Market Overview

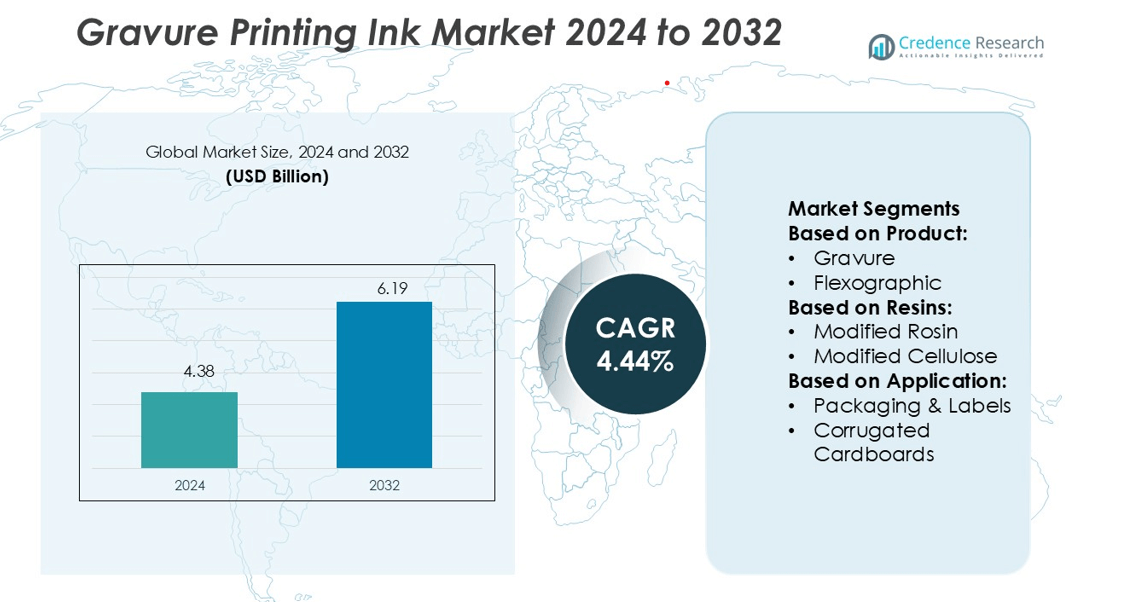

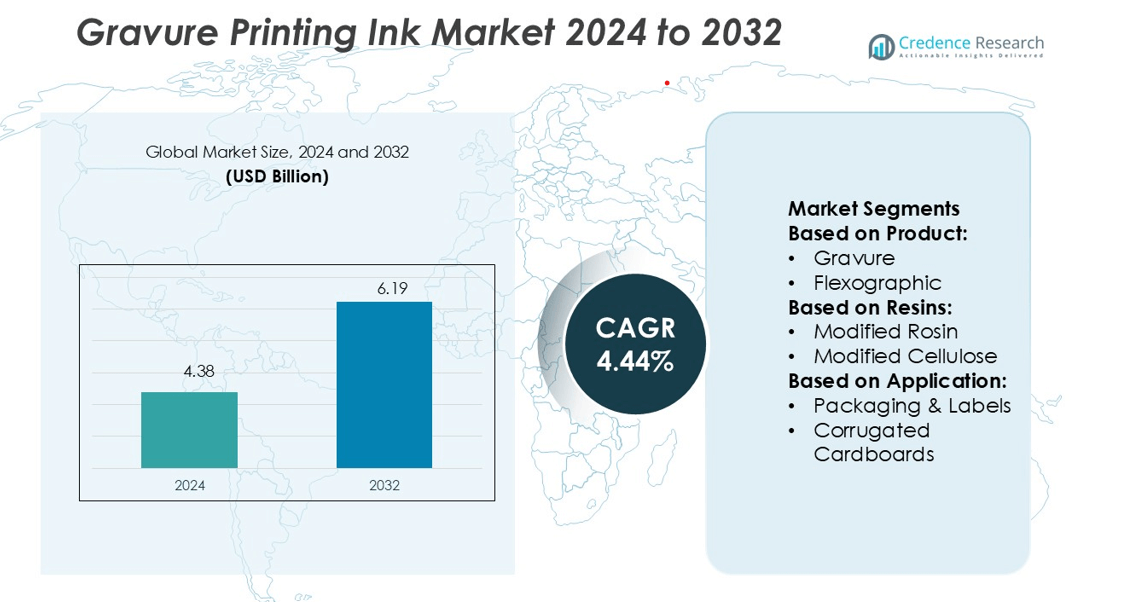

Gravure Printing Ink Market size was valued USD 4.38 billion in 2024 and is anticipated to reach USD 6.19 billion by 2032, at a CAGR of 4.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gravure Printing Ink Market Size 2024 |

USD 4.38 billion |

| Gravure Printing Ink Market, CAGR |

4.44% |

| Gravure Printing Ink Market Size 2032 |

USD 6.19 billion |

The Gravure Printing Ink Market is driven by key players such as Technocrafts India, Sakata, Flint Group, Mac-Mixu Coating & Chemicals, Worldtex Specialty Chemicals, Wikoff Color, DIC Corporation, CHEMICOAT, Siegwerk Druckfarben, and Dainichiseika Color & Chemicals Mfg. Co., Ltd. These companies focus on product innovation, sustainable ink development, and expanding their global presence through strategic partnerships and capacity enhancements. They are increasingly investing in low-VOC and water-based ink solutions to meet environmental regulations and evolving packaging demands. Asia Pacific leads the global market with a 35.6% share, supported by rapid industrial growth, strong packaging infrastructure, and high demand from food, beverage, and personal care sectors. This regional dominance is reinforced by rising investments in modern printing technologies and growing export-oriented production capacities.

Market Insights

- The Gravure Printing Ink Market was valued at USD 4.38 billion in 2024 and is expected to reach USD 6.19 billion by 2032, growing at a CAGR of 4.44% during the forecast period.

- Market growth is supported by rising demand for flexible packaging, strong printing infrastructure, and increasing adoption of water-based and low-VOC inks to meet environmental regulations.

- Technocrafts India, Sakata, Flint Group, Mac-Mixu Coating & Chemicals, Worldtex Specialty Chemicals, Wikoff Color, DIC Corporation, CHEMICOAT, Siegwerk Druckfarben, and Dainichiseika Color & Chemicals Mfg. Co., Ltd. lead the market through innovation and global expansion strategies.

- Regulatory pressures on solvent-based inks and competition from digital and flexographic printing technologies are key restraints impacting market growth.

- Asia Pacific dominates the market with a 35.6% share, while the gravure segment holds the largest product share due to its superior print quality and efficiency in high-volume packaging production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Gravure inks hold the largest market share in the Gravure Printing Ink Market due to their high print quality and efficiency in large-scale production. These inks are preferred for packaging, decorative laminates, and magazines because of their excellent color consistency and smooth coverage. Gravure inks also enable high-speed printing, reducing operational time for converters. Flexographic and digital inks are expanding, driven by eco-friendly formulations and quick-drying features. However, gravure’s dominance remains strong due to its superior performance in long-run printing applications, especially in flexible packaging and labeling sectors.

- For instance, Mac-Mixu’s “MAC POLY STAR” gravure ink is formulated for treated BOPP films and requires a substrate surface treatment of at least 38 dynes/cm to ensure good adhesion.

By Resins

Acrylic resins dominate the Gravure Printing Ink Market due to their strong adhesion, quick drying, and compatibility with various substrates. These properties make acrylic inks ideal for flexible packaging and labeling applications. The growing demand for low-VOC formulations also supports acrylic resin use, aligning with sustainability goals. Polyurethane and modified cellulose resins are gaining attention for their improved resistance and flexibility. Despite this, acrylic resins lead the market because they enable stable print quality and durability in high-speed printing environments, giving them an edge over other resin types.

- For instance, Wikoff’s Ultraprint 3.0 FLX system (flexographic / surface print) uses resin formulations able to resist 135 °C / 275 °F in surface print mode, and supports a 7-color press mixing approach (CMYK + orange, green, violet) to expand gamut.

By Applications

Packaging and labels represent the dominant application segment in the Gravure Printing Ink Market, holding the largest share due to rising demand from food, beverage, and personal care industries. Gravure inks offer superior image sharpness, making them ideal for branding and product differentiation. The growth of flexible packaging formats and e-commerce further fuels this segment. Corrugated cardboards and publication printing are expanding but remain secondary. Packaging’s strong position is supported by its consistent use in high-volume production and brand-focused print quality requirements.

Key Growth Drivers

Rising Demand for High-Quality Packaging

The Gravure Printing Ink Market is growing as packaging producers demand high-resolution and consistent print quality. Gravure inks deliver smooth finishes, rich colors, and sharp images, making them ideal for flexible packaging in food, beverage, and personal care industries. The rise of premium product branding further drives ink usage in pouches, labels, and wraps. Long-run printing capability also reduces per-unit cost, strengthening adoption. The need for visually appealing and durable packaging continues to boost gravure ink consumption in both developed and emerging markets.

- For instance, Dainichiseika states that 60 % of its gravure ink portfolio now consists of ESG / sustainability-oriented formulations, up from “less than half” five years ago.

Expansion of the Flexible Packaging Industry

Flexible packaging is expanding rapidly due to its lightweight structure, cost efficiency, and reduced material waste. Gravure printing inks play a central role in this growth, offering strong adhesion, fast drying, and compatibility with multiple substrates like PET, BOPP, and PE. These advantages make gravure inks suitable for high-speed printing lines used by FMCG and pharmaceutical industries. Global shifts toward sustainable and efficient packaging formats further enhance their adoption. This increasing use of flexible packaging is directly accelerating market expansion.

- For instance, Flint Group’s EkoCure F UV-LED curable flexo ink, suitable for substrates like BOPP, PE, and PLA films, supports line/solid printing at 4–6 cm³/m² and process printing at 2.3–3 cm³/m².

Technological Advancements in Ink Formulation

Innovations in gravure ink formulations are enabling improved performance and sustainability. Manufacturers are introducing low-VOC, water-based, and solvent-reduced inks to meet stricter environmental regulations. Enhanced adhesion, faster curing, and better resistance to abrasion and moisture make these inks ideal for high-demand packaging. Advanced formulations also allow better printability on diverse substrates, expanding their industrial applications. These technological improvements help converters maintain quality while reducing operational costs, making gravure inks more competitive against other printing technologies.

Key Trends & Opportunities

Shift Toward Sustainable Printing Solutions

Sustainability is shaping the Gravure Printing Ink Market. Ink producers are focusing on bio-based solvents, waterborne formulations, and recyclable substrate compatibility. This shift aligns with global regulatory standards and brand sustainability commitments. Companies adopting green printing solutions gain competitive advantage, especially in regions with strict environmental policies. These innovations also appeal to eco-conscious consumers, opening new market opportunities. As sustainability remains a key focus, gravure ink manufacturers can strengthen their market share through cleaner and safer ink alternatives.

- For instance, DIC opened a new production facility in Indonesia for coatings safe for direct food contact, targeting 1,000 tonnes/year of capacity in food-grade coatings—critical for sustainable packaging inks.

Integration with High-Speed Printing Lines

The increasing use of automated, high-speed printing presses offers strong opportunities for gravure inks. These inks provide excellent flow characteristics and consistent color density, supporting large-scale production with minimal downtime. This compatibility is crucial for converters aiming to improve throughput while maintaining quality standards. The trend is particularly strong in packaging hubs across Asia Pacific and Europe. As more industries invest in advanced printing technologies, gravure ink suppliers can expand their presence through process optimization and product innovation.

- For instance, Epple produces around 10,000 metric tons of ink per year, supplied globally, using Bühler’s grinding and dispersion equipment. This equipment supports highly efficient processes, such as single-pass pigment dispersion, though public sources do not confirm Epple’s specific use of Bühler K240 bead mills or SDVE-1300 three-roll mills.

Growth of E-Commerce Packaging Applications

E-commerce growth is driving demand for customized, durable, and visually appealing packaging. Gravure printing inks offer superior coverage, clarity, and long-lasting print quality suitable for branding on shipping and product packages. The surge in online retail has increased the need for efficient printing technologies that can handle high volumes with precision. This trend creates new opportunities for gravure ink producers to cater to fast-growing segments such as consumer electronics, apparel, and personal care products.

Key Challenges

Stringent Environmental Regulations

Gravure ink producers face increasing pressure from environmental regulations targeting solvent-based formulations. These inks often emit VOCs, requiring costly control systems and compliance measures. Transitioning to water-based alternatives demands significant R&D investments and equipment modifications. Stricter rules in Europe and North America increase operational costs and limit production flexibility. Companies that fail to adapt may face reduced competitiveness, fines, or market access restrictions. Meeting these evolving regulatory demands remains a major challenge for the industry.

Competition from Alternative Printing Technologies

Flexographic and digital printing technologies are advancing rapidly, offering cost-effective and flexible solutions. Their shorter setup times, lower material waste, and growing compatibility with sustainable inks threaten gravure’s traditional stronghold. Many converters prefer digital and flexo for shorter runs and variable designs, reducing reliance on gravure inks. To stay competitive, gravure ink producers must invest in innovation and emphasize advantages like high-speed output and superior image quality. This rising competition poses a key challenge for future market growth.

Regional Analysis

North America

North America holds a 28.4% share of the Gravure Printing Ink Market, driven by strong demand in packaging and labeling applications. The region benefits from advanced printing infrastructure, established FMCG brands, and rising investments in sustainable ink formulations. Food, beverage, and personal care industries are the primary consumers. Regulatory standards promoting low-VOC inks are accelerating the shift toward water-based gravure inks. The U.S. leads the regional market, supported by its large packaging sector and technological innovation. Canada and Mexico also contribute to growth through increasing adoption in flexible packaging production lines.

Europe

Europe accounts for 24.7% of the Gravure Printing Ink Market, supported by strict environmental regulations and strong printing technology adoption. The region emphasizes sustainable ink formulations, driving the use of water-based and bio-based gravure inks. Countries such as Germany, France, and Italy lead due to their robust packaging and publishing industries. Demand for high-quality, low-emission inks is growing rapidly across flexible packaging and commercial printing applications. European converters are also investing in high-speed presses, further supporting market expansion. This regulatory and technological environment keeps Europe a key market hub for gravure ink suppliers.

Asia Pacific

Asia Pacific dominates the Gravure Printing Ink Market with a 35.6% share, making it the largest regional segment. Rapid industrialization, expanding packaging industries, and rising consumer goods production drive strong demand. China, India, and Japan are key markets due to their large-scale packaging manufacturing bases and export-oriented industries. Flexible packaging for food, beverage, and pharmaceuticals significantly boosts ink consumption. Investments in high-speed printing infrastructure and cost-efficient manufacturing strengthen the region’s leadership. Growing adoption of sustainable ink technologies also positions Asia Pacific as a critical driver of future market growth.

Latin America

Latin America holds a 6.3% share of the Gravure Printing Ink Market, driven by increasing demand for flexible packaging across food, beverage, and retail industries. Brazil and Mexico lead the market, supported by expanding consumer goods production. Local converters are adopting gravure inks to improve print quality and meet branding needs. Though the region has fewer high-speed printing facilities compared to Asia Pacific and North America, modernization efforts are growing. Rising awareness of sustainable ink solutions and foreign investments in packaging infrastructure are expected to boost market penetration over the coming years.

Middle East & Africa

The Middle East & Africa represent 5% of the Gravure Printing Ink Market, with growth driven by expanding retail and FMCG sectors. The UAE, Saudi Arabia, and South Africa are key markets investing in packaging infrastructure. Demand is rising for high-quality labeling and flexible packaging to support food and personal care products. Although the market is smaller compared to other regions, increasing urbanization and industrialization create promising opportunities. Regional converters are gradually adopting modern printing technologies, supported by foreign investments and trade partnerships. This positive trajectory is expected to enhance the region’s market share over time.

Market Segmentations:

By Product:

By Resins:

- Modified Rosin

- Modified Cellulose

By Application:

- Packaging & Labels

- Corrugated Cardboards

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gravure Printing Ink Market is shaped by leading players including Technocrafts India, Sakata, Flint Group, Mac-Mixu Coating & Chemicals, Worldtex Specialty Chemicals, Wikoff Color, DIC Corporation, CHEMICOAT, Siegwerk Druckfarben, and Dainichiseika Color & Chemicals Mfg. Co., Ltd. The Gravure Printing Ink Market is characterized by intense competition, technological innovation, and strong regional expansion strategies. Companies are prioritizing the development of sustainable and low-VOC formulations to meet strict environmental standards, especially in Europe and North America. Advancements in water-based and solvent-reduced inks are enhancing print quality and broadening application across flexible packaging and labeling. Strategic collaborations with packaging converters and investments in advanced printing technologies support market penetration. The growing demand from food, beverage, personal care, and e-commerce packaging sectors is accelerating capacity expansions. Innovation, operational efficiency, and sustainability remain key factors shaping the competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Technocrafts India

- Sakata

- Flint Group

- Mac-Mixu Coating & Chemicals

- Worldtex Specialty Chemicals

- Wikoff Color

- DIC Corporation

- CHEMICOAT

- Siegwerk Druckfarben

- Dainichiseika Color & Chemicals Mfg. Co., Ltd

Recent Developments

- In September 2025, Packsize®, a leading market player in right-sized, sustainable, and on-demand packaging company, is collaborating with the EFI™, a leading technology company in revolutionizing from analog to digital imaging for the launch of an on-demand box system that combines full-color printing on boxes with the use of single automated solutions.

- In June 2025, Esko introduced the Esko Quartz flexo ecosystem as a major step in flexographic printing. The new Quartz technology allowed users to image microstructures at 2000 lpi with 4000 ppi resolution. This doubled the industry standard and improved ink transfer, helping flexo printers match gravure quality.

- In May 2024, Landa Digital Printing launched the next-generation B1 digital print technology, S11P Nanographic Printing Presses, and Landa S11. The launch will demonstrate enhanced production versatility and a print speed of 11,200 sph.

- In May 2024, Mimaki Engineering Co. Ltd. launched its carton ink cartridge; it is the move towards the replacement of traditional plastic cartridges with environmentally friendly paper alternatives and the significant trend toward the sustainable printing industry

Report Coverage

The research report offers an in-depth analysis based on Product, Resins, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as flexible packaging demand continues to grow globally.

- Water-based and low-VOC inks will gain wider adoption due to strict environmental norms.

- Technological advancements will improve printing speed and image quality.

- Asia Pacific will strengthen its position as the leading regional market.

- Sustainable ink solutions will drive new product developments and investments.

- Partnerships between ink producers and packaging converters will increase.

- Digital integration with automated printing lines will boost efficiency.

- Regulatory compliance will shape product innovation and market strategies.

- E-commerce growth will create new opportunities in labeling and branding.

- Companies will focus on scaling operations in emerging markets to meet rising demand.