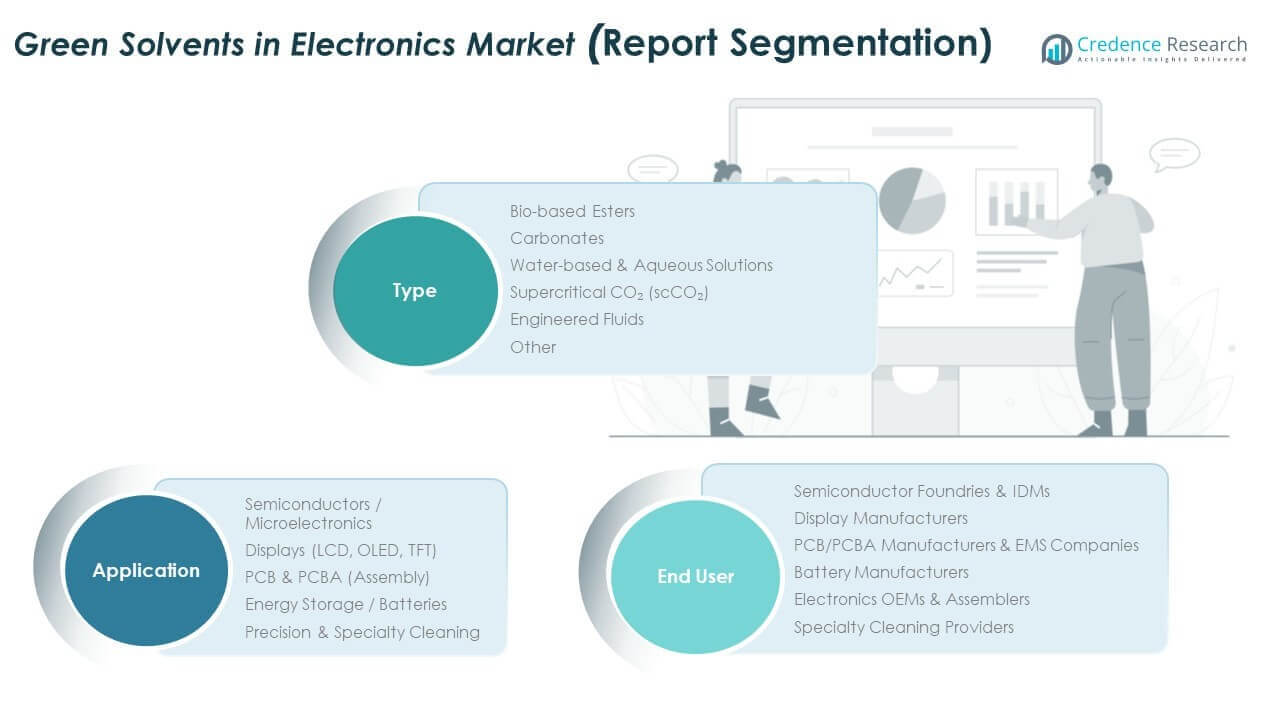

By Type

The Germany Green Solvents in Electronics Market demonstrates strong adoption of bio-based esters and carbonates due to their eco-friendly profiles. Water-based and supercritical CO₂ solvents are gaining momentum in niche segments like semiconductor cleaning and display applications. Engineered fluids are attracting attention for high-performance and specialty needs.

- For example, Bruker’s Wafer Clean 2200 system uses an advanced CO₂ snow cleaning process that is environmentally safe and fully automated, currently deployed in over 100 high-volume semiconductor production lines globally, including German fabs, to remove particulates and thin film organics without causing damage.

By Application

Semiconductors and PCB/PCBA dominate the market, driven by Germany’s advanced microelectronics and automotive electronics industries. Displays, especially OLED and TFT panels, represent rising demand areas. Energy storage applications, particularly EV batteries, are emerging as fast-growth segments.

- For example, Aixtron SE, based in Herzogenrath, Germany, leads semiconductor deposition technology innovations supporting these applications, with its G10 product family launched since 2022 specifically enhancing production efficiency and performance of compound semiconductors used in EV power electronics and data centers, contributing to energy savings at scale.

By End User

Semiconductor foundries and IDMs hold the largest demand share due to high-volume requirements in wafer processing. Display manufacturers and PCB/PCBA companies form another critical consumer base. Battery manufacturers and electronics OEMs are expanding solvent usage, reflecting the broader EV and renewable integration trend. Specialty cleaning providers add steady demand across diverse electronics applications.

Segmentation:

Segmentation:

By Type

- Bio-based Esters

- Carbonates

- Water-based & Aqueous Solutions

- Supercritical CO₂ (scCO₂)

- Engineered Fluids

- Others

By Application

- Semiconductors / Microelectronics

- Displays (LCD, OLED, TFT)

- PCB & PCBA (Assembly)

- Energy Storage / Batteries

- Precision & Specialty Cleaning

By End User

- Semiconductor Foundries & IDMs

- Display Manufacturers

- PCB/PCBA Manufacturers & EMS Companies

- Battery Manufacturers

- Electronics OEMs & Assemblers

- Specialty Cleaning Providers

Regional Analysis:

Southern Germany

Southern Germany holds the largest share of the Germany Green Solvents in Electronics Market, supported by its strong automotive and electronics manufacturing base. Bavaria and Baden-Württemberg host leading semiconductor facilities, automotive suppliers, and advanced research institutions. It benefits from a skilled workforce, well-established industrial clusters, and consistent investments in green technologies. Demand for solvents is driven by semiconductor fabrication, EV battery production, and PCB assembly. Universities and research centers in Munich and Stuttgart foster innovation in sustainable chemistry. Southern Germany’s industrial strength makes it the backbone of solvent adoption within the country.

Western Germany

Western Germany accounted for a significant portion of the market, anchored by North Rhine-Westphalia and Hesse. The region’s dominance in chemical production and electronics assembly drives solvent consumption. It benefits from proximity to major industrial hubs, strong logistics networks, and access to renewable energy initiatives. Large corporations headquartered here invest in green technologies to strengthen compliance and sustainability credentials. PCB and display manufacturers represent a critical consumer base in this area. It also gains momentum from collaborations between chemical producers and electronics OEMs, ensuring long-term growth.

Northern and Eastern Germany

Northern and Eastern Germany show steady but growing adoption, contributing a smaller share compared to southern and western regions. Berlin and Saxony are emerging as hubs for microelectronics and clean technology innovation. It benefits from government-backed initiatives supporting high-tech industries and sustainable development. Renewable energy projects in northern regions indirectly drive solvent demand through battery and storage applications. While the industrial base is smaller than in the south and west, rapid urban development supports steady uptake. Eastern Germany, particularly Dresden, has potential as semiconductor clusters expand. Together, these regions add diversity to the national market footprint.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Corbion N.V.

- Vertec BioSolvents Inc.

- Godavari Biorefineries Ltd.

- Galactic

- UBE Corporation

- Lotte Chemical

- Sabic

- Huntsman Corporation

- Merck KGaA

- BASF SE

- Dow Inc.

- Other Key Players

Competitive Analysis:

The Germany Green Solvents in Electronics Market is highly competitive, marked by the presence of multinational and domestic players. Companies like BASF SE, Merck KGaA, Dow Inc., and Huntsman Corporation leverage strong R&D to develop advanced formulations. It fosters innovation in bio-based and engineered solvents tailored for electronics. Partnerships, acquisitions, and regional expansions remain common strategies to secure market share. Smaller firms such as Vertec BioSolvents and Galactic focus on niche innovations. German companies gain advantage from proximity to Europe’s electronics ecosystem. The competitive landscape is shaped by sustainability positioning, product quality, and regulatory compliance.

Recent Developments:

- In September 2025, Corbion N.V. showcased its commitment to clean-label reformulation at the IBIE 2025 baking industry trade show by introducing Ultra Fresh Plus 100, a label-friendly solution designed to replace synthetic emulsifiers while preserving product softness, sliceability, and freshness, addressing key clean-label challenges in food production. This innovation supports bakers in maintaining quality and consistency with simpler formulations.

- In April 2025, UBE Corporation completed its acquisition of Lanxess’s polyurethane systems business, integrating Lanxess’s global polyurethane operations including production facilities and laboratories. This strategic acquisition positions UBE to strengthen its specialty chemicals portfolio, particularly in high-performance polyurethane resins relevant for industries like semiconductors, enhancing its footprint in advanced materials markets.

- Godavari Biorefineries Ltd. established an exclusive international license agreement with Catalyxx Inc. in December 2024 to utilize Catalyxx’s technology for converting ethanol into biobutanol and higher alcohols, with plans to build a facility producing 15,000 metric tons annually. This partnership boosts Godavari’s bio-based chemicals portfolio, advancing sustainable innovation aligned with global green transformation goals.

- Galactic launched a new spray dryer production facility in China by May 2025, significantly enhancing its capacity to produce high-quality food preservative powders, which supports its innovation pipeline and aligns with market demand for natural and sustainable ingredient solutions.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing focus on eco-friendly manufacturing in electronics

- Rising adoption in semiconductor cleaning and lithography

- Expansion of green solvents in OLED and flexible displays

- Strong policy support from German and EU regulators

- Increased collaboration between chemical and electronics firms

- Growing opportunities in EV battery and component manufacturing

- Advancements in bio-based and engineered solvent formulations

- Higher export potential to Asia Pacific electronics hubs

- Greater alignment with circular economy initiatives

- Long-term shift from hazardous to green solvents across sectors

Market Trends:

Market Trends:

Segmentation:

Segmentation: