Market Overview

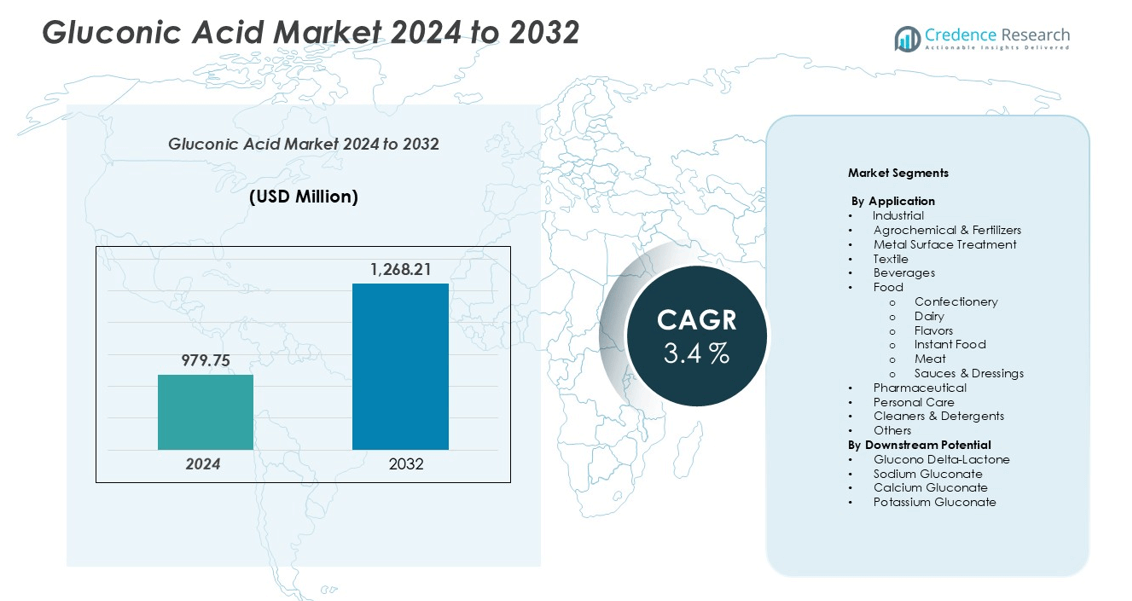

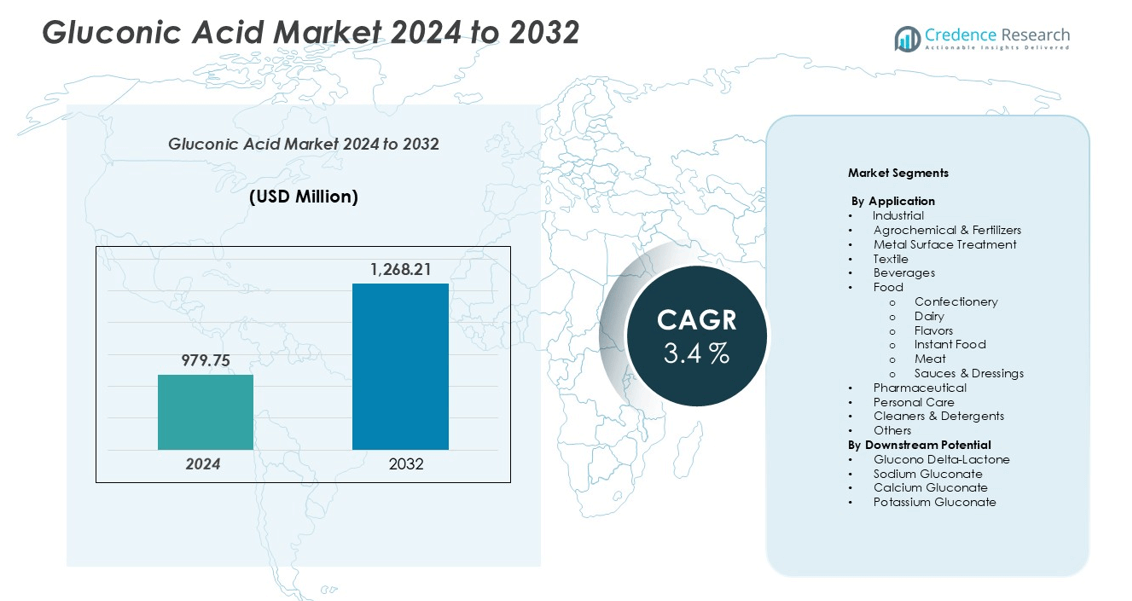

The gluconic acid market size was valued at USD 979.75 million in 2024 and is anticipated to reach USD 1,268.21 million by 2032, growing at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gluconic Acid Market Size 2024 |

USD 979.75 million |

| Gluconic Acid Market, CAGR |

3.4% |

| Gluconic Acid Market Size 2032 |

USD 1,268.21 million |

The global gluconic acid market is led by prominent players such as Jungbunzlauer, Evonik, Merck Millipore, Fuso Chemical Co., Ltd., PMP Fermentation Products, Inc., Prathista, R-Biopharm AG, Alfa Chemistry, TCI Chemicals, and Toronto Research Chemicals Inc. These companies dominate through advanced fermentation technologies, sustainable production processes, and diverse product portfolios catering to food, pharmaceutical, and industrial applications. Asia-Pacific is the leading regional market, accounting for approximately 38% of global revenue in 2024, driven by large-scale industrial production, rising demand for eco-friendly additives, and expanding food processing industries in China and India. North America and Europe collectively contribute about 53%, supported by strong regulatory frameworks and growing adoption of bio-based chemicals.

Market Insights

- The global gluconic acid market was valued at USD 979.75 million in 2024 and is projected to reach USD 1,268.21 million by 2032, growing at a CAGR of 3.4% during the forecast period.

- Rising demand for eco-friendly and biodegradable chemicals across food, beverage, and industrial applications is a key driver supporting market growth globally.

- Market trends highlight increasing adoption of bio-based production technologies, growing use of gluconic acid derivatives in pharmaceuticals and personal care, and expanding industrial applications of sodium gluconate.

- The market is moderately competitive, with major players such as Jungbunzlauer, Evonik, Merck Millipore, and Fuso Chemical Co., Ltd. focusing on innovation and sustainable fermentation processes; however, high production costs remain a restraint.

- Asia-Pacific dominates the market with 38% share, followed by North America (28%) and Europe (25%), while the food segment leads application demand, accounting for the largest market share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The gluconic acid market, by application, is broadly categorized into industrial, agrochemical & fertilizers, metal surface treatment, textile, beverages, food, pharmaceutical, personal care, cleaners & detergents, and others. Among these, the food segment dominated the market in 2024, accounting for the largest share due to its extensive use as an acidity regulator, preservative, and stabilizer in various food products. Within food applications, dairy and confectionery sub-segments led demand, driven by rising consumption of processed and functional foods, and increasing preference for natural ingredients in food formulations.

- For instance, Shandong Fuyang Bio-Tech Co., Ltd. has an annual production capacity of 150,000 tons of sodium gluconate, a key ingredient in food and other applications, leveraging its advanced fermentation technology to meet growing demand.

By Downstream Potential

Based on downstream potential, the market is segmented into glucono delta-lactone, sodium gluconate, calcium gluconate, and potassium gluconate. Among these, sodium gluconate dominated the market, capturing the highest share in 2024. Its extensive use in concrete admixtures, metal cleaning, and water treatment processes drives demand from construction and industrial sectors. The glucono delta-lactone sub-segment is also gaining traction in food processing and cosmetics due to its multifunctional properties as a coagulant, acidulant, and curing agent, aligning with the rising demand for sustainable and biodegradable chemical alternatives.

- For instance, BASF’s MasterGlenium 3030 admixture uses sodium gluconate-based retarders, supporting the production of over 200,000 cubic meters of high-performance concrete annually.

Key Growth Drivers

Rising Demand for Eco-friendly and Biodegradable Chemicals

The increasing global emphasis on sustainability and green chemistry is a major driver of the gluconic acid market. Derived through fermentation of glucose, gluconic acid is biodegradable, non-toxic, and environmentally safe, making it a preferred alternative to synthetic chemicals in food processing, cleaning, and industrial applications. Industries are increasingly replacing harmful chelating agents such as EDTA with gluconic acid derivatives due to their lower environmental impact. Moreover, regulatory support promoting the use of bio-based chemicals in Europe and North America is accelerating market adoption. The transition toward circular economy practices in the chemical sector continues to enhance the consumption of gluconic acid and its derivatives across multiple end-use industries.

- For instance, Shandong Fuyang Bio-Tech Co., Ltd. has an annual production capacity of 150,000 to 200,000 tons of sodium gluconate, utilizing advanced fermentation technology to meet the growing demand for eco-friendly chemicals.

Expanding Food and Beverage Industry Applications

The food and beverage industry represents one of the largest consumers of gluconic acid, primarily due to its role as an acidity regulator, preservative, and flavor enhancer. Growing consumer preference for processed, fortified, and clean-label food products is significantly boosting demand. Gluconic acid and its salts, such as calcium gluconate, are increasingly used in dairy products, beverages, and confectioneries for mineral fortification and pH stabilization. The rising popularity of functional and health-oriented foods further supports this demand. Additionally, expanding global food processing capacities and stringent food safety standards are compelling manufacturers to adopt naturally derived additives, reinforcing gluconic acid’s market growth across both developed and emerging economies.

- For instance, Corbion manufactures ingredients like gluconates and lactic acid derivatives for the food and beverage industry.

Rising Industrial Utilization and Infrastructure Development

Gluconic acid’s strong chelating properties make it valuable in industrial sectors such as construction, metal surface treatment, and textile processing. Among its derivatives, sodium gluconate is widely used as a concrete admixture due to its superior corrosion inhibition and water-reducing capabilities. Rapid urbanization, growing infrastructure investments, and advancements in sustainable construction materials are driving the use of gluconic acid-based additives. Furthermore, in metal finishing and textile dyeing, gluconic acid helps prevent scaling and improves surface quality. The continued industrial shift toward eco-friendly process chemicals further enhances its relevance, positioning gluconic acid as a critical component in next-generation industrial formulations.

Key Trends & Opportunities

Increasing Focus on Bio-based Production Technologies

A key trend in the gluconic acid market is the development of cost-efficient and sustainable bio-based production methods. Manufacturers are investing in advanced microbial fermentation and enzymatic biocatalysis technologies to enhance yield and reduce energy consumption. For instance, improved glucose oxidase-based processes have achieved higher conversion efficiencies, making large-scale production more viable. The adoption of renewable feedstocks such as corn and sugarcane for fermentation aligns with global sustainability goals. This technological shift not only reduces dependency on petrochemical-based intermediates but also creates new opportunities for partnerships between biotechnology firms and chemical manufacturers seeking to expand their green product portfolios.

- For instance, Shandong Fuyang Bio-Tech Co., Ltd. uses advanced fermentation technology to produce sodium gluconate. The company is one of the largest manufacturers of this biodegradable and eco-friendly chemical, and has a current annual production capacity of 150,000 tons of sodium gluconate.

Growing Demand in the Pharmaceutical and Personal Care Sectors

The pharmaceutical and personal care industries are emerging as promising growth frontiers for gluconic acid and its derivatives. Calcium and zinc gluconate are widely used as dietary supplements, while glucono delta-lactone is gaining traction in skincare formulations for its mild exfoliating and pH-regulating properties. Rising health awareness and demand for fortified supplements are fueling market expansion in pharmaceuticals. Meanwhile, the personal care sector is adopting gluconic acid in natural and hypoallergenic product lines, driven by consumer preferences for safe and bio-derived ingredients. This trend provides substantial growth opportunities for manufacturers focusing on high-purity, specialty-grade gluconic acid.

- For instance, Hindustan Zinc Ltd. (HZL) is preparing for a significant expansion in its operations is accurate. This is based on multiple official announcements and reports released by the company throughout 2025 detailing ambitious plans to double its production capacity.

Key Challenges

High Production Costs and Process Complexity

Despite its growing popularity, gluconic acid production remains cost-intensive due to the fermentation process, downstream purification requirements, and raw material costs. Maintaining optimal microbial conditions and achieving consistent yields add operational complexity, which can limit profitability for small and mid-sized producers. Energy consumption during crystallization and drying stages further escalates manufacturing expenses. Additionally, fluctuations in feedstock prices, such as glucose or corn, can impact cost stability. Addressing these challenges requires continuous process innovation, adoption of advanced bioreactors, and economies of scale to make gluconic acid production more competitive against synthetic chemical alternatives.

Competition from Synthetic and Substitute Chemicals

The market faces strong competition from synthetic chelating agents and alternative organic acids, including citric and lactic acids, which are often more cost-effective. In industrial applications, these substitutes can perform similar functions, such as pH regulation and metal ion binding, at lower prices. Limited awareness among end users about gluconic acid’s long-term environmental and performance benefits further restricts adoption. Moreover, the lack of standardized regulatory frameworks in certain regions complicates market penetration. To overcome this challenge, manufacturers are increasingly focusing on product differentiation, application-specific formulations, and sustainability branding to strengthen their competitive positioning.

Regional Analysis

North America

North America held a significant share of the global gluconic acid market in 2024, accounting for around 28% of total revenue. The region’s growth is driven by strong demand from the food and beverage, pharmaceutical, and construction sectors. The U.S. leads market consumption, supported by advanced food processing industries and increasing adoption of eco-friendly cleaning agents. Strict environmental regulations encouraging biodegradable chemicals further strengthen market demand. Expanding applications of sodium gluconate in concrete admixtures and surface treatment processes, coupled with rising interest in natural and fortified food ingredients, are key factors sustaining market growth in the region.

Europe

Europe accounted for approximately 25% of the global gluconic acid market in 2024, driven by stringent environmental regulations and strong industrial adoption. Countries such as Germany, France, and the Netherlands dominate due to extensive usage in food preservation, water treatment, and personal care formulations. The region’s focus on green chemistry and sustainable product development supports the substitution of synthetic additives with bio-based alternatives. Additionally, European manufacturers are investing in biotechnology-based fermentation to enhance production efficiency. The expanding pharmaceutical and nutraceutical industries across the EU further reinforce gluconic acid demand, particularly for calcium and sodium gluconate derivatives.

Asia-Pacific

Asia-Pacific emerged as the dominant region, capturing over 38% of the global gluconic acid market in 2024. Rapid industrialization, urbanization, and growth in food and beverage manufacturing are major contributors. China and India serve as leading producers and consumers, benefiting from low production costs and abundant raw material availability. Increasing construction activities and demand for sodium gluconate in concrete admixtures further propel regional growth. Moreover, rising health awareness and expanding processed food consumption are driving greater use of gluconic acid in food applications. Continuous technological advancements and government support for bio-based industries strengthen Asia-Pacific’s market leadership.

Latin America

Latin America accounted for around 5% of the global gluconic acid market in 2024. The region’s market growth is fueled by expanding food processing, agriculture, and construction industries in countries such as Brazil, Mexico, and Argentina. Growing consumer awareness of clean-label and fortified food products is promoting the use of gluconic acid in dairy and beverage formulations. Additionally, the adoption of sodium gluconate in infrastructure projects for concrete admixtures is increasing. However, limited local manufacturing capacity and dependence on imports from Asia remain challenges. Strategic investments in bio-based chemical production offer potential for future regional growth.

Middle East & Africa (MEA)

The Middle East & Africa region held approximately 4% of the global gluconic acid market in 2024. Market growth is primarily driven by rising construction activities and increasing industrial applications in metal treatment and cleaning sectors. Countries like Saudi Arabia, South Africa, and the UAE are witnessing growing demand for sodium gluconate-based admixtures in large-scale infrastructure projects. In addition, expanding food and beverage processing sectors and gradual adoption of eco-friendly chemicals support market development. However, limited technological expertise and higher import dependency constrain rapid expansion. Growing sustainability initiatives across industries are expected to create new opportunities in the region.

Market Segmentations:

By Application

- Industrial

- Agrochemical & Fertilizers

- Metal Surface Treatment

- Textile

- Beverages

- Food

- Confectionery

- Dairy

- Flavors

- Instant Food

- Meat

- Sauces & Dressings

- Pharmaceutical

- Personal Care

- Cleaners & Detergents

- Others

By Downstream Potential

- Glucono Delta-Lactone

- Sodium Gluconate

- Calcium Gluconate

- Potassium Gluconate

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global gluconic acid market is moderately consolidated, with key players focusing on technological innovation, product diversification, and strategic partnerships to strengthen their market presence. Major companies such as Jungbunzlauer, Evonik, Merck Millipore, Fuso Chemical Co., Ltd., and PMP Fermentation Products, Inc. dominate the market through extensive product portfolios and strong global distribution networks. These players are actively investing in advanced fermentation technologies to improve yield efficiency and sustainability. Regional participants like Prathista and R-Biopharm AG emphasize bio-based production and customized formulations for food and pharmaceutical applications. Additionally, research-focused firms such as Alfa Chemistry, TCI Chemicals, and Toronto Research Chemicals Inc. contribute to innovation in high-purity and specialty-grade gluconic acid derivatives. The competitive environment is shaped by increasing demand for eco-friendly chemicals, regulatory compliance, and cost optimization strategies, prompting continuous innovation and capacity expansion across the global value chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jungbunzlauer

- Evonik

- Merck Millipore

- Fuso Chemical Co., Ltd.

- PMP Fermentation Products, Inc.

- Prathista

- R-Biopharm AG

- Alfa Chemistry

- TCI Chemicals

- Toronto Research Chemicals Inc.

Recent Developments

- In March 2024, Corbion announced to develop gluconic acid production to assist with the burgeoning appeal in consumers, specifically in food, and beverage industries. This expansion will catalyze the growth of the gluconic acid industry.

- In May 2023, Skinceuticals developed a potent cream called glycolic 10 renew overnight, which improves skin glow by 36% while maintaining tolerability. This will steer interest towards gluconic acid as an alternative ingredient to similar dosage forms.

Report Coverage

The research report offers an in-depth analysis based on Application, Downstream Potential and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The gluconic acid market will experience steady growth driven by rising demand for sustainable and bio-based chemicals.

- Increasing adoption in food and beverage industries as a natural acidity regulator will continue to support market expansion.

- Technological advancements in microbial fermentation will enhance production efficiency and yield.

- Growing awareness of clean-label and organic ingredients will boost demand in food and personal care applications.

- Expanding infrastructure projects will strengthen the use of sodium gluconate in concrete admixtures.

- The pharmaceutical sector will see higher consumption of calcium and zinc gluconate for supplement formulations.

- Manufacturers will focus on cost optimization and process innovation to address high production expenses.

- Asia-Pacific will maintain its dominance due to strong industrial growth and supportive government policies.

- Strategic collaborations between biotechnology firms and chemical producers will accelerate innovation in the market.

- The shift toward circular economy and eco-friendly industrial practices will ensure long-term market sustainability.