Market Overview

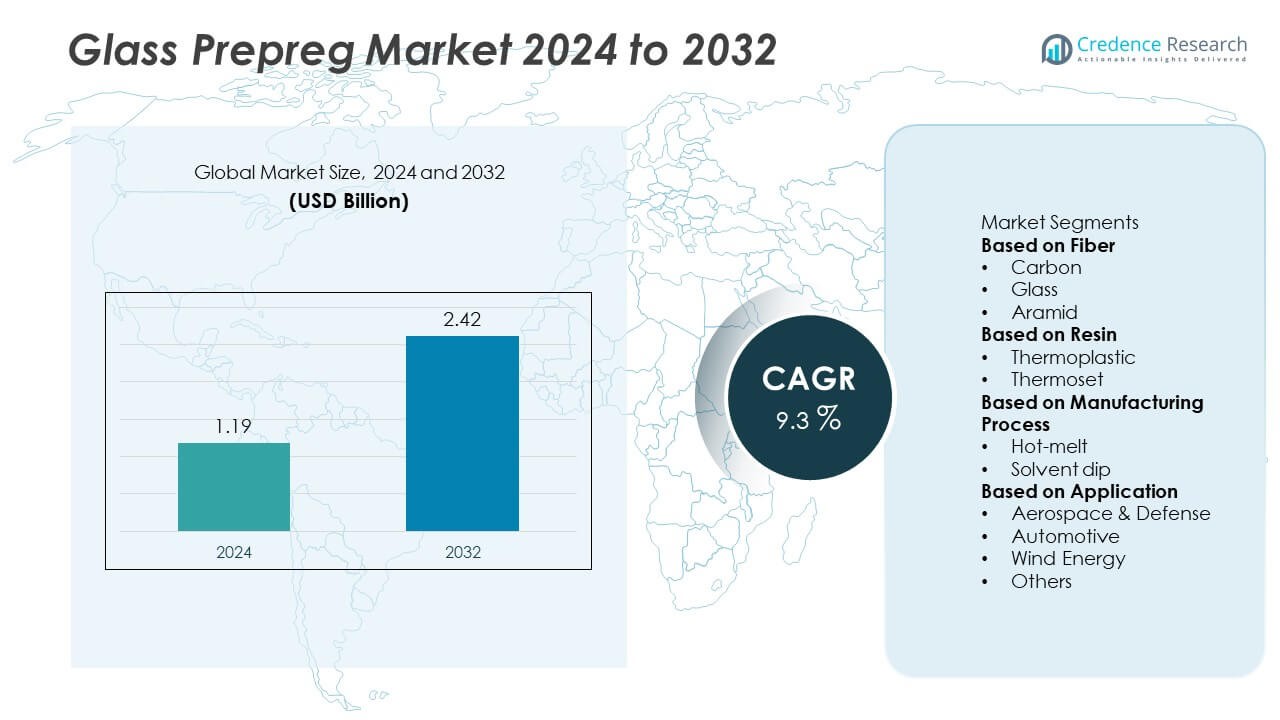

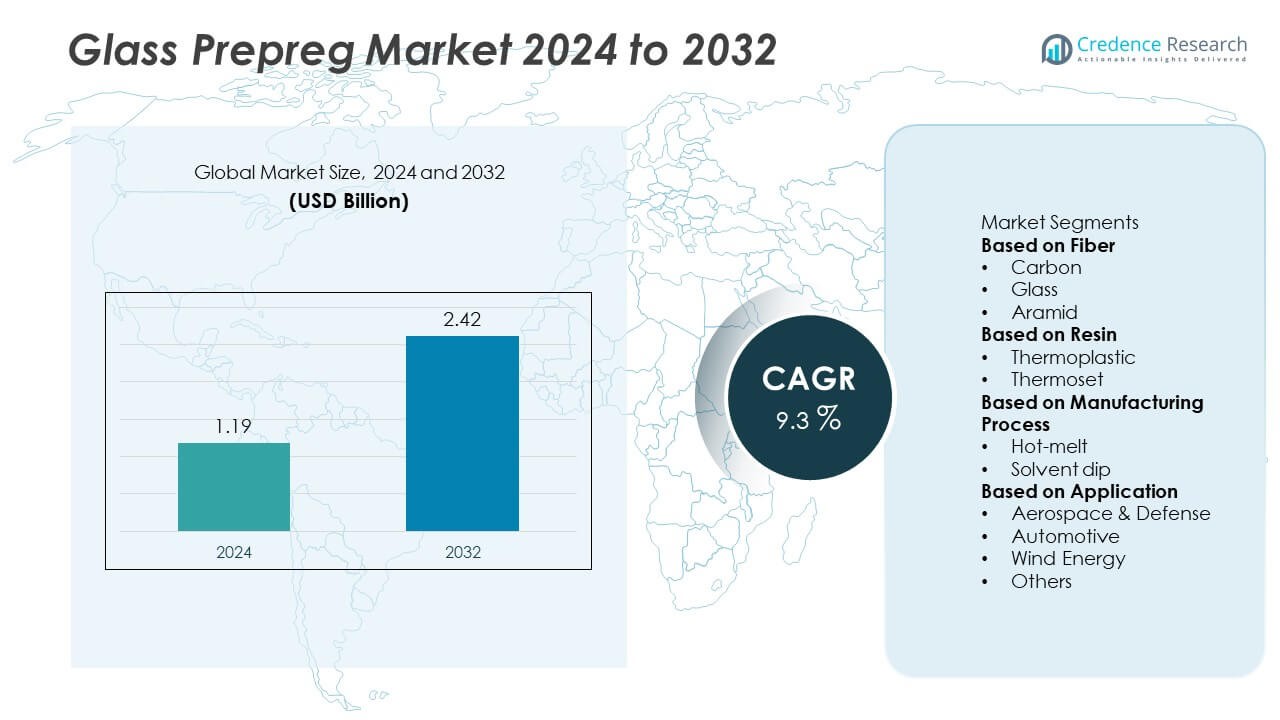

The global glass prepreg market was valued at USD 1.19 billion in 2024 and is projected to reach USD 2.42 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Prepreg Market Size 2024 |

USD 1.19 Billion |

| Glass Prepreg Market, CAGR |

9.3% |

| Glass Prepreg Market Size 2032 |

USD 2.42 Billion |

The glass prepreg market is dominated by key companies such as Toray Industries, Hexcel Corporation, Gurit Holding, Teijin Limited, Axiom Materials, Mitsubishi Rayon Co. Ltd., SGL Group, Royal Ten Cate NV, Park Electrochemical Corp., and Cytec Industries. These players lead through strong R&D capabilities, advanced manufacturing systems, and extensive global distribution networks. North America remains the leading region, accounting for 36% of the total market share in 2024, supported by robust aerospace and defense production. Asia-Pacific follows with 30% share, driven by rapid industrialization, wind energy expansion, and automotive lightweighting initiatives across China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global glass prepreg market was valued at USD 1.19 billion in 2024 and is projected to reach USD 2.42 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

- Growing demand from aerospace, defense, and wind energy sectors drives market expansion, with the glass fiber segment holding a 56% share due to its strength, durability, and cost-effectiveness.

- Key trends include the adoption of sustainable, recyclable composites and automation in prepreg production to improve quality and reduce waste.

- Major players such as Toray Industries, Hexcel Corporation, Gurit Holding, and Teijin Limited compete through product innovation, automation investments, and strategic partnerships across aerospace and renewable applications.

- North America leads the market with 36% share, followed by Asia-Pacific at 30% and Europe at 28%, while Latin America (4%) and Middle East & Africa (2%) show emerging potential supported by renewable energy and infrastructure growth.

Market Segmentation Analysis:

By Fiber

The glass fiber segment dominated the glass prepreg market in 2024, accounting for nearly 56% share. Its leadership stems from its high strength-to-weight ratio, corrosion resistance, and cost efficiency compared to carbon or aramid fibers. Glass prepregs are widely adopted in aerospace, wind energy, and automotive applications for structural reinforcement and lightweight design. Continuous innovations in E-glass and S-glass fiber types enhance thermal stability and mechanical properties. Manufacturers are expanding production capacities to meet rising demand for sustainable and high-performance composite materials in industrial and transport sectors.

- For instance, Owens Corning developed its Advantex E-glass fiber, which offers improved corrosion resistance compared to traditional E-glass. The company supplies glass fiber materials, such as its Ultrablade fabrics, to the wind blade manufacturing industry.

By Resin

The thermoset resin segment held the largest share of about 63% in 2024. Epoxy-based thermoset prepregs are preferred for their superior adhesion, chemical resistance, and dimensional stability. They are extensively used in aerospace and defense components, where high-temperature performance and durability are critical. Advancements in curing systems and resin formulations further improve processability and strength-to-weight ratios. Key producers are also focusing on low-VOC and recyclable resin chemistries to meet stringent environmental regulations. The thermoplastic resin segment, though smaller, is growing rapidly due to its reprocessability and reduced production cycle times.

- For instance, Hexcel Corporation’s HexPly M91 epoxy prepreg supports curing at 180°C, meets stringent aerospace-grade specifications for primary structures, and demonstrates excellent toughness, including very high residual compression after impact (CAI).

By Manufacturing Process

The hot-melt process segment led the market in 2024 with approximately 68% share. This dominance is attributed to its solvent-free nature, uniform resin distribution, and better control over fiber impregnation. The method enables consistent product quality and minimal environmental impact, aligning with sustainability goals in composite manufacturing. Hot-melt prepregs are widely used in aircraft structures, wind turbine blades, and sports equipment due to their superior mechanical performance. Increasing adoption of automation and precision machinery in production lines further strengthens this segment’s position in the global glass prepreg market.

Key Growth Drivers

Rising Demand from Aerospace and Defense Sector

The aerospace and defense industry remains the primary growth driver for the glass prepreg market. Glass prepregs offer high tensile strength, fatigue resistance, and lightweight properties, making them ideal for aircraft interiors, radomes, and structural components. Expanding aircraft production and increasing investments in next-generation military aircraft boost consumption. Companies such as Airbus and Boeing are integrating glass prepregs to reduce fuel consumption and enhance structural efficiency. The sector’s focus on advanced composite materials continues to drive steady market growth globally.

- For instance, Airbus relies on Hexcel composite materials, including HexPly® prepregs, for components on aircraft such as the A320neo, A350 XWB, and A380. These advanced composites contribute to significant weight savings, increased durability, and enhanced fuel efficiency.

Expansion of Wind Energy Installations

Rapid growth in wind energy projects significantly increases demand for glass prepregs used in turbine blades. Their high stiffness, moisture resistance, and dimensional stability make them suitable for large rotor designs. Global efforts toward renewable energy adoption and government incentives for clean power projects further strengthen this trend. Manufacturers are developing long, lightweight blades using glass prepregs to improve power efficiency. The shift toward sustainable energy generation continues to accelerate the segment’s demand in major regions such as China, the U.S., and Germany.

- For instance, LM Wind Power, a GE Renewable Energy company, manufactured a 107-meter turbine blade for the Haliade-X offshore wind turbine, using a combination of fiberglass, carbon fibers, and wood fused with a special resin for enhanced performance and efficiency.

Growth in Automotive Lightweighting Initiatives

Automotive manufacturers are increasingly using glass prepregs to reduce vehicle weight and improve fuel efficiency. The material provides superior mechanical strength and crash resistance, supporting compliance with emission and safety standards. Electric vehicle production amplifies this trend, as lightweight components help extend battery range. Companies like BMW and Toyota are integrating prepreg-based parts into structural and interior components. Continuous innovation in high-speed curing and cost-effective manufacturing processes further enhances the adoption of glass prepregs in automotive design and engineering.

Key Trends and Opportunities

Shift Toward Sustainable and Recyclable Composites

A growing focus on environmental sustainability is driving research into recyclable and low-emission prepreg materials. Manufacturers are adopting bio-based resins and solvent-free processes to minimize environmental impact. The development of thermoplastic glass prepregs offers reusability and lower waste generation, aligning with circular economy goals. Global aerospace and automotive OEMs are also prioritizing sustainable supply chains. These eco-friendly material advancements open new opportunities for market expansion while meeting stricter global environmental and regulatory standards.

- For instance, Solvay (now Syensqo) offers CYCOM® 5320-1, a toughened epoxy resin prepreg system designed for out-of-autoclave (OOA) manufacturing of primary aerospace structures. It is known for producing autoclave-quality parts with low porosity and providing excellent hot/wet and notched mechanical properties after curing.

Advancements in Manufacturing Automation

Automation and precision control in prepreg manufacturing are enhancing product consistency and production efficiency. Robotic handling, inline quality monitoring, and automated fiber placement reduce human error and production time. These improvements enable cost-effective mass production of complex composite structures for aerospace, wind energy, and sports sectors. The integration of digital manufacturing technologies such as AI-driven process control and predictive maintenance creates opportunities for faster scaling and improved profitability across the global glass prepreg supply chain.

- For instance, Toray Industries utilizes automated systems and AI-based defect detection in its manufacturing processes. The company is a major producer of advanced materials like carbon fiber and prepregs.

Key Challenges

High Production Costs and Complex Processing

The manufacturing of glass prepregs involves high material and equipment costs, limiting adoption among small-scale producers. Complex curing and storage requirements add further operational expenses. Additionally, the need for temperature-controlled handling during transportation increases logistics costs. These factors restrict the market’s ability to scale rapidly, especially in developing regions. Continuous innovation in resin chemistry and automated processing technologies is essential to reduce costs and enhance manufacturing efficiency across industries.

Limited Recycling and Disposal Infrastructure

Recycling of glass prepreg waste remains a major challenge due to the cross-linked structure of thermoset resins. Disposal of end-of-life components poses environmental risks, especially in aerospace and wind turbine applications. Current recycling technologies are energy-intensive and economically inefficient. The absence of large-scale infrastructure for composite waste management restricts sustainable growth. To address this, industry leaders are investing in mechanical recycling and pyrolysis methods to recover fibers and resins, promoting a circular economy for composite materials.

Regional Analysis

North America

North America held the largest share of 36% in the glass prepreg market in 2024. The region’s dominance stems from strong aerospace production and defense investments in the U.S. and Canada. Growing use in wind turbine manufacturing and electric vehicle components further supports market expansion. Major companies such as Hexcel Corporation and Toray Advanced Composites drive innovation through automated prepreg production and lightweight material development. Favorable government policies for renewable energy and advanced manufacturing continue to strengthen the region’s leadership position across multiple industrial sectors.

Europe

Europe accounted for 28% share of the glass prepreg market in 2024, led by the aerospace, automotive, and wind energy industries. Countries such as Germany, France, and the U.K. are major contributors due to established composite manufacturing infrastructure. The European Union’s decarbonization initiatives and regulations promoting sustainable materials accelerate adoption. Wind turbine blade production across Denmark and Spain also boosts regional demand. Key players including Gurit Holding AG and Solvay S.A. invest heavily in recyclable resin technologies and automated prepreg systems to meet performance and environmental goals.

Asia-Pacific

Asia-Pacific held 30% of the glass prepreg market in 2024, emerging as the fastest-growing regional segment. Rapid industrialization, expanding aerospace manufacturing in China and India, and growing wind power installations drive strong demand. Japan and South Korea also contribute through automotive lightweighting initiatives and electronics applications. Regional manufacturers such as Mitsubishi Chemical Corporation and Teijin Limited are investing in large-scale prepreg facilities. Government programs promoting renewable energy and high-performance materials further support market expansion, positioning Asia-Pacific as a critical hub for global composite supply and innovation.

Latin America

Latin America captured 4% share of the glass prepreg market in 2024. Brazil and Mexico dominate due to rising demand from wind energy, automotive, and construction sectors. Growing renewable energy investments and industrial modernization initiatives support market adoption. Local manufacturers are expanding composite capabilities to meet regional infrastructure and transportation needs. Partnerships with international suppliers help improve access to advanced prepreg technologies. The increasing use of lightweight materials in electric mobility and marine applications strengthens Latin America’s long-term potential within the global glass prepreg market.

Middle East & Africa

The Middle East & Africa accounted for 2% share of the global glass prepreg market in 2024. Regional growth is supported by increasing investment in wind energy, defense, and construction projects. The UAE and Saudi Arabia are emerging hubs for composite material adoption in aerospace and infrastructure applications. Government diversification plans, including Vision 2030, encourage local production of advanced materials. Expanding renewable energy projects across South Africa and Morocco further boost regional demand. Though small in size, the market shows strong prospects for future industrial and energy applications.

Market Segmentations:

By Fiber

By Resin

By Manufacturing Process

By Application

- Aerospace & Defense

- Automotive

- Wind Energy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the glass prepreg market is characterized by the presence of major players such as Gurit Holding, Hexcel Corporation, Axiom Materials, Mitsubishi Rayon Co. Ltd., SGL Group, Teijin Limited, Park Electrochemical Corp., Royal Ten Cate NV, Toray Industries, and Cytec Industries. These companies focus on expanding their product portfolios through technological innovations and strategic partnerships to meet growing demand across aerospace, automotive, and renewable energy sectors. Leading manufacturers are investing in automation, resin formulation advancements, and sustainable composite materials to enhance production efficiency and environmental performance. Many players are also integrating digital manufacturing technologies to improve process consistency and reduce waste. Mergers, acquisitions, and regional expansions remain key strategies for strengthening global supply networks and market reach. Continuous R&D efforts in high-strength, low-weight, and recyclable glass prepreg formulations are expected to sustain the competitive intensity and drive further product differentiation in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, SGL Carbon announced the manufacture of natural fiber prepregs for motorsports applications, marking a significant step towards sustainable materials in high-performance industries.

- In June 2025, Hexcel showcased its next-generation HexPly® M51 prepreg technology at the Paris Air Show. This innovation is designed for automated and fast processing to meet future high-rate parts production.

- In April 2025, Teijin announced the availability of DPP-compliant composite products, including glass fiber-reinforced materials.

Report Coverage

The research report offers an in-depth analysis based on Fiber, Resin, Manufacturing Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The glass prepreg market is expected to maintain strong growth driven by aerospace, automotive, and renewable energy applications.

- Increasing aircraft production and electric vehicle adoption will boost demand for lightweight composite materials.

- Growing wind energy installations will enhance usage of glass prepregs in turbine blade manufacturing.

- Manufacturers will focus on recyclable and bio-based resin systems to meet environmental regulations.

- Automation in prepreg manufacturing will improve consistency, reduce costs, and expand mass production capacity.

- Strategic partnerships and mergers will strengthen global supply chains and regional market penetration.

- North America will retain leadership with 36% share, supported by strong aerospace manufacturing.

- Asia-Pacific will record the fastest growth with 30% share, driven by industrialization and energy expansion.

- Europe will focus on sustainability and wind energy, maintaining a 28% market share.

- Continuous R&D in high-performance fiber and resin technologies will shape future material innovations.