Market Overview

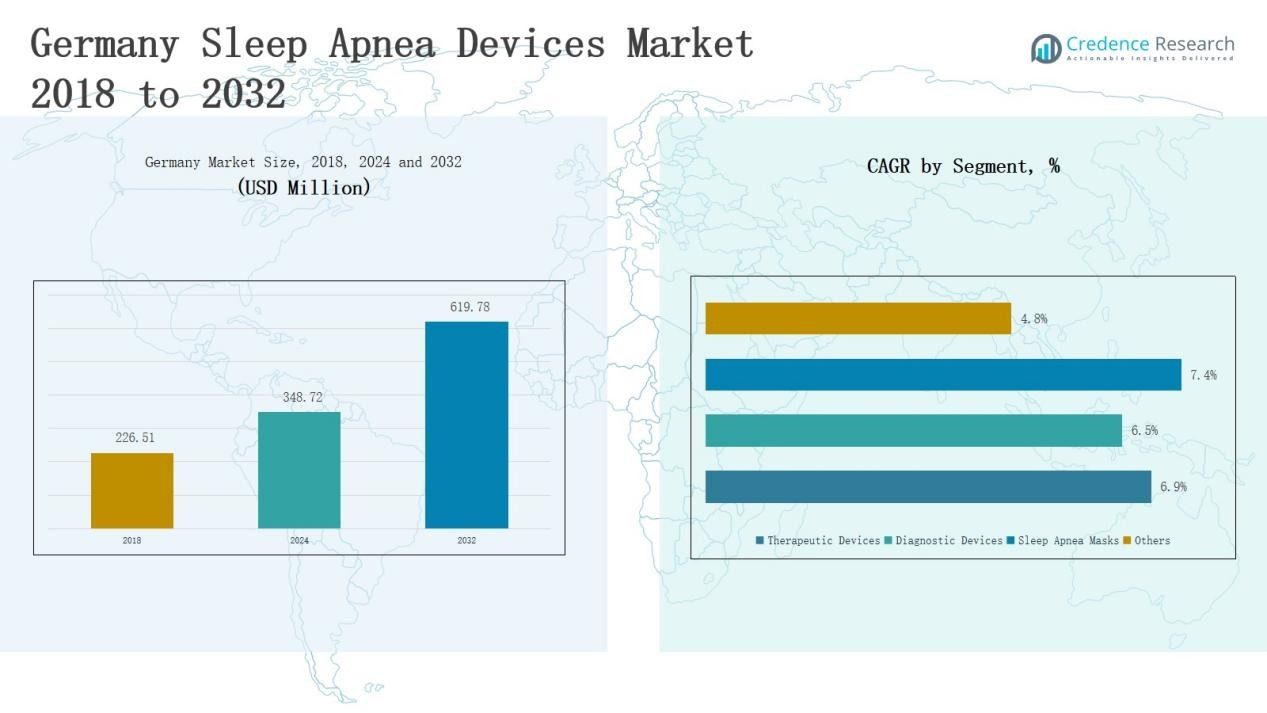

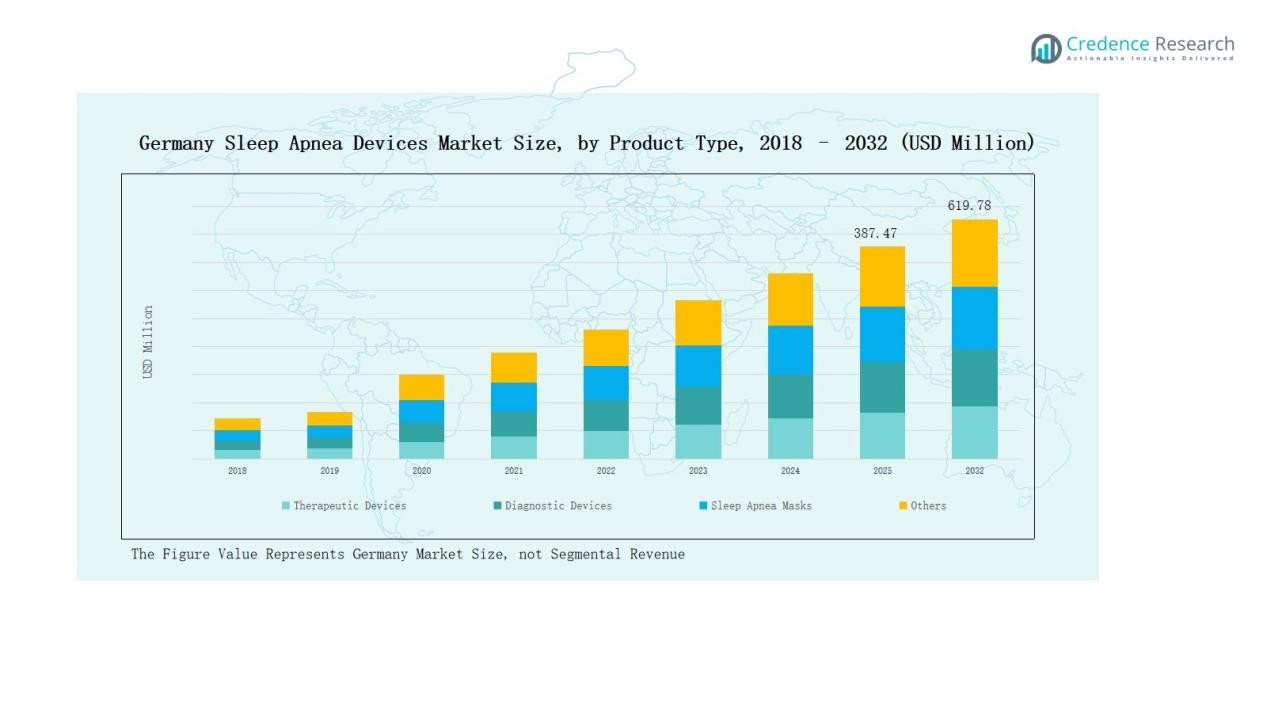

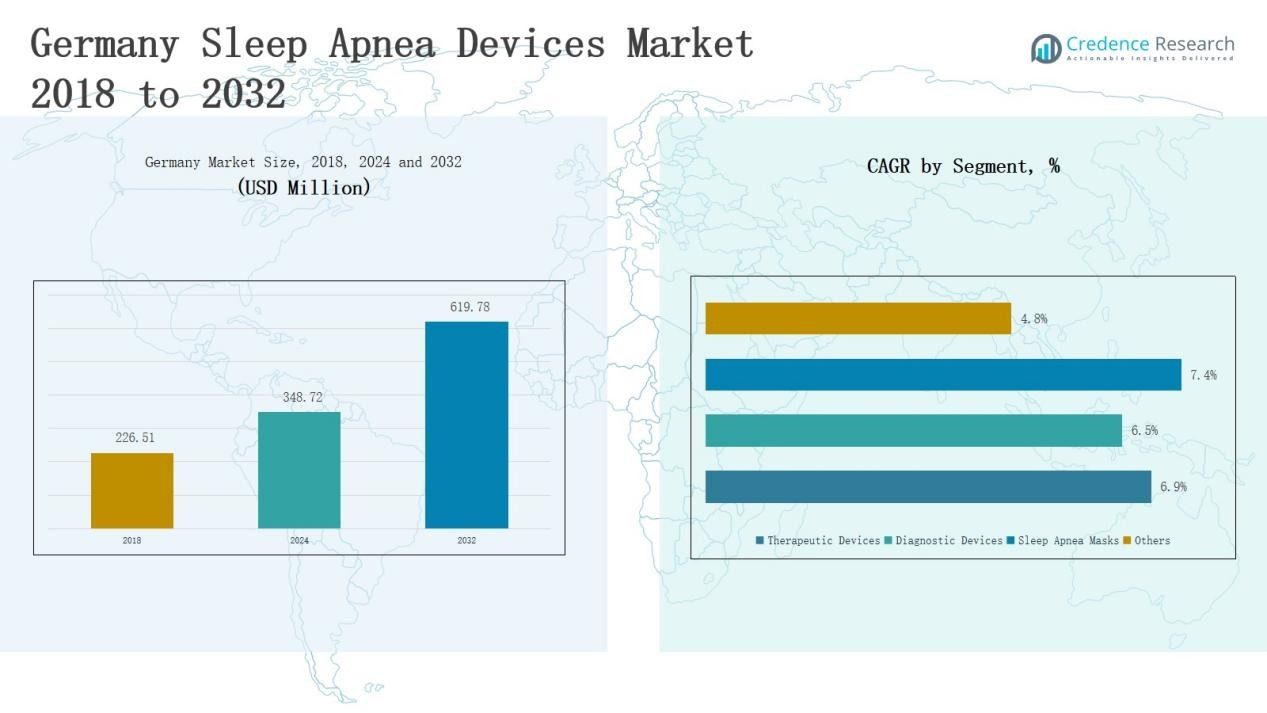

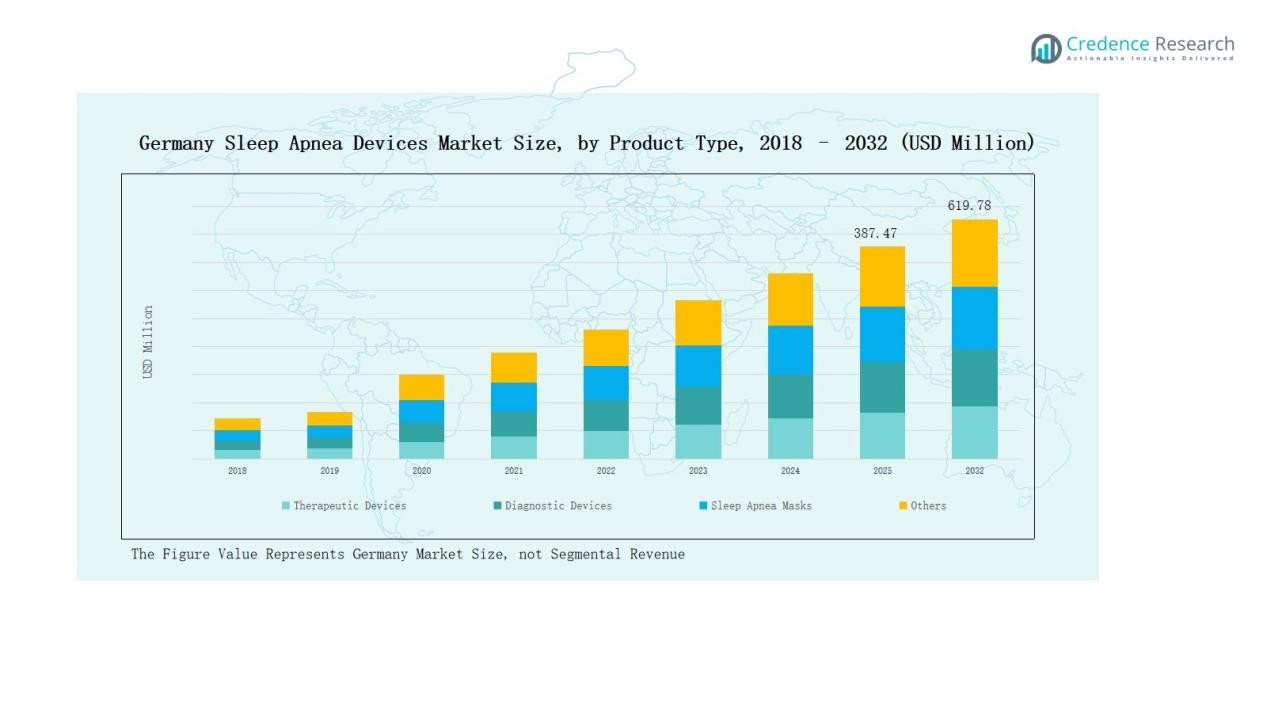

Germany Sleep Apnea Devices Market size was valued at USD 226.51 million in 2018, reached USD 348.72 million in 2024, and is anticipated to reach USD 619.78 million by 2032, growing at a CAGR of 6.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Sleep Apnea Devices Market Size 2024 |

USD 348.72 Million |

| Germany Sleep Apnea Devices Market, CAGR |

6.94% |

| Germany Sleep Apnea Devices Market Size 2032 |

USD 619.78 Million |

The Germany Sleep Apnea Devices Market is shaped by a mix of global leaders and strong domestic players, including Löwenstein Medical SE & Co. KG, ResMed Germany, Philips Respironics Germany, SomnoMed Germany, BMC Medical Germany, Drive DeVilbiss Germany, Inspire Medical Systems Germany, Sicat Germany, LivaNova PLC, and Zephyr Sleep Technologies. These companies compete through innovation in PAP devices, oral appliances, diagnostic systems, and connected solutions to strengthen patient adherence. Regional analysis highlights Southern Germany as the leading region, commanding 34% share in 2024, supported by advanced healthcare infrastructure, strong diagnostic adoption, and a concentration of medical technology hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Sleep Apnea Devices Market grew from USD 226.51 million in 2018 to USD 348.72 million in 2024, and will reach USD 619.78 million by 2032 at a 94% CAGR.

- Therapeutic devices dominated with 62% share in 2024, led by PAP devices at 41%, while diagnostic devices held 26%, driven by PSG and home sleep test kits.

- Hospitals and clinics led end-user demand with 47% share, followed by home care settings at 28%, and sleep laboratories at 21%, supporting advanced diagnostic adoption.

- Southern Germany commanded the largest regional share with 34% in 2024, supported by advanced healthcare infrastructure, high-income households, and concentration of medical technology hubs.

- Leading companies include Löwenstein Medical, ResMed, Philips Respironics, SomnoMed, BMC Medical, Drive DeVilbiss, Inspire Medical Systems, Sicat, LivaNova, and Zephyr Sleep Technologies.

Market Segment Insights

By Product Type

Therapeutic devices dominate the Germany sleep apnea devices market, holding around 62% share in 2024, led by Positive Airway Pressure (PAP) devices with nearly 41% share. PAP remains the gold standard due to its effectiveness in moderate-to-severe cases, supported by strong reimbursement and patient compliance improvements. Oral appliances and oxygen therapy devices are gaining traction as non-invasive alternatives, while diagnostic devices account for about 26% share, with polysomnography and home sleep test kits driving demand for early and accurate diagnosis.

- For instance, Philips introduced its DreamStation 2 CPAP device with compact design and improved digital connectivity, expanding its adoption among patients seeking comfort and ease of use

By End User

Hospitals and clinics lead the market with nearly 47% share in 2024, driven by advanced diagnostic infrastructure, physician preference, and high patient inflow. Sleep laboratories captured about 21% share, remaining critical for polysomnography and advanced assessments. Home care settings and individual users accounted for 28% share, reflecting the shift toward convenient, non-invasive solutions such as PAP devices, oral appliances, and portable home test kits. The “Others” category contributed around 4%, including rehabilitation centers and specialized outpatient facilities.

- For instance, ResMed introduced its AirSense 11 AutoSet device for remote patient monitoring, boosting adoption in at-home care.

Key Growth Drivers

Rising Prevalence of Sleep Apnea and Related Disorders

Germany is witnessing a growing number of diagnosed sleep apnea cases, primarily driven by rising obesity, aging demographics, and lifestyle-related risk factors. Increasing awareness of the health implications of untreated sleep apnea, such as cardiovascular diseases and diabetes, is boosting diagnosis rates. This has directly fueled demand for both therapeutic and diagnostic devices. Healthcare campaigns, physician recommendations, and insurance coverage improvements are further driving early detection, encouraging more patients to seek effective treatment solutions, and supporting steady device adoption.

- For instance, Philips expanded the use of its SleepMapper app in Germany, enabling patients to track CPAP therapy compliance and improve long-term treatment outcomes through digital engagement.

Advancements in Therapeutic and Diagnostic Technologies

Continuous innovation in PAP devices, oral appliances, and portable diagnostics is enhancing patient comfort and compliance in Germany. Companies are introducing auto-adjusting PAP systems, lightweight nasal masks, and digital monitoring features that integrate with mobile applications. Diagnostic advancements, such as home sleep test kits and AI-enabled polysomnography devices, are also improving detection accuracy and accessibility. These innovations reduce treatment barriers, expand usage beyond hospitals to homecare, and align with Germany’s growing preference for connected healthcare solutions, strengthening overall market growth.

- For instance, in diagnostics, Löwenstein Medical expanded access to home sleep testing with its SOMNOscreen HD device, which integrates AI-supported polysomnography features to improve detection accuracy in ambulatory settings.

Government and Insurance Support for Treatment Access

Germany’s robust healthcare system and favorable reimbursement policies remain a key growth driver for sleep apnea devices. Public and private insurance providers increasingly cover PAP devices, diagnostic tests, and follow-up care, improving affordability for patients. Additionally, government-backed health initiatives emphasize early detection of sleep-related disorders, supporting investments in diagnostic facilities and sleep laboratories. This structured framework lowers financial barriers, encourages higher adoption of advanced therapeutic solutions, and provides a stable foundation for sustained growth in the German market.

Key Trends & Opportunities

Shift Toward Home-Based and Portable Solutions

A strong trend in Germany is the shift from hospital-based treatments toward home-based solutions. Patients increasingly prefer portable PAP devices, oral appliances, and home sleep test kits due to convenience and lower costs. This trend is creating opportunities for manufacturers to design compact, user-friendly, and connected devices. The expansion of telehealth services further supports remote monitoring, enabling physicians to track patient adherence. This consumer-driven shift toward at-home solutions represents a major opportunity for sustained growth in the coming years.

- For instance, Philips has also strengthened its connected care portfolio with home sleep testing systems such as Alice NightOne, enabling physicians to remotely capture diagnostic data and support home-based care.

Integration of Digital Health and AI in Sleep Care

The adoption of digital health technologies and AI-powered tools is transforming sleep apnea management in Germany. Device manufacturers are integrating cloud connectivity, smartphone applications, and AI-based analytics to improve treatment adherence and diagnostic precision. Physicians can remotely monitor patient data, adjust therapies in real time, and improve long-term outcomes. This growing convergence of medical devices and digital platforms creates opportunities for innovative service models, partnerships between medtech and IT companies, and broader adoption of personalized treatment approaches in the market.

- For instance, ResMed’s myAir™ app boosted patient compliance from 70 % to 87 % among users monitored via AirView.

Key Challenges

High Cost of Advanced Devices and Diagnostics

The relatively high cost of PAP devices, oral appliances, and polysomnography systems poses a significant challenge, especially for patients outside comprehensive insurance coverage. While reimbursement support is available, some advanced features such as connected monitoring systems or premium mask designs increase out-of-pocket expenses. Sleep laboratories and clinics also face budget constraints in adopting advanced diagnostic technologies. These cost barriers can limit wider adoption, particularly among patients with mild cases, and restrain growth of advanced device categories within the German market.

Patient Non-Compliance and Therapy Dropouts

Despite the clinical effectiveness of PAP devices, patient non-compliance remains a persistent issue in Germany. Many users find PAP masks uncomfortable or noisy, leading to therapy discontinuation. Oral appliances and alternative treatments are gaining ground, but they are not suitable for all severity levels. Low long-term adherence reduces device replacement cycles and impacts overall market growth. Addressing patient comfort, offering personalized mask fittings, and enhancing device usability remain critical challenges for manufacturers striving to improve therapy acceptance.

Limited Awareness and Undiagnosed Cases

A substantial portion of the German population with sleep apnea remains undiagnosed, limiting the full potential of the market. Many patients dismiss symptoms such as snoring or daytime fatigue, delaying clinical evaluation. General practitioners may also under-refer patients to sleep specialists, slowing diagnosis rates. This lack of awareness hinders demand for diagnostic devices and delays therapeutic intervention. Expanding educational campaigns, improving physician training, and promoting at-home testing solutions are essential to reduce underdiagnosis and unlock further market opportunities.

Regional Analysis

Southern Germany

Southern Germany held the largest share of the Germany Sleep Apnea Devices Market in 2024 with 34%. The region benefits from high-income households, a strong private healthcare network, and advanced hospital infrastructure. Demand for PAP devices and oral appliances is supported by higher diagnosis rates and specialist availability. It also attracts investment from global manufacturers due to its concentration of medical technology hubs. Sleep laboratories are expanding rapidly, offering advanced diagnostic services. This dominance reflects strong awareness and patient preference for premium therapy solutions.

Western Germany

Western Germany accounted for 28% share in 2024, driven by its dense population and well-established healthcare facilities. The region shows strong adoption of PAP devices, supported by a mix of public and private insurers. Hospitals and clinics dominate the distribution channels, while homecare usage continues to rise. Manufacturers are targeting urban centers with compact, portable solutions to meet consumer convenience demand. Western Germany’s industrial base supports diagnostic technology integration, making it a growth region. It maintains a balanced demand across therapeutic and diagnostic devices.

Northern Germany

Northern Germany captured 20% share in 2024, supported by a mix of regional hospitals, specialized sleep clinics, and increasing awareness initiatives. Sleep laboratories play a significant role, with PSG systems widely used for diagnosis. Patient adoption of home sleep test kits is rising, especially in metropolitan areas like Hamburg. Demand for nasal and full-face masks is supported by ongoing replacement cycles. It benefits from government-backed healthcare campaigns that encourage early screening. The region continues to strengthen its role in supporting broader adoption of advanced therapies.

Eastern Germany

Eastern Germany held 18% share in 2024, reflecting steady growth in a region that historically lagged in healthcare investment. Expansion of public hospitals and diagnostic centers has improved access to treatment. Adoption of PAP devices is increasing due to stronger insurance coverage and growing physician recommendations. Homecare adoption remains lower than other regions, but portable solutions are gradually improving patient compliance. It represents a market with untapped potential, where awareness programs and affordable device offerings will drive further growth. Eastern Germany is emerging as a key growth contributor.

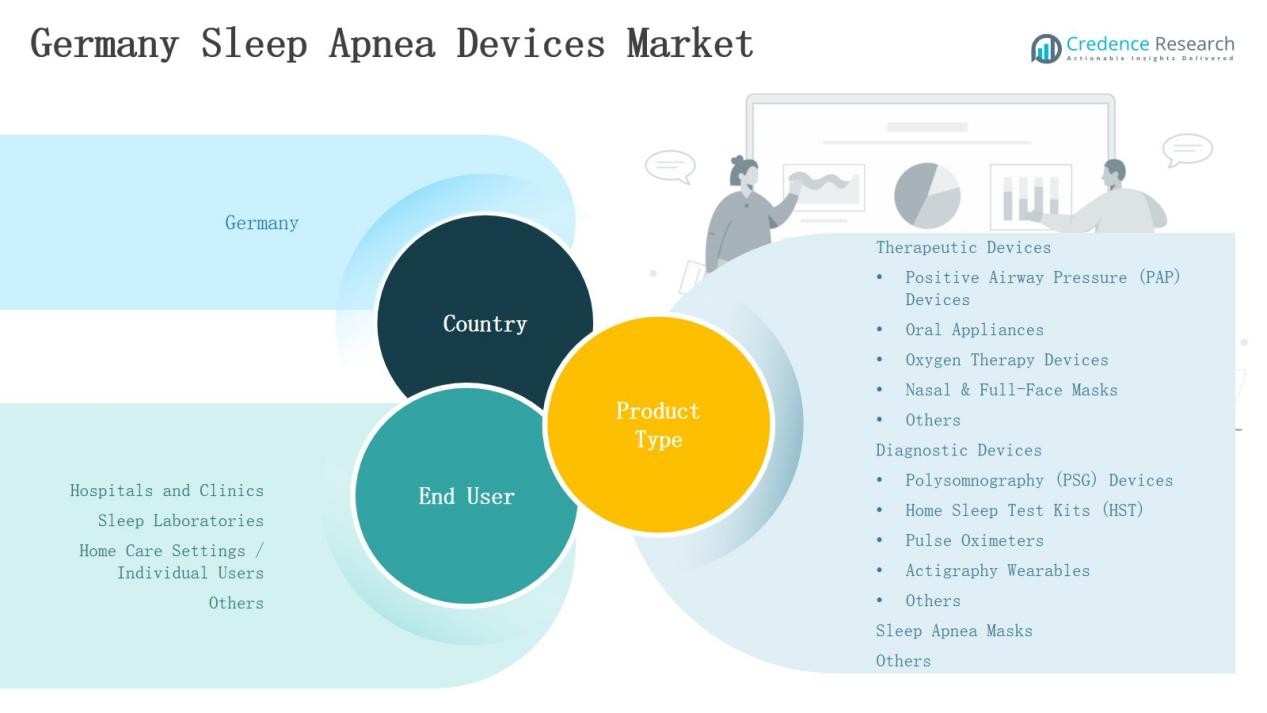

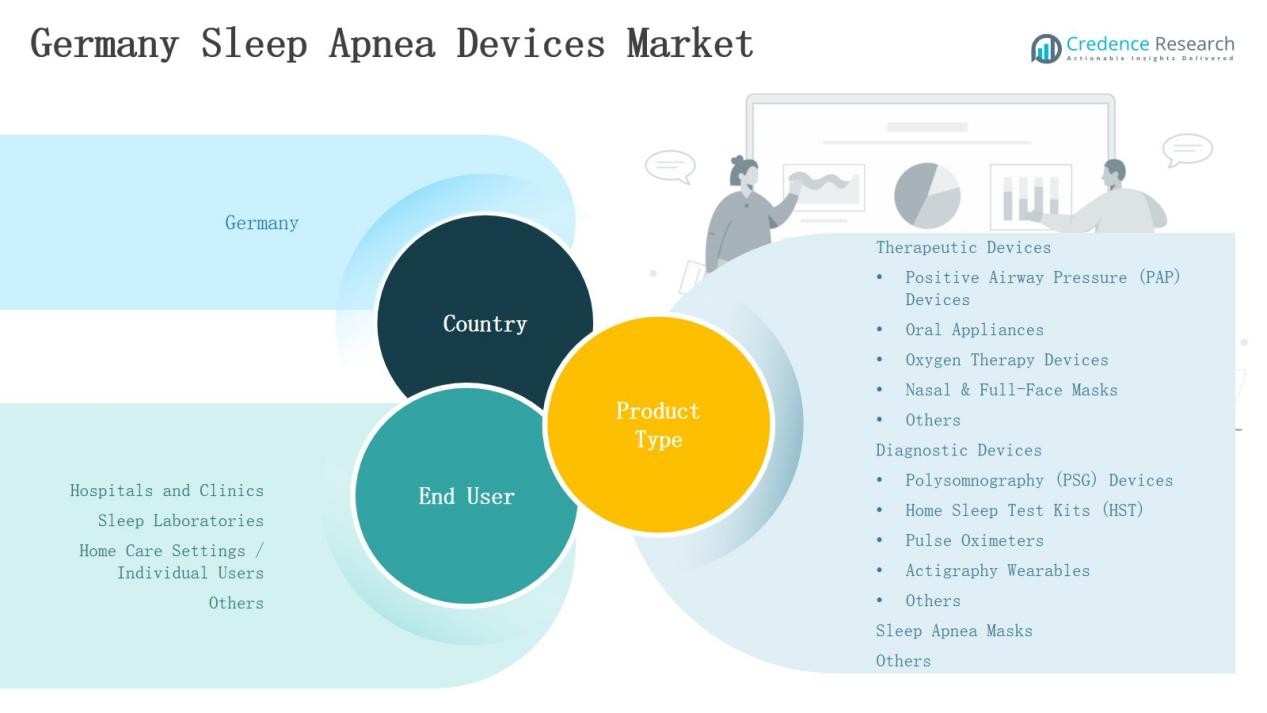

Market Segmentations:

By Product Type

Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- Oral Appliances

- Oxygen Therapy Devices

- Nasal & Full-Face Masks

- Others

Diagnostic Devices

- Polysomnography (PSG) Devices

- Home Sleep Test Kits (HST)

- Pulse Oximeters

- Actigraphy Wearables

- Others

Sleep Apnea Masks

Others

By End User

- Hospitals and Clinics

- Sleep Laboratories

- Home Care Settings / Individual Users

- Others

By Region

- Southern Germany

- Western Germany

- Northern Germany

- Eastern Germany

Competitive Landscape

The Germany Sleep Apnea Devices Market is highly competitive, with global leaders and strong domestic players shaping growth. Key companies include Löwenstein Medical SE & Co. KG, ResMed Germany, Philips Respironics Germany, SomnoMed Germany, BMC Medical Germany, Drive DeVilbiss Germany, Inspire Medical Systems Germany, Sicat Germany, LivaNova PLC, and Zephyr Sleep Technologies. These firms compete through diverse product portfolios covering PAP devices, oral appliances, diagnostic equipment, and sleep masks. Innovation remains central, with companies investing in portable, connected, and patient-friendly solutions to improve adherence and expand homecare adoption. Partnerships with hospitals, sleep laboratories, and insurers strengthen distribution networks and enhance market penetration. Domestic players leverage localized expertise and tailored offerings, while international firms focus on advanced technologies and brand trust. The landscape reflects a balance between cost-effective solutions and premium devices, creating a competitive environment where continuous R&D, product differentiation, and strategic alliances determine long-term success.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In September 2023, Nyxoah partnered with ResMed Germany to create a continuum of care covering diagnosis through therapy in the German obstructive sleep apnea market.

- In 2025, ResMed introduced the EasyCare Tx 2 titration software (compatible with its AirCurve 11 VPAP Tx device), highlighted at SLEEP 2025 for improving diagnostics & treatment workflows.

- In June 2025, Samsung expanded its Sleep Apnea feature on Galaxy Watch to 34 European markets after receiving CE marking.

- In 2024, Inspire Medical launched a European registry for hypoglossal nerve stimulation to collect long-term data on device outcomes.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for PAP devices will continue to grow due to high treatment effectiveness.

- Home sleep test kits will expand adoption, improving access to early diagnosis.

- Digital health integration will enhance therapy monitoring and patient adherence.

- Oral appliances will gain traction among patients preferring non-invasive solutions.

- Sleep laboratories will invest in advanced diagnostic systems for complex cases.

- Insurance support will strengthen affordability and encourage wider device adoption.

- Portable and travel-friendly devices will see higher demand from active patients.

- Replacement demand for masks and accessories will sustain recurring revenue streams.

- Awareness programs will reduce underdiagnosis and increase treatment penetration.

- Domestic and global players will compete through innovation and strategic alliances.