Market Overview:

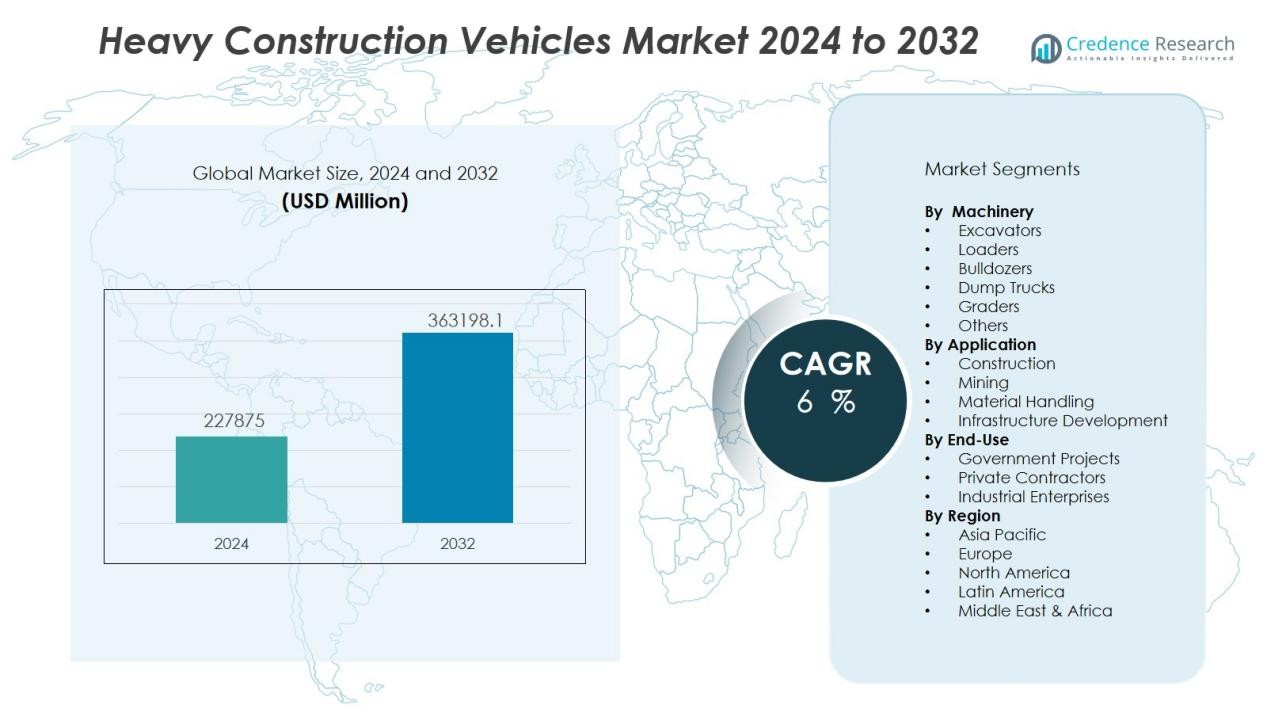

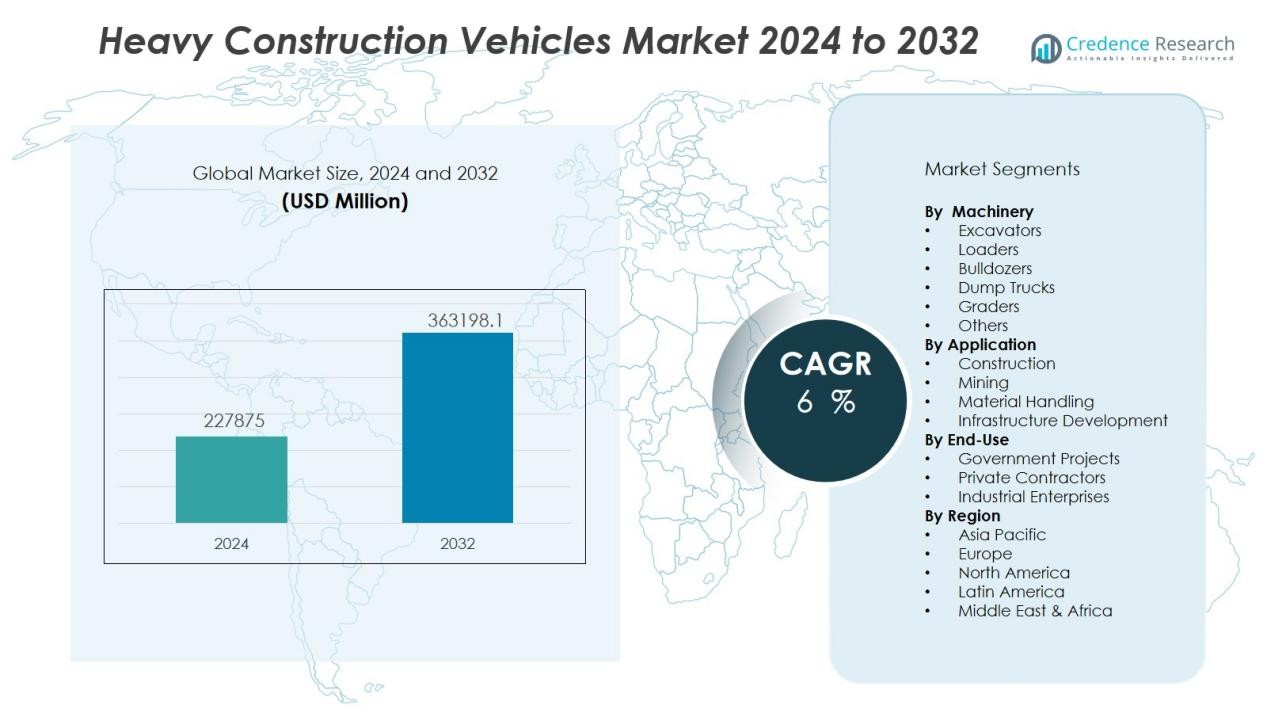

The heavy construction vehicles market size was valued at USD 227875 million in 2024 and is anticipated to reach USD 363198.1 million by 2032, at a CAGR of 6% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy Construction Vehicles Market Size 2024 |

USD 227875 Million |

| Heavy Construction Vehicles Market, CAGR |

6% |

| Heavy Construction Vehicles Market Size 2032 |

USD 363198.1 Million |

Growth in the market is primarily driven by increasing government expenditure on infrastructure modernization, rapid urbanization, and the expansion of the mining and energy sectors. Technological advancements, such as telematics, automation, and electric or hybrid-powered heavy vehicles, are enhancing operational efficiency, reducing downtime, and lowering environmental impact. Furthermore, demand for advanced safety features, high load-carrying capacity, and fuel efficiency is influencing design innovations and purchase decisions.

Regionally, Asia-Pacific dominates the heavy construction vehicles market due to robust construction activities in China, India, and Southeast Asia, supported by significant government-led infrastructure projects. North America follows, driven by investments in highway rehabilitation, energy projects, and smart city initiatives. Europe shows steady growth, with strong demand for eco-friendly and technologically advanced vehicles, especially in countries with stringent emission norms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The heavy construction vehicles market was valued at USD 227,875 million in 2024 and is expected to reach USD 363,198.1 million by 2032, growing at a CAGR of 6% during 2024–2032.

- Government-led infrastructure modernization projects, including highways, rail networks, and ports, are creating sustained demand for high-capacity machinery.

- Rapid urbanization and industrial growth, particularly in Asia-Pacific and Africa, are driving the need for advanced excavators, loaders, and multi-functional construction equipment.

- Technological advancements such as automation, telematics, and electric or hybrid drivetrains are improving operational efficiency and safety standards.

- Stringent emission regulations are encouraging the replacement of older fleets with low-emission, hybrid, and electric heavy machinery.

- Asia-Pacific holds 42% market share, supported by large-scale infrastructure projects in China, India, and Indonesia, while North America holds 27% and Europe 21%.

- High operational costs, frequent maintenance requirements, and global supply chain disruptions remain significant challenges for industry growth.

Market Drivers:

Government Infrastructure Investments Driving Large-Scale Equipment Demand:

Substantial government spending on infrastructure development is a primary driver for the heavy construction vehicles market. Projects such as highways, rail networks, bridges, airports, and ports require high-capacity machinery to meet construction timelines efficiently. Many emerging economies are implementing multi-year infrastructure programs to boost economic growth and connectivity. These initiatives are creating sustained demand for excavators, loaders, dump trucks, and other specialized vehicles. It positions manufacturers to secure long-term contracts with both public and private sector developers.

- For instance, Caterpillar’s 390F L hydraulic excavator leverages an Adaptive Control System valve to cut fuel consumption by 29% over the previous model while delivering the same high level of production.

Rapid Urbanization and Industrial Expansion Stimulating Construction Activities:

The accelerated pace of urbanization, especially in Asia-Pacific and parts of Africa, is fueling the requirement for heavy-duty construction equipment. Expanding urban centers demand residential complexes, commercial hubs, and public infrastructure, increasing reliance on high-performance machinery. The heavy construction vehicles market benefits from rising industrial zones and manufacturing facilities, which often require site preparation and road access. It prompts contractors to invest in advanced, multi-functional vehicles to handle diverse construction challenges. This trend supports continuous fleet upgrades and capacity expansions.

- For instance, Volvo Construction Equipment invested $261million in expanding its Shippensburg, Pennsylvania facility in 2024, adding production lines for mid- to large-size crawler excavators and wheel loaders, which will enable over 50% of North American machine supply to be produced locally and significantly boost regional capacity.

Technological Advancements Enhancing Operational Efficiency and Safety:

Innovations such as automation, telematics, GPS-based fleet management, and hybrid or electric drivetrains are transforming the heavy construction vehicles market. These technologies enable real-time monitoring, predictive maintenance, and optimized fuel consumption, improving productivity while reducing operational costs. Safety enhancements, including advanced braking systems, operator-assist features, and improved visibility, are increasingly standard in new models. It encourages faster adoption among contractors prioritizing workplace safety and efficiency. Manufacturers leveraging these advancements gain a competitive edge in securing large-scale projects.

Sustainability Goals and Emission Regulations Encouraging Equipment Modernization:

Stringent emission standards in major markets are compelling contractors to replace older fleets with environmentally compliant vehicles. Governments are promoting the adoption of electric, hybrid, and low-emission heavy construction equipment through incentives and regulatory frameworks. The heavy construction vehicles market is aligning with these sustainability objectives by developing machines with reduced carbon footprints and improved fuel efficiency. It creates opportunities for OEMs to innovate in green technologies while meeting global climate targets. The shift toward sustainable construction practices is accelerating demand for advanced, eco-friendly models.

Market Trends:

Adoption of Automation, Telematics, and Advanced Control Systems:

The integration of automation, telematics, and smart control systems is becoming a defining trend in the heavy construction vehicles market. Contractors are increasingly deploying GPS-enabled fleet management tools and real-time performance monitoring to maximize uptime and operational efficiency. Autonomous or semi-autonomous vehicles are gaining traction in large-scale projects where precision and productivity are critical. It enables remote diagnostics, predictive maintenance, and route optimization, reducing fuel costs and equipment downtime. Demand for operator-assist technologies, such as load-sensing hydraulics and advanced braking systems, is also increasing. This trend is enhancing safety standards while allowing operators to handle complex tasks with greater ease and accuracy.

- For instance, Komatsu’s FrontRunner Autonomous Haulage System has been commercially deployed on 700 haul trucks worldwide as of February 2024.

Shift Toward Electrification and Sustainable Equipment Solutions;

The push for environmental sustainability is accelerating the adoption of electric, hybrid, and low-emission heavy machinery. The heavy construction vehicles market is experiencing a growing transition from diesel-powered models to cleaner alternatives driven by global emission reduction targets. It is prompting manufacturers to invest in battery technology, hydrogen fuel cells, and energy-efficient drivetrains. Green construction initiatives, backed by regulatory incentives, are influencing procurement decisions among contractors and government agencies. Demand for equipment with lower noise levels and reduced carbon footprints is increasing in urban and sensitive project sites. This shift is reshaping product development strategies, encouraging OEMs to offer a broader range of eco-friendly, high-performance models.

- For instance, BAM Construction trialed the JCB 540-180H hydrogen-fuelled telehandler in Birmingham, UK in early 2025, completing daily lifting tasks seamlessly and reporting emission-free performance with refuelling managed easily by a mobile hydrogen trailer.

Market Challenges Analysis:

High Operational Costs and Maintenance Requirements Impacting Profitability:

The heavy construction vehicles market faces significant challenges from high fuel consumption, frequent maintenance needs, and costly spare parts. Operating expenses increase further in regions with fluctuating fuel prices or limited access to skilled service personnel. It can lead to delays in project timelines when equipment downtime occurs, impacting contractor profitability. Aging fleets require more frequent repairs, pushing companies to invest in replacements sooner than planned. For smaller contractors, these costs can limit the ability to compete for large-scale projects. Managing operational efficiency while controlling expenses remains a persistent concern for industry stakeholders.

Stringent Emission Regulations and Supply Chain Disruptions Limiting Growth:

Tightening global emission standards are compelling manufacturers to redesign equipment with advanced, compliant technologies, often raising production costs. The heavy construction vehicles market must adapt to evolving regulatory frameworks while maintaining affordability for buyers. It faces supply chain disruptions, particularly in sourcing critical components such as semiconductors, hydraulics, and batteries. Such shortages delay production schedules and extend delivery timelines for customers. Geopolitical uncertainties and fluctuating raw material prices further strain manufacturing operations. Meeting regulatory demands while ensuring steady supply remains a critical challenge for industry players.

Market Opportunities:

Rising Demand from Emerging Economies and Infrastructure Expansion:

Expanding infrastructure projects in emerging economies present a significant growth avenue for the heavy construction vehicles market. Large-scale investments in transportation, urban housing, and industrial zones are driving demand for advanced machinery. It benefits from government-backed initiatives aimed at improving connectivity and supporting economic development. Rapid population growth and urbanization in Asia-Pacific, Africa, and Latin America are creating sustained construction activity. This trend opens opportunities for both global and regional manufacturers to expand their presence. Offering tailored solutions for diverse terrains and project requirements can further strengthen market penetration.

Advancement in Green Technologies and Electrified Equipment Solutions:

The shift toward low-emission and electric-powered heavy construction vehicles creates a strong opportunity for manufacturers to lead in sustainable innovation. The heavy construction vehicles market is witnessing increasing interest from contractors seeking environmentally compliant, energy-efficient models. It allows companies investing in battery technology, hydrogen fuel cells, and hybrid systems to gain a competitive edge. Urban projects with strict noise and emission limits are driving the adoption of cleaner alternatives. Strategic partnerships with technology providers can accelerate product development and market entry. Early adoption of green technologies positions manufacturers to meet evolving regulations and customer preferences.

Market Segmentation Analysis:

By Machinery:

The heavy construction vehicles market is segmented into excavators, loaders, bulldozers, dump trucks, graders, and others. Excavators hold a dominant position due to their versatility in excavation, demolition, and material handling. Loaders and dump trucks are widely used in mining, quarrying, and large infrastructure projects. It is witnessing increasing adoption of bulldozers and graders in road construction and land development projects. Demand for specialized machinery is growing in applications requiring high precision and productivity.

- For instance, CASE Construction Equipment introduced Leica Geosystems-powered 2D and 3D control grader blades in June 2020, enabling land development teams to achieve programmed grading and significantly boost operator efficiency.

By Application:

Key applications include construction, mining, material handling, and infrastructure development. The construction segment leads the market, driven by urban expansion, residential complexes, and commercial infrastructure. Mining projects require high-capacity, durable equipment to operate in challenging environments. Infrastructure development projects, such as bridges, ports, and railways, are contributing to sustained demand. It benefits from diversified applications across multiple industries, ensuring steady equipment utilization.

- For instance, Caterpillar maintains the largest global connected fleet with over 1.2 million assets, supporting enhanced equipment utilization and productivity through real-time data insights.

By End-Use:

End-use categories include government projects, private contractors, and industrial enterprises. Government projects account for a significant share due to large-scale public infrastructure initiatives. Private contractors invest in advanced machinery to meet project deadlines and competitive standards. Industrial enterprises, including mining and energy companies, focus on long-lasting, high-performance equipment to support continuous operations. It creates a balanced demand base across both public and private sectors.

Segmentations:

By Machinery:

- Excavators

- Loaders

- Bulldozers

- Dump Trucks

- Graders

- Others

By Application:

- Construction

- Mining

- Material Handling

- Infrastructure Development

By End-Use:

- Government Projects

- Private Contractors

- Industrial Enterprises

By Regions:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 42% market share in the heavy construction vehicles market, driven by rapid urbanization and government-backed infrastructure programs. China, India, and Indonesia are at the forefront, investing heavily in highways, rail networks, ports, and renewable energy facilities. Large-scale residential and commercial developments are further boosting equipment demand. It benefits from competitive manufacturing hubs that lower production costs and enable faster supply to regional markets. The adoption of advanced technologies, such as telematics and automation, is also rising among major contractors. Strong construction activity in both public and private sectors ensures sustained growth in the region.

North America :

North America holds 27% market share, supported by significant federal and state funding for infrastructure rehabilitation. The United States is leading with large-scale highway modernization, bridge repairs, and clean energy projects that require advanced heavy machinery. The heavy construction vehicles market in this region is also influenced by the adoption of low-emission and hybrid equipment to meet stringent environmental standards. It is further strengthened by a mature rental market, allowing smaller contractors to access high-performance machinery without heavy capital investment. Canada is contributing through mining and energy sector developments. Technological innovation and aftermarket support remain key competitive advantages in the region.

Europe :

Europe holds 21% market share, with strong demand driven by sustainable construction practices and smart infrastructure projects. Countries such as Germany, France, and the UK are focusing on emission reduction, promoting the adoption of electric and hybrid heavy machinery. It benefits from well-established OEMs investing in digital fleet management and automation to enhance operational efficiency. Large-scale renewable energy projects, including wind and solar farms, are also boosting equipment requirements. Government incentives for eco-friendly machinery purchases are influencing buying decisions. The emphasis on high-performance, low-emission equipment positions Europe as a key market for technological advancements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Caterpillar

- Hitachi Construction Machinery Co., Ltd.

- Komatsu Ltd.

- AB Volvo

- Deere & Company.

- LIEBHERR

- CNH Industrial N.V.

- Kobelco Construction Machinery Co., Ltd.

- XCMG GROUP

- SANY

Competitive Analysis:

The heavy construction vehicles market is dominated by global manufacturers with extensive product portfolios, advanced technology integration, and strong distribution networks. Leading players such as Caterpillar, Hitachi Construction Machinery Co., Ltd., Komatsu Ltd., AB Volvo, Deere & Company, LIEBHERR, and CNH Industrial N.V. maintain competitive strength through continuous innovation, high-performance machinery, and robust aftersales support. It is characterized by high entry barriers due to capital intensity, regulatory compliance, and the need for advanced manufacturing capabilities. Companies are focusing on automation, telematics, and eco-friendly powertrains to align with sustainability goals and meet evolving customer demands. Strategic partnerships, mergers, and acquisitions are being leveraged to expand market presence and diversify product offerings. Strong brand reputation and reliability remain decisive factors for securing large-scale contracts in infrastructure, mining, and industrial projects.

Recent Developments:

- In April 2025, Caterpillar showcased the new Cat 775 off-highway truck at bauma-Munich, unveiling its next-generation model designed for future autonomous hauling.

- In April 2025, Hitachi Construction Machinery Co., Ltd. debuted the LANDCROS Connect Fleet Management System and LANDCROS Innovation Studios at bauma Munich, emphasizing connectivity and open co-creation partnerships with startups for digital transformation.

- In July 2024, Komatsu finalized its acquisition of German mining firm GHH Group GmbH to strengthen automation capabilities and expand its global service network.

Market Concentration & Characteristics:

The heavy construction vehicles market exhibits a moderately consolidated structure, with leading global manufacturers holding significant competitive influence through advanced product portfolios, strong distribution networks, and brand reputation. It is characterized by high capital requirements, stringent regulatory compliance, and continuous technological innovation in automation, telematics, and low-emission solutions. Regional players compete by offering cost-effective, application-specific machinery tailored to local project needs. Demand is driven by large-scale infrastructure projects, urban development, and industrial expansion, creating steady opportunities for both OEMs and aftermarket service providers. The market demonstrates cyclical patterns aligned with construction and mining sector investments, while sustainability initiatives are reshaping product development strategies.

Report Coverage:

The research report offers an in-depth analysis based on Machinery, Application, End-Use and Regions. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Infrastructure development in emerging economies will remain a primary growth driver, creating consistent demand for advanced heavy machinery.

- Adoption of electric and hybrid-powered vehicles will accelerate as contractors prioritize compliance with global emission standards.

- Integration of automation, telematics, and AI-driven control systems will enhance operational efficiency and reduce downtime.

- Rental services for heavy construction vehicles will expand, allowing smaller contractors to access high-performance equipment without heavy capital expenditure.

- Manufacturers will invest in battery technology and hydrogen fuel cell solutions to meet sustainability targets.

- Demand for multi-functional machinery capable of handling diverse terrains and applications will increase in both urban and remote projects.

- Digital fleet management solutions will gain prominence, enabling real-time tracking, predictive maintenance, and optimized fuel use.

- Regulatory pressure for noise reduction and low-emission operations will influence product design in densely populated areas.

- Strategic partnerships between OEMs and technology providers will speed up the development of smart, eco-friendly construction vehicles.

- Aftermarket services, including parts supply, refurbishment, and maintenance contracts, will become a crucial revenue stream for manufacturers.