Market Overview:

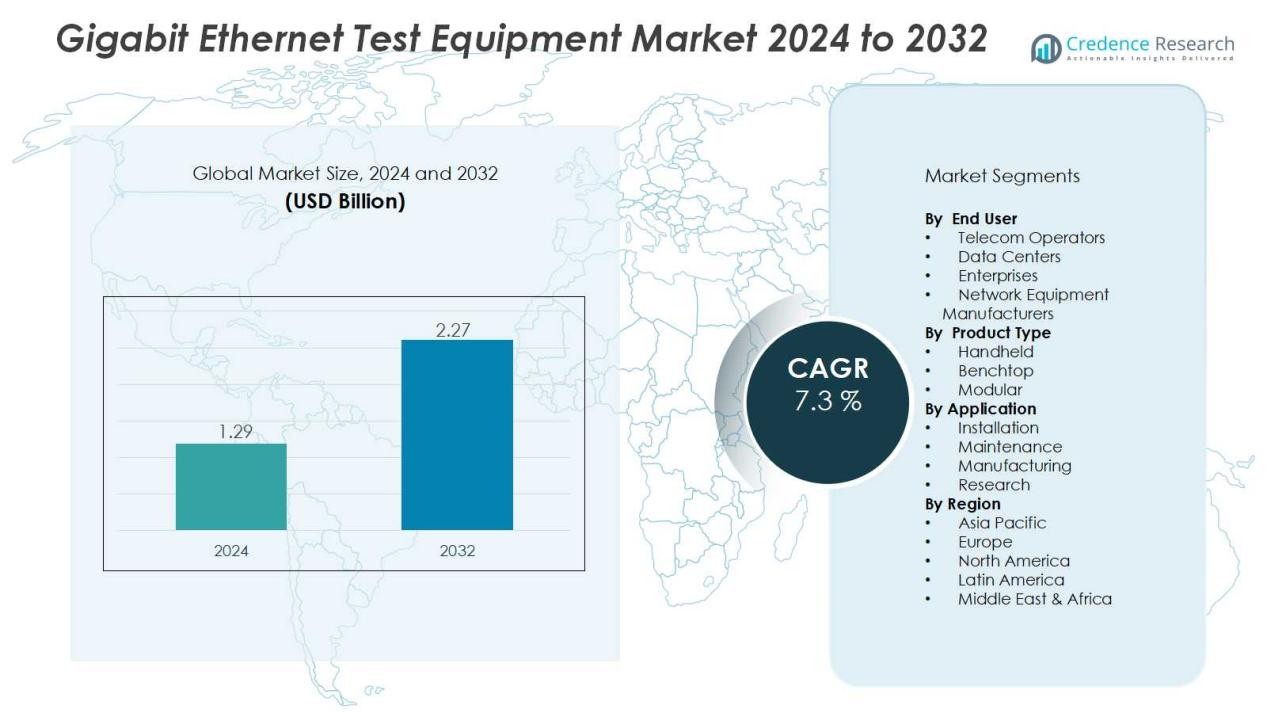

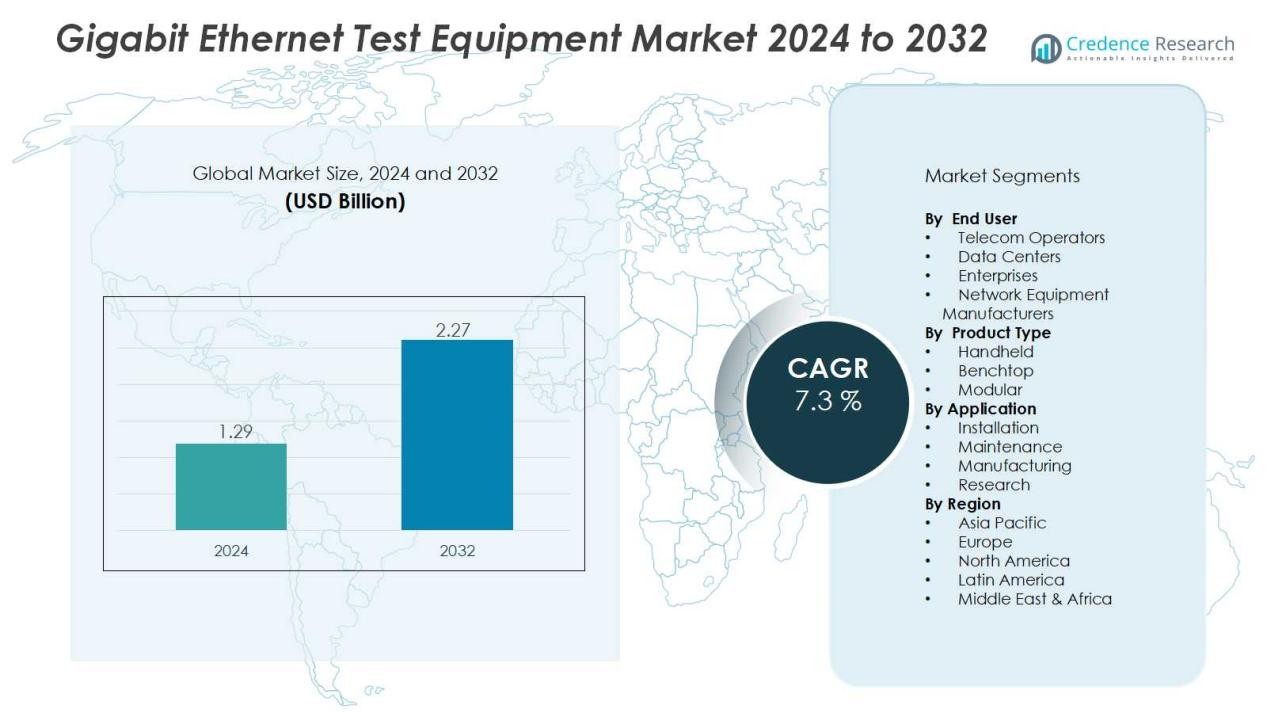

The Gigabit Ethernet Test Equipment Market size was valued at USD 1.29 billion in 2024 and is anticipated to reach USD 2.27 billion by 2032, at a CAGR of 7.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gigabit Ethernet Test Equipment Market Size 2024 |

USD 1.29 Billion |

| Gigabit Ethernet Test Equipment Market, CAGR |

7.3 % |

| Gigabit Ethernet Test Equipment Market Size 2032 |

USD 2.27 Billion |

Key drivers fueling the market include increasing deployment of 5G networks, cloud computing growth, and the expansion of hyperscale data centers. Rising adoption of IoT, edge computing, and video streaming services further boosts the need for advanced testing solutions to ensure low latency and network stability. Additionally, demand for automated, portable, and software-driven testing tools is strengthening, as enterprises seek efficiency, accuracy, and faster validation cycles for network performance.

Regionally, North America holds a major share due to advanced telecom infrastructure and strong investments in 5G rollouts. Europe follows with significant adoption in enterprise networks and government-supported digital initiatives. Asia-Pacific is the fastest-growing region, driven by large-scale digital transformation in China, India, and Southeast Asia, along with rapid growth in internet users and data traffic. Latin America and the Middle East & Africa also present emerging opportunities with rising telecom investments and IT modernization efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The gigabit ethernet test equipment market was valued at USD 1.29 billion in 2024 and is projected to reach USD 2.27 billion by 2032 at a CAGR of 7.3%.

- Rising 5G deployment drives strong demand as operators depend on advanced tools to validate network speed, reliability, and scalability.

- Expansion of data centers and cloud services fuels adoption, with enterprises requiring robust validation for low-latency and secure data transfer.

- IoT and edge computing integration boosts the need for high-speed testing solutions to ensure real-time interoperability and network stability.

- Shift toward automation and software-defined networking strengthens market growth as organizations demand scalable and AI-driven test platforms.

- High equipment costs and rapid technological changes pose challenges, particularly in emerging markets with limited budgets and resources.

- North America leads with 36% market share, Europe holds 28%, and Asia-Pacific accounts for 25% while emerging as the fastest-growing region.

Market Drivers:

Rising Demand from 5G Deployment and Telecom Expansion:

The gigabit ethernet test equipment market benefits from rapid 5G network deployment worldwide. Telecom operators rely on advanced test solutions to validate network speed, reliability, and scalability. Growing consumer demand for high-bandwidth services such as UHD streaming, online gaming, and real-time communication creates pressure for stronger testing frameworks. It ensures seamless connectivity while reducing downtime during large-scale rollouts.

- For instance, Sierra Wireless 5G modems connected to Intel NUC mini PCs have been used in automated testing pipelines running every 6 hours for over 6 months, exchanging downlink UDP traffic at rates up to 30 Mbps to validate Open RAN gNB performance.

Growth of Data Centers and Cloud Infrastructure:

The market gains strong momentum from the expansion of data centers and cloud services. Enterprises and hyperscale operators require robust testing to maintain secure, efficient, and low-latency data transfer. Increasing workloads, driven by SaaS platforms and storage solutions, demand consistent gigabit-level performance validation. The gigabit ethernet test equipment market supports this transition by ensuring smooth operations across hybrid and multi-cloud environments.

- For instance, in March 2025, Keysight Technologies launched DCA-M sampling oscilloscopes that enable testing of optical transceivers with bandwidths up to 1.6 Tbps and jitter performance below 90 femtoseconds, significantly enhancing gigabit ethernet validation capabilities.

Rising Adoption of IoT and Edge Computing Applications:

The integration of IoT devices and edge computing boosts the demand for network testing equipment. Billions of connected devices require high-speed communication with minimal latency for real-time analytics. The market plays a critical role in verifying interoperability, performance, and stability across diverse device ecosystems. It ensures that industrial automation, smart cities, and connected healthcare solutions function effectively at scale.

Increasing Focus on Automation and Software-Defined Networking :

The market experiences growth through the shift toward automated and software-defined networks. Organizations seek advanced test tools that reduce manual intervention while improving accuracy and speed. Integration of AI-driven analytics and virtual testing platforms further supports network agility. The gigabit ethernet test equipment market addresses these needs by enabling scalable validation processes that align with evolving enterprise and telecom infrastructures.

Market Trends:

Integration of Advanced Technologies and Virtualized Testing Platforms:

The gigabit ethernet test equipment market is witnessing a clear trend toward advanced technologies that enhance testing efficiency and scalability. Vendors are introducing solutions integrated with AI, machine learning, and automation to analyze network performance in real time. Virtualized testing platforms are gaining traction as enterprises shift toward cloud-native environments and remote operations. It helps organizations reduce dependency on physical infrastructure while ensuring cost efficiency. Growing adoption of 400G and 800G networks further accelerates the demand for equipment capable of multi-gigabit validation. The trend highlights the industry’s focus on future-ready solutions that support both current and next-generation network requirements.

- For instance, Spirent’s B2 800G test appliance supports 1x800G alongside different PAM4 modes adhering to Ethernet Technology Consortium 800GBASE-R standards, delivering high-density multi-rate testing that validates forwarding performance, MAC capacity, and latency with integrated end-to-end functionality.

Rising Demand for Portable, Software-Driven, and Energy-Efficient Solutions:

The market is also shaped by the rising preference for portable, software-driven, and energy-efficient test equipment. Enterprises and telecom operators are moving toward handheld devices and modular systems that provide flexibility in field testing. It addresses the growing need for mobility and real-time troubleshooting across complex networks. Demand for software-defined solutions enables faster updates and integration with existing IT ecosystems. Sustainability has become a priority, pushing vendors to design energy-efficient systems that lower operating costs and environmental impact. The gigabit ethernet test equipment market reflects these changes by delivering versatile products that combine portability, advanced analytics, and greener technology choices.

- For instance, Viavi Solutions’ T-BERD/MTS-5800-100G platform offers the industry’s smallest handheld dual-port 100G test instrument with capabilities including nanosecond-accurate latency measurements and support for 10 Mbps to 100 G interfaces, enabling technicians to perform comprehensive fiber and Ethernet testing on-site with a 100G maximum testing rate.

Market Challenges Analysis:

High Costs and Complexities of Advanced Testing Solutions:

The gigabit ethernet test equipment market faces challenges due to the high cost of advanced systems. Enterprises and telecom operators often struggle to justify large investments, especially in price-sensitive regions. It becomes more complex when testing needs involve multi-gigabit or terabit speeds, requiring specialized hardware and skilled professionals. Smaller companies find it difficult to match the technological investments of larger players. Rapid technological evolution also shortens product lifecycles, pushing organizations to make frequent upgrades. These factors collectively limit widespread adoption, particularly in emerging markets.

Standardization Gaps and Rapid Network Evolution:

Another key challenge lies in the lack of universal standards across global networks. Frequent changes in network protocols and technologies create compatibility issues for testing equipment. It demands continuous updates from vendors, raising development costs and extending time-to-market. The fast pace of network transformation, including the shift to 400G and beyond, often outpaces existing testing capabilities. Enterprises also face skill gaps, making it difficult to operate and maintain advanced tools effectively. The gigabit ethernet test equipment market must address these issues to ensure long-term relevance and scalability.

Market Opportunities:

Expansion of 5G, Cloud, and Data Center Ecosystems:

The gigabit ethernet test equipment market holds strong opportunities in the expansion of 5G, cloud, and data center ecosystems. Growing reliance on high-speed connectivity for applications such as streaming, remote work, and enterprise solutions creates demand for advanced validation tools. It enables operators and service providers to ensure reliability, low latency, and uninterrupted performance across large-scale deployments. Rising investments in hyperscale data centers further strengthen opportunities for equipment capable of multi-gigabit and terabit testing. Governments and private enterprises are also supporting digital infrastructure upgrades, enhancing long-term market prospects. This environment provides significant growth potential for vendors with innovative, future-ready testing solutions.

Growing Role of IoT, Edge Computing, and Emerging Technologies:

Emerging applications in IoT, edge computing, and AI-driven services present new revenue streams for the market. Billions of connected devices require high-speed, stable networks, creating strong opportunities for advanced test solutions. It ensures real-time interoperability, scalability, and efficiency across industries such as healthcare, manufacturing, and smart cities. The shift toward software-defined networking and network function virtualization expands opportunities for flexible and software-driven testing platforms. Sustainability-focused initiatives also encourage the adoption of energy-efficient solutions, adding another dimension of growth. The gigabit ethernet test equipment market is well-positioned to capitalize on these developments and drive innovation forward.

Market Segmentation Analysis:

By Product:

The gigabit ethernet test equipment market is segmented into handheld, benchtop, and modular systems. Handheld devices gain traction for field applications, offering portability and real-time troubleshooting. Benchtop solutions remain dominant in laboratories and R&D centers due to precision and advanced features. Modular systems attract enterprises seeking scalable solutions that adapt to evolving network demands. It supports a balanced product landscape catering to both field and lab-based testing requirements.

- For instance, VIAVI Solutions’ T-BERD/MTS-5800-100G handheld tester supports comprehensive rate testing from 1.5M to 112G OTU4 and achieves nanosecond-accurate latency measurements, enabling technicians to perform network activation and troubleshooting effectively onsite with the industry’s fastest RFC 2544 test suite.

By Application:

Key applications include installation, maintenance, manufacturing, and research. Installation and maintenance represent the largest share, driven by growing demand for reliable network deployment and troubleshooting. Manufacturing benefits from integration into quality control processes for telecom and data equipment. Research applications expand with rising investment in next-generation networks and advanced test protocols. It enables comprehensive validation across diverse use cases, reinforcing the relevance of test equipment.

- For instance, Fujitsu has completed over 3,600 network deployment projects globally with a 99.3% on-time delivery rate, demonstrating their capacity to support efficient and scalable network installations and maintenance operations.

By End User:

End users include telecom operators, data centers, enterprises, and network equipment manufacturers. Telecom operators lead adoption with a focus on validating 5G and high-speed broadband infrastructure. Data centers follow with rising demand for multi-gigabit and low-latency connections. Enterprises invest in testing tools to secure IT operations and cloud-based applications. The gigabit ethernet test equipment market also supports manufacturers by ensuring performance compliance and interoperability.

Segmentations:

By Product:

- Handheld

- Benchtop

- Modular

By Application:

- Installation

- Maintenance

- Manufacturing

- Research

By End User:

- Telecom Operators

- Data Centers

- Enterprises

- Network Equipment Manufacturers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds a market share of 36% in the gigabit ethernet test equipment market, supported by strong telecom infrastructure and advanced enterprise adoption. The United States leads with significant investments in 5G deployment, hyperscale data centers, and cloud services. It benefits from established technology vendors and ongoing digital transformation across industries such as finance, healthcare, and retail. Growth in video streaming and enterprise collaboration tools also drives demand for high-speed testing solutions. Canada contributes through government-backed broadband expansion projects and rising adoption of smart city initiatives. These factors collectively maintain North America’s position as a key revenue generator for the market.

Europe:

Europe holds a market share of 28%, supported by strong regulatory frameworks and widespread adoption of advanced networks. The gigabit ethernet test equipment market benefits from the region’s focus on digitalization, cybersecurity, and industrial automation. It is reinforced by initiatives like the European Union’s digital strategy and ongoing investments in 5G infrastructure. Germany, France, and the U.K. lead the market, driven by demand from automotive, manufacturing, and enterprise sectors. Growing preference for green and energy-efficient solutions also shapes product development in the region. These conditions support steady growth and innovation across European markets.

Asia-Pacific:

Asia-Pacific accounts for 25% market share and stands as the fastest-growing region in this industry. China leads with massive investments in telecom networks, data centers, and IoT integration. The gigabit ethernet test equipment market in India and Southeast Asia is expanding with government-led digital initiatives and a rising internet user base. It also benefits from the region’s rapid industrialization and strong demand for smart infrastructure. Japan and South Korea drive adoption through early deployment of advanced 5G networks and enterprise IT upgrades. This momentum positions Asia-Pacific as the next major growth hub for the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Anritsu

- Fluke Networks

- Exfo

- GAO Tek

- MultiLane

- Keysight Technologies

- Rohde & Schwarz

- Tektronix

- Spirent Communication

- Viavi Solutions

Competitive Analysis:

The gigabit ethernet test equipment market is highly competitive with leading players driving innovation and expanding product capabilities. Key companies include Anritsu, Fluke Networks, Exfo, GAO Tek, MultiLane, Keysight Technologies, and Rohde & Schwarz. These firms focus on delivering advanced solutions that meet the demands of telecom operators, data centers, and enterprises. It emphasizes precision, automation, and scalability to support multi-gigabit and terabit-level testing. Vendors actively invest in R&D to develop portable, software-defined, and energy-efficient equipment. Partnerships and acquisitions strengthen global reach while aligning product portfolios with emerging technologies such as 5G, IoT, and edge computing. Competitive differentiation is shaped by reliability, cost efficiency, and the ability to integrate seamlessly into evolving digital infrastructures.

Recent Developments:

- In September 2025, Keysight Technologies introduced two new millimeter-wave frequency extender modules and a precision calibration kit targeting next-generation wireless, defense, and semiconductor markets.

- In July 2025, Rohde & Schwarz acquired ZES ZIMMER Electronic Systems GmbH, expanding its test and measurement portfolio for power electronics focused on electromobility, industrial electronics, and renewable energy sectors.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The gigabit ethernet test equipment market will continue to evolve with the expansion of 5G and advanced telecom networks.

- Vendors will prioritize AI-driven analytics and automation to enhance testing efficiency and reduce manual intervention.

- Cloud computing growth will create strong demand for scalable, software-defined, and virtualized testing solutions.

- Data center expansion worldwide will push enterprises to adopt multi-gigabit and terabit validation systems.

- IoT and edge computing adoption will require advanced tools to ensure real-time communication and interoperability.

- Sustainability-focused enterprises will increasingly prefer energy-efficient and eco-friendly test equipment.

- Vendors will explore portable and modular solutions to support field testing and on-site troubleshooting.

- Cybersecurity concerns will drive the need for equipment capable of validating secure and resilient networks.

- Global digital transformation initiatives will encourage governments and enterprises to invest in modernized testing infrastructure.

- The gigabit ethernet test equipment market will see consolidation as leading players expand through partnerships and acquisitions.