Market Overview

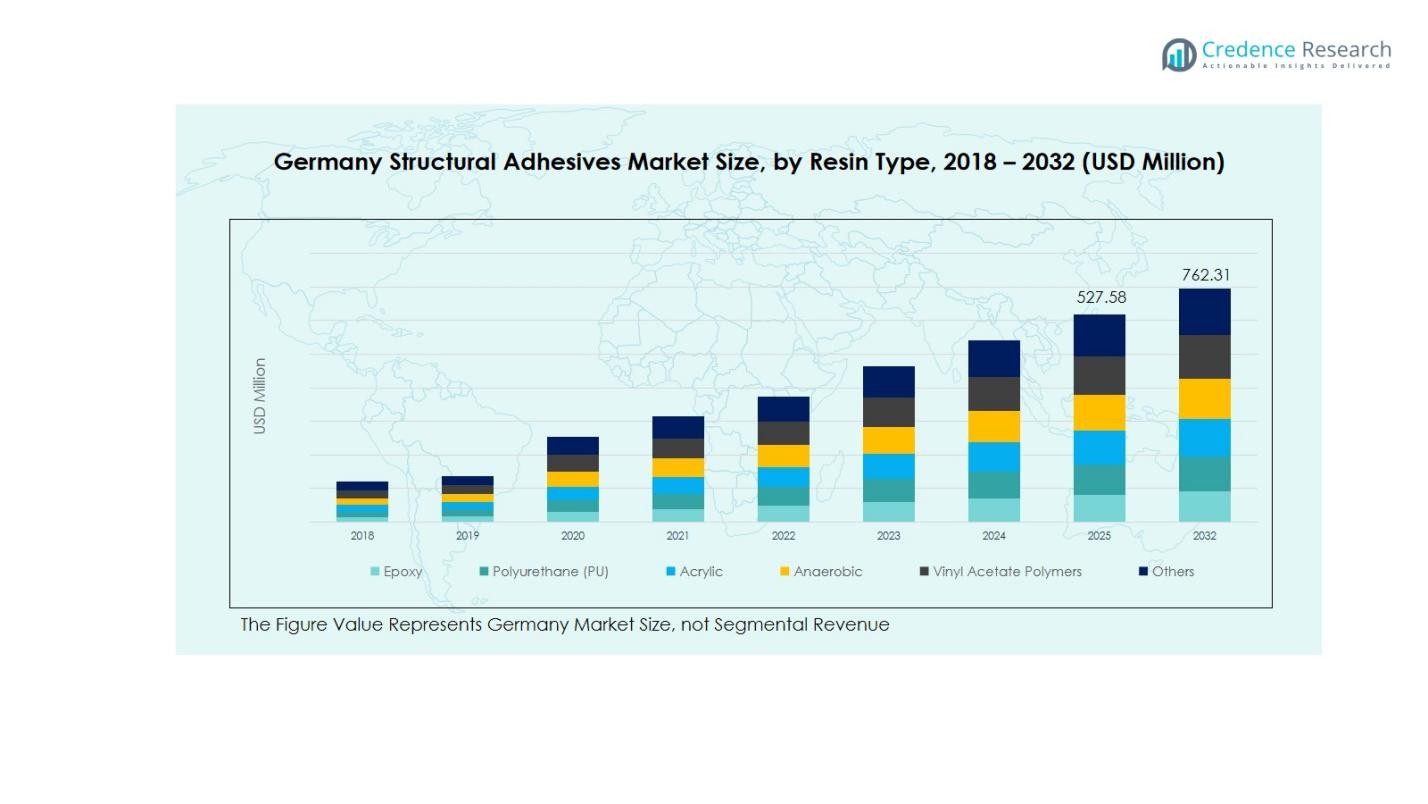

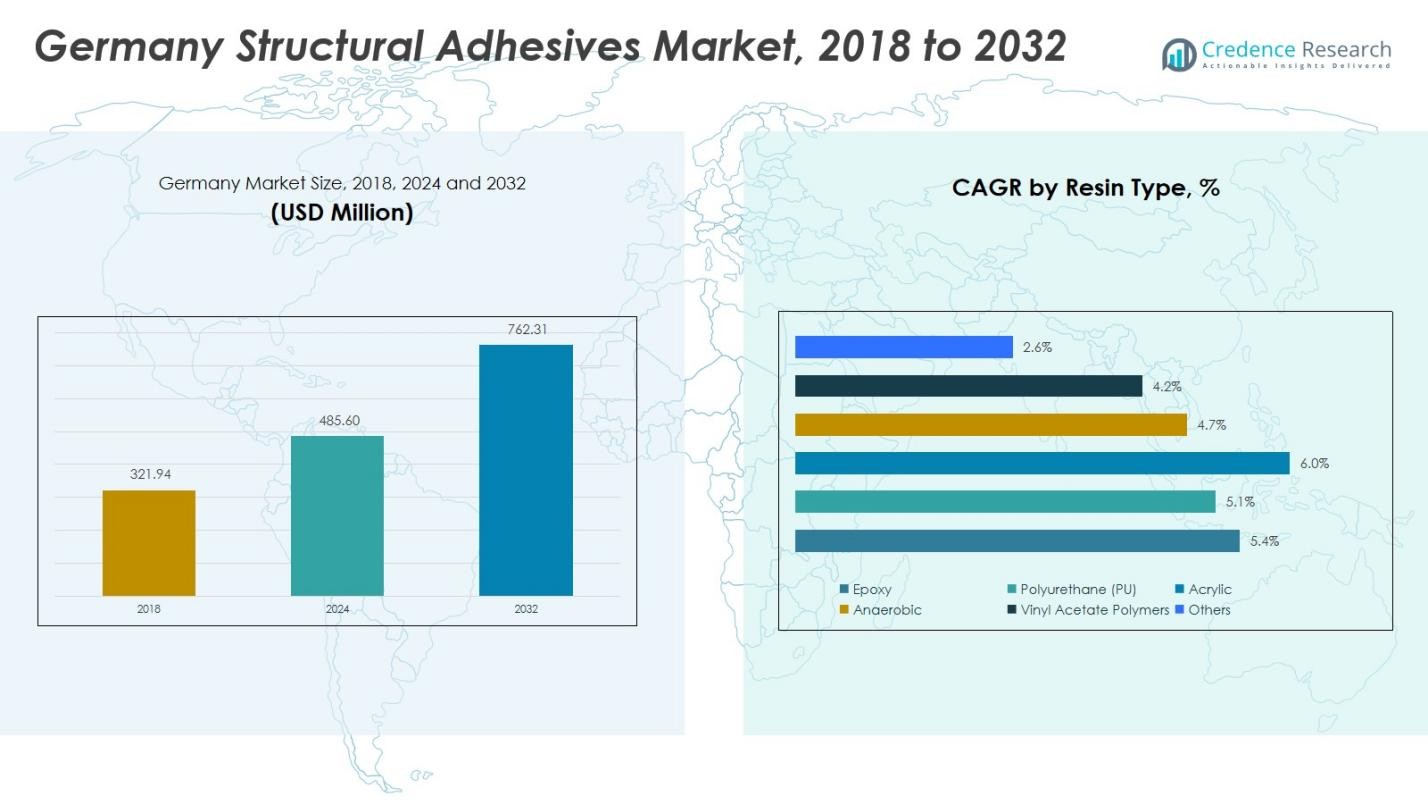

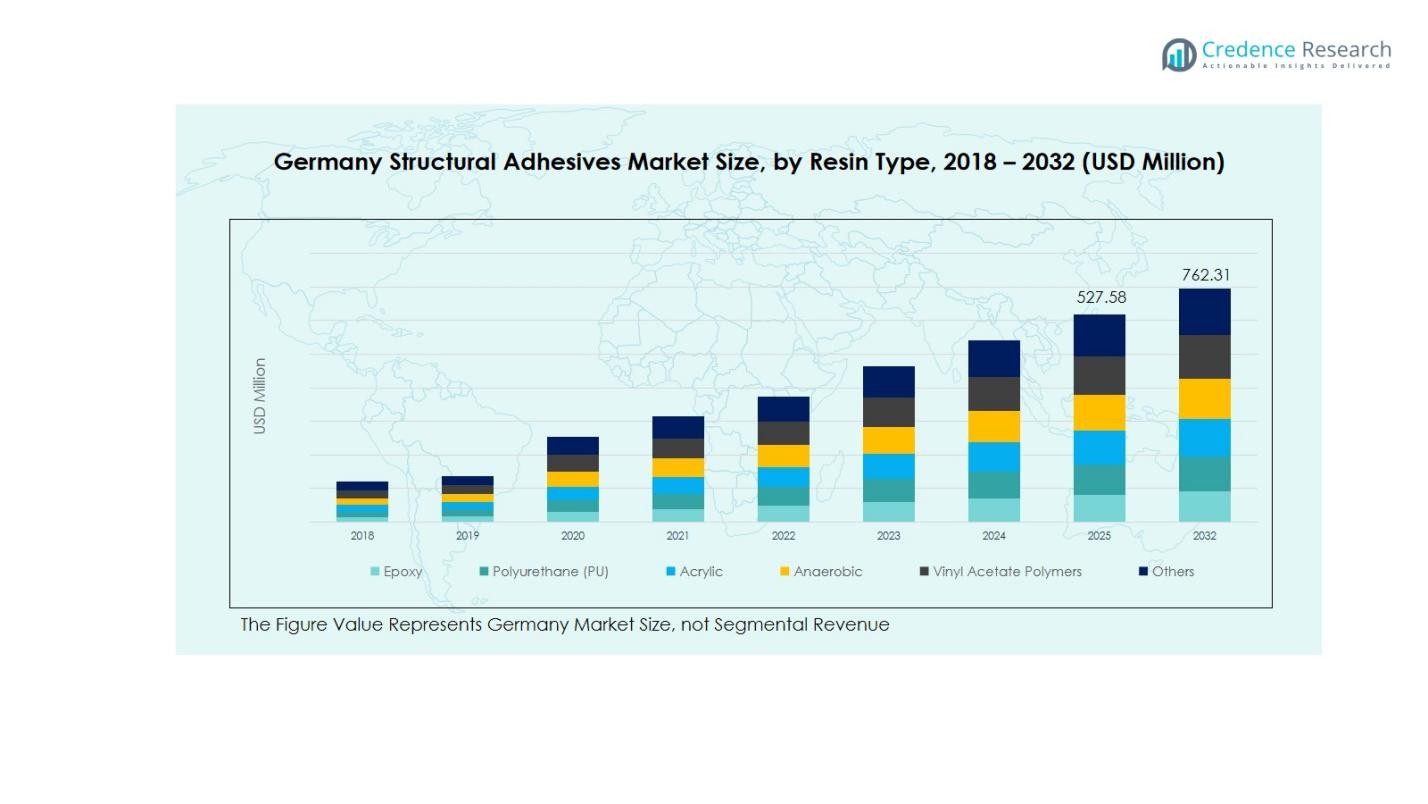

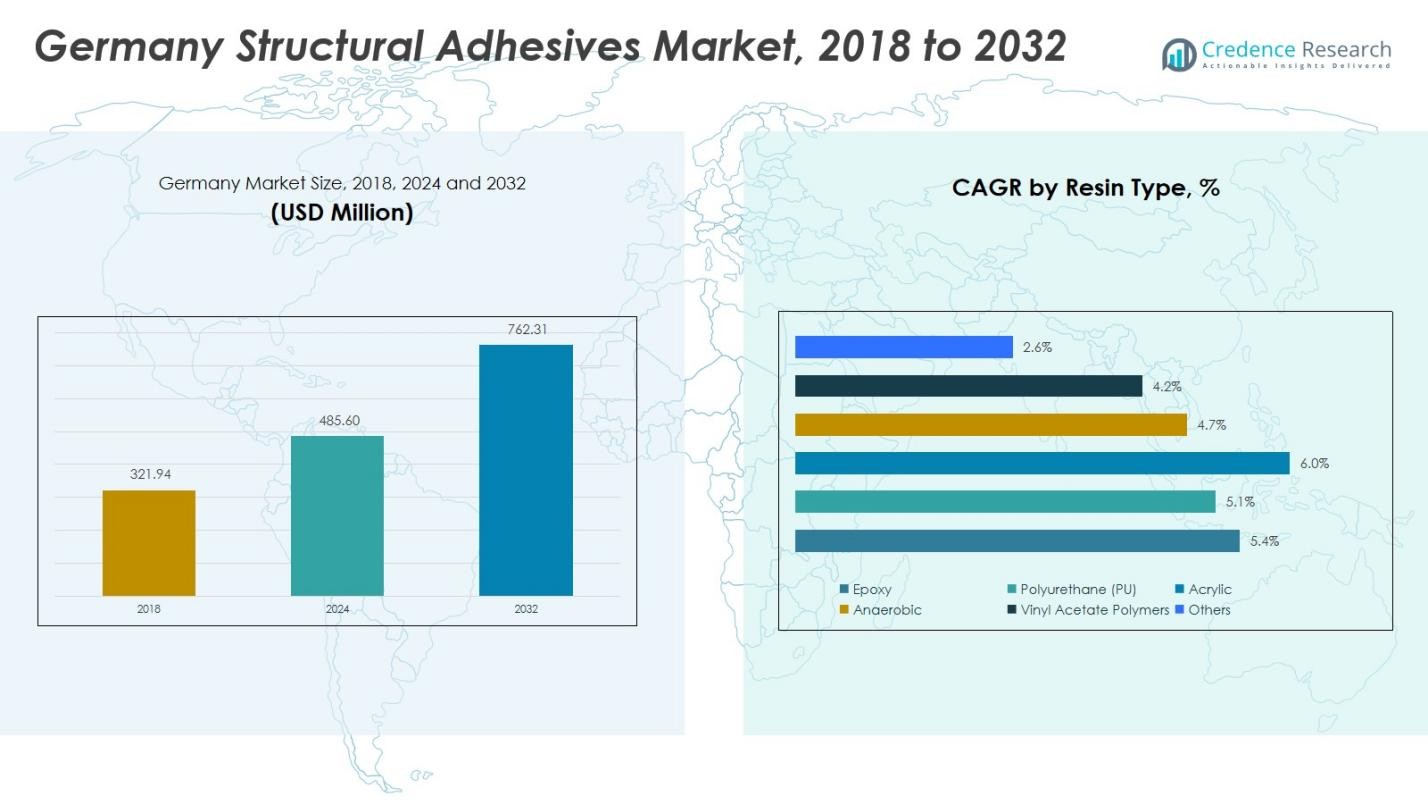

Germany Structural Adhesives Market size was valued at USD 321.94 Million in 2018, rising to USD 485.60 Million in 2024, and is anticipated to reach USD 762.31 Million by 2032, reflecting a CAGR of 5.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Structural Adhesives Market Size 2024 |

USD 485.60 Million |

| Germany Structural Adhesives Market, CAGR |

5.40% |

| Germany Structural Adhesives Market Size 2032 |

USD 762.31 Million |

The Germany Structural Adhesives Market is highly competitive, with top players including Henkel AG & Co. KGaA, BASF SE, Sika AG, Arkema S.A., H.B. Fuller Company, RPM International Inc., Compagnie de Saint-Gobain S.A., Jowat SE, Huntsman Corporation, and Lord Corporation. These companies focus on expanding product portfolios, investing in R&D for high-performance and eco-friendly adhesives, and strengthening regional distribution networks to maintain market leadership. Strategic partnerships, mergers, and acquisitions further enhance their technological capabilities and market presence. Bavaria emerges as the leading region, accounting for 28% of the market share in 2024, driven by a strong automotive and aerospace manufacturing base, advanced industrial infrastructure, and growing demand for lightweight and high-performance materials. The combination of established industry players and a dominant regional hub ensures sustained growth and innovation in Germany’s structural adhesives market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Structural Adhesives Market was valued at USD 485.60 Million in 2024 and is projected to reach USD 762.31 Million by 2032, growing at a CAGR of 5.40%. Epoxy holds the largest resin type share at 38%, while metal is the dominant substrate at 42%. Solvent-based adhesives lead the technology segment with 45% share, and Bavaria commands the highest regional share at 28%.

- Growth is driven by rising automotive and aerospace production, increasing demand for lightweight vehicles and aircraft, and adoption of high-performance adhesives across metal and composite applications.

- Market trends include a shift toward eco-friendly water-based adhesives, integration of advanced UV-curable and hybrid adhesives, and expansion of applications in electronics, industrial machinery, and renewable energy sectors.

- The market is highly competitive, led by Henkel AG & Co. KGaA, BASF SE, Sika AG, Arkema S.A., and other key players focusing on product innovation, strategic partnerships, and expanding regional presence.

- Restraints include high costs of advanced adhesives and competition from traditional joining methods, which may slow adoption in price-sensitive segments.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Resin Type:

The epoxy segment dominates the Germany Structural Adhesives Market, accounting for 38% of the revenue share in 2024. Its high mechanical strength, excellent chemical resistance, and versatility across automotive, aerospace, and industrial applications drive adoption. Polyurethane (PU) follows closely, valued for its flexibility and bonding performance on diverse substrates. Growing demand from automotive lightweighting and electronics industries propels overall resin-type growth. Acrylics and anaerobic adhesives hold moderate shares, while vinyl acetate polymers and other resins contribute minimally, reflecting their niche applications in specific industrial and construction sectors.

For instance, Master Bond offers epoxy adhesives that meet rigorous aerospace standards, including NASA low outgassing and Boeing specifications, providing high bond strength and durability under extreme temperatures and environmental conditions.

By Substrate:

Metal is the leading substrate segment in Germany, representing nearly 42% of the market share in 2024. Its widespread use in automotive, aerospace, and industrial manufacturing applications underpins this dominance. Composites are gaining traction due to lightweighting trends in vehicles and machinery, accounting for around 25% of the segment. Wood and plastics maintain moderate shares, supported by construction and furniture applications. Other substrates hold minimal market penetration. Drivers include increasing demand for high-performance bonding solutions and stringent structural integrity requirements across end-use industries, encouraging adoption of adhesives that enhance durability and assembly efficiency.

For instance, BMW actively incorporates high-strength steel and aluminum alloys in their automotive manufacturing to meet EU emission reduction targets, leveraging metal substrates for strength and lightweight properties.

By Technology:

Solvent-based adhesives lead the technology segment with approximately 45% market share in Germany, favored for their strong bonding capabilities and rapid curing characteristics. Water-based adhesives are growing steadily, representing around 30% of the market, driven by environmental regulations and increasing adoption of eco-friendly formulations. Other technologies, including hot-melt and UV-curable adhesives, account for the remaining share and are primarily used in niche industrial applications. Market growth is propelled by the automotive and construction sectors’ preference for high-performance adhesives that ensure long-term structural reliability while complying with sustainability and safety standards.

Key Growth Drivers

Rising Automotive & Aerospace Production

The Germany Structural Adhesives Market is propelled by robust growth in the automotive and aerospace sectors. Increasing production of lightweight vehicles and aircraft demands high-strength adhesives to replace mechanical fasteners, reduce weight, and enhance fuel efficiency. Epoxy and polyurethane adhesives are increasingly preferred for bonding metals and composites, supporting structural integrity. Stringent safety standards and durability requirements in transportation applications further drive adoption, ensuring adhesives remain a critical component in advanced vehicle assembly and aerospace manufacturing processes.

For instance, in the automotive sector, Henkel’s epoxy adhesives are widely used in electric vehicle battery systems to ensure structural bonding and thermal conductivity, enhancing safety and performance.

Demand for Lightweight and High-Performance Materials

Lightweighting initiatives across industrial and transportation sectors significantly drive the structural adhesives market in Germany. Manufacturers are replacing traditional fasteners with adhesives to join metal, composites, and plastics, improving performance and energy efficiency. High-performance adhesives offer superior mechanical strength, chemical resistance, and durability, meeting the growing need for multifunctional bonding solutions. The trend towards electric vehicles and lightweight machinery further accelerates market demand, as structural adhesives contribute to weight reduction without compromising reliability or structural integrity.

For instance, Dow’s Betamate 1496V, a one-component epoxy adhesive, is used in automotive body structures to bond oily galvanized steel, cold-rolled steel, and aluminum, enhancing crash stability and stiffness while offering sealing and corrosion protection.

Stringent Environmental and Safety Regulations

Environmental and workplace safety regulations are encouraging the adoption of structural adhesives in Germany. Water-based and low-VOC formulations are increasingly preferred to meet sustainability standards while ensuring compliance with industrial safety norms. Adhesives provide an alternative to welding or mechanical fastening, reducing emissions and energy consumption during assembly processes. Regulatory pressures in automotive, construction, and electronics industries promote investments in advanced adhesive technologies, driving market growth and fostering innovation in eco-friendly, high-performance bonding solutions.

Key Trends & Opportunities

Integration of Advanced Adhesive Technologies

The market is witnessing a growing trend toward integrating advanced adhesive technologies, such as UV-curable and hybrid adhesives, offering faster curing times and enhanced bonding strength. Adoption of these innovations opens opportunities for manufacturers to cater to high-end automotive, aerospace, and electronics applications. The focus on lightweight, multifunctional bonding solutions aligns with evolving industrial requirements, presenting an opportunity for companies to develop differentiated products and expand their presence in specialized segments.

For instance, 3M’s Structural Adhesive SA9820 is a two-part epoxy designed for automotive OEMs, offering high bond strength with the flexibility to cure at low temperatures, making it suitable for bonding carbon composites without distortion.

Expansion in Industrial Manufacturing and Electronics

Structural adhesives are increasingly applied in industrial machinery, electronics, and renewable energy sectors, creating significant market opportunities. Germany’s strong industrial base and electronics manufacturing ecosystem drive demand for adhesives that ensure durability, vibration resistance, and thermal stability. Growth in automation, robotics, and renewable energy infrastructure further boosts the need for high-performance bonding solutions, providing manufacturers with the chance to introduce innovative adhesives tailored to sector-specific applications and performance requirements.

For instance, Sika’s structural adhesives, such as the SikaForce® series, are widely used in automotive manufacturing to replace traditional mechanical fasteners like rivets and welds. These adhesives enhance crash durability and reduce vehicle weight, contributing to improved fuel efficiency and safety standards.

Key Challenges

High Cost of Advanced Adhesives

Despite strong demand, the high cost of advanced structural adhesives remains a market challenge. Premium epoxy, polyurethane, and hybrid adhesives require significant R&D and raw material investments, increasing overall product pricing. Small and medium-sized enterprises may face adoption barriers due to cost sensitivity, limiting market penetration. Manufacturers must balance performance and affordability to expand adoption, while ensuring that high-value applications in automotive, aerospace, and industrial sectors justify the investment in advanced adhesive solutions.

Competition from Traditional Joining Methods

Structural adhesives face competition from conventional mechanical fasteners, welding, and soldering techniques. Industries with established production processes may resist switching due to familiarity, perceived reliability, and lower initial costs of traditional methods. Overcoming this challenge requires demonstrating long-term benefits of adhesives, including weight reduction, improved structural integrity, and compliance with regulatory standards. Continuous innovation, targeted marketing, and performance validation are essential for encouraging adoption and mitigating competition from alternative joining technologies.

Regional Analysis

Bavaria

Bavaria holds a leading position in the Germany Structural Adhesives Market, accounting for 28% of the total market share in 2024. The region benefits from a strong automotive and aerospace manufacturing base, including major OEMs and suppliers, driving high demand for epoxy and polyurethane adhesives. Advanced industrial infrastructure and focus on lightweight and high-performance materials further support growth. Additionally, increasing investments in electronics and machinery production enhance the adoption of adhesives across multiple applications, ensuring Bavaria remains a critical hub for structural adhesive consumption and innovation within Germany.

North Rhine-Westphalia

North Rhine-Westphalia contributes 22% to Germany’s structural adhesives market in 2024, driven by its extensive industrial and manufacturing ecosystem. The region hosts numerous automotive, construction, and industrial machinery companies, fostering demand for high-strength adhesives. Metal and composite substrates dominate applications, while solvent-based adhesives remain widely used due to established manufacturing processes. Focus on sustainable and efficient bonding solutions further promotes market expansion. Continuous industrial modernization and investment in advanced manufacturing technologies support the adoption of high-performance adhesives, solidifying North Rhine-Westphalia’s strategic importance within the German market.

Baden-Württemberg

Baden-Württemberg accounts for 18% of the Germany Structural Adhesives Market, supported by its advanced automotive and aerospace sectors. The presence of globally recognized OEMs and suppliers drives demand for epoxy and polyurethane adhesives for lightweighting and structural applications. High investments in industrial manufacturing and engineering innovations contribute to market growth, while regional initiatives promoting environmentally friendly adhesives encourage adoption of water-based formulations. The increasing requirement for durable, chemical-resistant adhesives in machinery and electronics further enhances market penetration, establishing Baden-Württemberg as a key contributor to Germany’s overall structural adhesives consumption.

Hesse

Hesse represents 12% of the Germany Structural Adhesives Market in 2024, driven by a diverse industrial base encompassing automotive components, electronics, and construction materials. The region demonstrates growing adoption of high-performance adhesives, particularly for metal and composite bonding applications. Water-based and solvent-based technologies dominate, responding to both performance and regulatory requirements. Increasing focus on lightweight and multifunctional bonding solutions supports expansion, while strategic industrial development initiatives and rising demand from manufacturing and electronics sectors reinforce Hesse’s position as an important regional market for structural adhesives within Germany.

Lower Saxony

Lower Saxony holds 10% of Germany’s structural adhesives market, supported by automotive, machinery, and industrial manufacturing industries. The region emphasizes epoxy and polyurethane adhesives due to their strong mechanical and chemical resistance properties. Growing investments in electric vehicle production and lightweight industrial components accelerate adoption of advanced adhesives. Solvent-based and water-based adhesives are widely applied, reflecting compliance with environmental and regulatory standards. Focus on efficiency, durability, and performance across key sectors sustains market growth, making Lower Saxony a notable contributor to Germany’s structural adhesives consumption and overall market development.

Others (Saxony, Rhineland-Palatinate, Schleswig-Holstein, etc.)

Other regions collectively account for 10% of Germany’s structural adhesives market in 2024. These areas exhibit moderate demand, primarily driven by industrial manufacturing, construction, and electronics sectors. Adoption of epoxy, polyurethane, and acrylic adhesives is notable in specialized applications, while solvent-based and water-based formulations cater to regulatory and sustainability requirements. Growth is supported by increasing investments in industrial modernization, renewable energy, and lightweight manufacturing. While smaller than the major regional hubs, these areas provide steady demand and serve as emerging markets for high-performance adhesives, contributing to the overall development of Germany’s structural adhesives market.

Market Segmentations:

By Resin Type:

- Epoxy

- Polyurethane (PU)

- Acrylic

- Anaerobic

- Vinyl Acetate Polymers

- Others

By Substrate:

- Metal

- Composite

- Wood

- Plastic

- Others

By Technology:

- Solvent-based

- Water-based

- Others

By Application:

- Automotive & Transportation

- Aerospace

- Building & Construction

- Electronics

- Industrial Manufacturing

- Others

By Region:

- Bavaria

- North Rhine-Westphalia

- Baden-Württemberg

- Hesse

- Lower Saxony

- Others

Competitive Landscape

Competitive landscape in the Germany Structural Adhesives Market features key players such as Henkel AG & Co. KGaA, BASF SE, Sika AG, Arkema S.A., H.B. Fuller Company, RPM International Inc., Compagnie de Saint-Gobain S.A., Jowat SE, Huntsman Corporation, and Lord Corporation. The market is characterized by intense competition driven by continuous innovation in high-performance adhesives and growing demand across automotive, aerospace, and industrial sectors. Companies focus on expanding product portfolios, launching eco-friendly formulations, and enhancing distribution networks to strengthen their regional presence. Strategic partnerships, mergers, and acquisitions are common to gain technological expertise and improve market share. Additionally, firms are investing in R&D for lightweight and multifunctional adhesive solutions that meet regulatory standards. The competitive intensity encourages differentiation through superior bonding performance, durability, and sustainability, ensuring that established players maintain dominance while new entrants seek niche opportunities in specialized applications.

Key Player Analysis

- Henkel AG & Co. KGaA

- BASF SE

- Sika AG

- Arkema S.A.

- B. Fuller Company

- RPM International Inc.

- Compagnie de Saint-Gobain S.A.

- Jowat SE

- Huntsman Corporation

- Lord Corporation

Recent Developments

- In April 2025, Henkel AG & Co. KGaA partnered with Bodo Möller Chemie Group to enhance development and distribution of polyurethane- and silicone-based Sonderhoff 2K gasket foams, targeting automotive and industrial sectors.

- In April 2025, Synthomer and Henkel formed a strategic partnership and supply agreement focused on enabling carbon emission reductions in Henkel’s TECHNOMELT® hot melt adhesive product portfolio for the European, Indian, Middle Eastern, and African markets.

- In July 2025, Evonik Industries began using green electricity for its polybutadiene production in Marl, Germany. This initiative is part of Evonik’s sustainability strategy aimed at achieving a 25% reduction in scope 1 and 2 emissions from 2021 to 2030. POLYVEST® products are also available as ISCC Plus certified eCO variants.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Substrate, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily driven by automotive and aerospace demand.

- Adoption of lightweight and high-performance materials will continue to rise.

- Water-based and eco-friendly adhesives will gain increased preference due to regulations.

- Epoxy and polyurethane segments will maintain dominance across major applications.

- Metal and composite substrates will remain the primary focus for structural bonding.

- Solvent-based adhesives will see gradual replacement by sustainable formulations.

- Industrial manufacturing and electronics sectors will drive new growth opportunities.

- Innovation in hybrid and UV-curable adhesives will expand specialized applications.

- Strategic partnerships and mergers among key players will enhance market presence.

- Increasing emphasis on durability, safety, and performance will guide product development.a

Market Segmentation Analysis:

Market Segmentation Analysis: