Market Overview

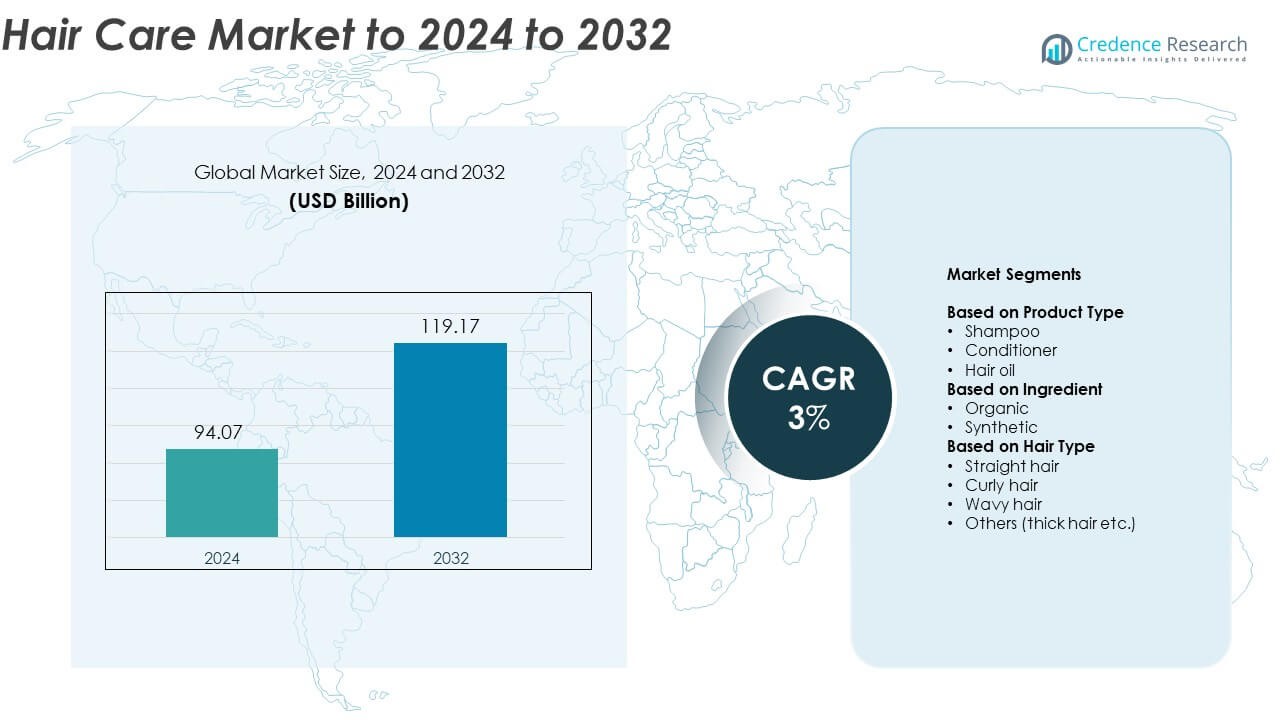

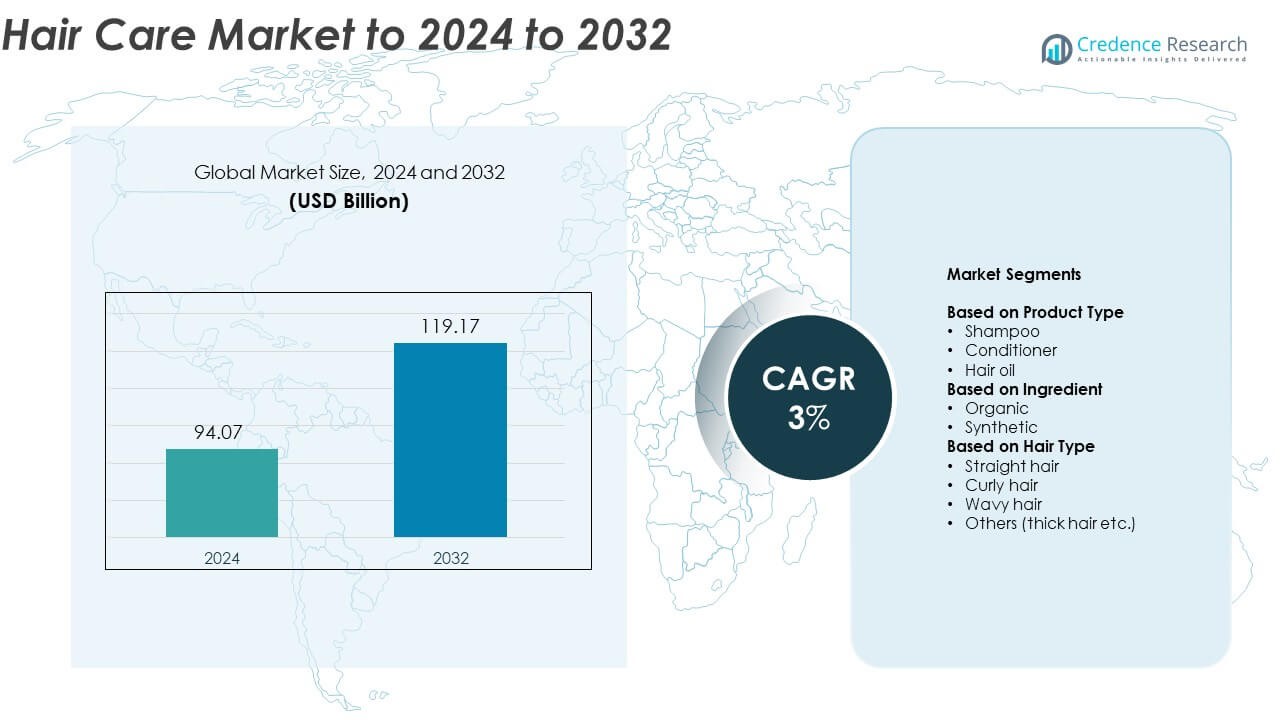

The hair care market size was valued at USD 94.07 Billion in 2024 and is anticipated to reach USD 119.17 Billion by 2032, at a CAGR of 3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hair Care Market Size 2024 |

USD 94.07 Billion |

| Hair Care Market, CAGR |

3% |

| Hair Care Market Size 2032 |

USD 119.17 Billion |

Leading players such as L’Oréal, Unilever, Procter & Gamble, Estée Lauder, and Shiseido dominate the global hair care market through innovation and brand diversity. These companies maintain strong distribution networks and invest heavily in R&D to address rising consumer demand for personalized, sustainable, and scalp-focused products. North America leads the global market with about 34% share, supported by high spending on premium and organic formulations. Europe follows with nearly 28% share, driven by sustainability-focused consumers, while Asia Pacific, holding around 24%, emerges as the fastest-growing region due to urbanization and expanding middle-class income levels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hair care market was valued at USD 94.07 Billion in 2024 and is projected to reach USD 119.17 Billion by 2032, growing at a CAGR of 3%.

- Rising awareness of scalp health, increasing demand for personalized solutions, and expansion of premium and organic product lines are driving market growth.

- Sustainable and clean-beauty trends continue to shape innovation, with brands focusing on biodegradable ingredients and eco-friendly packaging to attract conscious consumers.

- The market remains highly competitive with global leaders investing in R&D, digital marketing, and sustainable sourcing to strengthen brand positioning amid growing local competition.

- North America leads with 34% share, followed by Europe with 28%, while Asia Pacific, holding 24%, records the fastest growth. Among product types, the shampoo segment dominates with 41% share, supported by high frequency of use and product innovation across both mass and premium categories.

Market Segmentation Analysis:

By Product Type

The shampoo segment dominates the hair care market with nearly 41% share in 2024. Its leadership is driven by high product penetration, frequent usage, and a wide variety of formulations catering to scalp health, dandruff control, and hair strengthening. Consumers increasingly prefer sulfate-free, anti-hair fall, and moisturizing shampoos, reflecting a shift toward wellness-focused routines. Expanding product portfolios from major brands and the rise of personalized cleansing solutions further boost this segment’s growth across both mass-market and premium categories.

- For instance, Head & Shoulders launched BARE, a 9-ingredient anti-dandruff shampoo in May 2023.

By Ingredient

The synthetic ingredient segment leads the market, accounting for about 56% share in 2024. Synthetic formulations remain popular due to their cost-effectiveness, stability, and performance consistency in shampoos, conditioners, and hair oils. However, the demand for organic alternatives is growing rapidly as consumers become more ingredient-conscious and seek chemical-free, sustainable options. Increasing awareness about scalp sensitivity and eco-friendly packaging is encouraging manufacturers to blend natural actives with synthetic bases, enhancing product safety and appeal across global markets.

- For instance, Croda supplies more than 200 innovative cosmetic active ingredients for the cosmetics and personal care industry, which addresses various concerns for both skin and hair.

By Hair Type

The straight hair segment holds the largest share at approximately 38% in 2024. This dominance is attributed to a high global prevalence of straight hair and the availability of specialized products addressing smoothness, shine, and frizz control. Manufacturers focus on lightweight formulations and UV protection to meet the styling needs of straight hair users. Meanwhile, products designed for curly and wavy hair types are gaining traction as inclusivity and texture-specific care trends rise, driving broader product diversification within the market.

Key Growth Drivers

Rising Demand for Premium and Personalized Products

Consumers are shifting toward premium hair care solutions tailored to their individual needs. Brands are offering customized formulations based on scalp type, hair texture, and lifestyle. The growing adoption of advanced diagnostic tools and AI-driven product recommendations enhances personalization. Premium ranges with targeted benefits such as anti-hair fall, color protection, and scalp nourishment are driving strong sales, especially across urban markets. This trend reflects a broader move toward luxury and wellness-driven grooming habits.

- For instance, Function of Beauty’s algorithm supports up to 12 billion custom shampoo/conditioner combinations.

Growing Awareness of Hair and Scalp Health

Increasing consumer awareness about scalp care as part of overall wellness is boosting market growth. The focus has expanded beyond styling toward maintaining healthy hair through balanced pH levels and hydration. Rising incidences of hair thinning, dandruff, and pollution-related damage are encouraging frequent use of restorative products. Brands are investing in dermatologically tested and clinically backed formulations, aligning with the rising preference for scientifically proven efficacy.

- For instance, Selsun Blue shampoos list 1% selenium sulfide as the active anti-dandruff ingredient on FDA DailyMed.

Expansion of E-commerce and Digital Engagement

Online platforms are transforming the distribution landscape by providing convenience, wider choices, and instant access to global brands. E-commerce penetration in personal care categories has accelerated post-pandemic. Digital marketing and influencer campaigns enhance visibility and brand trust, particularly among younger consumers. Subscription models, personalized quizzes, and virtual consultations further strengthen customer engagement, making online channels a critical growth driver for the hair care industry.

Key Trends and Opportunities

Shift Toward Sustainable and Clean Beauty Formulations

Sustainability is reshaping product innovation, with brands adopting biodegradable ingredients and eco-friendly packaging. Consumers increasingly favor clean-label products free from sulfates, parabens, and silicones. The demand for cruelty-free and vegan hair care lines is also accelerating. Companies are investing in circular economy practices and transparency in ingredient sourcing, which positions sustainability as both a competitive advantage and a long-term growth opportunity.

- For instance, Unilever targets a 30% virgin-plastic reduction by 2026 and 40% by 2028, against a 2019 baseline. The company reached 21% recycled plastic use across its portfolio as of its latest 2024 reporting period (covering the year 2023). Unilever’s separate target is to achieve 25% recycled plastic use by 2025.

Integration of Technology in Product Development

AI and biotechnology are transforming hair care innovation, enabling the creation of precise, data-driven formulations. Advanced diagnostic tools analyze scalp conditions, offering tailored product recommendations. Smart hair devices and apps now support real-time care tracking and progress monitoring. These innovations elevate user experience and brand differentiation, presenting strong opportunities for tech-enabled personalization in premium product categories.

- For instance, Perfect Corp’s YouCam apps have surpassed 1 billion downloads, and its AI Hair Type Analysis identifies texture and curl patterns in seconds.

Key Challenges

Rising Raw Material Costs and Supply Chain Volatility

Fluctuating prices of essential oils, plant extracts, and chemical ingredients continue to challenge manufacturers. Disruptions in global logistics and dependency on imported raw materials increase production costs. Maintaining product quality and price stability has become complex for both mass and premium brands. Companies are now diversifying suppliers and adopting localized sourcing to mitigate these pressures and maintain profitability.

Counterfeit Products and Market Saturation

The growing presence of counterfeit and low-quality imitations in online and offline retail channels undermines consumer trust. Saturation in key product categories like shampoos and conditioners limits differentiation opportunities. Established brands face rising competition from emerging local and D2C players offering niche formulations. Strengthening brand authenticity, regulatory compliance, and consumer education are critical to overcoming these challenges.

Regional Analysis

North America

North America holds the largest share of about 34% in the global hair care market in 2024. Strong consumer spending on premium and natural products drives regional growth. The demand for clean-label, sulfate-free, and dermatologist-approved formulations remains high. Major brands are expanding through online retail and salon-exclusive lines to attract health-conscious consumers. The U.S. dominates due to high product innovation, while Canada’s market benefits from sustainable and vegan trends. Evolving male grooming habits and increased awareness of scalp wellness further support continued growth across this mature market.

Europe

Europe accounts for nearly 28% share of the hair care market in 2024. The region’s focus on sustainability, organic certification, and ingredient transparency fuels steady expansion. Consumers increasingly prefer eco-friendly packaging and cruelty-free products. Strong performance in countries like Germany, France, and the UK is supported by premium brand adoption and salon-grade treatments. Regulatory standards promoting safe and natural ingredients have shaped innovation. E-commerce and influencer-led campaigns also enhance brand reach, helping European manufacturers strengthen their position in global markets.

Asia Pacific

Asia Pacific represents approximately 24% share of the global hair care market in 2024. Rapid urbanization, rising disposable incomes, and increasing awareness of scalp care drive strong demand. Countries such as China, Japan, and India lead consumption, supported by evolving grooming routines and local brand innovation. Consumers prefer herbal and plant-based products tailored for regional hair types. Expanding retail channels and aggressive digital marketing strategies enhance accessibility. The region’s growing young population and preference for personalized care solutions continue to make it the fastest-growing market globally.

Latin America

Latin America holds around 8% share of the global hair care market in 2024. Growth is led by Brazil and Mexico, driven by high consumption of shampoos, conditioners, and oils. Cultural emphasis on hair appearance and increasing salon services contribute to product demand. Local brands are gaining traction through affordable, region-specific formulations using natural ingredients. Rising awareness about scalp health and digital retail growth also support expansion. Economic fluctuations remain a restraint, but innovation in mid-range and herbal-based categories sustains steady progress across the region.

Middle East & Africa

The Middle East and Africa region captures about 6% share of the hair care market in 2024. Growing focus on personal grooming, especially among younger consumers, is driving market penetration. The demand for anti-hair fall and moisturizing products remains high due to dry climatic conditions. Countries like the UAE and South Africa lead regional consumption, supported by rising retail modernization and beauty salon growth. Increasing availability of international brands and local manufacturing investments strengthen the competitive landscape. Natural oil-based and halal-certified products are gaining popularity among consumers seeking ethical and functional solutions.

Market Segmentations:

By Product Type

- Shampoo

- Conditioner

- Hair oil

By Ingredient

By Hair Type

- Straight hair

- Curly hair

- Wavy hair

- Others (thick hair etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hair care market features strong competition among global leaders such as L’Oréal, Unilever, Procter & Gamble, Estée Lauder, Shiseido, Henkel, KAO Group, LVMH, Johnson & Johnson, Coty, Revlon, Avon, Aveda, Paul Mitchell, and Redken. The industry is characterized by continuous innovation, brand diversification, and expanding product portfolios catering to varied hair types and consumer preferences. Companies focus on clean formulations, premium product launches, and sustainable packaging to strengthen brand equity. Digital marketing, influencer partnerships, and direct-to-consumer strategies are key tools for maintaining market relevance. Mergers, acquisitions, and collaborations with biotech and cosmetic research firms enhance product innovation and regional reach. Increasing investment in R&D supports the development of scalp-focused treatments, eco-friendly formulations, and personalized solutions. The competition is further intensified by emerging niche brands that target specialized segments such as vegan, organic, or gender-neutral hair care, compelling established players to adapt and modernize their strategies globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- L’Oréal

- Unilever

- Procter & Gamble

- Estée Lauder

- Shiseido

- Henkel

- KAO Group

- LVMH

- Johnson & Johnson

- Coty

- Revlon

- Avon

- Aveda

- Paul Mitchell

- Redken

Recent Developments

- In 2025, Aveda has been focusing on sustainability and personalized wellness in hair care. They emphasize naturally derived ingredients, eco-friendly packaging, and personalized scalp therapies and aromatherapy treatments as part of their holistic self-care approach.

- In 2025, Henkel Launched Schwarzkopf Gliss hair-care range across GCC markets.

- In 2025, L’Oréal signed an agreement to acquire the premium hair brand Color Wow in June 2025 (specifically, on June 30, 2025), and the acquisition was completed in September 2025.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Ingredient, Hair Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean, natural, and chemical-free hair care products will continue to rise.

- Personalization and AI-based diagnostics will shape future product development and marketing.

- E-commerce and digital engagement will further dominate hair care sales channels.

- Brands will focus on scalp health and preventive care rather than just cosmetic results.

- Sustainable packaging and eco-friendly manufacturing will become industry standards.

- Male grooming and gender-neutral product lines will expand the consumer base.

- Biotechnology will drive innovation in active ingredients and performance formulations.

- Premium and salon-grade products will see stronger growth across urban markets.

- Emerging economies will offer high potential through local brand innovation and accessibility.

- Strategic partnerships and R&D investments will enhance competitiveness and market diversification.