| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Graph Database Market Size 2024 |

USD 3,892.78 million |

| Graph Database Market, CAGR |

19.38% |

| Graph Database Market Size 2032 |

USD 16,051.91 million |

Market Overview:

The Graph Database Market size was valued at USD 1,940.00 million in 2018 to USD 3,892.78 million in 2024 and is anticipated to reach USD 16,051.91 million by 2032, at a CAGR of 19.38% during the forecast period.

Several factors are propelling the growth of the Graph Database Market. One of the primary drivers is the increasing demand for real-time analytics and the need for databases that can provide insights into complex relationships. Traditional relational databases are often limited in their capacity to manage highly interconnected data, whereas graph databases are specifically designed to handle such structures efficiently. Additionally, the rise of big data, the Internet of Things (IoT), and artificial intelligence (AI) has led to a massive increase in data complexity, further fueling the adoption of graph databases. Industries such as healthcare, retail, telecommunications, and finance are particularly benefiting from graph database technology due to its ability to model relationships and detect patterns in real-time, thereby enabling better decision-making and predictive capabilities.

In terms of regional analysis, North America currently dominates the graph database market, accounting for the largest market share. The region’s dominance is attributed to the presence of key players such as Microsoft, Amazon, and IBM, alongside high adoption rates in various sectors, including technology, finance, and telecommunications. The U.S. in particular has witnessed a rapid shift toward adopting advanced data management solutions, with many enterprises migrating their data storage and processing to cloud-based platforms. Europe follows as the second-largest market, driven by significant investments in AI, machine learning, and data analytics initiatives across the region. The growing focus on digital transformation in sectors such as banking, healthcare, and retail is expected to drive demand for graph databases in the region. The Asia Pacific market is also seeing a surge in growth, primarily due to the increasing digitalization in emerging economies like India, China, and Japan.

Market Insights:

- The Graph Database Market is expected to grow from USD 1,940 million in 2018 to USD 16,051 million by 2032, with a CAGR of 19.38%, driven by the increasing need for real-time analytics.

- The rise of big data, IoT, and AI has significantly increased data complexity, driving the adoption of graph databases for efficient management of interconnected data across industries.

- Real-time analytics and insights are key growth factors, as graph databases enable quick access to complex data relationships, helping businesses make fast, data-driven decisions.

- Cloud computing is enhancing graph database adoption by offering scalability, flexibility, and cost-efficiency, especially for organizations dealing with large datasets.

- The rapid digital transformation across industries like finance, healthcare, and retail is fueling the demand for advanced data management solutions, including graph databases.

- High implementation and maintenance costs pose a challenge, particularly for small and medium-sized enterprises (SMEs) that struggle with the required investment and specialized skills.

- Regional growth is strong, with North America leading the market, followed by Europe and Asia Pacific, as more enterprises embrace graph databases to optimize their data management strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Complexity of Data and the Need for Advanced Data Modeling

The growing complexity of data generated by businesses and consumers has increased the need for more efficient data management solutions. Traditional relational databases struggle to handle highly interconnected data, which has led to the rise of graph databases. These databases offer the ability to model and store data based on relationships, making it easier to understand complex interdependencies. In industries such as finance, healthcare, and telecommunications, where data relationships are intricate, graph databases provide a significant advantage. With the expansion of digital systems and IoT, companies face a data overload that requires intelligent systems capable of linking various data points. Graph databases meet this demand by offering efficient and scalable solutions for processing and analyzing complex datasets.

- Neo4j, for example, surpassed $200 million in annual recurring revenue in 2024 and is now used by 84% of Fortune 100 companies, demonstrating broad enterprise trust in its technology.

Growing Demand for Real-Time Analytics and Insights

Businesses require real-time insights to make data-driven decisions swiftly. Graph databases are designed to handle real-time analytics by providing quick access to interconnected data. They excel in processing data relationships and dependencies, which are common in use cases like fraud detection, social network analysis, and recommendation engines. Graph databases allow organizations to analyze massive datasets in real time and derive actionable insights. This capability is increasingly essential in sectors like e-commerce, where providing personalized recommendations can enhance customer experience and drive sales. The ability to analyze complex relationships in real-time empowers organizations to act quickly and effectively, contributing to the growing adoption of graph databases.

- In a real-world example, BT Group used a graph-based Service and Resource Inventory Management System to process over 50,000 product availability checks daily and handle more than 5,000 order reports per hour, reducing capacity planning time by 50% and human decision points by 60%.

Advancements in Cloud Computing and Data Storage Solutions

Cloud computing has emerged as a key enabler for the adoption of graph databases. The flexibility, scalability, and cost-efficiency offered by cloud platforms make them ideal for graph database deployment. Organizations increasingly prefer cloud-based solutions to manage their data, as they provide the ability to scale resources up or down according to demand. Cloud environments are also more capable of handling the large volumes of data associated with graph databases, making them more accessible to businesses of all sizes. The combination of cloud computing and graph databases facilitates faster data processing, improved analytics, and better storage management. This trend is particularly noticeable in sectors that require dynamic and scalable data management systems.

Rapid Digital Transformation Across Industries

Many industries are undergoing significant digital transformation, creating an environment that favors the use of graph databases. Companies are leveraging advanced data management solutions to enhance operational efficiency and improve decision-making. In industries such as retail, banking, and logistics, digital transformation efforts rely heavily on the ability to manage large-scale, interconnected data. Graph databases allow businesses to gain deeper insights into customer behavior, optimize supply chains, and enhance security protocols. The growing integration of artificial intelligence (AI) and machine learning (ML) with graph databases has further amplified their value, enabling organizations to make smarter, data-driven decisions faster. As more industries adopt digital technologies, graph databases are expected to play an essential role in shaping future data management strategies.

Market Trends:

Increasing Integration of Artificial Intelligence (AI) with Graph Databases

The integration of Artificial Intelligence (AI) with graph databases is becoming a significant trend in the market. AI technologies, including machine learning and deep learning, are being increasingly employed to enhance the capabilities of graph databases. By leveraging AI, organizations can uncover hidden patterns and make more accurate predictions based on their interconnected data. Graph databases, with their inherent ability to represent relationships, complement AI’s need for deep data analysis and insight generation. The combination of AI and graph databases helps businesses optimize processes such as fraud detection, recommendation systems, and predictive maintenance. AI-powered graph analytics is gaining traction in industries like banking, e-commerce, and healthcare, where data relationships are complex and critical for decision-making.

- In healthcare, for example, machine learning knowledge graphs built on platforms like Neo4j or TiDB link symptoms, diseases, and treatments, enabling AI-powered diagnostic models to deliver more accurate predictions and recommendations by leveraging the rich, interconnected data structure.

Rising Adoption of Cloud-Based Graph Database Solutions

The shift toward cloud computing continues to drive the growth of the graph database market. Cloud-based graph databases offer scalability, flexibility, and cost-efficiency, which are essential for modern businesses dealing with large datasets. Cloud platforms allow organizations to scale their graph databases according to their needs without investing heavily in on-premise infrastructure. This trend is particularly advantageous for small to medium-sized enterprises (SMEs) that require access to powerful data management solutions but cannot afford significant upfront costs. Leading cloud service providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are increasingly offering managed graph database services, further enhancing accessibility. Cloud adoption is expected to continue growing, expanding the reach and use of graph databases across industries.

Growth in the Use of Graph Databases for Fraud Detection and Cybersecurity

Fraud detection and cybersecurity are key areas where graph databases are experiencing significant adoption. The ability to track relationships between various data points, such as transactions, user behaviors, and connections within networks, is critical for identifying fraudulent activity and securing digital infrastructures. Graph databases provide superior analysis in uncovering complex fraud schemes by mapping out relationships and detecting anomalous patterns. In cybersecurity, graph databases help identify vulnerabilities and threats by mapping attack paths, network intrusions, and system weaknesses. Financial institutions, insurance companies, and government agencies are increasingly turning to graph databases to strengthen their security measures and detect fraud in real-time.

Expansion of Use Cases in Internet of Things (IoT) and Smart Devices

Graph databases are playing an increasingly important role in the Internet of Things (IoT) and smart device ecosystems. As IoT networks continue to expand, managing the vast amounts of data generated by interconnected devices becomes more complex. Graph databases offer a natural solution to model the relationships between devices, sensors, and data flows within IoT environments. It allows businesses to analyze interactions between IoT devices and optimize processes like predictive maintenance, resource allocation, and energy management. As smart cities, industrial automation, and connected devices become more prevalent, the need for robust, scalable graph database solutions grows. Industries ranging from manufacturing to utilities are adopting graph databases to manage the complexities of IoT data and improve operational efficiency.

- A practical deployment is Microsoft Azure Cosmos DB’s Gremlin API, which powers IoT platforms by modeling devices, sensors, and their relationships as a graph.

Market Challenges Analysis:

High Implementation and Maintenance Costs

One of the primary challenges faced by the graph database market is the high cost of implementation and maintenance. Businesses often need to invest heavily in skilled professionals who can design, deploy, and manage graph databases. The complexity involved in setting up a graph database infrastructure, especially for large-scale enterprises, requires significant resources in terms of time and cost. Many organizations face difficulties in justifying the initial investments when compared to traditional relational databases, which are less resource-intensive. Furthermore, maintaining a graph database requires specialized knowledge and continuous optimization to ensure optimal performance. These factors can be a barrier, particularly for small and medium-sized enterprises (SMEs) that are looking for cost-effective solutions.

Data Integration and Compatibility Issues

Another significant challenge in the graph database market is data integration and compatibility with existing systems. Graph databases often need to coexist with legacy systems, making integration a complex and time-consuming process. Many organizations already rely on relational databases or other NoSQL systems, and transitioning to or incorporating a graph database into the existing infrastructure can present compatibility issues. Data migration, synchronization, and consistency between different systems can create bottlenecks and disrupt ongoing operations. These challenges can hinder the widespread adoption of graph databases, particularly in industries where legacy systems are deeply embedded.

Market Opportunities:

Expanding Use of Graph Databases in Artificial Intelligence and Machine Learning

The increasing integration of artificial intelligence (AI) and machine learning (ML) offers significant opportunities for the graph database market. These technologies benefit from the ability of graph databases to manage and analyze complex relationships within large datasets. By incorporating graph databases, AI and ML models can achieve more accurate predictions, optimized decision-making, and improved data insights. Industries such as healthcare, finance, and retail are particularly poised to leverage graph databases for applications like fraud detection, personalized recommendations, and predictive analytics. The growing need for data-driven decision-making creates an expansive market opportunity for graph databases to support AI-powered systems.

Growth of Smart Cities and IoT Applications

The rapid development of smart cities and the proliferation of Internet of Things (IoT) devices present substantial opportunities for graph databases. As IoT networks expand, managing the vast amounts of interconnected data becomes more challenging, creating a need for efficient data models. Graph databases excel in representing relationships within IoT ecosystems, enabling real-time data processing and decision-making. Governments, utilities, and enterprises focusing on smart infrastructure, energy optimization, and urban planning can leverage graph databases to enhance operational efficiency. This growing trend in smart city initiatives provides a valuable opportunity for graph database solutions to become an integral part of future technological advancements.

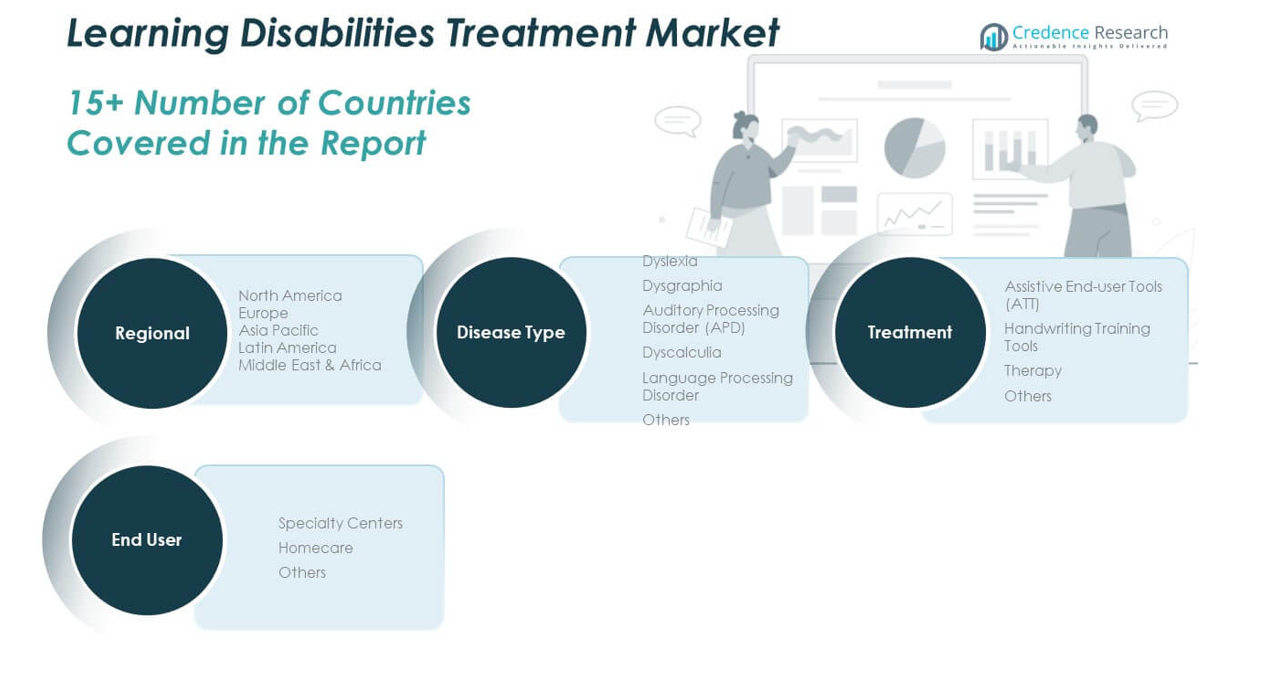

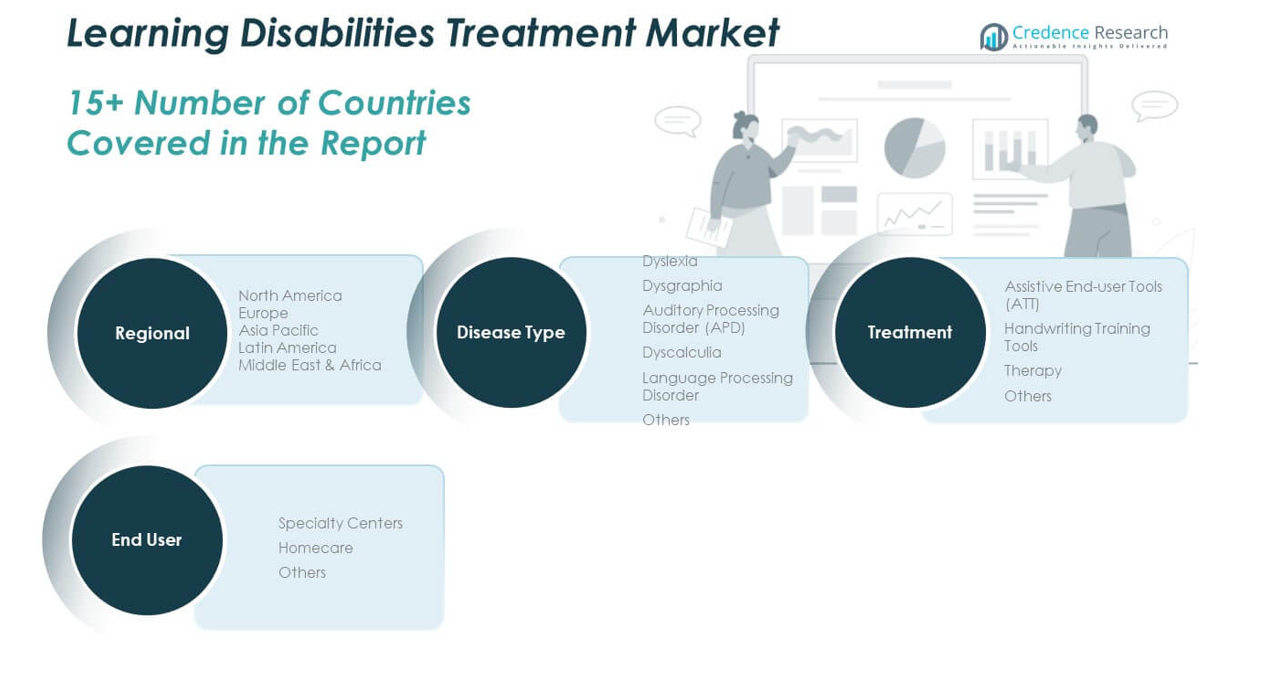

Market Segmentation Analysis:

The Graph Database Market is segmented across various categories, each catering to specific industry needs and technological advancements.

By Component Segment, the market is divided into Solutions and Services, with solutions providing the core database capabilities and services focusing on consulting, deployment, and support. These segments address the growing demand for real-time analytics and relationship modeling.

By Graph Type Segment includes Property Graph, Resource Description Framework (RDF), and Hypergraph. Property graphs are widely used due to their flexibility in representing relationships, while RDF is crucial for semantic web technologies, and hypergraphs cater to more complex relationships in certain technical fields.

- For instance, LinkedIn’s Knowledge Graph is built using a property graph model, enabling real-time connection recommendations for 950 million users by flexibly modeling people, jobs, and skills as nodes and relationships.

By Industry Segment covers key sectors such as BFSI, Retail & E-commerce, IT & Telecom, Healthcare & Life Sciences, Government & Public Sector, Media & Entertainment, and Supply Chain & Logistics. Each of these industries leverages graph databases to enhance data management, fraud detection, and decision-making processes.

- For instance, JPMorgan Chase uses TigerGraph to detect fraud in real-time, analyzing billions of transactions and relationships to identify suspicious patterns and reduce false positives.

By Deployment Segment includes Cloud and On-premise options, with cloud solutions gaining significant traction due to their scalability and cost-effectiveness.

By Application Segment encompasses Fraud Detection, Data Management & Analysis, Customer Analysis, Identity & Access Management, and Compliance & Risk, all of which rely on graph databases for their ability to manage complex, interconnected data for real-time insights and enhanced security. These segments are experiencing accelerated adoption due to the increasing complexity of data environments across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Component Segment:

By Graph Type Segment:

- Property Graph

- Resource Description Framework (RDF)

- Hypergraph

By Industry Segment:

- BFSI (Banking, Financial Services, and Insurance)

- Retail & E-commerce

- IT & Telecom

- Healthcare & Life Sciences

- Government & Public Sector

- Media & Entertainment

- Supply Chain & Logistics

- Others

By Deployment Segment:

By Application Segment:

- Fraud Detection

- Data Management & Analysis

- Customer Analysis

- Identity & Access Management

- Compliance & Risk

- Others

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America Graph Database Market

The North America Graph Database Market size was valued at USD 746.90 million in 2018, increasing to USD 1,484.02 million in 2024, and is anticipated to reach USD 6,148.76 million by 2032, at a CAGR of 19.46% during the forecast period. North America holds the largest market share in the graph database space, driven by the strong presence of key players such as Microsoft, Amazon, and IBM. The region’s technological leadership, combined with high investments in AI, machine learning, and big data analytics, is contributing to the rapid adoption of graph databases. Businesses across finance, healthcare, and telecommunications are leveraging graph databases for real-time analytics and data modeling. The increasing demand for cloud-based solutions and the shift toward data-driven decision-making in enterprises is also expanding the graph database market. High adoption rates of advanced technologies, coupled with a well-established infrastructure, support continued market growth in the region.

Europe Graph Database Market

The Europe Graph Database Market size was valued at USD 418.26 million in 2018, growing to USD 799.47 million in 2024, and is projected to reach USD 3,039.79 million by 2032, with a CAGR of 18.17% during the forecast period. Europe is witnessing significant growth in the adoption of graph databases, particularly due to the rapid digital transformation across industries such as banking, retail, and healthcare. The region is home to several prominent technology providers and is seeing an increasing trend in the integration of graph databases with AI and machine learning. Governments and enterprises are investing heavily in data analytics to enhance operational efficiency and customer experience, further driving the market. The rise of smart cities and IoT technologies is also fueling demand for graph databases, with companies focusing on improving connectivity and data flow management.

Asia Pacific Graph Database Market

The Asia Pacific Graph Database Market size was valued at USD 513.13 million in 2018, growing to USD 1,071.86 million in 2024, and is anticipated to reach USD 4,809.84 million by 2032, at a CAGR of 20.62% during the forecast period. Asia Pacific is expected to experience the highest growth rate in the graph database market, driven by the rapid adoption of digital technologies across emerging economies like India, China, and Japan. The increasing investments in AI, machine learning, and IoT applications, particularly in sectors like e-commerce, finance, and healthcare, are fueling the demand for advanced data management solutions like graph databases. As businesses look to manage complex, interrelated data more effectively, graph databases provide a valuable tool for real-time analytics and predictive modeling, further enhancing their appeal in the region.

Latin America Graph Database Market

The Latin America Graph Database Market size was valued at USD 120.47 million in 2018, growing to USD 239.37 million in 2024, and is projected to reach USD 900.99 million by 2032, with a CAGR of 18.02% during the forecast period. Latin America’s adoption of graph databases is growing steadily as businesses increasingly focus on big data analytics and customer relationship management. The region’s demand for graph database solutions is being driven by sectors such as retail, banking, and telecommunications, where managing complex, interdependent data is essential. The growth of cloud infrastructure and the growing digital transformation within enterprises are also contributing to the rising adoption of graph databases in the region. Small and medium-sized enterprises (SMEs) in Latin America are also benefiting from cloud-based graph database solutions that offer scalability at affordable costs.

Middle East Graph Database Market

The Middle East Graph Database Market size was valued at USD 95.25 million in 2018, rising to USD 181.77 million in 2024, and is anticipated to reach USD 685.31 million by 2032, at a CAGR of 18.05% during the forecast period. The Middle East region is experiencing rapid digital transformation across key industries such as oil and gas, finance, and healthcare. Governments and private enterprises are increasingly adopting advanced data management technologies to optimize operations and improve service delivery. Graph databases are particularly beneficial in these sectors, as they facilitate real-time data analysis and help identify patterns and relationships within complex data sets. The growing demand for smart city initiatives and IoT applications in the Middle East is also driving the need for efficient and scalable data solutions, further expanding the graph database market.

Africa Graph Database Market

The Africa Graph Database Market size was valued at USD 45.98 million in 2018, increasing to USD 116.29 million in 2024, and is projected to reach USD 467.21 million by 2032, at a CAGR of 19.19% during the forecast period. Africa is witnessing steady growth in the graph database market, with increased adoption in sectors like telecommunications, finance, and government. The region’s push toward digitalization and the need for efficient data analytics in emerging markets are key drivers of this growth. As enterprises in Africa continue to transition to data-driven decision-making, graph databases provide a solution for managing and analyzing complex relationships within large datasets. Cloud computing’s growing penetration in the region further enhances the scalability and accessibility of graph database solutions, making them a viable option for businesses across various industries.

Key Player Analysis:

- Oracle Corporation

- IBM

- Neo4j, Inc.

- Amazon Web Services, Inc. (AWS)

- Stardog

- Microsoft

- ArangoDB, Inc.

- TigerGraph

- Progress Software Corporation (MarkLogic)

- DataStax

Competitive Analysis:

The Graph Database Market is highly competitive, with several key players offering advanced solutions to meet the growing demand for real-time data analytics and complex relationship management. Leading companies such as Neo4j, Amazon Web Services (AWS), Microsoft, and IBM dominate the market, offering both on-premise and cloud-based graph database solutions. Neo4j is widely recognized for its open-source graph database platform and strong customer base across industries like retail, finance, and telecommunications. AWS provides managed services like Amazon Neptune, making graph databases more accessible for enterprises seeking scalability and performance. Microsoft and IBM integrate graph database solutions with their cloud platforms, offering flexibility and seamless integration with other enterprise applications. Smaller players such as TigerGraph and ArangoDB also contribute to market growth, focusing on niche applications like fraud detection and IoT data management. The increasing shift toward AI and machine learning integration offers new opportunities for competitive differentiation.

Recent Developments:

- In January 2025, Progress launched Progress Data Cloud, a managed Data Platform as a Service. This platform accelerates AI strategies and digital transformation by providing managed hosting for MarkLogic Server and Data Hub, with enhanced scalability, security, and deployment options for enterprise customers.

- In February 2025, IBM announced its intent to acquire DataStax, a major provider of NoSQL and vector database technology. This acquisition is set to strengthen IBM’s watsonx enterprise AI stack, enabling clients to harness unstructured data for generative AI applications at scale.

- In April 2024, Neo4j, a leading player in the graph database market, partnered with Google Cloud to launch new GraphRAG capabilities for generative AI applications. This collaboration aims to accelerate the development and deployment of generative AI solutions by providing enterprises with tools to manage real-time, contextually rich data and deliver accurate, explainable results.

- In December 2023, Amazon Web Services (AWS) introduced a new analytics database engine called Amazon Neptune Analytics, which combines the power of vector search and graph data. This product was launched during the AWS re:Invent conference in Las Vegas and is now available in several AWS regions, including the US East, US West, Asia Pacific, and Europe.

Market Concentration & Characteristics:

The Graph Database Market exhibits moderate concentration, with several key players controlling a significant share of the market. Leading companies such as Neo4j, Amazon Web Services (AWS), and Microsoft dominate the space, offering both cloud-based and on-premise solutions. These major players emphasize scalability, real-time analytics, and integration with AI and machine learning technologies to differentiate their offerings. While large enterprises hold a dominant position, smaller, specialized players like TigerGraph and ArangoDB focus on niche applications, such as fraud detection and IoT data management. The market is characterized by continuous innovation, with companies investing heavily in product development to meet the growing demand for efficient, flexible, and scalable graph database solutions. As cloud adoption increases, competition intensifies, especially in the managed services segment, where companies strive to offer seamless and cost-effective solutions to a broader customer base.

Report Coverage:

The research report offers an in-depth analysis based on Component, Graph Type, Industry, Deployment and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Graph Database Market is expected to continue growing at a robust pace, driven by increasing demand for real-time analytics and data modeling solutions.

- Cloud-based graph database solutions will dominate, providing scalability and flexibility to businesses of all sizes.

- Integration with AI and machine learning will become more widespread, enhancing predictive analytics and decision-making capabilities.

- The growing adoption of IoT technologies will boost the need for graph databases to manage interconnected data from smart devices.

- Increased focus on data security and fraud detection will drive further adoption in sectors like finance, healthcare, and retail.

- Regional markets in Asia Pacific and Latin America will experience significant growth as digital transformation accelerates in emerging economies.

- Smaller players will continue innovating, creating specialized solutions for niche applications such as cybersecurity and supply chain optimization.

- The rise of smart cities and smart infrastructure will increase the use of graph databases in urban planning and resource management.

- Greater focus on data governance and regulatory compliance will shape the development of graph database technologies.

Industry collaborations and partnerships will fuel innovation and enhance market competition, leading to more comprehensive and integrated solutions.