Market Overview:

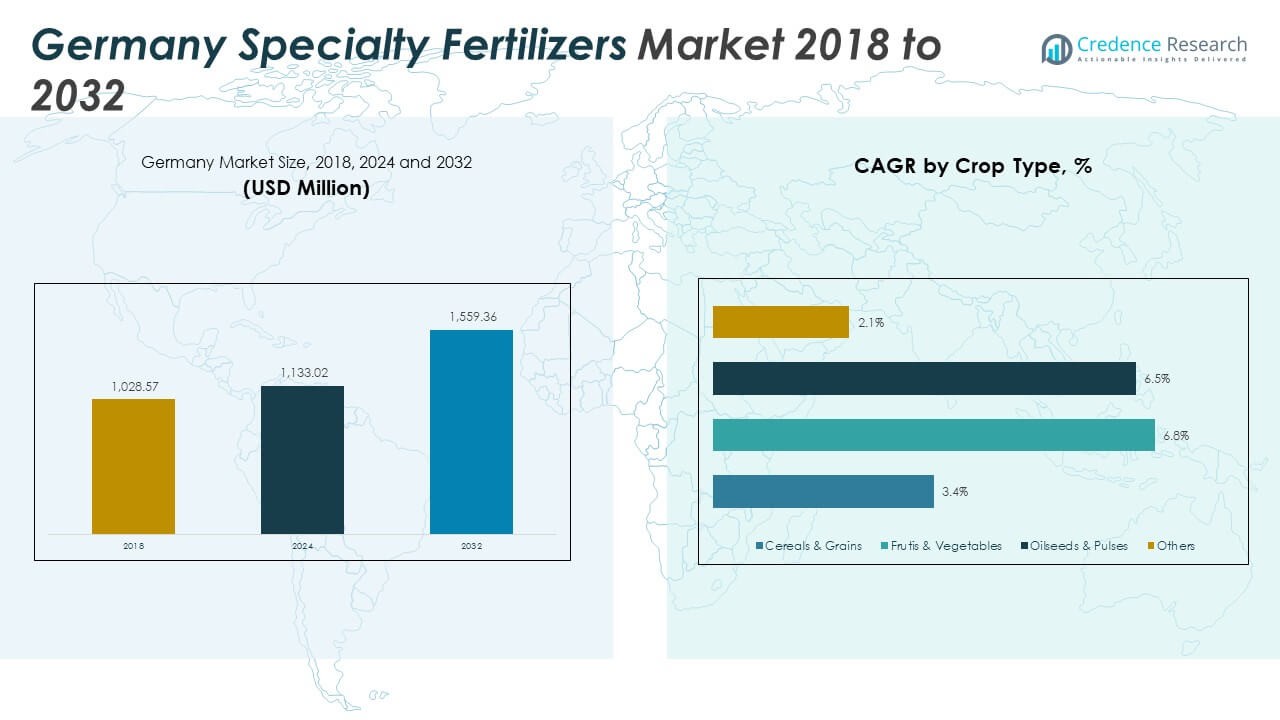

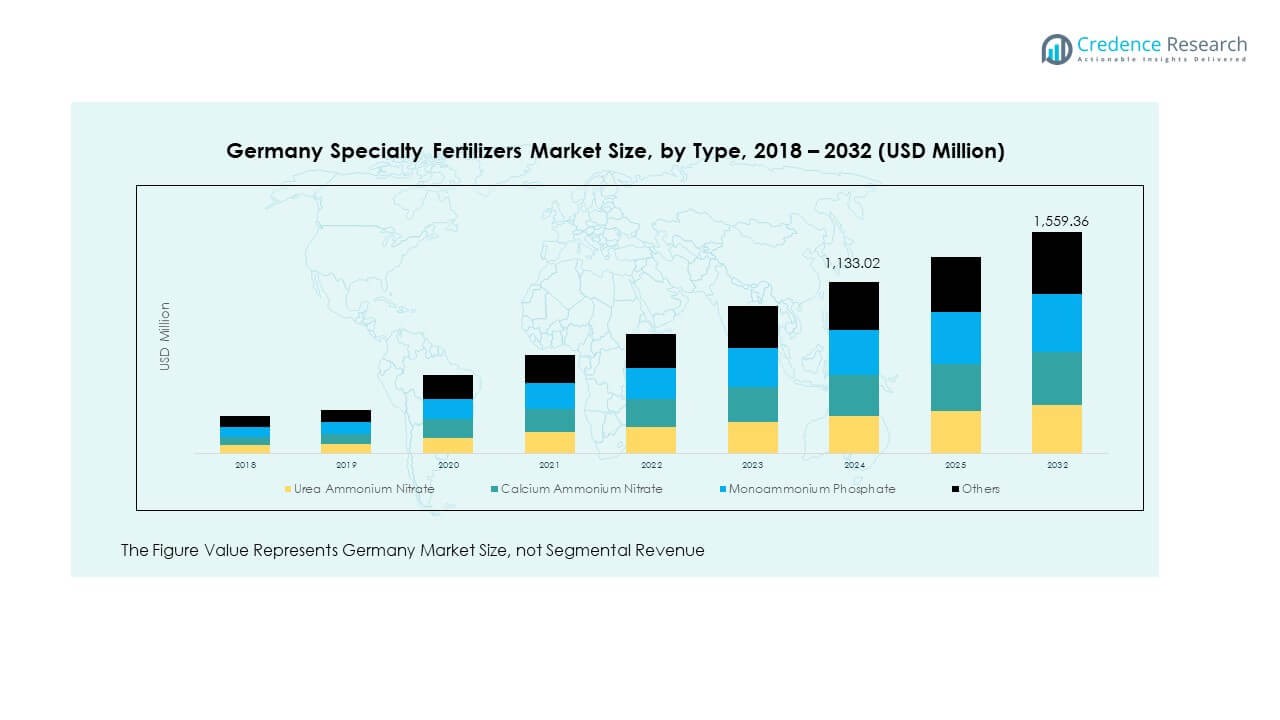

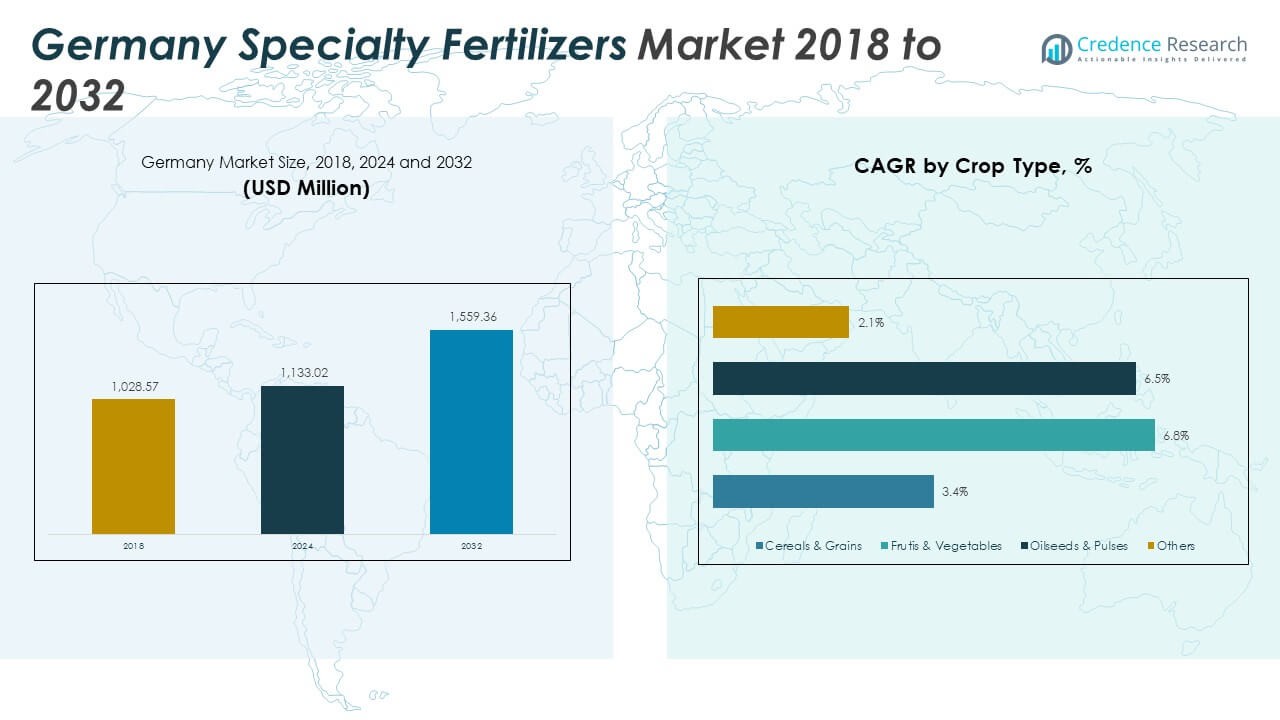

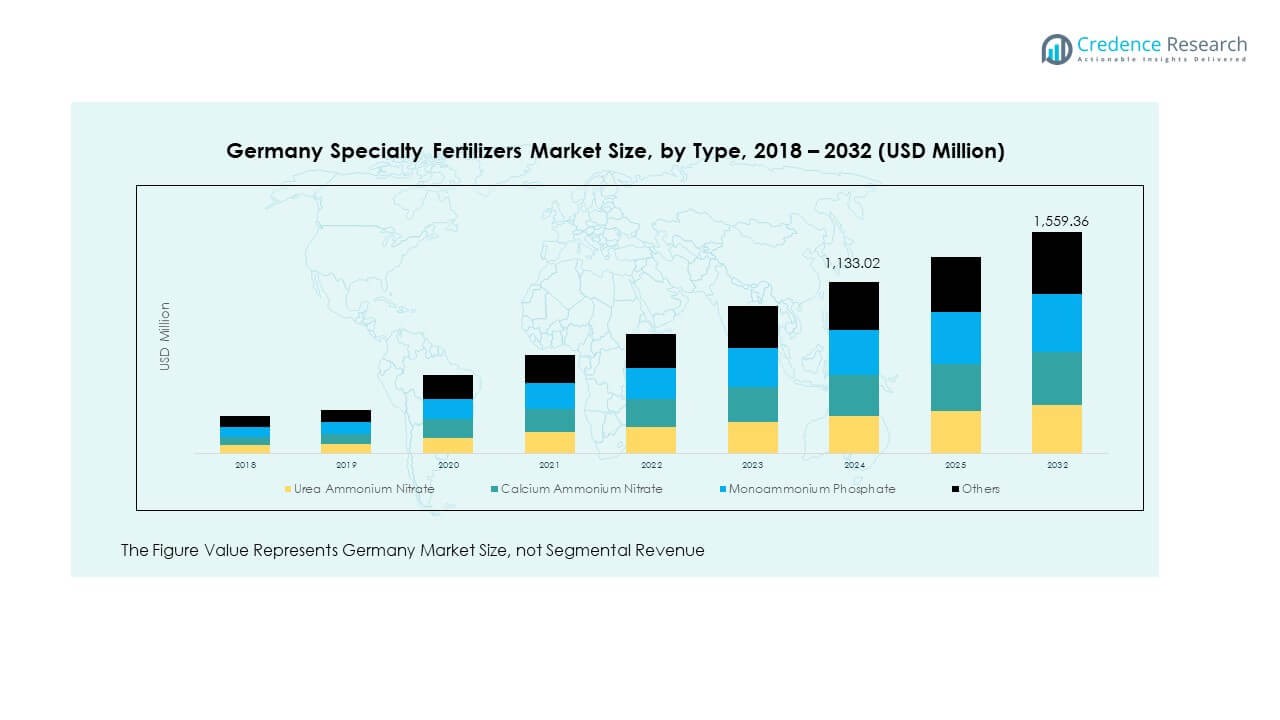

The Germany Specialty Fertilizers Market size was valued at USD 1,028.57 million in 2018 to USD 1,133.02 million in 2024 and is anticipated to reach USD 1,559.36 million by 2032, at a CAGR of 4.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Specialty Fertilizers Market Size 2024 |

USD 1,133.02 Million |

| Germany Specialty Fertilizers Market, CAGR |

4.07% |

| Germany Specialty Fertilizers Market Size 2032 |

USD 1,559.36 Million |

Market growth is driven by the rising need for enhanced crop productivity, strict environmental regulations, and the adoption of advanced farming practices. Farmers increasingly prefer controlled-release and water-soluble fertilizers to optimize nutrient use and reduce environmental impact. The market also benefits from expanding demand for high-value crops, including fruits, vegetables, and horticultural products. Government support for sustainable agricultural practices and the integration of modern technologies further enhance adoption levels across Germany.

Regionally, Western and Southern Germany lead due to advanced infrastructure, intensive farming, and higher demand for premium crop production. Northern Germany is emerging strongly with widespread adoption of precision farming techniques and larger cereal production. Eastern Germany shows gradual improvement as modernization and awareness initiatives increase the use of specialty fertilizers. Geographic diversity across these regions highlights distinct adoption patterns, shaped by crop types, farming practices, and sustainability targets, making Germany one of the most dynamic markets within the European agricultural sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Specialty Fertilizers Market was valued at USD 1,028.57 million in 2018, reached USD 1,133.02 million in 2024, and is anticipated to achieve USD 1,559.36 million by 2032, registering a CAGR of 4.07%.

- Western and Southern Germany hold 42% share, driven by intensive agriculture, high-value crops, and strong infrastructure; Northern Germany follows with 34%, supported by large cereal production and precision farming; Eastern Germany accounts for 24%, reflecting modernization and rising awareness.

- Eastern Germany, with 24% share, is the fastest-growing region due to modernization efforts, greenhouse expansion, and government-backed sustainability programs.

- Urea Ammonium Nitrate holds 38% share, making it the leading segment, driven by extensive use in cereals and row crops.

- Calcium Ammonium Nitrate accounts for 27% share, while Monoammonium Phosphate represents 22%, both supported by adoption in horticulture, fruit, and vegetable production, with the remaining 13% held by other specialty fertilizers.

Market Drivers

Rising Need For Crop Productivity And Yield Improvements

The demand for higher agricultural productivity remains a key driver in the Germany Specialty Fertilizers Market. Farmers face pressure to increase yield per hectare while maintaining soil fertility and crop health. It supports the adoption of products that ensure balanced nutrient release and efficient absorption. Specialty fertilizers deliver targeted solutions that match specific crop needs across fruits, vegetables, and cereals. It enables farmers to achieve superior results without overuse of traditional fertilizers. The technology-driven formulations reduce waste and maximize returns. Farmers increasingly prefer these products for precision farming systems. This creates steady demand across intensive agricultural zones.

Growing Focus On Resource Efficiency And Environmental Protection

Germany’s environmental regulations strongly influence fertilizer usage practices. Strict limits on nutrient runoff encourage farmers to adopt products with controlled release and enhanced nutrient use efficiency. The Germany Specialty Fertilizers Market benefits from this regulatory pressure as farmers move away from conventional fertilizers. It aligns with policies promoting reduced emissions and soil conservation. Controlled nutrient delivery minimizes environmental risks, especially nitrate leaching. Farmers see these fertilizers as a means to balance productivity with ecological responsibility. Sustainability targets reinforce product adoption across multiple regions. This strengthens long-term growth prospects for specialty fertilizer producers.

- For instance, COMPO EXPERT’s Floranid® Twin range, using ISODUR® and CROTODUR® technology, has been independently verified to provide controlled nitrogen release over up to 4 months, improving nutrient uptake and reducing nitrogen losses compared to conventional fertilizers, supporting stricter German nutrient runoff standards.

Increasing Adoption Of Advanced Farming Practices And Technologies

Modern agriculture practices such as fertigation and precision farming drive fertilizer innovation. Farmers are embracing digital tools to measure crop health and optimize nutrient delivery. The Germany Specialty Fertilizers Market supports these trends with water-soluble and micronutrient-enriched products. It enables growers to integrate fertilizers into irrigation systems, saving labor and resources. The focus on high-value crops further encourages this transition. Farmers adopt specialty fertilizers to support greenhouse cultivation, orchards, and vineyards. These practices enhance consistency in output and improve profitability. Growing awareness of modern solutions continues to accelerate adoption nationwide.

- For instance, Yara’s 2024 partnership projects in Europe, including Germany, now deliver advanced climate-adapted fertilizers and digital advisory tools to more than 1,000 farms and 128,000 hectares, as documented in Yara’s Integrated Report, enabling farmers to increase nutrient efficiency and yields through precision applications.

Supportive Government Initiatives And R&D Activities

Government funding and research partnerships stimulate development of advanced fertilizer solutions. Public institutions collaborate with private firms to create environmentally safe and efficient products. The Germany Specialty Fertilizers Market receives strong backing through sustainability programs and agricultural subsidies. It promotes adoption of nutrient management practices in line with European Union directives. National research bodies encourage bio-based and innovative formulations. Farmers gain confidence in using specialty fertilizers due to proven trials and awareness campaigns. Increased R&D investment ensures availability of solutions for diverse crops. Continuous innovation helps meet farmer needs and regulatory goals.

Market Trends

Shift Toward Bio-Based And Organic Specialty Fertilizers

Bio-based and organic fertilizers are gaining momentum among German farmers. Consumers demand healthier food and sustainable farming inputs. The Germany Specialty Fertilizers Market responds by introducing products from natural sources. It aligns with global sustainability targets and domestic agricultural policies. Farmers adopt bio-based fertilizers to improve soil health without synthetic inputs. Organic farming certifications further drive this trend across horticulture and crop production. Rising consumer trust in organic products strengthens long-term adoption. The market continues expanding with increased investments in green innovations.

Integration Of Smart Technologies With Fertilizer Application

Digital farming tools are transforming fertilizer application processes. Farmers now use sensors, drones, and GPS-based systems to optimize nutrient delivery. The Germany Specialty Fertilizers Market aligns with this transition by offering precision-friendly formulations. It supports the integration of fertilizers into smart irrigation and monitoring systems. Farmers gain real-time data for managing nutrient needs efficiently. Technology reduces wastage and ensures targeted absorption. These advancements enhance productivity across diverse farming conditions. The adoption of smart solutions fosters a more efficient and data-driven market landscape.

- For instance, Yara’s N-Sensor technology, widely used in Germany and throughout Europe as of 2025, enables real-time, site-specific nitrogen fertilization by measuring reflected light from crops. Documented case studies confirm that N-Sensor use led to up to 14% nitrogen savings in European oilseed and cereal cultivation, while also improving yield and crop quality. The technology is widely cited in recent agricultural technology reports as an authentic example of smart fertilizer application integration.

Rising Demand For High-Value Crop Cultivation

German farmers focus increasingly on crops with higher economic returns. Fruits, vegetables, and ornamental plants see greater fertilizer demand. The Germany Specialty Fertilizers Market provides tailored solutions for these segments. It ensures nutrient efficiency that supports quality and consistency. Controlled-release products are widely applied to achieve superior outcomes in greenhouse and open-field cultivation. Farmers prioritize specialty fertilizers to improve crop resilience and shelf life. Export-oriented producers particularly benefit from higher quality standards. This strengthens specialty fertilizer use across key agricultural regions.

Expansion Of Customized Fertilizer Solutions For Specific Crops

Farmers prefer solutions customized for crop type and soil condition. Fertilizer producers invest in R&D to meet these tailored needs. The Germany Specialty Fertilizers Market showcases growth through crop-specific nutrient formulations. It supports optimal nutrition across cereals, oilseeds, vineyards, and horticulture crops. Customized blends improve efficiency and minimize nutrient deficiencies. Demand rises for fertilizers aligned with local agronomic conditions. Producers gain advantage by offering solutions targeting regional crop requirements. This trend builds stronger farmer relationships and fosters market expansion.

- For instance, EuroChem’s research programs emphasize advanced phosphate fertilizers with enhanced solubility and crop-specific formulations, aiming to improve nutrient efficiency and support sustainable yield growth across European agriculture.

Market Challenges Analysis

High Cost Of Specialty Fertilizers And Farmer Adoption Barriers

The premium pricing of specialty fertilizers remains a major challenge. Many small and medium-scale farmers hesitate to shift from traditional fertilizers. The Germany Specialty Fertilizers Market faces resistance due to cost concerns and limited awareness. It creates a divide between large-scale commercial farmers and smaller holdings. Adoption rates remain higher in regions with advanced farming infrastructure. Cost-sensitive farmers view conventional fertilizers as more affordable options. Awareness campaigns and demonstration trials attempt to bridge this gap. Broader affordability will determine the pace of expansion.

Complex Regulatory Frameworks And Supply Chain Issues

Germany’s strict regulatory environment often slows the introduction of new fertilizer products. Meeting compliance requirements increases development costs for producers. The Germany Specialty Fertilizers Market must also adapt to supply chain disruptions impacting raw materials. It creates volatility in pricing and product availability. Import restrictions and rising input costs challenge local manufacturers. Farmers sometimes face delays in accessing advanced fertilizers during critical growing seasons. The regulatory landscape demands continuous adaptation and monitoring. Market participants must balance compliance with competitiveness to ensure long-term growth.

Market Opportunities

Rising Potential Of Sustainable And Eco-Friendly Fertilizers

Eco-friendly and sustainable products present strong growth prospects. Farmers increasingly adopt fertilizers that align with environmental goals. The Germany Specialty Fertilizers Market benefits from demand for bio-based and biodegradable products. It ensures solutions meet consumer and regulatory expectations. Adoption opportunities are rising across both conventional and organic farming systems.

Increasing Investment In Digital Farming Integration

Opportunities grow as digital farming expands across Germany. Specialty fertilizers integrated with smart irrigation and precision tools gain traction. The Germany Specialty Fertilizers Market finds value in offering data-driven nutrient solutions. It supports farmers with accurate applications, reduced wastage, and improved yields. Market growth aligns with expanding digital agriculture investments nationwide.

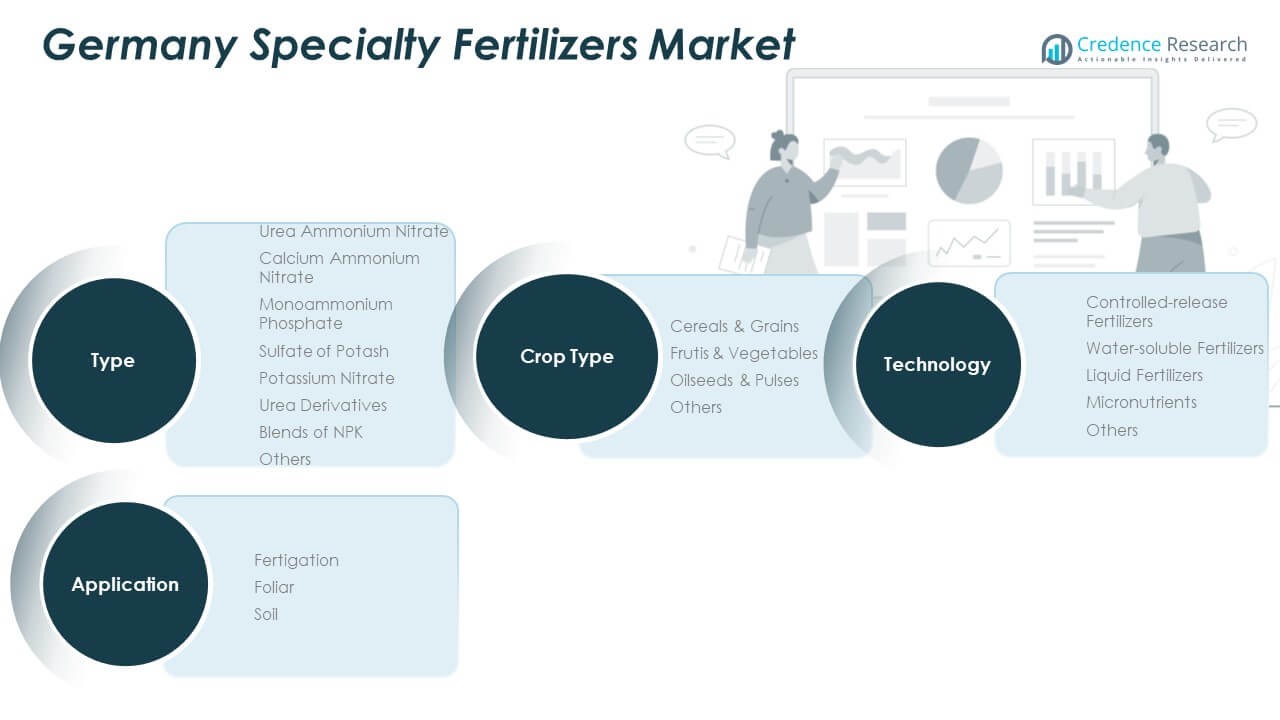

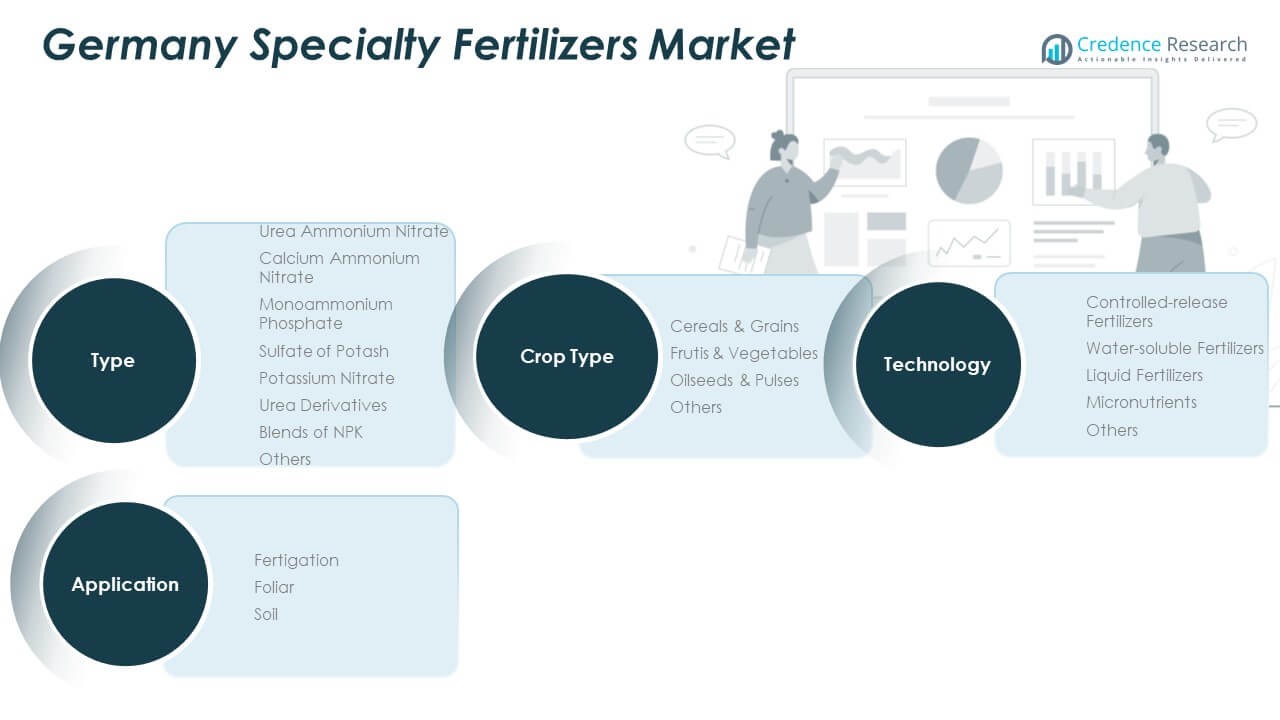

Market Segmentation Analysis

The Germany Specialty Fertilizers Market is characterized by a diverse product mix tailored to high-value crops and precision farming practices.

By type, urea ammonium nitrate and calcium ammonium nitrate secure significant demand due to their nitrogen efficiency, while monoammonium phosphate supports balanced nutrition in intensive farming. Sulfate of potash and potassium nitrate remain preferred for horticultural applications requiring chloride-free sources, whereas urea derivatives and NPK blends provide flexibility in customized formulations.

- For instance, in June 2024, Yara International opened Europe’s largest renewable hydrogen plant at Herøya, Norway, enabling nitrate-based mineral fertilizers with a carbon footprint around 50% lower than non-EU alternatives due to BAT catalytic emissions reduction technology.

By application, fertigation leads adoption due to its compatibility with advanced irrigation systems in greenhouses and vineyards. Foliar applications gain traction in horticulture for faster nutrient uptake and yield improvement. Soil applications remain relevant in traditional farming zones, though they face increasing competition from precision-driven methods. The Germany Specialty Fertilizers Market benefits from the strong integration of modern application techniques across crops.

By technology, controlled-release fertilizers play an important role in reducing nutrient losses, and water-soluble variants expand with the rise of precision fertigation. Liquid fertilizers gain relevance among cereal and horticulture producers seeking operational efficiency, while micronutrients support higher yields in specialty crops.

- For instance, COMPO EXPERT’s NovaTec fertilizers use DMPP (3.4-Dimethylpyrazolphosphate) technology to reduce nitrogen leaching and volatilization, backed by published technical catalog data showing demonstrably lower N losses and improved crop yields in German field applications.

By crop type, cereals and grains represent the broadest consumption base, while pulses and oilseeds benefit from balanced nutrient blends designed for protein-rich crops. Fruits and vegetables stand out as a key growth area supported by water-soluble and micronutrient-based fertilizers. Other crop categories, including ornamentals, also reflect opportunities with tailored specialty formulations.

Segmentation

By Type

- Urea Ammonium Nitrate

- Calcium Ammonium Nitrate

- Monoammonium Phosphate

- Sulfate of Potash

- Potassium Nitrate

- Urea Derivatives

- Blends of NPK

- Others

By Application

By Technology

- Controlled-release Fertilizers

- Water-soluble Fertilizers

- Liquid Fertilizers

- Micronutrients

- Others

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Regional Analysis

Western and Southern Germany

Western and Southern Germany account for the largest share of the Germany Specialty Fertilizers Market with 42%. These regions dominate due to intensive agricultural practices, high-value crop cultivation, and advanced greenhouse farming systems. It benefits from well-established infrastructure, strong farmer awareness, and higher purchasing power. Orchards, vineyards, and horticultural farms drive significant fertilizer demand. Farmers in these regions prefer controlled-release and water-soluble products that enhance efficiency. The strong focus on quality output for domestic and export markets supports sustained adoption.

Northern Germany

Northern Germany holds 34% share of the Germany Specialty Fertilizers Market. The region is characterized by large-scale cereal and oilseed production that drives consistent fertilizer use. It is witnessing a growing trend toward precision farming and integration of smart irrigation systems. Farmers increasingly invest in specialty fertilizers to manage soil health and improve crop yields. Strong policy support for sustainability enhances product uptake. The presence of large farms and cooperatives accelerates the use of advanced solutions. Expanding adoption of bio-based fertilizers is also reshaping demand patterns.

Eastern Germany

Eastern Germany represents 24% share of the Germany Specialty Fertilizers Market. The region shows steady growth due to modernization of agriculture and gradual adoption of advanced technologies. It is characterized by medium and small farms, where cost-sensitive decisions influence fertilizer choices. Government incentives encourage farmers to shift toward sustainable practices. Specialty fertilizers find traction in horticulture, fruit, and vegetable cultivation. Ongoing awareness campaigns improve acceptance and reduce reliance on conventional fertilizers. Expansion in greenhouse farming is expected to further strengthen demand in coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- K+S Aktiengesellschaft

- Compo Expert GmbH

- ICL Group Ltd.

- Yara International ASA

- Nutrien Ltd.

- The Mosaic Company

- EuroChem Group AG

- OCP Group

- Haifa Chemicals Ltd.

- CF Industries Holdings, Inc.

Competitive Analysis

The Germany Specialty Fertilizers Market is characterized by strong competition among multinational corporations and domestic players. Leading companies such as Yara International, EuroChem, ICL Group, K+S AG, and Groupe Roullier hold significant positions through advanced product portfolios and established distribution networks. It emphasizes innovation in controlled-release, water-soluble, and micronutrient fertilizers to meet sustainability and efficiency requirements. Companies focus on aligning with environmental regulations and farmer demand for crop-specific solutions. Partnerships with research institutions and agricultural cooperatives enhance product acceptance and strengthen market presence. Smaller regional firms compete by offering tailored solutions for local crops and soil conditions. The Germany Specialty Fertilizers Market benefits from this mix of global innovation and local expertise. It fosters a competitive environment where pricing strategies, technical support, and product customization drive differentiation. Investment in bio-based and eco-friendly formulations reflects the industry’s response to sustainability targets. Companies also expand through acquisitions and joint ventures to secure market share and improve technological capabilities.

Recent Developments

- In September 2025, ICL Group Ltd. executed a long-term strategic partnership with BioPrime to commercialize biofertilizer solutions in India using the BioNexus platform. This collaboration marks ICL’s entry into the microbial biofertilizers market, targeting phosphorus and zinc efficiency for soil health.

- In September 2025, Nutrien Ltd. its strategic divestment of a 50% stake in Argentina’s Profertil, the region’s leading granular urea manufacturer, in a deal valued at $600 million. The proceeds will be allocated toward targeted growth investments and operational priorities.

- In February 2025, K+S AG introduced the C: LIGHT product family, which lowers carbon emissions by up to 90% compared to traditional fertilizers. The new specialty potash and magnesium fertilizers support sustainable practices for German farmers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Crop Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-value crops will continue to expand fertilizer use across horticulture and greenhouse farming.

- Sustainability regulations will drive wider adoption of controlled-release and water-soluble products.

- Bio-based and organic specialty fertilizers will gain strong momentum with consumer and policy support.

- Precision farming integration will accelerate, linking fertilizers with smart irrigation and digital monitoring.

- Regional cooperatives and farmer groups will promote bulk adoption of customized crop-specific solutions.

- R&D investments will focus on nutrient efficiency, soil health, and environmentally safe formulations.

- Local producers will strengthen their role by offering affordable options tailored to small and medium farms.

- Imports of innovative products from EU markets will expand availability and competitive variety.

- Export-oriented farming will sustain demand for premium fertilizers to meet quality certifications.

- Strategic alliances and mergers among major players will enhance technological capabilities and market coverage.