Market Overviews

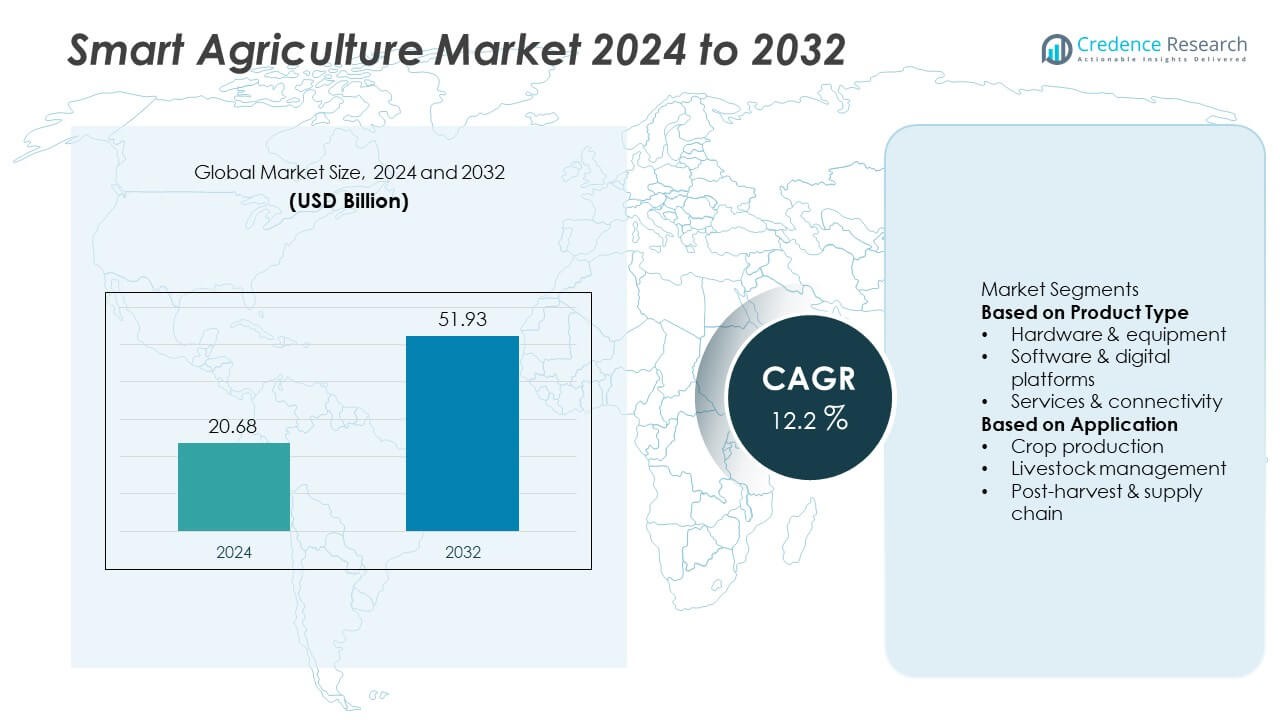

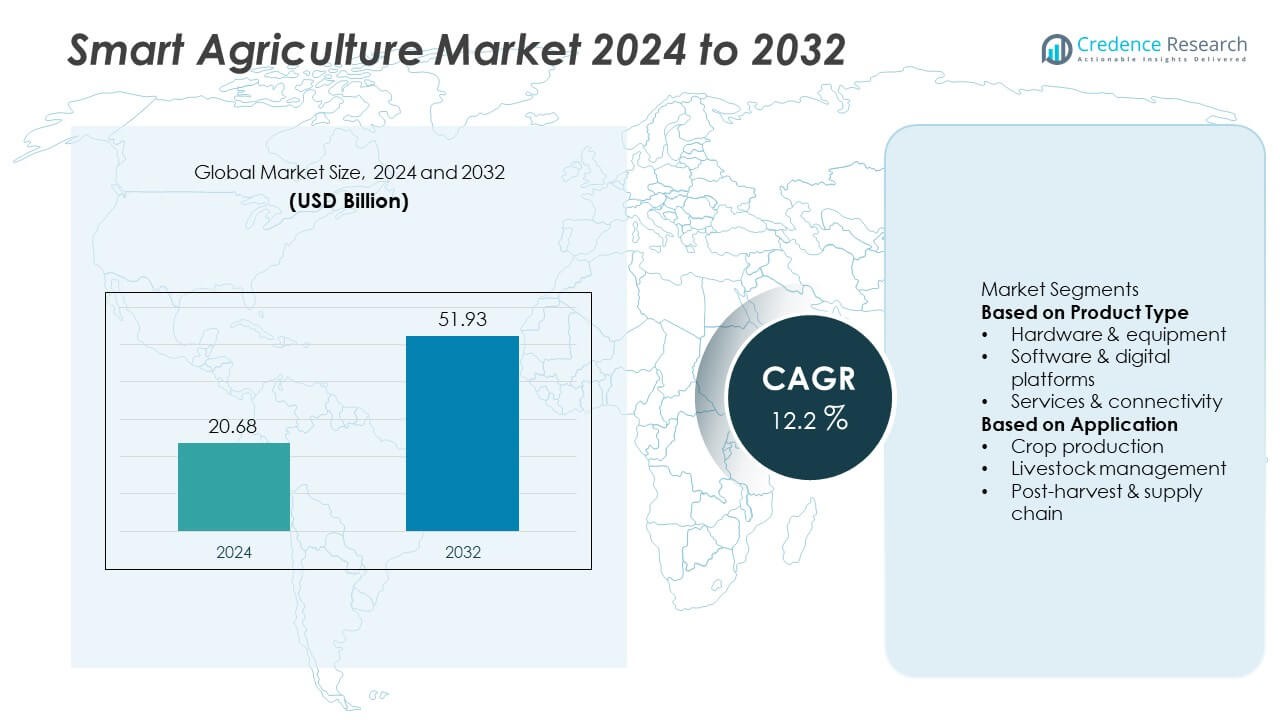

The smart agriculture market was valued at USD 20.68 billion in 2024 and is projected to reach USD 51.93 billion by 2032, growing at a CAGR of 12.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Agriculture Market Size 2024 |

USD 20.68 Billion |

| Smart Agriculture Market, CAGR |

12.2% |

| Smart Agriculture Market Size 2032 |

USD 51.93 Billion |

The smart agriculture market is led by major players such as Monarch Tractor, CNH Industrial, Bayer, Kubota, Mahindra & Mahindra, Carbon Robotics, CLAAS Group, AGCO, Farmers Edge, and John Deere & Company. These companies dominate the industry through innovations in precision farming, autonomous equipment, and AI-driven crop management systems. Asia-Pacific emerged as the leading region with a 29.5% market share in 2024, driven by rapid technology adoption and government-backed digital agriculture initiatives. North America followed with a 33.7% share, supported by advanced infrastructure and strong agritech investments, while Europe held a 27.8% share, led by sustainability-focused farming policies and automation in large-scale agricultural operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smart agriculture market was valued at USD 20.68 billion in 2024 and is projected to reach USD 51.93 billion by 2032, growing at a CAGR of 12.2%.

- Rising adoption of IoT sensors, drones, and automation systems drives market growth, with the hardware and equipment segment holding a 47.3% share due to increasing demand for precision farming tools.

- Integration of AI, machine learning, and data analytics is shaping new market trends by improving real-time decision-making, predictive crop analysis, and resource optimization.

- The market is competitive, featuring players such as Monarch Tractor, CNH Industrial, Bayer, and John Deere focusing on autonomous machinery, digital platforms, and sustainable farming solutions.

- North America led with a 33.7% share in 2024, followed by Asia-Pacific at 29.5% and Europe at 27.8%, supported by government initiatives, rapid technology deployment, and strong demand for efficient agricultural management systems.

Market Segmentation Analysis:

By Product Type

The hardware and equipment segment dominated the smart agriculture market in 2024, accounting for a 47.3% share. This dominance is driven by the rising use of IoT-based sensors, automated irrigation systems, drones, and GPS-enabled machinery. These tools enhance field monitoring, reduce input waste, and improve crop yields through data-based precision farming. Farmers increasingly invest in modern equipment to address labor shortages and optimize productivity. Continuous technological innovation, including smart tractors and autonomous robots, strengthens the hardware segment’s leadership across developed and emerging agricultural economies.

- For instance, John Deere’s 8R autonomous tractor is equipped with six pairs of stereo cameras and an Nvidia GPU, which enable real-time obstacle detection and centimeter-level positioning accuracy across large fields.

By Application

The crop production segment led the smart agriculture market in 2024, holding a 52.8% share. Its leadership stems from the growing adoption of precision farming technologies to enhance soil health, water management, and yield prediction. Automated irrigation, drone-based imaging, and satellite data analytics support efficient resource allocation and reduce operational costs. Government initiatives promoting sustainable crop cultivation and digital farming practices further accelerate adoption. Increasing global food demand and shrinking arable land continue to drive the use of intelligent agricultural systems for maximizing productivity.

- For instance, Bayer’s FieldView platform analyzed over 220 million acres of farmland using AI-driven yield modeling and weather-based analytics to optimize input use and crop rotation patterns.

Key Growth Drivers

Rising Adoption of IoT and Precision Farming Technologies

The increasing use of IoT-enabled sensors, drones, and automation tools is transforming traditional farming into data-driven operations. These technologies allow farmers to monitor soil conditions, moisture levels, and crop health in real time, improving productivity and resource efficiency. Precision farming minimizes input waste and ensures targeted application of fertilizers and water, reducing costs. Governments and agritech firms are actively promoting digital tools to support sustainable agriculture and enhance food security.

- For instance, Trimble Agriculture has deployed over 2 million connected devices globally through its precision agriculture platforms, offering field mapping accuracy of up to 2.5 cm using GNSS-based guidance.

Growing Need for Sustainable and Resource-Efficient Farming

Rising environmental concerns and water scarcity are pushing farmers toward smart agriculture solutions. Automated irrigation systems, climate control technologies, and AI-driven crop analytics optimize resource utilization and minimize environmental impact. These systems enable sustainable production while maintaining profitability. Increasing global emphasis on carbon reduction and green farming practices further accelerates the adoption of eco-efficient agricultural technologies across both developed and developing regions.

- For instance, Netafim’s precision irrigation systems manage over 10 million hectares of farmland worldwide, reducing water consumption by up to 4,000 cubic meters per hectare annually.

Government Initiatives and Agritech Investments

Supportive government policies and financial incentives are fueling the expansion of smart agriculture. Public-private partnerships and subsidies for precision farming equipment encourage adoption among small and medium-scale farmers. Venture capital investments in agritech startups have surged, focusing on automation, robotics, and data analytics. This financial and regulatory backing is enabling innovation, expanding digital infrastructure, and improving accessibility of smart agriculture solutions across global farming communities.

Key Trends & Opportunities

Integration of AI, Big Data, and Machine Learning

AI and data analytics are revolutionizing smart agriculture by enabling predictive insights for yield optimization, pest control, and climate adaptation. Machine learning algorithms process data from sensors and drones to guide farmers’ decisions in real time. These technologies enhance accuracy in crop management and forecasting, reducing dependency on manual observation. The growing adoption of AI platforms creates opportunities for agritech companies to deliver more intelligent and scalable farming solutions globally.

- For instance, IBM’s Watson Decision Platform for Agriculture utilizes AI, IoT, and weather data to provide insights for farmers on crop management and yield predictions, with pilot programs successfully implemented in regions like India.

Expansion of Drone and Robotics Applications

Drones and agricultural robots are gaining traction for field mapping, spraying, and crop surveillance. Their efficiency in covering large areas with minimal labor input reduces operational costs and increases accuracy in field management. The growing affordability of UAV technology and autonomous systems enables large-scale implementation in both crop and livestock management. Manufacturers are developing multi-purpose drones and robotic harvesters to meet diverse farming needs, creating new opportunities in the smart agriculture ecosystem.

- For instance, DJI Agriculture had deployed approximately 400,000 Agras drones globally by the end of 2024, with the newest models capable of spraying over 50 acres per hour with centimeter-level precision using RTK navigation.

Key Challenges

High Initial Costs and Limited Access for Small Farmers

The high cost of advanced agricultural technologies, including sensors, drones, and automation systems, remains a key challenge. Small-scale farmers in developing countries often lack access to financing and digital infrastructure. This limits widespread adoption despite growing awareness of smart farming benefits. Expanding micro-financing schemes, equipment leasing, and government-backed credit programs are essential to bridge the affordability gap.

Data Privacy and Connectivity Constraints

Smart agriculture relies heavily on real-time data collection and cloud-based systems, making cybersecurity and connectivity critical concerns. Limited internet access in rural areas hampers seamless data transmission, while weak data protection frameworks raise privacy risks. Farmers and service providers must invest in secure, scalable networks to prevent breaches. Strengthening rural connectivity and implementing strict data governance policies are necessary to ensure trust and reliability in digital agriculture operations.

Regional Analysis

North America

North America held a 33.7% share of the smart agriculture market in 2024, driven by strong technological infrastructure and widespread adoption of precision farming solutions. The U.S. leads the region with extensive use of IoT-enabled sensors, drones, and autonomous tractors. Supportive government programs promoting sustainable agriculture and water-efficient irrigation systems further accelerate adoption. High investments by agritech companies and research institutions enhance innovation in data-driven farming. Canada contributes significantly through greenhouse automation and livestock monitoring technologies, solidifying North America’s position as a leader in digital and connected farming solutions.

Europe

Europe accounted for a 27.8% share of the smart agriculture market in 2024. The region’s growth is supported by stringent environmental regulations and strong emphasis on sustainable and organic farming practices. Countries such as Germany, France, and the Netherlands lead adoption due to advanced agricultural mechanization and government-backed digital farming initiatives. The European Union’s Common Agricultural Policy encourages smart irrigation and precision livestock management. Rising labor costs and climate change adaptation needs further drive automation and AI integration, ensuring the region’s steady transition toward highly efficient and eco-friendly farming systems.

Asia-Pacific

Asia-Pacific led the smart agriculture market with a 29.5% share in 2024, emerging as the fastest-growing regional market. Rapid population growth and shrinking arable land have accelerated demand for advanced farming technologies. China, Japan, and India are key markets, focusing on drone monitoring, soil mapping, and automated irrigation systems to boost productivity. Government subsidies for agritech startups and precision agriculture equipment encourage adoption among farmers. Increasing smartphone penetration and digital platforms for farm management strengthen regional progress, making Asia-Pacific a key contributor to global agricultural digitization and sustainability.

Latin America

Latin America held a 5.2% share of the smart agriculture market in 2024. Brazil and Argentina lead the region due to the rising use of GPS-guided machinery, crop monitoring drones, and smart irrigation systems. Expanding agribusiness operations and increasing exports of grains and soybeans drive technology adoption. However, uneven connectivity and high initial costs limit large-scale deployment in remote areas. Ongoing collaborations between global agritech firms and local producers are improving technology accessibility and awareness, positioning Latin America as an emerging market for precision and sustainable farming solutions.

Middle East & Africa

The Middle East & Africa region captured a 3.8% share of the smart agriculture market in 2024. Growth is fueled by rising investments in water-efficient farming and desert agriculture technologies. The UAE, Saudi Arabia, and South Africa lead in adopting automated irrigation, climate-controlled greenhouses, and soil sensors to improve productivity in arid regions. Limited arable land and growing food demand are driving the shift toward technology-led farming. Government-backed programs promoting digital agriculture and partnerships with global technology providers are helping bridge infrastructure gaps and foster long-term regional growth.

Market Segmentations:

By Product Type

- Hardware & equipment

- Software & digital platforms

- Services & connectivity

By Application

- Crop production

- Livestock management

- Post-harvest & supply chain

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart agriculture market is highly competitive, featuring key players such as Monarch Tractor, CNH Industrial, Bayer, Kubota, Mahindra & Mahindra, Carbon Robotics, CLAAS Group, AGCO, Farmers Edge, and John Deere & Company. These companies focus on integrating advanced technologies such as IoT, AI, robotics, and data analytics to enhance farm productivity and sustainability. Leading players invest heavily in automation, precision farming equipment, and AI-powered farm management platforms. Strategic collaborations and acquisitions strengthen their technological portfolios and global market presence. Companies like John Deere and AGCO are pioneering autonomous machinery and connected tractor systems, while Bayer and Farmers Edge emphasize digital crop management and predictive analytics. The competition is further intensified by the rise of startups developing affordable precision tools for small and mid-sized farms. Overall, innovation, scalability, and data-driven insights remain central to maintaining leadership in the rapidly evolving smart agriculture industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Monarch Tractor

- CNH Industrial

- Bayer

- Kubota

- Mahindra & Mahindra

- Carbon Robotics

- CLAAS Group

- AGCO

- Farmers Edge

- John Deere & Company

Recent Developments

- In May 2025, Bayer AG announced a re-organisation of its Crop Science division in Germany to focus on strategic technologies, including ceasing some production and R&D activities at its Frankfurt site by end of 2028.

- In February 2025, Monarch Tractor began commercial rollout of its Autodrive™ fully-autonomous feature in its MK-V driver-optional tractor platform.

- In January 2025, Deere & Company (branded as John Deere) revealed several new autonomous agricultural machines at the CES 2025 show, including a second-generation autonomy kit with advanced computer vision and AI integration.

- In December 2024, Monarch announced the establishment of Monarch Tractor Europe N.V. headquartered in Antwerp, Belgium, signalling its formal entry into the European market with its MK-V electric tractor.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of IoT-based sensors and automation tools will continue to expand globally.

- AI and data analytics will play a key role in predictive crop management and yield optimization.

- Autonomous tractors, drones, and robotic harvesters will become standard in large-scale farming.

- Integration of cloud-based farm management systems will enhance operational efficiency and traceability.

- Demand for sustainable and water-efficient farming technologies will rise across all regions.

- Governments will increase investments and subsidies to promote digital agriculture adoption.

- Agritech startups will drive innovation with affordable and scalable precision farming tools.

- Partnerships between technology providers and equipment manufacturers will strengthen product ecosystems.

- Expansion of 5G networks will improve real-time data transmission and machine connectivity.

- Asia-Pacific will remain a key growth hub due to expanding agricultural digitization and urban food demand.